Community banks often represent a refreshing alternative to large national institutions. They offer a personalized approach to banking, fostering stronger relationships with customers and a deeper understanding of local economic needs. This personalized service extends beyond simple transactions, influencing everything from loan approvals to community investment strategies. This exploration delves into the key advantages of choosing a community bank, examining how these institutions contribute to both individual financial well-being and the overall health of their communities.

From streamlined loan processes and competitive interest rates to robust community involvement and a commitment to local economic growth, community banks provide a unique value proposition. This examination will highlight these advantages, comparing them to the offerings of larger banks and showcasing the tangible benefits for both customers and the wider community.

Personalized Service and Local Expertise

Community banks offer a distinct advantage over larger institutions: a deeply personalized approach to banking combined with unparalleled local expertise. This translates to a more responsive, understanding, and ultimately beneficial banking experience for customers, particularly small businesses and individuals within the community.

The personalized service provided by community banks fosters stronger customer relationships built on trust and understanding. Unlike larger banks where interactions are often transactional, community banks prioritize getting to know their customers individually, understanding their unique financial needs and goals. This personalized approach allows for tailored financial solutions and proactive advice, leading to better financial outcomes for customers.

Benefits of Personalized Service

Community banks prioritize building relationships with their customers, leading to a more personalized and attentive service experience. This contrasts sharply with larger banks, where customers may feel like just another number. At a community bank, your banker is likely to know your name, your business, and your family. They can offer tailored financial advice based on your specific circumstances, rather than a one-size-fits-all approach. This personalized attention extends to quicker response times for inquiries and a more proactive approach to problem-solving. For example, if a small business owner experiences a cash flow issue, their community bank relationship manager is more likely to work directly with them to find a solution, possibly offering short-term financing options or adjusting payment schedules.

Local Expertise and Community Involvement

Local expertise is a cornerstone of community banking. Bank employees often reside in the same community they serve, possessing an intimate understanding of the local economy, its challenges, and its opportunities. This knowledge allows them to provide more relevant financial advice and support to local businesses and individuals. For instance, a community bank might be more attuned to the seasonal fluctuations in a farming community or the specific needs of a local retail sector. This understanding extends beyond financial matters; community banks often have deep roots in the community, actively participating in local initiatives and supporting charitable causes.

Community Bank Support for Local Businesses and Initiatives

Community banks frequently demonstrate their commitment to the community through direct financial support of local businesses and initiatives. This support can take various forms, including providing loans to small businesses, sponsoring local events, and donating to charitable organizations. For example, a community bank might offer a low-interest loan to a local restaurant owner looking to expand their business, knowing that the success of the restaurant will benefit the entire community. Similarly, they might sponsor the local Little League team or donate funds to a community food bank, further demonstrating their dedication to the area’s well-being.

Responsiveness of Community Banks vs. Large Banks

| Issue Type | Community Bank Response Time | Large Bank Response Time | Resolution Efficiency |

|---|---|---|---|

| Loan Application Inquiry | Within 24-48 hours, often same-day contact | Several days to weeks, potentially longer | Faster, more personalized solutions |

| Account Inquiry/Problem | Immediate resolution in most cases, direct contact with a representative | Multiple calls, transfers, and potentially long wait times | Significantly faster and more direct |

| Fraudulent Activity Report | Prompt investigation and immediate action to mitigate losses | Potentially lengthy investigation process with less personal attention | More proactive and customer-focused approach |

| General Customer Service Request | Quick response, often direct contact with a familiar representative | Automated systems, potential difficulty reaching a human representative | More personal and efficient resolution |

Stronger Community Ties and Economic Impact

Community banks play a vital role in the economic health and vitality of their local communities. Unlike larger national banks, their focus remains firmly on the prosperity of the towns and cities they serve. This localized approach translates into tangible benefits for residents, businesses, and the overall economic landscape.

Community banks are more than just financial institutions; they are active participants in the growth and development of their surrounding areas. Their commitment goes beyond simply processing transactions; it extends to actively fostering a thriving local economy.

Investment in Local Projects and Infrastructure

Community banks often invest directly in local projects and infrastructure improvements. This can include providing loans for the construction of new schools, hospitals, or community centers. They may also participate in funding initiatives for local parks, transportation upgrades, or other public works projects that enhance the quality of life for residents. For instance, a community bank might provide a significant loan to a local developer building affordable housing, directly impacting the housing market and overall community well-being. This investment not only improves the community’s infrastructure but also creates jobs and stimulates economic activity.

