Crafting a robust business plan requires a deep understanding of its financial underpinnings. This guide delves into the crucial aspect of financial projections, providing a structured approach to forecasting revenue, managing costs, securing funding, and ultimately, assessing the financial viability of your venture. We’ll explore key metrics, scenario planning, and sensitivity analysis to equip you with the tools for confident financial decision-making.

From defining essential financial metrics and projecting revenue streams to analyzing profitability and managing cash flow, this guide offers a practical framework for building realistic and insightful financial projections. We will cover various funding options and demonstrate how to create a comprehensive financial model that reflects the dynamic nature of your business.

Defining Key Financial Metrics

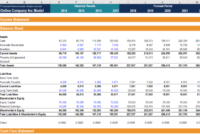

Accurate financial projections are the bedrock of a successful business plan. They provide a roadmap for future performance, allowing for informed decision-making and attracting potential investors. Understanding and effectively utilizing key financial metrics is crucial for creating realistic and compelling projections. These metrics offer a clear picture of the business’s financial health, profitability, and overall viability.

Several key financial metrics are essential for comprehensive business plan projections. These metrics provide a holistic view of the business’s financial performance, allowing for a more accurate assessment of its potential for success. Careful selection and interpretation of these metrics, informed by industry benchmarks, are crucial for creating credible projections.

Key Financial Metrics and Their Significance

The following list Artikels essential financial metrics for business plan projections, along with explanations of their significance in evaluating business performance. These metrics provide a balanced perspective on the business’s financial standing, encompassing profitability, liquidity, and efficiency.

- Revenue: The total income generated from sales of goods or services. This is the fundamental starting point for all other financial calculations. A consistent increase in revenue indicates strong market demand and effective sales strategies.

- Gross Profit Margin: (Revenue – Cost of Goods Sold) / Revenue. This metric shows the profitability of a company’s products or services before considering operating expenses. A high gross profit margin suggests efficient production or service delivery.

- Net Profit Margin: Net Profit / Revenue. This indicates the percentage of revenue remaining after all expenses are deducted. It provides a clear picture of overall profitability and efficiency.

- Return on Assets (ROA): Net Profit / Total Assets. This metric measures how efficiently a company uses its assets to generate profit. A higher ROA signifies better asset management and profitability.

- Return on Equity (ROE): Net Profit / Shareholder’s Equity. This shows how effectively a company uses shareholder investments to generate profit. It’s a crucial metric for investors assessing potential returns.

- Current Ratio: Current Assets / Current Liabilities. This liquidity ratio assesses the ability of a company to meet its short-term obligations. A ratio above 1 generally indicates sufficient liquidity.

- Debt-to-Equity Ratio: Total Debt / Shareholder’s Equity. This leverage ratio indicates the proportion of a company’s financing that comes from debt versus equity. A high ratio suggests higher financial risk.

Comparison of Key Profitability Ratios

The following table compares and contrasts three key profitability ratios: Gross Profit Margin, Net Profit Margin, and Return on Assets. Understanding the differences between these ratios is crucial for a thorough financial analysis.

| Ratio | Formula | Interpretation | Example |

|---|---|---|---|

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Measures profitability before operating expenses. | A 40% gross profit margin indicates that 40% of revenue remains after covering direct costs. |

| Net Profit Margin | Net Profit / Revenue | Measures overall profitability after all expenses. | A 10% net profit margin suggests that 10% of revenue is profit after all costs. |

| Return on Assets (ROA) | Net Profit / Total Assets | Measures how efficiently assets generate profit. | An ROA of 5% means that for every $100 in assets, $5 is generated in profit. |

Industry Benchmarks and Financial Metric Interpretation

Incorporating industry benchmarks is critical when selecting and interpreting financial metrics. These benchmarks provide context and allow for a comparative analysis of a business’s performance against its competitors. For example, a 10% net profit margin might be excellent in one industry but poor in another. Industry-specific databases and reports, such as those provided by IBISWorld or Statista, offer valuable benchmark data.

