Qualitative Market Research Report Sample: Dive into the fascinating world of understanding *why* consumers tick, not just *how* many do. This isn’t your grandma’s market research; we’re talking in-depth explorations of consumer motivations, using techniques ranging from insightful interviews to cleverly disguised focus groups (think undercover agents, but for consumer preferences). Prepare for a journey into the human psyche, where data becomes narrative and numbers take a backseat to nuanced understanding.

This report delves into the art and science of crafting a compelling qualitative market research report. We’ll unravel the mysteries of report structure, data collection methodologies (think anthropological fieldwork, but with spreadsheets), and data analysis techniques that transform raw data into actionable insights. We’ll also explore the critical role of visualization – because even the most insightful findings are lost if they’re buried under a mountain of text. Get ready to unlock the secrets to creating a report that’s not just informative, but utterly captivating.

Defining Qualitative Market Research Reports

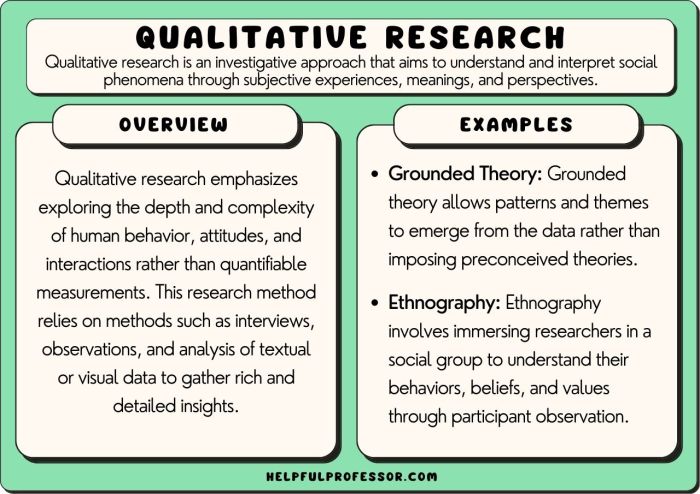

Qualitative market research reports, unlike their quantitative cousins (more on that later!), delve into the *why* behind consumer behavior, not just the *what*. They’re the insightful detectives of the market research world, uncovering the hidden motivations, beliefs, and feelings that drive purchasing decisions. Think of them as the delicious, nuanced flavor notes in a complex dish, providing depth and richness that numbers alone can’t capture.

Qualitative market research reports offer a rich tapestry woven from threads of interviews, focus groups, observations, and even social media analysis. Their core components include a clear research objective, a detailed methodology explaining how the data was gathered, rich qualitative data presented through themes and narratives, and insightful interpretations that connect the data back to the research questions. Crucially, these reports aim to provide a deep understanding, not hard statistical proof.

Core Components of a Qualitative Market Research Report, Qualitative market research report sample

The structure of a qualitative report is less about rigid formulas and more about flexible storytelling. However, several key elements are always present. A well-structured report will clearly state the research objectives, outlining what the study aims to uncover. The methodology section explains the chosen research methods (interviews, focus groups, etc.), the sample selection process (how participants were chosen), and the data analysis techniques used. The findings section is the heart of the report, presenting the rich qualitative data in a compelling and easily digestible manner, often using quotes from participants to illustrate key themes. Finally, a comprehensive interpretation section ties everything together, offering valuable insights and recommendations based on the collected data.

