Climate change presents a multifaceted threat, impacting every sector from agriculture to finance. Understanding and managing these risks is no longer a futuristic concern; it’s a critical imperative for businesses, governments, and individuals alike. This exploration delves into the complexities of climate change risk, examining the various types of risks, assessment methodologies, and mitigation strategies employed to navigate this evolving landscape. We’ll explore both successful and unsuccessful case studies, highlighting best practices and lessons learned along the way.

From acute events like extreme weather to chronic challenges like sea-level rise, the impacts are diverse and far-reaching. Effective risk management necessitates a comprehensive approach, integrating scientific projections, financial analysis, and robust policy frameworks. This necessitates a proactive and adaptable strategy, constantly evolving to meet the dynamic nature of climate change impacts.

Defining Climate Change Risk

Climate change risk encompasses the potential for adverse impacts resulting from climate change-related events and trends. Understanding these risks is crucial for effective adaptation and mitigation strategies. This involves a multifaceted approach, considering not only the physical impacts but also the economic and legal ramifications.

The Multifaceted Nature of Climate Change Risks

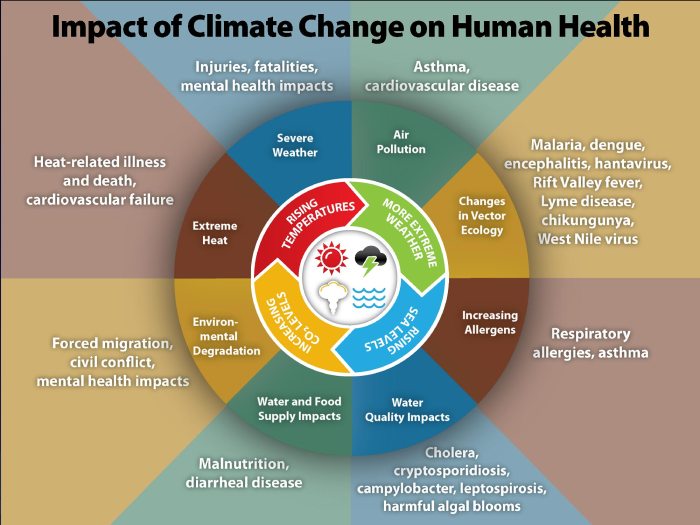

Climate change risks are complex and interconnected, spanning physical, transitional, and liability risks. Physical risks are the direct impacts of climate change, such as extreme weather events (floods, droughts, heatwaves) and sea-level rise. Transitional risks arise from the policy responses to climate change, such as carbon pricing or stricter environmental regulations, impacting businesses and economies. Liability risks involve legal repercussions for companies or individuals found responsible for contributing to climate change or failing to adapt adequately. These risks are not mutually exclusive; they often interact and amplify each other. For example, a severe flood (physical risk) could lead to increased insurance premiums (transitional risk) and potential lawsuits against responsible parties (liability risk).

Acute and Chronic Climate Risks

Acute climate risks are sudden and intense events with immediate impacts, such as hurricanes, wildfires, and heatwaves. These events can cause significant damage and disruption in a short period. Chronic climate risks, on the other hand, are gradual and long-term changes, such as sea-level rise, desertification, and changes in precipitation patterns. These changes can have far-reaching consequences over decades, gradually degrading ecosystems and impacting livelihoods. The difference lies in the timescale and intensity of the impact. The 2023 Canadian wildfires, for example, represent an acute risk, while the ongoing desertification of the Sahel region exemplifies a chronic risk.

Sectoral Vulnerabilities to Climate Change Impacts

Different sectors exhibit varying degrees of vulnerability to climate change impacts. The agricultural sector is highly susceptible to changes in temperature and precipitation patterns, impacting crop yields and livestock production. The financial sector faces risks from stranded assets (investments in fossil fuels becoming worthless) and increased insurance claims due to extreme weather events. Infrastructure, particularly coastal infrastructure, is vulnerable to sea-level rise and extreme weather, potentially causing significant economic losses and disruptions.

