The commodity market, a dynamic arena shaped by global events and intricate economic forces, presents both significant opportunities and considerable risks. Understanding the interplay of supply and demand, geopolitical factors, and technological advancements is crucial for navigating this complex landscape. This outlook delves into the current state of the market, providing insights into price forecasts, investment strategies, and potential future disruptions.

From the impact of inflation on agricultural prices to the influence of geopolitical instability on energy markets, we explore the key drivers shaping commodity values. We analyze major commodity indices, examining their performance and identifying potential trends for the coming months and years. This analysis aims to provide a balanced perspective, acknowledging both the potential for growth and the inherent uncertainties within the commodity sector.

Current Market Conditions

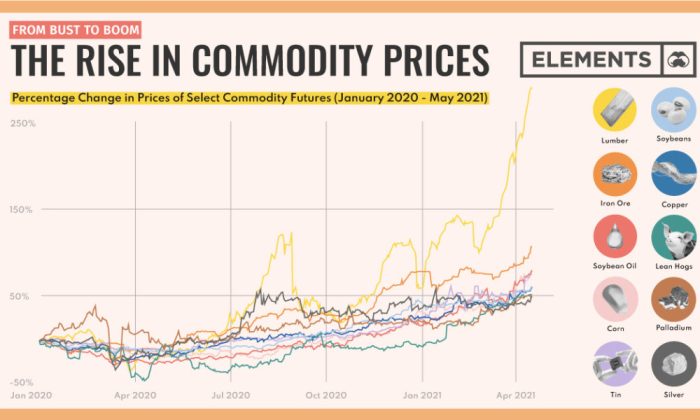

Commodity markets are currently experiencing a period of mixed signals, with significant volatility driven by a complex interplay of geopolitical events, inflationary pressures, and evolving supply-demand dynamics. While certain sectors show signs of strength, others face headwinds, creating a challenging environment for investors and producers alike.

Prevailing Sentiment in Commodity Markets

The overall sentiment in commodity markets is cautious optimism tempered by uncertainty. While some analysts predict continued price increases in specific sectors due to supply constraints, others express concern about the potential for a global economic slowdown, which could dampen demand and lead to price corrections. This uncertainty is reflected in the increased volatility observed across various commodity indices. For example, the recent rise in energy prices has been accompanied by increased price swings in agricultural commodities as investors grapple with the implications of the ongoing conflict in Ukraine and potential disruptions to global food supplies.

Impact of Geopolitical Events on Commodity Prices

Geopolitical instability significantly impacts commodity prices. The ongoing conflict in Ukraine, for instance, has dramatically disrupted global energy and agricultural markets. Russia’s role as a major exporter of oil, natural gas, and wheat has led to significant price increases in these commodities, impacting global inflation and energy security. Similarly, other geopolitical tensions, such as those in the Middle East and East Asia, can create supply chain disruptions and fuel price volatility. These events often lead to increased uncertainty, prompting investors to seek safe haven assets, which can further influence commodity prices.

Influence of Inflation on Commodity Demand and Supply

Inflation exerts a dual influence on commodity markets. High inflation can boost commodity prices as producers pass on increased costs to consumers. Simultaneously, it can also curb demand as consumers reduce spending on discretionary goods, potentially leading to price corrections in some sectors. The current inflationary environment is characterized by rising energy and food prices, which are directly linked to the cost of production across various sectors. This creates a complex dynamic where inflation both drives up prices and potentially limits demand, depending on the specific commodity and its price elasticity.

Performance of Major Commodity Indices

Major commodity indices reflect the varied performance across different sectors. For instance, energy indices have generally outperformed other sectors due to the ongoing energy crisis, while agricultural indices have experienced significant volatility driven by geopolitical factors and weather patterns. Precious metal indices have shown mixed results, with gold prices generally holding steady amidst uncertainty, while other metals have experienced more volatile price movements. The overall performance of these indices provides a broad overview of the commodity market’s health, although it is essential to consider individual commodity performance for a more nuanced understanding.

