Efficiently managing business expenses is crucial for profitability and financial health. A robust business expense tracking system streamlines this process, offering clarity and control over spending. From small startups to established enterprises, effective expense management is paramount for informed decision-making and sustainable growth. This guide delves into the core functionalities, benefits, challenges, and best practices for implementing a successful expense tracking system.

We’ll explore various software solutions, key features, user experience considerations, security protocols, and seamless integration with accounting software. Understanding these aspects will empower businesses to choose and implement a system that aligns perfectly with their specific needs and goals, ultimately leading to improved financial oversight and enhanced operational efficiency.

Defining Business Expense Tracking Systems

A business expense tracking system is a crucial tool for any organization, regardless of size. It streamlines the process of recording, categorizing, and analyzing financial outflows, providing valuable insights for better financial management and decision-making. Effective tracking prevents inaccuracies, simplifies tax preparation, and allows for proactive budget control.

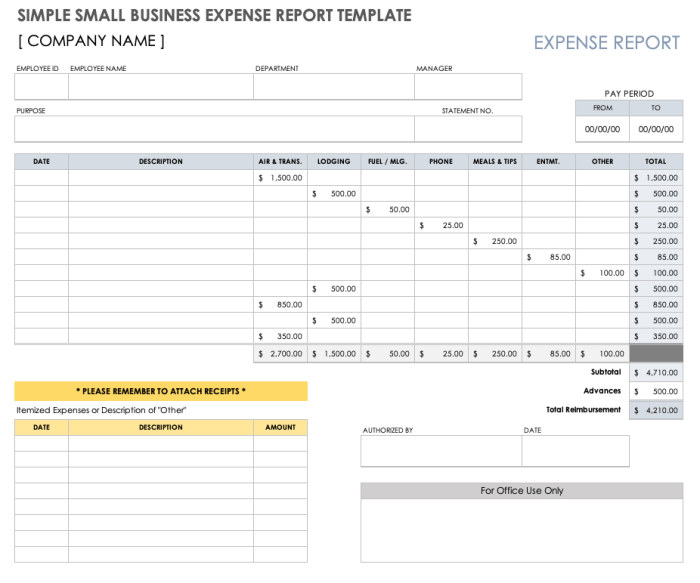

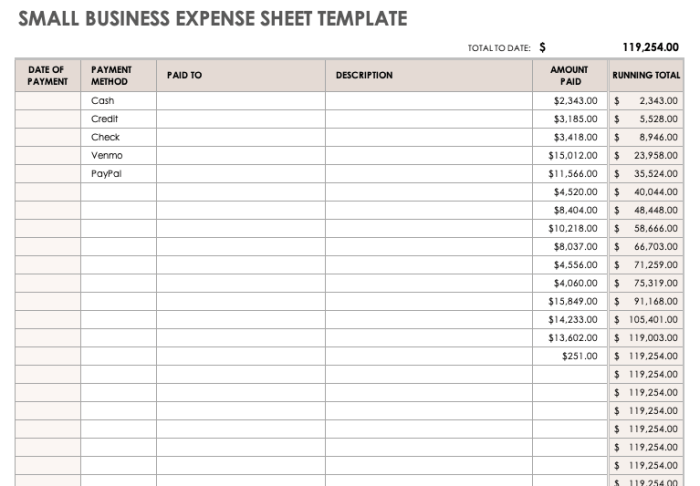

A core functionality of a business expense tracking system is to provide a centralized repository for all business-related expenses. This includes the ability to input expense details, such as date, description, amount, payment method, and relevant receipts or invoices. The system then automatically categorizes expenses, generates reports, and can even integrate with accounting software for seamless data transfer. Advanced systems offer features like mileage tracking, expense reimbursement workflows, and real-time expense monitoring.

Types of Business Expenses Tracked

Business expense tracking systems can accommodate a wide range of expense types. These typically fall under broad categories, but the specific categories can be customized to meet the unique needs of a business. Commonly tracked expenses include travel (airfare, lodging, transportation), office supplies, marketing and advertising, salaries and wages, rent and utilities, professional services (legal, consulting), software subscriptions, equipment purchases, and entertainment expenses. The system allows for detailed breakdowns within these categories, facilitating more granular analysis.

User Roles and Access Levels

Different users within a company will require varying levels of access to the expense tracking system. This is crucial for maintaining data security and ensuring that only authorized personnel can view or modify sensitive financial information. A typical system might include the following roles:

* Administrator: Has full access to all features, including user management, system configuration, and report generation. They can oversee all expenses and manage the system’s overall functionality.

