Mastering business finance is crucial for success in today’s competitive landscape. This guide delves into the core components of effective business finance training, exploring various methodologies, target audiences, and key topics. From financial statement analysis and budgeting to understanding financing options and key performance indicators (KPIs), we’ll equip you with the knowledge and skills to navigate the complexities of business finance.

We examine diverse training delivery methods, including online courses, workshops, and webinars, highlighting the importance of engaging and interactive learning materials. We’ll also discuss the evolving role of technology in business finance training and the future trends shaping this dynamic field, addressing the skills gap and ethical considerations inherent in responsible financial management.

Defining Business Finance Training

Business finance training equips individuals with the knowledge and skills necessary to manage and analyze financial aspects within a business context. It encompasses a wide range of topics, from basic accounting principles to advanced financial modeling techniques, ultimately aiming to improve decision-making and overall financial health. Effective programs go beyond theoretical knowledge and incorporate practical application through case studies and real-world scenarios.

Effective business finance training programs integrate several core components. A strong foundation in accounting principles is crucial, providing the language and framework for understanding financial statements. This is complemented by training in financial analysis, teaching participants how to interpret key financial metrics and identify trends. Crucially, effective programs also cover financial planning and forecasting, equipping individuals with the tools to project future performance and make informed strategic decisions. Finally, the integration of risk management principles is essential, enabling participants to understand and mitigate potential financial threats.

Target Audiences for Business Finance Training

Business finance training caters to a diverse range of individuals depending on their roles and responsibilities within an organization. Entrepreneurs, for example, benefit immensely from understanding financial modeling, cash flow management, and securing funding. Managers across various departments require training to interpret financial data relevant to their areas, make informed budget decisions, and contribute to the overall financial success of the organization. Employees, even those not directly involved in finance, benefit from a basic understanding of financial principles to make responsible financial decisions in their roles. For instance, sales teams understanding profitability analysis can better target high-value clients.

Training Methodologies in Business Finance Education

A variety of methodologies enhance the learning experience in business finance training. Lectures provide a structured delivery of core concepts and theories. Case studies offer real-world scenarios that challenge participants to apply their knowledge and develop problem-solving skills. Workshops and simulations provide hands-on experience with financial tools and techniques, reinforcing theoretical understanding through practical application. Interactive exercises and group discussions encourage collaboration and knowledge sharing among participants. Finally, online learning platforms offer flexibility and accessibility, enabling individuals to learn at their own pace and access resources anytime.

Curriculum for a Beginner-Level Business Finance Training Course

This curriculum focuses on foundational concepts and practical applications, suitable for individuals with limited prior finance experience.

| Module | Topics |

|---|---|

| Module 1: Introduction to Financial Accounting | Basic accounting principles, the accounting equation (Assets = Liabilities + Equity), the balance sheet, the income statement, the cash flow statement. |

| Module 2: Financial Statement Analysis | Ratio analysis (liquidity, profitability, solvency), interpreting financial statements, identifying key trends and performance indicators. |

| Module 3: Budgeting and Forecasting | Creating budgets, forecasting revenues and expenses, variance analysis, managing cash flow. |

| Module 4: Introduction to Financial Management | Working capital management, capital budgeting, sources of financing (debt vs. equity). |

Key Topics in Business Finance Training

This section delves into the core components of a comprehensive business finance training program. Understanding these key topics is crucial for effective business management and strategic decision-making. We will explore the practical application of financial tools and techniques to enhance profitability and sustainability.

Financial Statement Analysis in Business Decision-Making

Analyzing financial statements—balance sheets, income statements, and cash flow statements—is paramount for informed business decisions. These statements provide a snapshot of a company’s financial health, revealing its profitability, liquidity, and solvency. By understanding trends and patterns within these statements, businesses can identify areas for improvement, assess risk, and make strategic choices regarding investments, expansion, or cost-cutting measures. For instance, a declining gross profit margin might signal the need for pricing adjustments or cost control initiatives, while a high debt-to-equity ratio could indicate excessive reliance on borrowing and increased financial risk.

Budgeting and Forecasting Techniques

Budgeting and forecasting are integral to effective financial management. Budgeting involves creating a detailed plan for allocating resources, while forecasting projects future financial performance based on various assumptions and historical data. Businesses utilize various techniques, including zero-based budgeting (starting from scratch each year), incremental budgeting (adjusting the previous year’s budget), and rolling forecasts (continuously updating forecasts). For example, a retail business might use sales data from previous years and anticipated marketing campaigns to forecast sales revenue for the upcoming quarter, then allocate resources accordingly to meet projected demand and manage inventory levels.

