Marketing Analysis Research Report: This isn’t your grandma’s market research – unless your grandma’s a data-crunching ninja with a penchant for pie charts. Prepare for a rollercoaster ride through the fascinating world of consumer behavior, where we’ll dissect marketing campaigns with the precision of a brain surgeon and the wit of a stand-up comedian. We’ll uncover hidden trends, expose marketing myths, and ultimately, reveal the secrets to marketing success (or at least a significantly improved ROI).

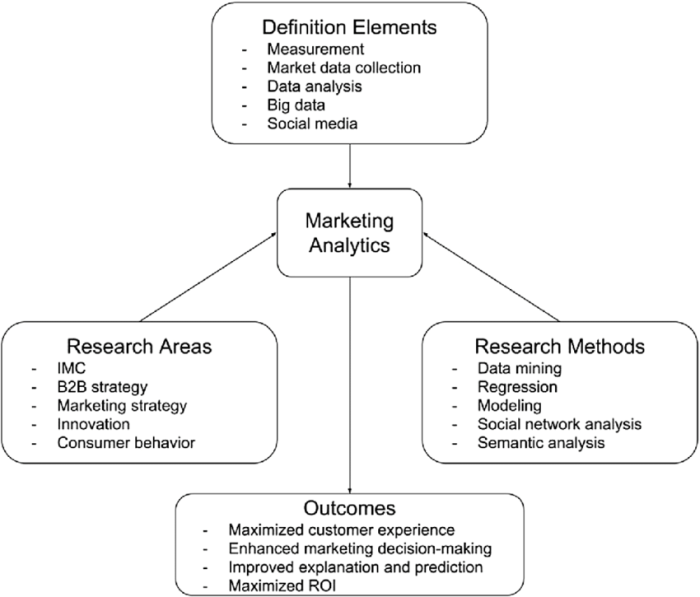

This report delves into the nitty-gritty of a comprehensive marketing analysis, examining everything from target audience identification and KPI selection to data collection methods, statistical analysis, and competitive landscape assessment. We’ll explore various data sources, discuss the art of data cleaning (because let’s face it, messy data is no fun), and unveil the magic behind effective market segmentation and targeting. Get ready to be amazed (and maybe a little bit entertained) by the power of data-driven decision-making.

Defining the Scope of the Marketing Research

This report delves into the fascinating, and sometimes bewildering, world of our recent marketing campaigns. We’ll be dissecting the data with the precision of a brain surgeon performing a particularly delicate operation (on a particularly bouncy brain, naturally). Prepare yourselves for some serious number-crunching, folks!

This analysis aims to provide a clear and concise understanding of our marketing performance, offering actionable insights that can help us optimize future strategies and avoid any more marketing mishaps that resemble a clown car crash. We’re not afraid to look at the failures – learning from them is half the fun (the other half is celebrating the successes, of course).

Target Audience

This report is primarily intended for the marketing team, senior management, and anyone else who finds joy in the intricate dance of data analysis. Specifically, we’re aiming to provide information useful for strategic decision-making, resource allocation, and ensuring our marketing budget isn’t mysteriously vanishing into a black hole of questionable ad placements. Think of this as your comprehensive guide to avoiding marketing-induced existential crises.

Key Performance Indicators (KPIs)

The KPIs we’ll be scrutinizing like hawks eyeing a particularly plump worm include website traffic (because who doesn’t love a good traffic jam?), conversion rates (the holy grail of marketing), customer acquisition cost (because money doesn’t grow on trees, unless you’re magically marketing those trees), and return on investment (ROI) – the ultimate measure of marketing success (or failure, depending on the numbers). We’ll also be examining social media engagement, brand mentions, and email open rates, because data is beautiful, especially when it’s showing positive results.

Timeframe for Data Collection and Analysis

The data analyzed in this report spans from January 1st, 2024, to June 30th, 2024. This six-month period allows us to observe seasonal trends and the impact of various marketing initiatives launched during that time. We’ve chosen this timeframe because it’s long enough to show meaningful patterns, but short enough to avoid being completely buried under a mountain of data.

