Competitive Analysis Template: Unlocking the secrets to market dominance starts with understanding your rivals. This isn’t about spying (though we’ll touch on ethically gathering intel!), it’s about strategically analyzing competitors to identify opportunities and avoid costly mistakes. We’ll equip you with a framework for dissecting your competition, from identifying key players and their strategies to visualizing market share and leveraging your findings for strategic planning. Prepare to outmaneuver your rivals!

This comprehensive guide walks you through a step-by-step process, from defining the scope of your analysis and identifying key competitors, to gathering data, presenting your findings in a compelling way, and finally, using your insights to inform strategic decision-making. We’ll cover everything from SWOT analysis to crafting visually engaging charts that tell a story – all within the context of a practical, user-friendly template. Get ready to gain a competitive edge!

Defining the Scope of Your Competitive Analysis Template

Crafting the perfect competitive analysis template is like baking the ideal cake: you need the right ingredients, the correct measurements, and a dash of strategic flair. A poorly defined scope is a recipe for disaster, leaving you with a soggy, uninformative mess instead of a delicious, insightful analysis. This section will guide you through defining a scope that’s both comprehensive and focused, ensuring your competitive analysis is as sharp as a Ginsu knife.

A robust competitive analysis template transcends generic frameworks; it’s tailored to the unique nuances of your industry. Ignoring industry-specific factors is like trying to fit a square peg into a round hole – it’s just not going to work. A template for a SaaS company will differ significantly from one designed for a gourmet cupcake bakery, for instance. The key performance indicators (KPIs) will vary, the competitive landscape will be drastically different, and the target audience will be worlds apart. Let’s delve into the specifics.

Industry-Specific Factors in Competitive Analysis

Consider these industry-specific factors when designing your template. A rigid, one-size-fits-all approach will inevitably fall short. The level of detail required for each factor will depend on the specifics of your industry. For example, regulatory compliance is a major concern in the pharmaceutical industry but might be less critical for a handmade jewelry business.

- Regulatory Environment: Compliance requirements, licensing, and legal considerations vary widely across industries. A thorough analysis should account for this.

- Technological Landscape: The pace of technological change is a critical factor. Industries with rapid innovation require a more dynamic and frequently updated template.

- Market Trends: Understanding prevailing trends, such as sustainability or personalization, is crucial for accurate competitive analysis.

- Supply Chain Dynamics: The complexity and fragility of supply chains impact competitiveness significantly. This is especially true in industries heavily reliant on global sourcing.

Key Performance Indicators (KPIs) for Different Business Models

KPIs are the lifeblood of your competitive analysis. Choosing the right ones is paramount. The appropriate KPIs will depend heavily on the business model employed by both your company and your competitors. Focusing on irrelevant metrics is like searching for your keys under a lamppost – even if the light is good, it’s not where you lost them.

| Business Model | Relevant KPIs |

|---|---|

| Subscription-based SaaS | Customer churn rate, monthly recurring revenue (MRR), customer lifetime value (CLTV), average revenue per user (ARPU) |

| E-commerce | Conversion rate, average order value (AOV), customer acquisition cost (CAC), return on ad spend (ROAS) |

| Brick-and-mortar retail | Sales per square foot, inventory turnover, customer traffic, same-store sales growth |

Defining Target Audiences Within the Competitive Analysis Template

Understanding your target audience and your competitors’ target audiences is fundamental to a successful competitive analysis. A clear understanding of demographics, psychographics, needs, and pain points allows for a more focused and effective strategy. Ignoring this crucial element is akin to sending a love letter to the wrong address – a complete waste of time and resources.

For each competitor, detail their primary target audience(s), highlighting key characteristics and preferences. Consider using personas to represent ideal customer profiles. This allows for a more nuanced understanding of how your competitors are positioning themselves within the market and how you can differentiate your offerings.

Identifying Competitors

Identifying your competitors is less about finding foes and more about understanding the landscape. Think of it as a meticulously crafted map, guiding your SaaS company to success – or at least, preventing a disastrous fall into a ravine of market irrelevance. Ignoring the competition is like navigating by the stars while blindfolded: possible, but statistically unlikely to end well.

This section will delve into the art of competitor identification, distinguishing between those who directly challenge your core offering and those who nibble at the edges of your market. We’ll examine the strengths and weaknesses of key players, providing a framework you can adapt to your own competitive analysis.