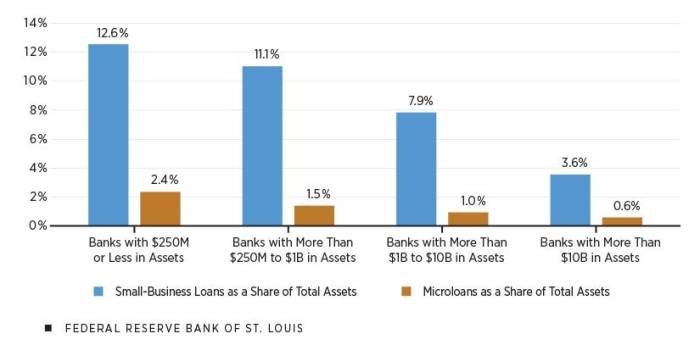

Support for Local Entrepreneurs and Small Businesses

Community banks are often the primary source of funding for local entrepreneurs and small businesses. These businesses form the backbone of many local economies, and community banks recognize their importance. They offer personalized service, understanding the unique needs and challenges of each business. They provide loans and financial guidance tailored to the specific circumstances of local enterprises, fostering growth and job creation within the community. This support can be crucial for startups lacking access to larger financial institutions or for established businesses needing capital for expansion or modernization. A prime example would be a local bakery receiving a loan to open a second location, creating new jobs and boosting the local economy.

Economic Ripple Effects of Community Bank Lending

The economic benefits stemming from community bank lending extend far beyond the initial loan recipient. Consider the following ripple effects:

- Job Creation: Loans to businesses lead to hiring, increasing employment within the community.

- Increased Tax Revenue: Thriving businesses generate more tax revenue for local governments, funding essential services.

- Higher Property Values: Investments in infrastructure and businesses improve the overall attractiveness of the area, leading to increased property values.

- Attracting New Businesses: A strong local economy, fueled by community bank support, attracts new businesses, further boosting growth and competition.

- Enhanced Community Well-being: Investments in community projects improve the quality of life, leading to a more vibrant and attractive community.

Simplified Banking Processes and Customer Relationships

Community banks often distinguish themselves through streamlined processes and a focus on building strong, personalized relationships with their customers. This contrasts sharply with the often impersonal and complex systems found in larger financial institutions. This focus on personalized service translates to a more efficient and satisfying banking experience for individuals and businesses alike.

The difference in approach is particularly evident when comparing loan application processes. Community banks typically have shorter approval times and less bureaucratic red tape, fostering a more collaborative and transparent process.

Loan Application Process Comparison

A key advantage of community banks lies in their simplified loan application processes. Unlike larger banks with their multi-layered approval systems and extensive paperwork requirements, community banks often offer a more direct and efficient approach. This often involves fewer forms, quicker processing times, and a more personalized interaction with loan officers who understand the local market and the applicant’s specific needs. For example, a small business owner applying for a loan at a community bank might work directly with a loan officer who understands the local economic landscape and can tailor the loan terms accordingly, rather than navigating a complex hierarchy within a larger bank.

Advantages of Direct Relationships with Decision-Makers

Having direct access to decision-makers is a significant advantage offered by community banks. This allows for quicker approvals, more flexible terms, and a more responsive and personalized service. The ability to discuss loan applications and financial strategies directly with the person who has the authority to approve them significantly streamlines the process and fosters a more collaborative relationship. For instance, if unforeseen circumstances arise during the loan process, the applicant can easily communicate with the decision-maker to find a mutually agreeable solution.

Examples of Flexible Lending Options and Personalized Financial Advice

Community banks frequently offer flexible lending options tailored to the unique circumstances of their clients. This might include customized repayment schedules, lower interest rates for long-standing customers, or loan products specifically designed to meet the needs of local businesses. Furthermore, community banks often provide personalized financial advice, helping customers to manage their finances effectively and achieve their financial goals. This personalized approach extends beyond lending, encompassing financial planning, investment advice, and general guidance on financial matters.

Fee and Interest Rate Comparison

While specific rates and fees vary greatly depending on individual circumstances and the current market conditions, community banks often compete favorably with larger institutions, particularly for certain types of loans and services. Below is a sample comparison, illustrating potential differences. Note that these are illustrative examples and actual rates and fees may vary significantly.

| Service | Community Bank (Example) | Larger Bank (Example) | Notes |

|---|---|---|---|

| Small Business Loan (Interest Rate) | 6.5% | 8.0% | Rates depend on creditworthiness and loan amount. |

| Personal Loan (Annual Fee) | $0 | $25 – $50 | Some community banks waive fees for loyal customers. |

| Checking Account (Monthly Fee) | $5 (waived with minimum balance) | $10 – $15 | Fees can vary based on account type and balance. |

| Overdraft Fee | $25 | $35 | Fees can be significantly higher for multiple overdrafts. |

Financial Stability and Security

Community banks are often perceived as pillars of financial stability within their communities. This perception stems from their inherent business model, which prioritizes local lending and fosters strong relationships with borrowers. This localized focus contributes to a more resilient and predictable lending portfolio compared to larger institutions with geographically diverse and often less-understood loan portfolios.

The risk management strategies employed by community banks differ significantly from those of larger institutions. Community banks typically maintain a more conservative lending approach, focusing on thorough due diligence and a deep understanding of the local economic landscape. This intimate knowledge allows them to better assess and mitigate risks associated with individual borrowers and projects. For example, a community bank might prioritize loans to local businesses with established track records, reducing their exposure to high-risk ventures. Conversely, larger banks, often dealing with a vast and impersonal array of loans across various sectors and geographies, might rely more heavily on complex risk models and diversification strategies, which can sometimes overlook crucial local factors.

