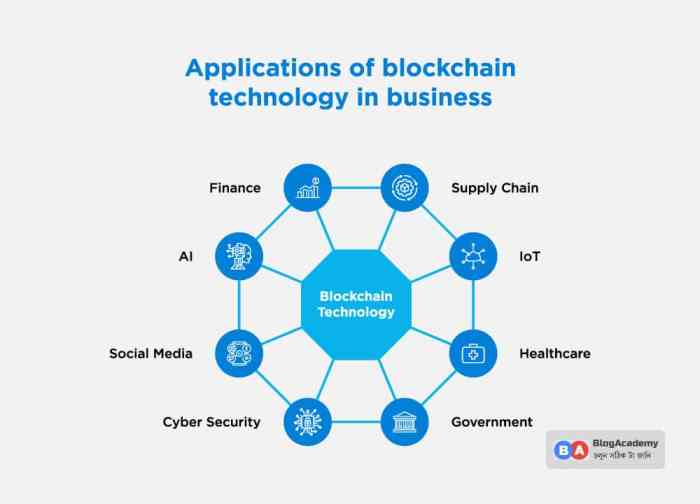

The intersection of blockchain technology and finance is rapidly reshaping the global economic landscape. This review delves into the transformative applications of blockchain, exploring its impact on decentralized finance (DeFi), payment systems, asset management, and supply chain finance. We’ll examine the benefits, risks, and regulatory challenges associated with this burgeoning field, showcasing successful projects and forecasting future trends.

From the rise of cryptocurrencies to the emergence of innovative DeFi protocols, blockchain’s influence is undeniable. This exploration will cover the core principles of blockchain, its advantages over traditional financial systems, and the potential for further disruption. We will also analyze the security concerns and regulatory frameworks that are vital to the responsible development and adoption of blockchain finance solutions.

Introduction to Blockchain Finance

Blockchain technology has revolutionized numerous sectors, and its impact on finance is particularly profound. At its core, blockchain is a decentralized, distributed ledger technology that records and verifies transactions across multiple computers. This eliminates the need for a central authority, enhancing security and transparency. Its core principles include immutability (once recorded, data cannot be altered), transparency (all participants can view the ledger), and decentralization (no single entity controls the network).

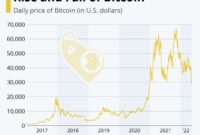

The integration of blockchain into finance has been a gradual but significant evolution. Initially, its application was primarily focused on cryptocurrencies like Bitcoin. However, its potential extended far beyond digital currencies. We’ve seen a progression from early experiments with cryptocurrencies to the development of more sophisticated applications, including decentralized finance (DeFi), security token offerings (STOs), and improved cross-border payment systems. This evolution continues, with ongoing exploration of blockchain’s potential in areas like supply chain finance and regulatory compliance.

Key Benefits of Blockchain in Finance

Blockchain offers several compelling advantages over traditional financial systems. Its decentralized nature reduces reliance on intermediaries, leading to faster and cheaper transactions. The immutability of the blockchain enhances security by minimizing the risk of fraud and data manipulation. Increased transparency fosters trust among participants, as all transactions are recorded on a public ledger. This transparency also improves auditability and regulatory compliance. Furthermore, blockchain’s automation capabilities streamline processes and reduce operational costs. For instance, the automation of payments can significantly reduce processing time and human error, leading to significant cost savings for financial institutions. The improved efficiency and reduced costs associated with blockchain are particularly attractive to businesses operating in cross-border transactions, where traditional systems can be slow and expensive. The reduced risk of fraud and improved transparency also leads to greater trust and confidence in financial transactions.

Decentralized Finance (DeFi) Applications

Decentralized Finance (DeFi) represents a transformative shift in the financial landscape, leveraging blockchain technology to offer a range of financial services without the need for intermediaries like banks or brokers. This section will explore various DeFi applications, comparing their functionalities, highlighting inherent risks and rewards, and illustrating a hypothetical scenario to showcase both advantages and disadvantages.

DeFi applications encompass a diverse ecosystem of services built upon blockchain networks. These applications generally aim to provide greater transparency, accessibility, and efficiency compared to traditional finance. The core functionalities often involve smart contracts, automated processes, and decentralized governance.