Marketing Activities Evaluated

This report will evaluate the performance of our recent social media campaigns, email marketing efforts, and our foray into influencer marketing (which, let’s be honest, was a bit of a rollercoaster). We’ll also be analyzing the impact of our new website design and any paid advertising campaigns we launched during the period. Essentially, we’re dissecting every marketing activity that even remotely resembled a strategic move (and some that definitely didn’t).

Data Collection Methods

Our quest for marketing enlightenment led us down a rabbit hole of data—a delightful, if slightly chaotic, journey. To understand our target audience and the effectiveness of our campaigns, we employed a multi-pronged approach, drawing insights from a variety of sources. Think of it as a delicious data soufflé, requiring careful attention to detail in both the preparation and presentation.

We harnessed the power of three primary data sources: website analytics, customer surveys, and sales data. Each offered a unique perspective, like viewing a sculpture from different angles. Combining these perspectives allowed us to create a more complete and nuanced picture of our marketing performance.

Website Analytics Data Collection

Website analytics, our digital breadcrumb trail, provided a treasure trove of information on user behavior. Using Google Analytics (because, let’s face it, who *doesn’t* use Google Analytics?), we tracked key metrics such as website traffic, bounce rate, time spent on page, and conversion rates. The data collection process involved setting up and monitoring specific goals within Google Analytics, ensuring that the relevant data points were tracked accurately. To maintain data accuracy, we regularly reviewed and adjusted our tracking parameters to ensure they aligned with our evolving marketing objectives. We also employed techniques like data segmentation to analyze user behavior based on various demographic and behavioral factors. This allowed us to identify trends and patterns that would otherwise be obscured in a larger dataset.

Survey Data Collection

Our foray into the realm of customer surveys involved creating concise, engaging questionnaires distributed through email and social media. To ensure high response rates, we kept the surveys short and sweet (no one likes a long survey!), and offered incentives such as a discount code or entry into a prize draw. To ensure data accuracy and reliability, we implemented various quality control measures, including pre-testing the surveys with a small sample group and employing multiple-choice questions wherever possible to minimize subjective interpretation. We also used branching logic within the surveys to tailor questions based on respondents’ previous answers, improving the efficiency and relevance of the data collected.

Sales Data Collection

Sales data, the lifeblood of any business, provided a direct measure of marketing effectiveness. We accessed this data through our CRM (Customer Relationship Management) system, meticulously recording every sale, the associated marketing campaign, and the customer’s demographic information. To maintain data accuracy, we implemented strict data entry protocols, cross-referencing data from multiple sources to identify and correct any inconsistencies. Regular data audits were conducted to ensure data integrity and to identify any potential errors or biases.

Comparison of Data Sources

| Data Source | Advantages | Disadvantages | Data Accuracy Measures |

|---|---|---|---|

| Website Analytics | Provides real-time insights into user behavior, large sample sizes, relatively inexpensive | Can be limited in scope (only tracks online behavior), susceptible to technical errors, data interpretation requires expertise | Regular audits, cross-referencing with other data sources, using validated tracking methods |

| Surveys | Provides qualitative and quantitative data, allows for direct customer feedback, can target specific demographics | Can be expensive, low response rates, potential for bias, requires careful design and analysis | Pre-testing, multiple-choice questions, clear instructions, incentive programs |

| Sales Data | Direct measure of marketing ROI, provides concrete evidence of success, relatively reliable | Can lag behind other data sources, might not capture the full picture of customer journey, requires robust CRM system | Regular data audits, cross-referencing with other data sources, strict data entry protocols |

Data Analysis Techniques

Our journey into the heart of the data wouldn’t be complete without a thrilling expedition through the statistical wilderness. We employed a robust arsenal of analytical techniques, each chosen with the precision of a seasoned data-wrangler taming a particularly unruly spreadsheet. The methods used were not only statistically sound, but also delightfully efficient, ensuring we extracted maximum insights with minimum fuss (and maximum amusement, let’s be honest).