Financing Options for Businesses

Businesses have access to a range of financing options to fund their operations and growth. Debt financing involves borrowing money, which must be repaid with interest. Examples include bank loans, lines of credit, and bonds. Equity financing involves raising capital by selling ownership stakes in the company, such as through issuing stock. The choice between debt and equity financing depends on factors such as the company’s risk tolerance, financial position, and long-term goals. A startup company, for example, might initially rely on equity financing from venture capitalists, while an established business with a strong credit rating might prefer debt financing to fund expansion projects.

Key Performance Indicators (KPIs) for Assessing Financial Health

Key Performance Indicators (KPIs) are quantifiable metrics used to track and evaluate a business’s financial performance. These indicators provide insights into various aspects of the business, including profitability, liquidity, efficiency, and solvency. Examples of KPIs include return on investment (ROI), gross profit margin, net profit margin, current ratio, and debt-to-equity ratio. Regular monitoring of these KPIs allows businesses to identify areas of strength and weakness, and to make data-driven decisions to improve performance. A consistent decline in ROI, for example, might necessitate a review of investment strategies or operational efficiency.

Financial Ratio Analysis

Understanding and interpreting financial ratios is essential for assessing a business’s financial health. Different ratios offer insights into various aspects of the business’s performance.

| Ratio | Formula | Interpretation | Example |

|---|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Measures short-term liquidity; higher is generally better. | A current ratio of 2.0 indicates that a company has twice as many current assets as current liabilities. |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Measures the proportion of debt to equity financing; lower is generally better. | A debt-to-equity ratio of 0.5 indicates that a company has half as much debt as equity. |

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Measures profitability after deducting direct costs; higher is better. | A gross profit margin of 40% indicates that 40% of revenue remains after deducting the cost of goods sold. |

| Return on Equity (ROE) | Net Income / Shareholder’s Equity | Measures the return generated on shareholder investment; higher is better. | An ROE of 15% indicates that for every dollar of shareholder equity, the company generated 15 cents in net income. |

Delivering Effective Business Finance Training

Effective delivery is crucial for successful business finance training. A well-structured program, using appropriate methods and engaging materials, ensures trainees grasp key concepts and apply them practically. The choice of delivery method, the design of training materials, and the assessment strategies all play vital roles in achieving these learning objectives.

Training Delivery Methods

Selecting the right training delivery method depends on factors like budget, trainee location, learning styles, and the complexity of the material. Different methods cater to various needs and preferences.

- Online Courses: Self-paced learning through platforms like Coursera or Udemy offers flexibility and accessibility. These often incorporate videos, quizzes, and interactive exercises. The advantage lies in scalability and cost-effectiveness, reaching a large audience at a lower per-person cost.

- Workshops: In-person workshops provide interactive learning through hands-on activities, group discussions, and direct interaction with the instructor. This method is particularly beneficial for complex topics requiring immediate feedback and collaborative problem-solving. The disadvantage is the higher cost and logistical complexities.

- Webinars: Live online sessions combine the accessibility of online courses with the interactivity of workshops. They allow for real-time Q&A sessions and immediate clarification of doubts. This is a cost-effective way to reach a geographically dispersed audience.

Creating Engaging and Interactive Training Materials

Engaging training materials are key to knowledge retention and application. A step-by-step approach ensures a structured and effective learning experience.

- Needs Assessment: Identify the specific learning objectives and the prior knowledge of the trainees. This forms the basis for designing relevant and appropriate content.

- Content Development: Structure the content logically, using clear and concise language. Incorporate various media like videos, infographics, and interactive simulations to cater to different learning styles.

- Interactive Elements: Integrate quizzes, polls, and case studies to actively involve trainees in the learning process. This fosters deeper understanding and better retention.

- Testing and Revision: Pilot test the materials with a small group to identify areas for improvement before deploying them to a larger audience.

Incorporating Real-World Case Studies

Real-world case studies provide context and relevance to abstract financial concepts. They demonstrate the practical application of theories and allow trainees to analyze real-life scenarios.

For example, a case study could involve analyzing the financial performance of a publicly traded company, examining its financial statements, and making investment recommendations based on the findings. Another example could focus on a company’s decision to take on debt financing versus equity financing, exploring the implications of each choice on the company’s financial health. These real-world examples help trainees connect theory to practice and develop critical thinking skills.

Effective Assessment Methods

Assessment methods should accurately gauge trainee understanding and identify areas needing further attention. A variety of methods ensures a comprehensive evaluation.

- Quizzes and Tests: These assess knowledge recall and comprehension of key concepts.

- Case Study Analyses: Evaluate the ability to apply learned concepts to real-world situations.

- Group Projects: Assess teamwork and problem-solving skills in a collaborative environment.

- Role-Playing Exercises: Evaluate the ability to apply financial knowledge in simulated professional settings.

Maintaining Learner Engagement

Sustained engagement is crucial for effective learning. Strategies to maintain learner interest include:

- Interactive Activities: Incorporating activities like group discussions, simulations, and games keeps trainees actively involved.

