Market research reports and industry analysis: These aren’t your grandma’s knitting patterns, folks. We’re diving headfirst into the fascinating world of data-driven decision-making, where spreadsheets sing and charts dance. This exploration will unravel the mysteries of primary versus secondary research, reveal the secrets of interpreting complex data (without causing a nervous breakdown), and ultimately equip you with the knowledge to conquer the corporate jungle armed with nothing but insightful reports and a healthy dose of skepticism.

This deep dive will cover everything from defining the core differences between market research reports and industry analyses to showcasing real-world examples of how these powerful tools have shaped successful business strategies. We’ll explore the methodologies used, the challenges encountered, and the ultimately satisfying feeling of turning data into actionable insights. Get ready to unleash your inner data detective!

Defining Market Research Reports and Industry Analysis

Let’s dive into the fascinating world of market research and industry analysis – a world where spreadsheets reign supreme and the quest for data is a never-ending adventure. While these two concepts are closely related, they are distinct enough to warrant a closer look. Think of them as cousins, sharing a family resemblance but with their own unique personalities.

Market research reports and industry analyses both aim to provide insights into specific markets, but they approach the task from different angles. Market research reports focus on a specific product, service, or brand, while industry analyses take a broader perspective, examining the entire industry landscape. It’s like comparing a detailed portrait of a single flower to a sweeping panorama of an entire garden.

Types of Market Research Reports

The world of market research reports is remarkably diverse, offering a buffet of options for businesses of all sizes and needs. These reports can be categorized based on their objective, methodology, or target audience. Choosing the right type is crucial for gaining valuable, actionable insights. The wrong report is like ordering a steak when you’re craving sushi – disappointing, to say the least.

- Market Sizing Reports: These reports estimate the overall size of a market, including its current value and projected growth. Imagine these reports as the grand scale model of a city, giving you an overall view of the market’s potential.

- Competitive Analysis Reports: These delve into the competitive landscape, identifying key players, their market share, and competitive strategies. Think of these as spy reports, revealing the strengths and weaknesses of your rivals.

- Consumer Behavior Reports: These reports explore consumer preferences, purchasing habits, and motivations. They’re like a decoder ring for understanding what makes your customers tick.

- Product/Service Launch Reports: These reports assess the potential success of a new product or service launch, including market demand and potential risks. These are your pre-flight checks before launching a new product into the market.

Key Data Points in Industry Analyses

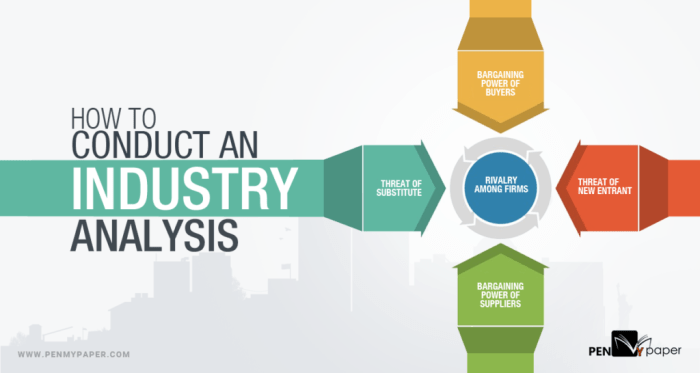

Industry analyses offer a broader, macroeconomic view. They’re less about specific products and more about the overall health and trends of an entire sector. Think of them as the bird’s-eye view, giving you context for your own market research.

Key data points typically include market size and growth rates (naturally!), regulatory landscape (because no one wants unexpected legal headaches), technological advancements (innovation is a double-edged sword!), competitive intensity (how fierce is the fight for market share?), and key industry trends (spotting future trends is a game-changer!). For example, an industry analysis of the electric vehicle market might highlight government incentives, advancements in battery technology, and the growing consumer demand for sustainable transportation.

Methodology Comparison: Market Research vs. Industry Analysis

The methods employed in market research and industry analysis differ significantly, reflecting their distinct objectives.

| Feature | Market Research Reports | Industry Analyses |

|---|---|---|

| Focus | Specific product, service, or brand | Entire industry |

| Data Sources | Surveys, focus groups, sales data, customer feedback | Industry publications, government reports, financial statements, market research databases |

| Methodology | Qualitative and quantitative methods | Primarily quantitative, using statistical analysis and modeling |

| Output | Detailed insights into specific market segments and consumer behavior | Overview of industry trends, market size, and competitive dynamics |

Sources and Methods for Gathering Information

Gathering reliable data is the backbone of any successful market research report; think of it as the scaffolding for a skyscraper of insightful conclusions. Without robust data, your analysis is just a whimsical guess, potentially leading to decisions as sound as a chocolate teapot. Therefore, selecting appropriate sources and employing effective methods is paramount. This section delves into the fascinating world of information acquisition, exploring reputable sources and contrasting primary and secondary research approaches.

