Navigating the complex world of business finance can feel daunting, but mastering its principles is key to success. This comprehensive training program equips individuals and businesses with the essential knowledge and skills to effectively manage finances, make informed investment decisions, and mitigate financial risks. From understanding fundamental financial statements to employing sophisticated forecasting techniques, this program provides a practical and insightful journey into the heart of business finance.

We explore core concepts like financial statement analysis, ratio interpretation, and financial planning, equipping you with the tools to assess business performance and make strategic decisions. The program also delves into investment appraisal techniques, risk management strategies, and the ethical considerations inherent in sound financial practices. Ultimately, this training aims to build confidence and competence in managing all aspects of business finance.

Introduction to Business Finance Training

Business finance training equips individuals and organizations with the knowledge and skills necessary to manage financial resources effectively. It’s crucial for making informed decisions about investments, budgeting, financial planning, and overall business growth. A strong understanding of business finance is essential for both the success of individual careers and the profitability and sustainability of businesses.

Types of Business Finance Training

Various types of business finance training cater to different experience levels and specific needs. These programs range from short, focused workshops to comprehensive degree programs. The choice depends on the individual’s learning style, career goals, and the specific financial skills they aim to develop. Common types include online courses, boot camps, workshops, certificate programs, and degree programs (associate’s, bachelor’s, or master’s). Each offers a unique learning experience and depth of knowledge.

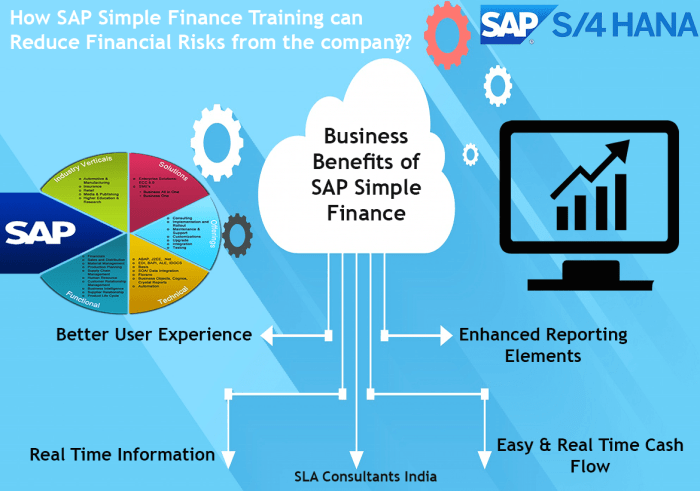

Benefits of Business Finance Training

Business finance training offers significant advantages for both individuals and businesses. For individuals, it enhances career prospects, increases earning potential, and fosters professional development. For businesses, it improves financial management, enhances decision-making, optimizes resource allocation, and ultimately contributes to increased profitability and sustainable growth. Effective financial management minimizes risk and maximizes returns on investment. Improved financial literacy also allows for better strategic planning and a more proactive approach to challenges.

Comparison of Business Finance Training Programs

The following table compares several representative business finance training programs. Note that program details, including cost and duration, can vary depending on the institution and specific program offerings. This table provides a general overview and should be used as a starting point for further research.

| Program Name | Duration | Cost (Approximate) | Target Audience | Curriculum Highlights |

|---|---|---|---|---|

| Coursera – Financial Accounting | Variable, self-paced | $49 – $79 per course | Beginners, professionals seeking upskilling | Financial statement analysis, accounting principles, budgeting |

| Udemy – Business Finance Fundamentals | Variable, self-paced | $10 – $200 per course | Entrepreneurs, small business owners | Financial planning, cash flow management, investment analysis |

| edX – Principles of Corporate Finance | Variable, self-paced | Free (audit) or $50 – $200 (verified certificate) | University students, professionals | Valuation, capital budgeting, risk management |

| Executive MBA Program (e.g., Harvard Business School) | 1-2 years | $100,000 – $200,000+ | Experienced professionals seeking senior management roles | Comprehensive business finance, strategy, leadership |

Core Concepts in Business Finance

Understanding the core concepts of business finance is essential for making informed decisions about a company’s financial health and future prospects. This section delves into the fundamental financial statements, key financial ratios, and their practical application in real-world business scenarios. We will explore how these tools provide valuable insights into profitability, liquidity, and solvency.