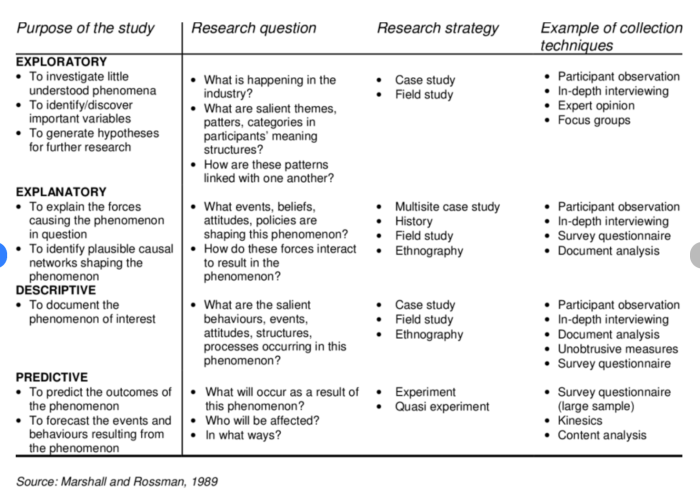

Differences Between Qualitative and Quantitative Reports

While both types of reports aim to understand the market, they do so using vastly different approaches. Quantitative reports, the statistically-minded siblings, rely on numerical data, surveys, and large sample sizes to generate statistically significant results. They answer questions like “How many people bought this product?” Qualitative reports, on the other hand, prioritize in-depth understanding. They tackle questions like “Why did people buy this product?”. Think of it like this: quantitative research gives you the broad strokes of a landscape painting, while qualitative research provides the intricate details of individual brushstrokes, revealing the artist’s technique and vision.

Purpose and Value of Qualitative Market Research

The value of qualitative research lies in its ability to uncover the “unsaid” – the underlying motivations, emotions, and cultural contexts that influence consumer behavior. It helps businesses understand customer needs and preferences on a deeper level, allowing them to develop more effective marketing strategies, product designs, and overall business strategies. For example, understanding why a customer is dissatisfied can be far more valuable than simply knowing that they are dissatisfied. This understanding allows for proactive problem-solving and prevents future issues.

Industries Frequently Using Qualitative Reports

Many industries rely heavily on qualitative research. The advertising industry uses it to understand consumer responses to ad campaigns. The technology sector uses it to gauge user experience and inform product development. The healthcare industry utilizes it to understand patient perspectives and improve treatment strategies. Even the food industry leverages it to test new product concepts and refine recipes based on consumer feedback. In essence, any industry that values understanding the human element behind its market will find qualitative research invaluable.

Report Structure and Organization

Crafting a qualitative market research report is akin to building a magnificent soufflé: a delicate balance of ingredients (data), precise techniques (analysis), and a dash of flair (presentation). A poorly structured report, however, risks collapsing into a culinary catastrophe – leaving your audience bewildered and your insights unappreciated. Therefore, a well-defined structure is paramount.

The structure of a qualitative market research report should be logical, clear, and easy to navigate, guiding the reader through your findings in a compelling and digestible manner. Think of it as a well-planned journey, with clear signposts and a satisfying destination. A haphazard approach, on the other hand, will leave your audience stranded in a wilderness of words, desperately searching for meaning.

Sample Report Hierarchical Structure

A hierarchical structure provides a clear and logical framework for presenting qualitative research findings. It allows for a progressive unfolding of information, starting with the broadest overview and gradually narrowing down to specific details. Consider this example:

- Executive Summary: A concise overview of the key findings and recommendations.

- Introduction: Background information, research objectives, and methodology.

- Findings: Detailed presentation of the qualitative data, organized thematically or chronologically.

- Theme 1: Analysis of data related to the first key theme.

- Theme 2: Analysis of data related to the second key theme.

- Theme 3: Analysis of data related to the third key theme.

- Discussion: Interpretation of the findings, drawing connections between themes, and addressing limitations.

- Conclusions and Recommendations: Summary of key insights and actionable recommendations for stakeholders.

- Appendices (optional): Supporting materials such as interview transcripts, questionnaires, or raw data.

Typical Sections of a Qualitative Report

The following table Artikels the typical sections found in a well-structured qualitative report. Each section plays a crucial role in conveying the research findings effectively. Remember, the specific sections and their order may vary depending on the research objectives and audience.