The quest for accurate market intelligence often leads researchers down a rabbit hole of information, some reliable, some… less so. Navigating this informational labyrinth requires a discerning eye and a healthy dose of skepticism. Fortunately, several reputable sources exist to guide your journey.

Reputable Sources for Market Research Data

Accessing credible information is crucial. Relying on questionable sources can lead to inaccurate conclusions and, ultimately, flawed business strategies. Therefore, we must carefully curate our sources. A multi-pronged approach is usually best.

- Government Agencies: Organizations like the U.S. Census Bureau, the Bureau of Labor Statistics, and similar international bodies provide invaluable demographic, economic, and industry-specific data. Their data is usually meticulously collected and publicly accessible, though sometimes requires some digging.

- Industry Associations: Trade associations often publish reports and statistics relevant to their specific industries. These reports frequently offer valuable insights into market trends, competitive landscapes, and emerging technologies. However, it is crucial to remember that these sources might present a somewhat biased perspective.

- Academic Databases: Databases like JSTOR, EBSCOhost, and ProQuest provide access to peer-reviewed academic articles and research papers. While these might not always provide the latest market trends, they offer deep dives into underlying theoretical frameworks and long-term patterns.

- Market Research Firms: Companies like Nielsen, Statista, and Mintel specialize in collecting and analyzing market data. They often offer comprehensive reports and custom research services, though this comes at a cost. It’s essential to assess their methodologies and potential biases.

- Company Annual Reports and Financial Statements: Publicly traded companies release annual reports containing valuable information about their performance, market share, and strategies. These reports offer a direct look into the workings of specific businesses within the industry.

Primary vs. Secondary Research Methods

The choice between primary and secondary research hinges on the specific research question, budget, and timeline. Both approaches offer unique advantages and disadvantages, making the selection a strategic decision rather than a mere preference.

- Secondary Research: This involves analyzing existing data collected by others. Advantages include cost-effectiveness and speed. Disadvantages include potential biases in the original data and limited control over data collection methodologies. Think of it as using pre-made ingredients – convenient, but you might not get exactly what you envisioned.

- Primary Research: This involves collecting original data through methods such as surveys, interviews, and focus groups. Advantages include greater control over data collection and the ability to gather specific information. Disadvantages include higher costs and longer timelines. This is akin to making your own ingredients from scratch – more effort, but you have complete control over the final product.

Conducting Effective Surveys and Interviews, Market research reports and industry analysis

Surveys and interviews are powerful tools for gathering primary data, but their effectiveness depends on careful planning and execution. A poorly designed survey can yield meaningless results, while a poorly conducted interview can lead to biased responses. Therefore, methodological rigor is essential.

- Surveys: Clear, concise questions are crucial. Avoid leading questions and ensure the survey is appropriately targeted to the desired demographic. Pilot testing the survey before full deployment is highly recommended to identify and rectify any potential issues. Using established survey platforms can significantly simplify the process and improve data quality.

- Interviews: A well-structured interview guide is essential to maintain consistency across interviews. Active listening and probing questions are key to eliciting insightful responses. Building rapport with interviewees helps foster trust and encourage more open and honest communication. Recording interviews (with consent) can facilitate thorough analysis later.

Data Collection Process Flowchart

A systematic approach to data collection ensures efficiency and minimizes errors. The following flowchart illustrates a typical process:

Imagine a flowchart with boxes connected by arrows. The boxes would include: 1. Define Research Objectives; 2. Determine Research Methodology; 3. Identify Data Sources; 4. Develop Data Collection Instruments (Surveys, Interviews, etc.); 5. Pilot Test Instruments; 6. Collect Data; 7. Clean and Validate Data; 8. Analyze Data. The arrows indicate the sequential flow from one step to the next.

Interpreting and Presenting Findings: Market Research Reports And Industry Analysis

Unraveling the mysteries hidden within your market research data can feel like deciphering an ancient scroll – exciting, potentially rewarding, and possibly a little bewildering. But fear not, intrepid researcher! With the right approach, transforming raw data into compelling insights is entirely achievable, even enjoyable. This section will guide you through the process of transforming numbers into narratives, charts into conversations, and data into decisions.