Vulnerability of Key Sectors

| Sector | Acute Risk | Chronic Risk | Mitigation Strategy |

|---|---|---|---|

| Agriculture | Droughts, floods, heatwaves | Changes in growing seasons, soil degradation, water scarcity | Drought-resistant crops, efficient irrigation, diversification |

| Finance | Extreme weather-related losses, market volatility | Stranded assets, increased insurance premiums | Climate risk assessment, sustainable investments, carbon pricing mechanisms |

| Infrastructure | Damage from floods, hurricanes, wildfires | Sea-level rise, increased maintenance costs | Climate-resilient design, improved drainage systems, relocation of vulnerable assets |

Assessing Climate Change Risks

Accurately assessing climate change risks is crucial for effective adaptation and mitigation strategies. This involves understanding the potential impacts of climate change on various sectors and developing methods to quantify and manage those risks. This process requires a multi-faceted approach, combining qualitative and quantitative techniques to paint a comprehensive picture of potential vulnerabilities and opportunities.

Methods for Assessing Climate Change Risks

Various methods exist for assessing climate change risks, each with its strengths and limitations. These methods can be broadly categorized as qualitative and quantitative. Qualitative assessments rely on expert judgment and stakeholder consultations to identify and prioritize risks, often employing techniques like Delphi surveys or scenario planning. Quantitative assessments, on the other hand, use numerical data and statistical models to estimate the likelihood and magnitude of potential impacts. This often involves probabilistic risk assessment or stress testing. A combination of both approaches is often the most effective way to understand the full range of climate risks.

Scenario Planning, Stress Testing, and Probabilistic Risk Assessment

Scenario planning involves developing plausible future scenarios based on different climate change pathways and socio-economic developments. This helps to explore a range of potential outcomes and identify vulnerabilities under different conditions. For example, a scenario might explore the impacts of a 2°C warming scenario on water resources in a specific region, contrasting this with a 4°C warming scenario. Stress testing, conversely, focuses on identifying the resilience of systems to extreme climate events or shocks. This might involve simulating the impact of a severe drought or a major flood on a critical infrastructure system, such as a power grid or transportation network. Probabilistic risk assessment uses statistical methods to quantify the likelihood and magnitude of different climate change impacts. This approach involves analyzing historical data, climate projections, and vulnerability assessments to estimate the probability of various outcomes and their associated costs. For instance, a probabilistic risk assessment might estimate the probability of exceeding a certain flood level in a coastal city over the next 50 years, considering sea-level rise projections and storm surge frequency. Each of these methods provides unique insights, and their combined use offers a more robust understanding of climate risk.

Data Collection and Analysis in Risk Assessment

Robust data collection and analysis are fundamental to effective climate risk assessment. Data sources include climate model projections (like those from the IPCC), historical climate data from meteorological stations and satellite observations, socio-economic data from censuses and surveys, and vulnerability assessments based on physical and social characteristics of communities. Limitations include data scarcity in certain regions, uncertainties in climate projections, and difficulties in quantifying non-climatic factors that influence risk. For example, accurate data on infrastructure vulnerabilities in developing countries may be limited, hindering the precision of risk assessments. Moreover, uncertainties inherent in climate models, such as variations in precipitation patterns, can affect the accuracy of projections.

Using Climate Models and Projections in Risk Assessments

Climate models provide projections of future climate conditions, such as temperature, precipitation, and sea level rise. These projections are crucial inputs for risk assessments, allowing researchers to estimate the potential impacts of climate change on various sectors. For example, climate models can be used to project changes in rainfall patterns, which can then be used to assess the risk of drought in agricultural regions. Similarly, sea-level rise projections can be used to assess the risk of coastal flooding in vulnerable areas. These projections are often incorporated into impact models, which simulate the effects of climate change on specific systems or sectors. The accuracy of these assessments depends heavily on the reliability of the underlying climate models and the quality of other data used. For instance, using high-resolution climate models for regional assessments will provide more specific and potentially more reliable projections compared to coarser global models.