Fundamental Financial Statements

The three core financial statements – the balance sheet, the income statement, and the cash flow statement – provide a comprehensive overview of a company’s financial position. Each statement offers a unique perspective, and together they paint a complete picture. The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time, illustrating the accounting equation: Assets = Liabilities + Equity. The income statement summarizes a company’s revenues and expenses over a period, revealing its profitability. Finally, the cash flow statement tracks the movement of cash both into and out of the business over a period, highlighting its liquidity. Analyzing these statements in conjunction allows for a thorough assessment of a company’s financial performance.

Key Financial Ratios and Their Significance

Financial ratios are calculated using data from the financial statements to provide insights into various aspects of a company’s performance. These ratios offer a standardized way to compare a company’s performance to its industry peers or its own historical performance. Key ratio categories include profitability ratios (e.g., gross profit margin, net profit margin, return on equity), liquidity ratios (e.g., current ratio, quick ratio), solvency ratios (e.g., debt-to-equity ratio, times interest earned), and efficiency ratios (e.g., inventory turnover, asset turnover). Understanding these ratios is crucial for making sound financial decisions.

Calculating and Interpreting Key Financial Ratios: A Step-by-Step Guide

Let’s consider the calculation and interpretation of the current ratio as an example. The current ratio is calculated by dividing current assets by current liabilities:

Current Ratio = Current Assets / Current Liabilities

A current ratio of 2.0 indicates that a company has twice as many current assets as current liabilities, suggesting strong short-term liquidity. However, a ratio that is too high might indicate inefficient use of assets. Similarly, a low ratio might signal potential liquidity problems. Other ratios are calculated using different combinations of financial statement items and interpreted within their specific contexts. For instance, the debt-to-equity ratio (Total Debt / Total Equity) measures a company’s financial leverage, with a higher ratio indicating greater reliance on debt financing.

Real-World Business Scenarios

Consider a startup seeking funding. Investors will meticulously analyze its financial statements and calculate key ratios to assess its viability. A high burn rate (cash outflow exceeding cash inflow) revealed by the cash flow statement could be a red flag. Similarly, a struggling retail company might use inventory turnover ratios to identify slow-moving products and adjust its inventory management strategy. A company considering a major acquisition would use leverage ratios to evaluate the target company’s financial health and risk profile before proceeding. Understanding these financial concepts is critical in negotiating favorable terms and mitigating potential risks.

Financial Planning and Forecasting

Financial planning and forecasting are crucial for the success of any business, whether it’s a startup or an established enterprise. A well-defined financial plan provides a roadmap for achieving financial goals, while accurate forecasting helps anticipate potential challenges and opportunities. This section will delve into the process of creating a financial plan, explore various forecasting methods, compare short-term and long-term planning strategies, and Artikel a structured approach to developing a comprehensive financial forecast.

Creating a Financial Plan for a New Business

Developing a financial plan for a new business involves a systematic approach. It begins with defining clear financial objectives, such as profitability targets, revenue projections, and funding requirements. This is followed by creating detailed financial statements, including a projected income statement, balance sheet, and cash flow statement. These statements should incorporate realistic assumptions about sales, costs, and expenses. The plan should also include a funding strategy, outlining how the business will secure the necessary capital. Finally, the plan should incorporate key performance indicators (KPIs) to track progress and make necessary adjustments along the way. A robust plan considers various scenarios, including best-case, worst-case, and most-likely outcomes, allowing for adaptable strategies. For example, a new restaurant might project different sales figures based on high, medium, and low customer traffic scenarios, influencing staffing and ingredient purchasing decisions.

Forecasting Methods Used in Business Finance

Several methods are employed for forecasting in business finance. Qualitative forecasting relies on expert judgment and intuition, often suitable for new ventures with limited historical data. Quantitative forecasting, conversely, utilizes historical data and statistical techniques. Time series analysis, for example, identifies trends and patterns in past data to predict future values. Regression analysis examines the relationship between variables to forecast future outcomes. Causal forecasting models consider external factors that might influence financial performance, such as economic conditions or competitor actions. For instance, a retail business might use regression analysis to predict sales based on factors like advertising spend and consumer confidence indices. The choice of method depends on the available data, the forecasting horizon, and the desired level of accuracy.

