Navigating the dynamic world of commodity markets requires a keen understanding of intricate factors influencing price fluctuations. From agricultural harvests susceptible to weather patterns to energy prices swayed by geopolitical tensions, this analysis delves into the multifaceted nature of commodity trading. We’ll explore fundamental and technical analysis techniques, risk management strategies, and the impact of regulations, offering a holistic perspective on this complex yet rewarding investment landscape.

This exploration will cover various commodity types, including energy, metals, and agricultural products, examining their unique characteristics and market behaviors. We will analyze the roles of key players – producers, consumers, and speculators – and the interplay of supply and demand in shaping market dynamics. Understanding these elements is crucial for making informed decisions within this volatile yet potentially lucrative arena.

Introduction to Commodity Markets

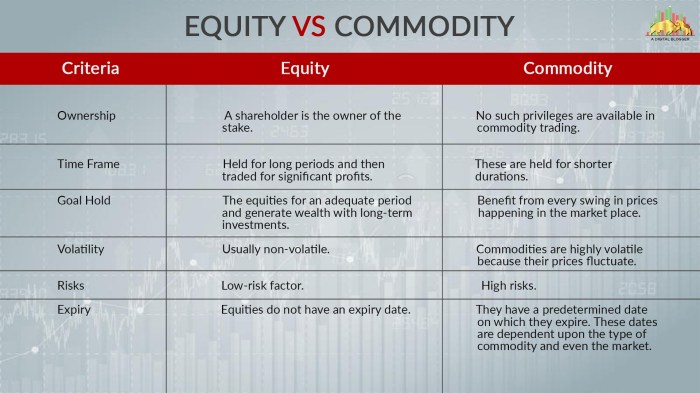

Commodity markets are vital components of the global economy, facilitating the trade of raw materials and primary agricultural products. These markets are characterized by significant price fluctuations driven by complex interactions between supply, demand, and speculation. Understanding their dynamics is crucial for businesses, investors, and policymakers alike.

Characteristics of Commodity Markets

Commodity markets are diverse, encompassing various sectors with unique characteristics. Energy markets, for example, involve the trading of crude oil, natural gas, and refined petroleum products. Price volatility in this sector is often influenced by geopolitical events, OPEC production quotas, and global economic growth. Metals markets, on the other hand, deal with precious metals like gold and silver, as well as industrial metals such as copper, aluminum, and iron ore. Demand for these metals is closely tied to industrial activity and technological advancements. Finally, agricultural commodity markets trade in crops like corn, wheat, soybeans, and coffee. Weather patterns, government policies, and consumer demand play a significant role in shaping prices within this sector. These markets often exhibit seasonality, with prices fluctuating based on harvest cycles and storage capacity.

Supply and Demand in Commodity Price Determination

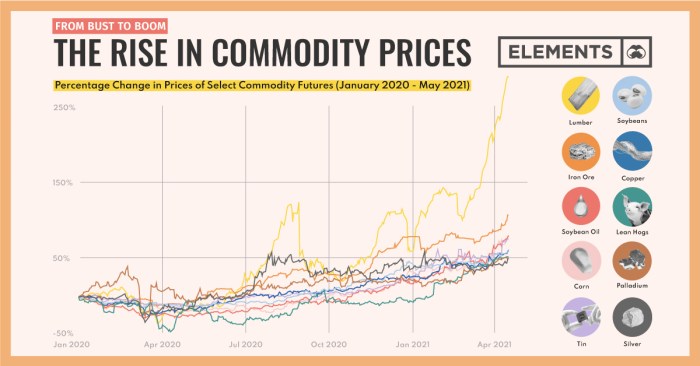

The fundamental principle governing commodity prices is the interaction of supply and demand. A high demand coupled with limited supply typically results in price increases, while abundant supply in the face of weak demand leads to price declines. However, this relationship is not always straightforward. Speculation, geopolitical instability, and unexpected events (like natural disasters) can significantly impact prices, creating deviations from the basic supply-demand equilibrium. For instance, a drought significantly impacting a major agricultural producing region could drastically reduce supply, leading to a sharp price increase even if demand remains relatively stable. Conversely, a major technological breakthrough that increases efficiency in production could lead to lower prices despite increasing demand.