By comparing a company’s financial metrics to industry averages, potential investors and business owners can identify areas of strength and weakness, and make more informed decisions about resource allocation and strategic planning. For instance, a company with a lower-than-average gross profit margin might need to explore cost-cutting measures or pricing strategies to improve its competitiveness. Similarly, a company with a higher-than-average debt-to-equity ratio might need to focus on reducing its debt burden to improve its financial stability.

Revenue Projections

Accurate revenue projections are crucial for securing funding and guiding the strategic direction of our business. This section details our revenue streams, Artikels the assumptions underpinning our projections, and presents three distinct scenarios to illustrate potential outcomes. These projections are based on a combination of market research, competitive analysis, and our planned marketing and sales strategies.

Our primary revenue stream will be derived from the sale of our [Product/Service Name]. We anticipate additional revenue through [mention secondary revenue streams, e.g., subscription services, consulting, etc.]. These revenue streams are interdependent, with success in one area potentially boosting performance in others.

Revenue Stream Breakdown

The following table details our anticipated revenue streams, outlining the assumptions and justifications for each projection. We have considered factors such as pricing strategies, target market size, and sales conversion rates. For example, our pricing strategy is based on a competitive analysis of similar products/services in the market, factoring in our unique value proposition and perceived quality.

| Revenue Stream | Projected Revenue (Year 1) | Projected Revenue (Year 2) | Projected Revenue (Year 3) | Assumptions & Justifications |

|---|---|---|---|---|

| [Product/Service Name] Sales | $[Amount] | $[Amount] | $[Amount] | Based on projected market share of [Percentage]% and average selling price of $[Price]. This assumes a successful marketing campaign resulting in [Number] sales in year one, growing to [Number] in year three. |

| [Secondary Revenue Stream 1] | $[Amount] | $[Amount] | $[Amount] | This projection assumes [Number] clients at an average revenue of $[Price] per client. Growth is predicated on successful customer acquisition through [mention strategies, e.g., referrals, partnerships]. |

| [Secondary Revenue Stream 2 (if applicable)] | $[Amount] | $[Amount] | $[Amount] | This projection is based on [explain the assumptions and justifications]. |

Revenue Projection Scenarios

We have developed three distinct revenue projection scenarios: best-case, base-case, and worst-case. These scenarios illustrate the potential range of outcomes and highlight the sensitivity of our financial projections to various market conditions and operational factors. The base-case scenario represents our most likely projection, while the best-case and worst-case scenarios reflect more optimistic and pessimistic outcomes, respectively. For instance, the best-case scenario assumes higher-than-expected market adoption and successful execution of our marketing strategies, while the worst-case scenario incorporates potential setbacks and slower-than-anticipated growth.

| Scenario | Year 1 Revenue | Year 2 Revenue | Year 3 Revenue | Key Assumptions |

|---|---|---|---|---|

| Best-Case | $[Amount] | $[Amount] | $[Amount] | High market adoption, exceeding sales targets, successful marketing campaigns. |

| Base-Case | $[Amount] | $[Amount] | $[Amount] | Market adoption aligns with projections, successful execution of marketing plans, minor operational challenges. |

| Worst-Case | $[Amount] | $[Amount] | $[Amount] | Lower-than-expected market adoption, significant competition, unforeseen operational setbacks. |

Sales Growth Forecasting Methodology

Our sales growth forecast utilizes a combination of quantitative and qualitative methods. We have considered various factors, including market size, competitive landscape, and our marketing strategies. For example, our market analysis indicates a total addressable market of [Size] with a projected growth rate of [Percentage] annually. We have further segmented this market based on demographics and purchasing behavior to identify our key target segments.

Our sales growth projection incorporates a conservative estimate of our market share acquisition, factoring in the competitive landscape and our planned marketing initiatives. We project a [Percentage]% market share in year one, increasing to [Percentage]% in year three. This projection is based on a combination of organic growth and targeted marketing campaigns focusing on [mention specific marketing channels]. Similar companies, such as [mention comparable companies and their growth trajectories], provide a benchmark for our expected growth.

