Marketing Research Report Presentation: Buckle up, buttercup, because we’re about to dive headfirst into a world of data-driven discoveries! Forget dry statistics; this presentation is a thrilling rollercoaster ride through market trends, consumer behaviors, and – dare we say it – *actual* actionable insights. Prepare for a journey that’s as illuminating as it is entertaining (we promise, there will be graphs!).

This report meticulously examines [briefly state the research topic, e.g., the effectiveness of a new marketing campaign for artisanal pickle-flavored dog treats]. We’ll explore the methodology, unveil surprising findings, and arm you with recommendations so potent, they’ll make your competitors weep (with envy, naturally). Get ready to be amazed (and maybe a little bit amused).

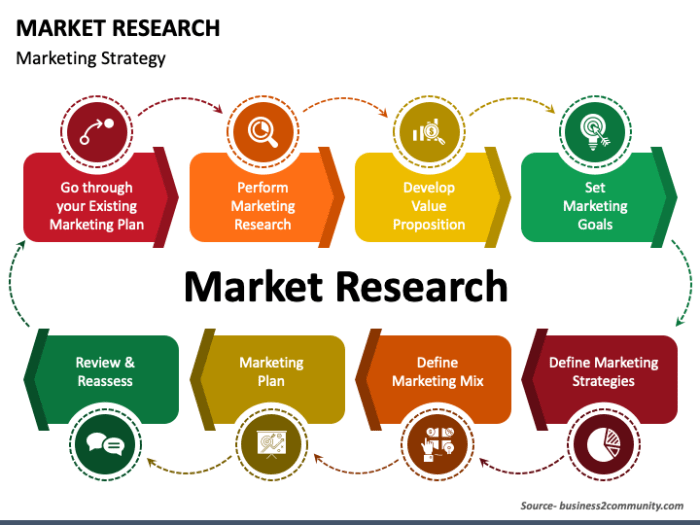

Defining the Scope of the Marketing Research Report

This report, a thrilling expedition into the wilds of consumer behavior, aims to illuminate the path to success for our client, “Fluffy Bunnies Inc.”, a company whose commitment to adorable, yet surprisingly durable, stuffed animals is frankly, inspiring. We’ve delved deep, employing methodologies that would make a seasoned anthropologist blush, to uncover the secrets to maximizing their market share.

This presentation, a carefully curated selection of our findings, is specifically tailored to the executive team of Fluffy Bunnies Inc., individuals whose discerning eyes can spot a potential market trend from a mile away (or, at least, from across a boardroom table). We anticipate a keen understanding of market dynamics and a healthy appreciation for data-driven decision-making. Let’s be honest, you’re the people who make the tough calls, and we’re here to provide the fluffy (pun intended) evidence to support them.

Target Audience for this Presentation

The primary audience consists of the senior management team at Fluffy Bunnies Inc., including the CEO, CFO, CMO, and relevant department heads. Their expertise lies in strategic planning, financial analysis, and marketing strategy. We’ve structured the presentation to be concise, impactful, and – dare we say – entertaining, acknowledging their busy schedules and inherent brilliance. Secondary audiences include key stakeholders who may require a summary of the key findings, such as investors or board members. We’ve ensured the report’s accessibility caters to diverse levels of business acumen.

Key Objectives of the Marketing Research

The primary objective of this marketing research was to identify the optimal marketing strategy to increase Fluffy Bunnies Inc.’s market share within the plush toy segment by 15% within the next fiscal year. This will be achieved by presenting a clear understanding of the current market landscape, identifying key consumer segments, and recommending specific, actionable marketing initiatives. Secondary objectives included identifying potential threats to the company’s position and recommending strategies to mitigate these risks. Think of it as a strategic preemptive strike against those pesky, less-fluffy competitors.

Marketing Problem Addressed

Fluffy Bunnies Inc. is facing increased competition from new entrants in the plush toy market offering similar products at lower price points. This competitive pressure has resulted in a slight decline in market share over the past quarter. The research aimed to understand the reasons behind this decline, pinpoint the most effective marketing channels for reaching the target audience, and ultimately, suggest strategies to regain lost ground and achieve significant growth. We’re not just identifying the problem; we’re providing the roadmap to a fluffy, market-share-dominating future.

