Cash Flow Forecasting Techniques are crucial for business success, acting as a financial crystal ball peering into the future. Understanding the nuances of short-term versus long-term forecasting, and mastering both direct and indirect methods, is paramount for financial stability. This guide will equip you with the knowledge to navigate the complexities of cash flow prediction, from basic methods to sophisticated statistical modeling, ensuring your business stays afloat and even thrives.

We’ll explore various forecasting methods, from the straightforward direct approach to the more nuanced indirect method, highlighting their strengths and weaknesses. We’ll delve into advanced techniques like statistical modeling and Monte Carlo simulations, offering practical examples and actionable strategies. The ultimate goal? Empowering you to create accurate, insightful forecasts that inform smart financial decisions.

Introduction to Cash Flow Forecasting: Cash Flow Forecasting Techniques

Forecasting cash flow isn’t just about number crunching; it’s the financial crystal ball that helps businesses avoid the dreaded “oops, we’re broke” moment. Accurate cash flow forecasting is the lifeblood of a thriving enterprise, providing the foresight needed to navigate the choppy waters of financial uncertainty. Think of it as your business’s early warning system, alerting you to potential pitfalls before they become full-blown disasters. Without it, you’re essentially sailing a ship without a map, relying solely on luck and hope – a recipe for financial shipwreck.

Accurate cash flow forecasting is paramount for business success because it allows for proactive financial management. Knowing when cash will be plentiful and when it will be scarce enables strategic decision-making. This means businesses can secure necessary funding, invest wisely, manage expenses effectively, and ultimately, increase their chances of long-term survival and prosperity. Imagine trying to run a marathon without knowing the terrain – you’d be exhausted and probably wouldn’t finish. Cash flow forecasting provides that essential roadmap.

Types of Cash Flow Forecasts

Cash flow forecasts come in various flavors, each tailored to a specific timeframe and purpose. Understanding the differences is crucial for making informed financial decisions. A poorly chosen forecasting method is like using a hammer to screw in a screw – it might work, but it’s inefficient and potentially damaging.

- Short-Term Cash Flow Forecasts: These typically cover a period of one to three months, providing a granular view of immediate cash inflows and outflows. They are invaluable for managing day-to-day operations, ensuring sufficient funds for payroll, rent, and other immediate expenses. Think of it as your daily weather report – it tells you what to expect in the immediate future, so you can pack accordingly (or in this case, manage your finances accordingly).

- Long-Term Cash Flow Forecasts: These forecasts span a longer period, usually one to five years or more. They offer a broader perspective on the company’s financial health, helping to assess long-term viability and guide strategic planning, such as expansion or major investments. This is like your yearly travel plan – it helps you anticipate larger expenses and plan your budget accordingly.

- Rolling Forecasts: These are dynamic forecasts that are constantly updated. As new data becomes available, the forecast is adjusted to reflect the current financial reality. It’s like a GPS that constantly recalculates your route based on traffic conditions – always keeping you on the most efficient path.

Businesses Benefiting Most from Robust Cash Flow Forecasting

While all businesses can benefit from cash flow forecasting, some rely on it more heavily than others. These are typically businesses operating in industries characterized by fluctuating revenues, significant capital expenditures, or tight margins.

- Startups: Startups often face cash flow challenges due to high initial investment costs and unpredictable revenue streams. Accurate forecasting is essential for securing funding and ensuring survival during the crucial early stages.

- Seasonal Businesses: Businesses with seasonal revenue fluctuations, such as retailers or tourism operators, rely on forecasting to manage cash flow effectively during periods of high and low demand. They can better prepare for slow periods and make the most of peak seasons.

- Construction Companies: Construction projects often involve large upfront investments and lengthy payment cycles. Robust cash flow forecasting is crucial for managing expenses and ensuring sufficient funds are available to complete projects.

Direct Forecasting Methods

Direct forecasting, in the whimsical world of finance, is like building a Lego castle – you meticulously add each brick (cash inflow and outflow) to create the magnificent structure (your cash flow forecast). Unlike some more abstract methods, it’s refreshingly straightforward: you estimate your future cash inflows and outflows directly, without relying on intermediary steps like sales projections. This approach, while seemingly simple, holds its own unique charm and challenges.

