Market share research reports: These aren’t your grandma’s pie charts! They’re the thrilling, data-driven narratives of corporate combat, where companies clash for dominance, armed with nothing but spreadsheets and insightful analysis. This exploration delves into the fascinating world of market share reports, uncovering the secrets behind their creation, interpretation, and ultimately, their power to shape business strategy. We’ll navigate the treacherous waters of data collection, conquer the peaks of insightful visualization, and even survive the occasional statistical earthquake.

From understanding the various types of reports and their key components to mastering the art of interpreting key metrics, we’ll leave no data point unturned. We’ll examine the diverse methodologies employed in gathering and analyzing data, compare and contrast different data sources, and address the inherent challenges of accessing and utilizing this valuable information. Prepare for a journey that’s both enlightening and, dare we say, entertaining.

Defining Market Share Research Reports

Market share research reports, in their purest form, are the delicious, data-driven desserts of the business world. They provide a sweet, insightful glimpse into the competitive landscape, revealing which companies are gobbling up the largest slices of the market pie. These reports aren’t just for number crunchers; they’re vital for strategic decision-making, from product development to marketing campaigns. Think of them as your crystal ball, albeit one filled with meticulously researched statistics rather than mystical fog.

Market share research reports come in a variety of flavors, each catering to a specific need. They’re not all created equal; some are quick, bite-sized summaries, while others are extensive, multi-layered analyses. The choice depends on the appetite of the consumer (or client, in this case).

Types of Market Share Research Reports

The type of market share report needed hinges on the specific questions being asked. A concise overview might suffice for a quick check-in, while a more detailed report is essential for complex strategic planning. For example, a company launching a new product might require a comprehensive report detailing competitor strengths and weaknesses, whereas a company simply monitoring its own performance might only need a quarterly summary. This variety ensures that businesses of all sizes can find the perfect fit.

Key Components of a Comprehensive Market Share Report

A truly comprehensive market share report is more than just numbers; it’s a narrative. It should tell a compelling story about the market, its players, and the dynamics at play. A well-structured report includes an executive summary (the appetizer, if you will), a detailed market overview (the main course), competitor analysis (the side dish), and a conclusion with recommendations (the dessert, of course). Market sizing, growth forecasts, and key trends are crucial ingredients, ensuring a balanced and informative meal. Furthermore, methodology sections provide transparency and allow readers to assess the reliability of the findings.

Data Collection and Analysis Methodologies

The data used to create these reports isn’t conjured from thin air; it’s meticulously gathered and analyzed using various methods. Primary research methods, such as surveys and interviews, provide firsthand insights directly from consumers and industry experts. These methods are like going straight to the source – interviewing the bakers themselves to understand the secret ingredient of their delicious pies. Secondary research, on the other hand, involves analyzing existing data from sources like industry publications, government reports, and company financials. This is like carefully studying recipes from renowned culinary experts. Sophisticated analytical techniques, such as regression analysis and statistical modeling, are then employed to interpret this data and draw meaningful conclusions. Think of this as the final step of perfecting the recipe through rigorous testing and refinement. The combination of both primary and secondary data provides a robust and reliable foundation for the report’s conclusions.

Sources of Market Share Data

Unraveling the mysteries of market share often feels like a thrilling treasure hunt, except the treasure isn’t gold doubloons, but valuable insights into consumer behavior and market dynamics. The quest begins with identifying the sources of this precious data, each with its own quirks and reliability. Navigating this landscape requires a keen eye and a healthy dose of skepticism – after all, not all shiny data is gold.

The primary sources of market share data are diverse and, frankly, sometimes a bit chaotic. Think of it as a bustling marketplace where different vendors offer their wares, each with varying levels of trustworthiness. We’ll explore these sources, examining their strengths and weaknesses, because understanding the origin of your data is as crucial as the data itself.

Company Internal Data, Market share research reports

Internal data, such as sales figures, customer relationship management (CRM) data, and production records, provides a valuable – albeit limited – perspective on market share. While this data offers a clear view of a company’s own performance, it lacks the broader context necessary for a complete market share analysis. For example, a company might boast high sales figures, but without data on competitors’ sales, it’s impossible to determine their true market share. The reliability is high regarding the company’s own performance, but the accuracy in representing the entire market is significantly lower. Accessing this data is generally straightforward, but its usefulness is intrinsically bound to the company’s own operational capabilities and data collection practices.

Industry Associations and Trade Groups

Industry associations and trade groups often collect and publish market share data, drawing on their member companies’ contributions. This data can offer a more comprehensive view than internal company data, but its accuracy depends heavily on the participation rate of member companies. If key players withhold information or the association’s methodology is flawed, the resulting data can be skewed or unreliable. Accessing this data may require membership fees or subscriptions, adding another layer of complexity. Think of it as a club – the more members who contribute, the more accurate the overall picture.

