Budgeting Software Review: Navigating the often-bewildering world of personal and business finance can feel like trying to herd cats wearing roller skates. Thankfully, a plethora of budgeting software exists to tame this chaotic financial jungle. From cloud-based behemoths to sleek mobile apps, these digital tools offer a range of features designed to help you track expenses, manage income, and finally, achieve that elusive financial zen. This review delves into the key features, user experience, security aspects, pricing models, and integrations of various budgeting software options, helping you choose the perfect tool for your needs – because wrestling with spreadsheets is so last decade.

This review examines a variety of budgeting software, comparing their strengths and weaknesses across several key criteria. We’ll explore the essential features you should look for, the importance of user-friendly interfaces, the critical role of data security, and the various pricing models available. We’ll also discuss the benefits of integrating budgeting software with other financial tools and provide illustrative examples of how different software applications handle common budgeting tasks. By the end, you’ll be armed with the knowledge to confidently select the budgeting software that best suits your financial style – whether you’re a meticulous planner or a delightfully disorganized spender.

Introduction to Budgeting Software

Ah, budgeting. The word itself conjures images of spreadsheets, endless calculations, and the faint scent of impending doom. But fear not, dear reader! The digital age has blessed us with budgeting software, a technological savior designed to wrestle your finances into submission (in a gentle, data-driven way, of course). This isn’t your grandmother’s ledger; we’re talking sophisticated tools that can help you track expenses, plan for the future, and maybe even achieve that elusive financial freedom.

Budgeting software, in its simplest form, is a digital tool that helps individuals and businesses manage their money. It streamlines the process of tracking income and expenses, setting financial goals, and analyzing spending habits. Think of it as a personal finance superhero, tirelessly working behind the scenes to keep your monetary life organized and (dare we say it) enjoyable.

Benefits of Budgeting Software

The advantages of employing budgeting software extend far beyond simple record-keeping. For personal finance, it offers a clear picture of your spending patterns, allowing you to identify areas where you might be overspending. This newfound awareness can lead to significant savings and better financial planning. For businesses, the benefits are even more pronounced, enabling better cash flow management, improved forecasting, and a more streamlined accounting process. Essentially, it’s like having a mini-CFO working 24/7, without the exorbitant salary.

Types of Budgeting Software

The world of budgeting software is surprisingly diverse, offering a range of options to suit various needs and preferences. Cloud-based software, like Mint or YNAB (You Need A Budget), provides accessibility from anywhere with an internet connection. Desktop applications, often offering more robust features, might be preferred by those who prioritize data security and offline access. Finally, mobile apps offer convenience and portability, allowing you to manage your budget on the go. The choice, ultimately, depends on your individual needs and technological comfort level.

Comparison of Budgeting Software

Let’s delve into a comparison of three popular budgeting software options to illustrate their diverse features. Remember, the “best” software depends entirely on your personal preferences and financial situation.

| Feature | YNAB (You Need A Budget) | Mint | Personal Capital |

|---|---|---|---|

| Pricing | Subscription-based | Free (with ads), premium options available | Free (with limitations), premium options available |

| Platform | Web, mobile | Web, mobile | Web, mobile |

| Key Features | Zero-based budgeting, goal setting, robust reporting | Automatic transaction categorization, spending tracking, bill reminders | Investment tracking, retirement planning, fee analysis |

| User-Friendliness | Steeper learning curve, but powerful features | Intuitive and easy to use | Good balance of features and ease of use |

Key Features of Budgeting Software

Choosing the right budgeting software can feel like navigating a minefield of spreadsheets and confusing jargon. But fear not, intrepid budgeter! With the right features, your financial life can transform from chaotic mess to organized masterpiece. This section will illuminate the essential features you should seek, turning your budgeting journey from a stressful chore into a surprisingly satisfying adventure.

The core functionality of any good budgeting software hinges on a few key elements: accurate expense tracking, reliable income recording, robust budgeting tools, and insightful reporting. These features, when combined effectively, provide a comprehensive overview of your financial health, empowering you to make informed decisions and achieve your financial goals. Think of it as your personal financial GPS, guiding you toward a more prosperous future.

