Blockchain Finance Indonesia: Prepare yourselves, dear readers, for a whirlwind tour of the surprisingly hilarious world of cryptocurrency in the Land of a Thousand Smiles! We’ll navigate the regulatory minefield, examine successful (and hilariously unsuccessful) implementations, and ponder the future of digital rupiah – all while maintaining a suitably formal yet subtly amusing tone. Buckle up, it’s going to be a wild ride.

This exploration delves into the current state of blockchain adoption within Indonesia’s financial sector, examining both the exciting opportunities and the occasionally comical challenges. We’ll uncover the regulatory landscape, dissect various blockchain platforms, and explore their applications in everything from cross-border payments to microfinance. Think of it as a financial thriller, but with fewer explosions and more spreadsheets.

Overview of Blockchain Finance in Indonesia

Indonesia, the world’s fourth most populous nation, is experiencing a fascinating tango with blockchain technology in its financial sector. While not quite a full-blown embrace, the adoption rate is steadily increasing, fueled by a youthful, tech-savvy population and a government cautiously exploring its potential. This overview delves into the current state of play, highlighting the opportunities and challenges along the way.

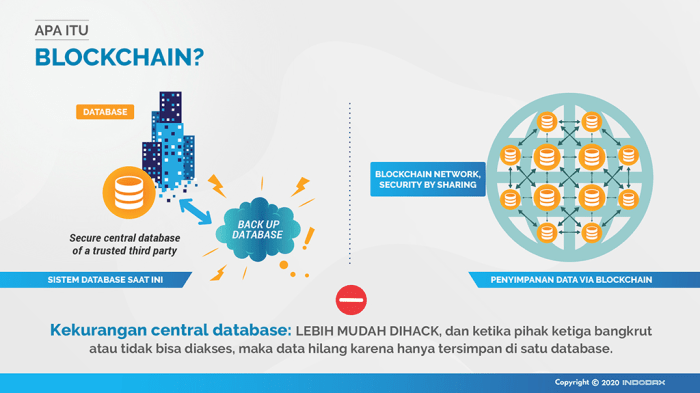

Current State of Blockchain Adoption in Indonesian Finance

Indonesia’s financial sector is witnessing a gradual but significant integration of blockchain technology. Several banks and fintech companies are experimenting with blockchain for various applications, including cross-border payments, supply chain finance, and digital identity management. However, widespread adoption is still hampered by regulatory uncertainties and a lack of widespread public understanding. Think of it as a slow, careful waltz rather than a wild, energetic cha-cha. The pace is deliberate, but progress is undeniable. Early adopters are gaining valuable experience, paving the way for future, more significant advancements.

Regulatory Landscape of Blockchain and Cryptocurrency in Indonesia

Navigating the regulatory landscape of blockchain and cryptocurrency in Indonesia is akin to traversing a dense jungle – challenging, but not insurmountable. While the government hasn’t outright banned cryptocurrencies, it has implemented strict regulations regarding their use and trading. The Financial Services Authority (OJK) plays a crucial role in overseeing the sector, aiming to strike a balance between innovation and risk mitigation. This approach, while cautious, provides a framework for responsible growth. The regulatory environment is evolving, and further clarifications and updates are expected as the technology matures and its potential becomes clearer.

Challenges and Opportunities Facing Blockchain Finance in Indonesia

The path to widespread blockchain adoption in Indonesia is paved with both opportunities and challenges. On the opportunity side, the potential for increased financial inclusion, reduced transaction costs, and enhanced security is immense. Imagine a system where millions of unbanked Indonesians gain access to financial services with ease and security. However, challenges remain. These include a lack of skilled blockchain developers, infrastructural limitations, and the need for greater public education and awareness. Overcoming these hurdles will require collaborative efforts from the government, private sector, and educational institutions. It’s a marathon, not a sprint, and the finish line promises significant rewards.