Commodity Market Participants

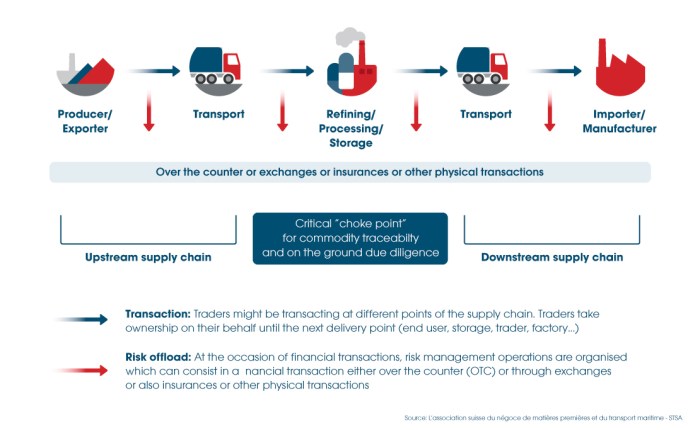

Several key players participate in commodity markets, each with their own motivations and strategies. Producers, such as farmers, mining companies, and energy producers, bring commodities to the market. Their primary goal is to maximize profits by selling their products at favorable prices. Consumers, including manufacturers, processors, and end-users, purchase commodities as inputs for their production processes or for direct consumption. Their objective is to secure reliable supplies at competitive prices. Speculators, meanwhile, participate in the market to profit from price fluctuations, taking long or short positions based on their market outlook. They play a crucial role in providing liquidity and price discovery, but their activities can also amplify price volatility. Other significant participants include intermediaries (brokers, traders, and exchanges), who facilitate the buying and selling of commodities, and financial institutions, who provide financing and risk management services.

Commodity Market Volatility

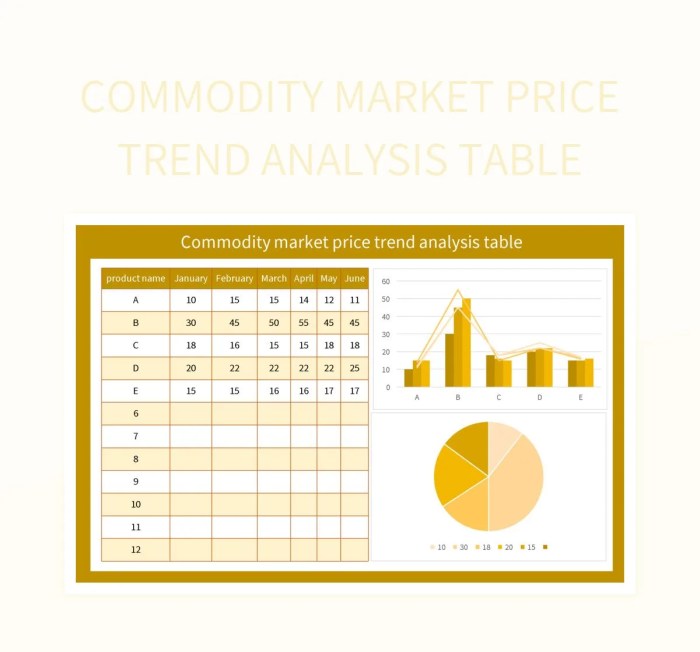

The following table provides a comparison of the historical volatility of different commodity markets, measured by the annualized standard deviation of price returns. Note that volatility can vary significantly over time depending on market conditions. This data is illustrative and should not be considered investment advice.

| Commodity Market | Average Annualized Volatility (Past 10 Years) | Factors Influencing Volatility | Example of Recent Volatility Event |

|---|---|---|---|

| Crude Oil | 20-30% | Geopolitical events, OPEC policy, global economic growth | 2022-2023 price spikes due to the war in Ukraine and supply chain disruptions |

| Gold | 10-15% | Safe-haven demand, inflation expectations, currency fluctuations | Increased volatility during periods of economic uncertainty |

| Corn | 15-25% | Weather patterns, global supply and demand, government policies | Price increases due to droughts in major producing regions |

| Copper | 15-20% | Global industrial activity, technological advancements, supply chain disruptions | Price fluctuations reflecting the cyclical nature of global industrial activity |

