Budgeting Strategies untuk Pemula: Conquering the world of personal finance doesn’t require a cape and a secret identity, just a healthy dose of planning and a dash of (responsible) fun! This guide dives headfirst into the surprisingly exciting world of budgeting, transforming the daunting task of managing your money into an empowering journey towards financial freedom. We’ll tackle everything from distinguishing needs versus wants (goodbye, impulse buys!) to mastering budgeting methods and building that elusive emergency fund – because adulting is hard enough without unexpected plumbing bills.

Prepare to embark on a thrilling adventure, where spreadsheets become your trusty sidekicks and saving becomes a surprisingly satisfying hobby. We’ll navigate the treacherous waters of debt, chart a course towards your financial goals, and even throw in some investment tips for good measure. So, buckle up, future financial wizards – it’s time to take control of your cash flow!

Understanding Basic Budgeting Concepts for Beginners

Embarking on your budgeting journey can feel like navigating a financial jungle, filled with confusing terminology and scary spreadsheets. But fear not, intrepid budgeter! This section will demystify the basics, turning your financial anxieties into a manageable, even enjoyable, process. We’ll equip you with the tools to tame your spending and finally achieve that elusive financial freedom (or at least, a slightly less stressful relationship with your bank account).

Needs versus Wants in a Personal Budget, Budgeting Strategies untuk Pemula

Distinguishing between needs and wants is the cornerstone of effective budgeting. Needs are essential for survival and well-being: rent or mortgage, groceries, utilities, transportation, and healthcare. Wants, on the other hand, are the delightful extras that enhance life but aren’t strictly necessary for survival. Think fancy coffee, that new video game, or that impulse online shopping spree (we’ve all been there!). Successfully budgeting involves prioritizing needs while carefully managing wants to avoid overspending. A helpful trick is to ask yourself: “Is this truly essential for my well-being, or is it simply a desire?” Honesty is key here; even a little self-awareness can make a big difference.

Tracking Income and Expenses for a Month

Tracking your money might sound tedious, but it’s the only way to truly understand your spending habits. Think of it as a financial detective story, where you’re uncovering the mysteries of your money trail. Here’s a step-by-step guide:

- Gather your financial documents: Bank statements, credit card statements, pay stubs – anything that shows your income and expenses.

- Choose a tracking method: You can use a spreadsheet, a budgeting app (many free options are available!), or even a simple notebook. The key is to find a method you’ll actually stick with.

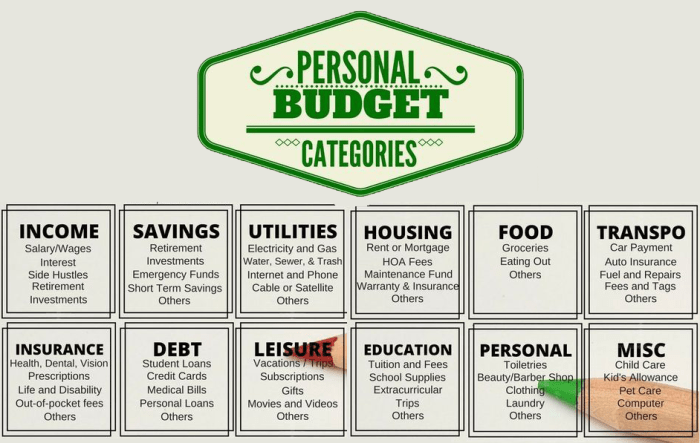

- Categorize your expenses: Group your spending into categories like housing, food, transportation, entertainment, etc. This will give you a clear picture of where your money is going.

- Record every transaction: This is crucial! Even small purchases add up. Be diligent and track everything for a full month to get a comprehensive overview.

- Analyze your spending: Once you’ve tracked your expenses for a month, review the data. Identify areas where you can cut back on spending without sacrificing your well-being.