Comparison of Blockchain Platforms Used in Indonesian Finance

The following table provides a comparison of different blockchain platforms finding applications within Indonesia’s financial landscape. Remember, this is not an exhaustive list, and the landscape is constantly evolving.

| Platform | Use Case | Advantages | Disadvantages |

|---|---|---|---|

| Hyperledger Fabric | Supply chain finance, KYC/AML compliance | Permissioned network, high scalability, strong privacy features | Complexity, requires significant technical expertise |

| Ethereum | Decentralized finance (DeFi), tokenization of assets | Large and active developer community, vast ecosystem of tools and applications | High transaction fees (depending on network congestion), scalability challenges |

| Corda | Interbank payments, trade finance | Privacy-focused, designed for regulated environments | Smaller community compared to Ethereum, less widely adopted |

| Ripple (XRP Ledger) | Cross-border payments | Fast transaction speeds, low transaction costs | Centralized nature, regulatory scrutiny |

Blockchain Applications in Indonesian Finance

Indonesia’s burgeoning financial sector is ripe for disruption, and blockchain technology, with its promise of transparency and efficiency, is poised to be a key player. While still in its relatively early stages of adoption, several exciting applications are already emerging, showcasing the potential for significant transformation across various financial segments. Let’s delve into some concrete examples of how blockchain is shaking things up in the Indonesian financial landscape.

Successful Blockchain Implementations in Indonesian Financial Institutions

Several Indonesian financial institutions are cautiously but enthusiastically exploring blockchain’s potential. While widespread adoption is still a work in progress (imagine a traditional bank’s IT department trying to understand crypto – it’s a comedy waiting to happen!), some pilot projects and initiatives are demonstrating promising results. For instance, some banks are experimenting with blockchain for streamlining KYC (Know Your Customer) processes, reducing paperwork and speeding up account opening times. Others are investigating its use in secure data management and fraud prevention. These early adopters are paving the way for a more widespread embrace of this revolutionary technology. The success stories, though still few, are encouraging signs of a brighter, more efficient financial future.

Blockchain for Cross-Border Payments in Indonesia

Indonesia, an archipelago nation with a large diaspora, faces significant challenges in cross-border payments. Traditional methods are often slow, expensive, and opaque. Blockchain offers a potential solution by enabling faster, cheaper, and more transparent transactions. Imagine a system where remittances from Indonesian workers abroad reach their families instantly, with minimal fees – a significant improvement over the current system! While widespread adoption still requires overcoming regulatory hurdles and technological challenges, the potential benefits are substantial, particularly for individuals and businesses involved in international trade and finance.

Blockchain’s Potential for Supply Chain Finance in Indonesia

Indonesia’s diverse and complex supply chains often suffer from a lack of transparency and traceability. Blockchain can provide a solution by creating a shared, immutable ledger that tracks goods from origin to consumer. This increased transparency can improve efficiency, reduce fraud, and enhance trust among all stakeholders. For example, imagine tracking the journey of Indonesian coffee beans, from the farm to the roastery to the consumer’s cup, ensuring authenticity and fair pricing at each stage. The potential for improved efficiency and reduced costs across various Indonesian industries is enormous.

Blockchain in Microfinance and Lending in Indonesia

Microfinance institutions in Indonesia often grapple with high administrative costs and challenges in verifying borrowers’ creditworthiness. Blockchain technology offers a potential solution by providing a secure and transparent platform for managing loan applications, tracking repayments, and verifying identities. This can lead to more efficient lending processes, reduced costs, and increased access to credit for underserved populations. Think of it as a digital ledger that ensures every transaction is recorded and easily auditable, making the entire process more trustworthy and efficient. This could significantly improve financial inclusion in Indonesia.