Fundamental Analysis of Commodities

Fundamental analysis in commodity markets focuses on the underlying factors influencing supply and demand. Unlike technical analysis, which relies on price charts and trading patterns, fundamental analysis delves into the real-world events and economic conditions shaping commodity prices. Understanding these factors is crucial for informed investment decisions.

Weather Patterns and Agricultural Commodity Prices

Weather significantly impacts agricultural production, directly affecting the supply of commodities like corn, soybeans, coffee, and sugar. Unfavorable weather conditions, such as droughts, floods, excessive heat, or unexpected freezes, can severely reduce crop yields, leading to a decrease in supply. This scarcity, in turn, drives up prices. Conversely, favorable weather conditions can result in bumper crops, increasing supply and potentially depressing prices. For example, a severe drought in a major corn-producing region could drastically reduce the global corn harvest, causing prices to spike. Conversely, abundant rainfall across key coffee-growing areas might lead to a surplus and lower coffee prices.

Geopolitical Events and Energy Commodity Prices

Geopolitical instability significantly influences energy commodity prices, particularly oil and natural gas. Political unrest, sanctions, wars, or disruptions to supply chains in major oil-producing regions can lead to supply shortages and price volatility. For instance, the ongoing conflict in Ukraine has significantly impacted global energy markets, leading to increased oil and natural gas prices due to sanctions against Russia, a major energy exporter. Similarly, political tensions in the Middle East, a key oil-producing region, can often trigger price spikes due to concerns about potential supply disruptions.

Macroeconomic Factors Affecting Commodity Markets

Several macroeconomic factors influence commodity prices. Inflation, for example, generally leads to higher commodity prices as the cost of production increases. Rising interest rates can dampen demand for commodities, as businesses and consumers may reduce investment and spending, potentially leading to lower prices. Currency fluctuations also play a role; a weaker domestic currency can make imports more expensive, increasing the price of commodities dependent on international trade. For example, a period of high inflation coupled with increased demand for raw materials can drive up the prices of metals like copper and aluminum. Conversely, a period of low inflation and higher interest rates might reduce the demand for commodities, leading to lower prices.

Supply and Demand Curves in Commodity Price Forecasting

Supply and demand curves are fundamental tools in forecasting commodity prices. The supply curve illustrates the relationship between the price of a commodity and the quantity producers are willing to supply. The demand curve shows the relationship between the price and the quantity consumers are willing to buy. The intersection of these curves determines the equilibrium price and quantity. Shifts in either the supply or demand curve, caused by factors discussed above, will lead to a new equilibrium price. For example, a decrease in supply (due to a drought) will shift the supply curve to the left, resulting in a higher equilibrium price. Conversely, an increase in demand (due to strong economic growth) will shift the demand curve to the right, also leading to a higher equilibrium price. Accurate forecasting requires analyzing these shifts and their impact on the equilibrium point.

Technical Analysis of Commodities

Technical analysis in commodity trading utilizes historical price and volume data to predict future price movements. Unlike fundamental analysis, which focuses on economic factors, technical analysis relies on chart patterns and indicators to identify potential trading opportunities. This approach assumes that past price movements offer clues about future price behavior, and that market psychology is reflected in price action.

Technical Indicators in Commodity Trading

Several technical indicators are commonly employed in commodity trading to generate buy or sell signals. These indicators help traders identify trends, momentum shifts, and potential reversals. Understanding their strengths and limitations is crucial for effective trading.

