Effective cash flow management is the lifeblood of any successful business, regardless of size. Understanding how to monitor, predict, and control the flow of money is crucial for growth, stability, and ultimately, survival. This guide delves into the world of cash flow management tools, exploring various software solutions and techniques to help businesses optimize their financial health.

From basic budgeting and forecasting to advanced optimization strategies, we’ll cover the essential components of a robust cash flow system. We will examine the advantages and disadvantages of different approaches, offering practical advice and real-world examples to illustrate the impact of effective (and ineffective) cash flow management. This comprehensive guide provides a roadmap for businesses to navigate the complexities of financial planning and ensure a healthy financial future.

Defining Cash Flow Management

Cash flow management is the process of monitoring and controlling the flow of money into and out of a business. It’s about ensuring you have enough cash on hand to meet your obligations, invest in growth opportunities, and maintain financial stability. Effective cash flow management is not just about accounting; it’s a crucial aspect of strategic business planning and operational efficiency.

Effective cash flow management is vital for businesses of all sizes, from small startups to large corporations. For small businesses, it’s often a matter of survival, as insufficient cash can quickly lead to insolvency. Larger businesses, while having more resources, still need robust cash flow management to optimize profitability, fund expansion, and weather economic downturns. Poor cash flow can hinder growth, limit investment opportunities, and ultimately jeopardize the long-term viability of any enterprise.

Key Components of a Robust Cash Flow Management System

A robust cash flow management system incorporates several key elements working in concert. These components ensure a comprehensive and proactive approach to managing finances. These include accurate forecasting, efficient invoicing and collections, optimized expense management, and proactive monitoring of key financial metrics. Regular review and adjustment of the system based on performance are also essential.

Common Cash Flow Challenges Faced by Businesses

Businesses frequently encounter various challenges impacting their cash flow. Delayed payments from clients, unexpected expenses, seasonal fluctuations in sales, and insufficient working capital are among the most common issues. For example, a seasonal business might experience a significant cash flow crunch during the off-season, while a business reliant on large contracts might face difficulties if payments are delayed. Accurate forecasting and contingency planning can mitigate these risks.

Best Practices for Improving Cash Flow Forecasting Accuracy

Accurate cash flow forecasting is the cornerstone of effective cash flow management. Several best practices contribute to improving forecasting accuracy. These include utilizing historical data, incorporating realistic sales projections based on market trends and sales cycles, factoring in potential delays in payments from customers, and consistently monitoring and adjusting forecasts based on actual performance. Sophisticated forecasting tools and techniques can also significantly improve the accuracy and reliability of predictions. For instance, a business could use data from previous years to predict seasonal fluctuations in demand and adjust their inventory accordingly, improving cash flow predictability.

Types of Cash Flow Management Tools

Effective cash flow management is crucial for the financial health of any business, regardless of size. Choosing the right tools can significantly improve efficiency and accuracy in tracking, analyzing, and forecasting cash flow. The market offers a wide variety of tools, each with its strengths and weaknesses, catering to different needs and budgets. Understanding these differences is key to selecting the optimal solution.

Categorization of Cash Flow Management Tools by Functionality

Cash flow management tools can be broadly categorized based on their core functionality. These categories often overlap, with many tools offering a combination of features. However, understanding these primary functions helps in identifying the most suitable tool for specific requirements. The main functional categories include budgeting, forecasting, and invoicing. Budgeting tools help in creating and tracking budgets, allowing businesses to monitor spending against planned allocations. Forecasting tools utilize historical data and various algorithms to predict future cash inflows and outflows. Invoicing tools streamline the process of creating, sending, and tracking invoices, ensuring timely payments.

Comparison of Software Solutions: Cloud-Based vs. Desktop

The choice between cloud-based and desktop cash flow management software depends on several factors, including budget, technical expertise, and data security preferences. Cloud-based solutions offer accessibility from anywhere with an internet connection, automatic updates, and often require less upfront investment. However, they rely on a stable internet connection and may raise concerns regarding data security and privacy. Desktop solutions, on the other hand, offer greater control over data and do not require an internet connection. They may, however, require more technical expertise to set up and maintain and might lack the collaborative features often found in cloud-based solutions.