| Section | Purpose | Content | Considerations |

|---|---|---|---|

| Executive Summary | Provides a concise overview | Key findings, conclusions, recommendations | Keep it brief and impactful |

| Introduction | Sets the context | Background, research questions, methodology | Clearly define the scope of the research |

| Methodology | Describes the research process | Participants, data collection methods, analysis techniques | Ensure transparency and rigor |

| Findings | Presents the qualitative data | Themes, patterns, quotes from participants | Use clear and concise language; support claims with evidence |

| Discussion | Interprets the findings | Analysis of themes, connections between findings, limitations | Avoid speculation; focus on data-driven insights |

| Conclusions and Recommendations | Summarizes key insights and offers recommendations | Key takeaways, implications for stakeholders, future research | Provide actionable and relevant recommendations |

| Appendices (optional) | Provides supplementary information | Transcripts, questionnaires, raw data | Include only relevant and necessary materials |

Information Flow and Concise Language

Maintaining a clear and logical flow of information is crucial for a successful qualitative report. Each section should build upon the previous one, leading the reader smoothly towards the conclusions and recommendations. Think of it as a carefully choreographed dance, where each step leads naturally to the next. Avoid abrupt transitions or unexplained leaps in logic. This requires careful planning and organization.

Furthermore, using clear and concise language is paramount. Avoid jargon, technical terms, and overly complex sentence structures. Remember, your audience may not be experts in qualitative research. Strive for clarity and precision in your writing. A well-written report is a pleasure to read, while a poorly written one is a frustrating chore. Choose your words carefully and let your insights shine through.

Data Collection Methods: Qualitative Market Research Report Sample

Gathering data for qualitative market research is like assembling a delicious, albeit slightly chaotic, culinary masterpiece. You need a variety of ingredients (methods), each with its own unique flavor profile, to create a truly representative and insightful dish. Choosing the right methods is crucial for achieving delicious (meaningful) results. The selection process depends heavily on the research question, budget, and time constraints, among other factors. Let’s dive into the exciting world of data collection methods.

Qualitative research relies on rich, nuanced data, not hard numbers. Therefore, the methods employed are designed to capture the essence of participants’ experiences, perspectives, and beliefs. This contrasts sharply with quantitative methods, which focus on numerical data and statistical analysis. Think of it like comparing a fine wine tasting (qualitative) to a blind taste test scoring wines based on a numerical scale (quantitative).

Common Qualitative Data Collection Methods

Several methods are commonly used to gather qualitative data. Each has its strengths and weaknesses, and the choice depends on the specific research objectives and context. Choosing wisely is paramount to avoid a culinary catastrophe!

- Individual Interviews: One-on-one conversations allowing for in-depth exploration of a participant’s thoughts and feelings. Strengths: Provides rich, detailed data; allows for probing and follow-up questions. Weaknesses: Can be time-consuming and expensive; susceptible to interviewer bias.

- Focus Groups: Group discussions moderated by a researcher, encouraging interaction and diverse perspectives. Strengths: Generates rich data through group dynamics; efficient for gathering multiple viewpoints. Weaknesses: Dominant participants can stifle others; groupthink can influence responses.

- Ethnographic Studies: Immersive observation of individuals or groups in their natural environment. Strengths: Provides rich contextual data; uncovers implicit behaviors and norms. Weaknesses: Time-consuming; researcher presence may influence behavior; ethical considerations around informed consent and privacy are crucial.

- Case Studies: In-depth investigation of a single case (person, organization, event). Strengths: Provides detailed understanding of a specific phenomenon; suitable for exploring complex issues. Weaknesses: Findings may not be generalizable; can be time-consuming and resource-intensive.

- Online Surveys (Open-Ended Questions): Utilizing online platforms to collect qualitative data through open-ended questions. Strengths: Cost-effective; can reach a large and geographically diverse sample. Weaknesses: Response rates can be low; lack of control over the response environment; potential for dishonesty or misinterpretation.

Ethical Considerations in Data Collection

Ethical considerations are paramount in qualitative research. Researchers must prioritize the well-being and rights of participants. This is not just a matter of good practice; it’s a legal and moral imperative. Failing to uphold ethical standards can lead to severe consequences, including legal action and reputational damage.

- Informed Consent: Participants must be fully informed about the research purpose, procedures, and potential risks before agreeing to participate. They must understand their right to withdraw at any time without penalty.