- Moving Averages: Moving averages smooth out price fluctuations, revealing underlying trends. Simple moving averages (SMA) calculate the average price over a specific period, while exponential moving averages (EMA) give more weight to recent prices. A common strategy involves using a combination of short-term and long-term moving averages; a bullish crossover occurs when a short-term MA crosses above a long-term MA, suggesting a potential uptrend. A bearish crossover is the opposite.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 generally suggest an overbought market, indicating a potential price correction, while readings below 30 suggest an oversold market, potentially signaling a price rebound. RSI is a momentum oscillator, not a trend indicator.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It consists of a MACD line and a signal line. Buy signals often emerge when the MACD line crosses above the signal line, while sell signals occur when the MACD line crosses below the signal line. Divergences between the MACD and the price chart can also provide valuable insights.

Chart Patterns in Commodity Markets

Chart patterns represent recurring price formations that often precede specific price movements. Recognizing these patterns can help traders anticipate potential price changes and time their entries and exits effectively.

- Head and Shoulders: This reversal pattern suggests a potential shift from an uptrend to a downtrend. It consists of three peaks, with the middle peak (the head) being the highest. A neckline connects the troughs on either side of the head. A break below the neckline confirms the pattern and often leads to a price decline.

- Double Tops/Bottoms: These patterns indicate potential trend reversals. A double top consists of two similar price highs, followed by a break below the neckline (connecting the two highs). A double bottom is the opposite, with two similar price lows, followed by a break above the neckline (connecting the two lows). These patterns suggest a potential trend reversal.

Comparison of Technical Analysis Methods

Different technical analysis methods offer unique perspectives on market behavior. While some focus on trend identification, others highlight momentum or volatility. Combining multiple indicators and chart patterns can provide a more comprehensive view of the market. For instance, using moving averages to identify the trend and RSI to gauge overbought/oversold conditions can help refine trading decisions. However, it’s crucial to remember that no single method guarantees success; market conditions can change rapidly, and no indicator is perfect.

Trading Strategy: RSI and Gold

This strategy uses the RSI indicator to trade gold. The strategy involves buying gold when the RSI falls below 30 (oversold) and selling when it rises above 70 (overbought). A 14-period RSI will be used. This approach aims to capitalize on short-term price corrections within a longer-term trend. Risk management is crucial; stop-loss orders should be placed to limit potential losses. This strategy should be adapted based on market volatility and individual risk tolerance. For example, during periods of high volatility, wider stop-loss orders might be necessary. Furthermore, confirming the RSI signals with other indicators or chart patterns could improve the accuracy of trading decisions. Successful implementation requires consistent monitoring and adaptation to changing market conditions.

Risk Management in Commodity Trading

Commodity trading, while offering substantial profit potential, is inherently risky. Fluctuations in prices, driven by a multitude of factors, can lead to significant losses if not properly managed. Effective risk management strategies are crucial for ensuring the long-term viability and success of any commodity trading operation. This section explores the key risks involved and the techniques employed to mitigate them.

Common Risks in Commodity Investments

Commodity markets are subject to various risks, some systemic and others specific to individual commodities. Price volatility is perhaps the most prominent risk. Prices can swing wildly due to factors such as supply and demand imbalances, weather events, geopolitical instability, and changes in economic conditions. Geopolitical risks, including wars, political instability, and trade disputes, can significantly impact commodity prices, creating uncertainty and potentially substantial losses. Furthermore, regulatory changes, currency fluctuations, and even unforeseen events (like pandemics) can introduce additional layers of risk. Understanding and assessing these risks is the first step toward effective risk management.

Risk Management Techniques in Commodity Trading

Several strategies can be employed to mitigate the risks inherent in commodity trading. Hedging, a fundamental risk management technique, involves taking an offsetting position in a related market to reduce the impact of price fluctuations. For instance, a farmer expecting to sell corn in the future might use futures contracts to lock in a price, protecting against potential price declines. Diversification, another key strategy, involves spreading investments across various commodities, geographies, and trading strategies. This approach reduces the impact of losses in any single investment by spreading the risk. Other techniques include using options contracts for price protection or participation in index funds which offer broad market exposure with reduced individual commodity risk.