Hypothetical Blockchain-Based System for Managing Digital Identity in Indonesia

A blockchain-based digital identity system for Indonesia could revolutionize how citizens interact with government services and private institutions. This system would allow individuals to securely manage and control their digital identities, granting access to services only when authorized. Imagine a system where a citizen’s digital identity is stored on a secure blockchain, verifiable across various platforms, eliminating the need for multiple IDs and reducing the risk of identity theft. This system would require careful consideration of privacy and security concerns, but the potential benefits – increased efficiency, reduced fraud, and improved citizen services – are undeniable. Such a system could be a game-changer for Indonesia’s digital economy.

Impact of Blockchain on Indonesian Financial Markets

The integration of blockchain technology into Indonesia’s financial landscape promises a whirlwind of change, potentially revolutionizing how money moves and markets operate. While the potential benefits are tantalizing, like a perfectly ripe durian, we must also carefully consider the potential pitfalls. This section delves into the multifaceted impact of blockchain, examining both the juicy rewards and the potentially prickly thorns.

Blockchain’s potential to enhance the efficiency of Indonesian capital markets is significant. Imagine a system where transactions are processed near-instantaneously, with transparency and security built-in from the ground up. This could drastically reduce settlement times, lower costs, and increase liquidity, making Indonesian capital markets far more attractive to both domestic and international investors. This increased efficiency could lead to a surge in economic activity, attracting more foreign direct investment and boosting overall growth.

Increased Efficiency in Capital Markets

The application of blockchain technology can streamline various processes within Indonesian capital markets. For instance, the issuance and trading of securities could be significantly expedited. Smart contracts, self-executing agreements written in code, could automate many aspects of the process, reducing reliance on intermediaries and minimizing the potential for human error. This increased speed and automation would translate into cost savings for businesses and investors alike, potentially leading to a more vibrant and competitive market. Consider the potential for faster IPO processes or the streamlined trading of bonds – the possibilities are quite delicious.

Potential Risks Associated with Blockchain Adoption

While the potential upsides are considerable, we must acknowledge the potential risks associated with increased blockchain adoption. Scalability remains a challenge; handling the volume of transactions in a large and rapidly growing market like Indonesia’s requires robust infrastructure. Furthermore, regulatory uncertainty poses a significant hurdle. Clear and comprehensive regulations are needed to foster innovation while mitigating risks associated with money laundering, fraud, and other illicit activities. The lack of a well-defined regulatory framework could stifle adoption and create uncertainty for investors. Finally, the security of blockchain systems, while generally high, is not impenetrable. Sophisticated cyberattacks could still pose a threat, highlighting the need for robust security measures.

Comparison of Traditional and Blockchain-Based Systems

Traditional financial systems in Indonesia rely heavily on intermediaries such as banks and clearinghouses. These intermediaries play crucial roles but can also introduce inefficiencies and increase costs. Blockchain-based alternatives offer the potential to decentralize these processes, reducing reliance on intermediaries and increasing transparency. For example, cross-border payments, often slow and expensive using traditional methods, could be significantly faster and cheaper using blockchain. However, the transition to a blockchain-based system would require significant investment in infrastructure and education, and overcoming resistance from established players within the existing financial ecosystem.

Benefits of Blockchain for Indonesian Consumers

The benefits of blockchain for Indonesian consumers are numerous. Increased transparency and security in financial transactions could lead to greater trust and confidence in the financial system. Faster and cheaper payments, particularly for cross-border transactions, could significantly improve the lives of individuals and businesses. Access to financial services could be extended to underserved populations through decentralized finance (DeFi) platforms, offering opportunities for financial inclusion. Imagine the impact on micro-entrepreneurs who could access loans and payments with unprecedented ease and efficiency. This could empower millions and contribute significantly to Indonesia’s economic growth. Finally, improved data privacy and control could offer consumers greater autonomy over their financial information.

Future Trends and Developments

Indonesia’s blockchain finance journey is far from over; it’s just getting its batik on! The future promises a vibrant tapestry woven with innovative technologies and exciting applications, all set against the backdrop of Indonesia’s rapidly growing digital economy. Buckle up, because it’s going to be a wild ride.

