Understanding cash flow is paramount for any business, regardless of size. Cash flow forecasting, the process of predicting future cash inflows and outflows, provides a crucial roadmap for navigating financial stability. This guide explores the essential aspects of cash flow forecasting, equipping you with the knowledge and tools to make informed financial decisions.

From defining the core concepts and identifying key components to mastering various forecasting methods and utilizing available software, we’ll delve into the practical application of cash flow forecasting. We’ll also cover strategies for improving forecast accuracy and visualizing your financial projections for clearer decision-making.

Defining Cash Flow Forecasting

Cash flow forecasting is the process of projecting a company’s future cash inflows and outflows over a specific period. It’s a crucial tool for businesses of all sizes, providing a vital roadmap for financial planning and decision-making. Understanding and effectively utilizing cash flow forecasts allows businesses to proactively manage their finances, identify potential shortfalls, and capitalize on opportunities for growth.

Cash flow forecasting serves different purposes depending on the size of the business. For small businesses, it’s often essential for securing loans, managing day-to-day expenses, and ensuring sufficient funds to meet payroll and other obligations. Larger corporations utilize cash flow forecasting for more complex financial planning, including capital budgeting, mergers and acquisitions, and long-term strategic investments. The level of detail and sophistication of the forecast will vary depending on the size and complexity of the business.

Key Differences Between Cash Flow Forecasting and Other Financial Statements

Unlike the income statement, which focuses on revenue and expenses over a period, and the balance sheet, which presents a snapshot of assets, liabilities, and equity at a specific point in time, a cash flow forecast concentrates solely on the movement of cash. It predicts the timing and amount of cash inflows (e.g., sales revenue, loan proceeds) and outflows (e.g., rent, salaries, material purchases). This focus on liquidity makes it uniquely valuable for managing working capital and ensuring the business has enough cash on hand to meet its obligations. While the income statement and balance sheet are crucial for understanding overall financial health, the cash flow forecast is vital for predicting short-term solvency and making informed financial decisions.

Industries Where Accurate Cash Flow Forecasting is Particularly Critical

Several industries rely heavily on accurate cash flow forecasting due to their inherent volatility or specific operational characteristics. The construction industry, for example, often involves significant upfront investment with delayed revenue streams, making precise cash flow projections essential for managing working capital and avoiding financial distress. Similarly, the healthcare industry, with its complex billing cycles and fluctuating patient volumes, benefits greatly from robust cash flow forecasting to ensure timely payment of staff and suppliers. Finally, the agricultural sector, with its dependence on seasonal harvests and unpredictable weather patterns, relies on accurate forecasting to secure financing, manage inventory, and plan for potential shortfalls.

Cash Flow Forecasting Methods

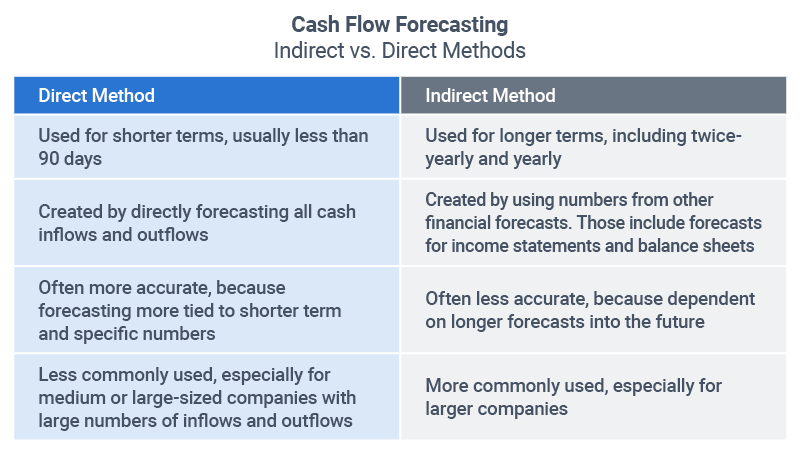

Choosing the appropriate method depends on the complexity of the business and the level of detail required. The direct and indirect methods are two common approaches.

| Method | Advantages | Disadvantages | Applicability |

|---|---|---|---|

| Direct Method | Simple and easy to understand; directly tracks cash inflows and outflows. | Requires detailed records of all cash transactions; can be time-consuming for businesses with many transactions. | Suitable for small businesses with simpler cash flows. |

| Indirect Method | Starts with net income and adjusts for non-cash items; requires less detailed transaction data. | Can be less transparent than the direct method; relies on the accuracy of the income statement. | Suitable for larger businesses with more complex financial structures. |

Key Components of a Cash Flow Forecast

A robust cash flow forecast relies on several key components working in concert. Accurate prediction of future cash inflows and outflows is crucial for effective financial planning and management, enabling businesses to make informed decisions about investments, resource allocation, and overall financial health. Understanding these components allows for a more precise and reliable forecast.

