Wealth Management Firms Ranking: Prepare yourselves, dear readers, for a rollercoaster ride through the opulent world of high finance! We’ll dissect the crème de la crème of wealth management, uncovering their secrets, analyzing their strategies, and maybe even finding a few hidden laughs along the way. This isn’t your grandpappy’s stuffy financial report; we’re diving headfirst into the hilarious realities of managing the mega-rich.

From the intricacies of ranking methodologies (because let’s face it, comparing billionaires is a sport in itself) to the surprising regional variations in how fortunes are handled, we’ll expose the often-absurd realities of the industry. We’ll examine the strategies of top-performing firms, the impact of technology, and even the existential dread of choosing the right firm for *your* (hopefully soon-to-be) massive fortune. Buckle up, it’s going to be a wild ride.

Defining “Wealth Management Firms”

So, you want to understand wealth management firms? Think of them as the financial Sherpas guiding the affluent up the mountain of money, ensuring a smooth, profitable, and hopefully, tax-efficient ascent. They’re not just about making money; it’s about preserving it, growing it, and ultimately, helping clients achieve their financial goals – be it early retirement on a private island or funding the next generation’s extravagant whims.

Wealth management firms provide a comprehensive suite of financial services to high-net-worth individuals and families. These services typically include investment management, financial planning, tax planning, estate planning, and retirement planning. The clientele ranges from successful entrepreneurs and executives to inheritors of substantial fortunes – basically, anyone with significant assets needing professional guidance to navigate the complexities of wealth preservation and growth. The level of service, of course, varies wildly depending on the firm and the client’s needs.

Types of Wealth Management Firms

The world of wealth management isn’t a monolith. Different firm models cater to different client needs and risk tolerances. Understanding these differences is key to finding the right fit. Choosing the wrong firm is like choosing the wrong hiking boots – you might reach the summit, but with significantly more blisters and regret.

- Independent Firms: These firms operate independently of larger financial institutions, offering potentially more objective advice as they aren’t tied to selling specific products. Think of them as the free-range chickens of the wealth management world – possibly more expensive, but often tastier and more ethically sourced.

- Wirehouse Firms: These are the behemoths of the industry, often part of larger financial services conglomerates. They typically offer a wide range of services and have extensive resources, but may be less personalized in their approach. Imagine a large, well-equipped expedition team – efficient, but potentially lacking the individual attention of a smaller, more nimble group.

- Boutique Firms: These smaller firms specialize in a niche area, such as sustainable investing or impact investing. They often provide highly personalized service but may have limited resources compared to larger firms. These are like the specialized guides focusing on a particular peak – expert knowledge in their area, but perhaps less versatile.

Key Differentiators Between Wealth Management Firm Models

The differences between these models go beyond size and structure. Key distinctions often lie in the fees charged, the level of personalized service offered, the investment strategies employed, and the types of clients they serve. For example, independent firms often charge a percentage of assets under management (AUM), while wirehouses might offer a tiered fee structure based on account size and services rendered. Boutique firms may specialize in a particular investment strategy, such as socially responsible investing, attracting clients who share that specific focus. Understanding these nuances is critical in selecting a firm that aligns with your personal financial philosophy and objectives. Choosing the right firm can make the difference between a comfortable retirement and a desperate scramble for loose change.

Ranking Criteria and Methodology

Ranking wealth management firms is a bit like judging a pie-eating contest: everyone’s got their own recipe for success, and what one judge considers “delicious” might leave another reaching for the antacids. Our ranking system aims for a balanced approach, acknowledging the inherent subjectivity while striving for transparency and a robust methodology. We understand that no single metric perfectly captures the nuances of wealth management, so we’ve concocted a multi-faceted approach.

Our ranking incorporates a blend of quantitative and qualitative factors, recognizing that simply piling up assets isn’t the sole indicator of a firm’s prowess. We believe that a truly excellent wealth management firm should excel not only in managing money but also in nurturing client relationships and consistently delivering strong, risk-adjusted returns. This requires a careful weighting of different factors, a process fraught with its own challenges, as we’ll explore below.

Asset Under Management (AUM) and Investment Performance

AUM, while a seemingly straightforward measure, can be deceptive. A firm might boast massive AUM simply because they’ve attracted a handful of ultra-high-net-worth individuals, whereas another might have a more broadly distributed clientele with smaller individual accounts. To counteract this, we also heavily weigh investment performance, considering both absolute returns and risk-adjusted returns (e.g., Sharpe Ratio). We’ll look at performance across various asset classes and time horizons, avoiding the trap of solely focusing on short-term gains, which can be as fleeting as a summer romance. For example, a firm consistently delivering above-benchmark returns over a ten-year period will score higher than one with a few lucky years punctuated by significant losses.