Short-Term and Long-Term Financial Planning Strategies

Short-term financial planning typically focuses on a period of one year or less. It emphasizes cash flow management, working capital needs, and short-term investments. Long-term financial planning, on the other hand, covers a longer horizon, often three to five years or more. It concentrates on strategic goals, capital budgeting decisions, and long-term financing strategies. While both are crucial, short-term planning provides immediate operational control, while long-term planning sets the overall direction. A company might use short-term planning to manage inventory levels and ensure sufficient cash for payroll, while long-term planning guides major investments like new equipment purchases or facility expansions. The integration of both is essential for sustainable growth.

Creating a Comprehensive Financial Forecast

A structured approach is vital for creating a comprehensive financial forecast. The process should begin with a thorough understanding of the business’s current financial position. This involves analyzing past performance, identifying key drivers of revenue and expenses, and assessing potential risks and opportunities. The next step is to develop detailed assumptions about future market conditions, sales volume, and operating costs. These assumptions should be based on market research, industry trends, and internal projections. Using these assumptions, the business can then prepare projected financial statements, including an income statement, balance sheet, and cash flow statement. Finally, the forecast should be regularly reviewed and updated to reflect changes in the business environment and actual performance. For example, a manufacturing company might forecast increased production costs based on projected increases in raw material prices, and adjust its pricing strategy accordingly. This iterative process allows for continuous refinement and improved accuracy.

Investment and Capital Budgeting

Capital budgeting is the process a business undertakes to evaluate potential major projects or investments. It’s a crucial element of financial planning, ensuring that resources are allocated effectively to maximize returns and minimize risk. This section will explore various techniques used in investment appraisal and examine different financing options available to businesses.

Investment Appraisal Techniques

Several methods exist for evaluating the financial viability of potential investments. Understanding their strengths and weaknesses is vital for sound decision-making. The most common techniques include Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period.

Net Present Value (NPV)

NPV calculates the difference between the present value of cash inflows and the present value of cash outflows over a period of time. A positive NPV indicates that the investment is expected to generate more value than it costs, making it a worthwhile undertaking. The formula for NPV is:

NPV = Σ [Ct / (1 + r)t] – C0

Where: Ct = net cash inflow during the period t, r = discount rate, t = number of time periods, and C0 = initial investment.

For example, consider an investment with an initial cost of $100,000 and expected annual cash inflows of $30,000 for five years, using a discount rate of 10%. Calculating the present value of each cash inflow and subtracting the initial investment will yield the NPV. A positive NPV suggests the project is financially sound.

Internal Rate of Return (IRR)

The IRR is the discount rate that makes the NPV of an investment equal to zero. It represents the expected annual rate of return on an investment. A higher IRR generally indicates a more attractive investment. IRR calculations are more complex than NPV and often require specialized software or financial calculators. For instance, a project with an IRR of 15% is generally considered more attractive than one with an IRR of 10%, assuming all other factors are equal.

Payback Period

The payback period is the length of time it takes for an investment to generate enough cash flow to recover its initial cost. It’s a simple measure of liquidity risk, focusing on how quickly an investment recoups its initial outlay. For example, if an investment costs $50,000 and generates $10,000 per year, the payback period is five years ($50,000 / $10,000). Shorter payback periods are generally preferred, especially in industries with high uncertainty.

Sources of Business Finance

Businesses can raise capital through various sources, each with its own advantages and disadvantages. The optimal choice depends on factors like the size of the investment, the company’s financial health, and market conditions.

Debt Financing

Debt financing involves borrowing money from lenders, such as banks or bondholders. This can include bank loans, lines of credit, or issuing corporate bonds. Debt financing offers tax advantages (interest payments are often tax-deductible), but it also increases the company’s financial risk (interest payments are obligatory).

Equity Financing

Equity financing involves raising capital by selling ownership shares in the company. This can be achieved through issuing new shares to existing shareholders or selling shares to new investors. Equity financing dilutes ownership but avoids the burden of debt repayment.

Other Sources

Other sources of finance include leasing, venture capital, and government grants. Each offers unique characteristics and suitability depending on the business’s specific needs and circumstances.

