Budgeting Apps Review Update: Dive headfirst into the wild world of personal finance apps! We’re not just talking about spreadsheets here, folks; we’re exploring a digital ecosystem teeming with AI-powered budgeting wizards, minimalist trackers, and subscription services that promise financial freedom (or at least a slightly less chaotic bank account). This review delves into the crème de la crème, comparing features, user experiences, and pricing models with the wit and precision of a seasoned financial detective.

From simple expense trackers to sophisticated AI-driven systems, we’ve rigorously tested a diverse range of budgeting apps. Our methodology involved a meticulous evaluation of each app’s functionality, user interface, and overall effectiveness in helping users manage their finances. We’ve considered everything from ease of use to data security, providing a comprehensive overview to help you navigate the often-bewildering world of budgeting apps.

Introduction to Budgeting Apps

Ah, budgeting apps – the digital saviors promising financial enlightenment and, dare we say, even a little joy in the often-grim world of personal finance. The market is positively bursting with them, a vibrant ecosystem of apps vying for your attention (and your hard-earned cash, ironically). From simple trackers to AI-powered wizards, there’s an app out there for every level of financial fluency – or, let’s be honest, every level of financial avoidance.

The current budgeting app landscape is a fascinating mix of simplicity and sophistication. We’ve seen a dramatic increase in both the number of apps available and the complexity of their features. This reflects a growing consumer demand for tools that can help manage increasingly complex financial lives. No longer is it enough to simply track expenses; users want predictive analytics, automated savings plans, and integration with other financial services.

Categorization of Budgeting Apps

Budgeting apps aren’t a monolithic entity; they fall into distinct categories based on their functionality and approach. Understanding these categories is crucial for selecting the app that best suits your individual needs and tech-savviness. For example, some are straightforward trackers, perfect for those who simply need a visual representation of their spending habits. Others leverage the power of artificial intelligence to provide personalized insights and recommendations, predicting future spending and suggesting ways to optimize your finances. And finally, there are subscription-based apps offering premium features and enhanced support. Think of it as choosing between a basic bicycle, a sleek electric bike, or a high-end, fully-customized racing machine – the choice depends entirely on your needs and budget (pun intended).

Key Features of Budgeting Apps

While features vary wildly across apps, some core functionalities are almost universally present. These features form the backbone of most budgeting apps, providing the essential tools for effective financial management. These commonly include expense tracking (obviously!), income recording, budgeting tools (allowing you to set financial goals and track progress), reporting and visualization (think charts and graphs that make your financial data less terrifying and more understandable), and account aggregation (linking to your various bank accounts and credit cards for a consolidated view). Many also offer debt management tools, savings goals features, and even investment tracking capabilities, blurring the lines between simple budgeting and comprehensive financial planning. The best apps often integrate seamlessly with other financial services, creating a centralized hub for managing all aspects of your financial life. Imagine a single dashboard showing your spending, savings, investments, and debt all in one place – it’s less stressful than it sounds, we promise.

Review Methodology

Selecting the right budgeting app is like choosing the perfect pair of socks – you want something comfortable, functional, and ideally, not riddled with holes. Our rigorous review process ensured we only considered the crème de la crème of the budgeting app world, sparing you the agony of downloading duds.

We meticulously evaluated a range of budgeting apps, focusing on those with a significant user base and consistently positive reviews across multiple platforms. Apps with questionable security practices or histories of data breaches were immediately disqualified – because nobody wants their financial secrets splashed across the internet like a particularly embarrassing vacation photo. Our selection also considered factors like app accessibility for users with disabilities and ease of integration with other financial platforms.

App Selection Criteria

The apps included in this review were chosen based on a combination of popularity, user ratings, and feature sets. We prioritized apps with a broad range of features, a user-friendly interface, and strong security measures. The apps were also assessed based on their platform availability (iOS and Android) and compatibility with other financial tools. Ultimately, we aimed for a diverse selection representing the budgeting app market’s spectrum.

Testing Process

Each selected budgeting app underwent a thorough testing process designed to mimic real-world usage. This included setting up budgets, tracking expenses, analyzing reports, and using various features like bill reminders and financial goal setting. We used both simulated and actual financial data to test the accuracy and reliability of each app’s calculations and projections. This involved meticulously tracking the app’s performance across different devices and network conditions. Think of it as a budgeting app boot camp – only instead of push-ups, we had painstaking data entry.

