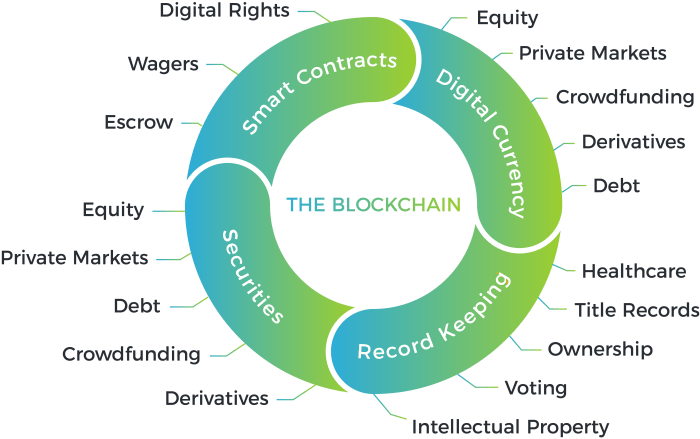

Blockchain technology is rapidly transforming the financial landscape, offering innovative solutions to long-standing challenges. From decentralized finance (DeFi) applications disrupting traditional banking to the secure issuance of security tokens, blockchain’s impact is undeniable. This exploration delves into the multifaceted applications of blockchain in finance, examining its potential to enhance efficiency, transparency, and security across various sectors.

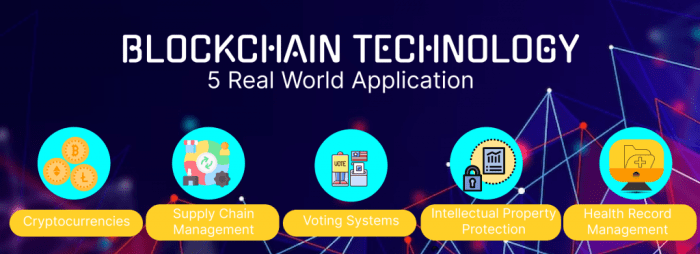

We will explore key areas like DeFi, security token offerings (STOs), blockchain-based payment systems, supply chain management, and investment management. Each area presents unique opportunities and challenges, and we’ll analyze both the advantages and limitations of blockchain adoption within these contexts. This examination aims to provide a comprehensive overview of the current state and future trajectory of blockchain’s influence on the financial world.

Decentralized Finance (DeFi) Applications

Decentralized Finance (DeFi) represents a transformative shift in the financial landscape, leveraging blockchain technology to offer financial services without intermediaries. This eliminates traditional gatekeepers, promising increased transparency, accessibility, and efficiency. The core principle is to build trust and security not through centralized institutions but through cryptographic algorithms and distributed consensus mechanisms.

Blockchain’s Role in Enabling Decentralized Financial Services

Blockchain technology underpins DeFi’s decentralized nature. Its immutable ledger ensures transparency and security in transactions, eliminating the need for trusted third parties. Smart contracts, self-executing agreements written in code, automate processes, reducing reliance on intermediaries and streamlining operations. The decentralized and transparent nature of the blockchain fosters trust among participants, enabling peer-to-peer lending, borrowing, and trading without the need for banks or other centralized institutions. This creates a more efficient and potentially fairer financial system.

Examples of DeFi Applications

Several DeFi applications demonstrate the technology’s potential. Decentralized exchanges (DEXs), such as Uniswap and SushiSwap, allow users to trade cryptocurrencies without intermediaries, offering greater liquidity and price discovery. Lending and borrowing platforms like Aave and Compound enable users to lend and borrow crypto assets, earning interest on deposits or accessing loans at competitive rates. Stablecoins, like DAI and USDC, provide price stability in the volatile cryptocurrency market, facilitating easier transactions and reducing risk. These applications offer benefits such as increased accessibility, reduced transaction fees, and greater control over personal finances.