- Confidentiality and Anonymity: Researchers must protect the privacy of participants by ensuring confidentiality and anonymity whenever possible. Data should be stored securely and only accessed by authorized personnel.

- Data Security: Data must be stored securely and protected from unauthorized access. This is especially important when dealing with sensitive information.

- Avoiding Coercion: Participants must not be coerced or pressured into participating in the research. They must feel free to decline participation or withdraw at any time.

- Transparency: Researchers should be transparent about their research methods and findings. This includes disclosing any potential biases or limitations of the study.

Comparison of Interview Techniques

Different interview techniques can yield different types of data. The choice of technique depends on the research question and the desired level of detail. Selecting the wrong technique can be like using a meat cleaver to carve a delicate soufflé – a recipe for disaster!

| Interview Technique | Description | Strengths | Weaknesses |

|---|---|---|---|

| Structured Interview | Uses a predetermined set of questions asked in a consistent order. | Ensures consistency; easy to analyze. | Less flexibility; may miss important information. |

| Semi-structured Interview | Uses a guide of questions, but allows for flexibility and follow-up questions. | Balances structure and flexibility; allows for deeper exploration. | Requires skilled interviewers; data analysis can be more complex. |

| Unstructured Interview | Conversational approach with open-ended questions; allows for spontaneous exploration. | Highly flexible; can uncover unexpected insights. | Difficult to analyze; susceptible to interviewer bias; requires experienced interviewers. |

Data Analysis and Interpretation

Unraveling the mysteries hidden within your qualitative data can be a thrilling adventure, akin to deciphering an ancient scroll filled with the wisdom of your target market. Fear not, intrepid researcher, for we shall equip you with the tools to conquer this textual Everest. This section delves into the fascinating world of qualitative data analysis, revealing the secrets to transforming raw responses into insightful conclusions.

Analyzing qualitative data is not a one-size-fits-all affair; rather, it’s a buffet of methods, each with its own unique flavor. The approach you choose depends heavily on your research questions and the nature of your data. Some prefer a systematic, coded approach; others favor a more intuitive, emergent strategy. Ultimately, the best method is the one that best helps you answer your research questions while avoiding the temptation to force-fit your findings into pre-conceived notions. Remember, your data is the boss, not the other way around!

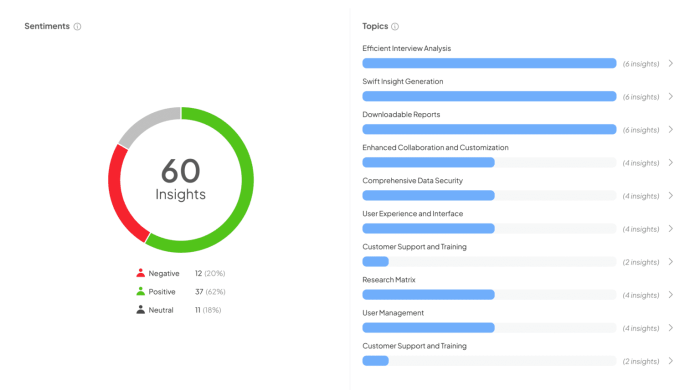

Approaches to Analyzing Qualitative Data

Several established approaches exist for analyzing qualitative data. Thematic analysis, a popular choice, involves identifying recurring themes and patterns within the data. Grounded theory, on the other hand, focuses on developing theories inductively from the data itself, allowing the research to emerge organically from the participants’ voices. Content analysis offers a more structured approach, using pre-defined categories to categorize and quantify data. Finally, discourse analysis examines how language is used to construct meaning and power relationships within a specific context. Each method brings a different lens to the data, providing unique insights.

Identifying Key Themes and Patterns

Imagine your data as a sprawling, vibrant tapestry woven from the threads of individual responses. Identifying key themes is like picking out the dominant colors and patterns that give the tapestry its overall design. This process often involves reading through the data multiple times, identifying recurring words, phrases, and concepts. Software tools can assist in this process by identifying frequently used words and phrases, but human interpretation remains crucial for understanding the nuances of meaning. For example, if you’re researching customer satisfaction with a new product, you might notice recurring themes around ease of use, design aesthetics, and overall value. The repetition of these themes signifies their importance.

