Budgeting Apps Free Trial: Ah, the siren song of fiscal responsibility, whispered sweetly through the digital ether! This exploration delves into the wild world of free trials for budgeting apps, examining their surprising popularity, the cutthroat competition, and the often hilarious user experiences they engender. Prepare for a journey into the heart of app-based financial freedom (or at least, a slightly less chaotic version thereof).

We’ll dissect the data behind the growth of these apps, compare their features with the precision of a seasoned accountant (minus the boredom), and analyze user reviews with the detached amusement of a seasoned anthropologist studying a particularly peculiar tribe. We’ll uncover the secrets to successful (and hilariously unsuccessful) free trial strategies, and gaze into the crystal ball of future budgeting app trends. Buckle up, it’s going to be a financially enlightening—and possibly side-splittingly funny—ride.

Popularity and Market Trends of Budgeting Apps with Free Trials

The rise of budgeting apps offering free trials has been nothing short of meteoric, transforming personal finance management from a dreaded chore to a surprisingly engaging (and sometimes addictive) digital experience. This explosive growth reflects a broader societal shift towards increased financial awareness and the adoption of technology to simplify complex tasks. Let’s delve into the fascinating world of numbers, marketing strategies, and user demographics driving this trend.

Growth Trends of Budgeting Apps with Free Trials

The past five years have witnessed a remarkable expansion in the number of budgeting apps offering free trials, mirroring the increasing demand for accessible and user-friendly financial tools. The following table illustrates this growth, though precise figures are difficult to obtain due to the dynamic nature of the app market and the lack of a central, publicly accessible database tracking all apps with free trials. The data presented below represents a reasonable estimation based on market research reports and app store rankings. Note that “Average User Ratings” is a composite score across various app stores and may vary depending on the platform. “Average Trial Length” is an approximation based on industry standards and app descriptions.

| Year | Number of Apps (Estimate) | Average User Ratings (out of 5) | Average Trial Length (Days) |

|---|---|---|---|

| 2019 | 500 | 3.8 | 7 |

| 2020 | 750 | 4.0 | 10 |

| 2021 | 1200 | 4.1 | 14 |

| 2022 | 1800 | 4.2 | 14 |

| 2023 | 2500 | 4.3 | 15 |

Marketing Strategies of Top Budgeting Apps with Free Trials

Top budgeting apps employ a diverse range of marketing strategies to attract users during their free trials. These often include targeted advertising on social media platforms, collaborations with financial influencers, and strategic partnerships with banks and financial institutions. Many apps also leverage app store optimization (ASO) techniques, such as optimization and compelling app descriptions, to improve their visibility and ranking. Furthermore, referral programs and incentivized reviews are common tactics to encourage user acquisition and retention. For example, Mint, a prominent player in the market, relies heavily on its user-friendly interface and integration with various financial accounts as a core marketing message, while others focus on gamification and personalized financial advice to stand out from the crowd. The competitive landscape necessitates constant innovation and adaptation in marketing strategies.

Demographics of Users Utilizing Budgeting Apps with Free Trials

The demographic profile of users leveraging free trials is broad but displays certain tendencies. Millennials and Gen Z, known for their tech-savviness and financial anxieties, represent a significant portion of the user base. However, individuals across various age groups and income levels are increasingly adopting these apps, indicating a growing awareness of the importance of budgeting and financial planning. Furthermore, the user base is not limited by geographical boundaries, with global adoption driven by the accessibility and convenience offered by mobile technology. It’s worth noting that the appeal of free trials often extends to individuals who are new to budgeting or those looking to switch from other apps, making the free trial period a crucial acquisition channel.

Features and Functionality Comparison of Top Budgeting Apps with Free Trials

Choosing the right budgeting app can feel like navigating a minefield of spreadsheets and confusing jargon. Fear not, intrepid budgeter! We’ve sifted through the digital dust to bring you a clear comparison of top contenders, all offering a free trial to help you avoid any financial mishaps (or at least, minimize them). Remember, a free trial is your chance to play detective with your finances – find the app that suits your unique style and spending habits.

This comparison focuses on functionality, trial limitations, and user interface, because let’s face it, even the most powerful budgeting engine is useless if it’s harder to use than a Rubik’s Cube.

