Effective cash flow management is the lifeblood of any successful business, regardless of size. Understanding how to forecast, improve, and control your cash flow is crucial for growth, profitability, and long-term stability. This guide provides practical strategies and insights to help you navigate the complexities of cash flow, ensuring your business remains financially healthy and resilient.

From understanding the fundamental differences between cash flow and profitability to mastering advanced techniques like invoice factoring and negotiating favorable payment terms, we will explore a comprehensive range of tools and techniques. We’ll also delve into the role of technology in streamlining cash flow processes and the importance of seeking professional guidance when needed. This guide aims to equip you with the knowledge and confidence to confidently manage your business finances.

Understanding Cash Flow

Effective cash flow management is crucial for business success. Understanding the difference between cash flow and profitability, the components of a cash flow statement, and common cash flow challenges are essential first steps towards building a healthy financial foundation. This section will clarify these key concepts.

Cash Flow versus Profitability

While often confused, cash flow and profitability are distinct concepts. Profitability, as reflected in the income statement, measures the difference between revenues and expenses over a period. It indicates whether a business is making a profit. Cash flow, on the other hand, focuses on the actual movement of money into and out of the business during a specific period. A profitable business might still experience cash flow problems if its customers pay slowly or if it has significant capital expenditures. For example, a company might report a net profit of $100,000 but only have $10,000 in cash on hand due to slow-paying clients and large inventory purchases. This highlights the importance of managing cash flow independently of profitability.

Components of a Cash Flow Statement

The cash flow statement provides a comprehensive overview of cash inflows and outflows. It’s typically divided into three main sections: operating activities, investing activities, and financing activities. Understanding each section allows businesses to pinpoint areas of strength and weakness in their cash management. Analyzing these sections helps identify trends and potential problems before they become critical.

Common Cash Flow Challenges

Businesses frequently face various cash flow challenges. These can include slow-paying customers, unexpected expenses (like equipment repairs or legal fees), seasonal variations in sales, and insufficient working capital. Underestimating the time it takes to collect payments from customers is a very common problem. Another frequent issue involves overspending on inventory, leading to tied-up capital and reduced cash flow. These challenges can significantly impact a business’s ability to meet its financial obligations and pursue growth opportunities. Proactive cash flow management strategies are crucial to mitigate these risks.

Types of Cash Flows

The following table illustrates the different types of cash flows and their impact on a business’s overall cash position.

| Type | Description | Example | Impact on Cash Flow |

|---|---|---|---|

| Operating Activities | Cash flows related to the day-to-day operations of the business. | Cash received from customers, payments to suppliers, salaries, rent. | Increases cash flow from positive operating activities; decreases cash flow from negative operating activities. |

| Investing Activities | Cash flows related to the purchase and sale of long-term assets. | Purchase of equipment, sale of property, investments in other companies. | Decreases cash flow for purchases; increases cash flow for sales. |

| Financing Activities | Cash flows related to how the business is funded. | Borrowing money, issuing stock, repaying loans, paying dividends. | Increases cash flow from borrowing or issuing stock; decreases cash flow from loan repayments or dividend payments. |

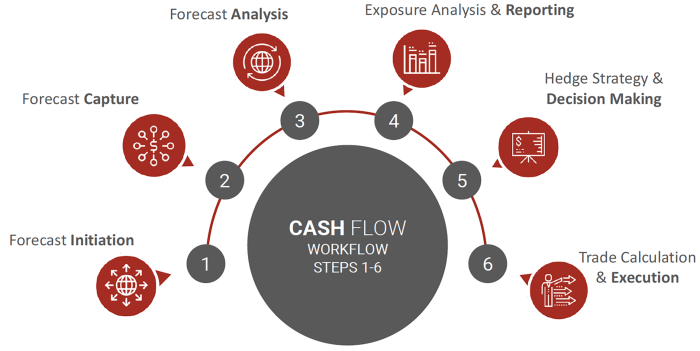

Forecasting Cash Flow

Accurate cash flow forecasting is crucial for the financial health of any small business. It allows you to anticipate potential shortfalls, plan for growth, and make informed financial decisions. Without a reliable forecast, businesses risk running out of cash, delaying payments, or missing opportunities. This section will Artikel a simple forecasting model and best practices to improve accuracy.