* Manager: Can approve or reject expense reports submitted by employees, generate reports for their team, and monitor spending within their department. Their access is typically limited to expenses related to their team or department.

* Employee: Can submit expense reports, track their own expenses, and view their expense history. They typically cannot access or modify the expense reports of other employees.

* Accountant: Can access all expense data for financial reporting and auditing purposes, often with read-only access to prevent accidental modifications.

Expense Tracking Software Comparison

| Software Name | Key Features | Pricing Model | Target Audience |

|---|---|---|---|

| Expensify | Smart receipt scanning, automated expense reports, integration with accounting software, mileage tracking | Freemium (free plan with limitations, paid plans for advanced features) | Small businesses, freelancers, and individuals |

| Zoho Expense | Multi-currency support, policy compliance features, expense approval workflows, detailed reporting | Subscription-based (various plans based on features and number of users) | Small to medium-sized businesses |

| QuickBooks Online | Comprehensive accounting software with integrated expense tracking, invoice creation, and financial reporting | Subscription-based (various plans based on features and number of users) | Small to large businesses |

Benefits and Challenges of Implementing a System

Implementing a business expense tracking system offers significant advantages for small businesses, streamlining financial management and improving overall efficiency. However, successful implementation requires careful planning and consideration of potential challenges. This section will explore the benefits, challenges, and cost-benefit analysis of different system types.

Advantages of Business Expense Tracking Systems for Small Businesses

A robust expense tracking system provides several key advantages for small businesses. Improved accuracy in financial reporting is paramount, minimizing errors and ensuring compliance with tax regulations. Real-time visibility into spending patterns allows for better budget control and proactive financial decision-making. Automated processes, such as receipt scanning and expense categorization, significantly reduce administrative burden, freeing up valuable time for other business activities. Finally, a well-organized system simplifies the process of preparing financial statements and tax returns, reducing the likelihood of costly mistakes and penalties.

Challenges in Implementing a Business Expense Tracking System

Implementing a business expense tracking system presents several potential challenges. Data security is a critical concern; systems must protect sensitive financial information from unauthorized access and breaches. User adoption is another key hurdle; employees must be properly trained and motivated to use the system consistently and accurately. Resistance to change and a lack of understanding can hinder successful implementation. Integration with existing accounting software can also be complex and time-consuming, requiring careful planning and potentially specialized expertise. Finally, the initial setup and ongoing maintenance costs must be carefully considered and weighed against the potential benefits.

Cloud-Based versus On-Premise Systems: A Cost-Benefit Comparison

The choice between a cloud-based and an on-premise expense tracking system involves a trade-off between cost, flexibility, and control. Cloud-based systems typically have lower upfront costs, as they eliminate the need for significant hardware investment and IT infrastructure. They also offer greater flexibility and accessibility, allowing employees to access the system from anywhere with an internet connection. However, cloud-based systems may involve recurring subscription fees and can raise concerns about data security and vendor lock-in. On-premise systems offer greater control over data security and system customization but require a larger upfront investment in hardware, software, and IT support. The optimal choice depends on the specific needs and resources of the business, considering factors such as budget, technical expertise, and data security requirements. For example, a small business with limited IT resources might find a cloud-based system more cost-effective and manageable, while a larger business with stringent security requirements might prefer an on-premise system.

Expense Submission, Approval, and Reporting Process Flowchart

The following flowchart illustrates a typical process for expense submission, approval, and reporting within a business expense tracking system.

[Imagine a flowchart here. The flowchart would begin with “Employee submits expense report (with supporting documentation)”. This would flow to “System validates expense report against company policy”. Next, a decision point: “Report valid?”. If yes, it flows to “Manager reviews and approves/rejects report”. If no, it flows back to “Employee corrects report and resubmits”. After approval, the flow continues to “Report routed to accounting department”. Finally, it concludes with “Financial reports generated and distributed”. Each step could have a brief description or notes about the process.]

Key Features and Functionality

A robust business expense tracking system should streamline the process of recording, categorizing, and analyzing financial outlays. Effective systems go beyond simple expense logging; they provide tools for insightful reporting and seamless integration with other business applications, ultimately improving financial management and decision-making. This section details the essential features and functionalities of such a system.

Essential features fall into several key areas, including data input, reporting and analysis, and integration with other business tools. A well-designed system will offer a balance of user-friendliness and powerful analytical capabilities.