Interpreting market research data involves more than just crunching numbers; it’s about identifying the underlying trends and patterns that tell a story about your market. This isn’t about finding needles in haystacks; it’s about spotting the entire bale of hay, understanding its composition, and figuring out where it’s going next.

Identifying Key Trends and Patterns

Identifying key trends and patterns requires a keen eye and a methodical approach. Think of yourself as a detective, meticulously examining clues to solve the case of consumer behavior. Start by looking for significant changes in key variables over time, such as sales figures, market share, or consumer preferences. For example, a consistent upward trend in online sales might suggest a growing preference for e-commerce, while a sudden dip in a particular product category could indicate the need for a marketing refresh. Correlations between different variables are also crucial; a strong positive correlation between advertising spend and sales, for instance, would suggest a successful marketing campaign. Remember, context is key. A seemingly insignificant fluctuation might be highly significant when viewed within the larger economic or social landscape.

Data Visualization Techniques

Now, let’s get visual! Numbers alone can be rather dull, but presented effectively, they can be captivating. Charts and graphs are your weapons of choice here. A simple line graph, for instance, is perfect for showing trends over time. Imagine a line graph depicting the growth of a tech startup’s user base over three years – a clear, upward-sloping line showcasing impressive growth. For comparing different categories, bar charts are ideal. Think of a bar chart comparing the market share of different soft drink brands, visually highlighting the dominant player and those struggling to keep up. Pie charts effectively illustrate proportions, such as the percentage of consumers preferring different flavors of ice cream. Scatter plots are excellent for identifying correlations between variables; imagine a scatter plot showing the relationship between customer satisfaction and purchase frequency. Remember, clarity is key; choose the right chart type for your data and keep it simple, avoiding unnecessary clutter.

Organizing Findings into a Compelling Narrative

Presenting your findings isn’t just about presenting data; it’s about telling a story. Think of your report as a captivating novel, with an engaging introduction, a well-structured plot, and a satisfying conclusion (although, we’ve already taken care of the conclusion part). Start by summarizing your key findings in a clear and concise manner. Then, delve deeper into the details, explaining the significance of your findings and drawing meaningful conclusions. Use strong verbs and avoid jargon whenever possible. Imagine telling the story of how a new product launch impacted the market share of competitors – a narrative approach will make your findings far more engaging and memorable than a simple list of numbers.

Presenting Complex Information Clearly

Sometimes, the information you’re dealing with is inherently complex. Don’t panic! There are ways to simplify even the most intricate datasets. One effective strategy is to break down complex information into smaller, more manageable chunks. Use clear headings and subheadings to guide the reader through your report. Tables are your friend here – they’re a fantastic way to present large amounts of data in an organized and easily digestible format. Imagine a table summarizing the demographic breakdown of your target audience – age, gender, income, location, etc. – all neatly presented for easy comprehension. Another technique is to use analogies and metaphors to explain complex concepts in a relatable way. Think of explaining a complex financial model using the analogy of a household budget – suddenly, it becomes far more accessible. Remember, the goal is to make your findings understandable and engaging, even for those without a background in market research.

Applications and Uses of Market Research Reports and Industry Analyses

Market research reports and industry analyses aren’t just dusty tomes gathering cobwebs in a corporate library; they’re the secret weapons of successful businesses. These reports provide invaluable insights, acting as crystal balls (albeit slightly hazy ones) that help companies navigate the often-turbulent waters of the marketplace. They translate complex data into actionable strategies, helping businesses make informed decisions and, let’s be honest, avoid some spectacularly embarrassing blunders.

These reports offer a wealth of information that can be applied across numerous business functions. From shaping product development to refining marketing strategies and guiding investment decisions, their influence is pervasive and profoundly impactful. Imagine trying to launch a new product without understanding your target market – it’s like trying to bake a cake without knowing if people prefer chocolate or vanilla! Market research prevents such culinary (and business) catastrophes.

Business Applications of Market Research Reports

Market research reports are incredibly versatile tools, offering a plethora of applications across various business functions. They provide crucial information on consumer behavior, competitor activities, and market trends. This information allows businesses to make data-driven decisions, rather than relying on gut feelings or outdated assumptions. For example, a company launching a new line of sustainable clothing could use market research to understand consumer preferences for sustainable materials, price points, and brand messaging. This would allow them to tailor their product and marketing efforts for optimal success, rather than launching a product no one wants (or can afford). The result? Increased profitability and a reduced risk of failure.