Expense Tracking

Effective expense tracking is the bedrock of any successful budgeting strategy. Software should allow for easy categorization of expenses (groceries, entertainment, rent, etc.), ideally with automated import capabilities from bank accounts and credit cards. Imagine the time saved – no more painstaking manual entry of every latte! Some software even utilizes AI to categorize transactions automatically, saving you even more precious time. The level of detail offered varies, with some allowing for subcategories and custom tags for ultimate precision.

Income Recording

Equally important is the ability to accurately record all income streams. Whether it’s a regular salary, freelance work, or investment returns, comprehensive income tracking provides a complete picture of your financial inflow. This feature should integrate seamlessly with expense tracking to provide a balanced view of your overall financial situation. Features such as scheduled income entries for recurring payments can further streamline the process, eliminating the need for repeated manual input.

Budgeting Tools

Budgeting tools are where the magic happens. Different software offers various budgeting methods. Zero-based budgeting, where you allocate every dollar to a specific category, requires meticulous planning but offers maximum control. The popular 50/30/20 rule, allocating 50% to needs, 30% to wants, and 20% to savings and debt repayment, provides a simpler framework. Look for software that supports your preferred method, or ideally, offers flexibility to switch between different approaches as your needs evolve.

Reporting

Comprehensive reporting is crucial for understanding your spending habits and identifying areas for improvement. Good software will generate various reports, including monthly summaries, category breakdowns, and comparisons to previous periods. Visual representations, such as charts and graphs, make it easier to spot trends and make data-driven decisions. Imagine effortlessly identifying that your “entertainment” category is consistently over budget – a clear signal to adjust your spending habits.

Advanced Features in Premium Budgeting Software

While basic features are essential, premium software often includes advanced tools that elevate your budgeting experience. These features can significantly enhance your financial management capabilities and provide a more holistic view of your finances.

- Goal Setting and Tracking: Set specific financial goals (down payment on a house, paying off debt) and track your progress. The software will project when you might reach your goal based on your current spending and saving habits.

- Investment Tracking: Monitor investment performance and integrate it with your overall budget. This provides a holistic view of your financial picture, including both income and investments.

- Debt Management Tools: Tools to manage and track debt repayment, including debt snowball or avalanche methods, allowing for strategic debt reduction.

- Financial Forecasting: Predict future cash flow based on your current spending and income patterns, allowing for proactive financial planning.

- Bill Payment Reminders: Automated reminders for upcoming bills to prevent late payments and associated fees. This feature can save you stress and potential financial penalties.

User Experience and Interface

Budgeting software, while designed to tame the beast of personal finance, can itself become a beast if its user interface is clunky and unintuitive. A poorly designed interface can transform a helpful tool into a frustrating chore, leading users to abandon ship before they even chart their financial course. Therefore, a positive user experience is paramount to the success of any budgeting software.

A well-designed interface is more than just aesthetically pleasing; it’s about making the software easily navigable and understandable for users of all technical skill levels. Features should be logically organized, information should be presented clearly, and data visualization should be intuitive and insightful, not overwhelming or confusing. Think of it as the difference between navigating a well-lit, clearly marked highway and driving through a dense, unmarked forest at night – one is efficient and stress-free, the other is…well, let’s just say it’s less enjoyable.

Factors Contributing to a Positive User Experience

Several key factors contribute to a positive user experience in budgeting software. Ease of navigation is crucial – users should be able to find what they need quickly and without difficulty. Clear data visualization, using charts, graphs, and other visual aids, helps users understand their financial situation at a glance. A clean, uncluttered design prevents cognitive overload, allowing users to focus on their financial goals rather than deciphering a confusing interface. Finally, responsive design ensures the software works seamlessly across different devices, from desktops to smartphones and tablets.

Examples of Good and Bad User Interface Design

Consider a budgeting app with a cluttered dashboard displaying dozens of metrics in tiny, illegible fonts. This is a textbook example of poor design. In contrast, an app with a clean, well-organized dashboard, using clear visuals to highlight key financial metrics, would be considered a positive example. Imagine a pie chart clearly showing the breakdown of your spending across different categories, versus a complex spreadsheet with thousands of rows of data – the pie chart wins hands down for its clarity and immediate understanding.