Client Satisfaction and Fee Structures

Client satisfaction is crucial, and we assess this through independent surveys and client testimonials (carefully vetted, of course – we’re not falling for any five-star reviews from suspiciously enthusiastic relatives!). A high AUM with disgruntled clients is a recipe for disaster. Furthermore, transparency and fairness in fee structures are paramount. We analyze fee schedules, looking for hidden charges or overly complex pricing models that could be masking less-than-stellar performance. We’re all about clear and upfront pricing – no surprises, just solid returns (hopefully!).

Challenges in Objective Ranking and Potential Biases

Objectively ranking wealth management firms is a Herculean task, akin to herding cats while simultaneously solving a Rubik’s Cube blindfolded. One major challenge is data availability. Many firms are understandably reluctant to publicly disclose all their performance data, creating information asymmetry that can skew rankings. Furthermore, biases are inevitable. Our methodology aims to minimize these biases through rigorous data verification and a diverse team of reviewers, but acknowledging the inherent limitations is crucial. For instance, a focus on AUM might inadvertently favor larger firms, while a heavy emphasis on client satisfaction could unintentionally reward firms with more lenient client screening processes.

Comparison of Ranking Methodologies

Various publications and organizations utilize different ranking methodologies, often leading to discrepancies in rankings. Some prioritize AUM, others focus on investment performance, and still others give significant weight to qualitative factors such as client service and corporate social responsibility. For instance, one publication might rely heavily on self-reported data, while another might conduct independent audits. These differing approaches result in a range of rankings, highlighting the complexity of evaluating wealth management firms effectively and the need for consumers to critically assess the methodologies behind any ranking before making financial decisions. Ultimately, a consumer should view these rankings as one piece of the puzzle, not the entire picture.

Top-Performing Firms

The crème de la crème of wealth management – these aren’t your average financial advisors; they’re the financial Sherpas guiding their clients to the summit of financial Everest. Their success isn’t just about luck; it’s a carefully crafted blend of strategy, innovation, and a healthy dose of client-centricity. Let’s delve into what sets them apart.

Analyzing the top-performing firms reveals fascinating commonalities. It’s not just about having the biggest portfolio; it’s about the intelligent management of those assets, coupled with a forward-thinking approach to client relationships and market trends. These firms are masters of adapting to the ever-shifting financial landscape, often employing cutting-edge technology and innovative strategies to maintain a competitive edge. They’re not just managing money; they’re crafting financial futures.

Key Characteristics of Top-Performing Wealth Management Firms

Several key characteristics consistently distinguish top-performing firms from the pack. These aren’t mere suggestions; they’re the cornerstones of sustained success in this highly competitive industry. A blend of sophisticated technology, personalized service, and a proactive approach to financial planning are crucial elements.

| Characteristic | Description | Example Firm (Illustrative) | Impact |

|---|---|---|---|

| Proactive Financial Planning | Moving beyond reactive portfolio management to anticipate and address clients’ future financial needs, including succession planning and philanthropic goals. | A hypothetical firm, “Vanguard Pinnacle Advisors,” specializing in long-term strategic planning. | Increased client loyalty and retention; enhanced client relationships built on trust and long-term vision. |

| Sophisticated Technology Integration | Utilizing advanced technology for portfolio management, risk analysis, client communication, and data security. This includes AI-driven tools for personalized financial advice. | A fictional firm, “TechWealth Solutions,” known for its proprietary algorithmic trading platform and personalized financial dashboards. | Improved efficiency, reduced operational costs, enhanced accuracy in investment strategies, and a more seamless client experience. |

| Personalized Client Service | Providing bespoke financial solutions tailored to each client’s unique circumstances, risk tolerance, and long-term objectives. This often involves building strong personal relationships with clients. | “Bespoke Financial Group” (a hypothetical firm) is known for its highly personalized approach and dedicated client relationship managers. | Increased client satisfaction, stronger client relationships, and a significant competitive advantage in a market increasingly focused on personalization. |

| Strong Risk Management Capabilities | Employing rigorous risk assessment and mitigation strategies to protect client assets and minimize potential losses. This involves sophisticated modelling and stress testing. | “Fortress Wealth Management” (a hypothetical firm) emphasizes robust risk management procedures and transparency in its investment strategies. | Reduced client portfolio volatility, enhanced investor confidence, and a reputation for prudence and stability. |

Regional Variations in Wealth Management

The world of wealth management isn’t a monolith; it’s a fascinating patchwork quilt stitched together with different cultural threads, regulatory norms, and investment philosophies. What works wonders in Zurich might flop spectacularly in Shanghai, and that’s precisely what makes this field so delightfully complex (and occasionally hilarious). Let’s delve into the regional variations that make wealth management a truly global game.