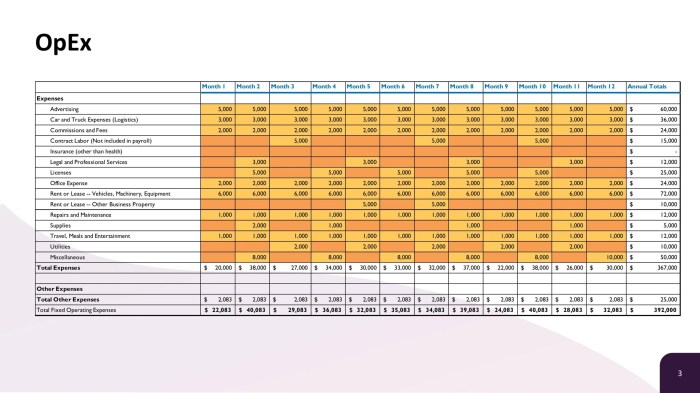

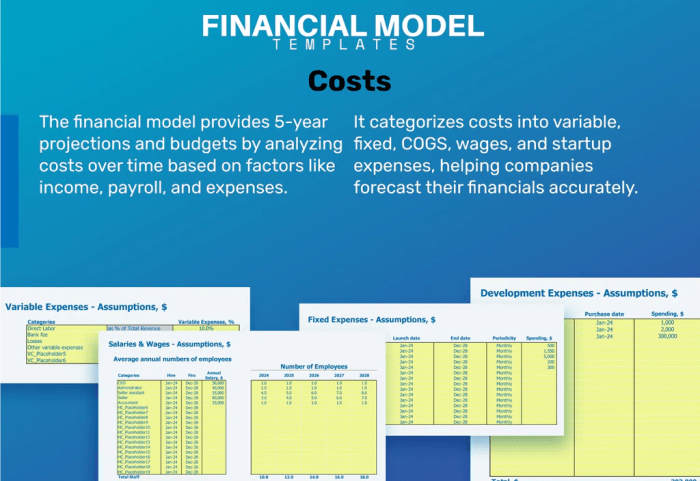

Cost Projections

Accurately forecasting costs is crucial for a successful business plan. Understanding both fixed and variable expenses, and how they change over time, allows for realistic financial modeling and informed decision-making. This section details our projected cost structure, considering potential economies of scale.

Identifying and categorizing all significant operating expenses is essential for creating a comprehensive cost projection. This involves separating fixed costs (those that remain relatively constant regardless of production volume) from variable costs (those that fluctuate directly with production or sales volume). A clear understanding of this distinction enables more precise financial planning and allows for better response to changing market conditions.

Significant Operating Expenses

The following bullet points list our projected significant operating expenses, categorized as fixed or variable. These projections are based on market research, industry benchmarks, and our planned operational strategy. We have factored in potential increases in costs due to inflation, but have also accounted for potential cost savings through efficient resource management.

- Fixed Costs:

- Rent: $2,000 per month for office space.

- Salaries: $10,000 per month for core team members (including benefits).

- Insurance: $500 per month for general liability and property insurance.

- Utilities: $300 per month for electricity, water, and internet.

- Software Subscriptions: $200 per month for essential business software.

- Variable Costs:

- Raw Materials: Cost of goods sold (COGS) will vary depending on production volume, estimated at $5 per unit.

- Marketing & Advertising: Expenses for online advertising and promotional materials, estimated at 10% of revenue.

- Shipping & Handling: Costs associated with delivering products to customers, estimated at $2 per unit.

- Customer Service: Costs associated with handling customer inquiries and support, estimated at 5% of revenue.