Regulatory Oversight and Deposit Insurance

Community banks, like all banks in the United States, operate under the strict regulatory oversight of federal and state agencies. This oversight includes regular examinations, capital requirements, and adherence to lending regulations designed to protect depositors and maintain the stability of the financial system. The Federal Deposit Insurance Corporation (FDIC) provides deposit insurance, protecting depositors’ funds up to $250,000 per depositor, per insured bank, for each account ownership category. This safety net provides a critical layer of protection, instilling confidence in the banking system and minimizing the risk of deposit losses, even in the event of a bank failure. This protection applies equally to community banks and larger institutions, ensuring that depositors in community banks benefit from the same level of security.

Customer Data Security Measures

Community banks prioritize the security of customer data through a multi-layered approach. Understanding the importance of safeguarding sensitive information is paramount to maintaining customer trust.

- Robust encryption protocols are used to protect data both in transit and at rest.

- Regular security audits and penetration testing identify and address potential vulnerabilities.

- Employee training programs emphasize the importance of data security and best practices.

- Multi-factor authentication is often implemented to enhance login security.

- Firewalls and intrusion detection systems provide real-time protection against cyber threats.

These measures, combined with ongoing investment in advanced security technologies, help ensure that customer data remains confidential and protected from unauthorized access.

Accessibility and Convenience

Community banks excel in providing accessible and convenient banking services, often surpassing the offerings of larger national institutions. Their commitment to localized service translates into a diverse range of options designed to cater to the specific needs of their customer base. This accessibility extends beyond traditional branch banking, encompassing modern digital platforms and personalized support.

Community banks recognize the importance of offering various service channels to meet diverse customer preferences. This multi-channel approach ensures accessibility for all, regardless of technological proficiency or geographical limitations. This contrasts with the sometimes impersonal and less localized approach of many national banks.

Service Channel Availability

Community banks typically maintain a physical presence through a network of local branches, providing face-to-face interaction for transactions and financial guidance. This contrasts with the reduced branch network often seen in national banks, which may rely more heavily on online and mobile services. Furthermore, community banks often invest in robust online and mobile banking platforms, offering features such as account management, bill pay, and mobile check deposit, mirroring the functionality found in national bank apps, but often with a more personalized user experience.

Convenience Comparison

The convenience offered by community banks often stems from their localized nature. Shorter wait times at branches, personalized service from familiar staff, and a greater understanding of local economic conditions contribute to a smoother and more efficient banking experience. While national banks offer extensive online and mobile capabilities, their impersonal nature and potentially longer wait times for in-person assistance can sometimes detract from overall convenience. For example, a local farmer needing immediate assistance with a loan application might find a community bank more convenient than navigating the complex systems of a large national bank.

In-Person Financial Advice and Support

A key advantage of community banks lies in their ability to provide readily available, in-person financial advice and support. Local bankers often develop strong relationships with their clients, leading to more personalized guidance on financial planning, investment strategies, and other financial matters. This personalized attention is a significant differentiator from national banks, where individual clients may interact with a larger number of less familiar representatives. This personalized approach allows for tailored solutions, ensuring that clients receive advice relevant to their specific financial circumstances and goals.

Geographic Reach and Accessibility: A Visual Representation

Imagine two maps. The first depicts a large national bank’s reach – a sprawling network covering the entire country, represented by a dense, evenly distributed network of dots. These dots represent branches, but their density suggests limited individual attention. The second map shows a community bank’s reach – a smaller, clustered network of dots concentrated within a specific region or town. These dots, though fewer in number, are larger and more closely spaced, visually representing the higher level of personalized service and accessibility within that defined geographic area. The contrast emphasizes the community bank’s deep local presence and the national bank’s broader, but potentially less personal, reach. The community bank’s map visually communicates its focus on building strong relationships within its served community.

Last Recap

In conclusion, the advantages of community banks extend far beyond convenient access and personalized service. They represent a vital part of the economic fabric of their communities, actively participating in local growth and offering a level of personal attention often missing in larger institutions. By prioritizing strong customer relationships and a deep understanding of local needs, community banks provide a compelling alternative for individuals and businesses seeking a more responsive and community-focused banking experience. The inherent stability and security they offer, combined with their commitment to local investment, solidify their position as a valuable asset for any community.

FAQs

What are the typical fees associated with community bank accounts?

Fees vary significantly between community banks, so it’s best to check with individual institutions. Generally, fees are comparable to or sometimes lower than those at larger banks, particularly for basic services.

How do community banks handle large deposits?

Most community banks can handle substantial deposits, though the specific processes and limits may differ. It’s advisable to contact the bank directly to discuss your specific needs and deposit arrangements.

Are community banks as technologically advanced as larger banks?

Many community banks offer robust online and mobile banking services, often integrating with modern financial technology. While the breadth of features might differ, most provide essential online and mobile banking functionalities.