Anti-Money Laundering Regulations are the unsung heroes of the financial world, silently battling the shadowy figures who try to launder their ill-gotten gains. These regulations, born from a need to curb illicit activities and maintain the integrity of global financial systems, have evolved into a complex web of laws and procedures. This guide delves into the intricacies of AML compliance, exploring everything from Know Your Customer (KYC) procedures to the latest technological advancements in combating financial crime. We’ll unravel the complexities, expose the red flags, and highlight the crucial role technology plays in this ongoing battle.

From the historical context of AML legislation to the cutting-edge applications of artificial intelligence in fraud detection, we aim to provide a clear and engaging overview. We’ll examine the differing regulatory landscapes across major jurisdictions, highlighting key legislation, enforcement agencies, and the potential penalties for non-compliance. This exploration will include detailed analyses of Customer Due Diligence (CDD), transaction monitoring, and the creation of robust compliance programs. Get ready for a fascinating journey into the world of financial crime prevention!

Overview of Anti-Money Laundering (AML) Regulations

The world of finance, while often glittering with the allure of vast fortunes, also harbors shadowy figures attempting to launder their ill-gotten gains. Enter Anti-Money Laundering (AML) regulations – the financial world’s unsung heroes, tirelessly battling the forces of illicit cash. These regulations aren’t just about stopping bad guys; they’re crucial for maintaining the integrity and stability of the global financial system. Think of them as the financial system’s immune system, fighting off the viral spread of dirty money.

