Industrial Sales & Marketing Research Study Report: This comprehensive study delves into the dynamic world of industrial sales and marketing, exploring current trends, effective strategies, and future projections. We’ll uncover the secrets to successful campaigns, navigate the complexities of lead generation, and master the art of crafting compelling sales presentations that resonate with industrial clients. Get ready for a deep dive into the nuts and bolts of boosting your bottom line in this often-overlooked sector.

From analyzing market landscapes and competitive pressures to optimizing CRM systems and measuring ROI, this report provides a practical, insightful guide for professionals seeking to enhance their industrial sales and marketing performance. We’ll examine various sales approaches, digital marketing channels, and the crucial role of data-driven decision-making in achieving sustainable growth within the industrial sector. Prepare to be amazed by the power of strategic industrial marketing!

Market Overview: Industrial Sales & Marketing

The industrial sales and marketing landscape is a fascinating beast – a complex ecosystem where B2B relationships are forged in the fires of technical specifications and nurtured with the gentle touch of personalized service. Forget catchy jingles and viral videos; here, success hinges on demonstrating tangible value and building trust. It’s a world where a well-placed technical white paper can be more effective than a Super Bowl ad.

The current state of the industry is one of dynamic change, driven by technological advancements, evolving customer expectations, and a globalized marketplace. Competition is fierce, and the need for sophisticated strategies is paramount. It’s a bit like a high-stakes game of industrial-strength chess, where every move needs to be calculated and precise.

Major Trends Shaping the Industrial Sales and Marketing Landscape

Three significant trends are currently reshaping the industrial sales and marketing landscape: the rise of digitalization, the increasing importance of data analytics, and the growing demand for personalized customer experiences. These trends are not merely buzzwords; they represent fundamental shifts in how businesses operate and interact with their clients.

Examples of Successful Industrial Marketing Campaigns

While specific details of successful campaigns are often proprietary, we can analyze general approaches. One successful strategy involves leveraging case studies to showcase the tangible benefits of a product or service. Imagine a compelling case study detailing how a new industrial lubricant reduced downtime for a major manufacturing plant by 15%, resulting in significant cost savings. This kind of concrete evidence speaks volumes to potential clients. Another successful approach is content marketing. Creating informative and engaging content such as white papers, webinars, and blog posts establishes thought leadership and attracts potential customers organically. A final successful tactic is personalized email marketing, focusing on segmented audiences with tailored messages. This is not a “one-size-fits-all” approach; rather, it demonstrates a deep understanding of individual client needs.

Challenges Faced by Industrial Marketers

Industrial marketers face a unique set of challenges. Long sales cycles, complex decision-making processes, and the need to demonstrate a deep understanding of technical specifications all contribute to the difficulty of the task. Furthermore, reaching and engaging a highly targeted audience can be challenging in a fragmented market. Building trust and credibility is also paramount, as industrial buyers are often risk-averse and demand a high level of assurance before committing to a purchase. Finally, accurately measuring the return on investment (ROI) of marketing activities can be difficult in the absence of readily available, comprehensive data.

Hypothetical Marketing Strategy for a New Industrial Product

Let’s consider a hypothetical scenario: a new type of high-efficiency industrial motor. Our marketing strategy would focus on demonstrating the significant cost savings and environmental benefits this motor offers. This would involve creating detailed case studies showcasing ROI calculations, emphasizing reduced energy consumption and lower carbon emissions. We would also develop a series of technical white papers explaining the motor’s advanced features and benefits, targeting engineers and procurement professionals. Furthermore, a targeted digital marketing campaign, utilizing LinkedIn and industry-specific publications, would focus on reaching key decision-makers. Finally, we would leverage webinars and in-person events to foster relationships and demonstrate the motor’s capabilities in a tangible way. The key is to present a compelling narrative that highlights both the technical superiority and the financial benefits of the product. This approach blends technical expertise with a focus on quantifiable results, a winning combination in the industrial marketplace.

Sales Strategies in the Industrial Sector

Navigating the industrial sales landscape is like traversing a minefield of complex specifications and demanding clients – a thrilling adventure, if you’re into that sort of thing. This section dissects effective sales strategies, transforming the potential minefield into a well-trodden path to success. We’ll explore various approaches, lead generation tactics, and pipeline management techniques that will have your sales team singing the blues…of success, of course.