Review Criteria

The following table summarizes our findings. Ratings are on a scale of 1 to 5 stars, with 5 stars representing exceptional performance. Remember, these are *our* opinions – your mileage may vary (especially if you’re budgeting for a luxury yacht).

| App Name | Feature | Rating (1-5 stars) | Comments |

|---|---|---|---|

| Mint | Budgeting & Tracking | 4 stars | User-friendly interface, robust features, but can be slow at times. |

| YNAB (You Need A Budget) | Goal Setting & Forecasting | 5 stars | Powerful features, excellent for detailed budgeting, but requires a subscription. |

| Personal Capital | Investment Tracking & Retirement Planning | 4 stars | Comprehensive features, strong investment tracking, but the interface can feel overwhelming for beginners. |

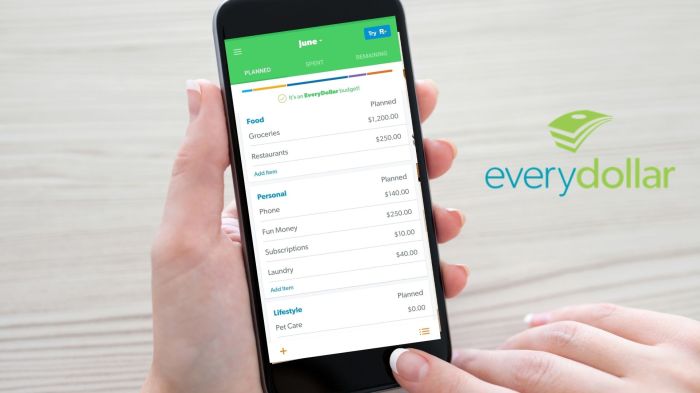

| EveryDollar | Zero-Based Budgeting | 3 stars | Simple interface, good for beginners, but lacks advanced features. |

| PocketGuard | Spending Limits & Alerts | 4 stars | Excellent for managing spending, helpful alerts, but limited customization options. |

Top Budgeting Apps

Ah, budgeting apps – the digital saviors promising financial enlightenment (or at least, slightly less financial panic). We’ve wrestled with spreadsheets, stared blankly at bank statements, and even tried the old-fashioned envelope system (which, let’s be honest, mostly ended up with crumpled receipts and a lingering scent of desperation). But now, with the help of technology, we can track our spending with the precision of a hawk eyeing a particularly juicy mouse. Let’s dive into the nitty-gritty of some top contenders.

Mint: A Budgeting Veteran

Mint, a long-standing player in the budgeting app arena, boasts a user-friendly interface that’s surprisingly intuitive, even for the digitally challenged among us. Its clean design and simple navigation make tracking expenses a breeze. The app automatically categorizes transactions, saving you the tedious task of manual entry. However, the automatic categorization can sometimes be a little… enthusiastic, lumping your “emergency pizza” purchase with “groceries.” Mint’s strength lies in its comprehensive overview of your financial life, connecting to various accounts for a holistic view. Yet, the sheer volume of information presented can feel overwhelming to some users.

YNAB (You Need A Budget): The Methodology Maestro

YNAB takes a different approach, emphasizing a zero-based budgeting method. Instead of simply tracking spending, YNAB encourages users to allocate every dollar to a specific category, ensuring all funds are accounted for. This method, while initially demanding, cultivates mindful spending habits. The app’s interface, while functional, is less visually appealing than Mint’s, prioritizing functionality over flashy aesthetics. YNAB’s strength is its powerful budgeting philosophy, which can be transformative for users committed to its system. However, the initial learning curve can be steep, and the app’s features are primarily focused on the zero-based budgeting methodology.

Personal Capital: The Investment-Focused Friend

Personal Capital distinguishes itself by incorporating investment tracking alongside budgeting features. It’s a powerful tool for those managing investment portfolios, providing insights into asset allocation and overall financial health. The interface is sleek and modern, offering a comprehensive dashboard that presents financial information clearly. However, the app’s focus on investment tracking might feel extraneous for users primarily concerned with day-to-day budgeting. While the investment tracking is a significant advantage for certain users, it might overwhelm others who are simply looking for a basic budgeting tool. Furthermore, the app requires a certain level of financial literacy to fully utilize its features.