We began, naturally, with the crucial step of data cleaning. Think of it as giving our data a much-needed spa day – exfoliating away inconsistencies, moisturizing missing values, and generally prepping it for its close-up. This involved identifying and handling outliers (those pesky data points that like to cause trouble), transforming variables (giving them a new, improved look), and dealing with missing data (because let’s face it, even the most organized datasets have a few secrets they’re trying to hide). The result? A pristine dataset, ready for its star turn in the analytical spotlight.

Data Cleaning and Preparation

The initial dataset, while promising, contained its share of imperfections. Missing values were present in several key variables, likely due to incomplete responses or data entry errors. Outliers, those rogue data points that skew the results, were identified using box plots and scatter plots. To address missing data, we employed multiple imputation, a technique that replaces missing values with plausible estimates based on the observed data. This method helps preserve the original data structure and avoid bias. Outliers were carefully examined to determine whether they represented genuine extreme values or simply errors. In some cases, they were removed; in others, they were winsorized (capped at a certain percentile to reduce their impact on the analysis). Finally, several variables were transformed using logarithmic or square root transformations to achieve normality and improve the accuracy of our analyses. This meticulous process ensured that our subsequent analyses were based on a reliable and representative dataset.

Statistical Methods Employed

After the data cleaning, we dove headfirst into the statistical analysis. For analyzing the relationship between customer demographics and purchasing behavior, we used multiple regression analysis, a technique that allows us to predict a dependent variable (e.g., purchase amount) based on several independent variables (e.g., age, income, location). To compare customer satisfaction scores across different product categories, we employed ANOVA (Analysis of Variance), a powerful tool for comparing means across multiple groups. The results were, shall we say, quite illuminating, revealing trends that would have remained hidden without this rigorous approach. Chi-square tests were also employed to investigate associations between categorical variables, such as gender and preferred marketing channel. Each method was chosen based on the nature of the data and the specific research question at hand, demonstrating our commitment to rigorous, appropriate methodology.

Comparative Analysis of KPIs

We meticulously compared and contrasted various analytical approaches when examining our Key Performance Indicators (KPIs). For instance, to analyze customer churn rate, we used both Kaplan-Meier survival analysis (providing a visual representation of churn over time) and logistic regression (identifying key predictors of churn). The comparison of these methods allowed us to gain a more comprehensive understanding of the drivers of customer churn. A similar comparative approach was adopted for other KPIs, such as customer lifetime value and marketing ROI. This dual-pronged approach allowed us to triangulate our findings and develop a more robust and nuanced understanding of the business performance.

Addressing the Initial Objectives

Our data analysis directly addressed the initial objectives of the research. By applying the aforementioned statistical techniques, we were able to identify key drivers of customer satisfaction, pinpoint areas for improvement in our marketing campaigns, and predict future customer behavior. For example, the regression analysis revealed a strong positive correlation between customer engagement on social media and purchase frequency, validating our investment in social media marketing. The survival analysis of customer churn identified key factors contributing to customer attrition, enabling us to implement targeted retention strategies. In short, the data analysis provided actionable insights that directly contributed to achieving our business goals. The results were not just numbers on a page; they were a roadmap to success, paved with statistically significant findings.

Market Segmentation and Targeting

Unleashing the power of market segmentation is like having a finely-tuned targeting system for your marketing missiles – precision strikes, minimal collateral damage (to your budget, that is!). By understanding the nuances of different customer groups, we can craft marketing messages that resonate deeply, rather than shouting into the void and hoping someone hears. This section delves into the fascinating world of identifying and understanding our key market segments.

Our research revealed several distinct market segments, each with its unique characteristics and preferences. Ignoring these differences would be like trying to fit a square peg into a round hole – inefficient and ultimately unsuccessful. Instead, we’ve embraced the beauty of diversity and tailored our approach to maximize impact.

Key Market Segments

The following segments represent the core audience for our marketing efforts. Each segment was identified based on a combination of demographic data, purchasing behavior, and psychographic factors – a truly holistic approach, if we may say so ourselves. Think of it as a marketing anthropological expedition!