Implementing Risk Management Strategies

Implementing effective climate change risk management requires a multifaceted approach encompassing both adaptation and mitigation strategies. This involves proactively addressing the impacts of climate change while simultaneously reducing greenhouse gas emissions to limit future risks. Successful implementation necessitates a strong understanding of the specific risks faced, the resources available, and the capacity to integrate climate considerations into existing operational frameworks.

Successful climate risk management isn’t merely about reacting to events; it’s about proactively shaping a more resilient future. This involves a strategic blend of adaptation and mitigation strategies, informed by robust risk assessments and tailored to specific organizational contexts. Effective implementation relies on collaboration, clear communication, and a commitment to long-term sustainability.

Adaptation Strategies

Adaptation strategies focus on adjusting to the current and projected impacts of climate change. These strategies aim to minimize vulnerabilities and maximize resilience. Examples include investing in infrastructure resilient to extreme weather events, developing drought-resistant crops, and implementing early warning systems for natural disasters. A key aspect of successful adaptation is incorporating climate projections into long-term planning and decision-making processes. This allows organizations to anticipate potential disruptions and develop appropriate responses.

Mitigation Strategies

Mitigation strategies aim to reduce greenhouse gas emissions and limit the extent of future climate change. These strategies involve transitioning to renewable energy sources, improving energy efficiency, adopting sustainable land management practices, and promoting carbon sequestration. Successful mitigation requires a systemic approach, involving both individual and collective action at various levels – from individual consumers to governments and multinational corporations. Investment in research and development of low-carbon technologies is also crucial.

Examples of Successful Climate Risk Management Initiatives

The city of Rotterdam, Netherlands, has implemented a comprehensive climate adaptation plan, including raising flood defenses, creating green spaces to absorb rainwater, and developing early warning systems for extreme weather events. This proactive approach has significantly reduced the city’s vulnerability to sea-level rise and flooding. Similarly, many insurance companies are integrating climate risk assessments into their underwriting processes, adjusting premiums based on the level of climate-related risk faced by policyholders. This incentivizes risk reduction and promotes a more sustainable approach to insurance. Furthermore, companies like Unilever have integrated sustainability goals into their business strategies, aiming to reduce their carbon footprint and improve their resilience to climate change impacts. Their efforts include sourcing sustainable raw materials, improving energy efficiency in their operations, and investing in renewable energy.

Integrating Climate Risk Management into Business Continuity Planning

A framework for integrating climate risk management into business continuity planning should begin with a comprehensive climate risk assessment, identifying potential climate-related disruptions to operations. This assessment should be incorporated into existing business continuity plans, outlining specific actions to mitigate and respond to these risks. This could include developing alternative supply chains, relocating critical infrastructure, or investing in backup power systems. Regular reviews and updates of the plan are essential to account for evolving climate risks and technological advancements. The plan should also include clear communication protocols to ensure effective coordination during emergencies.

Best Practices for Effective Climate Risk Communication and Stakeholder Engagement

Effective climate risk communication and stakeholder engagement are crucial for successful implementation of climate risk management strategies. It is vital to foster open and transparent communication to build trust and confidence.

- Tailor communication to specific audiences: Use clear and concise language appropriate for the knowledge and understanding of each stakeholder group.

- Use multiple communication channels: Combine different methods such as reports, presentations, workshops, and online platforms to reach a broader audience.

- Engage stakeholders proactively: Involve stakeholders in the risk assessment and planning processes to ensure their needs and concerns are addressed.

- Be transparent and honest about uncertainties: Acknowledge that some aspects of future climate change are uncertain, but emphasize the potential impacts and the need for proactive management.

- Focus on solutions and opportunities: Highlight the benefits of climate action, such as economic opportunities and improved resilience.