Market Research Firms

Market research firms, such as Nielsen, IRI, and Statista, are the titans of market share data. They employ sophisticated methodologies and extensive data collection networks to provide detailed market analyses. Their data is generally considered highly reliable and accurate, but comes at a premium price. Accessing their reports and datasets requires substantial financial investment, making it inaccessible to many smaller businesses. The reliability and accuracy are typically high, but the cost can be a significant barrier. These firms are essentially the experienced treasure hunters, but their services come with a hefty price tag.

Government Agencies and Public Data Sources

Government agencies and public data sources, such as the U.S. Census Bureau or Eurostat, can provide valuable macroeconomic data that indirectly informs market share analysis. This data, while freely available, often requires significant processing and interpretation to extract relevant market share insights. The reliability is usually high, but the data might not be specifically focused on market share, requiring extra effort to derive meaningful conclusions. Think of it as a treasure map – it provides clues, but you still need to do the digging.

Challenges in Accessing and Utilizing Market Share Data

The quest for accurate market share data is not without its obstacles. Cost is a major factor, with some high-quality data sources commanding substantial fees. Data inconsistency across different sources can lead to conflicting interpretations. Furthermore, the dynamic nature of markets means that data can quickly become outdated, necessitating frequent updates and analyses. Finally, the interpretation of data requires statistical expertise and a deep understanding of the market context to avoid drawing misleading conclusions. In short, it’s a challenging but rewarding adventure.

Interpreting Market Share Data

Interpreting market share data is like deciphering an ancient scroll – rewarding, but requiring a keen eye and a healthy dose of skepticism. While seemingly straightforward, the numbers can be misleading if not analyzed carefully, considering various factors and potential biases. Understanding the nuances is key to extracting valuable insights and making informed business decisions.

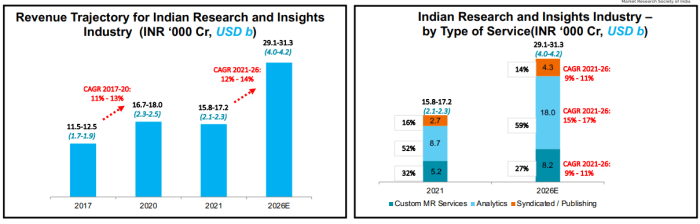

Market share reports typically present key metrics such as market share percentage, year-over-year growth, and revenue figures. These metrics, when viewed in isolation, can paint a rosy (or terrifying) picture, but a deeper dive reveals a more complex reality. For instance, a high market share doesn’t automatically translate to profitability, and rapid growth might be unsustainable. The context is crucial.

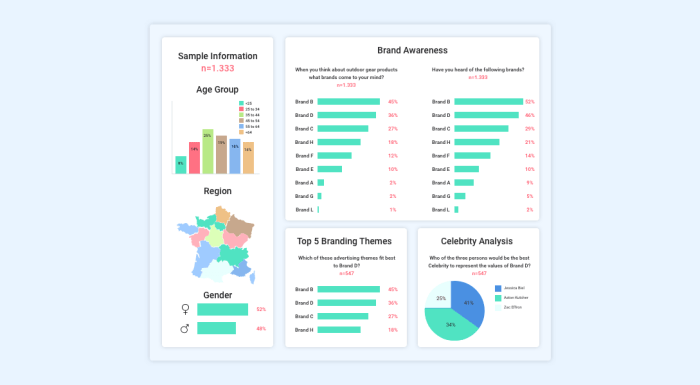

Visualizing Market Share Data

Visual representations are indispensable for understanding market share dynamics. Charts and graphs transform complex data into easily digestible formats, revealing trends and patterns that might be missed in raw numbers. A simple bar chart, for example, clearly shows the relative market share of different companies. A line graph illustrates the year-over-year growth trajectory, highlighting periods of expansion or contraction. Pie charts provide a quick visual representation of the overall market distribution. More sophisticated visualizations, such as bubble charts (combining size and color to represent multiple variables), can offer even richer insights.