Different Sales Approaches in Industrial Settings

Industrial sales differ significantly from consumer sales; it’s less about impulse buys and more about meticulously planned, long-term relationships. Three primary approaches dominate: solution selling, consultative selling, and transactional selling. Solution selling focuses on understanding a client’s problem and proposing a tailored solution, often involving multiple products or services. Consultative selling takes this a step further, acting as a trusted advisor and guiding the client through the entire process. Transactional selling, while less common in the industrial sector, focuses on a quick, straightforward sale, often involving standard products. The optimal approach often depends on the specific client, product, and industry. For example, a complex automation system would necessitate a solution or consultative approach, while a simple replacement part might warrant a transactional one.

Effective Lead Generation Techniques for Industrial Products

Generating leads in the industrial sector requires a more strategic approach than simply blasting out generic emails. Effective methods include targeted advertising in industry-specific publications and online platforms (think LinkedIn, not TikTok, unless you’re selling industrial-grade fidget spinners). Attending industry trade shows and conferences provides invaluable networking opportunities. Content marketing, such as creating informative white papers or case studies showcasing successful implementations, can also draw in potential clients. Finally, leveraging existing customer relationships for referrals can be incredibly powerful. Imagine the impact of a satisfied customer recommending your services to a competitor—a true testament to the quality of your product and service.

Qualifying Leads in the Industrial Sector

Qualifying leads in the industrial sector isn’t just about checking boxes; it’s about discerning genuine opportunities from time-wasting distractions. A thorough qualification process considers several factors: budget, authority (does the lead have the power to make purchasing decisions?), need (does the lead genuinely require your product or service?), and timeline (when are they looking to make a purchase?). Failing to properly qualify leads wastes valuable sales resources. Think of it as a preemptive strike against wasted time and effort. Instead of chasing every lead, focus on those most likely to convert.

Managing Industrial Sales Pipelines

Managing an industrial sales pipeline requires a structured approach. A robust CRM system is essential for tracking leads, opportunities, and sales activities. This allows for efficient management of the sales process, from initial contact to closing the deal. Regular pipeline reviews and forecasting are critical for identifying potential bottlenecks and adjusting strategies as needed. A well-managed pipeline ensures a consistent flow of opportunities and prevents any nasty surprises. Visualizing the pipeline (think Kanban board) can be a game-changer, allowing for a clear view of progress at a glance.

Creating a Compelling Sales Presentation for Industrial Clients

Presenting to industrial clients isn’t about dazzling them with flashy graphics; it’s about providing clear, concise, and data-driven information. Focus on the value proposition, demonstrating how your product or service solves their specific problem and delivers a quantifiable return on investment (ROI). Use case studies and testimonials to build credibility and showcase successful implementations. A compelling presentation should be informative, persuasive, and leave the client feeling confident in your ability to meet their needs. Remember, clarity trumps charisma in this context.

Marketing Channels for Industrial Products: Industrial Sales & Marketing Research Study Report

Reaching the right buyer in the industrial sector can feel like searching for a needle in a haystack made of high-strength steel. But fear not, intrepid marketer! This section delves into the diverse and sometimes surprisingly quirky world of industrial marketing channels, revealing strategies that are both effective and, dare we say, slightly less monotonous than staring at spreadsheets all day.

Digital marketing, once a novelty, is now a vital component of any successful industrial marketing strategy. However, the methods that work for selling consumer goods often fall flat in the B2B sphere. Understanding the nuances of each channel is crucial for maximizing ROI and avoiding expensive, time-consuming misfires.