Comparison of Popular Cash Flow Management Tools

The following table compares five popular cash flow management tools, considering their features, pricing, and user reviews (note that pricing and reviews can change over time, and these are snapshots based on readily available information).

| Tool | Features | Pricing | User Reviews (Summary) |

|---|---|---|---|

| Xero | Invoicing, expense tracking, bank reconciliation, reporting, payroll (in some plans) | Subscription-based, varying plans | Generally positive, praised for ease of use and comprehensive features. Some users find the pricing structure complex. |

| QuickBooks Online | Invoicing, expense tracking, bank feeds, financial reporting, inventory management (in some plans) | Subscription-based, varying plans | Widely used and well-regarded, known for its robust features and support. Some users find the interface less intuitive than others. |

| FreshBooks | Invoicing, expense tracking, time tracking, project management, client communication | Subscription-based, varying plans | Popular among freelancers and small businesses, praised for its user-friendly interface and excellent customer support. |

| Zoho Books | Invoicing, expense tracking, inventory management, project management, CRM integration | Subscription-based, varying plans | A good option for businesses needing integrated CRM functionality. User reviews are generally positive but suggest a steeper learning curve than some competitors. |

| Wave Accounting | Invoicing, expense tracking, reporting, payment processing | Freemium model (basic features free, paid plans for advanced features) | Popular choice for those seeking a free option with good functionality. Paid features offer enhanced capabilities. |

Spreadsheets versus Dedicated Software for Cash Flow Management

Using spreadsheets like Microsoft Excel or Google Sheets for cash flow management offers a cost-effective solution, providing flexibility and control. However, manual data entry is prone to errors, and complex formulas can be challenging to manage. Dedicated software, on the other hand, automates many processes, reducing errors and providing more sophisticated analysis and reporting capabilities. While generally more expensive, the time saved and improved accuracy often outweigh the cost for businesses with complex cash flow needs. For instance, a small business with simple transactions might find a spreadsheet sufficient, while a larger enterprise with multiple departments and complex financial transactions would benefit significantly from dedicated software.

Implementing Cash Flow Management Tools

Successfully integrating a cash flow management tool requires careful planning and execution. The right tool can significantly improve financial visibility and control, but a poorly implemented system can create more problems than it solves. This section details the steps involved in selecting, implementing, and overcoming potential challenges during the process.

Selecting and implementing a cash flow management tool involves a multi-stage process that requires careful consideration of your business needs and existing infrastructure. A phased approach, from initial assessment to ongoing maintenance, ensures a smooth transition and maximizes the benefits of the new system.

Selecting a Cash Flow Management Tool

Choosing the right tool is crucial. Consider factors such as the size and complexity of your business, your existing accounting software, the level of integration required, and the tool’s reporting capabilities. A thorough evaluation of different options, including free trials or demos, is highly recommended before making a final decision. The selected tool should align with your long-term financial goals and provide scalability for future growth.

Step-by-Step Guide for Tool Integration

Integrating a new cash flow management tool into an existing accounting system requires a structured approach. A phased rollout minimizes disruption and allows for thorough testing and adjustments.

- Data Migration: Carefully plan the transfer of existing financial data from your old system to the new tool. This may involve manual data entry, automated imports, or a combination of both. Thoroughly check for data integrity after the migration is complete.

- User Training: Provide comprehensive training to all users on how to effectively utilize the new tool. This includes tutorials, documentation, and ongoing support. Effective training minimizes errors and ensures efficient adoption.

- Testing and Validation: Before full implementation, thoroughly test the integrated system to identify and resolve any bugs or inconsistencies. This involves running various scenarios and comparing the results with your existing accounting data.

- Go-Live and Monitoring: Once testing is complete, implement the new system. Continuously monitor its performance and make adjustments as needed. Regular reviews ensure optimal functionality and identify areas for improvement.