Data Input and Management

Efficient data entry is paramount. The system should allow for multiple input methods, such as manual entry, receipt scanning (with OCR capabilities for automated data extraction), and import from bank statements. Features like customizable expense categories, automated expense allocation (based on predefined rules), and the ability to attach supporting documentation (receipts, invoices) directly to expense entries enhance accuracy and auditability. Data validation features, preventing erroneous entries, are also crucial. For example, the system could prevent the entry of expenses exceeding a predefined limit without manager approval.

Reporting and Analytics Capabilities

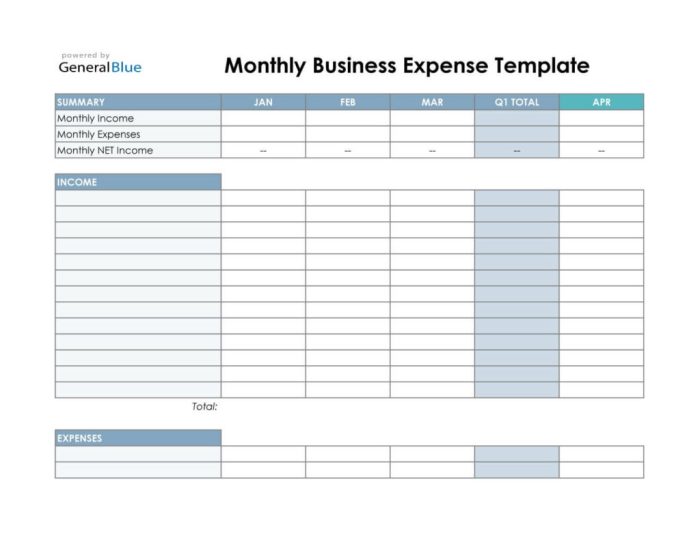

Comprehensive reporting and analytics are crucial for gaining insights into spending patterns. The system should offer a range of customizable reports, including:

- Expense summaries by category, employee, department, or project.

- Trend analysis showing spending over time.

- Budget vs. actual spending comparisons.

- Detailed expense reports for specific periods or projects.

- Customizable dashboards displaying key metrics.

Advanced analytics might include forecasting capabilities based on historical data and the ability to identify potential cost-saving opportunities. For instance, the system could highlight unusually high expenses in a specific category or identify trends that suggest potential budget overruns.

Integration with Other Business Software

Seamless integration with existing accounting software (e.g., QuickBooks, Xero) and other business applications (e.g., CRM, project management software) is essential. This integration should allow for automated data transfer, eliminating the need for manual data entry and reducing the risk of errors. For example, expense data could be automatically imported into the accounting software for accurate financial reporting, or project expenses could be automatically linked to specific projects in a project management system.

Feature Prioritization

The following list categorizes features by importance:

| Feature | Importance | Justification |

|---|---|---|

| Receipt scanning with OCR | High | Automates data entry, saving time and reducing errors. |

| Customizable expense categories | High | Allows for tailored reporting and analysis. |

| Integration with accounting software | High | Ensures accurate financial reporting and reduces manual work. |

| Budget vs. actual spending comparison reports | High | Provides crucial insights for financial planning and control. |

| Expense trend analysis | Medium | Helps identify spending patterns and potential cost-saving opportunities. |

| Multi-user access with permission controls | Medium | Ensures data security and accountability. |

| Automated expense allocation rules | Medium | Simplifies expense categorization and improves efficiency. |

| Data export capabilities (e.g., CSV, Excel) | Medium | Allows for data analysis using external tools. |

| Mobile app accessibility | Medium | Enables expense tracking on the go. |

| Advanced analytics and forecasting | Low | While beneficial, this functionality may not be necessary for all businesses. |

User Experience and Design Considerations

A user-friendly interface is crucial for the success of any expense tracking system. Intuitive navigation, clear data presentation, and robust error handling contribute significantly to user adoption and data accuracy. A well-designed system minimizes frustration, encourages consistent use, and ultimately leads to better financial management.

Effective visual representations of expense data are essential for quick comprehension and informed decision-making. Charts and graphs transform raw numbers into easily digestible insights, allowing users to identify spending patterns and areas for potential savings. Careful consideration of data visualization techniques is critical for enhancing user understanding and promoting data-driven financial planning.