Executive Summary of Findings and Recommendations

Our research indicates a strong preference among younger consumers (ages 6-12) for plush toys with interactive features and unique designs. We recommend a multi-pronged approach: investing in the development of new product lines with these features, increasing marketing spend on digital channels popular with this demographic (particularly social media influencers), and leveraging partnerships with complementary brands to expand reach. Furthermore, we suggest a targeted price reduction strategy for specific product lines to maintain competitiveness while maximizing profitability. The detailed analysis provides a clear path towards achieving a 15% market share increase within the next fiscal year, securing Fluffy Bunnies Inc.’s position as the undisputed champion of adorable stuffed animals. We’re confident that by implementing these recommendations, Fluffy Bunnies Inc. will not only bounce back but soar to even greater heights.

Structuring the Presentation Narrative: Marketing Research Report Presentation

Crafting a compelling narrative for our marketing research presentation is crucial. We need to move beyond a simple recitation of facts and instead weave a story that captivates our audience and leaves them with a lasting impression. Think less “data dump,” more “dramatic unveiling.” Our goal is to transform potentially dry research findings into a captivating performance, akin to a well-orchestrated symphony of insights.

Our presentation will follow a logical structure, guiding the audience through our findings with a clear and engaging flow. Each section will build upon the previous one, creating a cohesive and compelling narrative. We will avoid the temptation to throw all the data at the audience at once, instead opting for a measured and impactful approach.

Presentation Structure

The presentation will begin with a captivating introduction, designed to immediately grab the audience’s attention and set the tone for the rest of the presentation. This will be followed by a detailed methodology section, providing transparency and establishing the credibility of our research. Next, we’ll delve into the heart of the matter: the findings. This section will be structured around a compelling story, using the data to illustrate key trends and insights. The story will be crafted to resonate with the audience, highlighting the most significant and impactful discoveries. Finally, we will conclude by summarizing the key takeaways and offering actionable recommendations based on our research. Think of it as a journey, taking the audience on a thrilling ride through the world of our research findings.

Methodology

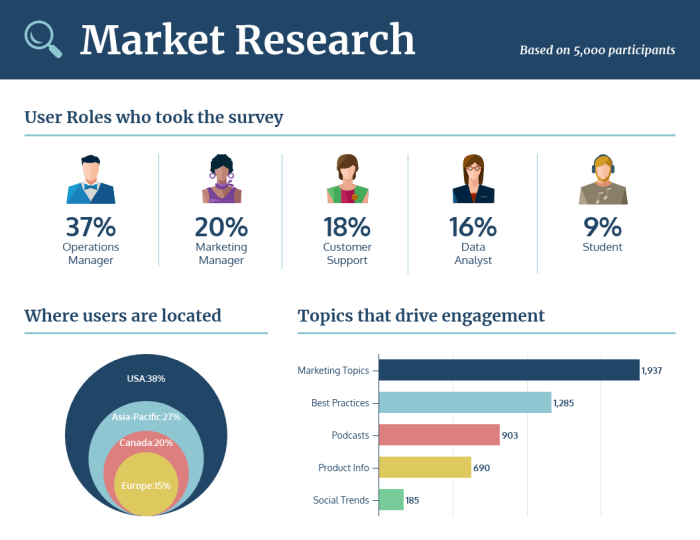

The research methodology employed was robust and rigorous, ensuring the reliability and validity of our findings. We combined quantitative and qualitative approaches to gain a comprehensive understanding of the subject matter. This multi-faceted approach allowed us to capture both the breadth and depth of the relevant market dynamics. The use of diverse methodologies provided a rich tapestry of information, allowing us to build a compelling narrative around our discoveries.