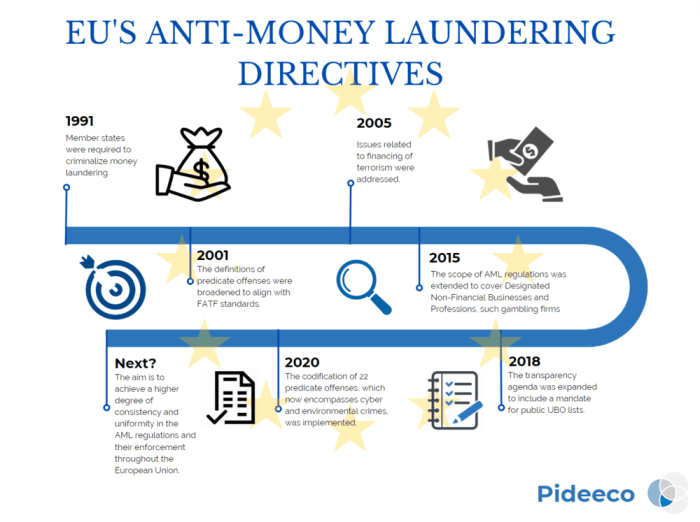

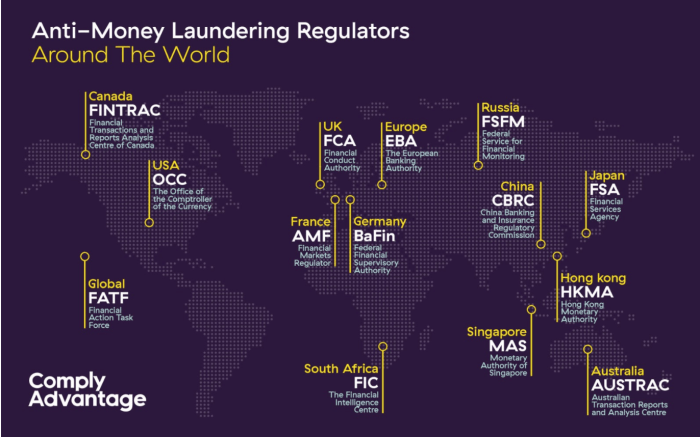

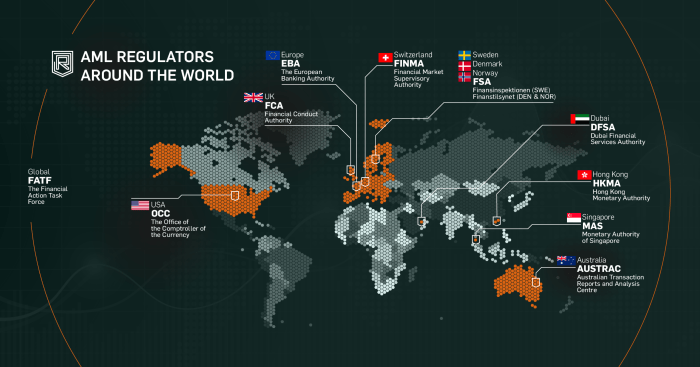

AML regulations aim to prevent the movement of illegally obtained money through legitimate financial channels. Their history is a fascinating cat-and-mouse game, with regulators constantly adapting to the ever-evolving tactics of money launderers. Early efforts were fragmented and largely ineffective, but the rise of international organized crime and terrorism in the late 20th century spurred a global push for more robust and coordinated AML frameworks. The creation of the Financial Action Task Force (FATF) in 1989 marked a significant turning point, establishing international standards and promoting cooperation between countries. Since then, AML regulations have become increasingly sophisticated, incorporating advanced technologies and data analytics to detect suspicious activity.

Key Principles Underlying AML Compliance

The core principles underpinning effective AML compliance are surprisingly straightforward, though their implementation can be devilishly complex. These principles emphasize a proactive approach, requiring financial institutions to understand their customers, monitor their transactions, and report any suspicious activity to the relevant authorities. This involves a multi-faceted approach encompassing robust customer due diligence (CDD), transaction monitoring, employee training, and the establishment of a comprehensive AML compliance program. Think of it as a financial security system, with multiple layers of protection to prevent money laundering attempts from succeeding. Failure to adhere to these principles can result in severe penalties, reputational damage, and even criminal prosecution.

Comparative Analysis of AML Regulations

AML regulations vary across jurisdictions, reflecting differing legal traditions and enforcement priorities. However, the underlying principles remain consistent. Below is a comparison of AML regulations in three major jurisdictions:

| Jurisdiction | Key Legislation | Enforcement Agency | Penalties for Non-Compliance |

|---|---|---|---|

| USA | Bank Secrecy Act (BSA), USA PATRIOT Act | Financial Crimes Enforcement Network (FinCEN) | Significant fines, criminal prosecution, imprisonment |

| UK | Proceeds of Crime Act 2002, Money Laundering Regulations 2017 | Financial Conduct Authority (FCA), National Crime Agency (NCA) | Unlimited fines, criminal prosecution, imprisonment |

| EU | Anti-Money Laundering Directive (AMLD), Regulation (EU) 2015/847 | Various national authorities, European Banking Authority (EBA) | Significant fines, criminal prosecution, imprisonment, license revocation |

The penalties for non-compliance, as illustrated in the table, are substantial and can severely impact financial institutions. These penalties serve as a strong deterrent against non-compliance and highlight the importance of robust AML programs. The ongoing battle against money laundering requires constant vigilance and adaptation, ensuring that the financial system remains a safe and secure environment for legitimate transactions.

Customer Due Diligence (CDD) Procedures

Customer Due Diligence (CDD) – the bane of many a bank employee’s existence, yet the bedrock of a financially stable and ethically sound world. Think of it as the meticulous detective work that prevents the shadowy figures of the underworld from laundering their ill-gotten gains. It’s a process so rigorous, it makes getting a library card look like child’s play.

CDD is essentially all about knowing your customer – inside and out, like a nosy neighbour with a penchant for detail. This involves verifying their identity, understanding their business activities, and assessing their risk profile. Failure to do so can result in hefty fines, reputational damage, and the kind of headache that only a triple espresso can cure.