Digital Marketing Channel Effectiveness

The following table compares the reach, cost, and effectiveness of several digital marketing channels commonly used in the industrial sector. It’s important to note that effectiveness is highly dependent on the specific industry, target audience, and execution of the campaign. Think of it as a starting point, not a guaranteed recipe for instant success (although we’d all love that, wouldn’t we?).

| Channel | Reach | Cost | Effectiveness |

|---|---|---|---|

| Email Marketing | Targeted, high engagement potential | Relatively low (depending on automation) | High, if list is well-segmented and content is valuable |

| Content Marketing (Blog, White Papers, Case Studies) | Broad, builds credibility and authority | Moderate to high (depending on content creation costs) | High, but requires consistent effort and high-quality content |

| Social Media Marketing (LinkedIn primarily) | Targeted, but requires active community engagement | Moderate (depending on advertising spend) | Moderate to high, depending on engagement and strategy |

| Search Engine Optimization () | Broad, long-term strategy | Moderate to high (depending on agency or in-house expertise) | High, but results take time to materialize |

Leveraging Industry Events and Trade Shows

Trade shows and industry events are not relics of the past; they’re still powerful networking opportunities. These events offer a chance for face-to-face interaction, relationship building, and demonstrating your products in a tangible way. Successful participation requires careful planning. This includes identifying key target audiences, crafting compelling presentations, and securing a prominent booth location (think prime real estate, but for industrial products). Consider pre-show marketing campaigns to generate leads and schedule meetings. Post-show follow-up is crucial for converting leads into sales. Don’t forget the swag! A well-designed branded item can be a surprisingly effective memory-jogger.

Key Performance Indicators (KPIs) for Industrial Marketing Campaigns

Measuring success in industrial marketing requires focusing on the right metrics. Simply counting website visits won’t cut it. Instead, concentrate on KPIs that directly impact the bottom line. These could include lead generation, conversion rates, customer acquisition cost, customer lifetime value, and return on investment (ROI). Regularly tracking and analyzing these KPIs allows for data-driven optimization of your campaigns, preventing you from wasting resources on ineffective strategies.

Content Calendar for a Hypothetical Industrial Marketing Campaign

A well-structured content calendar is essential for consistent and effective marketing. Consider this example for a hypothetical industrial automation company launching a new robotic arm:

| Week | Activity | Channel | Goal |

|---|---|---|---|

| 1 | Launch teaser campaign on LinkedIn and email | LinkedIn, Email | Generate initial interest |

| 2 | Publish a blog post highlighting the benefits of the new arm | Blog, Social Media | Educate target audience |

| 3 | Release a case study showcasing a successful implementation | Website, Email | Build credibility and trust |

| 4 | Participate in a relevant industry trade show | Trade Show | Generate leads and build relationships |

| 5 | Send a follow-up email to trade show attendees | Nurture leads |

Examples of Successful Content Marketing Strategies in the Industrial Sector

Successful industrial content marketing often focuses on providing valuable, problem-solving information to potential customers. For instance, a manufacturer of industrial pumps might create a series of white papers addressing common pump maintenance issues. A supplier of industrial software might develop a series of webinars demonstrating how their software can improve efficiency. A company specializing in industrial safety might produce case studies highlighting how their products prevented accidents. The key is to offer solutions to problems faced by your target audience, positioning your company as a trusted expert.

Customer Relationship Management (CRM) in Industrial Sales

In the often-grueling world of industrial sales, where deals can be as complex as a Swiss watch and as long-winded as a Wagner opera, a robust Customer Relationship Management (CRM) system isn’t just a nice-to-have; it’s the life raft keeping your sales team afloat. Think of it as your trusty sidekick, helping you navigate the treacherous waters of lead generation, deal closure, and – most importantly – keeping your customers happy enough to not switch to your competitor.

CRM systems are vital for managing the intricate relationships inherent in industrial sales. Unlike consumer sales, where a single transaction might be the end goal, industrial sales often involve ongoing relationships, complex negotiations, and multiple stakeholders. A well-implemented CRM acts as a central repository of all customer interaction data, ensuring that no crucial detail is ever lost in the shuffle (or buried under a mountain of paperwork).

Improved Sales Efficiency and Customer Satisfaction through CRM

Effective CRM systems streamline the sales process, leading to increased efficiency and higher customer satisfaction. For example, a CRM can automate repetitive tasks like sending follow-up emails or scheduling appointments, freeing up sales representatives to focus on building relationships and closing deals. Imagine the time saved – time that can be better spent on activities that actually generate revenue, instead of drowning in administrative tasks. Furthermore, a centralized database ensures consistent communication and personalized service, fostering stronger customer relationships and loyalty. A happy customer is a repeat customer, and in the industrial world, repeat customers are gold.