Industry Analyses and Strategic Decision-Making

Industry analyses provide a broader perspective, offering a deep dive into the competitive landscape of a specific sector. This macro-level view complements the micro-level focus of market research reports, painting a complete picture of the business environment. For example, an analysis of the pharmaceutical industry might reveal emerging trends in drug development, regulatory changes, and the impact of technological advancements. This information is crucial for companies operating in the industry to develop long-term strategies, anticipate challenges, and identify opportunities for growth. Ignoring these trends is akin to driving blindfolded – potentially exciting, but ultimately disastrous.

Comparative Use Across Industries

The applications of market research reports and industry analyses vary across different sectors. In the technology industry, for example, these reports are critical for understanding rapid technological advancements, emerging consumer preferences, and the competitive dynamics of a constantly evolving market. Imagine a tech company trying to launch a new smartphone without understanding the latest processor technology or consumer demand for specific features. It’s a recipe for disaster. In healthcare, on the other hand, these reports are crucial for understanding regulatory landscapes, patient demographics, and the effectiveness of new treatments. A pharmaceutical company launching a new drug would need to understand regulatory approval processes, potential side effects, and patient needs to ensure its success. These reports essentially act as a compass, guiding decision-making in diverse and dynamic markets.

Impact on Key Business Decisions

The impact of market research reports and industry analyses is significant and far-reaching. They directly influence critical business decisions across various departments.

- Product Development: Reports identify unmet consumer needs, inform product features, and guide pricing strategies, ensuring products resonate with the target market. Think of the success of the iPod – Apple’s research indicated a market need for a portable, user-friendly music player, leading to a revolutionary product.

- Marketing Strategies: Reports reveal target audience preferences, allowing for tailored marketing campaigns that maximize reach and engagement. Understanding your customer is key – Coca-Cola’s success is partly due to its ability to adapt its marketing to resonate with diverse demographics.

- Investment Decisions: Reports assess market viability, competitive landscape, and potential return on investment, guiding investment decisions and mitigating risk. Venture capitalists rely heavily on these reports to decide where to allocate funds, avoiding investment in failing ventures.

Illustrative Examples of Successful Applications

Market research, when done right, isn’t just about crunching numbers; it’s about uncovering hidden goldmines of information that can transform a business. Let’s explore some delightfully successful examples where market research acted as the fairy godmother, transforming business dreams into sparkling realities.

Successful Product Launch: The Case of the “Surprisingly Delicious” Pickle

A small, artisanal pickle company, “Dill-icious Delights,” was struggling to break into the mainstream market. Their pickles were undeniably delicious (we’re talking award-winning), but sales were sluggish. They commissioned market research that revealed a surprising insight: consumers associated artisanal pickles with being overly sour and expensive, limiting their appeal to a niche market. The research pinpointed a desire for a “gourmet-but-not-intimidating” pickle. Dill-icious Delights responded by launching a new line: “Surprisingly Delicious Pickles,” featuring a slightly sweeter, more approachable flavor profile and a more accessible price point. Sales skyrocketed, proving that sometimes, a little market research can make all the difference between a niche product and a market leader. The research also identified key demographic groups and their preferences, allowing for targeted marketing campaigns that further amplified their success.

Preventing Significant Business Risk: The Case of the “Avoided Apocalypse”

“Tech Titans,” a burgeoning software company, was on the verge of launching a new productivity app. Their internal projections were glowing, predicting massive success. However, a comprehensive industry analysis revealed a looming threat: a similar app, with superior features and a significant marketing budget, was about to launch from a much larger competitor. This analysis highlighted a critical vulnerability in Tech Titans’ initial marketing strategy, and showed that their predicted market share was wildly optimistic. Based on this analysis, Tech Titans revised their launch strategy, delaying the release to refine their product and allowing them to better position it against the competitor. They shifted their marketing focus, highlighting unique features that differentiated them from the larger competitor. This avoided a potentially disastrous head-to-head launch and allowed them to build a strong market position.

Improved Marketing Campaign: The Case of the “Unexpectedly Viral” Ad

“Cozy Candles,” a candle company, had a loyal customer base but wanted to expand their reach. Their initial marketing campaign focused on highlighting the high-quality ingredients and craftsmanship of their candles. Market research, however, revealed that consumers were more drawn to the emotional connection and ambiance candles provided. The research identified key emotional triggers like relaxation, comfort, and self-care. Cozy Candles revamped their marketing campaign, shifting the focus from product features to the feeling and experience of using their candles. They created a series of heartwarming, visually appealing advertisements showcasing people enjoying the warm glow and calming scents of their candles in various relaxing settings. The result? A viral social media campaign, a significant increase in brand awareness, and a substantial boost in sales. The shift in focus, driven by market research, proved incredibly effective.