- Regular Feedback: Providing timely and constructive feedback helps trainees track their progress and identify areas for improvement.

- Varied Learning Methods: Combining different teaching methods (lectures, discussions, case studies) caters to diverse learning styles.

- Real-World Applications: Emphasizing the practical relevance of the material helps trainees see the value of the training.

The Future of Business Finance Training

The landscape of business finance is constantly evolving, driven by technological advancements, shifting economic trends, and a growing emphasis on ethical conduct. Consequently, business finance training must adapt to equip professionals with the skills and knowledge needed to navigate this dynamic environment. This necessitates a forward-looking approach that integrates cutting-edge technologies, addresses emerging trends, and emphasizes ethical considerations.

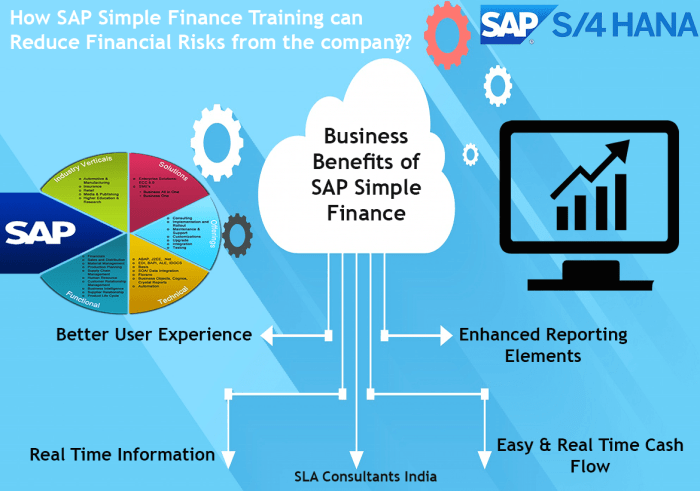

Technology’s Impact on Business Finance Training Delivery and Content

Technology is revolutionizing how business finance training is delivered and the content itself. Online learning platforms offer flexible and accessible training options, reaching a wider audience regardless of geographical location. Interactive simulations and virtual reality experiences provide immersive learning environments, enhancing engagement and knowledge retention. Artificial intelligence (AI) can personalize learning paths, providing tailored content based on individual needs and progress. For instance, AI-powered tutoring systems can offer immediate feedback and support, addressing specific learning challenges. Furthermore, the integration of data analytics tools into training programs allows for a more data-driven approach to learning, enabling learners to analyze real-world financial data and make informed decisions.

Emerging Trends in Business Finance and Their Implications for Training Curricula

Several emerging trends in business finance are reshaping the training landscape. The rise of fintech is transforming financial services, requiring training programs to incorporate knowledge of blockchain technology, cryptocurrency, and digital payments. Sustainable finance is gaining prominence, necessitating the inclusion of environmental, social, and governance (ESG) factors in investment decisions and financial reporting. The increasing complexity of global financial markets demands a deeper understanding of international finance and regulatory frameworks. Training curricula must adapt to these changes by integrating these emerging areas into their programs, ensuring graduates are equipped with the necessary expertise to succeed in a rapidly changing field. For example, a curriculum could include a module on ESG investing, covering the practical application of ESG criteria in portfolio management and analysis.

Incorporating Ethical Considerations into Business Finance Training

Ethical considerations are paramount in business finance. Training programs must emphasize the importance of integrity, transparency, and accountability in financial decision-making. This includes covering topics such as corporate governance, fraud prevention, and responsible investing. Case studies involving ethical dilemmas can help learners develop critical thinking skills and ethical judgment. For example, a case study could explore a scenario involving a conflict of interest and require learners to analyze the situation and propose ethical solutions. By integrating ethical considerations into the curriculum, training programs can foster a culture of responsible and ethical behavior among future finance professionals.

Addressing the Skills Gap in Business Finance

A significant skills gap exists in business finance, particularly in areas such as data analytics, fintech, and sustainable finance. Training initiatives can bridge this gap by offering specialized courses and certifications in these high-demand areas. Partnerships between educational institutions and industry professionals can ensure that training programs align with current industry needs. Furthermore, continuous professional development programs can help professionals upskill and reskill to meet the evolving demands of the industry. For example, a specialized course on data analytics in finance could equip learners with the skills to analyze large financial datasets and extract valuable insights.

Evolution of Business Finance Training Methods

A visual representation of the evolution of business finance training methods could be depicted as a timeline. The earliest stage, represented by a simple lecture hall, depicts traditional classroom-based learning. The next stage shows the introduction of textbooks and case studies, represented by open books alongside the lecture hall. The following stage illustrates the incorporation of computers and spreadsheets, shown as a computer screen superimposed on the lecture hall and books. The most recent stage depicts a vibrant, interconnected network of online learning platforms, virtual reality simulations, and AI-powered tutoring systems, highlighting the integration of technology in modern business finance training. This progression demonstrates the shift from passive learning to active, engaging, and technology-enhanced training methods.