Know Your Customer (KYC) Process and its Components, Anti-Money Laundering Regulations

The KYC process is the heart of CDD. It’s a multi-step procedure designed to confirm the true identity of your customer and the legitimacy of their transactions. Think of it as a rigorous identity parade, but instead of a lineup, you have documents, background checks, and maybe even a lie detector test (just kidding… mostly). The components of a robust KYC process typically include:

- Customer Identification Program (CIP): This involves collecting identifying information from customers, such as their name, address, date of birth, and government-issued identification. It’s the first step in verifying who they claim to be.

- Verification of Identity (VOI): This is where you delve deeper, comparing the information provided by the customer against independent sources to confirm its accuracy. Think credit reports, national databases, and even a quick Google search (okay, maybe not the last one).

- Beneficial Ownership Determination: For companies and other legal entities, this involves identifying the ultimate beneficial owner(s) – the individuals who ultimately control the entity. This can be tricky, but crucial to preventing shell companies from being used for illicit activities.

Enhanced Due Diligence for High-Risk Customers

Not all customers are created equal. Some, due to their nature of business or geographic location, present a higher risk of money laundering. For these high-risk customers, enhanced due diligence (EDD) is required. This involves going above and beyond the standard KYC procedures. Imagine it as switching from a regular magnifying glass to a high-powered electron microscope.

EDD procedures might include:

- More frequent monitoring of accounts and transactions: Keeping a closer eye on suspicious activity, like a hawk watching its prey.

- Independent verification of customer information from multiple sources: Leaving no stone unturned in the quest for truth.

- Increased scrutiny of the source of funds: Tracing the money back to its origins, like a financial archaeologist.

- Ongoing monitoring of the customer’s business activities: Keeping tabs on their dealings, like a watchful guardian angel (but with stricter rules).

Customer Onboarding and Ongoing Monitoring Flowchart

Imagine a flowchart as a visual roadmap for navigating the complexities of AML compliance. It would start with the customer application, then proceed through the various KYC and EDD steps, culminating in ongoing monitoring of the account. The flowchart would clearly illustrate the decision points, such as whether the customer is high-risk, and the appropriate actions to be taken at each stage. A simplified example would show a clear path from initial application to ongoing monitoring, with clear branching points for high-risk customer identification and subsequent EDD procedures. The process would loop back to ongoing monitoring, ensuring continuous vigilance against suspicious activity. Think of it as a never-ending cycle of vigilance – because the fight against money laundering never truly ends.

Transaction Monitoring and Reporting

Transaction monitoring and reporting – the thrilling detective work of the financial world! While it might not involve car chases and explosions, it’s just as crucial in combating the shadowy figures of money laundering. This process involves diligently scrutinizing financial transactions to identify suspicious patterns, acting as a crucial safeguard against illicit activities. Think of it as a financial bloodhound, sniffing out the bad actors.

Effective transaction monitoring systems are the backbone of any robust AML program. They’re not just about ticking boxes; they’re about proactively identifying potential money laundering attempts before they become full-blown scandals. These systems analyze vast amounts of data, looking for anomalies and red flags that might indicate something fishy is going on. The key is to strike a balance between thoroughness and efficiency – no one wants to be drowning in false positives.

Common Red Flags Indicative of Money Laundering Activities

Several indicators can signal that something isn’t quite right. These “red flags” are crucial clues that warrant further investigation. Ignoring them is akin to ignoring a smoke alarm – you’re inviting trouble.

- Structuring (Smurfing): Breaking down large transactions into smaller amounts to avoid detection. Imagine someone depositing $9,999 repeatedly instead of one $100,000 deposit. The sheer volume of smaller transactions becomes a red flag.

- Unusual Activity: Sudden and significant increases in transaction volume or value that deviate from a customer’s typical behavior. Think of a retiree suddenly making several large international wire transfers.

- Complex Transaction Patterns: Transactions involving multiple accounts, jurisdictions, and shell corporations, creating a convoluted trail designed to obfuscate the source of funds. It’s like trying to follow a labyrinthine maze created by a mischievous accountant.

- Suspicious Customer Profiles: Customers involved in high-risk industries (e.g., casinos, precious metals trading) or those with known links to criminal organizations. This isn’t about profiling, but about identifying individuals who may be more likely to engage in money laundering.