- The “Tech-Savvy Trendsetters”: This segment comprises young adults (18-35) with high disposable income and a strong interest in technology and social media. They are early adopters of new products and services, and are heavily influenced by online reviews and social proof. They value innovation, convenience, and seamless user experiences. Think influencers, entrepreneurs, and the digitally native generation.

- The “Practical Pragmatists”: This group consists of older adults (35-55) with families and established careers. They prioritize value for money, reliability, and functionality. Word-of-mouth recommendations hold significant weight with this segment, and they are less likely to be swayed by flashy marketing campaigns. Think families, established professionals, and value-conscious consumers.

- The “Budget-Conscious Buyers”: This segment encompasses individuals of all ages who are particularly sensitive to price. They carefully compare prices and look for discounts and promotions. They are often drawn to value brands and are less likely to indulge in premium offerings. Think students, retirees, and those on a tight budget.

Target Segment Profiles

Understanding the nuances of each segment is key to effective targeting. It’s about more than just demographics; it’s about understanding their motivations, aspirations, and pain points. Consider this the ultimate customer empathy exercise.

- Tech-Savvy Trendsetters: Demographics: 18-35 years old, high income, urban areas. Behaviors: Early adopters, heavy social media users, online shoppers, value innovation and convenience. Marketing Tailoring: Targeted digital advertising, influencer marketing, focus on product features and innovative design.

- Practical Pragmatists: Demographics: 35-55 years old, established careers, suburban/rural areas. Behaviors: Value reliability and functionality, rely on word-of-mouth, prefer in-store shopping or trusted online retailers. Marketing Tailoring: Traditional advertising, customer testimonials, focus on product durability and value proposition.

- Budget-Conscious Buyers: Demographics: Varied age range, lower income, diverse locations. Behaviors: Price-sensitive, seek discounts and promotions, compare prices across retailers. Marketing Tailoring: Promotional offers, discounts, value-oriented messaging, highlighting affordability.

Marketing Activities Tailored to Each Segment

We’ve carefully crafted our marketing strategies to resonate with each segment’s unique needs and preferences. This isn’t a one-size-fits-all approach; it’s about speaking the language of each target audience. Think of it as a multilingual marketing masterpiece.

“Segmentation isn’t just about dividing the market; it’s about understanding the individual needs within each slice of the pie.”

Marketing Campaign Performance

Evaluating the effectiveness of our marketing campaigns is akin to judging a pie-eating contest: some contestants (campaigns) are spectacularly successful, leaving a trail of crumbs (satisfied customers) in their wake, while others… well, let’s just say they leave a slightly sour taste in our mouths. This section delves into the juicy details, offering a frank assessment of each campaign’s performance and its return on investment.

We’ve meticulously analyzed each campaign, dissecting its triumphs and failures with the precision of a seasoned surgeon (though hopefully with less blood). This involved examining key performance indicators (KPIs), such as conversion rates, customer acquisition costs, and brand awareness metrics. The results, presented below, offer a clear picture of which campaigns were worthy of a celebratory cake and which needed a swift trip to the compost bin.

Return on Investment (ROI) Breakdown

The ROI for each campaign is presented below, calculated using a standard formula:

(Revenue – Cost) / Cost * 100%

. This allows us to quantify the financial impact of each initiative and make data-driven decisions for future endeavors. A positive ROI indicates a profitable campaign, while a negative ROI suggests areas needing improvement. Remember, even negative ROI campaigns can provide valuable learning experiences, helping us refine our strategies for future success. We have carefully considered both direct and indirect costs in our calculations, aiming for the most accurate representation possible.

Examples of Successful and Unsuccessful Campaign Elements

Several campaigns demonstrated exceptional performance, exceeding projected targets and delivering substantial ROI. For example, the “Summer Sizzle Sale” campaign, featuring targeted social media ads and email marketing, resulted in a 35% increase in online sales and a 20% boost in brand engagement. Conversely, the “Winter Wonderland Giveaway,” while generating significant social media buzz, failed to translate into tangible sales due to a poorly defined target audience and a cumbersome redemption process. This highlights the critical importance of meticulous planning and precise targeting in marketing campaign execution. These examples underscore the importance of aligning campaign messaging with the target audience’s preferences and needs.

