Blockchain Finance Applications Review: Prepare yourselves, dear readers, for a whirlwind tour of the wild, wild west of decentralized finance! We’ll explore how this revolutionary technology is reshaping the financial landscape, from DeFi’s dizzying heights to the surprisingly practical applications in supply chain management. Buckle up, it’s going to be a bumpy, yet enlightening, ride.

This review delves into the core principles of blockchain technology – decentralization, immutability, and transparency – and how they translate into tangible benefits for the financial sector. We’ll examine various applications, from decentralized finance (DeFi) platforms and blockchain-based payment systems to the intriguing world of security tokens and the potential for regulatory compliance enhancements. Get ready to unravel the mysteries (and maybe even the occasional absurdity) of blockchain’s impact on finance.

Introduction to Blockchain in Finance

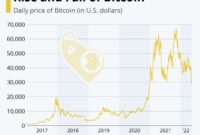

Blockchain technology, initially conceived as the backbone of Bitcoin in 2008, has since blossomed into a multifaceted tool with profound implications for the financial world. Its evolution has been nothing short of a rollercoaster, from a niche technological curiosity to a potential disruptor of established financial systems. This journey, marked by both exuberant hype and periods of sober reflection, has led us to a point where blockchain’s influence on finance is undeniable and constantly evolving.

The core principles underpinning blockchain’s relevance to finance are deceptively simple yet powerfully transformative. These principles, when combined, create a system that offers significant advantages over traditional financial mechanisms.

Decentralization

Decentralization is the cornerstone of blockchain technology. Unlike traditional databases controlled by a central authority (like a bank), blockchain distributes the database across a network of computers. This distributed ledger eliminates single points of failure and reduces the risk of manipulation or censorship. Imagine a financial system where no single entity holds all the power – that’s the essence of decentralization. This distributed nature enhances security and resilience, making the system less vulnerable to hacking or regulatory capture. For example, a decentralized exchange (DEX) operates without a central intermediary, empowering users with greater control over their assets.

Immutability

Once a transaction is recorded on a blockchain, it cannot be altered or deleted. This immutability is achieved through cryptographic hashing and consensus mechanisms, ensuring the integrity and trustworthiness of the data. Think of it as a permanent, tamper-proof record-keeping system. This characteristic is crucial for financial applications requiring high levels of security and auditability, such as tracking the provenance of assets or verifying the authenticity of financial instruments. For instance, tracking diamonds through their entire supply chain using blockchain prevents fraud and ensures ethical sourcing.

Transparency

While individual transactions might be pseudonymous (meaning the identities of the parties involved are not always publicly revealed), the blockchain itself is transparent. All transactions are recorded on the public ledger, allowing anyone to verify their validity. This transparency promotes accountability and trust. Of course, there are levels of privacy that can be built into blockchain systems, depending on the specific application. However, the underlying principle of transparency underpins the system’s integrity and fosters a higher level of confidence among participants. For example, supply chain finance platforms using blockchain can improve transparency between buyers, suppliers, and financiers.

Key Benefits of Blockchain for Financial Applications

The combination of decentralization, immutability, and transparency leads to several key benefits for financial applications. These include increased efficiency, reduced costs, enhanced security, improved transparency, and greater accessibility. The potential for innovation is vast, with applications ranging from cross-border payments and securities trading to supply chain finance and decentralized finance (DeFi). The reduced reliance on intermediaries often translates to lower transaction fees and faster processing times, while the enhanced security mitigates risks associated with fraud and cyberattacks. For example, Ripple uses blockchain technology to facilitate faster and cheaper cross-border payments.

Decentralized Finance (DeFi) Applications

The world of Decentralized Finance, or DeFi, is a wild, wild west of algorithmic cowboys and cryptographic cattle. Forget stuffy banks and their endless fees – DeFi offers a brave new world of financial services, all powered by the magic of blockchain. It’s a bit like a financial playground built on code, where anyone with an internet connection can participate, though maybe not everyone should.

DeFi applications are revolutionizing traditional finance by offering peer-to-peer financial services without intermediaries. This means faster transactions, lower costs, and increased transparency (mostly). However, it also introduces new risks, including smart contract vulnerabilities and the volatility of cryptocurrencies. Think of it as a rollercoaster: thrilling, potentially profitable, and definitely not for the faint of heart.