- Lack of Transparency: Customers who provide incomplete or inaccurate information about their business or source of funds. Think of someone who claims their millions come from “investments” but can’t provide any details.

Best Practices for Implementing Effective Transaction Monitoring Systems

Implementing a robust transaction monitoring system is paramount. It requires a multi-faceted approach, encompassing technology, training, and a commitment to continuous improvement. Think of it as building a high-security fortress, one brick at a time.

- Rule-Based Systems: Establish clear rules and thresholds for flagging suspicious transactions based on predefined parameters. These rules should be regularly reviewed and updated to adapt to evolving money laundering techniques.

- AI and Machine Learning: Leverage advanced technologies to identify complex and subtle patterns that might be missed by traditional rule-based systems. AI acts as the ever-vigilant guard, tirelessly scanning for anomalies.

- Data Integration: Integrate data from various sources, including customer information, transaction history, and publicly available data, to create a holistic view of customer activity. The more data you have, the clearer the picture becomes.

- Regular Review and Tuning: Continuously review and refine monitoring rules and thresholds based on identified patterns and emerging trends. This ensures the system remains effective in detecting new and sophisticated money laundering schemes.

- Staff Training: Provide comprehensive training to staff on AML regulations, red flags, and the use of transaction monitoring systems. A well-trained team is crucial to the system’s success.

Suspicious Activity Reporting (SAR) to Relevant Authorities

Reporting suspicious activity is not just a formality; it’s a critical step in disrupting money laundering networks. It’s the moment when all the investigative work culminates in action, and it requires accuracy and thoroughness. Think of it as the final, crucial piece of the puzzle.

A SAR typically includes detailed information about the suspicious activity, the customer involved, and any supporting documentation. Failure to report suspicious activity can have serious legal consequences.

- Example 1: A series of cash deposits totaling $90,000 from a known low-income individual.

- Example 2: A sudden and significant increase in wire transfers to offshore accounts with no clear business purpose.

- Example 3: Multiple transactions structured to avoid triggering reporting thresholds.

- Example 4: A customer providing inconsistent or false information about the source of funds.

- Example 5: Transactions linked to known or suspected terrorist financing activities.

AML Compliance Programs and Internal Controls

Building a robust Anti-Money Laundering (AML) compliance program isn’t just about ticking boxes; it’s about weaving a financial fortress impervious to the wily ways of money launderers. Think of it as a game of financial chess, where you’re anticipating every move the opponent might make. A well-structured program isn’t just about meeting regulatory requirements; it’s about safeguarding your institution’s reputation and ensuring its long-term survival.

A comprehensive AML compliance program requires a multi-faceted approach, incorporating risk assessment, employee training, ongoing monitoring, and, crucially, a responsive and adaptable internal control framework. Failure to do so can result in hefty fines, reputational damage, and even criminal prosecution – not exactly the ingredients for a successful financial recipe.

Essential Elements of a Comprehensive AML Compliance Program

A truly effective AML compliance program isn’t a one-size-fits-all solution. It must be tailored to the specific risks faced by the institution, considering factors like the type of business, customer base, and geographic location. However, certain core elements are universally crucial. These elements act as the foundational pillars supporting the entire structure, ensuring its stability and resilience against the pressures of AML threats.

- Risk Assessment: A thorough assessment identifying potential vulnerabilities and prioritizing areas needing attention. This involves analyzing transaction patterns, customer profiles, and emerging threats to pinpoint weaknesses in the system. Think of it as a financial security audit, identifying potential entry points for illicit funds.

- Customer Due Diligence (CDD): Rigorous procedures for verifying customer identities and understanding their business activities. This is akin to a thorough background check, ensuring that every customer is who they claim to be and their activities are above board.

- Employee Training: Regular and comprehensive training programs to educate staff on AML regulations and procedures. This equips employees with the knowledge and skills to identify suspicious activities and report them promptly. It’s like giving your financial troops the best possible training to fight the good fight.