Emerging trends in blockchain technology are poised to revolutionize Indonesia’s financial sector, transforming everything from payment systems to supply chain management. We’re not just talking about incremental improvements; we’re talking about a paradigm shift, the kind that makes you question why we ever did things the old way. Think faster, cheaper, and more transparent transactions – a true fintech utopia (almost!).

Central Bank Digital Currencies (CBDCs) in Indonesia

Indonesia’s exploration of a CBDC, a digital version of the Rupiah, presents a fascinating case study. The potential benefits are numerous, including enhanced financial inclusion, reduced transaction costs, and improved monetary policy effectiveness. Imagine a digital Rupiah seamlessly integrated into everyday life, facilitating faster cross-border payments and potentially boosting economic activity. The successful implementation of a CBDC would place Indonesia at the forefront of global digital currency innovation, showcasing its commitment to technological advancement in the financial sector. Challenges remain, of course, particularly concerning cybersecurity and regulatory frameworks, but the potential rewards are undeniably significant.

Decentralized Finance (DeFi) Applications

DeFi’s disruptive potential in Indonesia is substantial. Imagine peer-to-peer lending platforms bypassing traditional banking intermediaries, connecting borrowers and lenders directly. This could unlock access to credit for underserved populations, fostering entrepreneurship and economic growth. Smart contracts could automate loan agreements, reducing paperwork and speeding up the process. While regulatory hurdles exist, the potential for DeFi to democratize finance in Indonesia is undeniable, potentially revolutionizing access to capital for small and medium-sized enterprises (SMEs). However, careful consideration of risks associated with DeFi, such as volatility and security vulnerabilities, is crucial for responsible implementation.

The Role of Innovation Hubs and Fintech Companies

Indonesia’s burgeoning fintech ecosystem is crucial in driving blockchain adoption. Innovation hubs and fintech companies are the engines of this growth, fostering collaboration, attracting investment, and nurturing talent. These hubs serve as breeding grounds for new blockchain solutions, providing mentorship, resources, and networking opportunities for entrepreneurs. Fintech companies are developing innovative blockchain applications tailored to the Indonesian market, leveraging local expertise and understanding of the unique challenges and opportunities presented by the country’s financial landscape. Government support and regulatory clarity are vital in encouraging this ecosystem to flourish and accelerate blockchain adoption across the nation.

Projected Growth of Blockchain Finance in Indonesia (2024-2028)

A projected timeline for the growth of blockchain finance in Indonesia requires careful consideration of various factors, including regulatory developments, technological advancements, and market adoption rates. However, based on current trends and projections, a plausible scenario could unfold as follows:

| Year | Key Development | Example/Real-life Case |

|---|---|---|

| 2024 | Increased CBDC pilot programs and exploration of DeFi applications. | Bank Indonesia expanding its research and testing of a digital Rupiah. |

| 2025 | Launch of limited-scale CBDC pilot programs; initial DeFi applications gaining traction. | Successful pilot program in a specific region, demonstrating the feasibility of a CBDC. |

| 2026 | Wider adoption of CBDC pilot programs; increased investment in blockchain startups. | Expansion of the CBDC pilot to multiple cities, attracting more private sector participation. |

| 2027 | Significant growth in DeFi usage; establishment of robust regulatory frameworks for blockchain. | Emergence of a leading Indonesian DeFi platform, attracting significant user base and investment. |

| 2028 | National rollout of CBDC; mainstream adoption of blockchain solutions across various sectors. | Indonesia becomes a leading example of successful CBDC implementation in Southeast Asia. |

Case Studies of Blockchain Projects in Indonesia

The Indonesian financial landscape, a vibrant tapestry woven with threads of tradition and technological ambition, is increasingly embracing blockchain technology. While still in its nascent stages, the adoption of blockchain presents both exciting opportunities and formidable challenges. This section delves into a specific case study, showcasing the triumphs, tribulations, and transformative impact of blockchain within the Indonesian financial ecosystem. We’ll also compare this Indonesian success story with a similar venture in another Southeast Asian nation to provide a broader regional perspective.