A simple cash flow forecasting model for a small business typically involves projecting income and expenses over a specific period, usually monthly or quarterly. This projection is based on historical data, current sales trends, and anticipated changes in business operations. The difference between projected income and expenses provides the projected cash flow for that period. This projection allows business owners to identify potential cash surpluses or deficits and proactively manage their finances.

Simple Cash Flow Forecasting Model

A basic model involves creating a spreadsheet with columns for each month (or period) and rows for different income and expense categories. Income sources could include sales revenue, service fees, and interest income. Expense categories might include cost of goods sold, salaries, rent, utilities, and marketing expenses. For each category, you’ll input projected amounts based on historical data and future expectations. For example, if your average monthly sales were $10,000 over the past year, you might project similar sales for the coming months, adjusting for anticipated seasonal fluctuations or marketing campaigns. Subtracting total projected expenses from total projected income yields the net cash flow for each period.

Best Practices for Accurate Cash Flow Forecasting

Several best practices can significantly improve the accuracy of cash flow forecasts. These practices ensure the forecast reflects the realities of the business and provides a reliable basis for financial planning.

- Regularly review and update the forecast. Business conditions change, so regular updates are essential to maintain accuracy. Monthly reviews are ideal.

- Use historical data as a foundation. Analyze past financial statements to identify trends and patterns in income and expenses. This provides a solid base for your projections.

- Incorporate anticipated changes. Consider any upcoming changes to your business, such as new product launches, price increases, or marketing campaigns. These changes will impact your income and expenses.

- Be conservative in your estimates. It’s better to slightly underestimate income and overestimate expenses to avoid unexpected shortfalls.

- Seek professional advice. A financial advisor can offer valuable insights and help refine your forecasting model.

Seasonal Variations in Cash Flow

Many businesses experience seasonal fluctuations in cash flow. For example, a retail store might see higher sales during the holiday season and lower sales during slower periods. A landscaping business will likely have higher income during the spring and summer months. Failing to account for these variations can lead to inaccurate forecasts and financial difficulties. To address this, incorporate historical seasonal data into your forecast. If sales are typically 20% higher in December than in January, reflect this in your projections. This allows for better planning and management of resources during peak and slow periods.

Comparison of Forecasting Methods

Several methods exist for forecasting cash flow, each with its strengths and weaknesses. Choosing the right method depends on the complexity of your business and the availability of data.

- Moving Average: This method uses the average cash flow from a specific number of past periods to predict future cash flow. It’s simple to use but may not accurately reflect trends or seasonal variations. For example, a three-month moving average would average the cash flow from the last three months to predict the next month’s cash flow. This method is best suited for businesses with relatively stable cash flows.

- Regression Analysis: This statistical method uses historical data to identify relationships between variables and predict future cash flow. It can account for seasonal variations and other factors influencing cash flow. However, it requires more sophisticated statistical software and a good understanding of statistical concepts. A regression model might show a correlation between advertising spend and sales revenue, allowing for more accurate sales projections.