Lending and Borrowing Platforms

Lending and borrowing platforms within DeFi allow users to lend or borrow cryptocurrencies without relying on centralized institutions. Users can deposit their assets into lending pools, earning interest, while borrowers can access loans using their deposited assets as collateral. Platforms like Aave and Compound are prominent examples, each employing different risk management strategies and interest rate mechanisms. A key difference lies in the collateralization requirements and the types of cryptocurrencies supported. For instance, Aave may offer a wider range of supported assets and flexible borrowing options compared to Compound, which might focus on a smaller set of high-liquidity assets with stricter collateral requirements. The interest rates offered are dynamic, fluctuating based on supply and demand within the lending pool. This dynamic pricing mechanism offers potential for higher returns for lenders compared to traditional savings accounts, but also exposes borrowers to potentially volatile interest rates.

Decentralized Exchanges (DEXs)

Decentralized exchanges offer peer-to-peer trading of cryptocurrencies without the need for a centralized intermediary. Unlike traditional exchanges, DEXs leverage smart contracts to facilitate trades, enhancing security and transparency. Popular DEXs like Uniswap and SushiSwap utilize automated market makers (AMMs) to provide liquidity and execute trades. AMMs use algorithms to determine prices based on the ratio of assets in a liquidity pool. This differs from traditional order-book exchanges where buyers and sellers directly interact. While DEXs offer increased security and censorship resistance, they may suffer from lower liquidity and higher slippage compared to centralized exchanges, particularly for less popular tokens. Slippage refers to the difference between the expected price of a trade and the actual price executed, often resulting from price fluctuations during the transaction.

Risks and Rewards of DeFi Investments

DeFi investments present both significant opportunities and substantial risks. Rewards can include higher interest rates on lending, potentially higher returns from yield farming (providing liquidity to DEXs), and access to novel financial instruments. However, risks include smart contract vulnerabilities (exploits resulting in asset loss), impermanent loss (loss of value due to price fluctuations of assets in liquidity pools), and regulatory uncertainty. The decentralized and pseudonymous nature of DeFi introduces challenges in tracking and recovering assets lost to hacks or scams. Furthermore, the volatile nature of cryptocurrencies significantly impacts the overall profitability of DeFi investments. A real-world example illustrating these risks is the numerous exploits and hacks targeting DeFi protocols, leading to millions of dollars in losses for users. Conversely, successful projects have generated significant returns for early investors and liquidity providers.

Hypothetical DeFi Scenario

Imagine a scenario where a user, Alice, wants to earn passive income on her ETH holdings. She deposits her ETH into a DeFi lending platform. She earns interest on her deposited ETH. Simultaneously, Bob, needing a loan to purchase a non-fungible token (NFT), borrows DAI (a stablecoin) using his ETH as collateral. Alice benefits from passive income, while Bob secures a loan without needing a bank. This demonstrates the potential for increased financial inclusion and efficient capital allocation. However, if the price of ETH were to plummet significantly, Bob might face liquidation of his collateral (his ETH) if the value falls below the loan amount, resulting in a loss for Bob and potentially impacting Alice’s returns if the platform’s liquidity is compromised. This highlights the inherent volatility and risk associated with DeFi lending and borrowing.

Blockchain in Payment Systems

Blockchain technology is revolutionizing payment systems, offering the potential for faster, cheaper, and more secure transactions compared to traditional methods. Its decentralized nature and cryptographic security features address many long-standing challenges in the financial industry, particularly concerning cross-border payments and remittances.

The impact of blockchain on cross-border payments and remittances is significant. Traditional systems often involve multiple intermediaries, leading to delays and high fees. Blockchain, however, can streamline this process by creating a transparent and secure network for transferring value directly between parties, reducing reliance on intermediaries and associated costs. This efficiency is particularly beneficial for remittances, where billions of dollars are sent annually across borders, often at exorbitant fees. The speed and reduced costs associated with blockchain-based solutions offer a compelling alternative for individuals and businesses alike.

Examples of Blockchain-Based Payment Systems

Several blockchain-based payment systems are emerging, each with its unique functionalities. These systems leverage the inherent capabilities of blockchain to improve upon traditional payment methods. For example, RippleNet uses its own XRP cryptocurrency to facilitate faster and cheaper cross-border payments for financial institutions. Stellar, another blockchain network, focuses on micropayments and cross-border transactions, aiming to make financial services more accessible globally. These systems often incorporate features like smart contracts to automate processes and reduce the need for human intervention. Furthermore, some systems focus on privacy-enhancing features, using techniques like zero-knowledge proofs to protect user data while still maintaining transaction transparency on the blockchain.

