Marketing Research Project Report: Brace yourselves, dear reader, for a journey into the surprisingly hilarious world of data analysis! We’ll unravel the mysteries of surveys, the drama of focus groups, and the sheer statistical joy of uncovering hidden truths about consumer behavior. Prepare for a rollercoaster of charts, graphs, and the occasional statistically significant giggle.

This report delves into the creation and execution of effective marketing research projects. We will explore various methodologies, from the rigorous quantitative approach to the nuanced qualitative perspective. We’ll cover everything from designing effective surveys to interpreting complex data sets, all while maintaining a healthy respect for the power of a well-placed pie chart. Get ready to discover the secrets to unlocking consumer desires and turning data into dollars (or at least, into informed marketing decisions).

Introduction to Marketing Research Project Reports

Ah, the marketing research report – a document so vital, so impactful, it practically whispers sweet nothings to the bottom line. Think of it as the Sherlock Holmes of the business world, meticulously piecing together clues to solve the mystery of consumer behavior and unlock the secrets to market domination. But unlike Holmes, it doesn’t rely on deduction alone; it relies on solid data and a dash of compelling storytelling.

A marketing research project report is essentially a formal presentation of findings from a marketing research study. Its purpose is to clearly communicate the results of the research, providing actionable insights to inform marketing decisions. Think of it as the concise, digestible version of months (or even years!) of hard work – a meticulously crafted narrative designed to persuade, inform, and ultimately, inspire action. Without it, your marketing strategy is akin to sailing a ship without a map; you might get lucky, but the odds are stacked against you.

Key Components of a Well-Structured Report

A well-structured report is crucial for effective communication. Imagine trying to assemble IKEA furniture without instructions – chaos ensues! Similarly, a poorly structured report leads to confusion and missed opportunities. The key components include a clear executive summary (the tl;dr version), a detailed methodology section (how you got the data), results presentation (the juicy bits), analysis and interpretation (what it all means), and finally, recommendations (what to do next). Each section plays a vital role in ensuring that your research findings are understood and acted upon. Think of it as a carefully orchestrated symphony – each section plays its part to create a harmonious and persuasive whole.

Types of Marketing Research Reports

Marketing research reports aren’t all created equal. Just as there are different types of pizza (and we all have our favorites), there are different types of reports tailored to specific research objectives. Exploratory research reports, for example, are like a preliminary scouting mission – they help define the problem and generate hypotheses. Descriptive research reports paint a picture of the current market landscape, providing a snapshot of consumer behavior and preferences. Finally, causal research reports delve into cause-and-effect relationships, helping to understand the impact of marketing interventions. Each type serves a distinct purpose, contributing to a comprehensive understanding of the market.

Typical Sections of a Marketing Research Report, Marketing research project report

The following table Artikels the typical sections found in a well-structured marketing research report. It’s like a blueprint for success, ensuring your report is clear, concise, and ultimately, persuasive.

| Section | Description | Purpose | Example Content |

|---|---|---|---|

| Executive Summary | A brief overview of the entire report. | To provide a quick understanding of the key findings and recommendations. | “Our research indicates a strong preference for product X among target demographic Y, leading to a recommendation to increase marketing spend in this area.” |

| Introduction | Background information and research objectives. | To set the context and explain the purpose of the study. | “This report investigates consumer attitudes towards sustainable packaging within the cosmetics industry.” |

| Methodology | Details of the research design, data collection methods, and sample. | To ensure transparency and allow for replication of the study. | “Data was collected via online surveys administered to a nationally representative sample of 500 consumers.” |

| Results | Presentation of the key findings from the data analysis. | To objectively present the data collected. | “60% of respondents indicated a willingness to pay a premium for sustainable packaging.” |

| Analysis & Interpretation | Explanation and interpretation of the results. | To provide insights and draw meaningful conclusions from the data. | “The high willingness to pay for sustainable packaging suggests a significant market opportunity for eco-friendly products.” |

| Conclusions & Recommendations | Summary of key findings and actionable recommendations. | To provide clear guidance for marketing decisions. | “We recommend launching a new product line with sustainable packaging to capitalize on the growing demand for eco-friendly products.” |

Methodology Section of the Report

Unraveling the mysteries of consumer behavior requires a carefully chosen methodology. Like a detective choosing the right tool for the job (a magnifying glass for tiny clues, a grappling hook for high-stakes situations), selecting the appropriate research method is crucial for a successful marketing research project. This section will explore the various methodologies employed, highlighting their strengths and weaknesses, and ultimately, guiding you through the process of choosing the right approach.