Capital Budgeting Case Study: Expansion of a Coffee Shop

Let’s consider a small coffee shop considering expanding its operations by opening a second location. The initial investment would be $200,000, covering leasehold improvements, equipment, and initial operating expenses. Projected annual net cash inflows for the new location are $50,000 for the next ten years. Using a discount rate of 8%, we can calculate the NPV. If the NPV is positive, and the IRR is higher than the company’s cost of capital, the expansion would likely be considered financially viable. The payback period would also be calculated to assess how quickly the investment is recouped. The financing decision might involve a mix of bank loans (debt) and possibly attracting investors (equity) to share in the expansion’s potential returns. The decision will be made by weighing the NPV, IRR, payback period, and the financial risk associated with each financing option.

Risk Management in Business Finance

Effective risk management is crucial for the long-term success and sustainability of any business. Understanding and mitigating potential financial risks allows companies to protect their assets, maintain profitability, and achieve their strategic objectives. This section will explore common financial risks, strategies for mitigating them, and the role of insurance in a comprehensive risk management plan.

Common Financial Risks Faced by Businesses

Businesses face a diverse range of financial risks that can significantly impact their operations and profitability. These risks can be broadly categorized into market risks, credit risks, liquidity risks, and operational risks. Market risks stem from fluctuations in market conditions, such as interest rate changes or commodity price volatility. Credit risks involve the possibility of borrowers defaulting on loans or payments. Liquidity risks relate to a company’s ability to meet its short-term obligations, while operational risks encompass internal factors that could disrupt business activities. For example, a sudden increase in interest rates could significantly increase a company’s borrowing costs, impacting profitability. Similarly, a major supplier failing to deliver crucial materials could disrupt production and lead to lost sales, representing an operational risk.

Strategies for Mitigating Financial Risks

Several strategies can be employed to effectively mitigate financial risks. Diversification, hedging, and robust financial planning are key elements of a comprehensive risk management approach. Diversification involves spreading investments across different asset classes to reduce the impact of losses in any single area. Hedging uses financial instruments to offset potential losses from adverse price movements. For instance, a company expecting to receive significant payments in a foreign currency could use currency futures contracts to hedge against potential exchange rate fluctuations. Comprehensive financial planning involves accurate forecasting, budgeting, and monitoring of financial performance, allowing for early detection and mitigation of potential problems. A well-defined contingency plan is also crucial, outlining actions to be taken in the event of unforeseen circumstances. For example, a manufacturing company might diversify its supplier base to mitigate the risk of supply chain disruptions.

The Role of Insurance in Managing Financial Risk

Insurance plays a vital role in mitigating financial risks by transferring the potential financial burden of specific events to an insurance company. Various types of insurance, such as property insurance, liability insurance, and business interruption insurance, can protect businesses against a wide range of potential losses. Property insurance covers damage to physical assets, while liability insurance protects against lawsuits arising from business operations. Business interruption insurance provides financial support during periods when operations are disrupted due to unforeseen events. The selection of appropriate insurance coverage is crucial and depends on the specific risks faced by the business. For example, a technology company might prioritize cyber liability insurance to protect against data breaches, while a retail business might focus on property and liability insurance to cover theft and accidents.

Examples of Effective Risk Management Improving Business Outcomes

Effective risk management can significantly improve business outcomes by enhancing financial stability, protecting against losses, and enabling strategic growth. Companies with robust risk management frameworks are better positioned to weather economic downturns and capitalize on opportunities. For example, a company that effectively hedged against interest rate risk during a period of rising interest rates would have protected its profitability and maintained a competitive advantage. Similarly, a company with a comprehensive disaster recovery plan would be able to minimize business disruption and recover more quickly from unforeseen events like natural disasters. These examples demonstrate the crucial link between proactive risk management and improved financial performance and resilience.

Business Finance Software and Tools

Effective financial management is crucial for business success, and leveraging appropriate software and tools can significantly enhance efficiency and accuracy. This section explores commonly used business finance software, compares their features, Artikels essential selection criteria, and details how to optimize their use for improved financial performance.

Commonly Used Business Finance Software Packages

Several software packages cater to various business finance needs, ranging from simple accounting to complex financial modeling. Popular choices include QuickBooks, Xero, Sage, Zoho Books, and FreshBooks for small to medium-sized enterprises (SMEs). Larger corporations often utilize more comprehensive Enterprise Resource Planning (ERP) systems such as SAP, Oracle NetSuite, and Microsoft Dynamics 365 Finance. These ERP systems integrate various business functions, including finance, supply chain, and human resources, providing a holistic view of the organization’s financial health. Specialized software for specific financial tasks, such as investment management platforms or budgeting and forecasting tools, are also widely available.