Essential Data Points for Cash Flow Forecasting

Gathering the necessary data is the foundation of a successful cash flow forecast. Incomplete or inaccurate data will inevitably lead to unreliable predictions. The following data points are essential for building a comprehensive forecast:

- Sales Forecasts: Projected revenue based on sales history, market trends, and anticipated growth.

- Accounts Receivable: Estimates of outstanding invoices and expected collection times.

- Inventory Levels: Current inventory value and projected changes based on sales forecasts and purchasing plans.

- Accounts Payable: Outstanding bills and anticipated payment schedules to suppliers.

- Operating Expenses: Projected costs for salaries, rent, utilities, marketing, and other operational expenses.

- Capital Expenditures (CAPEX): Planned investments in fixed assets like equipment or property.

- Debt Repayments: Scheduled loan payments and interest expenses.

- Other Income and Expenses: Any other anticipated cash inflows or outflows, such as investment income or one-time expenses.

The Importance of Accurate Sales Forecasting

Accurate sales forecasting is arguably the most critical component of a cash flow forecast. It directly impacts projected cash inflows, influencing all other aspects of the forecast. For example, an overestimation of sales could lead to overspending on inventory or other resources, while an underestimation could result in missed opportunities or liquidity problems. Effective sales forecasting involves analyzing historical sales data, considering seasonal variations, market trends, and economic conditions, and incorporating any planned marketing or sales initiatives. Companies often use sophisticated forecasting models, including statistical methods and trend analysis, to improve accuracy. A case study of a retail company that accurately predicted a surge in demand during a holiday season by analyzing past data and successfully adjusted its inventory and staffing levels to maximize profits, illustrates the impact of a precise sales forecast.

Impact of Inventory Management on Cash Flow Predictions

Effective inventory management significantly influences cash flow. Holding excessive inventory ties up capital that could be used elsewhere, impacting cash availability. Conversely, insufficient inventory can lead to lost sales and potential disruptions to operations. Accurate inventory forecasting, considering lead times, storage costs, and demand fluctuations, is crucial for optimizing cash flow. For instance, a manufacturing company that implemented a just-in-time inventory system reduced its inventory holding costs and improved its cash flow significantly, illustrating how effective inventory management can enhance cash flow predictability.