- Transaction Monitoring: Implementing systems to monitor transactions for suspicious patterns. This involves using sophisticated software to flag unusual activities that might indicate money laundering. It’s like having a highly trained watchdog constantly guarding the financial gates.

- Suspicious Activity Reporting (SAR): Establishing clear procedures for filing SARs with the appropriate authorities. This ensures that potential money laundering activities are promptly reported, allowing law enforcement to investigate and take action. This is the crucial step of calling in the cavalry when suspicious activity is detected.

The Role of the AML Compliance Officer

The AML Compliance Officer is the program’s conductor, orchestrating the various elements to ensure harmonious operation. They are responsible for developing, implementing, and maintaining the AML compliance program, overseeing training, monitoring compliance, and coordinating with regulatory bodies. This individual is the gatekeeper, ensuring that all procedures are followed diligently and that the institution remains compliant with all relevant regulations. They’re the financial Sherlock Holmes, constantly investigating and ensuring the integrity of the institution’s financial dealings.

Key Internal Controls to Mitigate AML Risks

Internal controls act as the safety net, catching any errors or lapses before they escalate into major problems. They’re the fail-safes, ensuring that even if a system component malfunctions, the entire program doesn’t collapse. A robust internal control system ensures that AML procedures are followed consistently and effectively, reducing the risk of non-compliance.

- Segregation of Duties: Preventing any single individual from having excessive control over financial transactions. This is a classic control measure, ensuring that no one person can manipulate the system for their own gain.

- Independent Audits: Regular independent audits of the AML compliance program to assess its effectiveness and identify areas for improvement. This is like having a financial auditor regularly inspecting the fortress walls for any cracks or weaknesses.

- Documentation and Record Keeping: Maintaining meticulous records of all AML-related activities. This provides a clear audit trail, making it easier to trace transactions and investigate any suspicious activities. This ensures that all financial activities are thoroughly documented and easily traceable.

- Regular Review and Updates: Continuously reviewing and updating the AML compliance program to adapt to changing regulations and emerging threats. This ensures that the program remains effective in the face of evolving criminal tactics. It’s like updating the fortress’s defenses to counter new siege weapons.

Penalties and Enforcement Actions for Non-Compliance: Anti-Money Laundering Regulations

Navigating the world of Anti-Money Laundering (AML) regulations can feel like tiptoeing through a minefield of complex rules and potentially devastating consequences. One wrong step, and you could find yourself facing hefty fines, crippling legal battles, and a severely tarnished reputation. Let’s explore the realities of AML non-compliance and the painful price of neglecting these vital regulations.

The penalties for AML violations in the United States can vary wildly depending on the severity of the offense, the size of the institution involved, and the level of cooperation shown during the investigation. Think of it as a sliding scale of financial pain, ranging from a gentle tap on the wrist to a full-blown financial knockout. The regulatory bodies involved – including the Financial Crimes Enforcement Network (FinCEN), the Office of the Comptroller of the Currency (OCC), and the Federal Reserve – wield considerable power to impose sanctions.

Penalties for AML Violations in the United States

A range of penalties awaits those who stumble in the AML arena. Civil monetary penalties can reach millions of dollars, depending on the violation’s gravity. Criminal penalties, on the other hand, can involve significant fines and even imprisonment for individuals. Beyond financial repercussions, institutions might face operational restrictions, such as limitations on business activities or even license revocation. The reputational damage alone can be catastrophic, leading to loss of customer trust and significant financial losses. For example, a small bank might face a fine of several hundred thousand dollars for a minor procedural oversight, whereas a large multinational bank could face tens of millions of dollars in penalties for a systemic failure. The difference is often directly proportional to the size and scope of the institution and the amount of money involved in the suspicious transactions.