Comparison of Traditional and Blockchain Payment Systems

The following table compares the key characteristics of traditional and blockchain-based payment systems:

| Feature | Traditional Payment Systems | Blockchain Payment Systems |

|---|---|---|

| Transaction Speed | Variable, often several days for international transfers | Potentially near-instantaneous, depending on the specific system and network congestion |

| Fees | High, especially for international transfers, due to intermediary fees | Generally lower, but can vary based on network activity and transaction size |

| Security | Vulnerable to fraud and security breaches, relying on centralized intermediaries | Enhanced security through cryptography and decentralization, reducing single points of failure |

Security and Regulation of Blockchain Finance

The burgeoning field of blockchain finance presents a unique confluence of technological innovation and inherent security risks, demanding a robust regulatory framework to navigate its complexities. While offering significant advantages in transparency and efficiency, the decentralized nature of blockchain systems also introduces vulnerabilities that require careful consideration and proactive mitigation strategies. The regulatory landscape is still evolving, presenting both challenges and opportunities for fostering innovation while mitigating potential risks to users and the broader financial system.

The decentralized and immutable nature of blockchain technology, while a strength, also presents significant security challenges. These systems are susceptible to various attacks, necessitating a multi-faceted approach to security.

Security Vulnerabilities in Blockchain-Based Financial Systems

Several vulnerabilities can compromise the security of blockchain-based financial systems. These vulnerabilities range from technical flaws in smart contracts to social engineering attacks targeting users. Understanding these vulnerabilities is crucial for developing robust security measures. Examples include smart contract bugs, which can lead to unintended consequences and loss of funds; private key compromises, resulting in theft of assets; and 51% attacks, where a malicious actor controls a majority of the network’s hashing power to manipulate transactions. Furthermore, phishing scams and other social engineering tactics remain prevalent threats, exploiting user trust and lack of awareness. Robust security practices, including thorough code audits, secure key management, and user education, are essential to mitigate these risks.

The Current Regulatory Landscape for Blockchain Finance Globally

The regulatory landscape for blockchain finance varies significantly across jurisdictions globally. Some countries have embraced a relatively permissive approach, aiming to foster innovation while establishing basic consumer protection measures. Others have adopted a more cautious stance, implementing stricter regulations to mitigate perceived risks. For example, the European Union’s Markets in Crypto-assets (MiCA) regulation aims to provide a comprehensive legal framework for crypto-assets, while the United States employs a more fragmented approach with different regulatory bodies overseeing different aspects of the blockchain finance ecosystem. This fragmented approach presents challenges for businesses operating across multiple jurisdictions, highlighting the need for international cooperation and harmonization of regulatory standards. The lack of a universally accepted regulatory framework poses challenges for both businesses and users navigating this rapidly evolving space.

Challenges and Opportunities of Regulating Decentralized Finance (DeFi)

Regulating DeFi presents unique challenges due to its decentralized and borderless nature. Traditional regulatory mechanisms, designed for centralized financial institutions, are often ill-suited for the decentralized and pseudonymous nature of DeFi. Enforcing regulations on decentralized protocols and identifying responsible parties for compliance pose significant difficulties. However, the opportunities for regulation lie in promoting consumer protection, preventing illicit activities, and ensuring market stability. A balanced regulatory approach that fosters innovation while mitigating risks is crucial for the sustainable growth of the DeFi ecosystem. Finding this balance requires careful consideration of the unique characteristics of DeFi and a collaborative approach between regulators, developers, and the broader community. Examples of potential regulatory approaches include licensing frameworks for DeFi platforms, establishing clear guidelines for stablecoin issuers, and implementing robust anti-money laundering (AML) and know-your-customer (KYC) protocols adapted to the decentralized environment.

Blockchain in Asset Management

Blockchain technology is revolutionizing asset management by offering a secure, transparent, and efficient way to manage various assets, both tangible and intangible. Its decentralized nature and cryptographic security features are particularly well-suited to addressing the challenges associated with traditional asset management systems. This section explores how blockchain is used in managing digital assets and the benefits it provides.

Blockchain’s role in managing digital assets like cryptocurrencies and NFTs hinges on its ability to create a verifiable and immutable record of ownership. This eliminates the need for intermediaries and significantly reduces the risk of fraud and double-spending. The inherent transparency of the blockchain allows for easy tracking of asset movements and provenance, enhancing trust and accountability across the entire ecosystem.