Direct forecasting operates under a few key assumptions. Firstly, it assumes you possess a crystal ball (or at least a very good understanding) of your future business activities. You need to accurately predict your sales, expenses, and other cash movements. Secondly, it assumes that these predictions are relatively stable and won’t be wildly affected by unforeseen circumstances (like a sudden meteor shower disrupting your supply chain). Finally, it assumes you have the data to support your estimations – historical data, market research, and a healthy dose of intuition all play a crucial role.

Businesses Utilizing the Direct Method

The direct method isn’t just for theoretical finance textbooks; real-world businesses, particularly those with stable, predictable cash flows, find it highly effective. Imagine a subscription-based software company with a large, loyal customer base. Their recurring revenue is fairly predictable, making direct forecasting a breeze. Similarly, businesses with long-term contracts, such as construction firms working on large-scale projects, can utilize this method effectively, as their cash flows are largely determined by the project timeline and agreed-upon payments. Even a small bakery with consistent daily sales could leverage this approach, given their relatively predictable revenue stream.

Limitations of the Direct Method

While the direct method possesses an undeniable allure in its simplicity, it’s not without its quirks. Its Achilles’ heel lies in its dependence on accurate predictions. Unexpected events, such as economic downturns, changes in customer demand, or supply chain disruptions, can easily throw off your carefully constructed forecast. Moreover, the direct method can be incredibly time-consuming if you’re dealing with a complex business with numerous cash flow streams. It demands detailed analysis and meticulous record-keeping, which, let’s be honest, can be more challenging than herding cats.

Hypothetical Scenario: The “Flour Power” Bakery

Let’s consider “Flour Power,” a charming bakery with predictable daily sales. Using the direct method, we can forecast their cash flow for the next week.

| Date | Inflows ($) | Outflows ($) | Net Cash Flow ($) |

|---|---|---|---|

| Oct 26 | 500 | 200 | 300 |

| Oct 27 | 450 | 180 | 270 |

| Oct 28 | 550 | 220 | 330 |

| Oct 29 | 600 | 250 | 350 |

| Oct 30 | 520 | 210 | 310 |

| Oct 31 | 480 | 190 | 290 |

| Nov 1 | 580 | 230 | 350 |

Indirect Forecasting Methods

Ah, the indirect method – a delightfully sneaky way to predict your cash flow. Instead of directly estimating inflows and outflows (like those poor souls using the direct method), we start with something seemingly unrelated: net income. Think of it as a detective story, where net income is our crucial clue, leading us to the treasure chest of future cash flow. It’s less straightforward, but sometimes, the indirect route is the most efficient.

The indirect method uses net income as a starting point and then adjusts it for non-cash items and changes in working capital to arrive at a forecast of cash flow. This approach leverages the readily available information found in the company’s income statement and balance sheet, which, let’s face it, are far more readily available than detailed projections of every single transaction. It’s like using a shortcut through the woods instead of hacking through the dense undergrowth – less work, but possibly a slightly less precise result.

Comparison of Direct and Indirect Methods

The direct method meticulously details each anticipated cash inflow and outflow, providing a granular view of cash movements. Imagine meticulously tracking every penny – exhausting, but undeniably thorough. The indirect method, however, is more of a “big picture” approach, starting with net income and adjusting for non-cash items. It’s like looking at a map instead of walking every single path. The direct method is best suited for businesses with highly predictable cash flows, while the indirect method shines when dealing with more complex and variable cash flows. The choice depends on the specific needs and resources of the business. Think of it as choosing between a detailed topographical map and a simpler road map – both get you to your destination, but with different levels of detail.

Situations Favoring the Indirect Method

The indirect method proves particularly useful for companies with complex operations or those lacking detailed historical data on cash inflows and outflows. For example, a rapidly growing startup might find the direct method challenging due to the constant influx of new products and services, making precise cash flow projections difficult. The indirect method allows them to utilize their existing financial statements and adjust for known discrepancies. Similarly, a company undergoing significant restructuring or expansion might find the indirect method a more manageable approach during periods of uncertainty. It’s like using a compass when the detailed map is torn and illegible.

Implementing the Indirect Method: A Step-by-Step Guide

Now, for the moment you’ve all been waiting for – the step-by-step guide! Follow these instructions carefully, and you’ll be forecasting like a pro (or at least, like someone who’s read a guide on forecasting).

- Begin with Net Income: This is your starting point. Grab your income statement; it’s the foundation of our indirect method castle.

- Adjust for Non-Cash Items: Add back depreciation and amortization. These are expenses that don’t involve actual cash outflow. Think of it as accounting magic – poof! The expense disappears (from a cash flow perspective, that is).