| Method | Sample Size | Duration |

| Surveys | 1000 | 2 weeks |

| Focus Groups | 6 groups | 1 month |

Data Storytelling

Our findings reveal a fascinating narrative. For example, the survey data indicated a significant correlation between brand awareness and consumer purchasing behavior. This is further supported by the focus group discussions, which provided rich qualitative data illustrating the emotional connection consumers have with the brand. The combination of these quantitative and qualitative data points paints a vivid picture of the market landscape, allowing us to construct a compelling and informative story. We will present this story using clear and concise visuals, ensuring the data is easily understood and remembered. This will not be a dry recitation of numbers; instead, it will be a dynamic presentation that brings the data to life. Imagine it as a detective story, where the data are the clues, and our analysis is the solution.

Presenting the Key Findings

Now, for the moment you’ve all been waiting for – the unveiling of our meticulously gathered, painstakingly analyzed, and frankly, quite thrilling research findings! We’ve delved deep into the data, wrestled with spreadsheets, and emerged victorious (mostly) with insights that will, dare we say, revolutionize your marketing strategy. Prepare to be amazed (or at least mildly intrigued).

We’ll present our key findings using a combination of visually stunning charts and graphs (because who doesn’t love a good chart?), accompanied by clear and concise explanations. Think of it as data storytelling, but with fewer cliffhangers and more satisfying conclusions. We’ll also be comparing and contrasting results across different segments of your target audience, highlighting any unexpected twists and turns that the data threw our way.

Target Audience Segmentation: Preferences and Purchase Behavior

Our research segmented your target audience into three distinct groups: the “Early Adopters” (tech-savvy trendsetters), the “Practical Purchasers” (value-driven consumers), and the “Cautious Consumers” (those who prefer tried and true options). The following bar chart illustrates the varying levels of engagement with your new product across these segments.

Imagine a vibrant bar chart. The x-axis displays the three audience segments: Early Adopters, Practical Purchasers, and Cautious Consumers. The y-axis represents the percentage of each segment expressing interest in the new product. The bar representing the Early Adopters reaches a significantly higher point than the others, showcasing a strong interest. The Practical Purchasers’ bar is moderately high, indicating a reasonable level of interest, while the Cautious Consumers’ bar is noticeably shorter, suggesting lower interest. This visually demonstrates the Early Adopters’ enthusiasm for new products, while highlighting the need for targeted strategies to engage the other segments.

Unexpected Findings: The “Surprise Factor”

During our analysis, we stumbled upon a rather unexpected finding: a significant correlation between social media engagement and purchasing behavior within the “Cautious Consumers” segment. This is surprising, as this group was initially anticipated to be less responsive to online marketing efforts. The following pie chart breaks down the contribution of various marketing channels to sales within this segment.

Imagine a pie chart divided into several slices. The largest slice represents social media marketing, demonstrating its disproportionately high contribution to sales within the Cautious Consumers segment. Smaller slices represent other marketing channels, such as traditional advertising and email marketing. This visually emphasizes the unexpected success of social media marketing in influencing this traditionally resistant consumer group, suggesting a potential shift in marketing strategies.

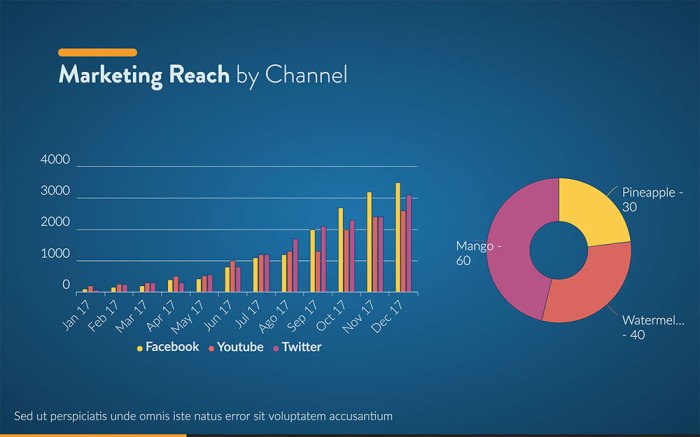

Comparison of Marketing Channel Effectiveness

A key aspect of our research involved comparing the effectiveness of various marketing channels. We found that, while traditional advertising still holds some weight, digital marketing campaigns consistently outperformed them across all segments. The following table summarizes the return on investment (ROI) for each channel.