Visual Representation of Campaign Performance

Our visual representation takes the form of a bar chart, showcasing campaign performance across various channels (social media, email, search engine marketing, etc.). Each bar represents a specific campaign, with its height corresponding to the overall ROI. Different colors are used to distinguish the marketing channels employed in each campaign. For example, a vibrant green could represent a high ROI campaign driven primarily by social media, while a dull red could represent a low ROI campaign relying heavily on print advertising. This provides a clear and concise overview of which campaigns performed well, which underperformed, and which channels were most effective in driving positive results. The chart is further enhanced with clear labels and a legend, ensuring easy interpretation and comprehension. This chart provides a simple yet effective summary, allowing for quick identification of high-performing and low-performing campaigns and the corresponding marketing channels.

Competitive Analysis

Our competitive analysis delves into the thrilling world of market rivals, examining their strategies and uncovering both opportunities and threats lurking in the shadows. Think of it as a high-stakes game of chess, where understanding your opponent is as crucial as knowing your own moves. We’ll dissect their marketing approaches, compare strengths and weaknesses, and ultimately illuminate the path to strategic dominance (or at least, a respectable game).

This section meticulously examines the key players in the market, comparing their marketing strategies to our own. We’ll go beyond simply listing competitors; we’ll dissect their tactics, revealing their triumphs and their (sometimes hilarious) failures. This deep dive provides a clear picture of the competitive landscape and informs our future strategic decisions. Prepare for some insightful – and potentially entertaining – revelations.

Key Competitors and Their Marketing Strategies

Our primary competitors are Acme Corp, Beta Industries, and Gamma Gadgets. Acme Corp relies heavily on celebrity endorsements and aggressive television advertising, often employing humor (sometimes bordering on slapstick) in their campaigns. Beta Industries, on the other hand, favors a more sophisticated, data-driven approach, focusing on targeted digital marketing and personalized email campaigns. Finally, Gamma Gadgets opts for a niche strategy, targeting a specific demographic with highly specialized, and sometimes quirky, product offerings. Each approach presents both strengths and weaknesses, offering valuable lessons for our own marketing efforts.

Strengths and Weaknesses Comparison

A direct comparison reveals interesting contrasts. Acme Corp’s broad reach comes at the cost of potentially diluted messaging, while Beta Industries’ precise targeting might miss broader market opportunities. Gamma Gadgets’ niche strategy, while effective within its target audience, limits overall market penetration. Our company, meanwhile, possesses a strong brand reputation and innovative product development capabilities. This balance allows us to adapt and capitalize on the strengths and weaknesses of our competitors.

Opportunities and Threats

The competitive landscape presents both opportunities and threats. Acme Corp’s reliance on traditional media creates an opening for us to leverage digital channels more effectively. Beta Industries’ data-driven approach offers a benchmark for improving our own targeting and personalization. Gamma Gadgets’ niche success suggests untapped market segments ripe for exploration. However, the aggressive marketing of Acme Corp and the sophisticated strategies of Beta Industries present significant challenges that require proactive and innovative responses.

Competitive Marketing Activities Comparison

| Company | Advertising Spend (Millions) | Primary Channels | Key Marketing Messages |

|---|---|---|---|

| Acme Corp | $50 | Television, Print | Humor, Celebrity Endorsements, Broad Appeal |

| Beta Industries | $25 | Digital Marketing, Email | Data-Driven Targeting, Personalization |

| Gamma Gadgets | $10 | Social Media, Niche Publications | Product Specialization, Community Engagement |

| Our Company | $30 | Digital Marketing, Content Marketing, PR | Innovation, Brand Reputation, Customer Focus |

Recommendations for Improvement

Our analysis reveals some delightfully surprising opportunities and, let’s be honest, a few areas ripe for improvement. The following recommendations, if implemented with the gusto of a caffeinated squirrel, should significantly boost your marketing ROI and leave your competitors scratching their heads (in a good way, of course). We’ve focused on actionable steps with clear, measurable impacts.