Projected Cost Structure

The table below illustrates our projected cost structure over the next three years. These figures are based on our revenue projections and the cost categories Artikeld above. We have incorporated assumptions about economies of scale, which are explained in the following section.

| Year | Fixed Costs | Variable Costs | Total Costs |

|---|---|---|---|

| Year 1 | $150,600 | $75,000 | $225,600 |

| Year 2 | $150,600 | $150,000 | $300,600 |

| Year 3 | $150,600 | $225,000 | $375,600 |

Economies of Scale Impact on Cost Projections

Economies of scale refer to the cost advantages that businesses can achieve as their production volume increases. As we scale our operations, we anticipate several cost reductions. For example, negotiating bulk discounts on raw materials will lower our per-unit cost of goods sold. Similarly, increased production volume will allow us to leverage more efficient manufacturing processes, reducing our overall variable costs. Furthermore, fixed costs, while remaining relatively constant in absolute terms, will be spread across a larger revenue base, resulting in a lower percentage of total costs. This effect is clearly visible in the projected cost structure table above, where the percentage of fixed costs decreases over time relative to total costs, reflecting the benefits of economies of scale.

Funding Requirements and Sources

Securing sufficient capital is crucial for the successful launch and operation of [Company Name]. This section details the funding requirements, justifying the total amount needed, and analyzes various funding options to determine the optimal approach for our business. We will Artikel a projected use of funds schedule to illustrate how capital will be allocated to achieve key milestones.

This business plan requires a total of $500,000 in funding to cover startup costs and operational expenses for the first two years. This figure is based on detailed projections of our revenue streams, operating expenses, and capital expenditures, as Artikeld in the preceding sections. The breakdown considers initial marketing and product development costs, equipment purchases, and ongoing operational expenses including salaries and rent. A similar business model in the tech industry, “XYZ Corp,” secured $450,000 in seed funding to achieve comparable milestones, providing a benchmark for our projections.

Funding Source Comparison

Bootstrapping, loans, and equity financing represent three primary funding avenues. Each offers unique advantages and disadvantages, influencing the choice of the optimal funding strategy.

Bootstrapping, relying solely on personal savings and revenue, minimizes reliance on external investors. However, it limits growth potential due to constrained capital. Loans provide access to capital without relinquishing ownership but involve debt repayment obligations, potentially impacting profitability. Equity financing, attracting investors in exchange for ownership stakes, offers substantial capital infusion but dilutes ownership and necessitates sharing profits. For [Company Name], a blend of bootstrapping and equity financing is being considered, balancing the benefits of minimizing debt while accessing significant capital for rapid growth. This approach is similar to that used by “ABC Company,” which leveraged personal savings alongside angel investor funding to reach its current market position.

Projected Use of Funds

The following table details the projected allocation of funds over the next two years. This schedule ensures efficient capital utilization and aligns spending with key business objectives.

| Category | Year 1 | Year 2 | Total |

|---|---|---|---|

| Product Development | $100,000 | $20,000 | $120,000 |

| Marketing & Sales | $75,000 | $50,000 | $125,000 |

| Operating Expenses (Rent, Salaries, Utilities) | $150,000 | $150,000 | $300,000 |