Three Budgeting Methods for Beginners

Several budgeting methods can help you manage your finances. Here’s a comparison of three popular and beginner-friendly options:

| Method Name | Description | Pros | Cons |

|---|---|---|---|

| 50/30/20 Rule | Allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. | Simple and easy to understand; provides a clear framework for spending. | May not be suitable for everyone, especially those with high debt or unexpected expenses. It’s a guideline, not a strict rule. |

| Zero-Based Budgeting | Assign every dollar of your income to a specific category, ensuring your income equals your expenses. | Helps you track your spending meticulously and avoid overspending; promotes mindful spending habits. | Requires more time and effort than other methods; can be challenging to maintain if your income fluctuates. |

| Envelope System | Allocate cash to different envelopes representing various expense categories. | Visual and tangible; helps prevent overspending in specific categories. | Less flexible than other methods; may not be suitable for everyone, particularly those who prefer digital banking. |

Setting Realistic Financial Goals

Setting financial goals is like planning a ridiculously ambitious road trip – you need a map (a budget!), a destination (your goals!), and a realistic idea of how long it’ll take (your timeline!). Without a clear plan, you’ll end up stranded on the side of the financial highway, wondering how you got so far off course (and probably broke). This section will help you avoid that financial fender-bender.

The process of setting both short-term and long-term financial goals involves a healthy dose of self-awareness, a dash of ambition, and a whole lot of realistic planning. Ignoring any of these ingredients can lead to a recipe for financial disaster – trust us, we’ve seen the burnt offerings.

Short-Term and Long-Term Goal Definition

Short-term goals are your quick wins – the things you can realistically achieve within a year. Think paying off a credit card, saving for a vacation, or buying a new appliance. These smaller victories build momentum and keep you motivated on your journey to larger financial goals. Long-term goals, on the other hand, are the big picture items, such as buying a house, funding your children’s education, or retiring comfortably. These require a more substantial commitment and a longer time horizon. The key is to break down these large goals into smaller, manageable short-term objectives. Think of it as tackling Mount Everest one base camp at a time, rather than attempting a single, death-defying leap to the summit.

Aligning Budgeting Strategies with Personal Goals

Your budget isn’t just a list of numbers; it’s the roadmap to achieving your financial goals. Without aligning your spending habits with your aspirations, your budget becomes a pointless exercise in number-crunching. Imagine trying to drive to Hawaii with a map of Alaska – you’ll end up somewhere…unexpected. A well-structured budget should directly reflect your short-term and long-term goals. For example, if your long-term goal is buying a house, your budget should include regular contributions to a savings account specifically earmarked for a down payment. Similarly, if your short-term goal is paying off credit card debt, your budget should prioritize debt repayment over discretionary spending.

Sample Financial Goal Worksheet

Creating a financial goal worksheet can significantly enhance your budgeting process. It provides a clear, visual representation of your goals, timelines, and associated budget allocations. This allows for consistent monitoring and adjustments as needed. Below is a sample worksheet:

| Goal Description | Timeline | Budget Allocation (Monthly) | Progress Tracking |

|---|---|---|---|

| Pay off credit card debt ($5,000) | 12 months | $416.67 | [Space for monthly updates] |

| Save for a down payment on a house ($20,000) | 36 months | $555.56 | [Space for monthly updates] |

| Vacation to Europe ($3,000) | 18 months | $166.67 | [Space for monthly updates] |

Remember, this is just a sample. Your worksheet should reflect your own personal goals and financial circumstances. The key is to be specific, realistic, and consistent in your tracking. Don’t be afraid to adjust your goals and budget as needed – life happens! But consistent monitoring and adjustment is key to success.

Creating a Personalized Budget Plan

Crafting a personal budget might sound about as thrilling as watching paint dry, but trust us, it’s the key to unlocking financial freedom (and maybe even a slightly more exciting life!). Think of it as a personalized financial roadmap, guiding you towards your goals without ending up lost in a sea of debt. This isn’t about deprivation; it’s about mindful spending and achieving your dreams.

A personalized budget is your financial compass, helping you navigate the sometimes-treacherous waters of personal finance. It’s a dynamic tool, not a rigid rulebook, so feel free to adjust it as your circumstances change. Remember, even the most meticulously planned budget needs occasional recalibration—it’s a journey, not a destination!