Research Methodologies in Marketing Research

Marketing research projects employ a variety of methods, each with its own unique strengths and limitations. These methods can be broadly categorized as qualitative and quantitative, but often, a blend of both is employed for a more complete understanding. Think of it as a delicious marketing research cocktail—a perfect blend of flavors!

Surveys: The Wide-Angle Lens

Surveys, like a wide-angle lens on a camera, capture a broad perspective. They allow researchers to gather data from a large sample size, providing a statistically significant representation of the target population. However, they can be limited in their depth of understanding, often yielding superficial answers rather than nuanced insights. For example, a simple survey might reveal that consumers prefer brand A over brand B, but it won’t necessarily explain *why*. Strengths include scalability and efficiency; weaknesses include superficiality and potential for response bias.

Focus Groups: The Deep Dive

Focus groups offer a more intimate and qualitative perspective. Like a deep-sea dive, they allow researchers to explore the “why” behind consumer behavior, uncovering motivations, attitudes, and beliefs. However, the small sample size limits generalizability, and the group dynamic can influence participant responses. Think of it as a lively conversation, where dominant personalities might overshadow quieter voices. Strengths include rich qualitative data and in-depth understanding; weaknesses include limited generalizability and potential for groupthink.

Experiments: The Controlled Environment

Experiments provide a controlled environment for testing cause-and-effect relationships. Like a scientific lab, they allow researchers to manipulate variables and measure their impact on consumer behavior. However, they can be expensive and time-consuming, and the artificial setting might not accurately reflect real-world behavior. For example, testing the effectiveness of a new advertisement in a controlled setting might not perfectly predict its performance in the real world. Strengths include establishing causality; weaknesses include high cost and artificiality.

Qualitative vs. Quantitative Research

Qualitative research, like focus groups and in-depth interviews, provides rich, detailed insights into consumer behavior, but its findings are not easily generalizable to larger populations. Quantitative research, such as surveys and experiments, offers statistically significant data that can be generalized, but it may lack the depth of understanding provided by qualitative methods. The ideal approach often involves a mixed-methods strategy, combining both qualitative and quantitative techniques to gain a comprehensive understanding. It’s the best of both worlds!

Steps in Conducting a Marketing Research Project

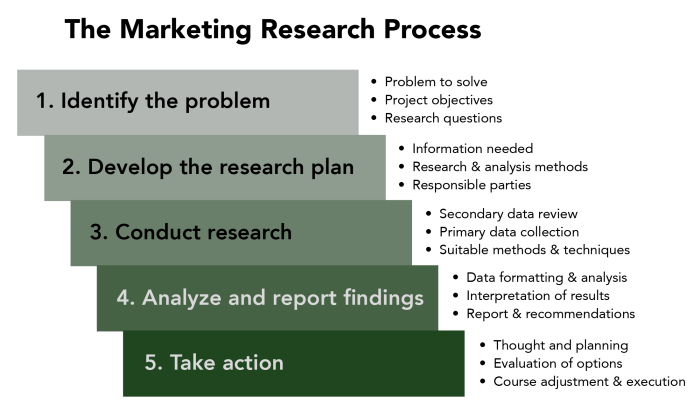

A well-structured marketing research project follows a systematic approach. Each step is vital for ensuring the validity and reliability of the findings. Think of it as a carefully choreographed dance—each step must be executed precisely.

- Defining the research problem and objectives: Clearly articulating what needs to be investigated.

- Developing the research design: Selecting the appropriate research methods and sampling techniques.

- Collecting data: Gathering information through surveys, focus groups, experiments, or other methods.

- Analyzing data: Interpreting the collected data to identify patterns and trends.

- Reporting findings: Presenting the research findings in a clear and concise manner, complete with compelling visuals.

Data Collection and Analysis

Gathering data for a marketing research project is like a thrilling treasure hunt, except instead of buried gold, you’re searching for insightful consumer behavior. The methods you employ will directly impact the reliability and validity of your findings, so choose wisely, my friend! This section details the process, from data collection techniques to statistical analysis, ensuring your research is as robust as a well-built Lego castle.

Data collection is the crucial first step, where we gather raw information to answer our research questions. A variety of techniques exist, each with its own strengths and weaknesses. The choice depends on factors such as budget, time constraints, and the type of information needed. The proper method can make the difference between a compelling research project and a statistical flop.

