Research Report Stock Market: Navigating the labyrinthine world of financial analysis can feel like decoding ancient hieroglyphs. But fear not, intrepid investor! This report unravels the mysteries behind stock market research reports, from identifying reliable sources to interpreting complex data visualizations. We’ll explore the different types of reports, dissect their key components, and arm you with the tools to confidently assess their value and integrate their findings into your investment strategies. Prepare for a journey into the heart of financial intelligence.

This exploration delves into the nuances of various research report types, highlighting their strengths and weaknesses. We’ll examine the methodologies behind these reports, comparing fundamental and technical analysis, and providing practical guidance on interpreting the findings. Furthermore, we’ll discuss the importance of critical evaluation, identifying potential biases, and ultimately, using this knowledge to make informed investment decisions. The goal is to empower you to navigate the world of stock market research with confidence and acumen.

Defining “Research Report Stock Market”

The term “research report stock market” might sound as exciting as a tax audit, but it’s actually the bedrock of informed investment decisions. Essentially, it refers to any document that analyzes aspects of the stock market to provide insights for investors, traders, or other market participants. This seemingly simple definition, however, encompasses a surprisingly broad range of publications, each with its own unique flavor and intended audience.

The scope of these reports can vary wildly, from a deep dive into a single company’s financials to a sweeping macroeconomic forecast affecting entire sectors. Some reports focus on specific industries, while others zoom in on particular investment strategies or market trends. Understanding the nuances of these different report types is crucial to avoid getting lost in a sea of data – or, worse, making investment decisions based on misleading information.

Types of Stock Market Research Reports

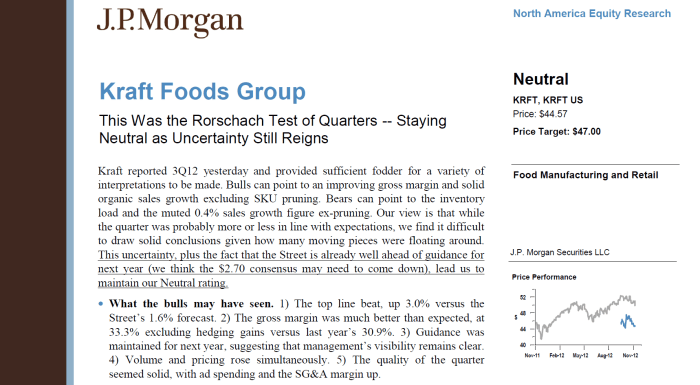

Research reports targeting the stock market are diverse, much like the personalities found on a trading floor. They fall into several broad categories, each serving a different purpose and employing different methodologies. Equity research reports focus on individual companies, providing detailed analysis of their financial performance, competitive landscape, and future prospects. Industry reports offer a broader perspective, examining the overall health and future trajectory of specific sectors (think technology, healthcare, or energy). Economic forecasts, on the other hand, take a macro view, predicting overall economic growth, inflation rates, and interest rate movements – all factors that significantly impact the stock market.

Sources of Stock Market Research Reports

Finding reliable stock market research reports requires a discerning eye. Sources range from highly reputable investment banks with teams of seasoned analysts (think Goldman Sachs or Morgan Stanley) to smaller boutique firms specializing in niche sectors. The internet is also awash with reports, but navigating this digital ocean requires caution. Blogs, online forums, and social media posts, while sometimes offering interesting perspectives, should be approached with a healthy dose of skepticism. Their reliability often lags behind that of established financial institutions.

The intended audience also varies. Reports from investment banks are often aimed at institutional investors (pension funds, mutual funds) and high-net-worth individuals, while those from online brokerages may target retail investors. Understanding the target audience helps determine the level of detail and complexity to expect.