- Monitor and evaluate communication effectiveness: Regularly assess how well communication is being received and make adjustments as needed.

Financial Implications of Climate Change Risk

Climate change presents a significant and evolving threat to global financial stability. The interconnectedness of economic systems means that the financial impacts of climate change are far-reaching, affecting various sectors and investment strategies. Understanding these implications is crucial for effective risk management and sustainable economic growth.

Physical Damage Costs

The direct physical impacts of climate change, such as extreme weather events (hurricanes, floods, wildfires), rising sea levels, and prolonged droughts, lead to substantial financial losses. These costs include damage to infrastructure, disruption of business operations, agricultural losses, and displacement of populations. For example, Hurricane Katrina in 2005 caused over $160 billion in damages, highlighting the potential for catastrophic financial losses from extreme weather. The increasing frequency and intensity of these events, driven by climate change, will continue to escalate these costs significantly in the coming decades. Moreover, the costs are not solely borne by the directly affected parties; the ripple effects through supply chains and global markets are substantial.

Stranded Assets

The transition to a low-carbon economy poses significant risks to assets whose value is tied to fossil fuels. This includes oil and gas reserves, coal mines, and power plants reliant on fossil fuel combustion. As governments and societies implement policies to mitigate climate change, such as carbon pricing and stricter emission regulations, the demand for fossil fuels will decline, rendering these assets “stranded”—meaning their value depreciates significantly or becomes entirely worthless. This represents a substantial financial risk for investors and companies holding these assets. For instance, the decline in the value of coal power plants due to the increasing adoption of renewable energy sources is a clear example of this risk.

Increased Insurance Premiums

The escalating frequency and severity of climate-related disasters are driving up insurance premiums. Insurance companies face increased payouts for claims related to extreme weather events, leading them to raise premiums to maintain profitability and cover their risk exposure. This increase in premiums affects businesses, homeowners, and individuals, adding to the overall financial burden of climate change. Moreover, some areas may become uninsurable due to the high risk of climate-related damage, creating further financial vulnerability. This effect is already visible in coastal regions highly susceptible to flooding and hurricanes.

Climate-Related Financial Disclosures

Enhanced transparency and accountability regarding climate-related financial risks are becoming increasingly important. Mandatory climate-related financial disclosures, such as those promoted by the Task Force on Climate-related Financial Disclosures (TCFD), encourage companies to assess and report their climate-related risks and opportunities. These disclosures provide investors and other stakeholders with crucial information to make informed decisions, promoting responsible investment and fostering a more resilient financial system. Better disclosure leads to a more accurate pricing of climate-related risks in financial markets.

The Role of Insurance and Reinsurance in Managing Climate Change Risks

The insurance and reinsurance industries play a crucial role in managing climate change risks. Insurance provides financial protection against climate-related losses, while reinsurance helps insurers manage their own risk exposure. However, the increasing frequency and severity of climate-related events are challenging the capacity of the insurance sector to adequately cover these risks. Innovative insurance products and risk transfer mechanisms, such as parametric insurance (which triggers payouts based on pre-defined parameters, like rainfall levels), are being developed to address these challenges. Furthermore, the role of public-private partnerships in managing catastrophic risks is becoming increasingly important.

Financial Instruments for Climate Risk Management

The following table compares different financial instruments used for climate risk management:

| Instrument | Description | Risk Management Function | Example |

|---|---|---|---|

| Green Bonds | Bonds issued to finance environmentally friendly projects. | Financing climate mitigation and adaptation projects. | Bonds issued by a municipality to fund renewable energy infrastructure. |

| Catastrophe Bonds (Cat Bonds) | Bonds whose payouts are triggered by specific catastrophic events. | Transferring catastrophe risk from insurers to investors. | Bonds issued by an insurance company that pay out if a major hurricane hits a specific region. |

| Weather Derivatives | Financial contracts whose value depends on weather-related variables. | Hedging against weather-related risks. | A contract that pays out if rainfall is below a certain threshold during a specific period. |

Policy and Regulatory Frameworks

Government policies and regulations play a crucial role in mitigating climate change risks. They provide the framework for incentivizing emissions reductions, adapting to unavoidable climate impacts, and fostering innovation in clean technologies. Effective policies translate scientific understanding into actionable strategies, shaping individual and corporate behavior to achieve broader environmental goals.