Examples of Enforcement Actions Against Organizations for AML Failures

Several high-profile cases highlight the consequences of AML failures. One notable example involves a major international bank that was fined tens of millions of dollars for failing to adequately monitor transactions, leading to the processing of billions of dollars in suspicious funds linked to drug trafficking. Another case involved a smaller regional bank that was forced to pay millions in fines and accept significant operational restrictions due to lax customer due diligence procedures. These enforcement actions serve as stark reminders of the importance of robust AML compliance programs. In one instance, a money services business was shut down completely due to repeated violations and a demonstrated lack of any effective AML program. These actions are not just about fines; they are about protecting the financial system from illicit activities.

Case Study: The Downfall of “Global Exchange Corp.”

Imagine “Global Exchange Corp.,” a fictional but realistically depicted international money transfer business. Initially successful, Global Exchange Corp. prioritized rapid growth over robust AML compliance. They skimped on employee training, failed to implement effective transaction monitoring systems, and ignored numerous red flags. The consequences were swift and brutal. Regulatory investigations revealed massive amounts of money laundering, leading to multi-million-dollar fines, criminal charges against several executives, and the eventual closure of the business. The company’s assets were seized, its reputation destroyed, and its employees left jobless. This fictionalized case study illustrates a common pattern: neglecting AML compliance ultimately leads to far greater costs than investing in it. The initial savings on compliance measures are dwarfed by the costs of investigations, fines, legal fees, and the ultimate loss of business.

Emerging Trends and Challenges in AML

The world of anti-money laundering (AML) is a thrilling rollercoaster ride, constantly evolving to match the ingenuity (and frankly, the sheer audacity) of those seeking to launder their ill-gotten gains. Technological advancements and increasingly sophisticated criminal networks present ever-shifting landscapes, demanding continuous adaptation and innovation from those fighting the good fight. Let’s delve into some of the most pressing trends and challenges.

The fight against money laundering is a never-ending game of cat and mouse, with the criminals constantly innovating new methods and the regulators struggling to keep up. This dynamic tension is fueled by technological advancements and the globalization of financial systems, creating a complex web of challenges that require a multifaceted approach.

The Impact of Cryptocurrency on AML Challenges

The rise of cryptocurrencies has undeniably added a new layer of complexity to AML efforts. The decentralized and pseudonymous nature of these digital assets makes tracing the flow of funds significantly more difficult than with traditional banking systems. Think of it as a global game of hide-and-seek, played with invisible ink and a whole lot of digital sleight of hand. The lack of centralized oversight and the potential for anonymity create fertile ground for illicit activities, requiring innovative approaches to monitoring and detection. For example, the use of mixers and tumblers obscures the origin and destination of cryptocurrency transactions, making it challenging to identify suspicious activity. Furthermore, the rapid growth and evolution of the cryptocurrency ecosystem necessitate constant adaptation of AML/CFT (Combating the Financing of Terrorism) frameworks.

Challenges Posed by Cross-Border Money Laundering Activities

Cross-border money laundering is like a sophisticated game of international tag – the money zips across borders, leaving a trail that’s difficult to follow. The complexity arises from the involvement of multiple jurisdictions, each with its own regulatory frameworks and levels of cooperation. This jurisdictional fragmentation makes it challenging to track the movement of funds and coordinate investigations effectively. Furthermore, differences in legal definitions and enforcement capabilities create loopholes that criminals can exploit. Consider the case of a complex scheme involving shell companies in multiple tax havens, moving funds through various jurisdictions to obscure their origin. Tracing the money’s trail becomes a Herculean task requiring international collaboration and sophisticated investigative techniques.

Evolving Strategies Employed by Financial Institutions to Combat Money Laundering

Financial institutions are increasingly adopting advanced technologies to combat money laundering. This includes utilizing artificial intelligence (AI) and machine learning (ML) algorithms to analyze vast amounts of transactional data and identify suspicious patterns. Imagine AI as a tireless detective, sifting through mountains of data to uncover hidden connections and anomalies that would be impossible for a human to spot. Enhanced due diligence procedures, including robust customer identification and verification processes, are also being implemented. Furthermore, many institutions are strengthening their internal controls and compliance programs, investing in specialized training for their staff, and fostering better collaboration with law enforcement agencies. These strategies, while not foolproof, represent a significant step towards a more effective AML framework.