Direct and Indirect Competitors of “Project Chimera,” a Hypothetical SaaS Project Management Tool

Let’s imagine “Project Chimera” is a new SaaS project management tool emphasizing AI-powered task automation and intuitive collaboration features. Below, we’ll identify both its direct and indirect competitors, those aiming for the same niche and those offering adjacent solutions.

| Competitor Name | Strengths | Weaknesses | Market Share (Estimated) |

|---|---|---|---|

| Asana | Widely adopted, robust feature set, excellent user interface, strong integrations. | Can be overwhelming for smaller teams, pricing can escalate quickly for larger organizations, AI features are relatively nascent. | 15% |

| Monday.com | Highly visual, customizable workflows, strong community support, effective for agile methodologies. | Steeper learning curve than some competitors, can become expensive for complex projects, reporting features could be improved. | 12% |

| Trello | Simple and intuitive interface, great for Kanban workflows, free plan available, excellent for smaller teams. | Limited advanced features, scalability issues for large projects, reporting capabilities are basic. | 8% |

These are just three examples; a thorough competitive analysis would involve a much more extensive list, including potentially niche players and emerging startups. Market share estimations are inherently imprecise and can vary depending on the source and methodology.

Analyzing Competitor Strategies

Unraveling the mysteries of your competitors’ strategies is like deciphering a particularly fiendish crossword puzzle – challenging, but ultimately rewarding. Understanding their approach allows you to sharpen your own game and avoid stepping on any particularly prickly metaphorical landmines. This section will equip you with the tools to dissect their tactics, revealing their strengths, weaknesses, and, most importantly, their vulnerabilities.

Analyzing competitor strategies involves understanding the fundamental approaches businesses use to achieve a competitive advantage. These strategies are often categorized into a few key types, each with its own set of advantages and disadvantages. Choosing the right strategy, or a clever combination thereof, is crucial for success in today’s cutthroat marketplace.

Competitive Strategy Types

Several established frameworks exist for categorizing competitive strategies. One popular model, Porter’s Generic Strategies, identifies three main approaches: cost leadership, differentiation, and focus (niche marketing). Each requires a distinct approach to resource allocation and operational efficiency.

- Cost Leadership: This strategy focuses on becoming the lowest-cost producer in the industry. Companies employing this strategy often leverage economies of scale, efficient operations, and cost-effective sourcing to offer their products or services at a lower price than competitors. Think Walmart – their massive scale allows them to negotiate incredibly low prices from suppliers, which they then pass on to consumers.

- Differentiation: This strategy focuses on creating a unique product or service that is perceived as superior to competitors’ offerings. This superiority can be based on quality, features, brand image, customer service, or any other factor that customers value. Apple is a prime example; they successfully differentiate their products through design, user experience, and brand prestige, commanding premium prices.

- Focus (Niche Marketing): This strategy involves concentrating on a specific segment of the market and tailoring products or services to meet the unique needs of that segment. A small, artisanal bakery focusing on gluten-free pastries is a good example; they cater to a specific customer base with specialized needs, often commanding higher prices than mass-market bakeries.

Comparative Strategy Analysis: Example

Let’s compare two hypothetical competitors in the coffee industry: “Brewtiful Beans,” a small, locally-owned coffee shop focusing on ethically sourced beans and a unique atmosphere, and “Joe’s Java Joint,” a large chain emphasizing speed, convenience, and low prices.

Brewtiful Beans employs a differentiation strategy, emphasizing high-quality coffee and a unique customer experience. Joe’s Java Joint, on the other hand, adopts a cost leadership strategy, prioritizing speed and affordability. Brewtiful Beans’ higher prices reflect its commitment to quality and experience, while Joe’s Java Joint’s lower prices appeal to a broader, more price-sensitive market. Their success depends on attracting different customer segments and effectively catering to their specific needs and preferences. Neither strategy is inherently “better”; their effectiveness depends on execution and market conditions.

SWOT Analysis of a Competitor

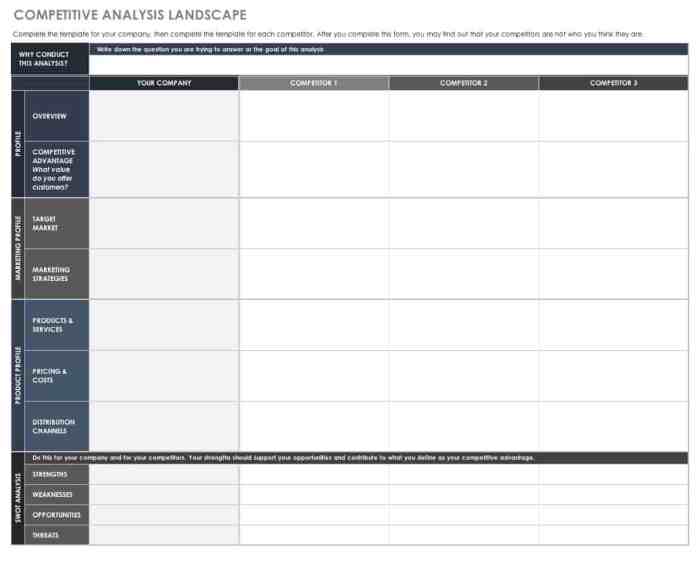

A SWOT analysis provides a structured framework for evaluating a competitor’s position. It considers their internal Strengths and Weaknesses, and their external Opportunities and Threats. This comprehensive assessment helps identify potential areas of vulnerability and opportunity for your own business.