- Ongoing Maintenance: Regular software updates and maintenance are essential to ensure the tool remains secure and efficient. This includes applying security patches and backing up data regularly.

Checklist of Essential Considerations

Before implementing any new cash flow management tool, a comprehensive checklist ensures a smooth transition and minimizes potential problems. This checklist covers key areas from data security to user adoption.

- Data Security: Assess the security features of the tool to ensure the protection of sensitive financial data. This includes encryption, access controls, and compliance with relevant data protection regulations.

- Integration Capabilities: Verify that the tool integrates seamlessly with your existing accounting software and other relevant systems. A smooth integration minimizes manual data entry and reduces errors.

- Reporting and Analytics: Evaluate the tool’s reporting and analytics capabilities to ensure it provides the insights you need to manage your cash flow effectively. The tool should provide customizable reports and dashboards.

- Scalability: Ensure the tool can adapt to your business’s growth and changing needs. Consider factors such as user capacity, data storage, and future expansion.

- Cost and Support: Evaluate the total cost of ownership, including licensing fees, implementation costs, and ongoing support. Ensure the vendor provides adequate support and documentation.

Potential Challenges and Strategies for Overcoming Them

Implementing a new cash flow management tool can present various challenges. Proactive planning and mitigation strategies are crucial for a successful implementation.

- Data Migration Issues: Data loss or corruption during migration can be a significant challenge. Implementing robust data backup and validation procedures minimizes this risk.

- User Resistance: Resistance to change from employees unfamiliar with the new tool can hinder adoption. Comprehensive training and ongoing support are essential to overcome this.

- Integration Difficulties: Unexpected integration problems between the new tool and existing systems can cause delays. Thorough testing and a phased rollout minimize these issues.

- Cost Overruns: Unforeseen costs during implementation can exceed the budget. Detailed cost planning and contingency budgeting help prevent this.

Key Features of Effective Tools

Effective cash flow management tools are crucial for businesses of all sizes. They provide the visibility and control necessary to optimize financial resources, predict potential shortfalls, and ultimately, improve profitability. The core features of a truly effective tool go beyond basic accounting functions; they offer a blend of real-time data, automation, and robust analytical capabilities.