Comparison of Features and Functionalities

The features and functionalities of business finance software vary significantly depending on the scale and complexity of the business. QuickBooks, for example, excels in basic accounting tasks like invoicing, expense tracking, and financial reporting. Xero offers similar features with a strong emphasis on cloud-based accessibility and real-time collaboration. Sage provides more advanced features suitable for larger businesses, including inventory management and project accounting. ERP systems like SAP offer extensive functionalities, including financial consolidation, advanced analytics, and integrated planning tools. The choice of software depends heavily on the specific needs and size of the business. For instance, a small business primarily needing invoicing and expense tracking might find QuickBooks sufficient, while a large multinational corporation would require the capabilities of an ERP system.

Essential Features to Look For When Choosing Finance Software

Selecting the right finance software requires careful consideration of several key features. A crucial aspect is the software’s ability to seamlessly integrate with existing systems, such as CRM or inventory management platforms. Scalability is also critical, ensuring the software can adapt to the business’s growth and changing needs. User-friendliness is essential for ensuring efficient adoption and utilization by employees. Robust reporting and analytics capabilities are vital for extracting meaningful insights from financial data. Security features are paramount, protecting sensitive financial information from unauthorized access or breaches. Finally, strong customer support is essential to address any technical issues or questions that may arise.

Effective Utilization of Business Finance Software to Improve Efficiency

Effective utilization of business finance software hinges on proper implementation and training. Accurate data entry is crucial for generating reliable reports and analyses. Regular data backups are essential to prevent data loss. Leveraging the software’s reporting and analytics features to monitor key financial metrics provides valuable insights into business performance. Automating repetitive tasks such as invoice generation and payment processing frees up valuable time and reduces the risk of human error. Regular software updates ensure access to the latest features and security patches. Finally, utilizing the software’s collaboration features facilitates efficient communication and teamwork among finance professionals.

Ethical Considerations in Business Finance

Sound ethical practices are the bedrock of sustainable and successful business finance. Ignoring ethical considerations can lead to significant legal repercussions, reputational damage, and ultimately, business failure. This section explores the critical ethical implications embedded within various financial decisions.

Ethical Implications of Financial Decisions

Financial decisions, from accounting practices to investment strategies, carry inherent ethical weight. Decisions must be made with integrity, ensuring fairness and transparency to all stakeholders. For instance, manipulating financial statements to inflate profits or mislead investors is a serious breach of ethics. Similarly, prioritizing short-term gains over long-term sustainability, such as aggressive cost-cutting measures that compromise product quality or employee well-being, can have devastating consequences. The pursuit of profit should never come at the expense of ethical conduct.

Transparency and Accountability in Financial Reporting

Transparency and accountability are cornerstones of ethical financial reporting. Accurate and complete financial statements provide stakeholders – investors, creditors, employees, and the public – with the information they need to make informed decisions. This requires adherence to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the jurisdiction. Regular audits by independent firms further enhance accountability and build trust. Hiding liabilities, manipulating earnings, or engaging in creative accounting are all violations of this principle and can result in severe penalties. For example, the Enron scandal vividly demonstrated the devastating consequences of a lack of transparency and accountability.

Consequences of Unethical Behavior in Business Finance

Unethical behavior in business finance carries a multitude of severe consequences. These include hefty fines and legal penalties, reputational damage that can be difficult to repair, loss of investor confidence leading to decreased market value, and erosion of trust among employees and customers. In extreme cases, unethical actions can lead to business failure and even criminal prosecution. The WorldCom accounting scandal, where billions of dollars were fraudulently reported, serves as a stark reminder of the potential costs of unethical practices. This ultimately harmed employees, investors, and the broader economy.