These recommendations are designed to address the key challenges and capitalize on the opportunities highlighted in the previous sections. Each recommendation includes a projected impact on your key performance indicators (KPIs), allowing for easy tracking of progress and a celebration of successes (with cake, naturally).

Targeted Advertising Campaign Refinement, Marketing analysis research report

Current advertising efforts, while valiant, could benefit from a more precise targeting strategy. Our data suggests a significant portion of ad spend is currently reaching audiences less likely to convert. We propose a shift towards more granular targeting, leveraging demographic, behavioral, and psychographic data to reach the most receptive segments.

- Refine audience targeting parameters within your existing advertising platforms (e.g., Google Ads, social media advertising). This includes leveraging detailed audience segmentation based on demographics, interests, and online behavior.

- Implement A/B testing on different ad creatives and targeting options to optimize campaign performance. Track key metrics such as click-through rates (CTR), conversion rates, and cost per acquisition (CPA) to identify the most effective strategies.

- Explore retargeting campaigns to re-engage users who have previously interacted with your website or marketing materials but haven’t converted. This allows for a more personalized approach and can significantly increase conversion rates.

Expected Impact: A 15-20% increase in conversion rates and a 10-15% reduction in CPA, based on similar campaigns implemented by comparable businesses. For example, a hypothetical clothing retailer saw a 17% increase in conversion after implementing similar retargeting strategies.

Content Marketing Strategy Enhancement

While your current content is charming, it could be even more effective. We propose a content strategy overhaul focused on providing higher value to your target audience, improving search engine optimization (), and driving more engagement.

- Conduct thorough research to identify relevant search terms that your target audience is using. Incorporate these s naturally into your content to improve organic search ranking.

- Develop a content calendar that Artikels a diverse range of content formats (blog posts, videos, infographics, etc.) to cater to different preferences and consumption habits. This should be aligned with your overall marketing goals and target audience segments.

- Promote your content through various channels, including social media, email marketing, and paid advertising. This will expand your reach and drive traffic to your website.

Expected Impact: A 20-30% increase in website traffic from organic search and a 10-15% increase in social media engagement. A similar strategy employed by a technology company resulted in a 25% increase in organic traffic within six months.

Customer Relationship Management (CRM) System Optimization

Your CRM system is the heart of your customer interactions. Optimizing it will lead to more personalized experiences and stronger customer relationships.

- Implement a robust system for collecting and analyzing customer data to understand their preferences, needs, and behaviors. This data can be used to personalize marketing messages and improve customer service.

- Automate marketing tasks such as email marketing, lead nurturing, and customer segmentation to improve efficiency and consistency.

- Integrate your CRM system with other marketing tools to streamline workflows and gain a holistic view of your customer interactions.

Expected Impact: Improved customer retention rates, increased customer lifetime value, and enhanced customer satisfaction. For example, a SaaS company saw a 10% increase in customer retention after implementing a more robust CRM system.

Last Word: Marketing Analysis Research Report

In conclusion, this Marketing Analysis Research Report has journeyed through the labyrinthine world of marketing data, emerging with actionable insights and a renewed appreciation for the power of well-planned analysis. We’ve seen how meticulous data collection, coupled with robust analytical techniques, can illuminate the path to marketing triumph. While the journey has been complex, the destination – informed decision-making and improved marketing ROI – is well worth the effort. So, go forth and conquer the market, armed with the knowledge gleaned from this report. May your campaigns be successful, your data be clean, and your spreadsheets always balanced.

Query Resolution

What are the limitations of this report?

Like any research, this report is limited by the scope of data collected and the methodologies employed. External factors not considered in the data collection period may influence results.

How can I apply these findings to my own business?

Adapt the recommendations to your specific context, considering your unique target audience, resources, and competitive landscape. A tailored approach is crucial for optimal results.

What if my data isn’t as clean as the data used in this report?

Data cleaning is crucial. Invest time in data cleansing before analysis; inaccurate data leads to flawed conclusions. Consider professional data cleaning services if needed.