Year-to-Date Performance of Commodity Sectors

| Commodity Sector | Year-to-Date Performance (%) | Volatility | Key Drivers |

|---|---|---|---|

| Energy | +15% (estimated) | High | Geopolitical tensions, supply constraints |

| Agriculture | +5% (estimated) | Medium | Weather patterns, geopolitical instability |

| Metals | -2% (estimated) | Medium | Global economic slowdown concerns |

| Livestock | +8% (estimated) | Low | Increased demand, feed costs |

Supply and Demand Dynamics

The interplay of supply and demand is the fundamental driver of commodity price movements. Understanding the factors influencing both sides of this equation is crucial for navigating the complexities of the commodity markets. This section will explore key elements impacting the supply and demand for several major commodities, considering technological advancements, shifting consumer preferences, and potential disruptions to the global supply chain.

Factors Influencing Commodity Supply

Several interconnected factors influence the supply of key commodities. Weather patterns significantly impact agricultural production, with droughts or floods potentially leading to substantial crop failures and price spikes. For oil, geopolitical instability, OPEC production quotas, and the pace of new discoveries all play critical roles. Gold supply, meanwhile, is largely determined by mining output, which is influenced by factors such as the price of gold itself (higher prices incentivize more mining), technological advancements in extraction, and the availability of labor and capital. These factors create a dynamic and often unpredictable environment.

Technological Advancements in Commodity Production

Technological advancements are reshaping commodity production across the board. In agriculture, precision farming techniques, including GPS-guided machinery and data analytics, are boosting yields and efficiency. Similarly, advancements in oil and gas extraction, such as hydraulic fracturing (“fracking”) and horizontal drilling, have unlocked previously inaccessible reserves. In mining, improved exploration techniques and automation are increasing output and reducing costs. These technological leaps, while increasing overall supply in many cases, can also create uneven impacts, potentially widening the gap between larger, more technologically advanced producers and smaller players.

Changing Consumer Preferences and Commodity Demand

Consumer preferences are a powerful force shaping commodity demand. The growing global population, particularly in developing economies, is driving increased demand for food and energy commodities. Simultaneously, shifts toward healthier diets are influencing demand for specific agricultural products, such as organic produce and plant-based proteins. The rise of electric vehicles is impacting demand for certain metals, like lithium and cobalt, while decreasing demand for petroleum-based fuels. These shifts require careful consideration when assessing future commodity market trends. For instance, the increased demand for lithium has led to significant price increases and a surge in lithium mining activities.

Potential Supply Chain Disruptions and Their Effects

Global supply chains are increasingly vulnerable to disruptions. Geopolitical events, such as wars or trade disputes, can severely impact the flow of commodities. Natural disasters, such as hurricanes or earthquakes, can damage infrastructure and disrupt production. Furthermore, pandemics, as demonstrated by the COVID-19 crisis, can cause widespread shortages and bottlenecks. The impact of such disruptions can be dramatic, leading to price volatility and shortages of essential commodities. The Suez Canal blockage in 2021 serves as a stark reminder of how a single event can have cascading effects across global supply chains, affecting the availability and price of numerous commodities.

Scenario: A Significant Supply Shock in the Oil Market

Imagine a scenario where a major oil-producing nation experiences a prolonged political instability leading to a significant reduction in oil exports. This sudden supply shock would immediately send oil prices soaring. The impact would be felt globally, with higher gasoline prices impacting consumers and businesses. Inflation would likely increase, potentially triggering a recessionary environment. Alternative energy sources would become more attractive, accelerating the transition to renewable energy. This scenario highlights the profound consequences of even a temporary disruption to the supply of a crucial commodity like oil. The 1973 oil crisis serves as a historical parallel, showcasing the widespread economic and social ramifications of such events.

Major Commodity Price Forecasts

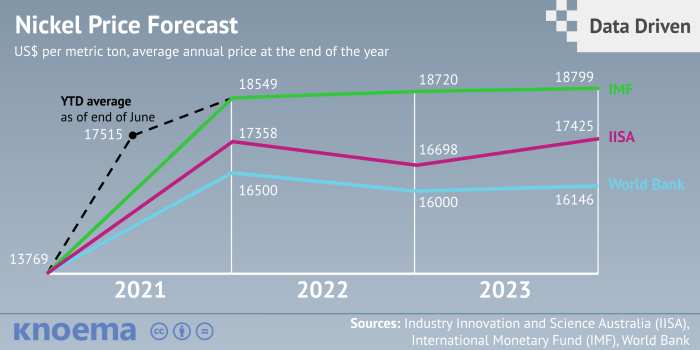

Predicting commodity prices is inherently complex, influenced by a multitude of interconnected factors including global economic growth, geopolitical events, weather patterns, technological advancements, and speculative trading. The forecasts presented below represent a synthesis of various analytical methodologies and market perspectives, acknowledging the inherent uncertainty involved in long-term projections. It’s crucial to remember these are estimates, not guarantees.