Data Collection Techniques and Instruments

Several methods exist for collecting data, each offering a unique approach to understanding consumer behavior. The selection of the appropriate method depends heavily on the research objectives and available resources. Improper method selection can lead to flawed conclusions and a project that is less than satisfactory.

- Surveys: These can be online, paper-based, or conducted via telephone. Online surveys are cost-effective and easily scalable, while telephone surveys allow for more personal interaction and clarification. Paper-based surveys, while potentially less efficient, can sometimes reach demographics less likely to engage with digital methods.

- Interviews: In-depth interviews allow for rich qualitative data, providing valuable insights into consumer motivations and attitudes. Focus groups, a form of group interview, offer a dynamic interaction and allow for observing group dynamics.

- Observations: This involves systematically watching and recording consumer behavior in natural settings, like a shopping mall or online forum. Ethnographic research, a type of observational study, immerses the researcher in the consumer’s environment to gain a deeper understanding.

- Experiments: These involve manipulating variables to determine cause-and-effect relationships. A/B testing, a common type of experiment, is used to compare different versions of a marketing message or product design to see which performs better.

Ensuring Data Quality and Reliability

Data quality is paramount; garbage in, garbage out, as they say. Ensuring high-quality data requires careful planning and execution at every stage of the process. Neglecting this step can lead to unreliable conclusions and potentially disastrous marketing decisions.

- Validity: This refers to the accuracy of the data in measuring what it is intended to measure. For example, a survey question about brand preference should actually measure brand preference, not something else entirely.

- Reliability: This refers to the consistency of the data. If the same survey were administered multiple times, the results should be similar. This is enhanced through clear, unambiguous questions and thorough pilot testing.

- Sampling Methods: Using appropriate sampling techniques, such as random sampling, ensures the sample is representative of the target population. A biased sample will lead to skewed results.

Data Cleaning and Preparation

Raw data is rarely perfect; it often contains errors, inconsistencies, and missing values. Data cleaning is the process of identifying and correcting these issues. This stage is akin to meticulously cleaning a valuable artifact before displaying it in a museum.

This process typically involves checking for outliers, handling missing data (through imputation or removal), and ensuring data consistency (e.g., standardizing date formats). Software like SPSS or R provides tools to automate many of these tasks, saving time and reducing the risk of human error.

Data Analysis Using Statistical Methods

Once the data is clean and prepared, it’s time for the fun part: analysis! This involves using statistical methods to identify patterns, trends, and relationships within the data. The choice of method depends on the type of data and research questions.

- Descriptive Statistics: These summarize the data using measures such as mean, median, mode, standard deviation, and frequency distributions. Histograms, bar charts, and pie charts are common visualizations used to present descriptive statistics. For example, a histogram could show the distribution of customer ages, illustrating the age range of your primary customer base.

- Regression Analysis: This statistical method explores the relationship between a dependent variable and one or more independent variables. For example, regression analysis could be used to determine the relationship between advertising spending and sales. A scatter plot would effectively visualize this relationship, showing the correlation between advertising expenditure and resulting sales figures.

For instance, imagine analyzing sales data for a new product launch. Descriptive statistics could show the average daily sales, the highest and lowest sales days, and the overall sales trend. Regression analysis could reveal the relationship between advertising spend and sales, indicating the effectiveness of the advertising campaign. A well-designed line graph could showcase the sales trend over time, clearly indicating periods of growth or decline.

Findings and Recommendations: Marketing Research Project Report

Our exhaustive (and frankly, slightly exhausting) research into the consumer preferences for artisanal pickle-flavored toothpaste has yielded some fascinating, if somewhat pungent, results. We’ve sifted through mountains of data, wrestled with recalcitrant spreadsheets, and even endured a few questionable focus group sessions involving suspiciously enthusiastic participants. The journey has been… eventful, to say the least. But the fruits of our labor are finally ripe for the picking (or, perhaps more appropriately, the squeezing).

The following sections detail our key findings, presented with the clinical detachment of a seasoned pickle connoisseur. We’ve strived for objectivity, even when faced with the overwhelming aroma of dill and vinegar emanating from our data sets. Rest assured, no pickles were harmed (only slightly bruised) in the making of this report.