Comparison of Traditional Finance and DeFi

Traditional finance relies on centralized institutions like banks and brokers, which control access to financial services and often charge high fees. DeFi, in contrast, offers decentralized, permissionless access, potentially lowering costs and increasing efficiency. However, DeFi also presents risks, including smart contract vulnerabilities and the volatility of cryptocurrencies. Traditional finance offers regulatory oversight and established consumer protection, while DeFi is largely unregulated, exposing users to greater risk. The table below summarizes the key differences.

| Feature | Traditional Finance | DeFi |

|---|---|---|

| Centralization | Highly centralized | Decentralized |

| Accessibility | Restricted access | Open and permissionless access |

| Transparency | Limited transparency | High transparency |

| Regulation | Heavily regulated | Largely unregulated |

Hypothetical DeFi Application: Decentralized Micro-loan Platform

This application would leverage blockchain to provide microloans to underserved populations globally. Users could create profiles, verifying their identity using decentralized identity solutions. Lenders could deposit funds into a smart contract, earning interest based on loan repayment. The smart contract would automate loan disbursement and repayment, reducing administrative overhead. The target audience includes individuals in developing countries lacking access to traditional banking services, allowing them to start businesses or meet immediate financial needs. The platform would incorporate robust risk assessment mechanisms and utilize stablecoins to mitigate currency volatility.

Comparison of DeFi Protocols

Different DeFi protocols operate on various blockchains, utilizing diverse governance models and security features. The table below provides a comparison of three prominent protocols.

| Protocol | Blockchain | Governance Model | Security Features |

|---|---|---|---|

| Aave | Ethereum, Polygon, Avalanche | Decentralized governance through AAVE token holders | Smart contract audits, risk management algorithms |

| Uniswap | Ethereum, Polygon, Optimism | Decentralized autonomous organization (DAO) | Open-source code, community audits |

| MakerDAO | Ethereum | Decentralized governance through MKR token holders | Over-collateralization, risk parameters |

Security Tokens and Asset Tokenization

Security tokens represent a significant advancement in the intersection of finance and blockchain technology. By leveraging blockchain’s inherent transparency, immutability, and security, security tokens offer a streamlined and efficient method for issuing and managing various financial instruments, transforming how assets are owned, traded, and governed. This technology has the potential to revolutionize capital markets and unlock new opportunities for investors and issuers alike.

The process of tokenizing real-world assets involves representing the ownership or rights to an asset – such as real estate, art, or intellectual property – as a digital token on a blockchain. This token acts as a verifiable and transferable representation of the underlying asset, offering fractional ownership possibilities and enhancing liquidity. However, this process requires careful consideration of legal and regulatory frameworks, which vary significantly across jurisdictions. Compliance with securities laws is paramount, ensuring that token offerings adhere to all relevant regulations and investor protection measures.

Benefits of Blockchain for Issuing and Managing Security Tokens

Blockchain technology offers several key advantages for issuing and managing security tokens. These include enhanced transparency through immutable records of ownership, reduced costs associated with traditional intermediaries, increased efficiency in transfer and settlement processes, and improved accessibility to a global investor base. The automated nature of blockchain transactions minimizes human error and streamlines compliance processes. Furthermore, the programmable nature of blockchain allows for the creation of sophisticated security token structures with embedded functionalities such as dividend payments or voting rights.

Tokenizing Real-World Assets: Legal and Regulatory Considerations

Tokenizing real-world assets involves navigating a complex legal and regulatory landscape. The legal classification of the token (as a security or utility token) significantly impacts the regulatory requirements. Issuers must comply with securities laws, anti-money laundering (AML) regulations, and know-your-customer (KYC) requirements. The legal framework governing the underlying asset also plays a crucial role, requiring careful consideration of property rights, intellectual property rights, and other relevant legal aspects. Jurisdictional differences further complicate matters, requiring issuers to understand and comply with the specific regulations of their target markets. For example, the SEC in the US has stringent regulations surrounding security token offerings, requiring issuers to register their offerings or qualify for exemptions.

Challenges and Risks Associated with Security Token Offerings (STOs)

Despite the potential benefits, STOs also present certain challenges and risks. These include the complexities of regulatory compliance, the potential for fraud and scams, the need for robust security measures to protect against hacking and theft, and the liquidity of the secondary market for security tokens. The lack of standardized regulatory frameworks across different jurisdictions can also pose a significant challenge for international STOs. Furthermore, the technical complexity of blockchain technology can present a barrier to entry for some investors. Finally, the volatility of the cryptocurrency market can indirectly impact the value of security tokens, even those backed by real-world assets.

Comparison of STOs and Initial Coin Offerings (ICOs)

STOs differ significantly from ICOs in terms of regulatory compliance and investor protection. ICOs, which were prevalent in the early days of cryptocurrencies, often lacked regulatory oversight and investor protection mechanisms. In contrast, STOs are designed to comply with existing securities laws, providing a higher level of investor protection and regulatory certainty. STOs typically involve more rigorous due diligence processes, KYC/AML compliance, and adherence to securities regulations. This results in a more regulated and less risky investment compared to the often unregulated nature of ICOs. This increased regulatory scrutiny makes STOs a more suitable option for institutional investors and those seeking compliance with established financial frameworks.