Position Sizing and Stop-Loss Orders

Position sizing and stop-loss orders are critical tools for controlling risk on individual trades. Position sizing refers to determining the appropriate amount of capital to allocate to each trade. A well-defined position sizing strategy prevents significant losses even if a trade moves against the trader’s expectation. Stop-loss orders automatically sell a position when the price falls to a predetermined level, limiting potential losses. The placement of a stop-loss order is crucial and should consider factors like price volatility and the trader’s risk tolerance. These tools are essential in preventing catastrophic losses and preserving trading capital.

Case Study: Effective Risk Management in Soybean Trading

Imagine a trader anticipating a soybean price increase due to a predicted drought in a major producing region. Instead of investing their entire capital in a single, large position, they employ a diversified approach, allocating a portion of their capital to soybean futures contracts and another portion to corn futures (a related commodity). They also set stop-loss orders at a level that would limit potential losses to a predetermined percentage of their capital. The drought does occur, and soybean prices rise as anticipated. However, unforeseen political instability in a key importing nation causes a temporary price dip. The stop-loss orders protect the trader from excessive losses during this dip, while the diversification into corn limits the overall impact of the negative event. The trader benefits from the price increase in soybeans, but the risk management strategies prevent a major setback from the unexpected political event, ultimately leading to a successful trading outcome.

Commodity Market Indices and ETFs

Commodity market indices and exchange-traded funds (ETFs) offer investors diversified exposure to the commodity markets, providing alternative investment strategies beyond direct commodity trading. Understanding their construction, benefits, risks, and comparative performance is crucial for informed decision-making.

Commodity indices are statistical measures designed to track the price movements of a basket of commodities. Their construction involves selecting specific commodities, assigning weights based on factors like market capitalization or production volume, and applying a methodology to calculate the overall index value. Different indices may utilize different methodologies and weighting schemes, leading to variations in performance and risk profiles. These indices serve as benchmarks for commodity market performance and are used to create commodity-linked investments such as ETFs.

Commodity Index Construction and Uses

Commodity indices are built using various methodologies. For example, some indices use a simple arithmetic average of the prices of the constituent commodities, while others employ more sophisticated methods such as geometric averaging or weighting by production volume. The selection of commodities included in an index is also critical and depends on the index’s intended focus. For instance, a broad commodity index might include energy, metals, and agricultural products, while a more specialized index might focus solely on precious metals. These indices are used by investors to track market performance, create investment strategies, and benchmark the performance of commodity-related investments. They also provide a basis for pricing commodity-linked derivatives and futures contracts.

Benefits and Risks of Investing in Commodity ETFs

Commodity ETFs offer several advantages. They provide diversification across different commodities, reducing the risk associated with investing in a single commodity. They are also relatively liquid and easy to trade, offering investors convenient access to the commodity markets. However, investing in commodity ETFs also carries risks. Commodity prices can be highly volatile, subject to factors such as weather patterns, geopolitical events, and changes in supply and demand. Furthermore, some commodity ETFs may track indices with specific biases or methodologies, potentially impacting their performance. The expense ratio associated with holding an ETF should also be considered.

Comparison of Commodity Indices and ETFs

Several major commodity indices exist, each with a unique composition and methodology. The Bloomberg Commodity Index, for example, tracks a broad range of commodities, while the Dow Jones-UBS Commodity Index focuses on a smaller selection. Similarly, numerous commodity ETFs are available, each tracking a specific index or basket of commodities. Comparing these indices and ETFs requires considering their underlying assets, weighting schemes, historical performance, and expense ratios. Performance can vary significantly depending on the specific commodities included and market conditions. For instance, an ETF focused on energy commodities might perform well during periods of high energy demand, while an ETF focused on agricultural commodities might be more sensitive to weather patterns and global food security concerns.