Comparison of Stock Market Research Report Types

| Report Type | Key Features | Data Sources | Typical Users |

|---|---|---|---|

| Equity Research | Company-specific financial analysis, valuation models, investment recommendations | Company filings (10-K, 10-Q), financial news, industry data, management interviews | Institutional investors, individual investors, portfolio managers |

| Industry Report | Analysis of industry trends, competitive landscape, growth prospects | Industry publications, market research databases, government statistics | Investors seeking sector exposure, strategic planners, industry analysts |

| Economic Forecast | Predictions of macroeconomic indicators (GDP growth, inflation, interest rates) | Government data, central bank reports, economic models | Portfolio managers, macro investors, central banks |

| Technical Analysis Report | Chart patterns, indicators, trading signals | Historical price and volume data | Short-term traders, day traders |

Key Components of a Stock Market Research Report

Dissecting a stock market research report is like peeling back the layers of an onion (though hopefully less tear-inducing). Each layer reveals crucial information, ultimately helping investors make informed – and hopefully profitable – decisions. A well-structured report provides a clear and concise path to understanding a company’s financial health and future prospects. Let’s delve into the essential components.

Executive Summary

The executive summary is the report’s tantalizing appetizer, a concise overview of the entire report’s findings. Think of it as the CliffsNotes version for busy executives (or anyone who appreciates brevity). It should highlight the key investment thesis, the company’s valuation, and the analyst’s recommendation – buy, sell, or hold. A strong executive summary grabs the reader’s attention and compels them to delve deeper into the delicious details. Without a compelling executive summary, your report risks ending up unread, gathering dust on a virtual shelf.

Methodology

This section details the analytical approach used to reach the report’s conclusions. Transparency is key here. Did the analysts use a discounted cash flow model? A relative valuation approach? A blend of both? Explaining the methodology builds credibility and allows readers to assess the validity of the findings. Imagine a recipe without instructions – you might get something edible, but you wouldn’t know how to replicate it, or if it’s even safe to eat!

Company Overview

This section provides a succinct yet comprehensive background of the company under scrutiny. It includes information such as the company’s history, its industry, its business model, and its competitive landscape. Think of it as setting the stage for the financial drama to unfold. Without a proper introduction, the financial numbers will just be a confusing jumble of numbers.

Financial Analysis

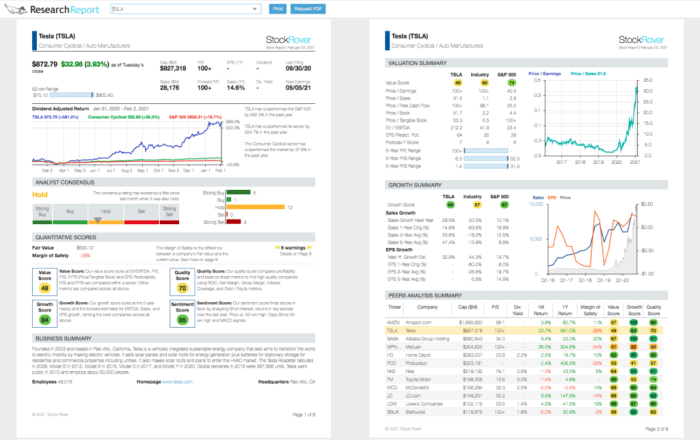

This is where the rubber meets the road. This section presents a detailed analysis of the company’s financial statements, including the income statement, balance sheet, and cash flow statement. Key ratios and trends are highlighted, offering insights into profitability, liquidity, and solvency. Effective visual representations, such as line graphs illustrating revenue growth over time or bar charts comparing key financial metrics against industry peers, make complex data digestible and impactful. For example, a line graph showing a consistent upward trend in earnings per share (EPS) would be far more compelling than a simple table of numbers.

Valuation

This section presents the analyst’s assessment of the company’s intrinsic value. Different valuation methodologies (e.g., discounted cash flow, comparable company analysis, precedent transactions) might be used, and the results are compared and reconciled. This section is crucial for determining whether the company’s current market price is undervalued, overvalued, or fairly valued. A clear and concise presentation, perhaps incorporating a sensitivity analysis showing the impact of different assumptions on the valuation, is vital for investor understanding.

Risks and Opportunities

No investment is without risk, and this section acknowledges and assesses the potential risks and opportunities facing the company. This might include macroeconomic factors, industry trends, competitive pressures, and regulatory changes. A well-structured discussion of these factors provides a balanced perspective, avoiding unrealistic optimism or undue pessimism. A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) presented visually, perhaps in a table format, could be particularly effective.