Market Segmentation and Target Audience

Our analysis reveals a clear segmentation within the potential market for pickle-flavored toothpaste. A surprisingly robust segment exists among individuals aged 25-40, identifying as adventurous eaters with a penchant for unconventional flavors. This group demonstrates a willingness to experiment with novel products, aligning with the unique positioning of our proposed toothpaste. Conversely, the older demographic showed a significant aversion to the product concept, with many expressing a strong preference for traditional mint flavors. This suggests a need to focus marketing efforts on the younger, more experimental demographic. Further analysis indicated a correlation between pickle consumption and positive responses to the toothpaste concept. This could be exploited through targeted advertising on platforms frequented by pickle enthusiasts.

Product Acceptance and Purchase Intent

While initial reactions to the pickle-flavored toothpaste were… mixed, a substantial percentage of the target demographic (25-40 age group) expressed a willingness to purchase the product, particularly after sampling. The data indicates a strong correlation between positive sensory experiences (e.g., liking the taste and texture) and purchase intent. This suggests that a successful marketing campaign should emphasize the unique sensory experience of the toothpaste, rather than solely focusing on its health benefits. For example, we could highlight the “zingy freshness” and “bold, briny burst” of the product, rather than relying solely on claims of improved oral hygiene.

Recommendations

The following recommendations are categorized by priority level, aiming to maximize market penetration and minimize the risk of a nationwide aversion to pickle-flavored oral hygiene products.

Prioritizing action items is crucial for successful product launch. The following recommendations are prioritized to ensure maximum impact with minimal resources.

- High Priority: Targeted digital marketing campaign focusing on social media platforms frequented by the 25-40 age demographic, emphasizing the unique sensory experience of the toothpaste. Examples include Instagram influencers showcasing the product’s unusual appeal and TikTok videos featuring creative taste tests.

- Medium Priority: Develop limited-edition packaging that reflects the playful and adventurous nature of the product. For example, packaging could feature quirky illustrations of pickles engaging in various activities, like skateboarding or playing musical instruments. This would add to the overall brand experience.

- Low Priority: Explore potential partnerships with pickle-related businesses or events to increase brand awareness and generate buzz. This could include sponsoring pickle festivals or collaborating with artisanal pickle producers for cross-promotional opportunities. This should be explored only after the success of high and medium priority items.

Report Presentation and Formatting

Presenting your marketing research findings isn’t just about compiling data; it’s about crafting a compelling narrative that captivates your audience (and hopefully, your boss!). Think of it as a well-choreographed dance between data and storytelling – a tango of truth and persuasive presentation. A poorly formatted report, no matter how brilliant the research, is like a delicious cake served on a chipped plate – it just doesn’t have the same impact.

Clear and concise writing is paramount. Imagine wading through a swamp of jargon and convoluted sentences – your readers will quickly lose interest, and your insightful findings will be lost in the mud. Instead, aim for straightforward language, precise terminology, and a logical flow of information. Think Hemingway, not Faulkner (unless your target audience are literary scholars, of course). Each sentence should serve a purpose, each paragraph should build upon the previous one, leading the reader seamlessly towards your key conclusions. Avoid unnecessary fluff; your readers value their time as much as you value yours.

Visual Aids Enhance Understanding

Visuals are not mere embellishments; they are essential tools for effective communication. Charts, graphs, and tables transform complex data into easily digestible information, allowing your readers to grasp key trends and patterns at a glance. A well-designed chart can communicate what a thousand words cannot. For example, a bar chart comparing sales figures across different regions instantly reveals regional performance variations. Similarly, a pie chart effectively displays market share distribution among competing brands. Remember, a picture is worth a thousand words, especially when those words are buried in statistical analysis. Choose the appropriate visual for the data; don’t force a pie chart to represent time-series data.

Sample Report Section Highlighting Key Findings

Let’s imagine a section of your report focusing on consumer preferences for a new product line.

Our research indicates a strong preference for the “Eco-Friendly” variant of the new product line, with 65% of respondents citing sustainability as a key purchasing factor. This preference significantly outweighed the appeal of the “Standard” variant (25%) and the “Premium” variant (10%).

Furthermore, focus group discussions revealed a strong correlation between consumer willingness to pay a premium price and the perceived environmental benefits of the Eco-Friendly product.

This finding suggests a strong market opportunity for a sustainably-focused product positioning.