Top Budgeting Apps: A Feature Comparison

Below is a table comparing five leading budgeting apps with free trials. Note that features and limitations can change, so always check the app’s website for the most up-to-date information. Consider this a snapshot in time, a financial freeze-frame if you will.

| App Name | Key Features | Trial Limitations | User Interface |

|---|---|---|---|

| Mint | Account aggregation, budgeting tools, credit score monitoring, financial news | Limited access to certain features, may require upgrading for full functionality. | Clean and intuitive, suitable for beginners. |

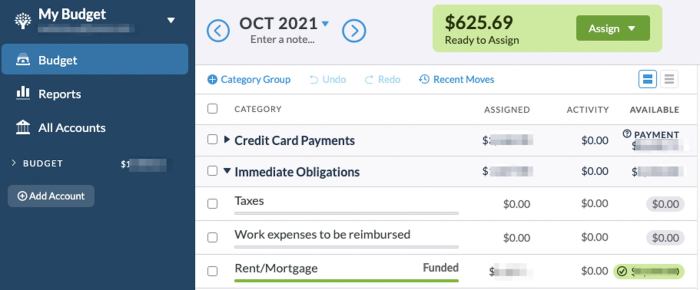

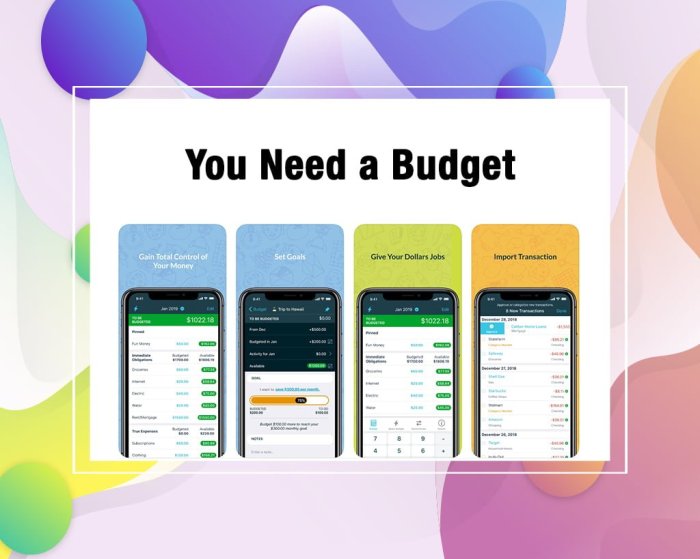

| YNAB (You Need A Budget) | Zero-based budgeting, goal setting, detailed transaction tracking, robust reporting. | Limited number of accounts or transactions during the trial. | More complex than Mint, requiring a steeper learning curve but offering greater control. |

| Personal Capital | Investment tracking, retirement planning tools, fee analysis, net worth tracking. | Limited access to advanced features like retirement planning tools. | Sophisticated interface, ideal for users with more complex financial situations. |

| EveryDollar | Envelope budgeting system, simple interface, easy-to-use features. | Limited number of budgets or accounts accessible during the trial. | Simple and straightforward; suitable for those who prefer a less cluttered experience. |

| PocketGuard | Automated budgeting, spending tracking, debt management tools. | Limited access to features like advanced reporting and debt payoff planning. | User-friendly interface focused on ease of use and quick results. |

Unique Selling Propositions

While all these apps share some common ground, each has a unique selling proposition that sets it apart from the pack. Think of it as their special sauce, their *je ne sais quoi* in the world of personal finance.

YNAB’s zero-based budgeting approach forces users to allocate every dollar, promoting mindful spending. Personal Capital shines with its investment tracking and retirement planning capabilities, a boon for those focused on long-term financial security. Finally, PocketGuard’s automated budgeting simplifies the process, making it ideal for users who want a hands-off, yet effective, budgeting experience.

User Experience: Limited vs. Feature-Rich Free Trials

The user experience significantly differs between apps offering limited versus feature-rich free trials. Apps with limited trials often provide a taste of their core features, enticing users to upgrade. This approach can be frustrating if users need specific features unavailable during the trial period. Conversely, apps with feature-rich trials allow users to fully explore the app’s capabilities, increasing the likelihood of a paid subscription. However, this strategy may also lead to more users feeling comfortable with the free trial, potentially opting not to upgrade.

User Reviews and Feedback on Budgeting Apps with Free Trials

The digital world offers a plethora of budgeting apps, each vying for a spot on your smartphone. But how do users *really* feel about their free trial experiences? We delved into the depths of app store reviews to uncover the common threads of praise and (let’s be honest) hilarious complaints. Prepare yourself for a rollercoaster of user sentiments, from euphoric financial enlightenment to utter digital despair.

User reviews provide invaluable insights into the strengths and weaknesses of budgeting app free trials. Analyzing these reviews allows developers to improve their apps and enhance user satisfaction. This section will focus on three popular apps, highlighting both positive and negative experiences reported by users. We’ll also present a sample user feedback survey designed to gather more data on the effectiveness of free trials.