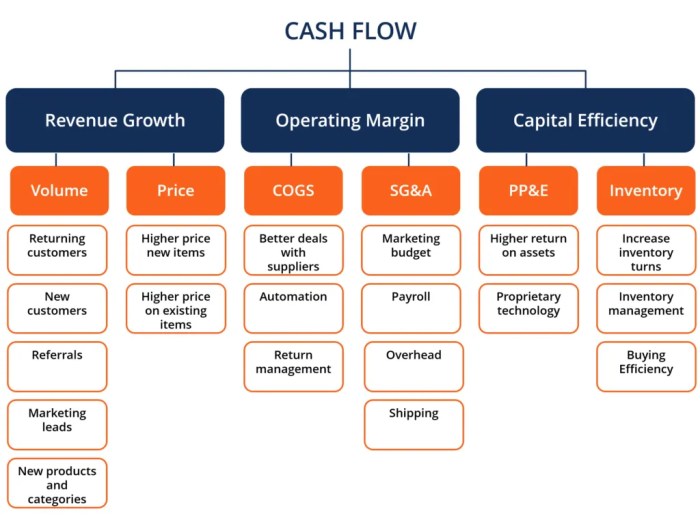

Improving Cash Flow

Effective cash flow management is crucial for the long-term health and sustainability of any retail business. Improving cash flow isn’t just about increasing sales; it’s about optimizing the entire financial cycle, from receiving payments to paying suppliers. This section will explore several strategies to bolster your retail business’s cash flow.

Five Strategies to Improve Retail Cash Flow

Implementing effective strategies to improve cash flow requires a multifaceted approach. The following strategies represent key areas where a retail business can focus its efforts to generate better cash flow.

- Accelerate Payment Collection: Offer early payment discounts to incentivize customers to pay invoices promptly. Implement automated payment reminders and utilize online payment systems for faster processing.

- Inventory Management: Optimize inventory levels to minimize storage costs and reduce the risk of obsolescence. Implement a just-in-time inventory system to ensure that you only purchase what you need, when you need it.

- Negotiate Better Payment Terms with Suppliers: Extend payment terms with suppliers whenever possible, giving your business more time to generate revenue before making payments. This provides crucial breathing room in your cash flow cycle.

- Control Expenses: Regularly review expenses and identify areas where costs can be reduced. This might involve negotiating lower prices with suppliers, reducing energy consumption, or streamlining operations.

- Explore Financing Options: Consider short-term financing options, such as lines of credit or invoice factoring, to bridge temporary cash flow gaps. These options can provide immediate access to capital when needed.

Invoice Factoring: Benefits and Drawbacks

Invoice factoring is a financing option where a business sells its outstanding invoices to a third-party factoring company at a discount. This provides immediate access to cash, freeing up working capital.

- Benefits: Immediate access to cash, improved cash flow, reduced administrative burden of managing receivables, potential for improved credit terms with suppliers.

- Drawbacks: The discount applied to the invoices reduces the overall amount received, factoring fees can be significant, and it can damage relationships with customers if not handled carefully. Factoring companies may also require a minimum invoice volume.

Negotiating Better Payment Terms with Suppliers

Negotiating favorable payment terms with suppliers is a crucial strategy for improving cash flow. A structured approach can significantly improve outcomes.

- Build a Strong Relationship: Establish a positive and professional relationship with your suppliers. This lays the groundwork for productive negotiations.

- Analyze Your Spending: Identify your key suppliers and analyze your spending patterns with each. This information provides leverage in negotiations.

- Propose Extended Payment Terms: Clearly and respectfully propose extending your payment terms, perhaps offering a small discount in exchange for prompt payment in the future. Be prepared to justify your request with your business’s financial stability.

- Negotiate Payment Schedules: Discuss different payment schedules that work for both parties. For instance, you could propose partial payments at intervals.

- Document the Agreement: Once an agreement is reached, document it in writing to avoid future misunderstandings.

Actionable Steps to Reduce Expenses

Reducing expenses is a direct way to improve cash flow. A systematic approach is key to identifying and implementing cost-saving measures.

- Negotiate Lower Prices with Suppliers: Regularly review supplier contracts and negotiate lower prices, especially for high-volume purchases.

- Reduce Energy Consumption: Implement energy-efficient practices, such as switching to LED lighting and optimizing heating and cooling systems.

- Streamline Operations: Identify and eliminate unnecessary processes or tasks that add to operational costs.

- Review and Optimize Marketing Spend: Analyze marketing ROI and adjust spending accordingly. Focus on high-performing channels.