- Account for Changes in Working Capital: Analyze changes in accounts receivable, accounts payable, and inventory. Increases in receivables reduce cash flow (customers haven’t paid yet!), while increases in payables increase cash flow (we haven’t paid our suppliers yet!). Inventory changes can be a bit trickier, but generally, increases reduce cash flow. This is where the detective work truly begins.

- Include Other Cash Flows: Add or subtract any other cash inflows or outflows not reflected in net income, such as proceeds from financing activities (loans, equity) or capital expenditures. This is the final piece of the puzzle.

- Arrive at Net Cash Flow: The result of all these adjustments is your forecasted net cash flow. Celebrate your success (with a sensible, budget-friendly celebration, of course).

Advanced Forecasting Techniques

Let’s ditch the rudimentary forecasting methods and dive into the exciting world of advanced techniques! Think of it as upgrading from a bicycle to a rocket ship – much faster, much more powerful, and significantly less prone to flat tires (metaphorically speaking, of course. We’re still dealing with the unpredictable nature of cash flow). These techniques add layers of sophistication, allowing for more accurate predictions and a deeper understanding of your financial future. Prepare for liftoff!

Statistical Modeling in Cash Flow Forecasting

Statistical modeling brings the power of mathematics to bear on your cash flow projections. Instead of relying solely on intuition or simple trend lines, these models use historical data to identify patterns and relationships, then extrapolate those patterns into the future. This allows for a more objective and potentially more accurate forecast, especially when dealing with complex datasets. Common statistical models employed include regression analysis (linear, multiple, etc.), time series analysis (ARIMA, exponential smoothing), and even machine learning algorithms. For example, a company might use multiple regression to predict sales based on factors like advertising spend, seasonality, and economic indicators. The model would then use these predicted sales to project cash inflows.

Incorporating Seasonality and Trends into Cash Flow Projections

Seasonality and trends are the rhythmic heartbeat of many businesses. Ignoring them is like trying to navigate a river without knowing its currents – you’ll likely end up stranded. Seasonality refers to predictable fluctuations in cash flow related to specific times of the year (e.g., increased sales during the holiday season for a retailer). Trends represent the longer-term direction of cash flow, reflecting growth or decline over time. To incorporate these factors, you can decompose your historical data to isolate seasonal components and trend components. This can be achieved through statistical methods like moving averages or more sophisticated time series decomposition techniques. Then, you can project these components separately and recombine them to generate a more realistic forecast. A clothing retailer, for example, would anticipate higher cash inflows during back-to-school season and holiday shopping periods and account for this in their forecast.

Discounted Cash Flow (DCF) Analysis in Forecasting, Cash Flow Forecasting Techniques

DCF analysis is a powerful tool for valuing investments and projects, and it also finds a useful place in cash flow forecasting, especially when dealing with long-term projections. The core concept is that money received in the future is worth less than money received today due to the time value of money. DCF analysis discounts future cash flows back to their present value using a discount rate that reflects the risk associated with the cash flows. This allows for a more realistic comparison of cash flows occurring at different points in time. For instance, a company considering a new factory might use DCF to assess whether the projected future cash flows from the factory justify the upfront investment. The formula is fairly straightforward:

PV = FV / (1 + r)^n

where PV is present value, FV is future value, r is the discount rate, and n is the number of periods.

Monte Carlo Simulations for Cash Flow Forecasting

Monte Carlo simulations are the heavyweight champions of cash flow forecasting. They inject a healthy dose of reality into your projections by acknowledging the inherent uncertainty in forecasting. Instead of relying on single-point estimates, Monte Carlo simulations run thousands or even millions of iterations, each using slightly different inputs based on probability distributions. This produces a range of possible outcomes, giving you a much clearer picture of the potential risks and rewards. Imagine a scenario where a company is forecasting sales. Instead of assuming a single sales figure, the Monte Carlo simulation might use a probability distribution to reflect the uncertainty in sales. The simulation then runs thousands of iterations, each with a different randomly selected sales figure drawn from the distribution. Software like Crystal Ball or @RISK can easily perform these simulations, providing visual representations of the results, such as probability distributions of net present value or internal rate of return. This provides a more robust and realistic picture of potential future cash flows than traditional deterministic methods.

Software and Tools for Cash Flow Forecasting

Predicting your future cash flow shouldn’t feel like predicting the weather in Scotland – perpetually unpredictable. Thankfully, technology offers a helping hand (or rather, a helpful spreadsheet). Various software and tools can streamline the process, transforming your cash flow forecast from a guessing game into a more informed, and dare we say, enjoyable experience. Let’s explore some of the options available to banish those cash flow blues.