Recommendation

This section summarizes the analyst’s investment recommendation, based on the analysis presented throughout the report. This is often presented as a “buy,” “sell,” or “hold” recommendation, along with a target price. This recommendation should be clearly justified by the preceding analysis. A poorly justified recommendation can lead to investor distrust and undermine the credibility of the report.

Appendix

This section provides supplementary information, such as detailed financial statements, industry data, and the analyst’s assumptions. This is a treasure trove of additional information for those who want to dig deeper.

Sample Table of Contents

| Section | Description | Page | Visuals |

|---|---|---|---|

| Executive Summary | Overview of Acme Corp’s financial performance and investment recommendation. | 1 | Key metrics summary table |

| Company Overview | Background on Acme Corp, its industry, and competitive landscape. | 3 | Industry map |

| Financial Analysis | Detailed analysis of Acme Corp’s financial statements. | 7 | Revenue and EPS growth charts |

| Valuation | Assessment of Acme Corp’s intrinsic value using DCF and comparable company analysis. | 15 | Valuation summary table |

| Risks and Opportunities | Discussion of potential risks and opportunities for Acme Corp. | 21 | SWOT analysis table |

| Recommendation | Analyst’s investment recommendation and target price. | 25 | None |

| Appendix | Supplementary data and detailed financial statements. | 27 | Financial statements |

Data Sources and Methodology

Crafting a compelling stock market research report isn’t just about crunching numbers; it’s about finding the right numbers to crunch, and knowing the best way to do the crunching. Think of it as a culinary masterpiece: the finest ingredients (data) and the most skillful preparation (methodology) are key to a delicious (and profitable) result. Choosing the wrong ingredients or botching the recipe could lead to a financial soufflé that collapses faster than a penny stock.

The foundation of any robust stock market research report lies in its data sources and the analytical methodologies used to interpret them. We’ll delve into the fascinating world of financial data acquisition and the various analytical techniques that can either make or break your investment strategy. Remember, even the most sophisticated methodology is useless without reliable data.

Data Sources for Stock Market Research Reports

Securing accurate and comprehensive data is the cornerstone of a successful research report. Think of it as building a house – you wouldn’t start without a solid foundation, would you? Our data sources represent the bricks and mortar of our analysis. We draw upon a multitude of sources to ensure a holistic perspective, ranging from the meticulously detailed financial statements of publicly traded companies to the often-whimsical pronouncements found in news articles. Company filings, those treasure troves of information, provide invaluable insights into a company’s performance and future plans. Economic indicators, like inflation rates and GDP growth, provide the macroeconomic context crucial for understanding the broader market environment. Finally, we don’t ignore the ever-present chatter of the market itself, using news articles and analyst reports to glean sentiment and market expectations. The combination of these diverse sources allows us to build a robust and well-rounded picture.

Analytical Methodologies

Now, let’s talk about how we use all that delicious data. We employ a variety of analytical methodologies, each with its own strengths and weaknesses. Fundamental analysis, the bedrock of value investing, involves meticulously evaluating a company’s intrinsic value by examining its financial statements, business model, and competitive landscape. Think of it as meticulously assessing the ingredients before you start cooking. Technical analysis, on the other hand, focuses on historical price and volume data to identify patterns and predict future price movements. It’s like studying the recipe book for clues about the dish’s final presentation. Finally, quantitative analysis leverages statistical models and algorithms to identify undervalued assets or predict market trends. This is the advanced culinary technique – the use of specialized equipment and precise measurements to create a perfect dish. Each approach offers unique insights, and a skilled analyst blends them for a comprehensive understanding.

Reputable Data Providers

Choosing your data providers is crucial. You wouldn’t trust just any source for your culinary ingredients, would you? Here’s a list of reputable sources, categorizing them for clarity:

- Free Options: While limited in scope, free options like Google Finance, Yahoo Finance, and Finviz offer basic financial data. These are great for getting a quick overview, but shouldn’t be your only source for serious research.

- Paid Options: For in-depth analysis, paid providers like Bloomberg Terminal, Refinitiv Eikon, and FactSet offer comprehensive data sets, advanced analytical tools, and real-time market information. Think of these as the professional-grade chef’s tools – essential for creating truly sophisticated research.