Lending and Borrowing in DeFi

Decentralized lending and borrowing platforms allow users to lend and borrow cryptocurrencies without the need for traditional financial institutions. These platforms utilize smart contracts to automate the lending process, ensuring transparency and efficiency. Popular platforms include Aave and Compound, which offer a range of lending and borrowing options with varying interest rates. The interest rates fluctuate based on supply and demand, creating a dynamic market. Imagine a global money market where the interest rates are determined by algorithms rather than central banks – slightly terrifying, yet strangely efficient.

DeFi Trading Platforms

Decentralized exchanges (DEXs) provide a platform for trading cryptocurrencies without the need for centralized intermediaries. Unlike traditional exchanges, DEXs use smart contracts to facilitate trades, offering greater security and transparency (again, mostly). Uniswap and SushiSwap are examples of popular DEXs that utilize automated market makers (AMMs) to determine asset prices. These AMMs use liquidity pools, where users provide liquidity in exchange for trading fees. It’s like a constantly-adjusting vending machine for cryptocurrencies, except the prices are set by the collective wisdom (and sometimes, the collective foolishness) of the market.

Yield Farming and Liquidity Provision

Yield farming involves lending or staking cryptocurrencies to earn interest or rewards. This is often done on DeFi platforms that offer high yields, attracting users seeking to maximize their returns. Liquidity provision, on the other hand, involves providing liquidity to DEXs in exchange for trading fees. Both yield farming and liquidity provision can be highly profitable, but they also carry significant risks. Think of it as a high-stakes game of financial Jenga – you can build a tower of profit, but one wrong move, and the whole thing could collapse. However, unlike traditional Jenga, the collapse could involve significant financial losses.

A Hypothetical DeFi Application: The Microloan Marketplace

Imagine a DeFi application designed to facilitate microloans to entrepreneurs in developing countries. This platform would leverage blockchain technology to create a transparent and secure lending environment, connecting borrowers with lenders globally. Smart contracts would automate the loan disbursement and repayment process, reducing the administrative overhead and minimizing the risk of fraud. This application could help bridge the financial gap for underserved communities, offering a much-needed boost to economic development. It’s a bit like Kickstarter, but for micro-businesses in need, with the added security and transparency of blockchain. The interest rates would be determined algorithmically, based on the borrower’s creditworthiness and the prevailing market conditions, offering a fairer and more efficient system than traditional microfinance institutions. This system could also incorporate reputation systems, allowing for a more nuanced assessment of borrower creditworthiness, moving beyond simple credit scores.

Blockchain for Payments and Remittances

The world of payments is ripe for disruption, and blockchain technology, with its inherent security and transparency, is shaking things up. Forget the days of agonizing waits and exorbitant fees for international transfers – blockchain offers a faster, cheaper, and more secure alternative. This section will delve into how blockchain is revolutionizing payments and remittances, transforming the way we send and receive money across borders.

Blockchain’s decentralized nature eliminates the need for intermediaries, like banks, significantly reducing transaction costs and processing times. This is particularly beneficial for cross-border payments, which traditionally involve multiple institutions, each taking a cut. Imagine a world where sending money to family abroad is as easy and inexpensive as sending a text message – that’s the promise of blockchain-based payment systems.

Examples of Blockchain-Based Payment Systems and Their Advantages

Several blockchain-based payment systems are emerging, each with its unique features and benefits. RippleNet, for example, utilizes Ripple’s XRP token to facilitate fast and low-cost international transactions, bypassing traditional banking networks. Stellar, another prominent player, boasts a similar approach, focusing on speed and accessibility for cross-border payments, particularly beneficial for underserved communities. These systems offer significant advantages over traditional methods by providing increased transparency, enhanced security through cryptographic methods, and reduced reliance on centralized authorities. The speed and lower costs are particularly appealing to individuals and businesses alike.

Blockchain Technology’s Improvement of Cross-Border Payments and Reduction of Transaction Costs

Traditional cross-border payments are notoriously slow and expensive, often involving multiple intermediaries and complex processes. Blockchain streamlines this process by creating a shared, immutable ledger that all parties can access. This eliminates the need for reconciliation between multiple banks, reducing delays and errors. Furthermore, the use of smart contracts automates certain aspects of the payment process, further reducing costs and improving efficiency. The transparency provided by the blockchain also minimizes the risk of fraud and enhances trust between parties. This results in lower transaction fees and faster processing times compared to traditional systems, making cross-border payments more accessible and affordable.