Feature Comparison

Understanding the core differences between these apps is crucial for choosing the right fit.

| Feature | Mint | YNAB | Personal Capital |

|---|---|---|---|

| Ease of Use | High | Medium | Medium |

| Investment Tracking | Limited | None | Extensive |

| Budgeting Methodology | Traditional | Zero-Based | Traditional |

| Visual Appeal | High | Medium | High |

User Experience and Feedback

Navigating the world of budgeting apps can feel like traversing a minefield of confusing interfaces and frustrating features. But fear not, intrepid budgeters! We’ve delved into the user experience of several top contenders, sifting through mountains of reviews to bring you the good, the bad, and the downright hilarious. Prepare for a rollercoaster of user opinions, ranging from ecstatic praise to exasperated sighs.

User feedback, gleaned from app stores and online forums, paints a vibrant (and sometimes chaotic) picture of the user experience. Analyzing this feedback allows us to pinpoint common pain points and celebrate the triumphs of intuitive design. We’ve anonymized all reviews to protect the innocent (and the slightly less innocent).

Anonymized User Reviews and Feedback

The sheer volume of user reviews is staggering. Some users rave about the ease of use and the insightful reports generated by certain apps, describing them as “life-changing” and “a godsend for my chaotic finances.” Others, however, express frustration with glitches, confusing interfaces, and a lack of customer support, resorting to colorful language that we’ve, of course, carefully sanitized for your reading pleasure. One particularly memorable review described a budgeting app as “a digital version of my accountant, but without the comforting smell of freshly brewed coffee.”

Hypothetical User Scenario and App Responses

Let’s imagine Sarah, a freelance graphic designer, receives a large unexpected payment for a project. How would our top-rated apps handle this windfall? In App A, Sarah would easily categorize the income and allocate a portion towards savings, debt repayment, and a much-needed vacation. App B might present a slightly more convoluted process, requiring multiple steps to properly categorize and allocate the funds. App C, however, might even suggest automatically allocating a percentage based on Sarah’s established spending habits, offering a personalized approach. The difference, in this scenario, highlights the varying levels of user-friendliness and automation each app offers.

Common Pain Points Reported by Users

Users consistently report several common frustrations. These include: difficulty in accurately tracking spending (especially for irregular expenses or cash transactions); lack of intuitive features for managing multiple accounts or shared finances; insufficient customer support; and, perhaps most surprisingly, the sheer number of notifications and reminders some apps bombard users with. One user famously declared that their budgeting app sent more notifications than their actual bank. Another lamented the lack of a “snooze” button for these notifications, adding, “It’s like my phone is constantly judging my spending habits.” This highlights the need for apps to strike a balance between helpful reminders and overwhelming notifications.

Specific Feature Comparisons

Budgeting apps, while all aiming for the same general goal (financial enlightenment, not financial ruin!), offer wildly different approaches to getting you there. Think of it like choosing a hiking trail: some are paved and easy, others are rocky and require a sherpa (and possibly a therapist). This section dives into the nitty-gritty of feature comparisons, focusing on expense tracking, budgeting tools, and the ever-important topic of data security. Prepare for a deep dive into the digital financial wilderness!

Expense tracking capabilities vary significantly. Some apps offer simple manual entry, perfect for those who enjoy the tactile satisfaction of recording every latte purchase. Others boast automatic transaction imports, a godsend for anyone who’s ever stared blankly at a mountain of bank statements. The accuracy and reliability of automatic imports, however, can be a mixed bag, so careful monitoring is crucial, especially in the initial setup phase. Imagine the chaos of an app misinterpreting your rent payment as a donation to a llama sanctuary – a hilarious, albeit costly, mistake.

Expense Tracking Capabilities

A robust expense tracking system is the backbone of any effective budgeting app. Several apps excel in this area by providing detailed categorization options, allowing users to meticulously track spending across various categories. For example, “Mint” and “Personal Capital” offer extensive categorization and visual representations of spending habits, allowing for quick identification of spending trends. On the other hand, simpler apps may lack this level of granularity, relying on more basic categorization schemes. The level of detail and customization offered directly impacts the user’s ability to gain meaningful insights into their financial behavior. Consider the difference between simply knowing you spent $500 on “eating out” versus knowing you spent $150 on fast food, $100 on nice restaurants, and $250 on coffee shop treats – suddenly, that daily latte habit is much clearer.