- Outsource Non-Core Functions: Consider outsourcing tasks that are not core to your business operations to reduce labor costs and improve efficiency.

Managing Accounts Receivable

Effective accounts receivable management is crucial for maintaining a healthy cash flow. Unpaid invoices directly impact your ability to meet operational expenses and invest in future growth. A robust system for tracking and collecting payments is essential for any business, regardless of size.

Timely Invoicing and Follow-Up

Prompt and accurate invoicing is the first step in efficient accounts receivable management. Delays in invoicing can lead to delayed payments and complicate reconciliation. A clear and concise invoice should include all necessary information: invoice number, date, customer details, description of goods or services, payment terms, and contact information. Following up on invoices is equally important. A systematic approach, such as sending automated reminders a few days before the due date and then again after the due date, can significantly improve payment rates. Consider using different communication channels, like email and phone calls, to reach customers effectively.

Collecting Overdue Payments

When invoices become overdue, a structured approach to collection is necessary. This could start with a polite reminder email, escalating to phone calls and, if necessary, formal letters. Consider offering payment plans for larger outstanding amounts to facilitate payment. For persistent non-payment, engaging a collections agency may be a last resort. Maintaining detailed records of all communication attempts is crucial for legal purposes if further action is required.

Strategies for Improving Customer Payment Behavior

Offering early payment discounts can incentivize customers to pay promptly. Clearly outlining payment terms and expectations upfront can also improve payment behavior. Providing online payment options, such as credit card or electronic bank transfers, can streamline the payment process and make it more convenient for customers. Proactive communication, such as sending regular statements or providing online access to invoices, keeps customers informed and encourages timely payments. Building strong relationships with customers based on trust and open communication is also key to fostering good payment practices.

Tracking Outstanding Invoices

Implementing a system for tracking outstanding invoices is essential for effective accounts receivable management. This could involve using accounting software, spreadsheets, or a dedicated accounts receivable management system. The system should track invoice numbers, dates, due dates, payment status, and any communication with the customer. Regularly reviewing outstanding invoices allows for timely follow-up and identification of potential problems. A visual representation, such as an aging report that categorizes invoices by their overdue status, can help prioritize collection efforts. This allows businesses to quickly identify invoices that are significantly overdue and require immediate attention.

Managing Accounts Payable

Effective management of accounts payable is crucial for maintaining a healthy cash flow. By strategically managing payments to vendors, businesses can optimize their cash reserves and improve their financial standing. This involves understanding payment terms, negotiating favorable conditions, and implementing efficient payment processes.

Early Payment Discounts

Taking advantage of early payment discounts offered by vendors can significantly reduce overall expenditure. These discounts incentivize prompt payment and effectively lower the cost of goods or services. For example, a 2% discount for payment within 10 days can translate to substantial savings annually, especially for businesses with high purchasing volumes. The decision to take advantage of an early payment discount should be based on a careful assessment of the discount rate versus the cost of borrowing funds if the payment is delayed. A simple calculation comparing the discount rate to the interest rate on available credit lines can determine the most financially advantageous option.

Negotiating Favorable Payment Terms

Building strong relationships with vendors allows for negotiation of more favorable payment terms. This could involve extending the payment period, securing longer payment terms, or negotiating more attractive early payment discounts. For instance, a business with a proven track record of timely payments might successfully negotiate an extended payment period from 30 days to 45 days, providing greater flexibility in cash flow management. Similarly, negotiating higher early payment discounts can also improve the overall financial health of the company. The key to successful negotiation lies in demonstrating financial stability and a commitment to building a long-term relationship with the vendor.

Managing Accounts Payable Process

The following flowchart illustrates a typical accounts payable process:

[Imagine a flowchart here. The flowchart would begin with “Invoice Received,” branching to “Invoice Verification” (checking for accuracy and completeness), then to “Approval Process” (authorizing payment), followed by “Payment Scheduling” (determining payment date based on terms and cash flow), and finally “Payment Processing” (making the payment and recording the transaction). The flowchart would include feedback loops for issues like discrepancies or payment delays.]