The effectiveness of climate action hinges on well-designed and consistently implemented policies. These policies influence investment decisions, technological advancements, and public awareness, ultimately shaping the trajectory of future climate change. A lack of robust policy frameworks can lead to increased vulnerability to climate-related risks and hinder progress toward a sustainable future.

National and International Climate Policies and Agreements

National and international climate policies vary significantly in their approaches and stringency. International agreements, such as the Paris Agreement, establish overarching goals and frameworks for collective action, while national policies translate these commitments into specific measures tailored to individual country contexts. The Paris Agreement, for example, aims to limit global warming to well below 2 degrees Celsius, preferably to 1.5 degrees Celsius, compared to pre-industrial levels. However, the agreement’s success depends on the ambition and effectiveness of individual national policies. Some countries have implemented comprehensive carbon pricing schemes, while others rely on a mix of regulations, subsidies, and voluntary initiatives. The European Union’s Emissions Trading System (ETS), a cap-and-trade system, stands as a notable example of a regional carbon pricing mechanism, demonstrating both successes and challenges in balancing economic competitiveness with environmental protection. In contrast, some nations primarily focus on renewable energy targets and energy efficiency standards. These differing approaches reflect varying economic capacities, political priorities, and national circumstances.

Carbon Pricing Mechanisms

Carbon pricing mechanisms, such as carbon taxes and cap-and-trade systems, are key instruments for incentivizing emissions reductions. A carbon tax directly levies a fee on carbon emissions, making polluting activities more expensive and encouraging businesses and individuals to reduce their carbon footprint. Cap-and-trade systems, on the other hand, set a limit on total emissions and allow companies to trade emission permits, creating a market-based mechanism for emissions reduction. Both approaches aim to internalize the external costs of carbon emissions, ensuring that polluters bear the full cost of their actions. The effectiveness of these mechanisms depends on the level of the carbon price, the scope of coverage, and the design of complementary policies. For example, a sufficiently high carbon price can significantly shift investment towards low-carbon technologies and energy sources. Revenue generated from carbon taxes can be used to fund climate mitigation and adaptation projects, or to offset other taxes, potentially reducing the overall tax burden on households and businesses. However, poorly designed carbon pricing schemes can lead to unintended consequences, such as carbon leakage (emissions shifting to countries with less stringent policies) or regressive impacts on low-income households.

Challenges in Implementing Effective Climate Change Policies

Implementing effective climate change policies faces numerous challenges. Political resistance from vested interests, economic concerns about competitiveness, and the complexity of coordinating international action all pose significant obstacles. Balancing economic growth with environmental protection requires careful policy design and implementation. Furthermore, the long-term nature of climate change makes it difficult to garner immediate political support for policies that may yield benefits only in the distant future. Effective communication and public engagement are crucial to build consensus and overcome public resistance to climate policies. Another challenge is ensuring equity and fairness in the distribution of costs and benefits associated with climate action. Policies must be designed to avoid disproportionately burdening vulnerable populations and regions. Finally, robust monitoring and evaluation systems are essential to assess the effectiveness of policies and make necessary adjustments to ensure they achieve their intended goals. For instance, the effectiveness of renewable energy subsidies depends on careful monitoring of their impact on market development and the avoidance of potential market distortions.

Technological Innovations for Risk Mitigation

Technological advancements are crucial in mitigating climate change risks. A multifaceted approach, incorporating both established and emerging technologies, is needed to effectively reduce greenhouse gas emissions, adapt to changing climate patterns, and build resilience against climate-related hazards. This section explores several key technological innovations and their roles in climate risk management.