Creating a Security Token: A Step-by-Step Guide

Creating a security token involves several key steps. First, the underlying asset must be carefully evaluated and legally documented. Next, a suitable blockchain platform needs to be selected, considering factors such as scalability, security, and regulatory compliance. Then, a smart contract needs to be developed and audited to govern the token’s functionalities and ensure compliance with legal requirements. After that, the token needs to be issued, following all relevant legal and regulatory procedures. Finally, a secure and compliant platform for trading the security tokens must be established. The entire process requires the expertise of legal, financial, and technical professionals to ensure compliance and success.

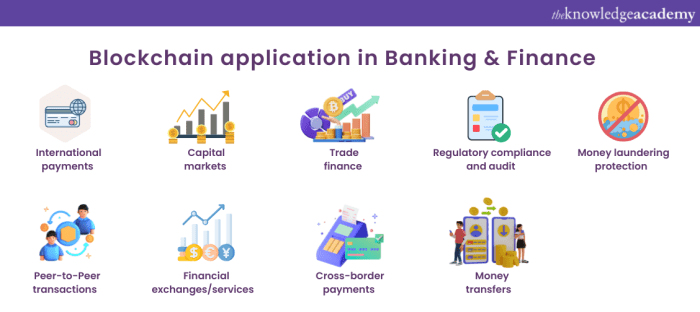

Blockchain-Based Payment Systems

Blockchain technology offers a revolutionary approach to payment systems, leveraging its inherent security and transparency to create faster, cheaper, and more efficient transactions. These systems bypass traditional intermediaries, such as banks, leading to significant cost reductions and improved speed. This section explores the functionalities, advantages, and comparative performance of various blockchain-based payment systems.

Examples of Blockchain-Based Payment Systems and Their Functionalities

Several blockchain-based payment systems are emerging, each with unique features and functionalities. Examples include RippleNet, Stellar, and Bitcoin itself. RippleNet focuses on facilitating cross-border payments for financial institutions, offering speed and cost efficiency. Stellar emphasizes micropayments and cross-border transactions, targeting individuals and businesses. Bitcoin, while not solely a payment system, provides a decentralized and secure method for peer-to-peer transactions. These systems operate by recording transactions on a distributed ledger, ensuring transparency and immutability. Each system utilizes its own consensus mechanism to validate transactions and maintain the integrity of the blockchain.

Advantages of Blockchain Payment Systems over Traditional Methods

Blockchain payment systems offer several key advantages over traditional methods. Transaction fees are significantly reduced due to the elimination of intermediaries. Processing times are drastically faster, often completing transactions within minutes or even seconds, compared to days with traditional banking systems. Increased security is provided through cryptographic techniques and the distributed nature of the blockchain, reducing the risk of fraud and data breaches. Furthermore, the transparency of blockchain transactions allows for better tracking and auditing of payments.

Performance Comparison of Blockchain Payment Systems

Different blockchain payment systems exhibit varying levels of performance in terms of transaction speed, scalability, and security. Bitcoin, for example, boasts robust security but faces limitations in transaction speed and scalability. RippleNet prioritizes speed and efficiency for large-scale transactions, while Stellar excels in handling a high volume of microtransactions. The choice of system depends on the specific needs and priorities of users and businesses. Security features, such as robust cryptographic algorithms and consensus mechanisms, are crucial considerations. Scalability, often measured by transactions per second (TPS), is critical for handling large transaction volumes.

Blockchain’s Enhancement of Cross-Border Payments

Blockchain technology significantly enhances cross-border payments by streamlining the process and reducing costs. Traditional cross-border payments involve multiple intermediaries, resulting in high fees, lengthy processing times, and complex procedures. Blockchain-based systems eliminate many of these intermediaries, reducing costs and speeding up transactions. This facilitates faster and cheaper international remittances, benefiting both businesses and individuals. The transparency and immutability of blockchain transactions also increase trust and accountability in cross-border payments.