Features of an Effective CRM System for Industrial Sales

An effective industrial CRM system needs more than just a contact list. It requires features specifically tailored to the complexities of B2B sales. A robust system should include features such as:

- Detailed Contact Management: Tracking not just individual contacts, but entire organizations, including their hierarchy and key decision-makers. Think of it as a meticulously organized family tree, but for businesses.

- Opportunity Management: Tracking the progress of each sales opportunity, from initial contact to final closure, with detailed notes and milestones. This allows for better forecasting and proactive management of deals.

- Sales Forecasting and Reporting: Providing real-time insights into sales performance, enabling data-driven decision-making and proactive adjustments to sales strategies. This is where the magic happens – turning data into actionable intelligence.

- Integration with Other Systems: Seamless integration with other business systems, such as ERP and marketing automation platforms, for a holistic view of customer interactions. Imagine a well-oiled machine, where every part works in perfect harmony.

- Customizable Workflows: Allowing businesses to tailor the system to their specific sales processes and workflows. One size does not fit all, and your CRM should reflect that.

Comparison of CRM Platforms for Industrial Businesses

The market offers a wide variety of CRM platforms, each with its own strengths and weaknesses. Some popular options include Salesforce, Microsoft Dynamics 365, HubSpot, and Zoho CRM. The choice of platform depends on factors such as budget, business size, and specific requirements. A thorough evaluation of different platforms is crucial to select the one that best aligns with the company’s needs and long-term goals. Choosing the wrong CRM is like buying a sports car when you need a pickup truck – it might look flashy, but it won’t get the job done.

Training Sales Representatives on CRM System Usage

A successful CRM implementation hinges on the effective training of sales representatives. A comprehensive training program should cover:

- System Navigation: Familiarizing sales representatives with the system’s interface and basic functionalities. This is the foundational step – getting everyone comfortable with the tools at their disposal.

- Data Entry and Management: Training on accurate and consistent data entry, ensuring data integrity and reliability. Accurate data is the lifeblood of a successful CRM system.

- Reporting and Analytics: Teaching sales representatives how to use the system’s reporting and analytics features to track performance and identify areas for improvement. This is where the data comes alive, providing actionable insights.

- Best Practices: Sharing best practices for using the CRM system to improve sales efficiency and customer satisfaction. Learning from the experiences of others can accelerate the learning curve significantly.

- Ongoing Support: Providing ongoing support and resources to address any questions or challenges that arise after the initial training. CRM implementation is an ongoing process, and continuous support is crucial for its success.

Competitive Analysis within Industrial Markets

The industrial landscape is a thrilling rollercoaster of innovation, cutthroat competition, and occasionally, questionable marketing decisions. Understanding the competitive dynamics is crucial for survival, and frankly, for bragging rights at the next industry gala. This section dives into a comparative analysis of three major players in the fictional, yet remarkably realistic, world of high-end industrial widget manufacturing.

Our chosen sector, high-end industrial widget manufacturing, is characterized by high barriers to entry, significant capital investment requirements, and a clientele that appreciates a good pun as much as they appreciate precise tolerances. We’ll analyze three competitors, WidgetCorp, GearGrinders Inc., and Sprocket Solutions, examining their marketing and sales strategies, identifying their strengths and weaknesses, and ultimately, crafting a competitive framework for success.

Competitor Profiles: WidgetCorp, GearGrinders Inc., and Sprocket Solutions, Industrial sales & marketing research study report

These three companies represent different approaches to the high-end industrial widget market. WidgetCorp, the established giant, relies on brand recognition and a vast distribution network. GearGrinders Inc., a relative newcomer, focuses on innovation and cutting-edge technology. Sprocket Solutions, a mid-sized player, emphasizes personalized customer service and niche market penetration. A comparison of their strategies reveals key insights into the competitive dynamics.

| Company | Marketing Strategy | Sales Approach | Strengths | Weaknesses |

|---|---|---|---|---|

| WidgetCorp | Extensive advertising campaigns, industry conferences, strong online presence. | Direct sales force, established distributor network. | Brand recognition, wide distribution, strong financial resources. | Can be slow to adapt to new technologies, potentially inflexible. |

| GearGrinders Inc. | Focus on showcasing technological innovation, participation in industry trade shows, targeted digital marketing. | Direct sales, emphasizing technical expertise. | Innovative products, highly skilled workforce, strong reputation for quality. | Relatively smaller market share, limited distribution network. |

| Sprocket Solutions | Targeted marketing to specific niche markets, personalized customer communication, strong social media presence. | Direct sales, emphasis on building long-term relationships. | Strong customer relationships, deep product knowledge, high customer satisfaction. | Limited scale, potentially vulnerable to larger competitors. |