Comparison of User Interfaces

| Software | Ease of Navigation | Data Visualization | Overall User Friendliness |

|---|---|---|---|

| Mint | Excellent – intuitive menu and clear categorization | Good – uses charts and graphs effectively | Excellent – caters to both beginners and experienced users |

| YNAB (You Need A Budget) | Good – but may have a steeper learning curve for beginners | Good – clear visual representation of budget allocation | Good – powerful features but requires some effort to master |

| Personal Capital | Good – well-organized dashboard, but some features are buried deep | Excellent – comprehensive overview of net worth and investments | Good – strong features, but navigation could be improved for simpler tasks |

Security and Data Privacy

Your financial life is, let’s face it, nobody’s business but your own. Choosing budgeting software means entrusting a significant amount of sensitive personal information to a third party. Therefore, understanding the security measures in place is paramount, lest your meticulously crafted budget becomes a feast for digital vultures. We’ll delve into the crucial aspects of data security and privacy, helping you choose a software that protects your financial secrets as fiercely as you do.

Security measures employed by budgeting software providers are as varied as the apps themselves, but generally fall into a few key categories. Think of them as the digital equivalent of a well-guarded vault, complete with multiple locks and alarms. A lack of robust security can lead to identity theft, financial fraud, and a whole lot of unnecessary stress – not exactly the ingredients for a successful budgeting journey.

Security Measures Employed by Budgeting Software

Budgeting software providers typically utilize a range of security measures to protect user data. These include robust encryption protocols, which scramble your data, making it unreadable to unauthorized individuals. Imagine your data as a top-secret message written in a code only you and the software can understand. Two-factor authentication (2FA) adds an extra layer of security, requiring a second form of verification beyond your password, such as a code sent to your phone or email. This is like having a second key to your vault, ensuring that even if someone gets hold of your password, they can’t access your data without the additional code. Regular security audits and penetration testing are also common practices, acting as regular security check-ups to identify and fix any vulnerabilities. Finally, many providers adhere to industry-standard data privacy regulations like GDPR and CCPA, ensuring your data is handled responsibly and in compliance with relevant laws.

Comparison of Security Protocols

Let’s hypothetically compare “BudgetBuddy Pro” and “Finance Fortress.” BudgetBuddy Pro uses AES-256 encryption (a very strong encryption standard), 2FA via authenticator apps, and undergoes annual security audits. Finance Fortress, on the other hand, employs the slightly less robust AES-128 encryption, offers 2FA via SMS (which is less secure than authenticator apps), and boasts quarterly security audits. While both offer security features, BudgetBuddy Pro’s stronger encryption and more secure 2FA method give it a slight edge in terms of overall security. Remember, this is a hypothetical comparison; always check the specific security details provided by the software provider.

Questions to Ask About Data Security

Before handing over your financial data, it’s wise to be a bit of a detective. Consider these vital questions:

- What type of encryption does the software use? (AES-256 is generally considered a strong standard.)

- Does the software offer two-factor authentication, and what methods are available? (Authenticator apps are generally more secure than SMS-based 2FA.)

- How often does the software undergo security audits and penetration testing?

- What data privacy regulations does the software comply with? (GDPR, CCPA, etc.)

- What is the software provider’s policy on data breaches, and what steps will they take to protect user data in case of an incident?

Pricing and Value

Choosing budgeting software is a bit like choosing a financial advisor – you want someone (or something) reliable, insightful, and not ridiculously expensive. The pricing models vary wildly, so understanding the value proposition is key to avoiding a budgeting software meltdown. Let’s dive into the wonderfully confusing world of budgeting software costs.

Budgeting software typically employs either a freemium model, where a basic version is free, or a subscription-based model with varying tiers of features and price points. Freemium models often lure you in with the promise of free budgeting, but then hit you with limitations on features or data storage, pushing you towards a paid subscription. Subscription models, on the other hand, offer a clearer picture upfront, but the monthly or annual fees can add up – potentially faster than your savings account if you’re not careful!

Pricing Models and Examples, Budgeting Software Review

Let’s examine the different pricing approaches. A freemium model, like that employed by some personal finance apps, provides a basic level of functionality for free, enticing users with the promise of easy budgeting. However, to unlock more advanced features, such as detailed reporting or unlimited account connections, users often need to upgrade to a paid subscription. This strategy can be effective for attracting a large user base, but it also relies on converting free users to paying customers. On the other hand, subscription-based models, like those offered by more comprehensive financial planning software, typically offer various tiers with escalating features and price points. These tiers allow users to choose a plan that best fits their needs and budget. For instance, a basic plan might include core budgeting features, while a premium plan might include advanced analytics and personalized financial advice.