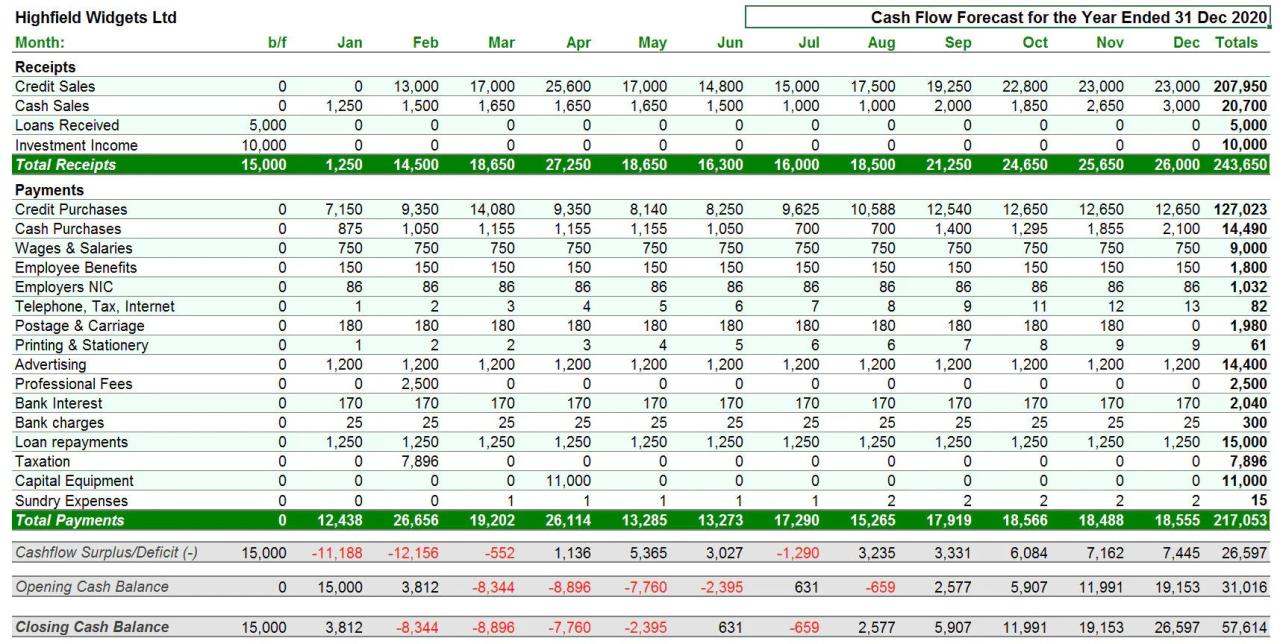

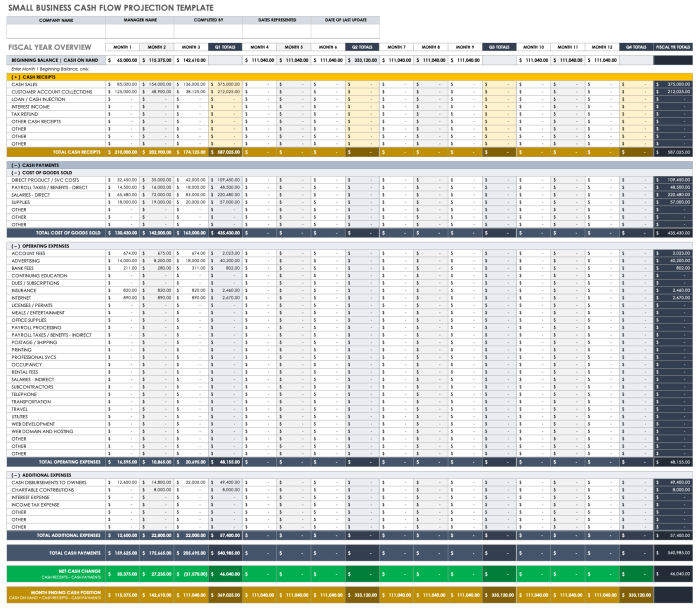

Sample Cash Flow Forecast Template

A simple cash flow forecast template can be structured as follows:

| Month | Beginning Cash Balance | Cash Inflows (Sales, etc.) | Cash Outflows (Expenses, etc.) | Ending Cash Balance |

|---|---|---|---|---|

| January | $10,000 | $25,000 | $20,000 | $15,000 |

| February | $15,000 | $20,000 | $18,000 | $17,000 |

| March | $17,000 | $30,000 | $22,000 | $25,000 |

Note: This is a simplified example. A more detailed template would include specific income and expense categories, as well as debt repayments and capital expenditures.

Methods and Techniques for Forecasting

Accurately predicting future cash flow requires employing appropriate forecasting methods. The choice of method depends on factors such as data availability, the desired level of accuracy, and the complexity of the business. Several techniques offer varying degrees of sophistication and applicability.

Comparison of Forecasting Methods

Trend analysis, regression analysis, and moving averages represent three common approaches to cash flow forecasting. Trend analysis identifies patterns in historical data to project future values. It’s simple to understand and implement, but assumes a consistent trend, which may not always hold true. Regression analysis establishes a statistical relationship between cash flow and other variables, offering a more nuanced prediction, but requires sufficient data and a strong correlation between variables. Moving averages smooth out short-term fluctuations by averaging cash flows over a specified period, providing a less volatile forecast, but may lag behind significant shifts in cash flow. The optimal method often involves a combination of these techniques.

Trend Analysis in Practice

Consider a small bakery whose monthly revenue has consistently increased by 5% over the past year. Using trend analysis, we can project next month’s revenue by simply increasing this month’s revenue by 5%. While straightforward, this method ignores external factors like seasonal changes or marketing campaigns that could significantly impact revenue.