Best Practices for User Interface Design

Designing a user-friendly expense tracking system involves several key best practices. The interface should be clean, uncluttered, and intuitive, using clear and consistent labeling. Navigation should be straightforward, allowing users to easily access different sections of the application. The system should also be responsive and adapt seamlessly to different screen sizes and devices. Furthermore, the system should be accessible to users with disabilities, adhering to accessibility guidelines such as WCAG. Consistent use of visual cues, such as color-coding for different expense categories, can further enhance usability. Finally, providing helpful tooltips and contextual guidance can significantly improve the user experience, especially for less tech-savvy users.

Examples of Effective Visual Representations of Expense Data

Several visual representations can effectively communicate expense data. A bar chart, for example, can visually compare spending across different categories over a specified period (e.g., monthly expenses categorized by type). A pie chart is useful for illustrating the proportion of spending allocated to various categories within a specific timeframe. A line graph can effectively show trends in spending over time, highlighting increases or decreases in expenditure. For example, a line graph could depict monthly spending over a year, allowing users to readily identify seasonal spending patterns.

Minimizing User Errors and Ensuring Data Accuracy

Several design elements contribute to minimizing user errors and ensuring data accuracy. Clear input fields with appropriate data validation (e.g., restricting numeric input for amounts, date validation) help prevent incorrect data entry. Automatic calculations and summaries reduce the risk of manual errors. Confirmation prompts before critical actions (e.g., deleting data) help prevent accidental data loss. Regular data backups and version control protect against data corruption or loss. Finally, the system should provide clear error messages and suggestions to guide users in correcting mistakes. For instance, an error message could indicate an invalid date format or an exceeding budget limit.

Sample Expense Submission Form

Imagine a form with clearly labeled fields: “Date” (with a date picker for easy selection), “Category” (a dropdown menu with pre-defined categories like “Food,” “Transportation,” “Utilities”), “Description” (a text field for a brief description of the expense), “Amount” (a numeric field with validation to prevent non-numeric input), and “Payment Method” (a dropdown menu with options like “Credit Card,” “Debit Card,” “Cash”). Each field is clearly labeled and has appropriate input validation to prevent errors. A “Submit” button initiates the submission process, and a confirmation message is displayed upon successful submission. The form design is clean, simple, and intuitive, guided by best practices for user experience.

Security and Data Privacy

Protecting sensitive financial data is paramount in any expense tracking system. A breach can have severe consequences for both the business and its employees, leading to financial losses, reputational damage, and legal liabilities. Therefore, robust security measures are not just a good practice, but a necessity. This section details the critical aspects of security and data privacy in the context of a business expense tracking system.

Data security in an expense tracking system requires a multi-layered approach encompassing various technical and procedural safeguards. Sensitive information, including transaction details, payment information, and employee compensation data, demands the highest level of protection. Failure to implement appropriate security measures exposes the organization to significant risks.

Encryption Methods for Data Protection

Encryption is a fundamental security measure. All data at rest and in transit should be encrypted using strong, industry-standard algorithms like AES-256. This ensures that even if data is intercepted, it remains unreadable without the correct decryption key. Furthermore, the encryption keys themselves should be securely managed and protected using robust key management systems. For example, using a hardware security module (HSM) for key storage adds an extra layer of protection against unauthorized access.

Access Control and User Authentication

Implementing robust access control mechanisms is crucial. This involves employing a multi-factor authentication (MFA) system, requiring users to provide multiple forms of authentication, such as a password and a one-time code from a mobile app, to verify their identity before accessing the system. Role-based access control (RBAC) should also be implemented, granting users access only to the data and functionalities relevant to their roles within the organization. For instance, an accountant should have broader access than a regular employee. Regular audits of user access rights should be conducted to ensure compliance and prevent unauthorized access.

Compliance with Data Privacy Regulations

Adherence to relevant data privacy regulations, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), is mandatory. This involves implementing measures to ensure data minimization, transparency, and user consent. The system should provide users with clear and concise information about how their data is collected, used, and protected. Data retention policies should be established and adhered to, ensuring data is only kept for as long as necessary. Furthermore, procedures for handling data breaches should be in place, including notification protocols for affected users and regulatory bodies.

Security Policy: User Authentication, Authorization, and Data Backup

A comprehensive security policy should be developed and implemented, outlining procedures for user authentication, authorization, and data backup. The policy should clearly define acceptable use policies, password management guidelines, and incident response procedures. User authentication should be strong and secure, leveraging MFA and password complexity requirements. Authorization should be based on the principle of least privilege, granting users only the necessary access to perform their duties. Regular data backups should be performed and stored securely offsite to protect against data loss due to hardware failure or cyberattacks. These backups should be regularly tested to ensure their recoverability. The security policy should also include provisions for regular security assessments and penetration testing to identify and address vulnerabilities.