Methodology for Price Forecasting

Our commodity price forecasts utilize a blend of quantitative and qualitative methods. Quantitative analysis incorporates econometric models that consider historical price data, macroeconomic indicators (such as GDP growth, inflation rates, and interest rates), and supply-demand fundamentals. Qualitative analysis incorporates expert opinions from industry analysts, assessments of geopolitical risks, and evaluations of technological disruptions. For example, our model for crude oil prices incorporates factors like OPEC+ production quotas, US shale oil output, and global demand projections from the International Energy Agency (IEA). We then weight these different methodologies to arrive at our final forecast. This process is iterative and refined based on ongoing market developments.

Six-Month, One-Year, and Five-Year Commodity Price Forecasts

The following table presents our forecasts for key commodities over the next six months, one year, and five years. These are point estimates, and actual prices may deviate significantly. The provided ranges represent a plausible band of outcomes considering potential upside and downside risks. Note that these forecasts are based on current market conditions and assumptions, and are subject to revision.

| Commodity | 6-Month Forecast (USD/unit) | 1-Year Forecast (USD/unit) | 5-Year Forecast (USD/unit) |

|---|---|---|---|

| Crude Oil (Brent) | 80-90 | 85-100 | 70-110 |

| Natural Gas (Henry Hub) | 3.5-4.5 | 4.0-5.5 | 4.5-7.0 |

| Gold | 1900-2050 | 1950-2200 | 2000-2500 |

| Copper | 4.0-4.5 | 4.2-5.0 | 4.5-6.0 |

Comparison of Analyst Forecasts

Different market analysts employ varying methodologies and assumptions, leading to diverse price forecasts. For instance, Goldman Sachs might be more bullish on oil prices due to their assessment of stronger global demand growth compared to, say, Morgan Stanley, which may emphasize the potential impact of a recession on demand. These differences in outlook highlight the inherent uncertainty and subjectivity involved in forecasting. While consensus views can provide valuable insights, it is crucial to consider the range of forecasts and the underlying assumptions driving them.

Upside and Downside Risks to Price Projections

Several factors could significantly influence commodity prices, creating both upside and downside risks to our forecasts. Upside risks for many commodities include unexpected supply disruptions (e.g., geopolitical instability, extreme weather events), a faster-than-expected global economic recovery, and increased investment in commodities-related sectors. Downside risks include a global recession, a significant technological breakthrough leading to increased efficiency or substitution, and unexpected shifts in government policies or regulations. For example, a major breakthrough in battery technology could significantly reduce demand for certain metals, negatively impacting their price projections. Conversely, a prolonged conflict in a major oil-producing region could lead to significantly higher oil prices than anticipated.

Investment Strategies in Commodity Markets

Investing in commodities offers a unique way to diversify a portfolio and potentially profit from global economic trends. However, the commodity market is characterized by volatility and requires a careful understanding of various investment vehicles and associated risks. This section Artikels several key strategies, their associated risks and rewards, and provides a hypothetical portfolio example.

Futures Contracts

Futures contracts are agreements to buy or sell a specific commodity at a predetermined price on a future date. This strategy allows investors to speculate on price movements, hedging against price risk, or gaining exposure to specific commodities. The high leverage inherent in futures trading amplifies both profits and losses, making it crucial to manage risk effectively through techniques like stop-loss orders. For example, a farmer might use futures contracts to lock in a price for their harvest, protecting against potential price drops. Conversely, a speculator might buy a futures contract believing the price of a commodity will rise, hoping to sell it later at a profit. The risk lies in the potential for significant losses if the market moves against the investor’s prediction.

Exchange-Traded Funds (ETFs)

Commodity ETFs provide diversified exposure to a basket of commodities, offering a less volatile and more accessible entry point than individual futures contracts. These funds track specific commodity indices, allowing investors to participate in the overall commodity market performance. ETFs are generally less risky than direct futures trading due to their diversification and lower leverage. However, their returns are also typically less dramatic. A successful investment in a broad-based commodity ETF might reflect the overall growth of the global economy, while an unsuccessful investment could be due to a downturn in several commodity sectors simultaneously.