Tokenization of Assets on a Blockchain

Tokenization involves representing real-world assets, such as real estate, art, or even intellectual property, as digital tokens on a blockchain. This process transforms fractional ownership into easily tradable units, enhancing liquidity and accessibility. For example, a valuable painting could be tokenized into a number of NFTs, each representing a fractional share of ownership. These tokens are then recorded on a blockchain, providing a verifiable and auditable record of ownership. The process typically involves several steps: asset valuation and division into fractional units; creation of smart contracts defining ownership rights and transfer conditions; minting of tokens representing these fractional units on a chosen blockchain platform; and finally, distribution of the tokens to investors. This creates a transparent and efficient system for trading fractional ownership, significantly improving liquidity and reducing transaction costs.

Benefits of Blockchain for Asset Tracking and Transparency

Blockchain technology offers several significant advantages in asset tracking and transparency. The immutable nature of the blockchain ensures that every transaction and transfer of ownership is permanently recorded, creating an auditable trail. This enhanced transparency reduces the risk of fraud and disputes, improving trust among stakeholders. Furthermore, real-time tracking capabilities allow for efficient monitoring of asset movement and location, improving inventory management and supply chain efficiency. For instance, in the luxury goods industry, blockchain can track the journey of a high-end handbag from manufacturing to the final consumer, verifying its authenticity and provenance. This significantly reduces counterfeiting and enhances brand protection. Similarly, in the supply chain management of pharmaceuticals, blockchain can ensure the integrity and authenticity of medicines throughout their distribution network, preventing the circulation of counterfeit drugs. The increased transparency and traceability provided by blockchain enhance accountability and efficiency across various sectors.

Blockchain for Supply Chain Finance

Blockchain technology offers a transformative solution for enhancing supply chain management, addressing longstanding challenges related to transparency, efficiency, and security. Its decentralized and immutable nature provides a robust platform for tracking goods, verifying authenticity, and streamlining processes across the entire supply chain network. This leads to significant cost reductions, improved risk management, and increased trust among all stakeholders.

The application of blockchain in supply chain finance is revolutionizing how businesses manage their operations, fostering greater collaboration and accountability. By providing a shared, transparent ledger, blockchain eliminates information silos and facilitates real-time visibility into every stage of the supply chain, from raw material sourcing to final product delivery. This enhanced transparency empowers businesses to make more informed decisions, optimize inventory management, and respond effectively to disruptions.

Improved Supply Chain Transparency and Efficiency

Blockchain’s decentralized ledger provides a single source of truth, accessible to all authorized participants in the supply chain. This shared visibility significantly improves transparency, allowing businesses to track goods in real-time, monitor their movement, and identify potential bottlenecks or delays. Improved transparency also facilitates better collaboration among suppliers, manufacturers, distributors, and retailers, leading to smoother operations and reduced lead times. For example, a clothing manufacturer can track the origin of its cotton, ensuring ethical sourcing and compliance with sustainability standards. This data is then available to consumers, who can verify the product’s authenticity and ethical production. Real-time tracking also helps optimize logistics, reducing transportation costs and improving delivery times.

Enhanced Traceability and Fraud Reduction

Blockchain’s immutable record-keeping capabilities make it an effective tool for combating fraud and counterfeiting. Each transaction and product movement is recorded on the blockchain, creating an auditable trail that can be easily verified. This makes it extremely difficult to alter or tamper with information, deterring fraudulent activities and enhancing the integrity of the supply chain. For instance, a food producer can use blockchain to track the entire journey of its products, from farm to table, verifying the origin, processing, and handling of ingredients. This enhances food safety and allows for quick identification and recall of contaminated products, minimizing health risks and financial losses. Similarly, luxury goods manufacturers can use blockchain to verify the authenticity of their products, preventing counterfeiting and protecting their brand reputation.

Implementing Blockchain in a Supply Chain: A Step-by-Step Procedure

Implementing blockchain in a supply chain requires careful planning and execution. The following steps Artikel a practical approach:

- Identify Key Stakeholders and Objectives: Define the specific goals for blockchain implementation, identify the key stakeholders involved (suppliers, manufacturers, distributors, retailers, etc.), and establish clear communication channels.

- Select a Suitable Blockchain Platform: Choose a blockchain platform that meets the specific requirements of the supply chain, considering factors such as scalability, security, and cost.