Renewable Energy Technologies

Renewable energy sources, such as solar, wind, hydro, geothermal, and biomass, offer viable alternatives to fossil fuels, significantly reducing carbon emissions. Solar photovoltaic (PV) technology continues to improve in efficiency and cost-effectiveness, making solar power a competitive energy source globally. Wind energy, particularly offshore wind farms, offers high energy yields. Hydropower remains a significant source of renewable energy, although its environmental impact needs careful consideration. Geothermal energy harnesses heat from the Earth’s interior, providing a consistent and reliable energy source. Biomass energy utilizes organic matter, offering a renewable energy option with potential for carbon neutrality depending on sustainable sourcing and management. The widespread adoption of these technologies requires substantial investment in infrastructure, grid modernization, and energy storage solutions.

Carbon Capture, Utilization, and Storage (CCUS)

CCUS technologies aim to capture carbon dioxide emissions from industrial sources and either utilize them in various applications or store them underground. Carbon capture can be implemented at power plants, industrial facilities, and even directly from the atmosphere (direct air capture, DAC). Utilization focuses on converting captured CO2 into valuable products, such as fuels or building materials. Storage involves injecting captured CO2 into geological formations for long-term sequestration. While CCUS offers a significant potential for emission reduction, the technology’s scalability, cost-effectiveness, and long-term safety remain crucial considerations. Large-scale deployment requires substantial research and development, along with appropriate regulatory frameworks to ensure safe and responsible storage practices.

Emerging Technologies in Climate Risk Management

Artificial intelligence (AI) and blockchain technology hold immense potential for enhancing climate risk management. AI can be utilized for improved climate modeling, predicting extreme weather events, optimizing renewable energy grids, and monitoring deforestation. Machine learning algorithms can analyze vast datasets to identify patterns and trends, enabling more accurate risk assessments and more effective adaptation strategies. Blockchain technology can improve transparency and traceability in carbon markets, enhancing the accountability of emission reduction projects. It can also facilitate the development of decentralized energy systems and support the creation of verifiable carbon credits. However, the ethical implications and potential biases associated with AI algorithms, as well as the energy consumption of blockchain technology, need careful consideration.

Cost and Benefits of Climate Mitigation Technologies

The costs and benefits of climate mitigation technologies vary significantly depending on the specific technology, its scale of deployment, and the context of its application. Renewable energy technologies, such as solar and wind, have experienced dramatic cost reductions in recent years, making them increasingly competitive with fossil fuels. However, upfront investment costs for infrastructure development remain significant. CCUS technologies are currently more expensive than other mitigation options, but their costs are expected to decline with technological advancements and economies of scale. The long-term benefits of climate mitigation technologies include reduced greenhouse gas emissions, improved air quality, increased energy security, and economic opportunities in the green sector. A comprehensive cost-benefit analysis is crucial for informed decision-making in selecting and implementing appropriate climate mitigation strategies.

Technological Applications Across Sectors

The following table illustrates the diverse applications of various technologies across different sectors:

| Technology | Sector | Application |

|---|---|---|

| Solar PV | Energy, Buildings | Electricity generation, building-integrated photovoltaics |

| Wind Energy | Energy | Electricity generation (onshore and offshore) |

| Carbon Capture | Energy, Industry | Capturing CO2 from power plants and industrial processes |

| AI | Various | Climate modeling, risk assessment, optimizing energy grids |

| Blockchain | Energy, Finance | Tracking carbon credits, facilitating peer-to-peer energy trading |

| Energy Storage (batteries) | Energy, Transportation | Grid stabilization, electric vehicle power |

| Smart grids | Energy | Improved efficiency and integration of renewable energy |

Illustrative Case Studies

Examining both successful and unsuccessful climate change risk management projects provides valuable insights into effective strategies and common pitfalls. By analyzing these case studies, we can identify best practices and areas needing improvement in the development and implementation of comprehensive climate risk management plans.