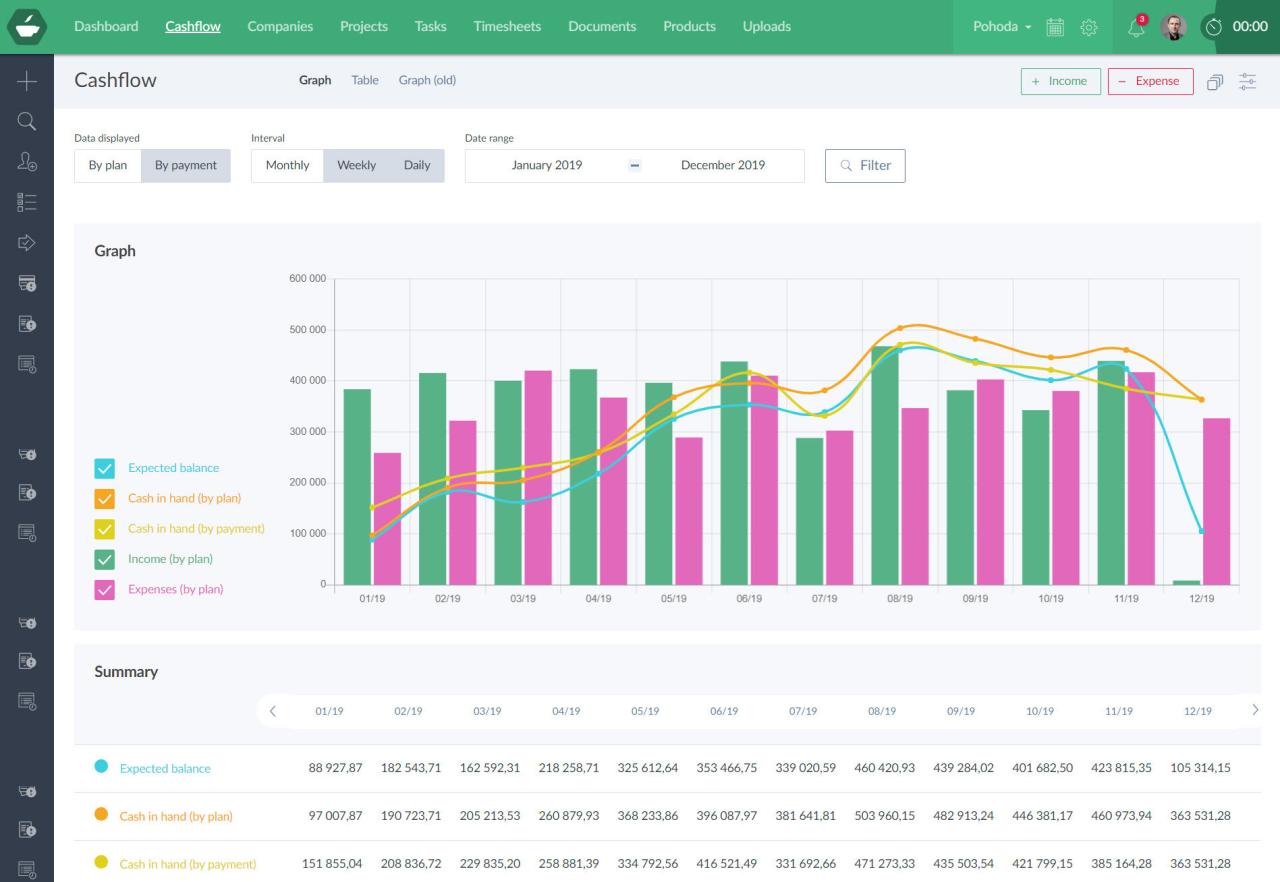

Real-time data visualization is paramount in effective cash flow management. It allows businesses to monitor their financial health continuously, rather than relying on periodic reports that may be outdated by the time they are reviewed. This immediate insight enables proactive decision-making, allowing for swift adjustments to spending, revenue generation strategies, or investment plans. For example, if a real-time dashboard shows a sudden drop in incoming payments, a business can immediately investigate the cause and take corrective action, preventing a potential cash flow crisis.

Real-Time Data Visualization and Enhanced Decision-Making

Real-time dashboards provide a dynamic view of cash inflows and outflows, enabling quick identification of trends and anomalies. Visual representations, such as charts and graphs, simplify complex financial data, making it easily understandable for both financial experts and non-financial personnel. This immediate access to information empowers faster and more informed decision-making, leading to improved operational efficiency and reduced financial risks. A company might use a real-time dashboard to monitor daily sales, compare them to projected sales, and identify any discrepancies that require immediate attention. This allows them to adjust marketing strategies or production schedules proactively.

Automation Features and Improved Efficiency

Automation features significantly reduce manual effort and improve the accuracy of cash flow management. Automated bank reconciliation, for instance, eliminates the time-consuming task of manually comparing bank statements with internal records. Automated invoice processing streamlines accounts payable and receivable, ensuring timely payments and collections. These automated processes not only save time and resources but also minimize human error, leading to more reliable financial data. A small business using automated invoice processing software could save hours per week previously spent on manual data entry, allowing staff to focus on more strategic tasks.

Reporting and Analytics for Actionable Insights

Robust reporting and analytics features are essential for gaining valuable insights from cash flow data. Effective tools provide customizable reports that can be tailored to specific business needs, allowing users to track key performance indicators (KPIs) and identify areas for improvement. Advanced analytics features can uncover hidden patterns and trends, providing a deeper understanding of cash flow dynamics. For example, a company could use reporting features to analyze seasonal fluctuations in cash flow and plan accordingly, ensuring sufficient funds are available during periods of high demand. The analytics might reveal that a specific product line consistently generates positive cash flow, guiding investment decisions and resource allocation.