A Monthly Budget Template

To effectively manage your finances, you need a clear overview of your income and expenses. This template provides a structured approach to creating your personalized monthly budget.

| Category | Income | Expenses | Savings | Debt Payments |

|---|---|---|---|---|

| Monthly Salary/Wages | Rent/Mortgage | Emergency Fund | Credit Card Debt | |

| Other Income (e.g., side hustle) | Utilities (electricity, water, gas) | Retirement Savings | Student Loans | |

| Total Income | Groceries | Investment Account | Other Debt | |

| Transportation (car payment, gas, public transport) | Total Debt Payments | |||

| Entertainment | ||||

| Clothing | ||||

| Healthcare | ||||

| Personal Care | ||||

| Other Expenses | ||||

| Total Expenses | Total Savings | |||

| Net Income (Total Income – Total Expenses) |

Remember to fill in the blanks with your specific income and expenses. The “Other Expenses” category is a catch-all for anything that doesn’t fit neatly into the other categories. Think of it as your “miscellaneous” fund—for those unexpected coffee runs or spontaneous purchases.

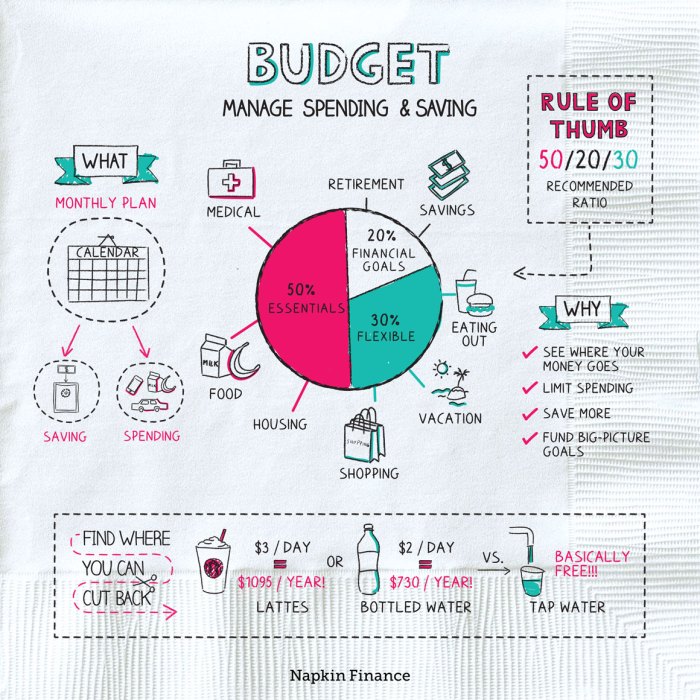

Common Budget Categories and Effective Allocation

Effectively categorizing your expenses is crucial for understanding where your money goes. Common categories include housing, transportation, food, utilities, entertainment, clothing, healthcare, personal care, debt payments, and savings. Allocating funds effectively involves prioritizing needs over wants and ensuring you’re saving for the future. For example, a common rule of thumb is the 50/30/20 budget rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. However, this is just a guideline; your ideal allocation will depend on your individual circumstances and financial goals.

Prioritized Expense Categories

Prioritizing your expenses is vital for responsible financial management. The order of importance can vary based on individual circumstances, but a general prioritization would be:

- Housing: This is usually your biggest expense, providing shelter and security.

- Debt Payments: Prioritizing debt repayment helps you avoid accumulating more interest and frees up more money in the long run. Think of it as paying yourself first, but to your future self.

- Food: Essential for survival. Finding ways to eat healthily and affordably is a win-win.

- Transportation: Necessary for work, school, and other essential activities. Consider cost-effective options like carpooling or public transport.

- Savings: Building an emergency fund and saving for future goals is crucial for financial stability.

- Healthcare: Maintaining your health is vital, and unexpected medical expenses can be devastating without proper planning.

- Entertainment: While important for well-being, entertainment expenses should be managed carefully and should come after essential needs and savings.

Remember, this is a suggested prioritization. Adjust it based on your individual needs and financial goals. The most important aspect is creating a budget that works for you and helps you achieve your financial aspirations.

Managing and Monitoring Expenses

Ah, expenses – the delightful little gremlins that nibble away at our hard-earned cash. But fear not, fledgling budgeters! Mastering expense management is less about deprivation and more about strategic ninja-like maneuvering. This section will equip you with the tools to tame those pesky expenses and watch your savings grow.

Effective expense management isn’t about eliminating all fun; it’s about making conscious choices. Think of it as a financial makeover, where you identify areas of unnecessary spending and redirect those funds towards your goals – whether it’s a down payment on a llama farm or finally conquering that mountain of student loan debt. The key is awareness and action.