Physical Commodities

Investing directly in physical commodities, such as gold or precious metals, involves purchasing and storing the asset. This approach is often favored by investors seeking a tangible asset and a hedge against inflation. However, it entails significant storage costs and logistical challenges, particularly for bulk commodities. A successful strategy here might involve buying gold during periods of economic uncertainty and holding it for the long term, benefiting from its historical role as a safe haven asset. Conversely, an unsuccessful strategy could involve purchasing a commodity with significant storage costs that loses value over time.

Comparison of Investment Strategies

The performance of different commodity investment strategies varies considerably depending on market conditions and the investor’s risk tolerance. Generally, futures contracts offer the highest potential returns but also carry the highest risk. ETFs provide a more moderate return profile with lower risk, while physical commodities offer a relatively stable, inflation-hedging investment with associated storage costs. Over long periods, commodity ETFs have often demonstrated more consistent returns than direct futures trading, although past performance is not indicative of future results.

Hypothetical Commodity Investment Portfolio

A hypothetical balanced commodity investment portfolio might allocate assets as follows: 40% in a broad-based commodity ETF (diversification and moderate risk), 30% in gold (inflation hedge and safe haven), and 30% in agricultural futures contracts (targeted exposure with higher risk/reward). This allocation balances diversification with targeted exposure to potentially higher-yielding sectors, while acknowledging the inherent risks of each strategy. The specific allocation should be adjusted based on the investor’s risk tolerance, investment horizon, and market outlook. For example, during periods of high inflation, a greater allocation to gold might be considered, whereas during periods of economic growth, a larger allocation to agricultural futures could be justified.

Geopolitical and Economic Risks

Commodity markets are inherently susceptible to a wide range of geopolitical and economic factors, often experiencing significant price volatility due to unforeseen circumstances. Understanding these risks is crucial for effective investment strategies and risk management. This section examines key elements influencing commodity price fluctuations.

Key Geopolitical Risks Impacting Commodity Prices

Geopolitical instability significantly impacts commodity prices. Conflicts, sanctions, and political uncertainty in major producing or consuming regions can disrupt supply chains, leading to price spikes. For instance, the war in Ukraine dramatically impacted global wheat and energy prices due to Ukraine’s role as a significant exporter. Similarly, tensions in the Middle East, a major oil-producing region, frequently trigger price volatility in the energy markets. These events highlight the inherent interconnectedness between global politics and commodity markets.

Economic Downturns and Commodity Demand

Economic downturns generally lead to decreased commodity demand. During recessions, industrial production slows, construction activity declines, and consumer spending reduces, all of which directly affect the demand for raw materials like metals, energy, and agricultural products. The 2008 global financial crisis, for example, resulted in a sharp drop in commodity prices across the board as global economic activity contracted. The severity of the impact varies depending on the specific commodity and the duration and depth of the recession.

Government Policies and Commodity Markets

Government policies play a substantial role in shaping commodity markets. Trade policies, such as tariffs and quotas, can significantly affect supply and demand. Subsidies to domestic producers can influence production levels and market share. Environmental regulations can impact extraction methods and production costs. For instance, carbon emission regulations are increasingly impacting the energy sector, driving a shift towards renewable energy sources and influencing the price of fossil fuels. Monetary policies, particularly interest rate changes, also affect commodity prices by influencing investment flows and the overall economic environment.

Climate Change and Commodity Production

Climate change poses significant risks to commodity production and pricing. Extreme weather events, such as droughts, floods, and heatwaves, can disrupt agricultural yields, impacting food prices and the availability of other agricultural commodities. Changes in temperature and precipitation patterns can also affect the productivity of other industries, such as mining and forestry. The increasing frequency and intensity of these events pose long-term challenges to commodity supply chains and price stability. For example, prolonged droughts in key agricultural regions can lead to food shortages and price inflation.

Impact of Unexpected Events on Commodity Markets

Unexpected events, such as natural disasters, pandemics, and unforeseen technological disruptions, can severely impact commodity markets. Natural disasters, like earthquakes or hurricanes, can damage infrastructure, disrupt production, and limit supply, leading to price increases. The COVID-19 pandemic, for example, caused significant disruptions in global supply chains, impacting the availability and price of various commodities. These unpredictable events underscore the inherent risk associated with commodity investments.

Technological Disruptions and Innovation

The commodity sector, traditionally reliant on established methods, is undergoing a significant transformation driven by technological advancements. These innovations are impacting every stage of the commodity value chain, from exploration and extraction to processing, transportation, and ultimately, consumption. The resulting shifts in efficiency, cost structures, and market dynamics are reshaping the landscape for producers, consumers, and investors alike.