Market Share Breakdown: A Fictional Example

The following table showcases a hypothetical market share breakdown for the incredibly competitive “Self-Inflating Unicorn Slipper” industry. Note the discrepancies between market share and revenue; Company A dominates in share but not in total revenue. This highlights the importance of looking beyond simple percentages.

| Company Name | Market Share (%) | Year-over-Year Growth (%) | Revenue (USD Millions) |

|---|---|---|---|

| Company A | 45 | 5 | 20 |

| Company B | 25 | 12 | 25 |

| Company C | 15 | -2 | 10 |

| Company D | 10 | 8 | 8 |

| Others | 5 | 3 | 2 |

Limitations of Market Share Data

While market share data offers valuable insights, relying solely on it for strategic decision-making can be perilous. Market share doesn’t tell the whole story. Several limitations exist:

Firstly, market share figures often rely on estimations and may not be entirely accurate, particularly in rapidly evolving markets. Secondly, focusing solely on market share can lead to neglecting other crucial factors such as profitability, customer satisfaction, and brand reputation. A company with a small market share might still be highly profitable due to premium pricing or efficient operations. Finally, market share doesn’t predict future performance. A company with a dominant market share today might face significant challenges tomorrow due to disruptive innovation or changing consumer preferences. Consider the rise of smartphones and the subsequent decline of feature phones – a stark reminder that even market leaders are not immune to the winds of change.

Applications of Market Share Research Reports

Market share reports, those delightful nuggets of competitive intelligence, aren’t just pretty charts and graphs; they’re the secret weapon in a business’s arsenal. They offer invaluable insights that can transform strategic planning from a hopeful guess into a well-informed, data-driven victory march. Understanding how to leverage these reports is the key to unlocking sustainable growth and competitive advantage. Think of them as your business’s crystal ball, but instead of hazy predictions, you get clear, actionable data.

Market share data is a powerful tool for strategic planning and decision-making, offering a clear picture of a company’s position within its market. This information allows businesses to identify areas of strength and weakness, informing resource allocation and strategic initiatives. The insights gleaned are not just for the boardroom; they permeate every aspect of a company’s operations, from product development to marketing campaigns. Ignoring market share data is akin to navigating a ship without a compass – you might get lucky, but the chances of hitting an iceberg are significantly higher.

Identifying Opportunities and Threats Using Market Share Data

Analyzing market share trends reveals emerging opportunities and potential threats. For instance, a company observing a significant increase in a competitor’s market share in a specific product segment might identify a need to innovate or improve its offerings in that area. Conversely, a declining market share might indicate the need for a strategic shift, such as exploring new market segments or revamping marketing strategies. Let’s say a fictional company, “Widget Wonders,” notices a rival’s sudden success with a smaller, eco-friendly widget. This signals a potential market shift towards sustainability, offering Widget Wonders an opportunity to develop their own eco-friendly line, rather than continuing to focus solely on their existing larger, less environmentally conscious model. The threat is losing market share to the competitor; the opportunity is to capitalize on the growing eco-conscious market.

Market Share Data Informing Product Development

Imagine a scenario where a beverage company, “Fizzical,” analyzes market share data and discovers a significant untapped segment of consumers seeking low-sugar, naturally flavored sparkling water. Their own market share in this segment is minimal. This data directly informs their product development strategy. Fizzical can leverage this information to develop new product lines targeting this specific consumer need, potentially leading to increased market share and revenue. The development of these new, low-sugar, naturally flavored sparkling waters is a direct result of market share analysis showing a gap in the market and the company’s relatively small presence within it. This demonstrates how data can drive innovation and strategic product development, preventing costly mistakes of creating products nobody wants.

Market Share Report Case Studies: Market Share Research Reports

Market share reports, when properly understood and utilized, can be the difference between a thriving business and one desperately clinging to relevance. They offer a crystal ball, albeit a slightly hazy one, into the competitive landscape, allowing businesses to make informed, data-driven decisions. Let’s delve into some illustrative examples, showcasing both the triumphs and pitfalls of market share analysis.

Fictional Case Study: The Triumph of “Fluffy Clouds” Marshmallows

Fluffy Clouds Marshmallows, a small but ambitious company, found themselves struggling against established giants in the confectionery market. Their market share was a paltry 2%, dwarfed by “Marshmallow Mania’s” dominant 60%. A comprehensive market share report revealed a surprising niche: a significant segment of consumers craved organic, locally-sourced marshmallows. Fluffy Clouds, capitalizing on this insight, launched a line of organic marshmallows using locally sourced sugar cane. This targeted approach, directly informed by the market share data, resulted in a remarkable 15% increase in market share within a year, proving that even David can topple Goliath with the right information. The report clearly highlighted a gap in the market, a gap that Fluffy Clouds cleverly exploited, highlighting the importance of detailed segmentation analysis in market share reports.

Comparative Case Study: Success and Failure in Market Share Interpretation

Let’s compare Fluffy Clouds’ success with the fictional case of “Zoom Zoom Scooters,” a company that misinterpreted its market share data. Zoom Zoom, initially boasting a 10% market share in the electric scooter market, saw a slight dip to 9% in the following quarter. Instead of investigating the reasons for this minor decline (perhaps a competitor launched a similar, slightly cheaper model), Zoom Zoom panicked. They launched a drastically redesigned scooter, alienating their loyal customer base and confusing potential new customers. Their market share plummeted to 4%, a stark contrast to Fluffy Clouds’ strategic growth. This case study underscores the critical need for a nuanced understanding of market share data, considering external factors and avoiding knee-jerk reactions based on superficial interpretations. The Zoom Zoom case exemplifies how a failure to contextualize market share data can lead to disastrous outcomes, whereas the Fluffy Clouds case showcases the potential for strategic growth when market share analysis is used thoughtfully.