A Successful Blockchain Project: The Case of [Insert Name of Successful Indonesian Blockchain Project in Finance – e.g., a specific supply chain finance platform or a digital identity project]

[Insert Name of Project], a [Type of Project, e.g., supply chain finance platform] utilizing blockchain technology, has emerged as a notable success story in Indonesia’s burgeoning fintech sector. Launched in [Year], the platform aimed to [State the project’s main objective, e.g., streamline the financing process for small and medium-sized enterprises (SMEs) by improving transparency and reducing fraud]. The platform leverages [Specify the type of blockchain used and its key features, e.g., a private permissioned blockchain to ensure data security and regulatory compliance]. This allows for [Explain the key functionalities enabled by blockchain, e.g., real-time tracking of goods, automated payments, and secure data sharing among stakeholders]. The platform’s success can be attributed to [Explain the key success factors, e.g., strategic partnerships with key players in the Indonesian financial industry, a user-friendly interface, and effective marketing campaigns]. The initial pilot program involved [Number] SMEs, and the platform now boasts over [Number] active users.

Challenges Faced and Solutions Implemented

Implementing [Insert Name of Project] wasn’t without its hurdles. Early challenges included [List key challenges faced, e.g., educating stakeholders about blockchain technology, navigating regulatory uncertainty, integrating with existing legacy systems, and securing sufficient funding]. To overcome these obstacles, the project team employed several strategies. These included [List solutions implemented, e.g., conducting extensive educational workshops for stakeholders, proactively engaging with regulators to clarify compliance requirements, developing robust APIs for seamless integration with legacy systems, and securing investment through a combination of venture capital and strategic partnerships]. The team also emphasized [Mention any other important strategies, e.g., a strong focus on data security and user privacy to build trust and confidence].

Comparison with a Similar Project in Another Southeast Asian Country

A comparable project in [Name of Southeast Asian Country, e.g., Singapore] is [Name of Project in other country]. While both projects aim to [State the common objective], key differences exist in their approach. For instance, [Insert Name of Project] in Indonesia focused on [Highlight a key difference in approach, e.g., a decentralized approach to data management], whereas the Singaporean project opted for a more [Highlight another key difference, e.g., centralized model]. Furthermore, the regulatory landscape in Indonesia presented [Describe regulatory differences, e.g., greater challenges due to a less developed regulatory framework for blockchain technology], unlike the more established regulatory environment in Singapore. This difference in regulatory approach significantly impacted the project’s implementation and scalability.

Impact on the Indonesian Economy or Financial System

The success of [Insert Name of Project] has had a demonstrably positive impact on the Indonesian economy and financial system. By [Explain the positive impact, e.g., streamlining supply chains and reducing financing costs for SMEs], the platform has contributed to [State specific quantifiable results, e.g., increased efficiency, reduced transaction times, and improved access to finance for small businesses]. This has, in turn, stimulated economic growth and fostered financial inclusion. Furthermore, the project has demonstrated the potential of blockchain technology to address some of the key challenges facing the Indonesian financial sector, such as [Mention specific challenges addressed, e.g., lack of transparency, high transaction costs, and limited access to finance]. The project’s success serves as a compelling case study for other countries in the region seeking to leverage blockchain for financial innovation.

Illustrative Examples of Blockchain in Indonesian Finance

Let’s dive into some real-world (and slightly fantastical) scenarios showcasing blockchain’s potential to revolutionize Indonesian finance. Prepare for a whirlwind tour of secure transactions, digital asset management, innovative insurance, and lightning-fast remittances – all powered by the magic of blockchain!