Resources and Tools for Business Finance Training

Effective business finance training relies heavily on the right resources and tools. Access to high-quality materials, interactive software, and a well-structured budget are crucial for delivering a successful program. This section details essential resources, software, budgeting considerations, the benefits of interactive elements, and relevant professional certifications.

Reputable Online Resources for Business Finance Training Materials

Numerous reputable online platforms offer comprehensive business finance training materials. These resources vary in their approach, catering to different learning styles and experience levels. Choosing the right platform depends on the specific training needs and budget.

- Coursera and edX: These platforms offer courses from top universities and institutions, often covering various aspects of business finance, from introductory concepts to advanced topics like financial modeling and valuation.

- Udemy and Skillshare: These platforms host a wide array of courses created by individual instructors, offering flexibility in course selection and pricing. Quality can vary, so careful review of instructor credentials and student reviews is essential.

- Corporate Finance Institute (CFI): CFI provides specialized training in corporate finance, offering certifications and in-depth courses covering various aspects of financial management.

- Investopedia: This website offers a vast library of articles, tutorials, and glossary terms related to finance, serving as a valuable supplementary resource for both trainers and trainees.

Software and Tools for Financial Modeling and Analysis in Training

Effective business finance training often involves practical application through financial modeling and analysis. Utilizing appropriate software enhances the learning experience and provides trainees with valuable hands-on skills.

- Microsoft Excel: Remains a cornerstone for financial modeling, offering a wide array of functions and tools for data analysis, forecasting, and valuation.

- Spreadsheet Software (Google Sheets): Offers a collaborative and cloud-based alternative to Excel, useful for group projects and real-time analysis.

- Financial Modeling Software (e.g., Capital IQ, Bloomberg Terminal): These professional-grade tools provide access to real-time market data, advanced analytical functions, and sophisticated modeling capabilities, though they often come with significant cost implications.

Sample Budget for Developing and Delivering a Business Finance Training Program

Developing and delivering a comprehensive business finance training program requires careful budget planning. Costs vary depending on the program’s scope, duration, and target audience. The following is a sample budget, which should be adapted to specific needs:

| Cost Category | Estimated Cost |

|---|---|

| Instructor Fees | $5,000 – $15,000 |

| Training Materials (online resources, workbooks) | $500 – $2,000 |

| Software Licenses (if applicable) | $0 – $5,000 |

| Venue Rental (if applicable) | $0 – $3,000 |

| Marketing and Promotion | $500 – $2,000 |

| Administrative Costs | $500 – $1,000 |

| Total Estimated Cost | $6,500 – $28,000 |

*Note: This is a sample budget and actual costs may vary significantly.*

Benefits of Using Simulations and Interactive Exercises in Business Finance Training

Incorporating simulations and interactive exercises significantly enhances the effectiveness of business finance training. These elements allow trainees to apply theoretical knowledge to practical scenarios, fostering deeper understanding and retention.

- Enhanced Engagement: Interactive exercises increase participant engagement and motivation compared to passive learning methods.

- Improved Knowledge Retention: Hands-on experience strengthens understanding and improves long-term retention of concepts.

- Development of Problem-Solving Skills: Simulations challenge trainees to analyze situations, make decisions, and evaluate outcomes, developing critical problem-solving skills.

- Risk-Free Environment for Experimentation: Simulations provide a safe environment to explore different strategies and learn from mistakes without real-world consequences.

Professional Certifications Related to Business Finance

Earning professional certifications demonstrates competence and enhances career prospects in business finance. Several reputable organizations offer certifications.

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Financial Risk Manager (FRM)

Epilogue

Effective business finance training empowers individuals and organizations to make informed financial decisions, leading to improved profitability and sustainability. By understanding financial statements, budgeting techniques, financing options, and key performance indicators, businesses can optimize their performance and achieve long-term success. This comprehensive guide provides a roadmap for acquiring the necessary skills and knowledge, equipping you to navigate the complexities of the business world with confidence.

Commonly Asked Questions

What are the prerequisites for Business Finance Training?

Basic accounting knowledge is helpful but not always required. Many courses cater to beginners and provide the necessary foundational information.

How long does Business Finance Training typically take?

Duration varies widely depending on the program’s intensity and scope, ranging from short workshops to extensive certification programs.

What career opportunities are available after completing Business Finance Training?

Opportunities include financial analyst, budget analyst, financial manager, and various roles in accounting and finance departments.

Is Business Finance Training worth the investment?

Absolutely. The skills gained directly contribute to improved financial management, leading to better decision-making and increased profitability for individuals and businesses.