Evaluating Value Proposition

Determining the value of a budgeting software package requires careful consideration of several factors beyond just the price tag. How well does the software meet your specific needs? Does it integrate with your existing financial accounts seamlessly? Does it offer the reporting and analysis tools that you require? Consider the time saved by automating tasks, the potential for improved financial decisions, and the reduction in stress from better financial organization. If a more expensive software saves you hours of manual work each month and prevents costly financial mistakes, it might be a better value than a cheaper alternative that requires significant manual input.

Pricing and Key Features Comparison

To illustrate, let’s compare three hypothetical budgeting software packages. Remember, these are examples and actual pricing and features can vary.

| Software | Pricing | Key Features |

|---|---|---|

| BudgetBuddy Basic | Free | Basic budgeting tools, limited transaction tracking, no advanced reporting. |

| BudgetMaster Pro | $9.99/month | Unlimited transaction tracking, advanced reporting, account aggregation, investment tracking, goal setting. |

| FinanceFlow Premium | $19.99/month | All features of BudgetMaster Pro, plus personalized financial advice, tax optimization tools, and dedicated customer support. |

Integration with Other Financial Tools: Budgeting Software Review

Integrating your budgeting software with other financial tools is like giving your financial life a supercharged espresso shot – it’s a serious boost of efficiency and insight. No more manual data entry, no more frantic spreadsheet juggling, just a streamlined, beautifully organized view of your entire financial ecosystem. Think of it as your personal financial conductor, harmonizing all your financial instruments into a symphony of savings.

The benefits are numerous and, frankly, quite delightful. Imagine effortlessly importing your bank transactions, investment account balances, and even credit card statements directly into your budgeting software. This eliminates the tedious task of manual data entry, reducing errors and freeing up precious time for more enjoyable activities (like, say, planning your next extravagant vacation). Real-time updates ensure your budget always reflects your current financial standing, providing a clear and accurate picture of your financial health. This eliminates the guesswork and allows for proactive financial management, preventing nasty surprises and fostering a sense of calm control over your finances.

Examples of Budgeting Software with Robust Integration Capabilities

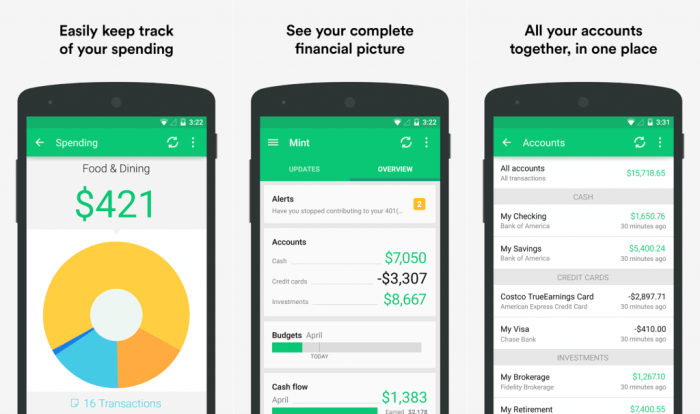

Several budgeting software platforms excel at seamless integration. Mint, for example, boasts a wide array of supported financial institutions, effortlessly connecting to bank accounts, credit cards, and investment accounts. YNAB (You Need A Budget) also offers robust integration capabilities, though its approach might be slightly more hands-on, requiring users to manually connect accounts but offering greater control over data flow. Personal Capital, a more sophisticated platform aimed at wealth management, provides in-depth integration, pulling data from various sources and providing a comprehensive overview of investments and net worth. These examples highlight the diversity of integration features available, catering to different user needs and technological preferences.