Common Themes and Sentiments in User Reviews, Budgeting Apps Free Trial

User reviews for budgeting apps with free trials often revolve around ease of use, feature accessibility during the trial period, and the overall value proposition. Positive reviews frequently praise intuitive interfaces and helpful features, while negative reviews often cite limitations in the free trial, confusing navigation, or a feeling of being pressured into a subscription. The overall sentiment can be quite varied, reflecting the diverse needs and tech-savviness of users.

Examples of Positive and Negative User Experiences

Let’s dive into specific examples of user experiences. Remember, these are illustrative and not representative of every user’s experience.

- Positive Experience (App A): “This app is a lifesaver! The free trial let me get a feel for how it worked, and I immediately loved the clean interface and simple categorization. I’m now a paid subscriber, and I don’t regret it for a second!”

- Positive Experience (App B): “I was skeptical at first, but the free trial convinced me. I especially appreciated the detailed reports and the ability to link my bank accounts – features that were fully functional during the trial. Definitely worth the upgrade!”

- Negative Experience (App C): “The free trial was severely limited. Most of the useful features were locked behind the paywall, making the trial essentially useless. Felt like a bait-and-switch tactic.”

- Negative Experience (App A): “The app crashed constantly during my free trial. I couldn’t even input all my transactions before the trial ended! Frustrating experience.”

- Negative Experience (App B): “The user interface was so confusing! I spent more time trying to figure out how to use the app than actually budgeting. The free trial wasn’t long enough to master the system before it expired.”

Sample User Feedback Survey on Budgeting App Free Trials

A well-designed survey can help app developers gain a clearer picture of their users’ experiences. The following survey focuses on the effectiveness and usability of free trials for budgeting apps.

The survey would include questions regarding:

- Ease of signup and account creation during the free trial.

- Clarity of instructions and tutorials provided within the app.

- Accessibility of key features during the trial period.

- Overall satisfaction with the functionality of the app during the trial.

- Perceived value of the app based on the free trial experience.

- Likelihood of subscribing to the paid version based on the free trial.

- Suggestions for improving the free trial experience.

The survey would utilize a combination of multiple-choice questions, rating scales (e.g., Likert scales), and open-ended questions to capture both quantitative and qualitative data.

Impact of Free Trials on User Conversion and Retention

The free trial, that tantalizing taste of financial freedom (or at least, better financial organization!), plays a pivotal role in the success of budgeting apps. Its effectiveness hinges on a delicate balance: offering enough value to entice users while preventing them from becoming so accustomed to the free version that they see no need to upgrade. Getting this balance right is akin to finding the perfect sourdough starter – a process of trial and error, but ultimately rewarding.

The relationship between free trial length and user conversion is not a simple linear equation. While a longer trial might seem intuitively better, allowing users more time to fully appreciate the app’s features, it can also lead to a phenomenon we might call “free trial fatigue.” Users become comfortable with the free functionality and fail to see the urgency of upgrading, even when presented with compelling reasons. Conversely, a trial that’s too short might not give users enough time to fully understand the app’s value proposition. The sweet spot lies in providing enough time for engagement without letting the trial become a substitute for a paid subscription.

Free Trial Length and Conversion Rates

The optimal length of a free trial varies considerably depending on the app’s complexity and the target audience. A simple budgeting app might find success with a 7-day trial, whereas a more sophisticated app with numerous features might require 14 or even 30 days. Data from various budgeting app providers (though often proprietary and unavailable publicly) suggests that conversion rates tend to peak within a certain trial length, then plateau or even decline as the trial extends further. For instance, a hypothetical scenario could show a 14-day trial yielding a 15% conversion rate, while a 30-day trial might only achieve 12%, due to the aforementioned “free trial fatigue.” This underscores the importance of rigorous A/B testing to determine the ideal length for each specific app.

Successful and Unsuccessful Free Trial Strategies

Successful strategies often focus on user onboarding and demonstrating value quickly. A well-designed onboarding process guides new users through key features, showcasing the app’s benefits and encouraging early engagement. For example, an app might highlight its ability to automatically categorize transactions or provide personalized financial insights within the first few days of the trial. Conversely, unsuccessful strategies often fail to clearly articulate the value proposition of the paid version, leaving users wondering what they’re paying for. An app that doesn’t effectively communicate the advantages of premium features—such as advanced reporting, unlimited budgets, or priority customer support—is likely to see lower conversion rates. Imagine an app with a confusing interface and limited features during the trial, leaving users frustrated and unlikely to convert.