Optimizing Payment Schedules

Effective strategies for optimizing payment schedules involve prioritizing payments based on various factors, such as discount opportunities, vendor relationships, and overall cash flow projections. For example, payments to vendors offering substantial early payment discounts should be prioritized, followed by payments to key suppliers to maintain strong business relationships. Payments to less critical vendors can be strategically delayed until the company’s cash position improves. Utilizing cash flow forecasting tools allows businesses to predict future cash inflows and outflows, enabling them to create a payment schedule that balances immediate needs with long-term financial health. This proactive approach minimizes the risk of late payments and maintains positive vendor relationships.

Budgeting and Financial Planning

Effective budgeting and financial planning are crucial for the long-term health and stability of any small business. A well-structured budget acts as a roadmap, guiding your financial decisions and helping you navigate potential challenges. It allows you to proactively manage cash flow, identify potential shortfalls, and make informed choices about investments and expenditures. This section will explore the creation and implementation of a simple budget, the role of budgeting in cash flow management, and the importance of regular financial reviews.

Simple Budget Template for a Small Business

A basic budget template should clearly Artikel income and expenses. This allows for a straightforward comparison between projected and actual figures. A simple spreadsheet or dedicated budgeting software can be used. The template should include categories for all anticipated income streams, such as sales revenue, service fees, or investment returns. Expense categories should encompass operational costs like rent, utilities, salaries, marketing, and supplies. It’s essential to be as detailed as possible to gain a comprehensive understanding of your financial position. Consider separating fixed costs (those that remain constant, like rent) from variable costs (those that fluctuate, like marketing spend). This allows for more accurate forecasting and better control over expenses. Finally, the template should have a section to track your net profit or loss (income minus expenses).

The Role of Budgeting in Cash Flow Management

Budgeting is integral to effective cash flow management. By projecting income and expenses, a business can anticipate periods of potential cash surpluses or deficits. This foresight allows for proactive measures to address potential shortfalls, such as securing lines of credit or adjusting spending. Regular monitoring of the budget against actual performance allows for early identification of variances, enabling timely corrective actions. A well-designed budget helps ensure that sufficient funds are available to meet obligations, preventing late payments and potential damage to creditworthiness. It also aids in identifying areas where costs can be reduced or efficiencies improved, leading to enhanced cash flow. For example, a business might identify that marketing costs are exceeding projections, prompting a review of marketing strategies and resource allocation.

The Importance of Regular Financial Reviews and Adjustments

Regularly reviewing and adjusting your budget is not merely a best practice; it’s a necessity. The business environment is dynamic; unforeseen circumstances, such as changes in market demand or unexpected expenses, can significantly impact financial performance. Monthly reviews allow for timely detection of variances between the budgeted and actual figures. These reviews should involve a comparison of key performance indicators (KPIs) against budget targets. Significant deviations require investigation to determine the underlying causes. This might involve analyzing sales figures, scrutinizing expense reports, or reviewing pricing strategies. Based on these analyses, adjustments to the budget can be made, ensuring that the financial plan remains relevant and effective. For instance, if sales are consistently below projections, the marketing budget might be increased or pricing strategies adjusted.

Best Practices for Setting Realistic Financial Goals

Setting realistic financial goals is paramount for successful budgeting. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Avoid overly ambitious targets that are unlikely to be met. Instead, base goals on historical data, market research, and industry benchmarks. For example, a realistic sales growth target might be a 10-15% increase year-over-year, based on past performance and market trends. Break down larger goals into smaller, manageable milestones. This provides a sense of accomplishment and keeps the business on track. Regularly review and adjust goals as needed, based on performance and changing market conditions. Remember that financial goals should align with the overall business objectives.