Influence of Data Sources on Conclusions

The data sources used directly impact the conclusions and recommendations of a research report. For example, relying solely on news articles without corroborating financial statements could lead to inaccurate assessments of a company’s financial health. Similarly, using only historical data for technical analysis might fail to account for significant shifts in market sentiment or unforeseen events. The selection of data sources, therefore, is not a trivial matter but a crucial step in ensuring the reliability and validity of the final analysis. A well-rounded approach, using diverse and reliable data sources, minimizes the risk of biased or incomplete conclusions. It’s like a skilled chef using a variety of spices to create a perfectly balanced flavor profile.

Interpreting and Utilizing Research Reports

Navigating the world of stock market research reports can feel like deciphering ancient hieroglyphs – fascinating, but potentially baffling. Understanding how to properly interpret and utilize these reports is crucial for making informed investment decisions, transforming you from a bewildered bystander to a savvy market participant. This section will equip you with the tools to critically assess reports, identify potential pitfalls, and integrate their findings into your investment strategy.

Critical Evaluation of Research Report Credibility and Objectivity

The credibility and objectivity of a research report are paramount. A report brimming with bullish predictions but lacking rigorous methodology is akin to a pirate map leading to a treasure chest filled with… pebbles. To assess credibility, examine the source’s reputation. Is it a well-respected research firm with a history of accurate predictions (or at least, well-reasoned ones)? Look for transparent methodology descriptions; a vague or missing methodology section is a giant red flag. Consider the report’s author(s): are they known experts in the field? Finally, check for evidence of peer review or independent verification. A report backed by solid evidence is far more reliable than one based on gut feeling (or inside tips from a suspiciously well-informed parrot).

Identifying Potential Biases or Conflicts of Interest

Even seemingly objective reports can harbor hidden biases. Conflicts of interest are a common culprit. For example, a research firm heavily invested in a particular company might produce a report overwhelmingly positive about that company’s prospects, even if the underlying fundamentals are shaky. Look for any overt statements of investment positions or affiliations. Also, pay attention to the tone and language used. Excessively optimistic or pessimistic language might signal bias. Furthermore, consider the report’s timing: was it released just before a major stock offering? Such timing could suggest a deliberate attempt to influence investor behavior. A healthy dose of skepticism is your best friend in this game.

Integrating Research Report Findings into an Investment Strategy

Research reports shouldn’t dictate your investment strategy; rather, they should inform it. Think of them as valuable pieces of a larger puzzle, not the entire picture. Integrate findings by comparing them with your own analysis of the market and the company in question. Consider multiple reports from different sources to gain a broader perspective, avoiding the pitfall of relying solely on one potentially biased viewpoint. Remember, diversification is key; don’t put all your eggs in one basket based solely on a single research report, no matter how persuasive it might seem. Treat each report as a data point, not a divine revelation.

Hypothetical Scenario: Research Report and Investment Decision

Let’s imagine a research report from a reputable firm, “Wise Owl Investments,” predicted a significant increase in demand for sustainable energy stocks due to upcoming government regulations. The report meticulously detailed the regulatory changes, analyzed the market share of various companies in the sector, and presented a robust financial model supporting its projections. Based on this report, along with my own independent research confirming the regulatory changes and market trends, I decided to allocate a portion of my portfolio to a leading sustainable energy company, “GreenPower Inc.” GreenPower Inc.’s stock price did indeed increase significantly in the following months, aligning with Wise Owl Investments’ prediction, resulting in a profitable investment. However, this success was partially due to the independent verification of the prediction, highlighting the importance of cross-referencing information.

Visualizing Stock Market Data: Research Report Stock Market

Let’s face it, staring at columns of numbers representing stock prices is about as exciting as watching paint dry. Unless you’re a particularly enthusiastic accountant, that is. Fortunately, the world of data visualization offers a far more engaging – and insightful – approach to understanding the often-complex world of stock market performance. Visual aids transform abstract financial data into readily digestible information, allowing investors to quickly grasp trends, identify patterns, and make more informed decisions. They are, in short, the unsung heroes of successful investment strategies.

Visual aids are crucial because they allow us to process complex financial information quickly and efficiently. The human brain is far better at interpreting visual cues than it is at deciphering endless spreadsheets. A well-designed chart can instantly reveal trends that might take hours to uncover through purely numerical analysis. Furthermore, visuals can make complex relationships between different financial metrics more easily understandable, fostering a deeper comprehension of market dynamics. In essence, they translate the cryptic language of finance into a universal language everyone can understand.