Advanced Cash Flow Management Techniques

Effective cash flow management isn’t just about tracking income and expenses; it’s about strategically optimizing your cash position to maximize profitability and minimize risk. Advanced techniques go beyond basic budgeting and forecasting, employing sophisticated strategies to proactively manage both inflows and outflows.

Cash Flow Optimization Strategies

Cash flow optimization involves proactively managing cash inflows and outflows to improve liquidity and profitability. This isn’t simply about reducing expenses; it’s about strategically timing payments and receipts to maximize the net cash position. Several key strategies contribute to effective cash flow optimization. For example, negotiating favorable payment terms with suppliers can extend the payment cycle, freeing up cash for other priorities. Simultaneously, incentivizing early payments from customers can accelerate cash inflows. Effective cash flow optimization requires a holistic view of the entire financial cycle, identifying opportunities to improve both sides of the equation.

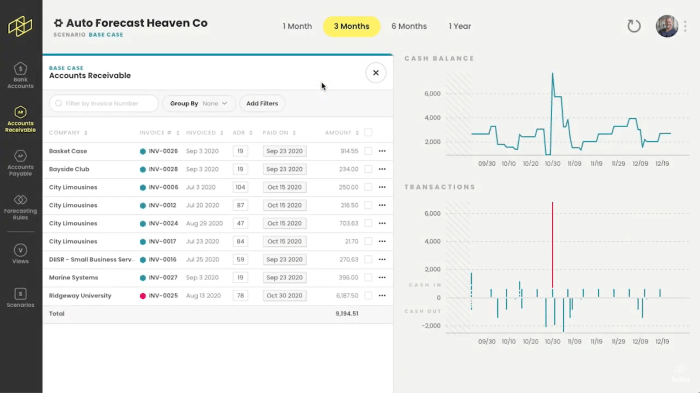

Improving Accounts Receivable Management

Accelerating cash inflows from accounts receivable is crucial for maintaining healthy cash flow. Implementing robust credit policies, including thorough credit checks and clear payment terms, minimizes bad debt risk. Proactive follow-up on overdue invoices, utilizing automated reminder systems and collection agencies when necessary, ensures timely payments. Offering early payment discounts can incentivize customers to pay sooner, improving cash flow predictability. Regularly reviewing aging receivables reports helps identify potential problems early and allows for proactive intervention. For example, a company could implement a tiered discount system: 2% discount for payment within 10 days, 1% for payment within 20 days, and the full amount due after 30 days. This incentivizes quicker payments without significantly impacting profitability.

Managing Accounts Payable to Optimize Cash Outflow

Strategic management of accounts payable can significantly impact cash flow. Negotiating extended payment terms with suppliers provides more time to manage cash flow. Taking advantage of early payment discounts only when it aligns with overall cash flow goals ensures cost-effectiveness. Centralizing the accounts payable process and utilizing automated payment systems can improve efficiency and reduce errors. Maintaining strong relationships with suppliers can facilitate flexible payment arrangements during periods of cash flow stress. For instance, a business might negotiate a 30-day payment term instead of a 15-day term, providing crucial breathing room. They should also carefully analyze which early payment discounts are truly worthwhile based on their overall cash position and interest rates.

Advanced Cash Flow Forecasting Scenarios

Advanced cash flow forecasting goes beyond simple projections; it incorporates various scenarios and sensitivity analyses to anticipate potential challenges and opportunities. These advanced techniques are particularly beneficial in several scenarios.

- Seasonal Businesses: Businesses with fluctuating sales throughout the year (e.g., retailers during holidays) benefit greatly from forecasting to anticipate cash flow peaks and troughs. This allows for proactive planning of financing needs or investment opportunities.

- Capital Expenditures: Planning for significant capital expenditures (e.g., purchasing new equipment) requires accurate forecasting to ensure sufficient funds are available. Scenario planning can account for potential cost overruns or delays.