Key Takeaways and Lessons Learned

These case studies demonstrate the power—and potential peril—of market share reports. Successful utilization hinges on careful analysis, contextual understanding, and a strategic approach to leveraging the insights gained. Simply observing a change in market share is insufficient; a thorough investigation into the underlying reasons for those changes is crucial. Moreover, reacting to market share fluctuations without a comprehensive understanding of the competitive landscape and consumer behavior can be detrimental. The success of Fluffy Clouds and the failure of Zoom Zoom serve as powerful reminders of the importance of informed decision-making, based on a complete and accurate interpretation of market share data.

Future Trends in Market Share Research

The crystal ball is a bit hazy, but peering into the future of market share research reveals a fascinating landscape of evolving methodologies and technological advancements. Gone are the days of relying solely on dusty spreadsheets and painstaking manual data entry; the future is faster, more insightful, and frankly, a little less prone to accidental coffee spills on crucial datasets.

The rapid evolution of data collection and analysis techniques is transforming how we understand market dynamics. This shift is driven by the increasing availability of data, the development of sophisticated analytical tools, and a growing need for real-time insights in an increasingly competitive marketplace. The sheer volume of data now available, from social media interactions to IoT device usage, presents both exciting opportunities and significant analytical challenges.

Emerging Data Collection and Analysis Trends

The integration of alternative data sources, such as social media sentiment analysis and web scraping, is becoming increasingly common. This allows researchers to gain a more holistic understanding of consumer behavior beyond traditional survey methods. For example, analyzing social media posts about a particular product can reveal valuable information about consumer perception and brand loyalty, providing a richer picture than sales figures alone. Furthermore, advanced statistical modeling and machine learning algorithms are being used to identify complex patterns and relationships within massive datasets, allowing for more accurate predictions and more nuanced interpretations of market trends. Imagine a model that predicts not just market share, but also the specific demographic segments most likely to switch brands based on a competitor’s new product launch – now *that’s* predictive power.

Challenges and Opportunities in Market Share Research

The increasing complexity of data necessitates the development of more robust and sophisticated analytical tools. This presents a significant challenge, requiring researchers to adapt and acquire new skills in data science and advanced analytics. However, this also presents an incredible opportunity for innovation. The development of new methodologies and tools will lead to more accurate and insightful market share reports, providing businesses with a crucial competitive advantage. For instance, the ability to accurately predict consumer response to pricing changes could significantly improve revenue management strategies. The challenge lies in navigating the ethical considerations surrounding data privacy and ensuring the responsible use of AI-powered analytical tools.

Impact of New Technologies

Artificial intelligence (AI) and big data are revolutionizing market share research methodologies. AI-powered tools can automate data collection, cleaning, and analysis processes, significantly reducing the time and resources required for research. Big data analytics enables researchers to analyze massive datasets, uncovering hidden patterns and insights that would be impossible to detect using traditional methods. For example, AI can identify subtle shifts in consumer preferences based on online search behavior or social media engagement, providing early warning signs of changing market dynamics. Consider a scenario where an AI system detects a surge in online searches for a competitor’s product – a proactive response to this could potentially mitigate market share loss. This proactive approach is a key benefit of incorporating these new technologies.

Last Point

So, there you have it: a whirlwind tour through the captivating world of market share research reports. While the journey might seem daunting at first – filled with graphs, numbers, and the occasional statistical anomaly – understanding these reports empowers businesses to make informed decisions, anticipate market shifts, and ultimately, seize victory in the ongoing battle for market dominance. Remember, a well-analyzed market share report isn’t just a document; it’s a strategic weapon, a crystal ball peering into the future of your business. Use it wisely, and may the odds be ever in your favor.

Answers to Common Questions

What’s the difference between market share and market size?

Market size refers to the overall value or volume of a market, while market share represents a specific company’s portion of that market.

How often should market share reports be updated?

Frequency depends on market dynamics. Fast-paced industries might require monthly updates, while others might suffice with quarterly or annual reports.

Can market share reports predict future performance?

While they offer valuable insights, market share reports are not crystal balls. They inform, but don’t definitively predict future success due to external factors.

What are some common pitfalls to avoid when interpreting market share data?

Beware of focusing solely on market share without considering other crucial factors like profitability, customer satisfaction, and emerging trends. Also, ensure your data sources are reliable and representative of the entire market.