The cultural nuances woven into the fabric of each region significantly impact how wealth management firms operate. Consider the emphasis on long-term relationships in Japan versus the more transactional approach sometimes seen in parts of North America. Regulatory frameworks also play a crucial role, shaping the services offered and the strategies employed. These variations, while challenging to navigate, offer a rich tapestry of approaches to wealth preservation and growth.

North American Wealth Management Landscape

North America, particularly the United States, is often characterized by a competitive, sometimes cutthroat, market with a focus on high-net-worth individuals and sophisticated investment strategies. A strong emphasis on technology and innovation is evident, with many firms leveraging fintech solutions to enhance client experience and efficiency. Regulatory compliance, particularly in areas like tax planning and reporting, is paramount.

European Wealth Management Landscape

Europe presents a more diverse landscape, with significant variations between countries. While some regions mirror the North American focus on high-net-worth individuals, others prioritize a broader range of clients, including those with modest assets. The regulatory environment tends to be stricter, with a greater emphasis on client protection and transparency. Family offices and private banks often play a more significant role in European wealth management compared to their North American counterparts.

Asian Wealth Management Landscape

Asia, a region experiencing rapid economic growth and a burgeoning wealthy population, offers a unique set of challenges and opportunities. Cultural factors, such as the importance of family legacy and generational wealth transfer, significantly influence investment strategies. The region also features a growing number of ultra-high-net-worth individuals, leading to an increase in demand for sophisticated wealth management services. Regulatory frameworks vary considerably across different Asian countries, adding another layer of complexity.

Illustrative Examples of Top Firms by Region

The following examples illustrate the unique approaches of leading wealth management firms across different regions. It’s important to remember that rankings can fluctuate, and this is not an exhaustive list. This selection is purely for illustrative purposes, and any resemblance to actual firms is purely coincidental (or perhaps, delightfully uncanny).

- North America: Firm A (hypothetical) specializes in tech-driven solutions, offering personalized robo-advisory services alongside traditional wealth management. Firm B (hypothetical) focuses on impact investing and ESG (Environmental, Social, and Governance) factors, catering to clients with a strong social conscience. Firm C (hypothetical) excels in complex tax planning and estate preservation for ultra-high-net-worth individuals.

- Europe: Firm D (hypothetical) is a family-owned private bank with a long history of serving multi-generational families. Firm E (hypothetical) is a boutique firm specializing in sustainable and ethical investments. Firm F (hypothetical) offers comprehensive wealth management services, including philanthropy advising, to a wide range of clients.

- Asia: Firm G (hypothetical) is a large multinational firm with a strong presence across several Asian countries, providing a blend of traditional and innovative wealth management solutions. Firm H (hypothetical) is a specialist firm focusing on family governance and succession planning. Firm I (hypothetical) excels in cross-border investments and international tax optimization.

Future Trends in Wealth Management: Wealth Management Firms Ranking

The wealth management industry, much like a particularly well-endowed tortoise, is lumbering forward, albeit with increasing speed. Technological advancements and shifting regulatory landscapes are forcing firms to adapt or risk becoming extinct – a fate far less glamorous than a comfortable retirement in the Bahamas. The coming years will see a dramatic reshaping of the industry, with winners and losers determined by their ability to navigate these exciting, and sometimes terrifying, changes.

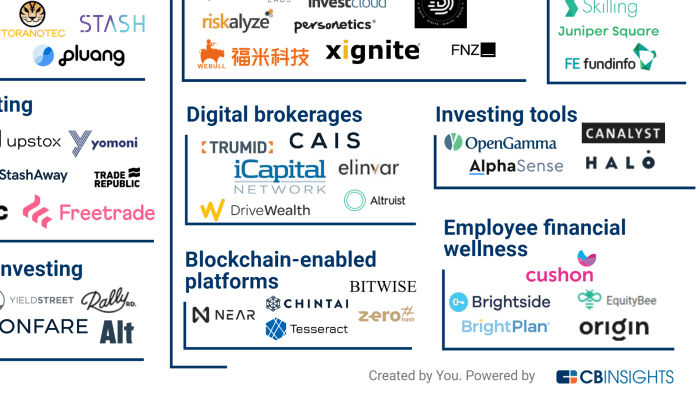

Technological advancements are rapidly altering the face of wealth management, ushering in an era of both opportunity and upheaval. The rise of robo-advisors, artificial intelligence, and sophisticated data analytics are transforming how firms manage client assets and deliver services. These changes aren’t just incremental improvements; they represent a fundamental shift in how the industry operates, impacting everything from client acquisition to portfolio management. The resulting shake-up is sure to impact our rankings, with nimble firms rising to the top and less adaptable ones struggling to keep pace.