- Economic Uncertainty: During periods of economic uncertainty, advanced forecasting helps businesses assess the impact of various economic conditions on their cash flow, allowing for contingency planning.

- New Product Launches: Launching a new product involves significant upfront investment, and accurate forecasting is crucial to ensure sufficient funding and manage expectations regarding revenue generation.

- Mergers and Acquisitions: Forecasting cash flow post-merger or acquisition is essential to assess the financial viability of the deal and plan for integration costs.

Illustrative Examples of Cash Flow Management

Effective cash flow management is crucial for business success. Understanding how proper (or improper) management impacts a business’s trajectory is key to implementing effective strategies. The following examples illustrate the significant role cash flow plays in both business failure and extraordinary growth.

Business Failure Due to Poor Cash Flow Management

Imagine a rapidly growing online retailer experiencing a surge in sales. This seemingly positive situation masked a critical problem: the company’s rapid expansion outpaced its ability to collect payments from customers and manage its inventory effectively. Long credit terms offered to customers, coupled with slow-paying suppliers and significant upfront investment in new product lines, created a severe cash crunch. The company struggled to meet its payroll, pay rent, and purchase essential supplies. Despite high sales figures, the lack of available cash led to missed payments, penalties, damaged credit ratings, and ultimately, bankruptcy. The contributing factors were a mismatch between sales growth and cash inflows, poor credit management, and insufficient planning for the financial demands of rapid expansion. This illustrates the critical need for forecasting and proactive cash flow management even during periods of strong sales growth.

Successful Cash Flow Management in a Growing Business

Conversely, consider a successful bakery chain that implemented a robust cash flow management system. This system incorporated detailed sales forecasting, rigorous inventory control, and efficient accounts receivable management. By implementing a point-of-sale system that provided real-time sales data, they could accurately predict daily cash inflows. Strict credit policies for wholesale customers minimized bad debt, and a just-in-time inventory system reduced storage costs and minimized capital tied up in inventory. The bakery also proactively sought financing options, securing a line of credit to cover unexpected expenses or seasonal fluctuations in demand. This allowed them to smoothly navigate periods of lower sales, reinvest profits into expansion, and consistently meet their financial obligations. The result was sustained growth, increased profitability, and a strong financial foundation for future expansion.

Effective Cash Flow Management and Business Growth

Effective cash flow management is not merely about avoiding bankruptcy; it’s a catalyst for growth. By optimizing cash inflows and outflows, businesses can strategically invest in new opportunities, expand into new markets, and enhance operational efficiency. For instance, a company with a healthy cash flow can afford to invest in advanced technology, hire skilled employees, and pursue research and development initiatives, all of which contribute to long-term competitiveness and expansion. A strong cash position also provides a buffer against economic downturns, allowing the business to weather challenging periods and emerge stronger. This proactive approach allows for strategic decision-making, fostering sustainable and profitable growth.