Regression Analysis Application

A larger retail chain might use regression analysis to forecast sales based on factors like advertising spend, customer traffic, and economic indicators. By analyzing historical data and identifying statistically significant relationships, the company can create a more accurate forecast that accounts for multiple influencing variables. For example, if data shows a strong correlation between advertising spend and sales, a regression model can predict sales based on planned advertising expenditure.

Moving Averages Example

A seasonal business like a Christmas tree farm could use a moving average to smooth out the highly variable monthly sales figures. A 12-month moving average would provide a more stable forecast, reflecting the overall annual sales trend, rather than the dramatic fluctuations between peak season and off-season. This helps in planning inventory and staffing levels more effectively.

Spreadsheet-Based Cash Flow Forecasting

Building a cash flow forecast using a spreadsheet program like Microsoft Excel or Google Sheets involves a structured approach.

Step-by-Step Guide to Spreadsheet Forecasting

- Data Collection: Gather historical cash flow data (e.g., monthly or quarterly) including inflows and outflows.

- Data Entry: Input this data into a spreadsheet, clearly labeling each column (e.g., month, sales revenue, cost of goods sold, operating expenses, etc.).

- Forecast Inflows: Project future inflows based on chosen forecasting methods (trend analysis, regression, moving averages, or a combination). For example, if using trend analysis, calculate future sales by applying a growth rate to historical sales data. If using moving averages, calculate the average of the past several periods’ cash inflows.

- Forecast Outflows: Project future outflows, considering factors like planned purchases, rent payments, salaries, etc. Ensure these are aligned with business plans and budgets.

- Net Cash Flow Calculation: Subtract total outflows from total inflows for each period to obtain the net cash flow.

- Cumulative Cash Flow Calculation: Calculate the cumulative cash flow by adding the net cash flow of each period to the previous period’s cumulative cash flow. This reveals the overall cash position over time.

- Charting and Visualization: Create charts and graphs to visualize the forecast, making it easier to identify potential cash flow shortages or surpluses.

Incorporating Seasonality and Cyclical Patterns

Seasonal variations and cyclical patterns significantly impact cash flow. To incorporate these, historical data should be analyzed to identify recurring peaks and troughs. Seasonal indices can be calculated to adjust the base forecast. For instance, if a business experiences higher sales during the holiday season, the forecast for those months should be adjusted upwards based on historical data. Similarly, cyclical patterns, such as economic booms and recessions, should be considered when making longer-term projections. Using past cyclical data to inform future predictions can improve forecast accuracy. For example, if a business experienced a sales dip during a past recession, that historical data can be used to inform the forecast during a future economic downturn.

Analyzing and Interpreting the Forecast

A well-prepared cash flow forecast is not merely a prediction; it’s a powerful tool for proactive financial management. Analyzing the forecast allows businesses to identify potential risks and opportunities, enabling informed decision-making and ultimately, improved financial health. Understanding the nuances of the forecast – both the positive and negative aspects – is crucial for effective strategic planning.

Analyzing the forecast involves a careful examination of projected inflows and outflows over the forecast period. This detailed review reveals potential areas of concern and highlights opportunities for improvement. By comparing projected cash balances to minimum operating requirements, businesses can pinpoint potential cash flow shortfalls or surpluses. For instance, a consistent negative cash balance indicates a significant need for corrective action, while consistently high positive balances may suggest opportunities for investment or debt reduction.

Identifying Potential Cash Flow Shortfalls or Surpluses

Identifying potential cash flow shortfalls or surpluses involves comparing projected cash inflows (e.g., sales revenue, loan proceeds) with projected cash outflows (e.g., operating expenses, debt repayments, capital expenditures) for each period within the forecast. A shortfall occurs when projected outflows exceed inflows, resulting in a negative cash balance. Conversely, a surplus arises when inflows exceed outflows, leading to a positive cash balance. A simple comparison of these figures period by period will quickly highlight potential problem areas. For example, a seasonal business might experience a significant cash shortfall during the off-season, while a rapidly growing company might face a temporary shortfall as it invests heavily in inventory or equipment. Careful analysis can also reveal trends – for example, consistently increasing operating expenses may signal a need for cost-cutting measures.