Budgeting Tools and Goal Setting

Beyond basic expense tracking, budgeting apps offer a variety of tools to help users manage their finances effectively. Goal setting features, for instance, allow users to define financial objectives, such as saving for a down payment or paying off debt. Apps like “YNAB” (You Need A Budget) excel in this area, employing a zero-based budgeting methodology that encourages users to allocate every dollar to a specific purpose. In contrast, other apps might offer simpler goal-setting features, focusing on basic savings targets rather than comprehensive budgeting strategies. The effectiveness of these tools depends heavily on the user’s financial discipline and their ability to stick to a pre-determined budget. Imagine setting a goal to save for a dream vacation, meticulously tracking expenses, and then finally watching that balance grow – the satisfaction is immeasurable (and far outweighs the cost of that llama sanctuary donation).

Data Security and Privacy

The security and privacy of financial data are paramount. Reputable budgeting apps employ robust security measures, such as encryption and two-factor authentication, to protect user information from unauthorized access. However, it’s crucial to review each app’s privacy policy carefully before sharing sensitive financial data. Some apps might share anonymized data with third-party partners for analytical purposes, while others maintain a stricter policy regarding data sharing. Consider the potential risks and benefits before entrusting your financial life to any given app. Remember, your financial information is like a prized family recipe – you wouldn’t want just anyone getting their hands on it!

Pricing and Subscription Models

Ah, the money matters! Let’s delve into the surprisingly complex world of budgeting app pricing – because even saving money can cost money, apparently. We’ll examine the various subscription models and help you decide if the price is right for your financial aspirations (and sanity). Remember, a good budgeting app should help you *save* money, not break the bank!

Budgeting apps employ a variety of pricing strategies, ranging from completely free (with limitations, of course) to subscription models with varying levels of features and support. Understanding these models is crucial to selecting an app that fits both your needs and your wallet.

Subscription Model Comparison

| App Name | Free Version | Paid Version(s) | Pricing | Value Proposition |

|---|---|---|---|---|

| Mint | Yes, with ads and limited features | No | Free (with limitations) | A good starting point for basic budgeting; however, the limitations might push users towards paid alternatives if they need advanced features. |

| YNAB (You Need A Budget) | No | Subscription | Monthly/Annual Subscription | YNAB offers a robust feature set designed for meticulous budgeting and financial planning. The subscription cost reflects the comprehensive tools and support provided. |

| Personal Capital | Yes, with core features | No | Free (with some advanced features behind a paywall) | Personal Capital offers a strong free version with net worth tracking and investment management tools. Additional features for more advanced users are available for a fee. |

| EveryDollar | Yes, with basic features | Subscription | Monthly/Annual Subscription | EveryDollar’s free version provides a foundation for zero-based budgeting. The paid version unlocks additional features like debt-reduction tools and enhanced reporting. |

| PocketGuard | Yes, with ads and limited features | Subscription | Monthly/Annual Subscription | PocketGuard’s free version provides a simple overview of your finances. The paid version removes ads and provides more detailed insights and features. |

Free Version Limitations

Many budgeting apps offer free versions, but these often come with restrictions. These limitations can include things like fewer transaction tracking capabilities, limited account connections, the presence of intrusive advertisements, and restricted access to advanced features such as reporting or financial analysis tools. Essentially, the free version might give you a taste, but the full feast requires a subscription. Think of it as a delicious sample versus a full, satisfying meal. The sample is nice, but sometimes you crave the whole thing.

Visual Representation of App Features

The visual appeal of a budgeting app is paramount; it’s the window to your financial soul (and let’s be honest, sometimes that soul needs a little visual TLC). A well-designed interface can transform the often-dreaded task of budgeting into something almost… enjoyable. We’ll examine the visual strategies employed by two leading apps, showcasing how they use color, charts, and overall design to present complex financial data in a digestible and, dare we say, delightful way.

Mint’s Dashboard Design

Mint, a long-standing budgeting champion, prioritizes a clean, uncluttered dashboard. Imagine a calming oasis in the desert of your personal finances. The color scheme is predominantly a soothing teal and soft grey, with pops of brighter color used sparingly to highlight key metrics, such as upcoming bills or significant spending categories. The primary data visualization technique is the use of circular progress bars, affectionately known as pie charts (but way more aesthetically pleasing than that school project you made in 5th grade). These visually represent the proportion of your budget allocated to different categories (housing, food, entertainment – you know the drill). A clear, concise summary of your current account balances is prominently displayed, keeping the user constantly informed about their financial health. The overall aesthetic is modern, minimalist, and incredibly user-friendly, making even the most financially challenged among us feel comfortable navigating their way through their finances. The simplicity is, in fact, the app’s strength, avoiding the visual clutter that can make other budgeting apps feel overwhelming.