Strategies for Reducing Unnecessary Expenses

Let’s face it: we all have those sneaky little expenses that creep in like unwanted houseguests. Identifying and conquering these requires a bit of detective work, but the rewards are well worth the effort. Think of it as a financial treasure hunt, where the treasure is more money in your pocket!

- Subscription Audits: We subscribe to so many things these days – streaming services, gym memberships, software trials that never end… Review your subscriptions monthly. Are you really using them all? Cancel the ones that gather digital dust.

- Dining Out De-escalation: Eating out is fun, but it can quickly drain your budget. Aim to reduce dining out to a couple of times a month, focusing on special occasions or trying new restaurants instead of frequenting fast food joints.

- Impulse Purchase Prevention: The siren song of online shopping is strong. Implement a waiting period before purchasing non-essential items. If you still want it after a week, then proceed. Often, the urge fades.

- Coffee Cost Containment: Daily lattes can surprisingly add up. Brew your own coffee at home. The savings are substantial, and you can experiment with fun flavors.

Common Budgeting Pitfalls and Solutions

Even the most well-intentioned budgeters stumble. Knowing the common pitfalls can help you avoid them, preventing budget meltdowns and fostering financial resilience. It’s like knowing the terrain before embarking on a challenging hike – preparation is key.

| Pitfall | Solution |

|---|---|

| Underestimating Expenses | Track spending meticulously for at least a month to get a realistic picture of your spending habits. |

| Ignoring Small Expenses | Those seemingly insignificant daily expenses (coffee, snacks) accumulate quickly. Track them diligently. |

| Lack of Flexibility | Life throws curveballs. Build a buffer into your budget for unexpected expenses (car repairs, medical bills). |

| Unrealistic Goals | Set achievable financial goals. Start small, celebrate milestones, and gradually increase your savings targets. |

Utilizing Budgeting Apps or Spreadsheets

Technology can be your best friend in budgeting. Budgeting apps and spreadsheets offer powerful tools to track spending, analyze budget performance, and stay organized. Think of them as your financial copilots, guiding you on your journey to financial freedom.

Creating a simple budget spreadsheet is surprisingly easy. Here’s a basic structure:

| Category | Budgeted Amount | Actual Spending | Difference |

|---|---|---|---|

| Housing | $1000 | $950 | $50 |

| Food | $500 | $550 | -$50 |

| Transportation | $200 | $180 | $20 |

| Utilities | $150 | $160 | -$10 |

| Entertainment | $100 | $80 | $20 |

| Savings | $200 | $200 | $0 |

In this example, the “Difference” column shows the variance between the budgeted amount and actual spending. Positive numbers indicate underspending, while negative numbers show overspending. Regularly reviewing this spreadsheet allows you to identify areas needing adjustment.

Building an Emergency Fund

Let’s face it, life throws curveballs. Sometimes those curveballs are as subtle as a slightly higher grocery bill, and sometimes they’re the kind that leave you scrambling for a spare tire… and maybe a spare kidney. An emergency fund is your financial safety net, preventing a minor wobble from becoming a full-blown financial faceplant. Think of it as your adult-sized security blanket, but instead of soothing anxieties, it soothes your bank account.

Having an emergency fund isn’t just about avoiding financial panic; it’s about maintaining financial stability. It’s your buffer against unexpected expenses, allowing you to navigate life’s little (and big) surprises without resorting to high-interest debt or selling your prized collection of rubber ducks. A well-stocked emergency fund provides peace of mind, letting you focus on what truly matters – like perfecting your rubber ducky display.

Emergency Fund Importance and Role in Financial Stability

An emergency fund acts as a crucial shield against unforeseen financial hardships. Without it, a sudden job loss, unexpected medical bill, or car repair can quickly spiral into a debt crisis. The fund allows you to cover these expenses without depleting your savings or resorting to high-interest loans, thereby maintaining financial stability and preventing long-term financial distress. Imagine facing a $1,000 car repair without an emergency fund – it’s a recipe for stress-induced hair loss. With a fund, you simply pay the bill and move on, maintaining your financial equilibrium.

Step-by-Step Guide to Building an Emergency Fund

Building an emergency fund doesn’t require a six-figure salary or a winning lottery ticket. Even small, consistent contributions can make a significant difference over time.