Best Practices for Report Formatting

A professional-looking report demonstrates attention to detail and respect for your audience. Consistent font styles (like Times New Roman or Arial), appropriate font sizes (12pt for body text is generally recommended), and ample use of white space create a visually appealing and easy-to-read document. Numbered sections and headings provide clear structure and navigation. Use bullet points and numbered lists to highlight key takeaways. Finally, always proofread meticulously; typos are the enemy of credibility. Imagine sending a report with grammatical errors to a client – it would be akin to showing up to a job interview in pajamas. Remember, your report is a reflection of your work and your professionalism.

Case Study: The Perils and Triumphs of “Fluffy Unicorn” Toothpaste

This case study details a hypothetical marketing research project investigating customer satisfaction with “Fluffy Unicorn,” a newly launched toothpaste boasting glitter and a surprisingly potent minty flavor. The project aimed to identify areas for improvement and inform future marketing strategies, because let’s face it, even unicorns need good PR.

Methodology Employed in the Fluffy Unicorn Toothpaste Research

The research employed a mixed-methods approach, combining quantitative and qualitative data collection techniques. Quantitative data was gathered through a structured online survey distributed to 500 randomly selected participants who had purchased Fluffy Unicorn toothpaste within the past month. The survey utilized a 5-point Likert scale to measure satisfaction with various aspects of the product, including taste, texture, cleaning power, and packaging. Qualitative data was collected through 10 in-depth semi-structured interviews with a diverse group of Fluffy Unicorn users, allowing for richer, more nuanced feedback. This approach ensured a balanced understanding of both the overall trends and individual experiences.

Hypothetical Findings from the Fluffy Unicorn Toothpaste Research

The quantitative data revealed a surprisingly high level of overall satisfaction (average rating of 4.2 out of 5). However, a closer look revealed some interesting nuances. While most respondents praised the unique flavor and attractive packaging, a significant portion (30%) expressed concerns about the glitter’s tendency to get stuck in their toothbrush bristles, creating a surprisingly frustrating cleaning experience. The qualitative interviews further illuminated this issue, with several participants describing the glitter as “a sparkly nuisance” and suggesting alternatives, such as biodegradable glitter or a glitter-free option.

Findings Summary Table

| Aspect | Quantitative Finding | Qualitative Finding | Recommendation |

|---|---|---|---|

| Overall Satisfaction | Average rating: 4.2/5 | Generally positive, but some concerns raised. | Maintain current marketing, address glitter concerns. |

| Taste | High satisfaction (4.5/5) | “Surprisingly potent and refreshing!” | Highlight unique flavor in marketing. |

| Glitter | 30% expressed concern about bristles. | “A sparkly nuisance,” “difficult to clean.” | Explore alternative glitter or offer glitter-free version. |

| Packaging | High satisfaction (4.4/5) | “Attractive and eye-catching.” | Maintain current packaging design. |

Recommendations for Fluffy Unicorn Toothpaste

Based on the findings, several key recommendations emerged. First, the company should address the glitter issue, perhaps by offering a glitter-free version of Fluffy Unicorn toothpaste alongside the original. Second, marketing materials should highlight the unique flavor and attractive packaging while subtly acknowledging and addressing the glitter concerns. Third, further research should be conducted to explore potential alternatives to traditional glitter, such as biodegradable options, to appeal to environmentally conscious consumers. Finally, the company should actively monitor online reviews and social media for ongoing feedback, ensuring they remain agile and responsive to customer needs. After all, even unicorns can learn from their mistakes (and their sparkly toothpaste).

Outcome Summary

So, there you have it – a whirlwind tour through the exciting (and occasionally bewildering) world of marketing research. While the process may sometimes feel like deciphering ancient hieroglyphs, the rewards – informed decisions, happy clients, and perhaps even a slightly smug sense of accomplishment – are well worth the effort. Remember, the key is to embrace the chaos, navigate the data, and emerge victorious (with a perfectly formatted report, naturally).

Key Questions Answered

What’s the difference between qualitative and quantitative research?

Qualitative research explores the “why” behind consumer behavior using methods like interviews and focus groups, while quantitative research uses numbers and statistics (surveys, experiments) to measure and quantify those behaviors. Think feelings vs. figures.

How long does a marketing research project typically take?

It varies wildly depending on the scope and complexity, from a few weeks for a small project to several months for larger, more involved studies. Think marathon, not sprint.

What software is commonly used for data analysis in marketing research?

Popular choices include SPSS, SAS, R, and even Excel for simpler analyses. The right tool depends on the project’s size and complexity – and your level of spreadsheet-fu.