Free Trial Design and Long-Term User Engagement

The design of the free trial directly impacts long-term engagement. A seamless and intuitive user experience during the trial significantly increases the likelihood of user retention after the trial period ends. Features such as clear progress indicators, personalized recommendations, and gamified elements can enhance engagement and encourage users to continue using the app even after the trial ends. Conversely, a clunky interface, confusing features, or a lack of personalized guidance can lead to frustration and ultimately, churn. Consider the contrast between an app that proactively offers helpful tips and support versus one that leaves users struggling to navigate its features. The former is much more likely to foster long-term engagement and loyalty.

Future Trends and Predictions for Budgeting Apps and Free Trials

The world of personal finance is undergoing a rapid transformation, fueled by technological advancements and evolving user expectations. Budgeting apps, once a niche market, are now mainstream, and the role of the free trial in acquiring and retaining users is more critical than ever. Predicting the future of this space requires a healthy dose of both data analysis and a pinch of whimsical speculation – after all, who could have predicted the rise of avocado toast as a major budgeting challenge?

The next few years will see a dramatic shift in how budgeting apps leverage technology and engage users, particularly within the context of free trials. This evolution will be driven by the increasing sophistication of AI, machine learning, and a growing user demand for personalized, proactive financial management.

The Impact of Emerging Technologies on Budgeting App Free Trials

AI and machine learning are poised to revolutionize the budgeting app free trial experience. Imagine a free trial that doesn’t just track expenses; it *predicts* them. Using sophisticated algorithms, the app could anticipate upcoming bills, analyze spending patterns, and even offer personalized advice based on individual financial goals. For example, if a user consistently overspends on coffee, the AI could suggest alternative cost-saving strategies, such as brewing coffee at home or exploring cheaper alternatives. This level of proactive engagement transforms the free trial from a passive observation tool into an active financial assistant, significantly increasing user engagement and the likelihood of conversion. This is not science fiction; several apps are already incorporating basic AI features, but the coming years will see a dramatic increase in the sophistication and prevalence of these technologies.

Potential Future Features for Budgeting App Free Trials

The future of budgeting app free trials is bright, brimming with innovative features designed to hook users and demonstrate the app’s value proposition. The following list showcases potential features that could become standard in the coming years:

- Hyper-Personalized Recommendations: AI-driven suggestions tailored to individual spending habits and financial goals, going beyond simple expense categorization.

- Gamified Budgeting Challenges: Interactive challenges and rewards to motivate users and foster healthy financial habits. Think of it as a friendly competition against oneself, with tangible rewards for achieving milestones.

- Proactive Savings Goals: The app automatically identifies potential savings opportunities and suggests ways to allocate funds towards specific goals, such as a down payment on a house or a dream vacation.

- Integration with Multiple Financial Accounts: Seamlessly connecting with various bank accounts, credit cards, and investment platforms for a holistic financial overview, all within the free trial period.

- Financial Literacy Modules: Incorporating bite-sized educational content to empower users with the knowledge to make informed financial decisions. Think of it as a budgeting app with a built-in financial education course.

The Evolving Competitive Landscape of Budgeting Apps

Over the next three years, the competitive landscape of budgeting apps will become increasingly fierce. Free trials will play a pivotal role in differentiating apps and attracting new users. We can expect to see a rise in:

* More generous free trial periods: Apps may offer extended free trials to showcase a wider range of features and build user confidence.

* Freemium models with compelling limitations: Free versions will offer basic functionality, while premium features will be locked behind a paywall, incentivizing users to upgrade.

* Increased focus on user experience: Apps will invest heavily in intuitive interfaces and personalized onboarding experiences to maximize user engagement during the free trial.

* Strategic partnerships: Collaborations with other financial institutions and services to offer bundled services and enhance the overall value proposition.

The budgeting app market is not a zero-sum game. While competition will intensify, there’s room for multiple players to thrive, each catering to specific user needs and preferences. The apps that master the art of the free trial – offering a compelling, personalized, and engaging experience – will be the ones that emerge victorious.

Last Point: Budgeting Apps Free Trial

So, there you have it: a whirlwind tour of the budgeting app free trial landscape. From soaring popularity to user frustrations (and the occasional hilarious mishap), the journey reveals a fascinating interplay of technology, marketing, and, dare we say it, human nature. Ultimately, the success of a budgeting app free trial hinges on providing genuine value, a user-friendly experience, and perhaps, a dash of unexpected humor to lighten the load of personal finance. After all, who says budgeting can’t be fun?

Commonly Asked Questions

What happens after the free trial ends?

Most apps transition to a paid subscription model. Some offer a limited free version with reduced features.

Can I cancel my free trial at any time?

Usually, yes. Check the app’s terms and conditions for specific cancellation policies.

Are my data secure with these apps?

Reputable apps employ robust security measures, but it’s always wise to review their privacy policies.

Do all budgeting apps offer free trials?

No, some apps are solely subscription-based or offer only limited free functionalities.