Competitive Analysis Framework

A robust competitive analysis requires a structured approach. We propose a framework incorporating market share analysis, SWOT analysis for each competitor, and a detailed examination of pricing strategies and product differentiation. This allows for a comprehensive understanding of the competitive landscape and the identification of opportunities.

The key to competitive advantage lies not just in understanding your competitors, but in understanding the evolving needs of your customers and adapting more quickly than the competition.

Recommendations for Differentiation

To differentiate effectively in this competitive market, a company needs a clear value proposition. This could involve focusing on a specific niche, developing unique product features, providing superior customer service, or leveraging technology to streamline processes. For example, focusing on sustainable manufacturing practices or offering advanced data analytics alongside the widgets could provide a significant competitive edge.

A key recommendation is to embrace agility and adaptability. The industrial widget market is constantly evolving, and companies that can quickly respond to changing customer needs and technological advancements will be best positioned for success. Ignoring this advice is akin to ignoring a rogue widget rolling towards your expensive equipment – a recipe for disaster.

Measuring the ROI of Industrial Marketing Efforts

Measuring the return on investment (ROI) of industrial marketing campaigns can feel like navigating a minefield blindfolded – but fear not! With the right tools and approach, you can transform this seemingly daunting task into a precise and profitable endeavor. This section Artikels methods to track and analyze the effectiveness of your industrial marketing spend, turning vague hunches into concrete, quantifiable results.

Methods for Tracking ROI of Industrial Marketing Campaigns

Several approaches exist for accurately tracking the ROI of industrial marketing. These methods often involve a combination of quantitative and qualitative data, providing a holistic view of campaign performance. Ignoring these methods is like trying to build a skyscraper without blueprints – it’s possible, but highly improbable to succeed.

- Attribution Modeling: This involves assigning credit for sales to various marketing touchpoints. For instance, a complex sale might involve website visits, email interactions, and trade show attendance. Attribution models (like multi-touch attribution) help determine the relative contribution of each touchpoint, providing a clearer picture of which activities drive the most revenue.

- Marketing Automation Platforms: These platforms track interactions across multiple channels, providing detailed insights into lead generation, conversion rates, and customer journeys. Data from these platforms provides valuable input for ROI calculations.

- Salesforce Integration: Integrating marketing automation with CRM systems allows for precise tracking of leads from initial contact to closed sales. This detailed tracking allows for a direct correlation between marketing activities and sales revenue.

Key Metrics for Assessing Industrial Marketing Effectiveness

The metrics you choose to track will depend on your specific campaign goals. However, several key metrics are consistently valuable in assessing the effectiveness of industrial marketing. These metrics are the lifeblood of your analysis, providing the essential data points for informed decision-making.

- Cost Per Lead (CPL): The total cost of a marketing campaign divided by the number of leads generated. A lower CPL indicates greater efficiency.

- Conversion Rate: The percentage of leads that convert into customers. A higher conversion rate suggests effective lead nurturing and sales processes.

- Customer Lifetime Value (CLTV): The predicted revenue a customer will generate throughout their relationship with your company. A higher CLTV justifies greater investment in customer acquisition.

- Return on Ad Spend (ROAS): The revenue generated from advertising divided by the advertising cost. This metric specifically measures the effectiveness of advertising campaigns.

Attributing Sales to Specific Marketing Activities

Attributing sales directly to specific marketing activities can be challenging, particularly in complex sales cycles. However, using sophisticated attribution models and integrating marketing and sales data can significantly improve accuracy. Without accurate attribution, your ROI calculations will be as reliable as a chocolate teapot.

For example, a lead generated through a targeted LinkedIn campaign might eventually result in a sale weeks or even months later. By tracking the customer’s journey through your CRM and marketing automation systems, you can accurately attribute the sale to the initial LinkedIn interaction.