Comparison of Transaction Speeds and Fees

The following table compares the transaction speeds and fees of several blockchain-based payment systems. Note that these figures can vary depending on network congestion and other factors. Consider these figures as representative averages rather than absolute values.

| Payment System | Average Transaction Speed | Average Transaction Fee (USD) | Notes |

|---|---|---|---|

| RippleNet (XRP) | 4 seconds | $0.001 – $0.10 | Speed highly dependent on network conditions. Fees vary greatly. |

| Stellar (XLM) | 2-5 seconds | $0.0001 – $0.01 | Generally faster and cheaper than RippleNet, but with similar variability. |

| Bitcoin | 10-60 minutes | $1 – $50+ | Significantly slower and more expensive than Ripple and Stellar, though improving. |

| Ethereum | 10-30 minutes | $1 – $100+ | Similar to Bitcoin in speed and cost variability, highly dependent on network congestion. |

Security Tokens and Asset Tokenization

The world of finance is undergoing a thrilling metamorphosis, and at the heart of this transformation lies the revolutionary concept of security tokens. Forget dusty certificates and complicated paperwork; we’re talking about digitizing assets, from real estate to fine art, and unleashing a wave of efficiency and accessibility. Think of it as giving your grandma’s prized porcelain collection a blockchain-powered makeover – suddenly, fractional ownership and global trading become surprisingly simple.

Security tokens represent a groundbreaking approach to asset management, leveraging blockchain technology to create digital representations of traditional financial instruments. This digitization offers a plethora of advantages, streamlining processes and opening up new avenues for investment. It’s like swapping your clunky rotary phone for a sleek smartphone – the functionality is vastly improved, and the experience is infinitely more user-friendly.

Benefits of Tokenizing Assets Using Blockchain Technology, Blockchain Finance Applications Review

Tokenizing assets using blockchain offers several compelling advantages. Firstly, it dramatically increases liquidity. Imagine selling a share of a valuable painting without the hassle of traditional art market intermediaries – instant, transparent, and globally accessible. Secondly, fractional ownership becomes incredibly easy, allowing smaller investors to participate in previously exclusive markets. Finally, the transparency inherent in blockchain technology significantly reduces the risk of fraud and enhances trust among all stakeholders. This is a game-changer for markets often plagued by opacity and counterparty risk.

Creating and Managing Security Tokens on a Blockchain

The process of creating and managing security tokens involves several key steps. First, the asset needs to be legally vetted and structured appropriately for tokenization. This might involve legal consultations to ensure compliance with securities laws. Next, a smart contract is designed and deployed on a chosen blockchain platform. This contract defines the token’s characteristics, including its rights and restrictions. Then, the tokens are issued and distributed to investors. Finally, ongoing management of the tokens involves monitoring the smart contract, handling any necessary updates, and ensuring compliance with regulatory requirements. Think of it as building a sophisticated digital safe for your valuable assets, with all transactions meticulously recorded and auditable on the blockchain.

Comparison of Blockchain Platforms for Security Token Issuance

Choosing the right blockchain platform for security token issuance is crucial. Different platforms offer varying levels of scalability, security, and regulatory compliance. The following table provides a comparison of some popular options:

| Platform | Scalability | Security | Regulatory Compliance |

|---|---|---|---|

| Ethereum | Moderate | High (with proper smart contract auditing) | Complex, varies by jurisdiction |

| Hyperledger Fabric | High | High (permissioned network) | More easily tailored to regulatory needs |

| R3 Corda | Moderate | High (private network focused on financial institutions) | Designed with regulatory compliance in mind |

| Polygon (MATIC) | High | High (with proper security measures) | Growing ecosystem with increasing regulatory focus |

This comparison is not exhaustive and the suitability of a particular platform depends heavily on specific project requirements. It’s a bit like choosing the right car – a sports car might be flashy, but a minivan might be better for a large family. The ideal blockchain platform depends on the size and nature of the asset being tokenized, as well as the regulatory landscape.