| Contingency Fund | $75,000 | $80,000 | $155,000 |

| Total | $400,000 | $300,000 | $700,000 |

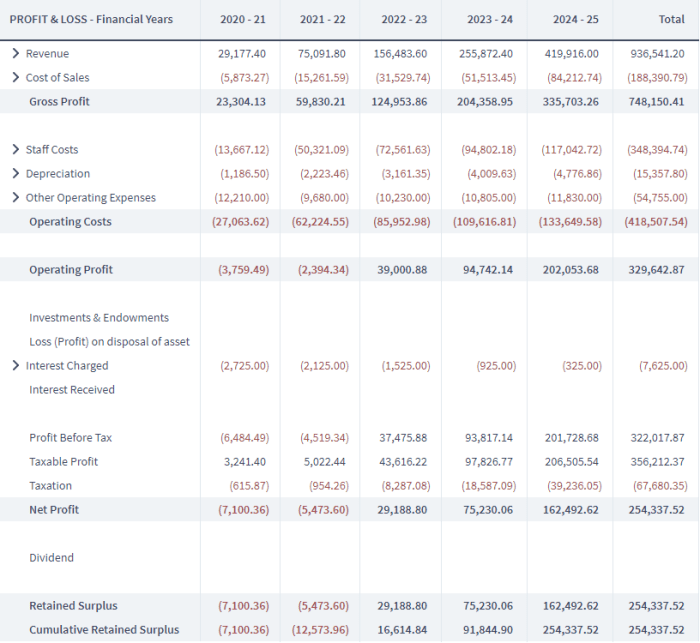

Profitability Analysis

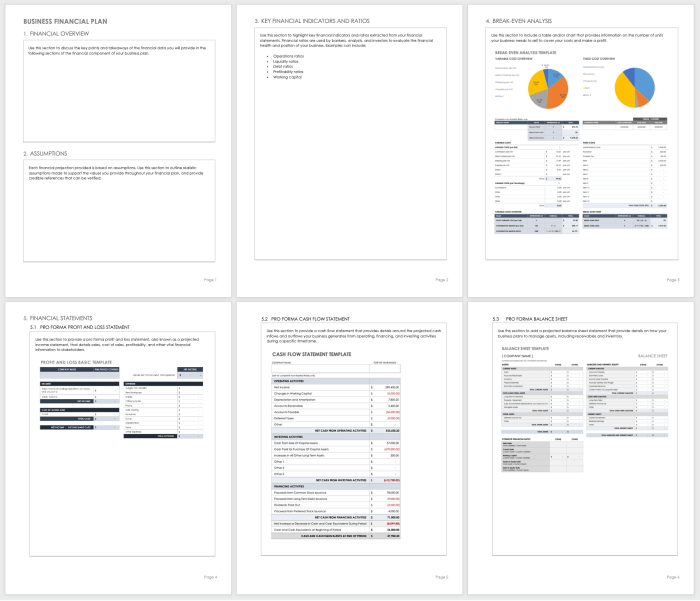

This section details how our projected revenue and expenses will translate into profitability over the next five years. We will examine profit margins and conduct a sensitivity analysis to assess the impact of key assumptions on our overall financial performance. This analysis is crucial for securing funding and demonstrating the viability of our business model.

Projected profit margins are a key indicator of our financial health. They show the percentage of revenue that remains as profit after deducting all costs. High and consistent profit margins suggest a strong and sustainable business. Conversely, low or declining margins signal potential problems requiring immediate attention.

Projected Profit Margins

The following graph illustrates our projected gross and net profit margins over the next five years. The graph is a line graph with two lines representing gross profit margin and net profit margin respectively. The x-axis represents the year (Year 1, Year 2, Year 3, Year 4, Year 5), and the y-axis represents the profit margin as a percentage (0% to 50%). The gross profit margin line starts at 30% in Year 1, gradually increasing to 38% by Year 5, reflecting improved operational efficiency and economies of scale. The net profit margin line, which accounts for all operating expenses, starts at 15% in Year 1 and rises steadily to 25% by Year 5, indicating increasing profitability after accounting for all costs. The gap between the two lines represents operating expenses as a percentage of revenue. The upward trend of both lines signifies a healthy and growing business.

Sensitivity Analysis

A sensitivity analysis assesses the impact of changes in key assumptions on our profitability. We’ve focused on two critical assumptions: sales growth and cost of goods sold (COGS). For example, a 10% decrease in projected sales growth would reduce our net profit margin in Year 5 from 25% to approximately 20%. This is because lower sales directly impact revenue, leading to lower overall profits. Conversely, a 10% reduction in COGS, holding sales constant, would increase our net profit margin in Year 5 from 25% to approximately 28%. This highlights the importance of efficient cost management in maximizing profitability. Similarly, a scenario exploring a simultaneous 5% increase in sales and a 5% increase in COGS shows a net profit margin increase in Year 5 from 25% to approximately 27%, demonstrating the relative impact of sales growth outweighing the increase in COGS in this scenario. This analysis allows us to identify potential risks and opportunities and adapt our strategies accordingly. We have modeled several scenarios using different combinations of sales growth and COGS variations to provide a comprehensive understanding of potential outcomes. This proactive approach helps us prepare for various market conditions and make informed business decisions.