Major Commodity ETFs: Composition and Historical Performance

The following table presents a simplified overview. Note that past performance is not indicative of future results, and actual returns can vary significantly. This data is for illustrative purposes only and should not be considered investment advice. Consult financial professionals for personalized investment strategies.

| ETF Name | Underlying Assets | Approximate Allocation (Illustrative) | Historical Performance (Illustrative – 5-year average annual return) |

|---|---|---|---|

| Invesco DB Commodity Index Tracking Fund (DBC) | Broad range of commodities | Energy: 30%, Metals: 30%, Agriculture: 20%, Livestock: 10%, etc. | (Illustrative: 2%) |

| iShares S&P GSCI Commodity-Indexed Trust (GSG) | Broad range of commodities | Energy: 40%, Metals: 30%, Agriculture: 20%, Livestock: 10%, etc. | (Illustrative: 3%) |

| PowerShares DB Agriculture Fund (DBA) | Agricultural commodities | Corn, Soybeans, Wheat, Sugar, Coffee, etc. | (Illustrative: 1%) |

| United States Commodity Index Trust (USCI) | Broad range of US-produced commodities | Energy, Metals, Agriculture, etc. | (Illustrative: 4%) |

Impact of Regulation and Policy

Government regulations and international policies significantly influence commodity markets, impacting prices, production, and trade. These influences are multifaceted, stemming from various governmental actions and international agreements. Understanding these impacts is crucial for effective commodity market analysis and investment strategies.

Government regulations play a pivotal role in shaping commodity markets. These regulations can encompass various aspects, from production quotas and environmental standards to trade restrictions and tax policies. The interaction between these regulatory measures and market forces often determines the overall dynamics of commodity prices and availability.

Government Regulations in Commodity Markets

Government regulations directly impact commodity markets through various mechanisms. For example, production quotas for agricultural commodities like sugar or milk can limit supply, driving prices upward. Conversely, deregulation can lead to increased production and potentially lower prices. Environmental regulations, such as those limiting deforestation or promoting sustainable farming practices, can affect the availability of commodities derived from natural resources, like timber or palm oil. Similarly, tax policies on commodities can influence their price competitiveness both domestically and internationally. For instance, a carbon tax on fossil fuels can increase their price, potentially shifting demand towards renewable energy sources.

Impact of International Trade Agreements

International trade agreements significantly affect commodity prices by influencing access to global markets. Agreements like the World Trade Organization (WTO) agreements aim to reduce trade barriers, such as tariffs and quotas, leading to increased competition and potentially lower prices for consumers. However, these agreements can also have negative consequences for domestic producers if they lack the competitive edge to survive in a globalized market. Conversely, protectionist trade policies, such as tariffs or subsidies, can shield domestic producers from foreign competition but can also lead to higher prices for consumers and potential trade disputes. The North American Free Trade Agreement (NAFTA), later replaced by the United States-Mexico-Canada Agreement (USMCA), provides a real-world example of how trade agreements can reshape commodity markets, impacting agricultural products and manufactured goods alike.

Environmental Policies and Commodity Markets

Environmental policies are increasingly shaping the commodity landscape. Regulations aimed at mitigating climate change, protecting biodiversity, and reducing pollution can significantly impact the production and consumption of various commodities. For instance, regulations limiting greenhouse gas emissions from the energy sector can drive up the price of fossil fuels, potentially favoring renewable energy sources. Similarly, regulations restricting deforestation can reduce the supply of timber and other forest products, leading to price increases. The European Union’s Emissions Trading System (ETS), a cap-and-trade system for greenhouse gas emissions, serves as a prime example of how environmental policy directly affects commodity markets, particularly in the energy sector.

Government Subsidies and Agricultural Commodity Production

Government subsidies significantly influence agricultural commodity production. Direct subsidies, such as payments to farmers for producing specific crops, can increase supply, potentially leading to lower prices for consumers. However, these subsidies can also distort markets, leading to overproduction and environmental concerns. Indirect subsidies, such as tax breaks or research funding, can also impact production levels. For example, government subsidies for corn production in the United States have historically contributed to its large-scale cultivation and relatively low prices globally. Conversely, the absence or reduction of subsidies can lead to decreased production and potentially higher prices. The impact of such subsidies can vary depending on the commodity, the level of subsidy, and the overall market conditions.

Case Studies of Commodity Market Events

Understanding significant commodity market events provides invaluable insights into market dynamics and risk management strategies. Analyzing past occurrences allows for a better appreciation of the interconnectedness of global events, economic factors, and commodity price fluctuations. This section will delve into a detailed case study of a major commodity market event to illustrate these points.