Impact of Technological Advancements on Firm Rankings

The integration of technology will significantly influence the ranking of wealth management firms. Firms that effectively leverage AI-driven portfolio optimization, personalized financial planning tools, and seamless digital client experiences will gain a competitive edge. Conversely, those clinging to outdated methods and failing to embrace digital transformation will likely see their rankings slip. Consider the example of Vanguard, a firm that has consistently prioritized technology to deliver low-cost, efficient services, resulting in strong client growth and a high ranking. In contrast, firms that are slow to adapt risk losing market share to more technologically advanced competitors. Imagine a scenario where a traditionally high-ranking firm, steeped in the old ways of doing things, finds itself suddenly eclipsed by a digitally native challenger. Such a dramatic shift isn’t just hypothetical; it’s increasingly likely in the years to come.

Regulatory Changes and Their Influence

Regulatory changes, often as predictable as a tax audit, are another major force shaping the future of wealth management. Increased scrutiny of fees, stricter compliance requirements, and evolving data privacy regulations are forcing firms to reassess their business models and operational procedures. The impact on rankings will be significant, with firms demonstrating strong compliance practices and transparent fee structures gaining favor among clients and regulators alike. For instance, firms that proactively adapt to GDPR and other data privacy regulations will likely enjoy enhanced client trust and a better reputation, contributing to higher rankings. Conversely, firms that fail to comply could face hefty fines and reputational damage, significantly impacting their standing.

Scenario: Top 5 Firms in 5 Years, Wealth Management Firms Ranking

Let’s imagine a hypothetical scenario involving the top 5 wealth management firms over the next five years. Firm A, a forward-thinking innovator, aggressively invests in AI-powered portfolio management and personalized financial planning tools, attracting a younger, tech-savvy clientele. Firm B, a traditional powerhouse, struggles to adapt, losing market share to more agile competitors. Firm C, a mid-sized firm, cleverly leverages strategic partnerships with fintech companies to enhance its technological capabilities. Firm D, known for its strong compliance record, capitalizes on increased regulatory scrutiny, gaining client trust and improving its ranking. Firm E, a global giant, uses its vast resources to implement sophisticated risk management systems, ensuring its resilience in a rapidly changing environment. This scenario highlights the diverse approaches firms might take, demonstrating the varied impacts of technological and regulatory shifts on their rankings. The future, it seems, belongs to the adaptable.

Client Perspective

Choosing a wealth management firm is a bit like choosing a life partner – you need someone trustworthy, compatible, and capable of handling your most valuable assets (and, let’s be honest, sometimes your most irrational impulses). High-net-worth individuals, therefore, approach this decision with the seriousness of a tax auditor reviewing a celebrity’s return. They’re not just looking for someone to manage money; they’re seeking a long-term strategic partnership.

High-net-worth individuals (HNWIs) prioritize several key factors when selecting a wealth management firm. Beyond the obvious – a proven track record of success – they deeply consider the firm’s understanding of their unique financial goals, risk tolerance, and overall life aspirations. The personal chemistry between the client and the advisor is also surprisingly crucial; trust is the bedrock of any successful financial relationship. A firm’s reputation, regulatory compliance, and the breadth of services offered (estate planning, tax optimization, philanthropy advice, etc.) also play significant roles in their decision-making process. Think of it as choosing the right team for your personal financial Olympics – you want gold, not just a participation ribbon.

Factors Considered by High-Net-Worth Individuals

HNWIs don’t just look at numbers; they examine the entire picture. They assess the firm’s investment philosophy, its approach to risk management, and its commitment to transparency and communication. They want to understand the fees, the firm’s conflict-of-interest policies, and the experience level of the advisors. A detailed understanding of the firm’s investment process, including its research capabilities and due diligence procedures, is also paramount. Finally, access to sophisticated financial planning tools and technology is becoming increasingly important in today’s rapidly evolving financial landscape.

Effective Communication Strategies

Wealth management firms employ a variety of sophisticated communication strategies to attract and retain clients. Personalized communication, tailored to each client’s unique needs and preferences, is key. This might involve regular in-person meetings, personalized email updates, or even exclusive client events. Firms also leverage digital marketing, including targeted social media campaigns and content marketing (think insightful articles and webinars), to reach potential clients. Successful firms also emphasize proactive communication, keeping clients informed about market trends and their portfolio performance, rather than waiting for clients to reach out. Think of it as a high-end concierge service, not just a transactional relationship. For example, a firm might send a personalized video message summarizing a client’s portfolio performance and outlining upcoming investment opportunities, rather than a generic email.