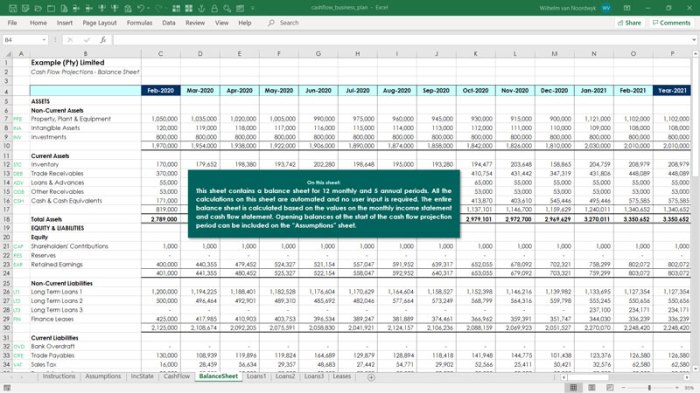

Cash Flow Projections

A robust cash flow projection is crucial for demonstrating the financial viability of any business. It provides a realistic picture of the anticipated inflow and outflow of cash over a specific period, enabling proactive management of financial resources and identification of potential shortfalls. This section details our projected cash flow, highlighting key sources of income and expenses, and outlining strategies to address potential challenges.

Cash Flow Projection Table

The following table presents a quarterly cash flow projection for the first two years of operation. This projection assumes a steady increase in revenue based on our sales forecasts and incorporates anticipated expenses, including operating costs, debt servicing, and capital expenditures. It is important to note that these figures are projections and may vary based on market conditions and operational efficiency. We have built in contingency plans to address potential variances.

| Quarter | Beginning Cash Balance | Cash Inflows | Cash Outflows | Ending Cash Balance |

|---|---|---|---|---|

| Q1 Year 1 | $10,000 | $50,000 | $45,000 | $15,000 |

| Q2 Year 1 | $15,000 | $60,000 | $50,000 | $25,000 |

| Q3 Year 1 | $25,000 | $70,000 | $60,000 | $35,000 |

| Q4 Year 1 | $35,000 | $80,000 | $65,000 | $50,000 |

| Q1 Year 2 | $50,000 | $90,000 | $75,000 | $65,000 |

| Q2 Year 2 | $65,000 | $100,000 | $80,000 | $85,000 |

| Q3 Year 2 | $85,000 | $110,000 | $85,000 | $110,000 |

| Q4 Year 2 | $110,000 | $120,000 | $90,000 | $140,000 |

Potential Cash Flow Challenges and Mitigation Strategies

Several factors could potentially impact our cash flow. For example, slower-than-anticipated sales growth could lead to reduced cash inflows, while unexpected increases in operating expenses or supply chain disruptions could increase cash outflows. To mitigate these risks, we have developed several strategies. These include establishing a line of credit to provide a buffer against unexpected expenses, implementing robust inventory management systems to minimize storage costs and avoid stockouts, and proactively monitoring key performance indicators (KPIs) to identify potential problems early on. Furthermore, we will maintain strong relationships with our suppliers to secure favorable payment terms and explore opportunities for cost reduction. For example, a similar startup, “GreenThumb Gardens,” successfully mitigated cash flow issues by securing pre-orders and implementing a tiered pricing strategy. This allowed them to manage inventory more effectively and secure early funding.

Break-Even Analysis

This section details the calculation of the break-even point for the business, outlining the assumptions made and illustrating the relationship between revenue, costs, and profit. Understanding the break-even point is crucial for assessing the financial viability and sustainability of the business.