Steps Involved in a Blockchain-Based Payment Transaction

The following flowchart illustrates the typical steps in a blockchain-based payment transaction:

+-----------------+ +-----------------+ +-----------------+ +-----------------+

| Sender Initiates |---->| Transaction Broadcast |---->| Transaction Verification |---->| Transaction Confirmation |

| Payment | | to Network | | by Nodes | | by Network |

+-----------------+ +-----------------+ +-----------------+ +-----------------+

^

|

+-----------------+

| Transaction Added |

| to Blockchain |

+-----------------+

This flowchart depicts the basic process: The sender initiates the payment, the transaction is broadcast to the network, nodes verify the transaction, and finally, the network confirms the transaction by adding it to the blockchain. The specific steps may vary slightly depending on the particular blockchain payment system used.

Supply Chain Management and Traceability

Blockchain technology offers a revolutionary approach to supply chain management, enhancing transparency and traceability in ways previously unimaginable. Its inherent immutability and distributed ledger capabilities create a secure and auditable record of every step in a product’s journey, from origin to consumer. This increased visibility fosters trust, improves efficiency, and mitigates risks across the entire supply chain.

Blockchain’s impact stems from its ability to create a shared, immutable record of transactions. Each transaction, representing a stage in the supply chain, is cryptographically secured and linked to previous transactions, forming a chronological chain. This prevents tampering and ensures the authenticity of data, providing all stakeholders with a single source of truth.

Industries Benefiting from Blockchain-Based Supply Chain Management

Several industries are already reaping the benefits of blockchain in supply chain management. The food industry, for example, utilizes blockchain to track the origin and handling of food products, ensuring food safety and preventing outbreaks of foodborne illnesses. Luxury goods manufacturers leverage blockchain to combat counterfeiting and verify the authenticity of their products. The pharmaceutical industry uses blockchain to track the movement of drugs, ensuring their integrity and preventing the distribution of counterfeit medications. Furthermore, the automotive industry is exploring blockchain’s potential for tracking vehicle parts and materials throughout the manufacturing process.

Challenges of Implementing Blockchain in Supply Chain Management

Despite its numerous advantages, implementing blockchain in supply chain management presents certain challenges. Integration with existing legacy systems can be complex and costly, requiring significant investment in new infrastructure and software. Data security is another critical concern; ensuring the confidentiality and integrity of sensitive supply chain data requires robust security measures. Furthermore, achieving widespread adoption requires collaboration among various stakeholders across the supply chain, which can be difficult to coordinate. Finally, the scalability of blockchain solutions needs to be addressed to handle the large volumes of data generated by complex supply chains.

Design of a Blockchain-Based System for Tracking the Movement of Goods

A blockchain-based system for tracking goods could utilize smart contracts to automate various processes. Each product would have a unique digital identity, represented by a token on the blockchain. This token would record key information such as the product’s origin, manufacturing date, transportation details, and handling history. Smart contracts would trigger automated actions based on predefined events, such as notifying stakeholders of a shipment’s arrival or alerting authorities of potential quality issues. Access control mechanisms would ensure that only authorized parties can access and modify data. The system would leverage secure APIs for seamless integration with existing enterprise resource planning (ERP) systems. The system would be designed for scalability to accommodate future growth and increasing data volume. Data encryption would protect sensitive information.

Visual Representation of a Blockchain-Based Supply Chain Tracking System

Imagine a vibrant, dynamic visualization. A central, pulsing sphere represents the blockchain, radiating lines connecting to various smaller spheres, each representing a different stage in the supply chain: raw material sourcing, manufacturing, packaging, distribution, retail, and finally, the consumer. Each smaller sphere glows with a unique color, representing different data points—location, temperature, and timestamps—that are immutably recorded on the blockchain. As goods move through the supply chain, the connecting lines pulse with light, indicating the flow of information. The overall image conveys a sense of seamless integration, transparency, and secure tracking. The pulsating spheres represent the dynamic nature of the supply chain, while the interconnectedness of the lines highlights the collaborative aspect of blockchain technology. The varying colors of the spheres add a visual layer to the data points recorded, enhancing the overall understanding of the system. The overall aesthetic is clean, modern, and reassuring, emphasizing the security and trustworthiness of the blockchain-based system.

Blockchain in Investment Management

Blockchain technology offers a transformative potential for investment management, promising increased efficiency, transparency, and security in handling digital assets and investment portfolios. Its decentralized and immutable nature addresses many of the pain points associated with traditional investment processes, particularly in areas such as record-keeping, settlement, and access to information.