- Design the Blockchain Architecture: Develop a detailed architecture that Artikels the data to be recorded on the blockchain, the access controls for different stakeholders, and the processes for data entry and verification.

- Develop and Deploy the Blockchain Solution: Develop the necessary software and applications to integrate the blockchain solution with existing supply chain systems. Deploy the solution in a phased approach, starting with a pilot project before scaling to the entire supply chain.

- Test and Validate the Solution: Thoroughly test the blockchain solution to ensure its functionality, security, and scalability. Validate the solution by comparing its performance with existing supply chain processes.

- Monitor and Maintain the Solution: Continuously monitor the performance of the blockchain solution and make necessary adjustments to optimize its efficiency and effectiveness. Regularly update the software and security protocols to ensure the system’s long-term sustainability.

Future Trends in Blockchain Finance

The field of blockchain finance is rapidly evolving, driven by technological advancements and increasing adoption. Several key trends are shaping its future, promising both significant disruption and innovative solutions to existing financial challenges. These trends are interconnected and will likely accelerate each other’s growth in the coming years.

The convergence of blockchain technology with other emerging technologies, particularly Web3, is poised to revolutionize finance. Web3, with its emphasis on decentralization, user ownership, and tokenized economies, creates fertile ground for blockchain-based financial applications to flourish. This synergy promises a more transparent, efficient, and inclusive financial system.

Web3’s Impact on Financial Services

Web3 technologies, including decentralized applications (dApps), decentralized autonomous organizations (DAOs), and non-fungible tokens (NFTs), are fundamentally altering the financial landscape. DApps offer alternative financial services, bypassing traditional intermediaries and reducing costs. DAOs enable community-governed financial projects, fostering greater transparency and participation. NFTs are transforming asset ownership and trading, opening new avenues for investment and fundraising. For example, decentralized exchanges (DEXs) built on Web3 protocols are already offering increased liquidity and reduced transaction fees compared to centralized exchanges. The rise of DAOs managing investment funds represents a shift towards community-driven asset management. NFT marketplaces facilitate the fractional ownership and trading of assets ranging from digital art to real estate, enhancing liquidity and accessibility.

Central Bank Digital Currencies (CBDCs) and Stablecoins

The exploration and implementation of CBDCs are gaining significant momentum globally. Many central banks are investigating the potential benefits of issuing digital versions of their fiat currencies, aiming to improve payment efficiency, reduce reliance on intermediaries, and enhance financial inclusion. Simultaneously, the stablecoin market continues to evolve, with various projects striving to create stable and reliable digital assets pegged to fiat currencies or other assets. The interplay between CBDCs and stablecoins will be crucial in shaping the future of digital payments and financial stability. For instance, the digital Yuan in China is already undergoing pilot programs, showcasing the potential for CBDCs to streamline cross-border payments. Meanwhile, the continued development of stablecoins backed by reserves of fiat currency or other assets aims to address the volatility inherent in cryptocurrencies.

Increased Institutional Adoption of Blockchain

Large financial institutions are increasingly exploring and integrating blockchain technology into their operations. This adoption is driven by the potential to improve efficiency, reduce costs, and enhance security across various financial processes. We are witnessing a gradual shift from experimentation to practical implementation in areas like asset management, trade finance, and payments. For example, several major banks are now using blockchain to streamline cross-border payments, reducing processing times and costs. Investment firms are exploring blockchain-based solutions for asset tokenization and decentralized trading platforms.

A Speculative Scenario: Blockchain Finance in 2028

In five years, we can envision a financial landscape where blockchain-based solutions are deeply integrated into mainstream finance. CBDCs may be widely adopted in several countries, facilitating seamless cross-border payments and reducing reliance on traditional banking systems. Decentralized finance (DeFi) protocols will offer a wider range of financial services, competing directly with traditional institutions. The use of NFTs for fractional ownership of assets, including real estate and intellectual property, will be commonplace. DAOs will play a more significant role in managing investment funds and other financial ventures. The regulatory landscape will have evolved, providing a clearer framework for blockchain-based financial activities, balancing innovation with consumer protection. However, challenges related to scalability, interoperability, and security will continue to be addressed. This scenario is not a prediction, but rather a plausible projection based on current trends and technological advancements. It reflects a world where blockchain technology is no longer a niche innovation but a fundamental component of the global financial system.