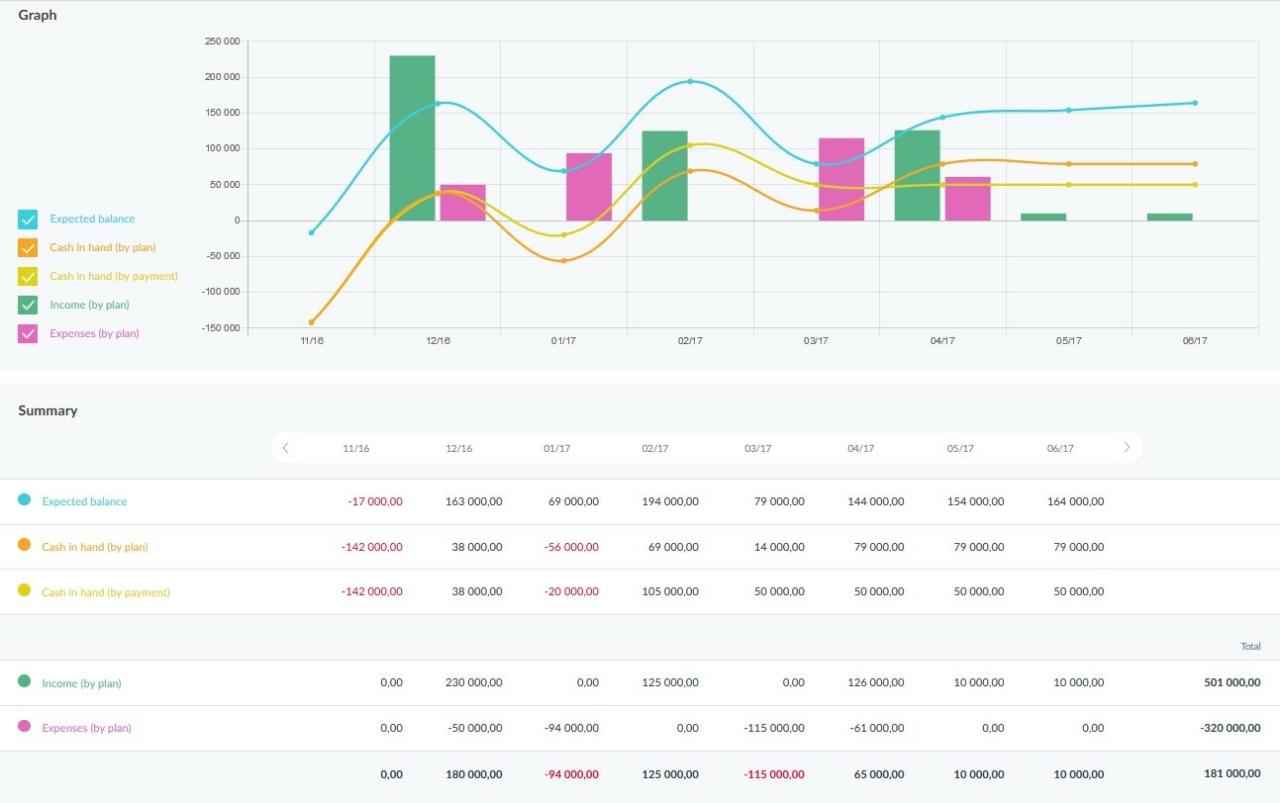

Visual Representation of a Healthy Cash Flow Statement

Imagine a graph showing cash flow over a year. The line representing inflows consistently exceeds the line representing outflows, resulting in a steadily increasing net cash flow balance. The graph clearly shows a positive trend throughout the year, with only minor dips during predictable periods like the end of a quarter when invoices are paid, but these dips are quickly recovered. This visual representation highlights consistent profitability and the ability to generate surplus cash, indicating strong cash flow management. The chart would also show predictable patterns, for instance, seasonal increases in cash inflow during peak seasons followed by slightly lower inflows during off-seasons, but always maintaining a positive balance. This demonstrates a business’s ability to forecast and manage its cash flow effectively, ensuring financial stability and preparedness for future investments and growth.

Summary

Mastering cash flow management is not merely about balancing the books; it’s about gaining a strategic advantage. By leveraging the right tools and techniques, businesses can transform their financial outlook, paving the way for sustainable growth and increased profitability. This guide has equipped you with the knowledge and resources to confidently navigate the complexities of cash flow, ensuring your business thrives in the long term. Remember, proactive cash flow management isn’t just good business practice; it’s essential for survival and success.

FAQ

What is the difference between cash flow and profit?

Profit represents the overall earnings after deducting all expenses. Cash flow, however, focuses on the actual movement of money into and out of the business during a specific period.

How often should I review my cash flow?

Ideally, cash flow should be monitored regularly, at least weekly or monthly, to catch potential issues early.

Are there free cash flow management tools available?

Yes, several free tools and spreadsheets exist, but they often lack the advanced features of paid software.

What if my business operates in multiple currencies?

Choose a tool that supports multi-currency transactions and accurate conversion rates to avoid complications.