Successful Climate Change Risk Management: The City of Rotterdam’s Adaptation Strategy

Rotterdam, a city highly vulnerable to rising sea levels and extreme weather events, implemented a proactive and comprehensive adaptation strategy. The city recognized its vulnerability early on and invested significantly in infrastructure upgrades and innovative planning. Specific actions included strengthening flood defenses, developing early warning systems for extreme weather, and implementing nature-based solutions like restoring coastal wetlands to act as natural buffers against storm surges. These measures, coupled with public awareness campaigns and community engagement initiatives, significantly reduced the city’s vulnerability to climate-related risks. The results include a demonstrable decrease in flood damage, improved resilience to extreme weather events, and increased public awareness and preparedness. A key lesson learned is the importance of long-term planning, collaboration across various stakeholders, and continuous monitoring and adaptation of strategies in response to evolving climate risks. Rotterdam’s success highlights the value of integrating climate resilience into urban planning and infrastructure development.

Unsuccessful Climate Change Risk Management: The Case of Coastal Communities in Bangladesh

Many coastal communities in Bangladesh experienced significant challenges in managing climate change risks due to a combination of factors. Limited resources, weak governance structures, and a lack of access to early warning systems hindered effective adaptation measures. The failure to adequately address issues like sea-level rise, increased salinity, and extreme weather events led to significant displacement, loss of livelihoods, and environmental degradation. The lack of integrated planning, inadequate investment in resilient infrastructure, and insufficient community engagement contributed to the negative outcomes. Lessons learned include the crucial need for increased funding and technical support for vulnerable communities, strengthening institutional capacity for effective risk management, and the importance of integrating climate change considerations into development planning at all levels. The case highlights the disproportionate impact of climate change on vulnerable populations and the necessity of equitable and inclusive approaches to risk management.

Comparison of Case Studies: Best Practices and Areas for Improvement

Comparing Rotterdam’s success with the challenges faced by coastal communities in Bangladesh reveals key differences in approach and outcome. Rotterdam’s proactive approach, substantial investment, strong governance, and community engagement resulted in significant improvements in climate resilience. In contrast, the lack of resources, weak governance, and limited community involvement in Bangladesh led to significant vulnerabilities. Best practices highlighted by Rotterdam include early risk assessment, integrated planning, long-term investment in resilient infrastructure, and strong community engagement. Areas for improvement, as evidenced by the Bangladesh case, involve ensuring equitable access to resources and support for vulnerable communities, strengthening institutional capacity, and promoting inclusive decision-making processes in climate risk management. The comparison underscores the importance of context-specific approaches, recognizing that effective risk management requires tailored strategies that consider the unique challenges and capacities of different communities.

Closing Summary

Successfully navigating the challenges of climate change requires a proactive, multi-faceted approach. By understanding the diverse risks, implementing effective mitigation and adaptation strategies, and fostering transparent communication and collaboration, we can build resilience and secure a sustainable future. The journey demands continuous learning, adaptation, and a commitment to innovative solutions, ensuring that climate risk management remains a central focus in decision-making processes across all sectors.

FAQ Resource

What is the difference between adaptation and mitigation in climate change risk management?

Adaptation focuses on adjusting to the current and future effects of climate change (e.g., building seawalls), while mitigation aims to reduce greenhouse gas emissions to limit the severity of climate change (e.g., transitioning to renewable energy).

How can small businesses effectively manage climate change risks?

Small businesses can start by assessing their vulnerability to climate impacts, implementing energy-efficient practices, and exploring insurance options to cover climate-related damages. They can also engage with local initiatives and support sustainable supply chains.

What is the role of insurance in climate change risk management?

Insurance plays a vital role in transferring and managing climate-related financial risks. Insurance companies can provide coverage for climate-related damages, incentivize risk reduction measures, and provide financial resources for recovery efforts.