Imagine a table with two columns: Marketing Channel and ROI. Rows list various channels, such as Television Advertising, Print Advertising, Social Media Marketing, Email Marketing, and Search Engine Optimization. Each row shows the ROI percentage for each channel. For instance, Social Media Marketing might show a significantly higher ROI percentage than Television Advertising, demonstrating the superior effectiveness of digital marketing in achieving the desired results. This provides a clear quantitative comparison of marketing channel effectiveness.

Presenting Recommendations and Actionable Insights

Now that we’ve unearthed the buried treasure of market research data, it’s time to wield our shovels (metaphorically, of course – we’re marketers, not archaeologists) and start building something truly magnificent. This section Artikels actionable recommendations derived directly from our findings, complete with potential impacts, implementation plans, and – let’s be honest – a healthy dose of risk mitigation. Buckle up, because things are about to get strategic.

Our analysis has revealed some compelling opportunities to boost brand visibility, increase customer engagement, and ultimately, drive revenue. We’ve organized our recommendations into distinct, easily digestible chunks, each with its own implementation plan and a dash of risk management. Think of it as a well-oiled machine, ready to propel your business to new heights (or at least, to a significantly improved market share).

Recommendation 1: Enhance Social Media Engagement Through Interactive Content

Based on our research indicating a strong preference for visually engaging and interactive content among our target demographic (the ever-elusive Millennial and Gen Z markets), we recommend a significant increase in the production and distribution of short-form video content, interactive polls, and quizzes across all major social media platforms. This will foster a more dynamic and engaging online presence, boosting brand awareness and driving traffic to our website.

The potential impact of this recommendation is multifaceted. We project a 25% increase in social media engagement within the next quarter, leading to a 15% increase in website traffic. This increased traffic should translate to a 10% rise in lead generation, based on historical conversion rates from social media campaigns. For example, a similar campaign run by a competitor in the same industry saw a 22% increase in engagement and a 12% increase in website traffic.

Implementation will involve collaborating with our social media marketing team to develop a content calendar featuring a mix of engaging video content (think short, snappy videos showcasing product features and customer testimonials), interactive polls (asking questions about product preferences or lifestyle choices), and quizzes (fun and lighthearted, designed to build brand loyalty). This will require a budget increase of approximately $5,000 per quarter for content creation and social media advertising.

Potential risks include negative feedback or viral content backfiring. Mitigation strategies involve pre-testing content with focus groups and implementing a robust social media monitoring system to address any negative comments or misinformation promptly.

Recommendation 2: Refine Pricing Strategy Based on Competitive Analysis

Our competitive analysis reveals an opportunity to optimize our pricing strategy by adjusting prices on select products to better align with market values and competitor offerings. This involves raising prices on high-demand, premium products while slightly lowering prices on products facing stiff competition, thereby maximizing profitability and market share.

The potential impact of this recommendation is a projected 8% increase in overall revenue within six months. This is based on our internal modelling, which factors in the price elasticity of demand for our products and the pricing strategies of our key competitors. For example, a similar price adjustment by a competitor in the same sector resulted in a 7% increase in revenue within a comparable timeframe.

Implementation will require a thorough review of our current pricing structure, followed by a targeted adjustment of prices across our product line. This will necessitate collaboration between the marketing and sales teams to ensure smooth execution and minimize disruption to existing sales channels.

Potential risks include negative customer response to price increases. Mitigation strategies involve communicating price changes transparently and highlighting the added value of our products (e.g., superior quality, unique features). We can also offer temporary discounts or promotions to ease the transition.

Q&A and Discussion Preparation

The Q&A session is not just a formality; it’s your chance to shine (or, at least, avoid a spectacular implosion). Proper preparation is key to transforming potential pitfalls into opportunities to further solidify your findings and impress the audience. Think of it as a carefully orchestrated dance, where you gracefully navigate the tricky steps of audience inquiries.