- Assess your current financial situation: Before you start saving, take stock of your income and expenses. This will help you determine how much you can realistically contribute to your emergency fund each month.

- Set a realistic savings goal: Aim for 3-6 months’ worth of living expenses. This provides a sufficient cushion for most emergencies. For example, if your monthly expenses are $2,000, aim for a fund of $6,000-$12,000.

- Automate your savings: Set up automatic transfers from your checking account to your savings account each month. This ensures consistent contributions without requiring constant manual effort. Think of it as a forced savings plan – your future self will thank you.

- Start small, stay consistent: Begin with small, manageable amounts. Even $25 a week adds up over time. The key is consistency, not the initial amount.

- Track your progress: Regularly monitor your emergency fund’s growth. This helps you stay motivated and adjust your savings strategy as needed. Celebrate milestones along the way! A small treat for reaching a savings goal is perfectly acceptable – just don’t spend it all on rubber ducks.

Visual Representation of Emergency Fund Growth

Imagine a bar graph. The horizontal axis represents time (months), and the vertical axis represents the amount of money in your emergency fund. Let’s say you start with $0. After month one, with a $100 contribution, the bar reaches $100. Month two, another $100, brings the bar to $200. Each month, the bar grows steadily taller, representing the accumulation of your savings. By month six, assuming consistent contributions, the bar will be significantly taller, showcasing the power of consistent saving. By month twelve, the bar should be considerably longer, demonstrating the significant growth over a year. The graph visually illustrates how small, consistent contributions accumulate over time, creating a substantial emergency fund. This isn’t just a line on a graph; it’s your financial security growing before your eyes.

Debt Management Strategies

Ah, debt. That delightful little financial gremlin that whispers sweet nothings about instant gratification while simultaneously plotting your financial downfall. But fear not, aspiring budgeting ninjas! We’re here to equip you with the weaponry (metaphorical, of course – we don’t condone violence against debt) to conquer this pesky foe. This section will delve into the art of debt management, transforming you from a debt-ridden victim to a debt-slaying champion.

Debt management strategies aren’t about wishing your debt away; they’re about creating a structured plan to systematically eliminate it. The key is to understand your debt landscape, identify your strengths, and choose a strategy that aligns with your personality and financial situation. Two popular methods are the debt snowball and the debt avalanche. Let’s dissect these titans of debt destruction.

Debt Snowball vs. Debt Avalanche

The choice between the debt snowball and debt avalanche methods often comes down to psychology versus pure mathematical efficiency. Both methods aim to eliminate debt, but they attack it from different angles.

The debt snowball method focuses on paying off the smallest debt first, regardless of its interest rate. Once that small debt is vanquished, you roll the momentum into tackling the next smallest debt, and so on. This method is psychologically rewarding, offering frequent small victories that keep you motivated. Think of it as a snowball gathering mass as it rolls downhill – your momentum increases with each conquered debt.

The debt avalanche method, on the other hand, prioritizes paying off the debt with the highest interest rate first. This approach minimizes the total amount of interest paid over the long run, saving you money in the long haul. It’s the mathematically superior strategy, but it can be less motivating in the early stages since the largest debts might take longer to pay off.

- Debt Snowball Advantages:

- Provides early psychological wins, boosting motivation.

- Easier to visualize progress and maintain momentum.

- Debt Snowball Disadvantages:

- May result in paying more interest overall.

- Can be slower to eliminate total debt.

- Debt Avalanche Advantages:

- Minimizes total interest paid, saving you money.

- Faster overall debt elimination.

- Debt Avalanche Disadvantages:

- Can be less motivating initially, as progress might seem slow.

- Requires more discipline and patience.

Prioritizing High-Interest Debt

Let’s face it: high-interest debt is like a financial vampire, sucking the lifeblood (your money) out of your wallet. Prioritizing these debts is crucial, regardless of whether you choose the snowball or avalanche method. High-interest debts, such as credit card debt, accrue interest rapidly, making them more expensive in the long run. The longer you carry them, the more you pay in interest, essentially throwing money away. Think of it this way: every dollar you pay towards high-interest debt is a dollar less that the interest-vampire can claim. Therefore, aggressively tackling these debts first helps you save money and gain financial freedom faster. Imagine the celebratory dance you’ll do when that high-interest monster is finally slain!