Comparison of Integration Features: Mint vs. YNAB

Let’s compare the integration features of two popular budgeting software platforms: Mint and YNAB. Mint takes a more automated approach, automatically importing transactions from linked accounts. This is incredibly convenient for users who prefer a hands-off approach. However, this automation can sometimes lead to minor inaccuracies that require manual correction. YNAB, on the other hand, emphasizes manual entry and categorization of transactions, offering greater control and accuracy but demanding more user involvement. While Mint might be quicker to set up, YNAB’s more manual approach provides a deeper understanding of spending habits and allows for more nuanced budgeting strategies. The choice between the two depends entirely on individual preferences and comfort levels with technology.

Advantages and Disadvantages of Software Integrations

Before diving headfirst into the wonderful world of integrated budgeting, let’s consider the pros and cons.

The advantages of integrating your budgeting software with other financial tools are significant:

- Time Savings: Automatic data import eliminates manual data entry.

- Accuracy: Reduced risk of human error in data input.

- Real-time Insights: Up-to-the-minute view of your financial situation.

- Improved Financial Management: Facilitates proactive budgeting and financial planning.

- Holistic Financial Overview: Consolidated view of all your financial accounts.

However, there are potential drawbacks to consider:

- Security Risks: Sharing your financial data with third-party software carries inherent risks.

- Data Privacy Concerns: Ensure the software provider has robust data protection measures in place.

- Technical Glitches: Integration issues can occur, leading to data inconsistencies or access problems.

- Dependence on Technology: Over-reliance on automated systems can reduce financial literacy.

- Learning Curve: Some integrations may require a learning curve to master effectively.

Illustrative Examples of Budgeting Software in Action

Choosing the right budgeting software can feel like navigating a minefield of spreadsheets and algorithms. Fear not, intrepid budgeter! Let’s examine how three different software applications tackle the everyday challenges of financial management, focusing on their user interfaces and workflows. We’ll illustrate how these tools can tame your finances, transforming the often-dreaded process of budgeting into something…dare we say…enjoyable?

This section provides detailed descriptions of how three hypothetical budgeting software applications—BudgetBuddy, FinanceFlow, and MoneyMaestro—handle common budgeting tasks. Each application offers a unique approach, highlighting the diverse landscape of budgeting software available.

BudgetBuddy: A Visual Delight for the Budget-Conscious

BudgetBuddy prioritizes visual clarity and intuitive navigation. Its dashboard resembles a colorful, interactive pie chart, dynamically updating as you input data. Adding expenses is as simple as clicking on a slice of the pie representing a spending category (e.g., “Groceries,” “Entertainment,” “Rent”). The software automatically categorizes transactions if linked to a bank account, but manual adjustments are easily made. Creating a budget involves adjusting the size of each pie slice, providing an immediate visual representation of your spending allocations. Reports are generated with visually appealing charts and graphs, highlighting spending trends and areas for potential savings. The workflow is remarkably smooth, with a clear and logical progression through each task. Even the most spreadsheet-averse individual should find BudgetBuddy’s interface refreshingly simple.