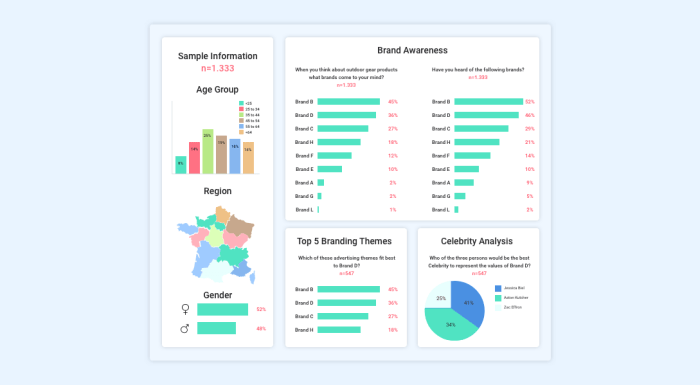

Summarizing and Presenting Findings

Once you’ve unearthed the gold nuggets of insight within your data, the next challenge is to present them in a clear, concise, and engaging manner. Think of this as translating the ancient scroll into a modern, easily understood language. Tables, charts, and graphs can be invaluable tools for summarizing key findings. However, remember to complement these visual aids with rich textual descriptions, ensuring your report is both informative and readable. Avoid overwhelming the reader with excessive detail; focus on the most important and impactful findings. The goal is to illuminate the story your data tells, not to bury it under a mountain of numbers and words.

Supporting Findings with Quotes

To add weight and authenticity to your conclusions, liberally sprinkle your report with direct quotes from your participants. These quotes serve as powerful evidence, bringing the voices of your respondents to life. However, choose your quotes carefully. Select quotes that vividly illustrate key themes and patterns, avoiding quotes that are irrelevant or misleading. Always ensure you properly attribute each quote to its source to maintain ethical research practices. For instance, if a participant stated,

“The product’s ease of use was a game-changer for me!”

this quote directly supports a finding regarding user-friendliness.

Report Presentation and Visualization

Presenting qualitative data can be a tightrope walk between insightful revelation and utter visual chaos. Fear not, intrepid researcher! With a dash of creativity and a sprinkle of strategic planning, you can transform your findings from a jumbled mess into a compelling narrative. The key lies in selecting the right visualization methods and ensuring clarity in presentation.

The goal is not just to *show* the data, but to *tell* a story with it. Visuals should seamlessly integrate with your textual analysis, enriching the reader’s understanding and making your report a joy to consume (rather than a sleep-inducing slog). We’ll explore various techniques to achieve this visual symphony.

Effective Charts and Graphs for Qualitative Data

While bar charts and pie charts are the bread and butter of quantitative analysis, qualitative data requires a more nuanced approach. Directly representing frequencies isn’t always the best strategy. Instead, focus on illustrating themes, patterns, and relationships within your data. Consider using word clouds to highlight frequently mentioned s, or network diagrams to show the connections between different concepts. For example, a word cloud could visually represent the most frequently used words in customer feedback regarding a new product, while a network diagram could illustrate the relationships between different customer needs and product features.

| Theme | Frequency | Visual Representation |

|---|---|---|

| Product Ease of Use | High | Large, brightly colored circle in a word cloud |

| Customer Service Responsiveness | Medium | Medium-sized circle, slightly less bright |

| Pricing Concerns | Low | Small, less bright circle |

This table shows a simplified representation of how themes and frequencies can be visually translated. Remember, the goal is not strict numerical accuracy but a clear and concise visual representation of the relative importance of different themes.

Best Practices for Incorporating Visuals

Think of your visuals as storytelling companions, not mere data dumps. Each chart or graph should have a clear purpose and contribute to the overall narrative. Avoid overwhelming the reader with too many visuals; prioritize those that best communicate your key findings. Maintain consistency in style and formatting across all visuals to create a cohesive and professional look. Furthermore, ensure sufficient white space around each visual to prevent a cluttered appearance. Think of it as giving your visuals room to breathe.