Examples of Ethical Dilemmas and Appropriate Responses

Ethical dilemmas are often complex and nuanced. Consider a scenario where a company is facing financial distress. One option might be to cut costs by laying off employees, impacting their livelihoods. However, this could also negatively affect morale and productivity. An alternative might be to explore other options, such as negotiating with creditors or seeking government assistance, which might be a more ethical, albeit more challenging, route. Another example involves insider trading, where an individual uses confidential information to make personal gains at the expense of other investors. The appropriate response in such cases is to adhere strictly to regulations and report any suspected violations. Maintaining a strong ethical culture within the organization, supported by a robust code of conduct and ethics training, is crucial in navigating these dilemmas.

Continuing Professional Development in Business Finance

The dynamic nature of the business world necessitates continuous learning and adaptation for professionals in business finance. Staying abreast of evolving market trends, regulatory changes, and technological advancements is crucial for maintaining competitiveness and ensuring effective decision-making. This section explores the importance of continuing professional development (CPD) in business finance and Artikels various avenues for achieving it.

The benefits of ongoing learning in business finance are multifaceted. Enhanced knowledge leads to improved analytical skills, more informed strategic planning, and ultimately, better financial outcomes for organizations. Furthermore, continuous development demonstrates a commitment to professional excellence, boosting credibility and career prospects. Staying current with regulations prevents costly mistakes and ensures compliance, while understanding new technologies empowers professionals to leverage innovative tools and techniques for greater efficiency.

Avenues for Continuing Professional Development

Several pathways exist for business finance professionals to pursue ongoing learning. These options cater to diverse learning styles and schedules, offering flexibility and accessibility.

- Certifications: Professional certifications, such as the Chartered Financial Analyst (CFA) designation or the Certified Public Accountant (CPA) license, demonstrate a high level of competency and can significantly enhance career prospects. These rigorous programs require extensive study and examination, providing a structured approach to expanding knowledge.

- Workshops and Seminars: Industry-specific workshops and seminars offer focused training on current topics and trends. These events often provide opportunities for networking with other professionals and learning from experienced practitioners.

- Online Courses and Webinars: Numerous online platforms offer a vast array of business finance courses, from introductory modules to advanced specializations. These options provide flexibility, allowing professionals to learn at their own pace and convenience. Many reputable universities and institutions offer online courses and webinars, delivering high-quality content.

- Conferences and Industry Events: Attending conferences and industry events allows professionals to stay updated on the latest trends, network with peers, and learn from leading experts in the field. These events often feature keynote speakers, panel discussions, and workshops covering a wide range of topics.

Benefits of Staying Updated

Staying updated with the latest trends and regulations offers several key advantages. For example, understanding the implications of new accounting standards (like IFRS 17) can prevent costly errors and ensure compliance. Familiarity with emerging technologies, such as artificial intelligence (AI) in financial modeling, can improve efficiency and accuracy. Moreover, keeping abreast of market trends allows professionals to make more informed investment decisions and anticipate potential risks.

Resources for Enhancing Business Finance Knowledge

Numerous resources are available to support continuing professional development.

- Professional Organizations: Organizations such as the CFA Institute, the American Institute of Certified Public Accountants (AICPA), and the Financial Executives International (FEI) offer resources, publications, and events that keep professionals updated.

- Online Learning Platforms: Platforms like Coursera, edX, Udemy, and LinkedIn Learning offer a wide range of business finance courses from reputable institutions.

- Industry Publications: Journals such as the Journal of Finance, the Review of Financial Studies, and industry-specific magazines provide insights into current research and trends.

- Government and Regulatory Websites: Websites of regulatory bodies like the Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA) provide access to important updates and regulations.

Wrap-Up

By mastering the concepts and techniques presented in this Business Finance Training program, participants will gain a comprehensive understanding of financial management, empowering them to make data-driven decisions and achieve sustainable growth. The practical applications, real-world examples, and exploration of ethical considerations ensure that participants are not only knowledgeable but also responsible financial stewards. This program serves as a strong foundation for both personal and professional financial success in the dynamic business landscape.

Clarifying Questions

What is the prerequisite for this training?

Basic accounting knowledge is helpful but not strictly required. The training is designed to be accessible to a wide range of participants.

Are there any certifications offered upon completion?

The availability of certifications depends on the specific program provider. Check the individual program details for certification information.

What software is covered in the training?

The specific software covered varies by program, but common packages like QuickBooks, Xero, and Excel are frequently included.

Can I access course materials after the training concludes?

Access to course materials after completion depends on the program provider’s policy. Inquire with the provider for details.