The Role of Technology in AML Compliance

The fight against money laundering is a David versus Goliath battle, with sophisticated criminals constantly evolving their tactics. Fortunately, David has some powerful new weapons in his arsenal: technology. The application of cutting-edge tools is revolutionizing AML compliance, allowing businesses to keep pace with – and even outsmart – the bad actors. This section explores how technology, particularly artificial intelligence and RegTech solutions, are transforming the landscape of AML compliance.

Artificial intelligence and machine learning are used in AML detection by analyzing vast amounts of transactional data to identify suspicious patterns that would be impossible for humans to spot within a reasonable timeframe. Think of it as having a tireless, hyper-focused detective working 24/7, sifting through millions of transactions to uncover hidden connections and anomalies. These algorithms can identify subtle red flags, such as unusual transaction volumes, unusual transaction partners, or transactions that deviate significantly from a customer’s established pattern. The power of AI lies in its ability to learn and adapt, constantly improving its accuracy as it processes more data. For instance, an AI system might initially flag a large transaction as suspicious. However, if it learns that this is a regular occurrence for a particular customer, it will adjust its parameters and stop flagging it as suspicious.

Artificial Intelligence and Machine Learning in AML Detection

AI and machine learning algorithms analyze transactional data, identifying anomalies and patterns indicative of money laundering. This includes identifying unusual transaction volumes, frequencies, and locations, as well as detecting connections between seemingly unrelated transactions or accounts. The technology can also analyze unstructured data, such as news articles or social media posts, to assess risk factors. For example, a sudden increase in transactions linked to a company mentioned in a news report about a suspected money laundering scheme might trigger an alert. The algorithms constantly learn and adapt, becoming more effective at identifying suspicious activity over time.

Benefits and Limitations of RegTech Solutions for AML Compliance

RegTech solutions offer several advantages. They automate previously manual and time-consuming processes, improving efficiency and reducing operational costs. They also enhance accuracy, reducing the risk of human error. Furthermore, they provide better scalability, enabling businesses to handle increasing volumes of data and transactions. However, RegTech solutions are not without their limitations. The initial investment can be substantial, and ongoing maintenance and updates are required. There is also the risk of false positives, which can lead to unnecessary investigations and disruptions. Finally, the effectiveness of a RegTech solution depends on the quality of the data it is fed; garbage in, garbage out.

Hypothetical Scenario: Technology Identifying and Preventing Money Laundering

Imagine a fictional online gambling platform, “LuckySpin,” using an AI-powered AML system. A high-roller, “Mr. Big,” deposits a large sum of money, seemingly legitimate. However, the AI system flags this deposit because it identifies unusual patterns in Mr. Big’s previous transactions, combined with publicly available information indicating Mr. Big’s recent involvement in a high-profile tax evasion case. The system further cross-references Mr. Big’s IP address with known shell company addresses and suspicious online forums. Based on this comprehensive analysis, LuckySpin automatically blocks Mr. Big’s account, preventing further transactions and reporting the suspicious activity to the relevant authorities. This swift action, powered by technology, effectively thwarts a potential money laundering operation before it can fully materialize. This scenario highlights the proactive and preventative capabilities of technology in AML compliance.

International Cooperation in Combating Money Laundering

The global fight against money laundering is, shall we say, a rather messy affair. Criminals are remarkably adept at traversing borders, leaving a trail of ill-gotten gains in their wake, much like a particularly mischievous snail leaving a shimmering slime trail across a priceless Persian rug. International cooperation, therefore, isn’t just a good idea; it’s the only sensible approach to tackling this complex problem. Without a coordinated global effort, we’d be chasing shadows in a game of international financial whack-a-mole.