Blockchain for Regulatory Compliance

The intersection of blockchain and regulatory compliance in finance is a fascinating dance – a tango between cutting-edge technology and age-old rules. While the inherent transparency of blockchain seems like a regulatory dream come true, the reality is a bit more nuanced, presenting both exciting opportunities and formidable challenges. Think of it as a high-stakes game of regulatory Jenga – one wrong move, and the whole system could crumble. But played correctly, it could be a game-changer.

Blockchain’s immutable ledger promises to revolutionize how we track and verify financial transactions. This inherent transparency offers a powerful tool for regulators to monitor compliance, identify suspicious activity, and ultimately, maintain the integrity of the financial system. Imagine a world where every transaction is auditable, traceable, and virtually tamper-proof – a regulatory utopia, perhaps? Well, almost.

Enhanced Transparency and Traceability in Financial Transactions

Blockchain’s decentralized and transparent nature provides an unparalleled level of traceability for financial transactions. Every transaction is recorded on a distributed ledger, creating an immutable audit trail that can be easily accessed by authorized parties. This enhanced transparency allows regulators to monitor transactions in real-time, identify potential compliance violations, and investigate suspicious activities more efficiently. For example, imagine tracking the flow of funds in a complex international trade deal. With blockchain, the entire journey of the money, from origin to destination, is clearly documented, making it far easier to detect money laundering or other illicit activities. This level of visibility significantly reduces the time and resources required for regulatory investigations, leading to more effective oversight.

Improved Audit Trails and Fraud Reduction

The immutable nature of blockchain significantly improves audit trails, making it nearly impossible to alter or delete transaction records. This feature is crucial in preventing fraud and enhancing accountability within the financial system. Traditional auditing processes often involve sifting through mountains of paperwork, making it difficult and time-consuming to identify discrepancies or fraudulent activities. Blockchain streamlines this process by providing a single, verifiable source of truth. For instance, consider the challenges of auditing a complex supply chain involving multiple intermediaries. With blockchain, each transaction and movement of goods can be verified, eliminating the possibility of fraudulent invoices or misrepresentation of inventory. This not only reduces the risk of fraud but also improves efficiency and trust within the supply chain.

Challenges of Implementing Blockchain for Regulatory Compliance

While the potential benefits are significant, implementing blockchain for regulatory compliance faces several challenges. Interoperability between different blockchain platforms remains a major hurdle, as does the need for robust data privacy and security measures. Furthermore, the legal and regulatory frameworks surrounding blockchain technology are still evolving, creating uncertainty for financial institutions. Consider the complexities of integrating blockchain technology into existing legacy systems, which often require significant investment and technical expertise. Also, regulatory bodies need to adapt their oversight approaches to leverage the unique features of blockchain effectively. The need for clear guidelines and standards is paramount to ensure the successful adoption of blockchain for regulatory compliance. A well-defined regulatory framework is crucial to foster innovation while maintaining the integrity and stability of the financial system.

Blockchain and Supply Chain Finance

The often-chaotic world of supply chain finance is ripe for disruption, and blockchain technology, with its inherent transparency and security, is stepping up to the plate. Imagine a supply chain where everyone – from the farmer growing coffee beans to the barista brewing your morning latte – has a clear, immutable record of every transaction and the location of every bean. That’s the promise of blockchain in supply chain finance, a promise that’s starting to become a reality.

Blockchain improves transparency and efficiency in supply chain finance by creating a shared, immutable ledger that all participants can access. This shared view eliminates information asymmetry, a common problem in traditional supply chains where different parties have different levels of information, leading to delays, disputes, and inefficiencies. Think of it as a digital, tamper-proof trail for every single coffee bean, from farm to cup. This transparency fosters trust among all stakeholders and streamlines processes. The efficiency gains are significant, leading to reduced costs and improved speed of delivery. No more wondering where your shipment is – the blockchain knows.

Tracking Goods with Blockchain

Blockchain enables real-time tracking of goods throughout the supply chain. Each product can be assigned a unique digital identity, allowing for precise monitoring of its journey. This eliminates the need for manual tracking and reconciliation, reducing errors and improving accountability. For example, a luxury handbag manufacturer could use blockchain to track its leather from tannery to finished product, ensuring authenticity and preventing counterfeiting. The entire history of the handbag’s creation is permanently recorded on the blockchain, creating a verifiable pedigree for the consumer. This not only enhances brand trust but also combats the multi-billion-dollar problem of counterfeit goods.