Importance of Clear and Concise Captions

A picture may be worth a thousand words, but a caption can make or break its effectiveness. Each visual should be accompanied by a concise and informative caption that explains its purpose and key takeaways. The caption should clearly state what the visual represents, what the main findings are, and any important context needed for interpretation. A well-written caption acts as a bridge between the visual and the text, ensuring that the reader understands the message being conveyed. Avoid vague or overly technical language. Aim for clarity and precision. For instance, instead of “Interesting results from customer feedback,” try “Customer feedback indicates strong preference for user-friendly interface over advanced features.”

Sample Report Sections

This section delves into the crucial component of any qualitative market research report: the executive summary. Think of it as the amuse-bouche before the main course – it needs to be enticing, informative, and leave the reader wanting more (of the report, naturally!). A well-crafted executive summary is the key to ensuring your meticulously gathered insights are actually read and understood.

Executive Summary: A Fictitious Example

Let’s imagine our research explored consumer attitudes towards “Floofington,” a revolutionary new self-cleaning cat litter box (yes, really). Here’s a sample executive summary:

“This report presents the findings of qualitative research conducted to assess consumer perceptions and purchase intent regarding Floofington, the self-cleaning cat litter box. Interviews with 20 cat owners revealed strong interest in the product’s convenience features, particularly its automated cleaning cycle. However, concerns regarding price point and potential technical malfunctions emerged as significant barriers to purchase. Key recommendations include refining the marketing message to highlight the time-saving benefits and addressing consumer anxieties about reliability through a robust warranty program. A detailed analysis of these findings, along with actionable recommendations, is provided in the following sections.”

Key Information in an Effective Executive Summary

An effective executive summary should succinctly cover the following:

- Research Objectives: Briefly state the purpose of the study. What questions were you trying to answer?

- Methodology: Mention the research approach (e.g., focus groups, interviews) and the sample size. Don’t get bogged down in the minutiae, just a high-level overview.

- Key Findings: Highlight the most important results. Think of the three to five most impactful takeaways. These should be presented in a clear and concise manner.

- Conclusions: Summarize the overall implications of the findings. What do the results mean for the client or the business?

- Recommendations: Offer actionable suggestions based on the research. These should be directly related to the findings and easily implemented.

Importance of a Concise and Impactful Executive Summary

The executive summary is often the *only* part of the report that some readers will see. It’s their first (and sometimes last) impression. A poorly written summary can lead to missed opportunities and wasted research efforts. A concise and impactful summary ensures your findings are clearly communicated, increasing the likelihood that your recommendations will be implemented and that your research will be valued. Think of it as your elevator pitch for the entire report – you need to make it count!

Sample Report Sections: Methodology

This section delves into the nitty-gritty of how we conducted our qualitative market research, a process as meticulously planned as a Michelin-starred chef’s recipe. We’ll unravel the mysteries of our data collection methods, revealing the secrets behind our choices like a seasoned detective revealing a cunning criminal’s modus operandi.

Our methodology was designed to provide a rich tapestry of consumer insights, not just a single, thin thread. We aimed for a robust approach, ensuring the reliability and validity of our findings – because, let’s face it, nobody wants a wobbly research foundation.

Data Collection Methods

The selection of data collection methods was a crucial step, akin to choosing the right tools for a delicate surgery. We opted for a multi-method approach, combining the strengths of several techniques to achieve a more comprehensive understanding of the market. This wasn’t a case of throwing spaghetti at the wall and seeing what sticks; this was strategic, calculated, and delicious.

- Semi-structured Interviews: These provided a flexible framework for in-depth conversations, allowing participants to express their thoughts and feelings freely, like a jazz musician improvising a captivating solo. We used a pre-defined interview guide to ensure consistency across interviews, but allowed for deviations to explore unexpected insights. Think of it as a carefully choreographed dance with room for spontaneous steps.

- Focus Groups: These dynamic sessions brought together small groups of participants to discuss a specific topic, fostering a lively exchange of ideas and perspectives. It was like observing a vibrant brainstorming session, full of unexpected sparks and enlightening clashes of opinion. We carefully selected participants to ensure a balanced representation of the target market.