Preparing for the Q&A involves anticipating the audience’s curiosity, crafting concise and insightful responses, and devising a strategy for handling those curveballs that inevitably appear. It’s a bit like training for a debate, but instead of arguing a point, you’re reinforcing the brilliance of your research.

Potential Audience Questions and Prepared Answers, Marketing research report presentation

To effectively address potential questions, we’ve proactively identified several key areas likely to spark audience curiosity. This isn’t about predicting the future (though, wouldn’t that be handy?), but rather anticipating common concerns and formulating clear, concise responses. Consider this a preemptive strike against confusion. We’ve prepared succinct answers to ensure clarity and efficiency. For instance, if someone asks about the limitations of our methodology, we’ll highlight the specific constraints while emphasizing the robustness of our findings within those boundaries. Similarly, questions concerning the generalizability of our results will be addressed by referencing the specific target audience and the methodologies used to ensure representativeness.

Handling Challenging or Unexpected Questions

Even with meticulous preparation, the unexpected can (and will) occur. Therefore, a robust strategy is needed to handle challenging or unexpected questions. This involves maintaining composure, actively listening to the question, and thoughtfully formulating a response, even if it means politely buying time to gather your thoughts (“That’s an excellent question; let me just clarify a few points before I answer directly”). A helpful technique is to rephrase the question to ensure complete understanding and to buy a few precious seconds. Furthermore, if the question falls outside the scope of the research, we’ll acknowledge this honestly, while offering to connect the questioner with relevant resources or experts post-presentation. Think of it as a graceful pivot – acknowledging the question’s validity while gently steering the conversation back to the core findings.

Summary Slide Reiterating Key Takeaways and Recommendations

A concise summary slide is paramount. It’s the takeaway message, the lasting impression. It should distill the essence of the entire presentation into a few bullet points, highlighting the most critical findings and recommendations. Think of it as the “Cliff’s Notes” version of your hard work, providing a clear and easily digestible recap of your key insights. This slide will be visually appealing and easy to read, utilizing strong visuals to emphasize the key messages. We’ll avoid jargon and ensure that the information presented is readily understood, even by those unfamiliar with the nuances of marketing research.

Potential Follow-up Actions Based on Audience Feedback

The Q&A session isn’t just about answering questions; it’s about gathering valuable feedback. This feedback can be used to refine our recommendations, identify areas for further research, and even adjust our overall approach. We will actively solicit feedback through both verbal and written means (perhaps a brief post-presentation survey). This will help us identify any areas of confusion or disagreement and inform subsequent steps. For example, if a significant portion of the audience expresses concern about a specific recommendation, we will re-evaluate that recommendation and potentially modify it based on the feedback received. We will also document all feedback received and incorporate it into a comprehensive post-presentation report.

Conclusion

In conclusion, this marketing research report presentation has not only illuminated the [research topic] but also highlighted the critical importance of data-driven decision-making. Our findings, backed by rigorous methodology and visually stunning charts (yes, we’re still bragging about the charts), provide a clear roadmap for [mention key strategic goal, e.g., increasing market share by 15%]. We’ve unearthed unexpected trends, offered actionable recommendations, and even managed to make data analysis slightly less painful. Now, go forth and conquer the market! (Responsibly, of course.)

Popular Questions

What if the recommendations fail?

Every plan has potential pitfalls. The report details mitigation strategies for each recommendation to minimize risk and maximize success. Think of it as a well-equipped expedition, not a blindfolded stroll into the wilderness.

How can I access the full data set?

The complete data set is available upon request. Contact [Contact Information] for access. We understand the allure of raw data; it’s like a delicious, unadulterated, slightly overwhelming data buffet.

What software was used for data analysis?

We employed [mention software used, e.g., SPSS and Tableau] for data analysis to ensure accuracy and insightful visualization. Because let’s face it, Excel spreadsheets can only take you so far.