Managing Payments with Blockchain

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, are revolutionizing payments in supply chain finance. These contracts automatically trigger payments upon the fulfillment of certain conditions, such as the delivery of goods or the completion of a specific stage in the supply chain. This automation reduces the risk of payment delays and disputes, improving cash flow for all parties. Imagine a scenario where payment for a shipment of textiles is automatically released to the supplier once the buyer confirms receipt and quality inspection. This eliminates the need for lengthy invoicing and payment processing cycles, freeing up valuable time and resources.

Reducing Financing Risks with Blockchain

Blockchain technology significantly mitigates financing risks in supply chains by providing increased visibility and transparency. Lenders can gain real-time insights into the status of shipments and inventory, reducing their exposure to fraud and default. For instance, a bank financing a shipment of electronics can track the goods’ movement through the blockchain, verifying their arrival at the destination and ensuring timely repayment. This enhanced transparency and traceability allow lenders to make more informed lending decisions, potentially leading to lower interest rates and increased access to finance for businesses.

Illustrative Flowchart of Blockchain in Supply Chain Finance

Imagine a flowchart depicting the process. It would begin with the supplier registering goods on the blockchain, assigning each a unique identifier. This identifier then follows the goods through each stage of the supply chain – transportation, warehousing, customs clearance – each event recorded on the blockchain. Upon delivery, the buyer verifies the goods and the smart contract automatically triggers payment to the supplier. The entire process is transparent, auditable, and efficient, minimizing delays and disputes. The flowchart would clearly show the movement of goods, the associated documentation, and the automated payment triggers, all linked through the immutable blockchain ledger.

The Future of Blockchain in Finance

The future of blockchain in finance is, shall we say, less predictable than a bitcoin price chart on a particularly volatile day. While the technology is undeniably disruptive, its full potential remains shrouded in a fog of both exciting possibilities and daunting challenges. This section will delve into the potential trends, hurdles, and – dare we say it – crystal ball gazing regarding blockchain’s role in the financial world of tomorrow.

Predicting the future is a risky business, akin to investing in a meme coin based solely on a catchy name. However, based on current trends and technological advancements, we can make some educated guesses about the likely trajectory of blockchain in finance.

Potential Future Trends and Developments

Several key areas are poised for significant blockchain-driven transformation. We can expect to see increasing integration of blockchain technology into existing financial systems, rather than a complete upheaval. This will involve a gradual, albeit potentially revolutionary, shift. Imagine a future where microtransactions are processed instantly and securely, bypassing cumbersome intermediaries, and where fractional ownership of assets is streamlined and transparent. This is not science fiction; it’s the potential reality blockchain offers. Furthermore, advancements in scalability and interoperability will be crucial for widespread adoption. Solutions like sharding and cross-chain communication protocols are already showing promise in addressing these critical limitations. The development of more user-friendly interfaces will also be essential for mass adoption, making the technology accessible to a wider range of users.

Challenges and Risks Associated with Widespread Adoption

The path to blockchain utopia is not without its potholes and speed bumps. Scalability remains a major hurdle; processing millions of transactions per second on a decentralized network is a significant engineering challenge. Regulatory uncertainty also looms large. Governments worldwide are still grappling with how to effectively regulate this nascent technology, creating a climate of uncertainty that can stifle innovation. Security is another paramount concern. While blockchain itself is inherently secure, vulnerabilities can exist in the applications built on top of it, making robust security protocols crucial. Furthermore, the energy consumption of some blockchain networks, particularly those using proof-of-work consensus mechanisms, remains a significant environmental concern.

Predictions for the Future of Blockchain Technology in the Financial Industry

Predicting the future is, let’s be honest, a fool’s errand. However, based on current trends, we can anticipate several key developments. By 2030, we might see widespread adoption of central bank digital currencies (CBDCs), offering a secure and efficient alternative to traditional fiat currencies. The integration of blockchain into supply chain finance will likely become commonplace, improving transparency and traceability. Asset tokenization will continue to gain traction, allowing for fractional ownership of assets ranging from real estate to art. However, these predictions come with caveats. The rate of adoption will depend on several factors, including regulatory developments, technological advancements, and the overall economic climate. The path to widespread adoption is not guaranteed, but the potential rewards are substantial enough to warrant continued investment and exploration. Think of it as a high-risk, high-reward investment – but with potentially far-reaching consequences for the global financial system.