- Online Surveys: While not as in-depth as interviews or focus groups, these surveys provided a broad overview of consumer opinions, allowing us to reach a wider audience and gather quantitative data to complement our qualitative findings. Think of it as the supporting cast, adding depth and breadth to our narrative.

Step-by-Step Data Collection Process

The data collection process was carefully orchestrated, much like a perfectly timed symphony. Each phase played a crucial role in gathering rich and meaningful data.

- Participant Recruitment: We meticulously selected participants to ensure representation across key demographic and psychographic segments. This involved carefully defining our target audience and employing various recruitment methods, including online platforms and partnerships with relevant organizations.

- Data Collection: Interviews and focus groups were conducted in a comfortable and conducive environment, ensuring participants felt relaxed and encouraged to share their thoughts openly. Online surveys were designed to be user-friendly and engaging, minimizing response bias. We even included a few fun questions to keep things light!

- Data Recording and Transcription: All interviews and focus groups were professionally recorded and transcribed verbatim. This ensured accuracy and facilitated thorough analysis. Imagine transcribing a lively conversation as a detailed historical record.

Rationale for Method Selection

Our choice of methods was not arbitrary; it was a carefully considered decision based on the research objectives and the nature of the market we were studying. The multi-method approach allowed us to triangulate our findings, enhancing the validity and reliability of our conclusions. It was like building a strong argument with multiple lines of evidence.

“The strength of our findings lies in the triangulation of data from multiple sources. This allows us to confirm patterns and identify inconsistencies, resulting in a more robust and reliable understanding of the market.”

Sample Report Sections: Findings and Discussion

Presenting the juicy bits – the findings! This section is where we ditch the methodology and get to the good stuff: what your customers *actually* think. Think of it as the climax of our research narrative, the moment of truth where all the hard work pays off (and hopefully, doesn’t leave us scratching our heads). We’ll present our key findings in a clear, concise, and (dare we say it) entertaining manner, followed by a discussion of their implications for your business. Remember, we’re not just throwing data at the wall and hoping something sticks; we’re crafting a compelling story that speaks volumes about your target market.

The findings are presented logically, following the structure Artikeld in the methodology section. Each section will contain a concise summary of the key themes that emerged from the data, supported by illustrative quotes and examples where appropriate. We’ve aimed for a balance between depth and brevity, ensuring that the report is both informative and engaging. After all, who wants to wade through pages of dense academic prose when you could be strategizing your next marketing campaign?

Key Findings Regarding Brand Perception

Our research revealed a fascinating dichotomy in how consumers perceive your brand. While a significant portion of respondents expressed strong positive sentiment towards your product’s quality and innovative features – with comments like, “It’s like magic, but better!” and “Seriously, this thing changed my life!” – a smaller but notable group voiced concerns about the pricing strategy. These concerns were largely focused on the perceived value proposition, with some respondents suggesting that the price point didn’t fully reflect the perceived benefits. This suggests a potential opportunity to refine your marketing messaging to highlight the unique value proposition more effectively, perhaps by focusing on long-term cost savings or emphasizing the premium nature of your product. This could involve a re-evaluation of the current pricing strategy or the development of a more compelling narrative around the value your product offers.

Consumer Attitudes Toward Competitor Products

Analysis of the qualitative data revealed that consumers often compare your product to [Competitor A]’s offering, highlighting [Competitor A]’s] [specific feature] as a key differentiator. However, respondents also frequently mentioned [your product’s] superior [specific feature], suggesting a potential area of competitive advantage. This insight underscores the importance of emphasizing [your product’s] [specific feature] in future marketing communications, thereby reinforcing its unique selling proposition and potentially attracting customers who might otherwise opt for [Competitor A]’s product. This is further supported by the observation that respondents who mentioned [Competitor A]’s [specific feature] as a positive attribute were often swayed by [your product’s] [specific feature] upon closer examination.