Using Technology for Cash Flow Management

In today’s fast-paced business environment, effective cash flow management is crucial for success. Leveraging technology can significantly enhance your ability to monitor, predict, and control your cash flow, leading to improved financial health and better decision-making. This section explores the various technological tools and strategies that can streamline your cash flow processes.

Accounting Software for Cash Flow Management

Accounting software offers a comprehensive solution for managing cash flow. These programs automate many manual tasks, providing real-time insights into your financial position. Features such as automated bank reconciliation, invoice generation and tracking, and expense categorization significantly reduce the time and effort required for accurate cash flow monitoring. The resulting data allows for better forecasting and proactive management of potential shortfalls. For example, QuickBooks and Xero are popular choices, offering various features tailored to different business sizes and needs. These platforms provide detailed reports that visually represent cash inflows and outflows, making it easy to identify trends and potential issues.

Features of a Good Cash Flow Management App

A robust cash flow management app should offer a range of features designed to simplify and improve financial oversight. Key features include real-time bank account synchronization, automated transaction categorization, customizable reporting dashboards, and the ability to project future cash flow based on historical data and forecasts. The app should also allow for easy collaboration with accountants and other financial stakeholders. Integration with other business tools, such as CRM and inventory management systems, further enhances efficiency by providing a holistic view of the business’s financial health. A user-friendly interface is also crucial for ease of use and accessibility.

Financial Dashboards for Monitoring Cash Flow

Financial dashboards provide a centralized and visually appealing overview of key cash flow metrics. These dashboards typically display crucial data points such as current cash balance, projected cash flow for the next few months, outstanding invoices, and upcoming payments. By presenting this information in an easily digestible format, such as charts and graphs, dashboards enable quick identification of potential cash flow problems. For example, a dashboard might highlight a period of low cash flow in the coming weeks, prompting proactive measures such as negotiating payment terms with suppliers or accelerating collections from customers. Regular monitoring of these dashboards allows for timely interventions and minimizes the risk of financial difficulties.

Automating Cash Flow Processes with Technology

Technology offers significant opportunities to automate various aspects of cash flow management. Automated bank feeds eliminate manual data entry, reducing errors and saving valuable time. Automated invoice generation and payment reminders improve the efficiency of accounts receivable management, while automated payment processing streamlines accounts payable. Furthermore, sophisticated software can predict future cash flow based on historical data and various forecasting models, providing valuable insights for proactive planning. For instance, a company could use software to automate recurring bill payments, ensuring timely payments and avoiding late fees. This automation frees up valuable time for staff to focus on strategic tasks, improving overall business efficiency.

Seeking Professional Advice

Effective cash flow management is crucial for business success, but it can be complex. While many businesses can manage their cash flow effectively using the strategies discussed previously, there are times when seeking professional guidance is essential for optimal financial health and long-term growth. Understanding when to seek professional help and leveraging their expertise can significantly improve your financial outcomes.

Seeking professional financial advice is not a sign of weakness, but rather a proactive step towards strengthening your financial foundation. It’s particularly beneficial during periods of significant change or uncertainty, when the complexities of cash flow management may overwhelm internal resources.

When to Seek Professional Financial Advice

Several situations indicate the need for professional financial advice regarding cash flow. These situations often involve significant financial decisions or periods of rapid growth or unexpected challenges that require specialized knowledge and experience to navigate effectively. Ignoring these situations could lead to irreversible financial consequences.

- Rapid business growth: When a business experiences rapid expansion, its cash flow needs and management strategies must adapt quickly. A financial advisor can help forecast future needs, optimize resource allocation, and ensure sufficient funding to support growth without compromising profitability.

- Significant financial challenges: Facing unexpected economic downturns, supply chain disruptions, or significant debt burdens requires expert advice to develop a robust recovery plan. A financial consultant can assess the situation, create a viable turnaround strategy, and guide the business through the challenges.

- Complex financial transactions: Major acquisitions, mergers, or investments involve intricate financial calculations and legal considerations. A financial advisor can provide guidance and analysis to ensure these transactions are structured effectively to optimize cash flow and minimize risks.