Strategies for Mitigating Potential Cash Flow Problems

Several strategies can mitigate potential cash flow problems identified in the forecast. These strategies can be broadly categorized into improving cash inflows, reducing cash outflows, and securing external financing. Improving cash inflows might involve accelerating invoice payments from customers, offering early payment discounts, or exploring new revenue streams. Reducing cash outflows could involve negotiating better terms with suppliers, delaying non-essential purchases, or streamlining operations to improve efficiency. Securing external financing may involve obtaining a short-term loan, a line of credit, or seeking investor funding. The choice of strategy depends on the nature and severity of the cash flow problem, the business’s risk tolerance, and the availability of resources. For example, a small business facing a temporary shortfall might negotiate extended payment terms with suppliers, while a larger company might secure a line of credit to finance expansion.

Using the Forecast to Support Strategic Decision-Making

The cash flow forecast is a valuable tool for strategic decision-making. It can inform decisions related to investment, expansion, pricing, and resource allocation. For instance, a positive cash flow forecast might support investment in new equipment or expansion into new markets. Conversely, a negative cash flow forecast might necessitate a reassessment of pricing strategies, cost-cutting measures, or a delay in expansion plans. Analyzing the forecast can also reveal the impact of different strategic choices. For example, a business considering a price increase can use the forecast to estimate the impact on sales volume and overall cash flow. Similarly, the forecast can be used to evaluate the financial implications of different marketing campaigns or product development initiatives. A company planning a major capital expenditure project can use the forecast to determine the project’s feasibility by assessing its impact on future cash flows.

Actionable Steps Based on Different Forecast Scenarios

The following actionable steps can be taken based on the forecast’s projected scenario:

The forecast provides a critical roadmap for informed decisions. Acting proactively based on its predictions significantly enhances a business’s ability to navigate financial challenges and capitalize on opportunities.

- Positive Forecast: Invest in growth opportunities (new equipment, expansion), accelerate debt repayment, increase marketing efforts, explore acquisitions, develop new product lines.

- Negative Forecast: Negotiate better payment terms with suppliers, reduce operating expenses (e.g., renegotiate contracts, improve efficiency), explore short-term financing options (e.g., lines of credit, loans), delay non-essential purchases, implement cost-cutting measures.

- Neutral Forecast: Maintain current operations, explore new revenue streams, invest in strategic initiatives with moderate risk, strengthen financial reserves, assess opportunities for innovation and improvement.

Software and Tools for Cash Flow Forecasting

Accurate cash flow forecasting is crucial for business success, and utilizing appropriate software can significantly enhance the process. Many tools are available, each offering varying levels of functionality and complexity, catering to businesses of all sizes and financial sophistication. Selecting the right software depends heavily on understanding your specific needs and resources.

Software solutions designed for cash flow forecasting automate many of the manual tasks associated with creating and analyzing forecasts, leading to increased efficiency and accuracy. They typically offer features that go beyond simple spreadsheet calculations, providing advanced analytical capabilities and visualization tools. This allows businesses to make more informed decisions based on a clearer understanding of their financial future.

Capabilities of Cash Flow Forecasting Software

A wide range of software solutions exist, from simple spreadsheet add-ins to sophisticated enterprise resource planning (ERP) systems. Spreadsheet programs like Microsoft Excel or Google Sheets, while readily available, often require significant manual input and lack advanced analytical features. Dedicated cash flow forecasting software, on the other hand, automates data entry, performs complex calculations, and offers advanced visualization tools. More comprehensive solutions, such as ERP systems, integrate cash flow forecasting with other business functions, providing a holistic view of the company’s financial health. For example, a small business might use a simple cloud-based solution with basic forecasting capabilities, while a large corporation might leverage a complex ERP system integrated with its accounting and inventory management systems.

Comparison of Software Features and Benefits

The choice between different software options hinges on several key factors. Consider the size and complexity of your business, the level of detail required in your forecasts, and your budget. Some software offers advanced features such as scenario planning, what-if analysis, and integration with other financial systems. These advanced features allow for more sophisticated forecasting and risk assessment. For instance, a software with scenario planning capabilities could allow a business to model the impact of different economic conditions on its cash flow. Other software might focus on ease of use and accessibility, prioritizing a user-friendly interface over advanced analytics. The benefits of choosing the right software include improved accuracy, reduced time spent on forecasting, better decision-making, and enhanced financial control.