The 2020 Oil Price Crash

The unprecedented collapse in oil prices during the first half of 2020 serves as a stark example of the volatility inherent in commodity markets. This event was driven by a confluence of factors, resulting in a dramatic and rapid price decline.

The primary catalyst was the COVID-19 pandemic. Lockdowns implemented globally led to a significant reduction in economic activity, drastically curtailing demand for oil. Simultaneously, a price war between Saudi Arabia and Russia exacerbated the situation. These two major oil producers engaged in a production increase competition, flooding the market with oil at a time when demand was plummeting. Storage capacity became severely strained, further depressing prices.

Causes of the 2020 Oil Price Crash

Several contributing factors led to the dramatic oil price collapse. The following points highlight the key drivers:

- Demand Destruction due to COVID-19: The pandemic caused unprecedented travel restrictions and economic shutdowns, leading to a massive drop in oil consumption across various sectors, including transportation, aviation, and manufacturing.

- OPEC+ Production Dispute: The breakdown of the OPEC+ agreement between Saudi Arabia and Russia resulted in a significant increase in oil supply at a time when demand was already falling sharply. This supply glut overwhelmed the market.

- Storage Capacity Constraints: As oil prices plummeted, storage facilities quickly filled to capacity. The lack of sufficient storage exacerbated the supply glut and further pressured prices downwards.

- Investor Sentiment: Negative investor sentiment amplified the price decline. Concerns about the economic impact of the pandemic and the oil price war led to widespread selling pressure.

Consequences of the 2020 Oil Price Crash

The oil price crash had far-reaching consequences across the global economy and the energy sector:

- Financial Distress in the Energy Sector: Many oil and gas companies faced severe financial difficulties, with some declaring bankruptcy due to the sharp decline in revenue.

- Job Losses: The crisis resulted in significant job losses in the energy sector and related industries.

- Geopolitical Implications: The price war between Saudi Arabia and Russia highlighted the geopolitical complexities of the oil market and the potential for instability.

- Impact on Inflation: While initially deflationary due to lower energy prices, the crash had longer-term inflationary implications as it disrupted supply chains and increased input costs for various industries.

Lessons Learned from the 2020 Oil Price Crash

The 2020 oil price crash provided several valuable lessons for investors and traders:

- Diversification is Crucial: The event highlighted the importance of diversifying investment portfolios to mitigate risk. Over-reliance on a single commodity can lead to significant losses during periods of market volatility.

- Geopolitical Risk Assessment: Investors and traders need to carefully assess geopolitical risks and their potential impact on commodity prices. Unexpected events, such as the OPEC+ dispute, can have a significant influence on market dynamics.

- Demand Elasticity: Understanding the elasticity of demand for a commodity is crucial. The pandemic demonstrated the significant impact that sudden changes in demand can have on prices.

- Risk Management Strategies: Implementing robust risk management strategies, such as hedging and stop-loss orders, is essential to protect against sudden price swings.

Ultimate Conclusion

Successfully navigating the commodity market demands a balanced approach, integrating fundamental and technical analysis, robust risk management, and a keen awareness of regulatory influences. By understanding the interplay of macroeconomic factors, geopolitical events, and market-specific trends, investors and traders can position themselves for success while mitigating potential risks. This comprehensive analysis serves as a valuable resource for anyone seeking to understand and participate in this complex and dynamic market.

Top FAQs

What are the main types of commodities?

Major commodity categories include energy (oil, natural gas), metals (gold, silver, copper), agricultural products (corn, wheat, soybeans), and livestock.

How do I get started in commodity trading?

Begin with thorough research and education. Consider opening a brokerage account with access to futures and options markets. Start with small trades and gradually increase your investment as you gain experience.

What is hedging in commodity trading?

Hedging involves using financial instruments to mitigate price risk. For example, a farmer might sell futures contracts to lock in a price for their harvest, protecting against potential price drops.

Are commodity markets regulated?

Yes, commodity markets are subject to significant regulation at both national and international levels to ensure fair trading and prevent market manipulation.