Integration with Accounting Software

Integrating your business expense tracking system with your accounting software offers significant advantages in streamlining financial processes and reducing manual data entry. This integration creates a seamless flow of financial information, improving accuracy and efficiency while saving valuable time and resources. By connecting these two crucial systems, businesses can achieve a higher level of financial control and gain deeper insights into their spending habits.

The benefits of integrating an expense tracking system with accounting software are substantial. Automated data transfer eliminates the need for manual data entry, reducing the risk of human error and saving considerable time. This automation also facilitates faster financial reporting and analysis, allowing businesses to make more informed decisions based on accurate and up-to-date financial information. Furthermore, a streamlined workflow improves overall operational efficiency and reduces the potential for discrepancies between expense reports and accounting records.

Integration Methods

Several methods exist for integrating expense tracking systems with accounting software. The optimal choice depends on the specific needs and technical capabilities of the businesses involved. Each method presents a unique set of advantages and disadvantages.

- Direct Integration: This method involves a direct, real-time connection between the two systems. Data is automatically transferred as it’s entered into the expense tracking system. Advantages include real-time data synchronization and minimal manual intervention. Disadvantages include potential complexities in setup and maintenance, requiring technical expertise.

- API Integration: Application Programming Interfaces (APIs) allow for programmatic data exchange between systems. This method offers flexibility and scalability, accommodating various data formats and system configurations. Advantages include flexibility and scalability. Disadvantages include the need for technical expertise for setup and maintenance, and potential compatibility issues.

- File-Based Integration: This simpler method involves exporting data from the expense tracking system (e.g., as a CSV file) and importing it into the accounting software. Advantages include simplicity and ease of implementation. Disadvantages include potential for data inconsistencies and errors due to manual intervention, and slower data transfer compared to direct or API integration.

Data Points Exchanged

Common data points exchanged between expense tracking systems and accounting software include: expense date, vendor name, expense category, description of expense, payment method, amount, receipt image (often stored separately), and tax information. The specific data points exchanged will vary depending on the features of each system and the business’s requirements. For example, a business might also exchange data related to employee reimbursements or project assignments.

Integrating a Hypothetical System with Xero

This example Artikels a step-by-step guide for integrating a hypothetical expense tracking system, “ExpenseTrackPro,” with Xero, a popular accounting software. This is a simplified example and specific steps might vary depending on the software versions.

- Account Setup in Both Systems: Create corresponding accounts in both ExpenseTrackPro and Xero to ensure consistent categorization of expenses. This involves matching chart of accounts.

- API Key Generation: In Xero, obtain the necessary API keys and credentials for accessing the Xero API. These credentials are vital for secure communication between the systems.

- ExpenseTrackPro Configuration: Configure ExpenseTrackPro to connect to Xero using the obtained API keys. This typically involves entering the API keys and specifying the desired data synchronization settings.

- Testing the Integration: Input test expenses in ExpenseTrackPro. Verify that the data successfully transfers to Xero. Check for any discrepancies or errors in the data transfer.

- Ongoing Monitoring: Regularly monitor the integration to ensure data integrity and identify any issues promptly. This may involve checking for errors in the log files.

Wrap-Up

Implementing a business expense tracking system is an investment that yields significant returns in terms of improved financial visibility, reduced administrative burdens, and enhanced compliance. By carefully considering the factors Artikeld in this guide – from choosing the right software to prioritizing data security – businesses can establish a robust system that fosters financial stability and contributes to long-term success. The key takeaway is that a well-designed and implemented system is not merely an expense; it’s a strategic tool for growth and responsible financial management.

Query Resolution

What are the legal implications of not tracking business expenses properly?

Failure to accurately track expenses can lead to issues with tax audits, potential penalties, and difficulties in securing funding or loans. Consult with a tax professional for specific legal advice.

How do I choose the right expense tracking system for my business size?

Consider your business size, budget, number of users, and required features. Small businesses might benefit from simpler, less expensive solutions, while larger enterprises may need more sophisticated systems with advanced features and integrations.

Can I integrate my expense tracking system with my existing CRM?

Many modern expense tracking systems offer integrations with various CRMs. Check the specific software’s capabilities to confirm CRM compatibility and the data points that can be shared.

What is the typical cost of implementing and maintaining an expense tracking system?

Costs vary greatly depending on the chosen software (subscription-based, one-time purchase), implementation complexity, and ongoing maintenance requirements. Research pricing models carefully before committing.