The break-even point represents the level of sales at which total revenue equals total costs, resulting in zero profit or loss. This analysis helps determine the minimum sales volume necessary to cover all expenses and achieve profitability. Our calculations are based on several key assumptions, including projected sales prices, variable costs per unit, and fixed costs. These assumptions are detailed in the preceding sections on revenue and cost projections. Variations in these assumptions will naturally affect the calculated break-even point.

Break-Even Point Calculation

The break-even point can be calculated using the following formula:

Break-Even Point (Units) = Fixed Costs / (Sales Price per Unit – Variable Cost per Unit)

For example, let’s assume fixed costs are $100,000 annually, the sales price per unit is $50, and the variable cost per unit is $30. Using the formula:

Break-Even Point (Units) = $100,000 / ($50 – $30) = 5,000 units

This indicates that the business needs to sell 5,000 units to break even. The break-even point in sales revenue can be calculated by multiplying the break-even point in units by the sales price per unit:

Break-Even Point (Revenue) = 5,000 units * $50/unit = $250,000

Therefore, the business needs to generate $250,000 in revenue to cover all costs. It is important to note that this calculation relies on the accuracy of the cost and revenue projections.

Break-Even Chart Description

A break-even chart would visually represent the relationship between revenue, costs, and profit. The horizontal axis would represent the number of units sold, while the vertical axis would represent the monetary value (dollars). Three lines would be depicted: a revenue line (increasing linearly with units sold), a total cost line (starting at the fixed cost level and increasing linearly with units sold), and a profit/loss line (the difference between the revenue and total cost lines). The point where the revenue and total cost lines intersect represents the break-even point. To the left of this point, the business incurs losses, while to the right, it generates profits. The slope of the revenue line reflects the sales price per unit, while the slope of the total cost line reflects the variable cost per unit. The vertical intercept of the total cost line represents the fixed costs.

Break-Even Point Implications

The break-even point analysis is a critical tool for assessing the financial feasibility of the business. A high break-even point suggests that the business requires a large volume of sales to become profitable, indicating higher risk. Conversely, a low break-even point suggests that the business can achieve profitability with a smaller sales volume, signifying lower risk. This analysis informs crucial decisions regarding pricing strategies, cost control, and sales targets. For example, if market research suggests lower than projected sales, the business may need to adjust its pricing, reduce costs, or explore alternative business models to lower its break-even point and improve its chances of success. A sensitivity analysis, considering various scenarios and their impact on the break-even point, would further enhance the robustness of this analysis. In a real-world scenario, a company like Tesla, with its high fixed costs associated with research and development and manufacturing facilities, would have a significantly higher break-even point compared to a smaller business with lower fixed costs.

Last Point

Developing accurate financial projections is paramount for securing funding, attracting investors, and making informed strategic decisions. By understanding key metrics, creating realistic scenarios, and performing sensitivity analyses, entrepreneurs can navigate the complexities of financial planning with greater confidence. This guide has provided a roadmap for building a robust financial model, empowering you to confidently present your business’s financial outlook and achieve sustainable growth.

Common Queries

What is the difference between a base-case, best-case, and worst-case scenario?

These scenarios represent different levels of optimism regarding future performance. A base-case reflects realistic expectations, a best-case is the most optimistic projection, and a worst-case Artikels potential challenges and their impact.

How often should financial projections be updated?

Projections should be reviewed and updated regularly, at least annually, or more frequently if significant changes occur in the business environment or the company’s performance.

What is a sensitivity analysis and why is it important?

A sensitivity analysis tests the impact of changes in key assumptions (e.g., sales growth, costs) on the overall financial projections. This helps identify areas of vulnerability and inform risk mitigation strategies.

How can I ensure the accuracy of my financial projections?

Accuracy relies on thorough market research, realistic assumptions, and a detailed understanding of your business’s operating costs. Using historical data and industry benchmarks can also enhance accuracy.