Technological advancements are significantly improving efficiency and reducing costs across the commodity sector. New technologies are optimizing resource extraction, streamlining processing methods, and enhancing logistics. This leads to increased output with fewer resources, lower operational expenses, and ultimately, a more competitive market.

Impact of New Technologies on Commodity Extraction and Processing

The adoption of advanced technologies is revolutionizing commodity extraction and processing. For instance, in mining, automation and remote sensing technologies are increasing efficiency and safety while minimizing environmental impact. Similarly, in agriculture, precision farming techniques utilizing GPS, sensors, and data analytics are optimizing resource use and improving yields. The application of AI and machine learning in refining processes allows for greater control and precision, leading to higher-quality products and reduced waste. These technological advancements contribute to a more sustainable and efficient commodity production process.

Potential for Technological Advancements to Improve Efficiency and Reduce Costs

The potential for cost reduction and efficiency gains through technological innovation is substantial. Consider the use of robotics in manufacturing: automated systems can operate continuously, reducing labor costs and improving consistency. Furthermore, the implementation of blockchain technology offers the potential for greater transparency and traceability throughout the supply chain, reducing fraud and inefficiencies associated with information asymmetry. Predictive maintenance, enabled by data analytics and IoT sensors, minimizes downtime and reduces maintenance costs. These examples highlight the significant potential for technology to optimize commodity production and distribution.

Implications of Automation and Artificial Intelligence on Commodity Markets

Automation and AI are reshaping commodity markets in several ways. Increased automation leads to lower labor costs and potentially higher production volumes, influencing supply dynamics. AI-driven predictive analytics can improve forecasting accuracy, enabling better inventory management and price risk mitigation. However, the widespread adoption of automation also raises concerns about job displacement in certain sectors. The need for reskilling and upskilling the workforce will be crucial to manage this transition effectively. Moreover, the increasing reliance on data and algorithms introduces new vulnerabilities related to cybersecurity and data privacy.

Emerging Technologies that Could Significantly Alter the Commodity Landscape

Several emerging technologies are poised to significantly alter the commodity landscape. 3D printing, for example, has the potential to revolutionize manufacturing by enabling on-demand production and reducing transportation costs. Nanotechnology offers opportunities for developing new materials with enhanced properties, leading to innovations in various commodity sectors. Furthermore, advancements in biotechnology, such as gene editing and precision breeding, hold the potential to revolutionize agricultural production, increasing yields and enhancing resilience to climate change. The integration of these technologies will drive further efficiency gains and reshape commodity markets.

Visual Representation of Technological Advancements on Commodity Supply Chains

Imagine a diagram showing a traditional commodity supply chain as a series of interconnected boxes representing extraction, processing, transportation, and retail. Now, overlay this with lines representing various technologies: a dashed line showing automated mining equipment connected to the extraction box; a solid line connecting the processing box to a data center symbolizing AI-driven optimization; a dotted line representing blockchain technology securing the transportation phase; and finally, a thick line highlighting 3D printing enabling direct-to-consumer production. This illustrates how technology integrates at each stage, streamlining the entire process, increasing efficiency, and ultimately reducing the overall cost and environmental impact.

Outcome Summary

In conclusion, the commodity market outlook reveals a landscape of both challenges and opportunities. While geopolitical risks and economic uncertainties persist, technological innovation and evolving consumer preferences are reshaping the sector. Strategic investment approaches, informed by a thorough understanding of market dynamics and risk assessment, are essential for successful participation. Staying abreast of current events and future trends will be paramount for navigating this complex and ever-changing market.

FAQ Compilation

What are Exchange Traded Funds (ETFs) and how do they relate to commodity investing?

ETFs are investment funds that track specific commodities or indices. They offer diversified exposure to the commodity market with relatively low costs and ease of trading, making them accessible to a wide range of investors.

How can climate change impact commodity prices?

Climate change can significantly affect commodity prices through extreme weather events, impacting agricultural yields and disrupting supply chains. Changes in weather patterns can also affect energy production and resource availability.

What are the ethical considerations of commodity investing?

Ethical considerations in commodity investing include factors such as environmental sustainability (e.g., deforestation linked to agricultural commodities), labor practices in extraction industries, and the potential for price volatility to impact vulnerable populations.