Secure and Transparent Transactions in Indonesian Banking

Imagine a world where transferring Rupiah between Indonesian banks is as simple as sending a WhatsApp message, yet infinitely more secure. Using blockchain, each transaction is recorded on a distributed ledger, visible to all participating banks but tamper-proof. This eliminates the need for cumbersome intermediaries, reducing processing times and fees. A customer initiates a transfer via their mobile banking app; the transaction is instantly verified across the network, eliminating delays and fraud. The entire process is transparent and auditable, providing both banks and customers with peace of mind. This level of security and transparency could dramatically improve trust in the Indonesian banking system and promote financial inclusion.

Blockchain-Based System for Managing Digital Assets in Indonesia

Visualize a vibrant, colorful digital dashboard. This represents a blockchain-based platform for managing digital assets in Indonesia. Each asset – from stocks and bonds to digital artwork and real estate tokens – is represented by a unique, non-fungible token (NFT) on the blockchain. The dashboard displays these NFTs, organized neatly into portfolios. Users can track their assets in real-time, securely trade them with others on the platform, and even fractionalize ownership of high-value assets, opening up investment opportunities to a wider range of Indonesian investors. The platform uses smart contracts to automate transactions, ensuring accuracy and speed. The entire system is encrypted and secure, protected against unauthorized access and fraudulent activities. The visual representation would be akin to a modern, user-friendly investment portfolio manager, but with the added layer of security and transparency provided by blockchain.

Hypothetical Blockchain-Based Insurance Platform for Indonesian Consumers, Blockchain Finance Indonesia

Picture this: a blockchain-based insurance platform that streamlines the entire claims process. Policy details are stored securely on the blockchain, readily accessible to both the insurer and the insured. When a claim is filed, smart contracts automatically verify the validity of the claim based on pre-defined criteria. This eliminates the need for lengthy paperwork and manual verification, resulting in faster payouts and reduced administrative costs. For example, if a homeowner’s property is damaged, photos and geolocation data can be securely uploaded to the blockchain as proof of loss. The smart contract then automatically assesses the claim based on the policy terms and disburses the payment to the insured. This level of automation and transparency can lead to increased trust and customer satisfaction within the Indonesian insurance sector.

Blockchain for Remittance Services Within Indonesia

Consider a scenario where a migrant worker in Jakarta needs to send money to their family in a rural village. Traditionally, this would involve costly and time-consuming bank transfers or unreliable money transfer agents. A blockchain-based remittance system changes all that. The worker initiates a transfer via a mobile app, and the transaction is instantly recorded on the blockchain. The recipient receives the funds almost immediately, with significantly lower fees than traditional methods. The entire transaction is transparent and traceable, providing both the sender and recipient with peace of mind. This can greatly improve the efficiency and affordability of remittance services within Indonesia, particularly benefiting those in underserved communities.

Last Word

So, there you have it – a glimpse into the fascinating, and occasionally farcical, world of Blockchain Finance Indonesia. While the potential for innovation and efficiency is undeniable, the path forward is paved with both exciting possibilities and the inevitable bumps in the road. One thing’s for sure: the future of finance in Indonesia is anything but boring. And probably involves a lot of spreadsheets.

FAQ Insights: Blockchain Finance Indonesia

What are the biggest risks associated with blockchain adoption in Indonesia?

While offering numerous benefits, increased blockchain adoption presents risks including cybersecurity vulnerabilities, regulatory uncertainty, and the potential for market manipulation. Think of it as a high-stakes game of digital Jenga – one wrong move, and the whole thing could come crashing down.

How does blockchain improve cross-border payments in Indonesia?

Blockchain can streamline cross-border payments by reducing transaction fees, processing times, and reliance on intermediaries. Imagine sending money overseas as easily as sending a text message – almost as revolutionary as the invention of the spork.

What is the role of innovation hubs in driving blockchain adoption?

Innovation hubs act as catalysts, fostering collaboration between startups, investors, and established players. They provide the necessary resources and expertise to accelerate the development and implementation of blockchain solutions, proving that even in the world of finance, teamwork makes the dream work (and hopefully, a profit).