- Planning for major investments: Significant capital expenditures, such as purchasing new equipment or expanding facilities, require careful financial planning. A financial advisor can assist in evaluating the financial viability of these investments and help structure financing options to minimize the impact on cash flow.

- Lack of internal expertise: Smaller businesses or those lacking dedicated financial staff may benefit greatly from the expertise of a financial professional who can provide ongoing guidance and support in managing cash flow effectively.

The Role of a Financial Advisor in Cash Flow Management

A financial advisor plays a multifaceted role in assisting businesses with their cash flow management. Their expertise goes beyond simply reviewing financial statements; they act as strategic partners, providing insights and guidance to improve financial performance.

A financial advisor can help develop comprehensive cash flow forecasts, identify areas for improvement, and recommend strategies to optimize cash flow. They can also assist in negotiating better terms with vendors and creditors, improving collections processes, and implementing more efficient financial systems. Furthermore, they can provide guidance on securing financing and managing debt effectively.

Benefits of Working with a Financial Consultant

Engaging a financial consultant offers numerous benefits that can significantly improve a business’s financial health and long-term sustainability. These benefits extend beyond simply improving cash flow; they contribute to overall business success.

- Improved financial planning: Financial consultants help businesses develop comprehensive financial plans that address both short-term and long-term cash flow needs. This includes creating realistic budgets, forecasting future cash flows, and developing strategies to mitigate financial risks.

- Enhanced financial control: They assist in implementing effective financial controls and systems, improving the accuracy and timeliness of financial reporting, and enhancing the overall transparency of the business’s financial position.

- Access to specialized expertise: Financial consultants possess in-depth knowledge of various financial instruments, investment strategies, and tax regulations. This specialized expertise allows them to provide tailored advice and solutions that optimize cash flow and minimize tax liabilities.

- Objective perspective: An external consultant can offer an unbiased assessment of a business’s financial situation, identifying potential weaknesses and opportunities for improvement that may be overlooked by internal staff.

- Reduced financial risks: By proactively identifying and addressing potential financial risks, financial consultants help businesses mitigate potential problems and improve their overall financial stability.

Resources for Finding Qualified Financial Professionals

Finding a qualified and reputable financial professional is crucial. Several resources can help you locate experienced advisors who can meet your specific needs.

- Professional organizations: Organizations such as the Financial Planning Association (FPA) and the National Association of Personal Financial Advisors (NAPFA) maintain directories of certified financial planners and advisors.

- Online directories: Many online platforms, such as those provided by financial institutions, list financial professionals and their credentials.

- Referrals: Networking with other business owners or seeking referrals from trusted sources can lead to qualified professionals.

- Due diligence: Thoroughly research any potential advisor, checking their credentials, experience, and client testimonials before engaging their services.

Ending Remarks

Mastering cash flow management isn’t merely about balancing the books; it’s about strategically positioning your business for sustained success. By implementing the strategies Artikeld in this guide—from accurate forecasting and proactive expense reduction to leveraging technology and seeking expert advice when necessary—you can transform your approach to finances. This proactive management will not only safeguard your business against financial instability but also empower you to seize opportunities for growth and expansion, ensuring a brighter and more secure financial future.

FAQ Guide

What is the difference between cash flow and profit?

Profit reflects your overall earnings after deducting all expenses. Cash flow, however, focuses on the actual movement of money into and out of your business within a specific period.

How often should I forecast my cash flow?

Ideally, you should forecast your cash flow monthly, or even more frequently for businesses with highly volatile cash flows. This allows for timely adjustments and proactive management.

What are some signs of poor cash flow?

Signs include difficulty paying bills on time, consistently low cash balances, frequent reliance on credit, and inability to invest in growth opportunities.

What is the best accounting software for small businesses?

Several excellent options exist, such as QuickBooks, Xero, and FreshBooks. The best choice depends on your specific business needs and budget.