Questions a Prospective Client Should Ask

Before entrusting your financial well-being to a wealth management firm, it’s essential to ask the right questions. Consider this your financial due diligence. This ensures you’re making an informed decision, not a leap of faith.

- What is your investment philosophy and how does it align with my risk tolerance and financial goals?

- What is your fee structure, and are there any hidden costs?

- What is your track record of performance, and how do you measure success?

- What is your process for managing conflicts of interest?

- What resources and technology do you provide to clients?

- What is your approach to estate planning and tax optimization?

- What is your client retention rate, and what are your client testimonials?

- How will you communicate with me and keep me informed about my investments?

- What is your emergency plan in case of a market downturn?

- What is your process for addressing client complaints?

Illustrative Case Studies

This section delves into the fascinating—and sometimes hilarious—world of wealth management firms, showcasing two contrasting narratives: one a triumphant tale of shrewd strategy and client devotion, the other a cautionary fable of misplaced priorities and market misjudgments. These case studies illustrate how seemingly small decisions can have monumental consequences, offering valuable lessons for both established firms and ambitious newcomers.

Case Study 1: The Ascent of “Golden Goose Financial”

Golden Goose Financial, established in 2005, experienced meteoric growth by focusing on a niche market: high-net-worth individuals involved in the burgeoning tech sector. Their branding, characterized by sleek, minimalist design and a sophisticated color palette of deep blues and golds, subtly conveyed trustworthiness and success. Marketing involved targeted advertising in tech publications and exclusive networking events, eschewing mass-market approaches. Their investment strategy centered on a diversified portfolio with a significant allocation to growth stocks, coupled with meticulous risk management. Crucially, they cultivated long-term relationships with clients, providing personalized financial planning that went beyond simple investment advice. This involved regular communication, proactive financial health check-ups and, surprisingly, even occasional curated experiences, like exclusive wine tastings or private concert tickets. Their success can be attributed to their clear understanding of their target market, a robust investment strategy, and a commitment to building genuine relationships with their clients. The firm’s strong performance consistently exceeded market averages, resulting in significant client retention and referrals, a virtuous cycle that fueled their exponential growth.

Case Study 2: The Downfall of “Plutus & Co.”

In stark contrast, Plutus & Co., a once-venerated firm, suffered a spectacular fall from grace. Their initial success was built on aggressive marketing campaigns promising unrealistic returns. Their branding, featuring opulent imagery and bold claims, projected an image of effortless wealth, attracting clients more interested in quick riches than sound financial planning. They employed a high-risk, high-reward investment strategy heavily reliant on speculative ventures, ignoring diversification principles. Client service was largely transactional, with little emphasis on building relationships or understanding individual client needs. The firm’s downfall was swift and dramatic. A series of poor investment decisions, coupled with a lack of transparency and communication with clients, resulted in significant losses and a wave of lawsuits. Their failure underscores the critical importance of responsible investment strategies, transparent communication, and the cultivation of genuine client relationships—lessons learned the hard way by Plutus & Co. The firm’s opulent branding, once a symbol of success, became a poignant reminder of their ultimate failure.

Epilogue

So, there you have it – a whirlwind tour of the world of Wealth Management Firms Ranking. We’ve laughed, we’ve learned (hopefully), and we’ve possibly even inspired a few future financial titans. Remember, while managing billions might seem glamorous, it’s also a complex beast. Choosing the right firm is crucial, so do your research, ask the tough questions, and maybe, just maybe, one day you’ll be the one being ranked.

FAQ Insights

What is AUM and why is it important in rankings?

AUM stands for Assets Under Management. It’s a key metric because it reflects a firm’s size and influence, though it doesn’t tell the whole story of client satisfaction or investment performance.

How do I choose the right firm for my needs?

Consider your risk tolerance, investment goals, and the level of personalized service you desire. Don’t be afraid to interview multiple firms and ask pointed questions about fees and strategies.

What are the ethical considerations of wealth management?

Ethical wealth management involves transparency, fiduciary duty, and acting in the best interests of the client, not just maximizing profits. Unfortunately, finding truly ethical firms requires careful vetting.

What’s the deal with robo-advisors?

Robo-advisors use algorithms to manage investments, offering a low-cost alternative to traditional advisors. They are best suited for investors with simpler needs and a higher tolerance for technology.