Hypothetical Industrial Marketing Campaign ROI Report

Let’s imagine a hypothetical campaign for a manufacturer of industrial pumps.

| Metric | Value |

|---|---|

| Marketing Spend | $50,000 |

| Leads Generated | 200 |

| Qualified Leads | 50 |

| Sales Closed | 15 |

| Average Deal Size | $20,000 |

| Total Revenue Generated | $300,000 |

| ROI | 500% (($300,000 – $50,000) / $50,000) |

This simplified example demonstrates how to calculate ROI. In reality, more granular data and sophisticated attribution models would provide a more nuanced understanding.

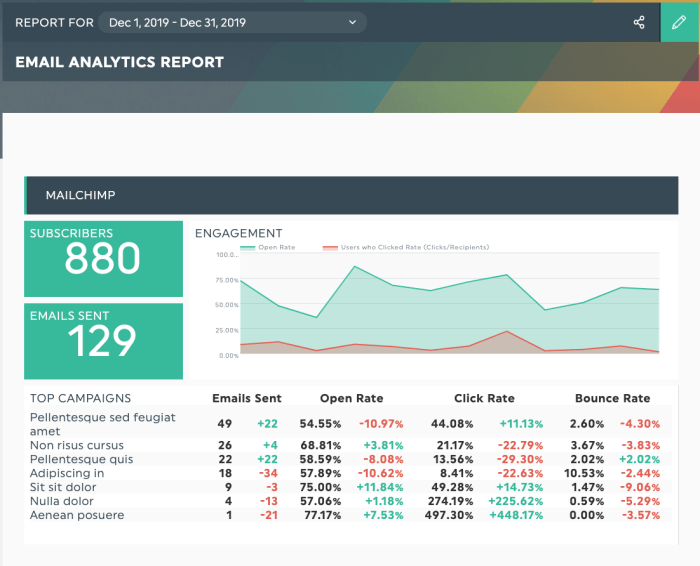

Dashboard Visualizing Key Marketing Performance Indicators

A well-designed dashboard provides a clear, concise overview of key marketing performance indicators (KPIs). Imagine a dashboard with interactive charts and graphs showing CPL, conversion rates, ROAS, and other relevant metrics over time. This visual representation facilitates quick identification of trends and areas needing improvement. This dashboard would be the central hub for monitoring campaign performance and making data-driven decisions. The visual appeal makes the data easily digestible, transforming complex information into actionable insights.

Future Trends in Industrial Sales and Marketing

The industrial landscape is evolving at a breakneck pace, leaving those clinging to outdated methods in the dust – or perhaps, more accurately, coated in a fine layer of rust. To thrive, industrial sales and marketing teams must embrace innovation and adapt to the rapidly changing technological and economic tides. Failing to do so risks being swept away by the current of progress, leaving behind a wake of missed opportunities and dwindling market share. This section explores the key future trends shaping the industrial sector and provides a roadmap for navigating this exciting (and slightly terrifying) new frontier.

The convergence of several technological advancements is reshaping how industrial products are sold and marketed. These aren’t just incremental improvements; they represent a fundamental shift in how businesses operate and interact with their customers. The impact on sales and marketing strategies is profound, requiring a rethinking of traditional approaches and a willingness to experiment with new methodologies.

Emerging Technologies Impacting Industrial Sales and Marketing

The digital revolution continues to disrupt traditional industrial sales and marketing. Artificial intelligence (AI), the Internet of Things (IoT), and advanced data analytics are no longer futuristic fantasies; they are tools that are actively reshaping the industrial landscape. AI-powered CRM systems offer predictive analytics, allowing for more targeted marketing campaigns and proactive customer service. IoT devices embedded in industrial equipment provide real-time data on performance, enabling predictive maintenance and optimized operations. Advanced data analytics allow companies to identify previously unseen trends and patterns, leading to more effective decision-making. For example, a manufacturer using IoT sensors could predict equipment failures before they occur, proactively scheduling maintenance and avoiding costly downtime. This predictive capability translates directly into increased efficiency and improved customer satisfaction. Similarly, AI-driven sales forecasting can optimize inventory management and improve supply chain efficiency, allowing for a more responsive and agile business.