Managing Digital Assets and Investment Portfolios

Blockchain’s inherent ability to securely record and track ownership of assets makes it ideally suited for managing digital assets like cryptocurrencies, security tokens, and NFTs. A blockchain-based system provides a transparent and auditable record of asset ownership, eliminating the need for intermediaries and reducing the risk of fraud or errors. Investment portfolios can be represented as smart contracts, automatically executing trades and rebalancing based on predefined parameters. This automation streamlines the investment process, reduces operational costs, and enhances overall efficiency. For example, a blockchain-based platform could automatically execute a rebalancing trade when a portfolio’s asset allocation deviates from its target percentages.

Benefits of Blockchain for Investment Processes

The application of blockchain in investment management offers several key benefits. Improved transparency allows all stakeholders – investors, fund managers, and custodians – to access real-time information about asset holdings and transactions. This increased transparency builds trust and reduces information asymmetry. Enhanced efficiency stems from the automation of processes, faster settlement times, and reduced reliance on intermediaries. Security is significantly improved through cryptographic techniques and the immutability of the blockchain, minimizing the risk of fraud and data breaches. Furthermore, fractional ownership of assets becomes simpler and more efficient, allowing for increased liquidity and access to previously illiquid investments.

Risks and Challenges of Blockchain in Investment Management

Despite its potential, the adoption of blockchain in investment management faces several challenges. Regulatory uncertainty remains a significant hurdle, as the legal framework surrounding blockchain-based investment platforms is still evolving. Scalability issues can limit the ability of blockchain networks to handle large transaction volumes. Cybersecurity threats, while mitigated by blockchain’s inherent security, still exist and require robust measures to prevent attacks. The integration of blockchain technology with existing legacy systems can be complex and expensive. Finally, the lack of widespread adoption and the need for user education and training are significant obstacles to overcome.

Comparison of Traditional and Blockchain-Based Approaches

Traditional investment management relies heavily on centralized intermediaries such as brokers, custodians, and clearinghouses. This centralized structure can lead to inefficiencies, high costs, and security vulnerabilities. In contrast, blockchain-based approaches leverage a decentralized network, reducing reliance on intermediaries and fostering greater transparency and efficiency. Traditional methods often involve manual processes and lengthy settlement times, while blockchain offers automation and near-instantaneous settlement. However, traditional systems are well-established and regulated, whereas blockchain technology is still relatively new and requires further regulatory clarity.

Key Features of a Blockchain-Based Investment Platform

The following features would characterize a robust blockchain-based investment platform:

- Secure digital asset custody: Utilizing multi-signature wallets and other security protocols to safeguard investor assets.

- Automated trading and rebalancing: Smart contracts executing trades based on predefined strategies.

- Transparent transaction history: Immutable record of all transactions accessible to authorized parties.

- Fractional ownership and tokenization: Enabling investment in assets with high liquidity and low minimum investment amounts.

- Real-time portfolio monitoring: Investors can access up-to-date information on their portfolio performance.

- Compliance and regulatory reporting: Integration with regulatory reporting frameworks.

- Decentralized governance: Community-driven decision-making processes.

Concluding Remarks

The integration of blockchain technology into finance promises a future characterized by increased efficiency, transparency, and security. While challenges remain regarding regulation, scalability, and interoperability, the potential benefits are substantial. As blockchain matures and adoption increases, we can anticipate further innovation and disruption across the financial ecosystem, leading to more inclusive and accessible financial services for individuals and businesses alike. The journey towards a fully decentralized and blockchain-powered financial future is underway, and its implications are far-reaching.

Questions Often Asked

What are the regulatory challenges facing blockchain finance applications?

The regulatory landscape for blockchain finance is still evolving. Different jurisdictions have varying approaches, creating uncertainty and hindering wider adoption. Challenges include establishing clear legal frameworks for cryptocurrencies, security tokens, and DeFi platforms, as well as addressing issues related to taxation, anti-money laundering (AML), and know-your-customer (KYC) compliance.

How secure are blockchain-based payment systems?

Blockchain’s inherent security features, such as cryptographic hashing and distributed ledger technology, offer enhanced security compared to traditional payment systems. However, the security of a blockchain-based payment system also depends on the implementation and security practices of the specific platform. Vulnerabilities can exist in smart contracts, exchanges, and user devices, requiring robust security measures to mitigate risks.

What is the environmental impact of blockchain technology in finance?

The energy consumption of some blockchain networks, particularly those using proof-of-work consensus mechanisms, has raised environmental concerns. However, advancements in technology, such as proof-of-stake, are significantly reducing energy consumption. The environmental impact also depends on the specific blockchain used and the efficiency of its implementation.