Saving and Investing for the Future

So, you’ve mastered the art of budgeting – congratulations, you magnificent money manager! Now it’s time to take your financial prowess to the next level: securing your future by saving and investing. Think of it as building a financial fortress, brick by brick, to withstand the inevitable economic dragons that may appear.

Saving and investing are two sides of the same coin, but they play different roles in your financial journey. Saving is like parking your money in a safe, readily accessible spot. It’s for short-term goals, like that much-needed vacation or a new washing machine (because let’s be honest, who wants to hand-wash their delicates?). Investing, on the other hand, is about letting your money work for you, potentially generating higher returns over the long term, but with a higher degree of risk. It’s for those bigger, bolder dreams, like early retirement or a down payment on a house that doesn’t resemble a hobbit hole.

Low-Risk Investment Options for Beginners

Choosing your first investment can feel like navigating a minefield of jargon and complex strategies. But fear not, intrepid investor! There are plenty of low-risk options perfect for beginners. These options generally offer lower returns than higher-risk investments, but they also carry less risk of losing your principal. This means you’re less likely to lose the money you initially invested.

- High-Yield Savings Accounts: These accounts offer interest rates higher than regular savings accounts, allowing your money to grow steadily, albeit slowly. Think of it as a slightly more exciting version of your piggy bank.

- Certificates of Deposit (CDs): CDs are like a savings account on steroids. You lock your money away for a specific period (e.g., 6 months, 1 year, 5 years), and in return, you receive a fixed interest rate. The longer you lock it up, the higher the interest rate tends to be. It’s a great option if you have a specific short-to-medium term goal in mind and don’t want to touch the money until the CD matures.

- Money Market Accounts (MMAs): MMAs are a hybrid between a savings account and a checking account. They offer higher interest rates than savings accounts but usually allow limited check-writing privileges. It’s a good balance between accessibility and earning slightly better interest.

- Government Bonds: These are considered very low-risk because they’re backed by the government. You lend the government money for a set period, and they pay you interest. It’s like being a mini-loan shark, but in a very responsible, patriotic way.

Hypothetical Investment Plan for a Beginner

Let’s imagine you’re a beginner with a monthly savings of $200. We’ll focus on a diversified approach, spreading your investments across low-risk options to minimize potential losses while still aiming for growth.

Month 1-6: Build your emergency fund. Aim for 3-6 months’ worth of living expenses. This means putting $1200-$2400 into a high-yield savings account before moving to other investments. This is your financial safety net – crucial for weathering unexpected storms.

Month 7-12: Start investing $100 monthly in a CD with a 1-year term, and continue saving $100 in your high-yield savings account. This allows you to benefit from slightly higher interest rates while maintaining liquidity.

Month 13 onwards: Consider investing $50 monthly in government bonds and continuing to contribute $50 to the high-yield savings account and $100 to the CD. This provides a further diversified low-risk approach.

Important Note: This is a *hypothetical* plan. Your actual investment strategy should be tailored to your individual circumstances, risk tolerance, and financial goals. Consult a financial advisor for personalized guidance.

Ending Remarks: Budgeting Strategies Untuk Pemula

Mastering Budgeting Strategies untuk Pemula isn’t about restricting yourself; it’s about empowering yourself. By understanding your spending habits, setting realistic goals, and employing effective strategies, you can transform your financial future. Remember, even small steps towards better financial management can lead to significant long-term gains. So, ditch the financial fear, embrace the budgeting brilliance, and watch your money work wonders for you. Happy budgeting!

Query Resolution

What if I make a mistake in my budget?

Don’t panic! Budgeting is an iterative process. Mistakes are learning opportunities. Review your budget regularly, adjust as needed, and keep learning.

How often should I review my budget?

At least monthly. This allows you to track progress, identify areas for improvement, and make necessary adjustments based on your spending patterns.

Can I use budgeting strategies if I’m self-employed?

Absolutely! Self-employment requires even more diligent budgeting. Track income and expenses meticulously, and consider setting aside more for taxes and unexpected costs.

What if I don’t have any savings to start an emergency fund?

Start small! Even $10 a week adds up. Focus on consistently contributing, and gradually increase the amount as your financial situation improves.