International organizations play a pivotal role in establishing global AML standards and promoting cooperation amongst nations. These standards aim to create a consistent approach to identifying, preventing, and prosecuting money laundering activities, preventing criminals from exploiting gaps in one country’s regulations to launder money elsewhere. Think of it as a global “do not launder” list, collaboratively maintained to keep the world’s financial systems clean(er).

The Role of the Financial Action Task Force (FATF) in Setting AML Standards

The Financial Action Task Force (FATF) is arguably the most significant player in the international AML arena. Established in 1989, this intergovernmental organization sets international standards, promotes the effective implementation of national AML/CFT (Combating the Financing of Terrorism) measures, and works to identify and counter money laundering and terrorist financing risks. The FATF’s recommendations are widely considered the gold standard for AML/CFT compliance, influencing legislation and regulatory frameworks across the globe. Its influence is akin to a financial referee, ensuring fair play (or at least, less dirty play) in the international financial system. Non-compliance with FATF standards can result in severe consequences, including sanctions and reputational damage, making countries very keen to follow the rules. Think of it as a very serious game of financial Jenga, where pulling out the wrong piece (non-compliance) could bring the whole tower crashing down.

Comparison of AML Regulatory Frameworks: FATF vs. Egmont Group

While the FATF focuses on setting standards and evaluating countries’ compliance, the Egmont Group takes a more collaborative approach. The Egmont Group is a network of Financial Intelligence Units (FIUs) from various countries. FIUs are the agencies responsible for receiving, analyzing, and disseminating financial intelligence related to money laundering and terrorist financing. The Egmont Group facilitates the secure exchange of information between FIUs, allowing for better cross-border investigations. The FATF sets the rules; the Egmont Group helps enforce them through intelligence sharing. It’s like a detective agency for the global financial system, connecting the dots across borders. While FATF provides the overall framework, the Egmont Group emphasizes practical cooperation, providing a vital operational component to the global AML effort.

The Importance of Information Sharing and Collaboration Between Countries

The free flow of information is the lifeblood of effective AML efforts. Money laundering schemes are often complex and involve multiple jurisdictions. Without effective information sharing, investigators are like blindfolded wrestlers trying to pin down a greased pig. Collaboration allows countries to connect the dots, identify patterns, and build stronger cases against money launderers. This collaborative effort can lead to the disruption of transnational criminal networks and the recovery of stolen assets. Imagine a global network of investigators, connected like a high-tech spiderweb, instantly sharing information to catch the financial criminals before they can escape. The success of international AML cooperation hinges on the seamless exchange of information between countries, turning a fragmented battle into a coordinated assault on financial crime.

Final Thoughts

Navigating the labyrinthine world of Anti-Money Laundering Regulations requires vigilance, proactive measures, and a deep understanding of evolving threats. While the fight against money laundering is an ongoing battle, the implementation of robust compliance programs, leveraging technological advancements, and fostering international cooperation are crucial steps towards safeguarding the integrity of our financial systems. By understanding the complexities of AML compliance, financial institutions and businesses can protect themselves from significant legal and reputational risks, contributing to a more secure and transparent global financial landscape. The stakes are high, the challenges are real, but the rewards of a cleaner financial system are immeasurable.

General Inquiries

What happens if my company fails to comply with AML regulations?

Penalties for non-compliance vary widely by jurisdiction but can include hefty fines, legal action, reputational damage, and even criminal charges for individuals involved.

How often should AML procedures be reviewed and updated?

AML procedures should be reviewed and updated regularly, at least annually, to account for changes in legislation, technology, and emerging money laundering techniques.

Are there any specific training requirements for employees involved in AML compliance?

Yes, most jurisdictions require specific AML training for employees handling financial transactions or involved in compliance functions. The specifics of training requirements vary by location and industry.

What is the role of a compliance officer in AML?

A compliance officer is responsible for overseeing the implementation and effectiveness of the organization’s AML program, ensuring adherence to regulations, and reporting suspicious activities.

Can small businesses ignore AML regulations?

No, AML regulations apply to businesses of all sizes. While the complexity of compliance may vary, all businesses handling financial transactions must adhere to relevant AML laws.