Case Studies of Successful Blockchain Finance Projects

This section examines three prominent blockchain finance projects, analyzing their approaches, underlying technologies, and achieved outcomes to illustrate the diverse applications and potential of blockchain in the financial sector. These case studies highlight both the successes and challenges encountered in implementing blockchain-based financial solutions.

Ethereum

Ethereum’s success stems from its pioneering role in establishing the smart contract paradigm. This functionality allows for the creation of decentralized applications (dApps) that automate complex financial transactions and processes. Its native cryptocurrency, Ether (ETH), fuels the network and facilitates interactions within the ecosystem. Ethereum’s robust and adaptable architecture has fostered the development of a thriving DeFi ecosystem, encompassing decentralized exchanges (DEXs), lending platforms, and stablecoins. The platform’s open-source nature and large developer community have contributed significantly to its widespread adoption and continuous innovation. However, scalability challenges, high transaction fees (gas fees), and occasional network congestion remain ongoing concerns.

Chainlink

Chainlink focuses on bridging the gap between blockchain networks and real-world data. It acts as a decentralized oracle network, providing secure and reliable off-chain data feeds to smart contracts. This is crucial for DeFi applications requiring real-time information, such as price feeds for decentralized exchanges or loan risk assessments. Chainlink’s success lies in its ability to deliver trustworthy data to smart contracts, enhancing the security and functionality of various DeFi protocols. Its modular architecture allows for integration with different blockchain networks and data sources, fostering interoperability and broader adoption. The network’s robust security mechanisms and decentralized nature mitigate single points of failure and enhance the overall reliability of the data feeds.

Ripple (XRP)

Ripple’s technology, while controversial due to ongoing legal battles, has seen significant adoption within the cross-border payments sector. Its solution, XRP, aims to provide a faster, cheaper, and more efficient alternative to traditional SWIFT transactions. RippleNet, its network of financial institutions, utilizes XRP to facilitate near real-time international money transfers. The success of Ripple lies in its focus on practical applications within the existing financial infrastructure, targeting a specific pain point—slow and expensive cross-border payments. However, the regulatory uncertainty surrounding XRP and its centralized nature, contrasting with the decentralized ethos of many other blockchain projects, remain significant factors impacting its long-term prospects.

Comparative Analysis of Success Metrics

The following table provides a comparative overview of the success metrics for these three projects. Note that precise quantitative metrics are difficult to definitively compare due to the evolving nature of the blockchain space and the differing objectives of each project. This table offers a qualitative comparison based on publicly available information and general market perception.

| Metric | Ethereum | Chainlink | Ripple (XRP) |

|---|---|---|---|

| Market Capitalization | High (amongst the highest in the cryptocurrency market) | Significant (reflecting its importance in the DeFi ecosystem) | Significant (although subject to considerable volatility and regulatory uncertainty) |

| Adoption Rate | Very High (widely used for DeFi and NFT applications) | High (integrated into numerous DeFi protocols) | High within the cross-border payments sector, but limited elsewhere |

| Technological Innovation | High (pioneering smart contracts and decentralized applications) | High (solving the oracle problem crucial for DeFi security) | Moderate (focus on practical application within existing financial systems) |

| Regulatory Landscape | Evolving (subject to varying regulations across jurisdictions) | Evolving (relatively less scrutiny compared to other cryptocurrencies) | Highly Contentious (facing significant regulatory challenges) |

Closure

Blockchain technology’s impact on finance is profound and far-reaching. This review has highlighted the potential for increased efficiency, transparency, and security across various financial sectors. While challenges remain regarding regulation and security, the innovative applications of blockchain in DeFi, payments, asset management, and supply chain finance promise to revolutionize how we conduct financial transactions and manage assets. The future of finance is undeniably intertwined with the continued development and adoption of blockchain technology.

FAQs

What are the main risks associated with DeFi?

DeFi carries risks including smart contract vulnerabilities, lack of regulatory oversight, price volatility of cryptocurrencies, and potential for hacks or scams.

How does blockchain improve supply chain transparency?

Blockchain creates a shared, immutable ledger tracking goods throughout the supply chain, enhancing traceability and reducing fraud by providing verifiable records of origin, movement, and handling.

What is tokenization of assets?

Tokenization represents real-world assets (like real estate or art) as digital tokens on a blockchain, enabling fractional ownership and easier trading.

What are some examples of successful blockchain finance projects?

Examples include projects like Ethereum (for DeFi), Ripple (for cross-border payments), and Chainlink (for decentralized oracles).