Visual Representation of a Key Market Trend: The “Soaring Sales of Sustainable Sneakers”

A line graph illustrated the increasing sales of sustainable sneakers over a five-year period. The X-axis represented the years, and the Y-axis represented sales figures in millions of units. The line itself showed a consistently upward trend, starting relatively low in the first year and then steadily rising each year, with a particularly sharp incline in the final two years. This visual representation clearly demonstrated the growing consumer demand for environmentally friendly footwear, indicating a significant shift in consumer preferences and a lucrative market opportunity for companies investing in sustainable manufacturing practices. The graph’s steep incline in the last two years highlighted the accelerating growth of this market segment, indicating a trend that is likely to continue.

Challenges and Limitations

Market research, while a powerful tool for understanding consumer behavior and industry trends, isn’t without its quirks and challenges. Think of it as a delicious cake – it can be incredibly insightful, but if the recipe (methodology) is flawed or the ingredients (data) are suspect, the final product might leave a bit to be desired. This section delves into the potential pitfalls and limitations that can affect the accuracy and reliability of market research findings.

Potential Biases and Limitations in Market Research Data

Market research, like any human endeavor, is susceptible to bias. Data collection methods can inadvertently skew results. For instance, a survey conducted solely online might exclude individuals without internet access, leading to a sample that doesn’t accurately represent the entire population. Similarly, leading questions in a questionnaire can subtly influence responses, creating a biased dataset. Furthermore, the timing of data collection can be critical; a study conducted during an economic downturn might paint a drastically different picture than one conducted during a period of growth. These limitations underscore the importance of carefully considering the methodology and potential biases inherent in any research project. The choice of sampling method, the phrasing of questions, and even the time of year the research is conducted can significantly impact the results. For example, a study on ice cream sales conducted during winter might produce drastically different results than one conducted during summer.

Interpreting Complex Data Sets

Interpreting complex datasets requires more than just number-crunching; it demands a keen eye for detail and a healthy dose of skepticism. Market research often involves sifting through massive amounts of data from various sources – sales figures, consumer surveys, social media sentiment, and more. The challenge lies in identifying meaningful patterns and correlations amidst the noise. Statistical analysis is crucial, but equally important is the ability to contextualize the findings within the broader market landscape. For example, a seemingly significant drop in sales might be explained by seasonal factors or competitor actions rather than a fundamental shift in consumer preferences. Failing to consider the broader context can lead to misinterpretations and inaccurate conclusions.

Difficulties in Forecasting Future Market Trends

Predicting the future is a notoriously tricky business, and market forecasting is no exception. While sophisticated statistical models and predictive analytics can be helpful, they are not crystal balls. Unforeseen events – economic downturns, technological disruptions, geopolitical shifts – can dramatically alter market trajectories. Furthermore, consumer behavior is notoriously unpredictable; trends can emerge and disappear with surprising speed. Consider the rapid rise and fall of certain social media platforms or the unexpected success of niche products. Forecasting future market trends requires a blend of quantitative analysis and qualitative insight, coupled with a healthy dose of humility. Overreliance on past trends can be misleading, as unexpected disruptions can quickly render previous patterns obsolete. For example, the rise of e-commerce dramatically altered retail landscapes, rendering many traditional forecasts obsolete.

It is crucial to approach market research findings with a critical and discerning eye. Don’t just accept the numbers at face value; question the methodology, consider potential biases, and always seek to understand the broader context before drawing conclusions.

Epilogue

So, there you have it: a whirlwind tour of the exciting and often hilarious world of market research reports and industry analysis. While the process may sometimes feel like deciphering ancient hieroglyphs (especially when dealing with particularly stubborn datasets), the rewards are immense. By mastering the art of data interpretation and strategic application, businesses can navigate the ever-shifting marketplace with confidence, avoid costly mistakes, and ultimately achieve remarkable success. Now go forth and conquer… the data!

Question Bank

What’s the difference between qualitative and quantitative research?

Qualitative research focuses on in-depth understanding of opinions, experiences, and motivations (think interviews and focus groups), while quantitative research uses numerical data to measure and analyze trends (think surveys and statistical analysis).

How much does market research typically cost?

The cost varies wildly depending on scope, methodology, and the research firm. Expect a wide range, from a few thousand dollars for smaller projects to hundreds of thousands for extensive, multi-national studies.

Can I conduct my own market research?

Absolutely! While professional firms offer expertise and resources, many smaller businesses successfully conduct basic market research using free online tools and surveys. However, be aware of potential biases and limitations.

How long does a market research project take?

Project timelines are highly variable, ranging from a few weeks for simple projects to several months or even years for large-scale, complex studies.