Case Studies

The world of blockchain in finance isn’t just theoretical; it’s brimming with real-world successes. These aren’t just isolated incidents; they represent a paradigm shift, proving blockchain’s ability to revolutionize traditional financial processes. Let’s delve into some compelling examples of how blockchain has transformed the financial landscape, leaving a trail of efficiency and transparency in its wake. Buckle up, because it’s going to be a wild ride!

Examining successful blockchain finance implementations reveals common threads of innovation, careful planning, and a healthy dose of audacity. By analyzing these case studies, we can glean valuable insights into the factors that contribute to successful blockchain adoption, and perhaps even predict the future of this rapidly evolving field. Think of it as a financial archeological dig, uncovering the treasures of technological advancement.

Ripple’s XRP and Cross-Border Payments

Ripple, a company utilizing its native cryptocurrency XRP, has made significant strides in facilitating faster and cheaper cross-border payments. Their technology allows financial institutions to send and receive money across borders almost instantly, bypassing the traditional correspondent banking system, which is notoriously slow and expensive. This streamlined process has attracted numerous banks and payment providers, demonstrating the practical applications of blockchain in international finance. The reduction in transaction fees and processing times is a major selling point, proving that blockchain isn’t just a buzzword, but a viable solution to real-world problems. Imagine a world where transferring money internationally is as easy as sending a text message – that’s the promise of Ripple’s approach.

IBM’s Blockchain for Trade Finance

IBM has been a pioneer in applying blockchain technology to trade finance. Their platform streamlines complex processes such as letters of credit, significantly reducing the time and cost involved in international trade transactions. By providing a shared, transparent ledger, IBM’s solution enhances trust and efficiency among various stakeholders, including buyers, sellers, and banks. The result? Faster processing times, reduced paperwork, and lower risks of fraud – a win-win for everyone involved. This isn’t just about making things faster; it’s about creating a more secure and reliable system for global commerce.

Chainlink’s Decentralized Oracle Network

Chainlink stands out as a crucial component of the DeFi ecosystem, acting as a bridge between blockchain networks and real-world data. This is vital because many smart contracts rely on off-chain data for execution. Chainlink’s decentralized oracle network ensures the reliability and security of this data feed, preventing manipulation and boosting the trustworthiness of DeFi applications. Without a reliable oracle network, DeFi’s potential would be severely hampered. Chainlink’s success demonstrates the importance of robust infrastructure in supporting the growth of blockchain-based financial systems. It’s like the plumbing of the DeFi world – essential but often overlooked.

The factors contributing to the success of these implementations are multifaceted, but some key elements stand out.

- Strategic Partnerships: Successful blockchain projects often leverage collaborations with established players in the finance industry, gaining access to resources and expertise.

- Scalability and Performance: Addressing scalability challenges is crucial for widespread adoption. Solutions must be able to handle high transaction volumes without compromising speed or efficiency.

- Regulatory Compliance: Navigating the regulatory landscape is paramount. Projects that proactively engage with regulators and comply with relevant laws are more likely to succeed.

- User Experience: Blockchain solutions should be user-friendly and intuitive. Complex interfaces can hinder adoption, even if the underlying technology is groundbreaking.

Comparing these case studies reveals both similarities and differences in their approaches. While all three leverage blockchain’s core features – transparency, security, and immutability – they address different aspects of the financial industry.

| Feature | Ripple | IBM | Chainlink |

|---|---|---|---|

| Focus | Cross-border payments | Trade finance | Decentralized oracles |

| Target audience | Banks, payment providers | Businesses, banks | DeFi applications |

| Key innovation | Faster, cheaper international transfers | Streamlined trade processes | Reliable off-chain data feeds |

Illustrative Examples

Let’s ditch the theoretical musings and dive headfirst into the exhilarating world of blockchain in action! We’ll explore two compelling scenarios that showcase the practical applications of this revolutionary technology, leaving no stone unturned (or, you know, block unchained).

We’ll begin with a detailed look at how blockchain can streamline KYC/AML compliance, followed by a visual exploration – in words, of course – of a smart contract executing a loan agreement. Buckle up, it’s going to be a wild ride!