YNAB’s Visual Focus on Goal Tracking

You Need A Budget (YNAB), on the other hand, takes a slightly different approach. While Mint emphasizes a holistic overview, YNAB’s visual strength lies in its robust goal-tracking system. Imagine a vibrant, dynamic landscape where each peak represents a financial goal, and the progress you make is shown by a satisfying ascent. The color palette is brighter and more energetic than Mint’s, reflecting the app’s focus on proactive budgeting. Instead of pie charts, YNAB utilizes bar graphs and line charts to illustrate progress towards goals, providing a more granular view of spending habits and goal attainment. A key visual element is the “Give Every Dollar a Job” philosophy, which is visually represented through the allocation of funds to specific budget categories, clearly showing where each dollar is earmarked. The overall aesthetic is less minimalist than Mint’s, but the vibrant design keeps the user engaged and motivated, turning budgeting from a chore into a visually rewarding game of financial mastery.

Future Trends in Budgeting Apps

The world of personal finance is constantly evolving, and budgeting apps are right there with it, hurtling towards a future where managing your money is less of a chore and more like playing a (financially responsible) video game. Prepare yourself for a glimpse into the exciting – and potentially less stressful – future of budgeting.

The integration of artificial intelligence (AI) and machine learning (ML) is poised to revolutionize how we interact with budgeting apps. These technologies are no longer futuristic fantasies; they’re already subtly changing the game, and the coming years will see a dramatic increase in their sophistication and impact.

AI and Machine Learning Enhancements

AI and ML are set to transform budgeting apps from simple tracking tools to proactive financial advisors. Imagine an app that not only tracks your spending but also predicts your future cash flow, identifies potential overspending areas, and even suggests ways to optimize your savings strategy. This isn’t science fiction; companies like Mint and YNAB are already incorporating elements of this technology. For instance, some apps can now categorize transactions with impressive accuracy, learning from your past spending habits to improve their predictions over time. Future iterations could go further, analyzing your spending patterns to automatically adjust your budget, alert you to potential subscription creep, and even negotiate better deals on your behalf. Think of it as having a personalized financial assistant available 24/7.

Predictive Analytics and Personalized Financial Advice, Budgeting Apps Review Update

This feature will leverage advanced algorithms to analyze spending patterns, income fluctuations, and financial goals to provide highly personalized financial advice. Instead of generic tips, users might receive tailored recommendations based on their unique circumstances. For example, an app could suggest specific ways to reduce spending in areas where the user consistently exceeds their budget or offer tailored investment strategies aligned with their risk tolerance and financial objectives. A real-world example of this would be an app suggesting a reduction in dining-out expenses based on analysis of the user’s spending habits, perhaps recommending meal-prepping or utilizing discount services. The app could even suggest specific recipes or nearby budget-friendly restaurants.

Gamification and Behavioral Economics

The incorporation of game mechanics, such as points, badges, and leaderboards (although perhaps not the leaderboards!), can significantly enhance user engagement and motivation. Budgeting apps could reward users for achieving their financial goals, making the process more fun and less daunting. This approach leverages principles of behavioral economics to encourage positive financial habits. Imagine earning virtual rewards for sticking to your budget or unlocking new features after achieving a savings milestone. The integration of gamification could transform budgeting from a tedious task into an engaging experience.

Last Point

So, after navigating the labyrinthine world of budgeting apps, what have we learned? Well, the market is surprisingly diverse, offering solutions for every financial personality, from the meticulously organized to the delightfully chaotic. While no single app reigns supreme, our review highlights the strengths and weaknesses of each, allowing you to choose the perfect digital financial companion. Ultimately, the best budgeting app is the one that best suits your individual needs and, let’s be honest, your level of commitment to actually using it. Happy budgeting!

Answers to Common Questions: Budgeting Apps Review Update

What about data security? Are my financial details safe?

Data security varies significantly between apps. Look for apps with robust encryption and transparent privacy policies. Always check reviews for any reports of security breaches.

Can I use these apps on multiple devices?

Most budgeting apps offer cross-platform compatibility (iOS, Android, web). However, features may vary slightly depending on the device.

What if I need customer support?

Check the app’s website or app store listing for contact information. Responsiveness and helpfulness of customer support can vary widely.