Numerous software solutions cater to businesses of all sizes, from simple spreadsheet programs to sophisticated enterprise resource planning (ERP) systems. The best choice depends on your specific needs, budget, and technical expertise. A small bakery might find a spreadsheet sufficient, while a multinational corporation will likely require a more robust system.

Popular Software and Tools

Choosing the right software is crucial for accurate and efficient cash flow forecasting. The following list presents some popular options, each with its own strengths and weaknesses.

- Spreadsheet Software (e.g., Microsoft Excel, Google Sheets): These are widely accessible and offer basic forecasting capabilities. They allow for manual input and formula-based calculations, providing flexibility but requiring more manual effort.

- Accounting Software (e.g., QuickBooks, Xero): These integrate accounting data directly, automating data entry and providing more sophisticated reporting features, including cash flow projections. They generally offer more automation than spreadsheets.

- Dedicated Cash Flow Forecasting Software (e.g., CashFlows, FloQast): Designed specifically for cash flow management, these offer advanced features like scenario planning and what-if analysis, providing a more in-depth and nuanced view of potential cash flow outcomes. They typically come with a price tag to match their capabilities.

- Enterprise Resource Planning (ERP) Systems (e.g., SAP, Oracle): These comprehensive systems integrate various business functions, including financial management, providing a holistic view of the organization’s financial health. They are best suited for large enterprises with complex financial structures.

Comparison of Three Software Options

Let’s compare three popular options: Excel, QuickBooks, and dedicated cash flow forecasting software (represented here by a hypothetical example, “CashFlowPro”).

| Feature | Excel | QuickBooks | CashFlowPro |

|---|---|---|---|

| Cost | Relatively inexpensive (often included with Microsoft Office) | Subscription-based, varying costs depending on the plan | Subscription-based, typically more expensive than QuickBooks |

| Ease of Use | Requires some spreadsheet knowledge | User-friendly interface, relatively easy to learn | May require specialized training |

| Automation | Minimal automation, mostly manual data entry | Automates data entry from accounting transactions | High level of automation, including scenario planning and what-if analysis |

| Reporting Capabilities | Basic reporting features | Comprehensive reporting features, including cash flow statements | Advanced reporting and visualization tools |

| Scalability | Can be scaled to handle larger datasets, but becomes cumbersome | Scales well with business growth | Designed for scalability, suitable for large enterprises |

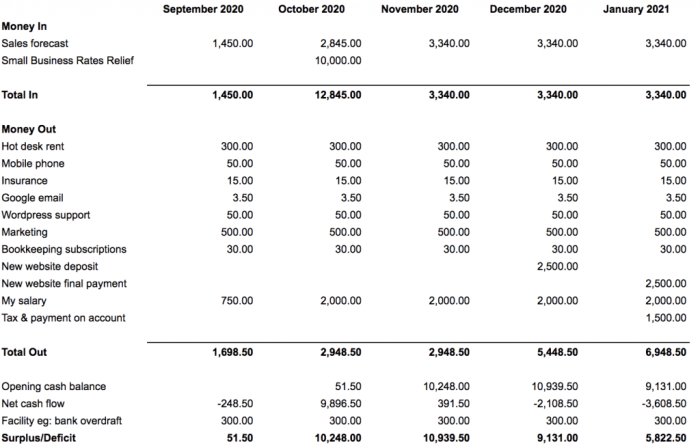

Creating a Simple Cash Flow Forecast in Excel

Even without fancy software, a simple cash flow forecast can be created in Excel. This example demonstrates a basic forecast, highlighting the key components.

Step 1: Setting up the Spreadsheet. Create columns for “Month,” “Cash Inflows,” “Cash Outflows,” and “Net Cash Flow.” The “Month” column lists the months of your forecast period (e.g., January, February, March).

Step 2: Inputting Data. Enter your expected cash inflows (e.g., sales revenue, loan proceeds) and cash outflows (e.g., rent, salaries, material costs) for each month. These figures should be based on your business’s historical data, sales projections, and budget.

Step 3: Calculating Net Cash Flow. In the “Net Cash Flow” column, subtract the “Cash Outflows” from the “Cash Inflows” for each month. This shows your net cash position for each month. A positive number indicates a surplus, while a negative number indicates a deficit.