Potential Future Trends in the Industrial Sector

Several key trends are poised to significantly impact the industrial sector in the coming years. Sustainability is becoming increasingly important, with customers demanding eco-friendly products and processes. This trend necessitates a shift towards sustainable manufacturing practices and transparent communication about environmental impact. Another significant trend is the increasing demand for customized products and services. Mass personalization is becoming the norm, requiring flexible manufacturing processes and targeted marketing strategies. Furthermore, the rise of Industry 4.0, with its emphasis on automation, data analytics, and connectivity, is transforming manufacturing processes and supply chains, demanding a skilled workforce adept at managing complex systems. Consider the example of a company that offers customized industrial 3D printing services; they leverage AI to analyze customer requirements and optimize the printing process, resulting in a unique product tailored to the customer’s specific needs. This agility and responsiveness are key competitive advantages in today’s market.

Impact of Future Trends on Sales and Marketing Strategies

These emerging technologies and trends necessitate a fundamental shift in industrial sales and marketing strategies. A move towards data-driven decision-making is crucial. Companies must leverage data analytics to understand customer needs, personalize marketing messages, and optimize sales processes. Furthermore, building strong customer relationships is paramount. Proactive customer service and personalized communication are essential for fostering loyalty and driving repeat business. Finally, embracing digital marketing channels is no longer optional; it’s a necessity. Companies must establish a strong online presence and utilize digital tools to reach their target audience effectively. Siemens, for example, has successfully integrated digital technologies into its sales and marketing strategies, leveraging data analytics to personalize customer interactions and improve operational efficiency. Their commitment to digital transformation has significantly enhanced their market position.

Examples of Companies Successfully Adapting to Change

Several companies have successfully navigated these changes. GE, for instance, has invested heavily in digital technologies, using data analytics to optimize its operations and improve customer service. Their Predix platform, a cloud-based industrial internet platform, collects and analyzes data from various industrial machines, enabling predictive maintenance and optimized performance. This proactive approach has allowed them to maintain a competitive edge. Similarly, Rolls-Royce has implemented advanced data analytics to monitor its aircraft engines in real-time, providing customers with predictive maintenance services and minimizing downtime. These proactive strategies have solidified their reputation for reliability and efficiency.

Strategic Plan for Adapting to Future Trends

A successful adaptation strategy requires a multi-pronged approach. Firstly, invest in digital technologies and data analytics capabilities. This includes upgrading CRM systems, implementing IoT devices, and investing in data analytics expertise. Secondly, develop a robust digital marketing strategy. This involves creating a strong online presence, utilizing targeted advertising, and engaging with customers through social media. Thirdly, foster a culture of innovation and continuous improvement. This means encouraging experimentation, embracing new technologies, and continuously adapting to changing market conditions. Finally, prioritize customer relationship management. Building strong relationships with customers is essential for long-term success in the increasingly competitive industrial landscape. This might involve implementing personalized communication strategies, offering proactive customer support, and building a strong reputation for reliability and quality. A structured approach with clear KPIs and regular review meetings is essential to track progress and make necessary adjustments.

Final Conclusion

In conclusion, navigating the industrial sales and marketing landscape requires a multifaceted approach that blends strategic planning with agile execution. This report has illuminated key trends, effective strategies, and crucial performance indicators for success. By understanding the unique challenges and opportunities within the industrial sector, businesses can effectively tailor their approaches to maximize ROI and establish lasting relationships with clients. The future of industrial sales and marketing is bright—and this report provides the roadmap to get there. So, buckle up and prepare for takeoff!

Essential Questionnaire

What are some common mistakes in industrial marketing?

Common mistakes include neglecting personalized communication, failing to understand the unique needs of industrial clients, and underestimating the power of content marketing in building brand awareness and trust.

How can I measure the effectiveness of my industrial marketing campaigns?

Track key metrics like website traffic, lead generation, conversion rates, and customer lifetime value. Analyze data from various channels to understand which strategies are yielding the best results.

What is the best CRM system for industrial sales?

The “best” CRM depends on your specific needs and budget. Consider factors like scalability, integration capabilities, and user-friendliness when making your selection. Research platforms tailored to B2B and industrial sales.

How can I improve my sales presentations for industrial clients?

Focus on demonstrating a clear understanding of the client’s challenges and presenting solutions that address their specific needs. Use data-driven insights and case studies to build credibility and showcase your expertise.