Blockchain for KYC/AML Compliance: A Step-by-Step Scenario

Imagine a bustling international bank, perpetually wrestling with the Sisyphean task of Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance. Mountains of paperwork, endless manual checks, and the ever-present risk of fraud make their lives a living nightmare. Enter blockchain, the knight in shining armor (or, perhaps, a knight in shimmering cryptographic hash).

This scenario Artikels how a blockchain-based system could revolutionize their KYC/AML processes.

- Customer Onboarding: A new customer initiates the process by submitting their identification documents (passport, driver’s license, etc.) digitally. These documents are not simply stored; they are cryptographically hashed and added to the blockchain as immutable records.

- Verification and Validation: A trusted third-party verification service, perhaps a specialized KYC/AML provider, authenticates the submitted documents. This verification is also recorded on the blockchain, creating a transparent and auditable trail.

- Data Sharing (with Permission): The bank can securely share verified KYC/AML data with other financial institutions on the blockchain network, reducing duplication of effort and speeding up transactions. Access control mechanisms ensure only authorized parties can access specific data.

- Continuous Monitoring: The blockchain system continuously monitors the customer’s activity for any suspicious patterns. If anomalies are detected, alerts are automatically triggered, enabling proactive risk management.

- Reduced Fraud Risk: The immutability of blockchain records minimizes the risk of data tampering or fraudulent activities, fostering a more secure and trustworthy financial ecosystem.

The data flow involves the customer, the verification service, and the bank, all interacting on a shared, secure blockchain ledger. This drastically simplifies the process, reduces costs, and significantly improves compliance.

Smart Contract for Loan Agreement Execution

Let’s visualize a smart contract executing a loan agreement on a blockchain. Imagine a simple graphic representing a flowchart. At the top, we have the borrower initiating the loan request, specifying the loan amount, interest rate, and repayment schedule. This information is encoded into the smart contract’s code.

The next box shows the contract being deployed onto the blockchain. This deployment is essentially the contract’s official “birth” on the blockchain, creating a permanent, immutable record. The contract’s code, visible to all participants, dictates the terms of the agreement.

Next, the lender reviews the loan application and the smart contract code, then executes the contract by sending the loan amount to the borrower’s designated wallet address. This is depicted as a transaction flowing from the lender’s box to the borrower’s box.

The contract’s code now automatically monitors the borrower’s repayments. Each repayment is a transaction recorded on the blockchain, reducing the possibility of disputes or missed payments. If the borrower defaults, the contract’s logic triggers automatic actions, such as penalties or collateral seizure, all executed transparently and autonomously on the blockchain.

Finally, upon full repayment, the contract self-destructs, completing its cycle. This entire process, from initiation to completion, is documented on the blockchain, creating an irrefutable record of the loan agreement. The visual representation is essentially a flowchart demonstrating the sequential execution of the smart contract’s logic, emphasizing the transparency and automation offered by blockchain technology. This eliminates the need for intermediaries and significantly reduces the risk of fraud or disputes. The smart contract’s code would include conditional statements (if-then-else) to manage different scenarios, such as on-time payments versus late payments, ensuring the contract functions according to its pre-defined rules.

Epilogue

So, there you have it – a glimpse into the exciting, sometimes chaotic, always evolving world of blockchain in finance. While challenges remain, the potential for transformation is undeniable. From streamlining payments to revolutionizing asset management, blockchain’s influence is only going to grow. Whether you’re a seasoned crypto enthusiast or a curious newcomer, the journey into blockchain finance promises to be both rewarding and, dare we say, entertaining.

Expert Answers: Blockchain Finance Applications Review

What are the biggest risks associated with blockchain finance?

While offering numerous benefits, blockchain finance also presents risks like scalability issues, regulatory uncertainty, security vulnerabilities (smart contract exploits), and the volatility of cryptocurrency markets.

How does blockchain improve KYC/AML compliance?

Blockchain enhances KYC/AML by providing an immutable record of transactions and identities, facilitating easier verification and reducing the risk of fraudulent activities.

Is blockchain technology truly secure?

The security of blockchain depends heavily on the specific implementation. While the underlying technology is robust, vulnerabilities can exist in smart contracts or within the platforms themselves. It’s not inherently unhackable, but it offers significantly improved security compared to centralized systems in many cases.

What is the difference between public and private blockchains in finance?

Public blockchains, like Bitcoin, are open and transparent, while private blockchains offer greater control and privacy, often used for internal financial applications within institutions.