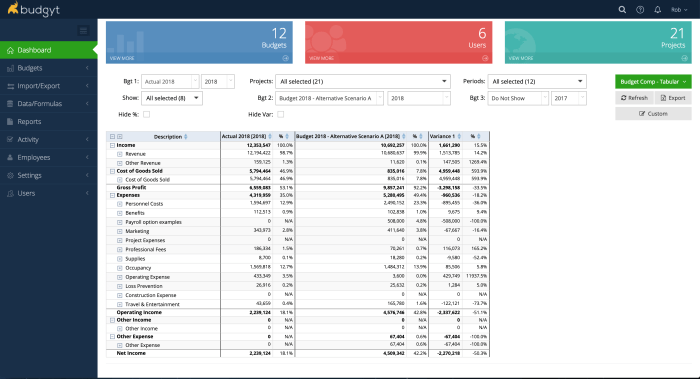

FinanceFlow: The Powerhouse for Detailed Analysis

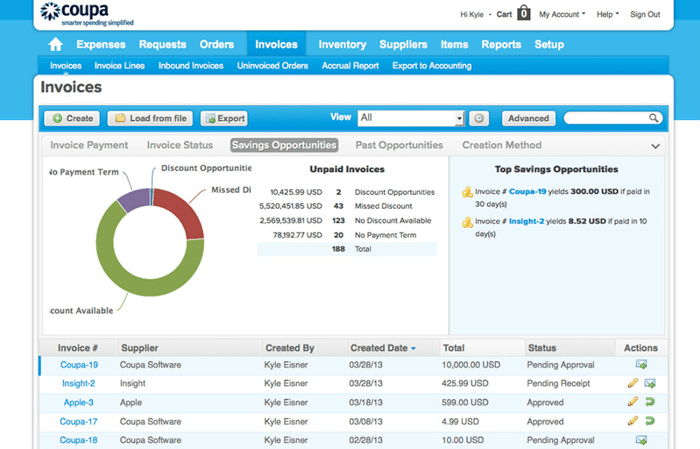

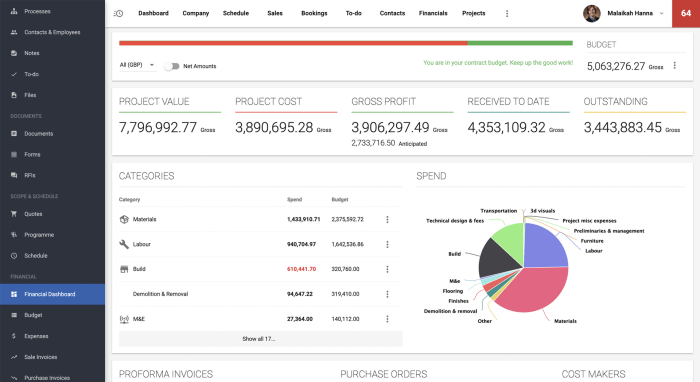

FinanceFlow caters to users who prefer a more detailed, data-driven approach to budgeting. The interface is less visually flamboyant than BudgetBuddy’s, opting instead for a clean, organized layout with numerous customizable options. Expense tracking involves detailed input forms, allowing for meticulous categorization and the addition of notes or tags for each transaction. Budget creation is a more structured process, requiring the user to input specific numerical targets for each category. FinanceFlow shines when it comes to reporting. It generates comprehensive reports, including detailed breakdowns of expenses, variance analysis, and forecasting tools based on historical spending patterns. While the initial learning curve might be steeper than BudgetBuddy’s, FinanceFlow’s powerful analytical capabilities make it a compelling choice for users seeking granular control and in-depth insights into their finances. Its advanced features may feel overwhelming to some, but the rewards are considerable for those willing to invest the time.

MoneyMaestro: The All-in-One Solution for Seamless Integration

MoneyMaestro distinguishes itself through its comprehensive integration capabilities. It seamlessly connects with various bank accounts, credit cards, and investment platforms, automatically importing transaction data. The user interface is clean and functional, balancing visual appeal with efficient data management. Budget creation is straightforward, with customizable templates and the ability to set both short-term and long-term financial goals. MoneyMaestro’s reporting features are robust, offering a range of customizable reports that can be exported in various formats. The strength of MoneyMaestro lies in its ability to provide a holistic view of a user’s financial situation, consolidating information from multiple sources into a single, easily accessible dashboard. Its comprehensive integration is a major advantage for users who prefer a centralized financial management system. The software’s strength is its ability to effortlessly combine multiple financial accounts into one streamlined experience.

Last Word

Ultimately, the best budgeting software is the one that seamlessly integrates into your life and helps you achieve your financial goals. While features and pricing are important factors, user experience and data security should never be overlooked. Remember, the goal isn’t just to track your money; it’s to gain control of it and make informed financial decisions. So, take your time, explore the options, and find the software that empowers you to conquer your financial future – one meticulously tracked latte at a time. Happy budgeting!

Essential Questionnaire

What is the difference between cloud-based and desktop budgeting software?

Cloud-based software stores your data online, accessible from anywhere with an internet connection. Desktop software stores data on your computer, offering offline access but limiting accessibility from other devices.

Can budgeting software help with tax preparation?

Some budgeting software offers features that help categorize expenses for tax purposes, but it’s not a replacement for professional tax advice.

Is my data safe with budgeting software?

Reputable budgeting software providers employ robust security measures, but always check their privacy policies and security protocols before using their services. Look for encryption and two-factor authentication.

How do I choose the right budgeting method for me?

Experiment with different methods like zero-based budgeting or the 50/30/20 rule to find what works best for your spending habits and financial goals. Many software options support multiple methods.