Importance of Choosing Appropriate Software for Business Size and Complexity

Selecting software that aligns with your business size and complexity is paramount. A small business with simple financial needs might find a basic, cloud-based solution sufficient. This type of software is often more affordable and easier to use. However, a larger enterprise with complex financial operations might require a more robust, integrated solution, potentially an ERP system, to manage its cash flow effectively. Choosing software that is too simplistic can limit forecasting capabilities and lead to inaccurate projections. Conversely, selecting software that is overly complex can be costly, difficult to implement, and may introduce unnecessary complications. The right fit ensures efficient forecasting without compromising accuracy or usability.

Key Functionalities of Good Cash Flow Forecasting Software

A good cash flow forecasting software package should possess several core functionalities. These include automated data import from various sources (e.g., accounting software, bank statements), customizable forecasting periods (e.g., monthly, quarterly, annually), multiple scenario planning capabilities, robust reporting and visualization tools (e.g., charts, graphs), and integration with other business applications. Furthermore, strong security features to protect sensitive financial data are essential. The software should also provide clear and concise reports that are easily understood by both financial professionals and non-financial stakeholders. For example, the ability to generate customized reports that highlight key cash flow metrics and trends can provide valuable insights for decision-making.

Improving Forecasting Accuracy

Accurate cash flow forecasting is crucial for effective financial management. Improving the accuracy of your forecasts requires a multi-faceted approach, combining robust data collection with insightful analysis and a commitment to continuous improvement. By implementing the strategies Artikeld below, businesses can significantly enhance the reliability of their cash flow projections.

Techniques for Improving Sales Forecasts

Accurate sales forecasting is the bedrock of a reliable cash flow forecast. Several techniques can significantly improve the accuracy of these projections. Using a combination of these methods often yields the best results.

- Historical Data Analysis: Analyzing past sales data, identifying trends, and seasonal variations provides a strong foundation for future predictions. For example, a retail business might notice a significant increase in sales during the holiday season, allowing them to anticipate higher cash inflows during those months.

- Market Research: Understanding market trends, competitor activity, and customer behavior offers valuable insights. Surveys, focus groups, and analysis of industry reports can provide crucial information for refining sales forecasts.

- Sales Force Input: Gathering sales forecasts from individual sales representatives provides a ground-level perspective. This approach can incorporate valuable insights into customer pipeline and potential future deals.

- Statistical Forecasting Methods: Employing statistical models, such as moving averages or exponential smoothing, can help identify patterns and trends in sales data, leading to more accurate predictions. For instance, a moving average forecast smooths out short-term fluctuations, providing a clearer picture of underlying sales trends.

Common Pitfalls to Avoid When Creating a Cash Flow Forecast

Several common mistakes can significantly undermine the accuracy of a cash flow forecast. Avoiding these pitfalls is crucial for generating reliable projections.

- Underestimating Expenses: Failing to account for all potential expenses, including unexpected costs, can lead to significant inaccuracies. A contingency fund should be considered in the forecast to account for unforeseen circumstances.

- Overly Optimistic Sales Projections: Inflating sales forecasts can create a false sense of financial security. Realistic sales projections, based on thorough market analysis, are crucial for accurate forecasting.

- Ignoring Seasonal Variations: Failing to consider seasonal fluctuations in sales and expenses can lead to significant discrepancies between the forecast and actual cash flow. Businesses with seasonal sales patterns should adjust their forecasts accordingly.

- Inaccurate Debt Repayment Schedules: Incorrectly accounting for loan repayments or other debt obligations can lead to inaccurate cash flow projections. Careful tracking and accurate recording of debt obligations are essential.

Incorporating Feedback Loops to Refine Future Forecasts

Regularly reviewing and adjusting the cash flow forecast based on actual results is crucial for continuous improvement. Feedback loops ensure that the forecast remains relevant and accurate over time.

For example, a company could compare its actual monthly revenue against the forecasted revenue. If there is a significant variance, they can investigate the reasons for the discrepancy. This could involve analyzing sales performance, marketing effectiveness, or external factors impacting sales. This analysis informs adjustments to future forecasts, making them more accurate. This iterative process of comparing actuals to forecasts and adjusting the model is key to improving forecasting accuracy over time.

Importance of Regular Review and Adjustment of the Cash Flow Forecast

The cash flow forecast is not a static document; it’s a dynamic tool that should be regularly reviewed and adjusted to reflect changing circumstances. Regular review ensures the forecast remains a useful and accurate guide for financial decision-making.

Regular review, ideally monthly, allows for early identification of potential cash flow problems. This enables proactive measures to be taken, mitigating potential financial difficulties. Furthermore, adjustments based on actual performance ensure the forecast remains a reliable tool for financial planning and decision-making.