Step 4: Creating Charts (Optional). Visualizing your data with charts can make it easier to understand trends and identify potential problems. A simple line chart showing net cash flow over time can be particularly insightful.

Example: Let’s say your business expects $10,000 in sales in January and $12,000 in February, with fixed monthly costs of $8,000. Your Excel sheet would show:

Imagine a simple table here with columns for Month, Cash Inflows, Cash Outflows, and Net Cash Flow. January would show $10,000 inflow, $8,000 outflow, and $2,000 net cash flow. February would show $12,000 inflow, $8,000 outflow, and $4,000 net cash flow. A line chart would then visually represent this increasing net cash flow.

Remember, this is a simplified example. A real-world forecast would be much more detailed and would incorporate more variables.

Analyzing and Interpreting Cash Flow Forecasts

Predicting the future is a fool’s errand, or so they say. But in the world of finance, a well-crafted cash flow forecast is less about predicting the apocalypse and more about avoiding a mild financial indigestion. Analyzing these forecasts, however, requires a discerning eye and a healthy dose of skepticism – after all, even the best predictions can go sideways faster than a greased piglet at a county fair. This section will equip you with the tools to dissect your cash flow forecast and make it work for you, not the other way around.

Key Metrics for Cash Flow Analysis

Understanding the numbers in your cash flow forecast isn’t just about adding and subtracting; it’s about interpreting the story they tell. Several key metrics provide a more nuanced understanding than simply looking at the raw cash inflow and outflow. These metrics act as financial detectives, highlighting areas of strength and weakness within your cash flow.

- Cash Flow Margin: This metric reveals the percentage of revenue that translates into actual cash. A higher margin indicates better cash management and profitability. For example, a cash flow margin of 20% means that for every $1 of revenue, $0.20 is left as cash after all expenses are paid. This metric helps to identify potential issues with operational efficiency and pricing strategies. A consistently low margin might signal a need for cost-cutting measures or a price increase.

- Operating Cash Flow: This represents the cash generated from the core business operations. It’s a vital indicator of a company’s ability to generate cash from its primary activities, excluding financing and investing activities. A healthy operating cash flow is crucial for sustaining the business, paying debts, and reinvesting in growth. A declining operating cash flow, despite increasing revenue, could suggest rising operational costs that need attention.

Identifying Cash Flow Shortfalls and Surpluses

Spotting potential problems (or delightful windfalls) in your cash flow forecast is like finding a hidden Easter egg – rewarding and potentially crucial. Analyzing trends and comparing forecasts to previous periods or industry benchmarks is key. Shortfalls and surpluses are not inherently bad or good; it’s the context that matters.

Identifying shortfalls often involves comparing projected cash inflows with projected outflows. A shortfall indicates that your expenses exceed your income within a given period. Surpluses, conversely, indicate that your income exceeds your expenses. These analyses should be performed on a monthly, quarterly, and annual basis to gain a comprehensive view of your cash flow health.

Using Cash Flow Forecasts for Informed Business Decisions

Cash flow forecasting isn’t just a passive activity; it’s a dynamic tool that should inform strategic decisions. By understanding potential shortfalls, businesses can proactively adjust their spending, seek financing, or renegotiate payment terms. Similarly, surpluses can be used to invest in growth opportunities, pay down debt, or build a financial cushion for unexpected events. Forecasts, when properly interpreted, are your roadmap to financial stability and growth.

Hypothetical Scenario and Corrective Action Plan

Let’s imagine “Widgets R Us,” a fictional widget manufacturer, projects a significant cash shortfall in Q4 due to increased raw material costs and seasonal slowdown in sales.

- Scenario: Widgets R Us’ Q4 cash flow forecast reveals a $50,000 shortfall.

- Analysis: The shortfall stems from a 20% increase in raw material costs and a 15% decrease in projected sales compared to Q3.

- Corrective Actions:

- Negotiate with Suppliers: Explore options to secure better pricing or extended payment terms with raw material suppliers.

- Reduce Operational Costs: Implement cost-cutting measures, such as streamlining production processes or negotiating better deals with service providers.

- Seek Short-Term Financing: Consider obtaining a short-term loan or line of credit to cover the shortfall.

- Adjust Marketing Strategy: Develop a targeted marketing campaign to stimulate sales during the typically slow season.