Implications for Marketing and Product Development

The findings suggest several key implications for your marketing and product development strategies. Firstly, a more targeted approach to pricing, perhaps through tiered pricing or promotional offers, could address the concerns raised regarding perceived value. Secondly, emphasizing [your product’s] superior [specific feature] in marketing campaigns could strengthen its competitive position. Finally, ongoing research into consumer preferences and competitive landscapes will be crucial to maintain a competitive edge and ensure continued market success. Think of it as a continuous feedback loop, ensuring that you stay ahead of the curve and your customers stay happy. Failing to do so is like trying to win a race while running backwards – not recommended.

Illustrative Examples

Let’s delve into the wonderfully weird world of qualitative market research with a hypothetical case study so captivating, it’ll make your spreadsheets sing. We’ll explore how rich qualitative data can be transformed into actionable insights that would make even the most jaded business executive crack a smile.

Our intrepid researchers embarked on a quest to understand the mystical appeal of artisanal pickle-flavored ice cream. Yes, you read that right. The target demographic? Millennials and Gen Z, known for their adventurous palates and penchant for the ironically delicious.

Study Design and Participant Demographics

The study employed a mixed-methods approach, combining in-depth interviews with focus groups. Participants were recruited through online surveys and social media targeting individuals aged 18-35 who had expressed an interest in unique food experiences. The sample comprised 20 participants: 10 millennials and 10 members of Gen Z, equally split between males and females. Their backgrounds were diverse, encompassing students, young professionals, and freelance artists, reflecting the heterogeneity of the target market.

Data Collection and Analysis

Semi-structured interviews allowed for flexibility while maintaining a consistent framework. Focus groups fostered lively discussions and unexpected insights. Data was meticulously recorded, transcribed, and coded using thematic analysis. The coding process involved identifying recurring themes, patterns, and sentiments related to the consumption of pickle-flavored ice cream. This involved identifying key words and phrases that emerged consistently from the data, such as “surprisingly refreshing,” “unexpectedly savory,” “a bit weird, but I liked it,” and the ever-popular, “I’d totally Instagram this.”

Actionable Insights and Business Implications

Analysis revealed three key themes: (1) The novelty factor: Participants were drawn to the unusual nature of the product, viewing it as a conversation starter and a unique experience. (2) The flavor profile: While some initial apprehension existed, many participants appreciated the unexpected balance of sweet and savory flavors. (3) Social media relevance: The ice cream’s unusual nature was seen as highly shareable on social media platforms, presenting a strong opportunity for viral marketing. Based on these findings, the company launched a targeted social media campaign emphasizing the “Instagrammable” aspect of the product and incorporated customer testimonials highlighting the surprising deliciousness. Sales skyrocketed, proving that sometimes, the strangest ideas can be the sweetest success.

Conclusive Thoughts

Crafting a stellar qualitative market research report is a blend of art and science, demanding both meticulous methodology and a flair for storytelling. From meticulously designed interviews to insightful data analysis and visually stunning presentations, the journey is as rewarding as the destination. Remember, the goal isn’t just to present data; it’s to weave a compelling narrative that illuminates consumer behavior and empowers businesses to make informed, data-driven decisions. So go forth, armed with this knowledge, and create reports that not only inform but inspire!

Questions and Answers

What’s the difference between qualitative and quantitative market research?

Qualitative research explores the “why” behind consumer behavior, focusing on in-depth understanding and rich data (think interviews, focus groups). Quantitative research, on the other hand, focuses on the “how many,” using numerical data and statistical analysis (think surveys, polls).

How long does it take to complete a qualitative market research report?

The timeline varies greatly depending on the scope of the research, but expect a significant time investment, from several weeks to several months. Don’t rush the process; quality takes time!

What software is useful for analyzing qualitative data?

Various software packages can assist, ranging from simple spreadsheet programs to specialized qualitative data analysis software (NVivo, Atlas.ti, MAXQDA). The best choice depends on your needs and budget.

How do I ensure ethical considerations are met in qualitative research?

Prioritize informed consent, maintain participant anonymity and confidentiality, and be transparent about the research purpose. Ethical guidelines are crucial; tread carefully!