Chart Types and Their Applications

Different chart types serve distinct purposes in visualizing stock market data. Choosing the right chart is crucial for effectively communicating the desired information. A mismatched chart type can lead to misinterpretations and flawed conclusions, potentially costing investors dearly (which, let’s be honest, is never fun).

- Line Charts: These are ideal for showing the price movements of a stock over time. They clearly illustrate trends, such as upward or downward trajectories, and highlight significant price changes. A simple line chart can quickly show whether a stock is experiencing growth, decline, or stagnation.

- Bar Charts: Bar charts are useful for comparing the performance of different stocks or sectors over a specific period. They allow for easy visual comparison of various data points, making it simple to identify the best or worst performers. Think of them as the “who’s on first?” of stock market visualization – clearly showing who’s leading and who’s lagging.

- Candlestick Charts: These charts provide a more detailed view of price movements, indicating the opening, closing, high, and low prices for a given period. They are particularly useful for identifying patterns and signals that can be used in technical analysis. Candlestick charts are the Sherlock Holmes of stock market visualization – they uncover hidden clues that others miss.

Examples of Effective and Ineffective Visualizations, Research report stock market

An effective visualization is clear, concise, and avoids unnecessary clutter. It uses appropriate chart types to highlight key trends and patterns, making it easy for the viewer to understand the data presented. For example, a line chart showing the steady growth of a tech company’s stock price over five years is an effective visualization. It clearly communicates the company’s success.

Conversely, an ineffective visualization might be overly complex, cluttered with unnecessary details, or use an inappropriate chart type. For example, a pie chart showing the daily price fluctuations of a stock would be highly ineffective, as the constantly changing data makes this chart type unsuitable. The result is a confusing and ultimately useless graphic, leaving the viewer more bewildered than informed.

Hypothetical Chart: Five-Year Performance of “Acme Corp”

Let’s imagine a candlestick chart visualizing the performance of Acme Corp, a fictional but wildly successful purveyor of novelty rubber chickens, over a five-year period (2019-2023). The chart would show daily opening, closing, high, and low prices. Key data points would include:

- 2019: A period of relatively stable growth, with a gradual upward trend indicated by predominantly green candlesticks (closing price higher than opening price).

- 2020: A significant dip in early 2020 (likely due to a global pandemic and a temporary shortage of rubber), shown by long red candlesticks (closing price lower than opening price). However, a strong recovery is evident in the latter half of the year, with a series of long green candlesticks.

- 2021-2022: Sustained growth with several minor corrections (short red candlesticks within an overall upward trend), indicating healthy market activity and investor confidence.

- 2023: A period of consolidation, with smaller price fluctuations and a mix of green and red candlesticks, suggesting a period of market stabilization after the previous years’ growth.

The overall interpretation would highlight Acme Corp’s resilience in the face of market challenges and its consistent long-term growth. The chart would visually demonstrate that despite short-term setbacks, the company’s stock has shown a positive trajectory over the five-year period.

Ultimate Conclusion

In conclusion, understanding stock market research reports is paramount for successful investing. While the process may initially seem daunting, by mastering the art of critical analysis, identifying reliable sources, and interpreting complex data visualizations, you’ll transform from a passive observer into an active and informed participant in the financial markets. This report serves as your guide, equipping you with the knowledge and tools to confidently navigate the exciting, yet often unpredictable, world of stock market investments. Remember, informed decisions are the cornerstone of successful investing.

Q&A

What is the difference between fundamental and technical analysis?

Fundamental analysis assesses a company’s intrinsic value based on its financial statements and economic factors, while technical analysis uses price charts and trading volume to predict future price movements.

Where can I find free stock market research reports?

Many brokerage firms offer free reports, although access may be limited. Financial news websites and government agencies also provide free data, though it may require more interpretation.

How often should I review stock market research reports?

The frequency depends on your investment strategy and the volatility of the market. Regular review, at least quarterly, is generally recommended for actively managed portfolios.

What are the limitations of stock market research reports?

Reports can be biased, outdated, or based on incomplete data. Always conduct your own due diligence before making investment decisions.