Improving Cash Flow Forecasting Accuracy

Accurate cash flow forecasting is the holy grail of financial planning – a crystal ball that reveals the future, allowing businesses to avoid the perilous pitfalls of insolvency and instead, sail smoothly towards prosperity. However, unlike genuine crystal balls, achieving accuracy requires more than just wishful thinking. It demands meticulous attention to detail and a healthy dose of methodological rigor.

The foundation of any accurate cash flow forecast is, quite simply, accurate data. Garbage in, garbage out, as the old saying goes. This seemingly obvious point is often overlooked, leading to forecasts that are about as reliable as a weather prediction made by a goldfish. Let’s delve into the specifics of ensuring your data is pristine.

Accurate Data Input in Cash Flow Forecasting

The accuracy of your cash flow forecast is directly proportional to the accuracy of your input data. Inaccurate or incomplete data will inevitably lead to inaccurate projections. This means meticulously tracking all income and expenses, ensuring timely and accurate recording of transactions, and regularly reconciling bank statements. Consider using automated accounting software to minimize manual data entry errors and improve the overall efficiency of your data collection process. For instance, if you consistently misclassify expenses or fail to account for small, recurring costs, your forecast will be significantly off the mark, potentially leading to a cash crunch when you least expect it. Imagine a business forgetting to account for its monthly software subscription – a seemingly small expense that, when compounded over time, can significantly impact the overall forecast.

Techniques for Improving Sales and Expense Projections

Predicting the future is, to put it mildly, challenging. However, we can use various techniques to improve the accuracy of our sales and expense projections. Sophisticated statistical methods, such as regression analysis, can help identify trends and patterns in historical data, allowing for more informed predictions. Additionally, incorporating external factors such as economic indicators, industry trends, and seasonal variations can significantly enhance the accuracy of projections. For example, a seasonal business like a ski resort should factor in the expected snowfall and tourist influx when forecasting sales for the upcoming winter season. Similarly, businesses should anticipate fluctuations in raw material costs or changes in energy prices when forecasting their expenses.

Common Errors in Cash Flow Forecasting and Methods for Avoiding Them

Cash flow forecasting, despite its seemingly straightforward nature, is prone to a variety of errors. One common mistake is failing to account for all sources of cash inflow and outflow. Another is underestimating the impact of unexpected events. Ignoring seasonal variations is another frequent pitfall. To avoid these errors, businesses should develop a comprehensive list of all potential cash inflows and outflows, incorporate contingency planning for unexpected events, and utilize historical data to identify and account for seasonal trends. A thorough review process, involving multiple individuals, can also help identify and correct potential errors before they impact the final forecast. For example, a company might overlook a one-time large payment for equipment, significantly impacting their cash flow for that specific period.

Incorporating Sensitivity Analysis to Assess the Impact of Uncertainty on Cash Flow Projections

Sensitivity analysis is a powerful tool for assessing the impact of uncertainty on cash flow projections. It involves systematically varying key input variables (e.g., sales volume, expenses, interest rates) to observe their effect on the final forecast. This allows businesses to identify the variables that have the greatest impact on their cash flow and to develop contingency plans to mitigate potential risks. For example, a business might conduct a sensitivity analysis to determine the impact of a 10% decrease in sales volume on their cash flow, enabling them to proactively adjust their spending or explore alternative financing options. This proactive approach transforms the forecast from a static prediction into a dynamic tool for risk management.

Closing Summary

Mastering cash flow forecasting isn’t just about crunching numbers; it’s about gaining a strategic advantage. By understanding the different techniques, utilizing appropriate software, and regularly analyzing your forecasts, you can proactively manage your finances, identify potential pitfalls, and seize opportunities for growth. So, ditch the guesswork and embrace the power of predictive financial planning – your business’s future depends on it!

Frequently Asked Questions

What’s the difference between a cash flow forecast and a budget?

A budget is a plan for future spending and income, while a cash flow forecast predicts the actual movement of cash in and out of your business over a specific period. Budgets are often aspirational; cash flow forecasts aim for accuracy.

How often should I update my cash flow forecast?

Frequency depends on your business’s volatility. Monthly updates are common for most businesses, but those with highly fluctuating cash flows might need weekly or even daily updates.

What if my cash flow forecast shows a shortfall?

A shortfall indicates potential problems. Develop a corrective action plan by identifying areas to cut costs, explore financing options, or accelerate revenue generation. This is where proactive planning shines!

Can I use free software for cash flow forecasting?

Yes, several free spreadsheet programs (like Google Sheets) offer the basic tools needed. However, dedicated financial software may provide more advanced features and automation for larger or more complex businesses.