Visualizing Cash Flow Forecasts

Visualizing cash flow forecasts is crucial for effective communication and insightful analysis. Transforming raw numerical data into easily digestible visual formats allows stakeholders to quickly grasp trends, identify potential problems, and make informed decisions. Different visualization methods cater to various needs and preferences, offering a powerful way to enhance understanding and facilitate collaborative planning.

Effective visualization helps stakeholders understand the overall financial health of a business at a glance. It facilitates quick identification of periods of surplus or deficit, highlighting potential cash flow bottlenecks or opportunities for improvement. Visual representations are particularly useful when presenting forecasts to non-financial audiences, simplifying complex data and making it more accessible.

Chart and Graph Types for Cash Flow Visualization

Several chart types are well-suited for depicting cash flow forecasts. The choice depends on the specific information to be emphasized and the audience’s familiarity with different visual formats. Line graphs are excellent for showcasing trends over time, while bar charts effectively compare cash inflows and outflows across specific periods. Area charts can highlight the cumulative cash balance, providing a clear picture of the overall financial position.

Benefits of Visual Aids in Communicating Cash Flow Information

Visual aids significantly enhance the communication of cash flow information. They simplify complex data, making it easily understandable for a wider audience, including non-financial stakeholders. Visual representations allow for quick identification of trends, patterns, and potential issues. They also facilitate better collaboration and decision-making by providing a common visual framework for discussion and analysis. Furthermore, visual aids improve the retention of information, making it easier for stakeholders to remember key insights from the forecast.

Examples of Effective Visual Representations

A line graph showing monthly cash flow over a year would clearly illustrate seasonal variations or unexpected spikes in expenses. A bar chart comparing projected cash inflows and outflows for each quarter would quickly highlight potential shortfalls. A stacked bar chart could visually represent the composition of cash inflows (e.g., sales, investments, loans) and outflows (e.g., operating expenses, debt repayments, capital expenditures). A waterfall chart can effectively display the cumulative effect of cash inflows and outflows over time, clearly showing the net change in cash balance.

Line Graph Example: Hypothetical Cash Flow Forecast

Consider a hypothetical line graph illustrating a small business’s cash flow forecast for the next 12 months. The x-axis represents the months (January to December), and the y-axis represents the cash balance in thousands of dollars. The line itself would show the projected cash balance fluctuating throughout the year. Key data points could include:

* January: Starting balance of $10,000.

* March: A significant inflow due to seasonal sales, peaking at $30,000.

* June: A dip in the balance due to increased operating expenses, falling to $15,000.

* September: Another sales peak, reaching $25,000.

* December: Ending balance of $20,000.

The graph would clearly show the cyclical nature of the business’s cash flow, highlighting periods of surplus and deficit. Clear labels on both axes and a descriptive title (e.g., “Projected Cash Flow: Next 12 Months”) would enhance readability and understanding. Color-coding could further differentiate inflows and outflows. This visual representation quickly communicates the overall financial health and potential risks or opportunities.

Final Summary

Effective cash flow forecasting is not merely a financial exercise; it’s a strategic tool that empowers businesses to proactively manage their resources, mitigate risks, and seize opportunities. By understanding the principles Artikeld in this guide, businesses can build a strong foundation for financial health and sustainable growth. Regular review, adaptation, and a commitment to accurate data input are key to harnessing the full potential of cash flow forecasting.

Questions Often Asked

What is the difference between cash flow forecasting and budgeting?

Cash flow forecasting predicts future cash flows, while budgeting allocates funds for planned expenses. Forecasting is forward-looking, while budgeting is often more focused on the present and near future, often working in conjunction.

How often should I update my cash flow forecast?

The frequency depends on your business’s volatility. Monthly updates are common for most businesses, but more frequent updates (weekly or even daily) may be necessary for businesses with highly variable cash flows.

What if my forecast is inaccurate?

Inaccuracies highlight areas needing improvement. Analyze the discrepancies, adjust your forecasting methods, and refine your data collection processes. Regular review and feedback loops are essential for continuous improvement.

Can I use a simple spreadsheet for cash flow forecasting?

Yes, especially for smaller businesses. Spreadsheets offer flexibility and are a good starting point. However, as your business grows, dedicated software may become more efficient.