Let’s analyze Brewtiful Beans using a SWOT framework:

| Strengths | Weaknesses |

|---|---|

| High-quality, ethically sourced coffee | Limited geographic reach |

| Unique and inviting atmosphere | Higher prices than competitors |

| Strong local brand reputation | Smaller marketing budget |

| Opportunities | Threats |

| Expansion into new locations | Increased competition from larger chains |

| Introduction of new product lines (e.g., pastries) | Fluctuations in coffee bean prices |

| Partnerships with local businesses | Changing consumer preferences |

By systematically analyzing Brewtiful Beans’ strengths, weaknesses, opportunities, and threats, you can develop a more effective competitive strategy, capitalizing on their vulnerabilities and mitigating potential risks. Remember, a well-executed SWOT analysis is a crucial step in developing a robust competitive strategy.

Gathering Competitor Data

Gathering intel on your competitors is like being a super-spy, but instead of gadgets, you’ll be using spreadsheets and websites. The goal is to understand their pricing, features, and marketing strategies – all without breaking any laws or ethical codes (we’re aiming for “charmingly sneaky,” not “jail time”). This data will be the bedrock of your competitive analysis, providing invaluable insights into how you can outsmart (or at least, out-perform) the competition.

This section details methods for ethically and effectively gathering competitor data, focusing on publicly available information. We’ll explore various data sources and discuss best practices to ensure you’re operating within legal and ethical boundaries. Remember, we’re playing the long game here; sustainable competitive advantage comes from playing fair, but playing smart.

Competitor Pricing Data Collection

Collecting competitor pricing data is crucial for understanding your market positioning. This involves systematically gathering pricing information for comparable products or services. Methods include directly visiting competitor websites, checking online marketplaces like Amazon or eBay, and analyzing price lists or brochures if available. Remember to document the date and source of your data for accurate tracking and future analysis. For example, if you’re analyzing pricing for cloud storage services, you would compare prices across different storage tiers and plans offered by various competitors, noting any discounts or promotional offers. Inconsistencies in pricing across different sales channels should also be noted.

Competitor Feature Analysis

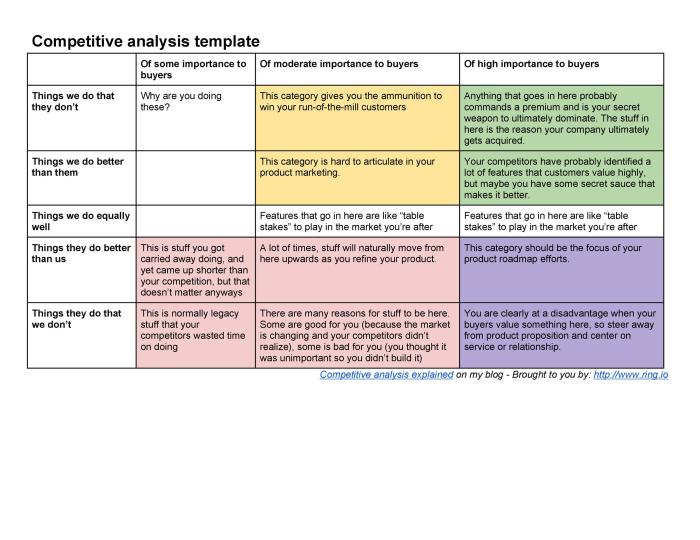

Analyzing competitor features requires a detailed examination of the functionalities and capabilities of their offerings. This involves carefully reviewing their websites, product documentation, marketing materials, and even user reviews to identify key features and compare them to your own. For instance, if you’re analyzing project management software, you’d meticulously compare features such as task management, collaboration tools, reporting capabilities, and integrations with other software. Create a feature comparison matrix to easily visualize the differences and similarities. This will help you identify areas where you excel and areas where you might need improvement.

Analyzing Competitor Marketing Efforts

Understanding your competitors’ marketing strategies is key to formulating your own effective approach. This involves analyzing their website content, social media activity, advertising campaigns, and public relations efforts. For example, if you’re a small coffee shop, analyzing your competitor’s Instagram presence – the types of photos they post, the frequency of posts, the engagement levels – will reveal much about their target audience and marketing strategies. Note their use of s, their tone and style of communication, and the platforms they favor. This information will provide a clearer picture of their marketing budget and their overall marketing objectives.

Ethically Sourcing Competitor Information

Ethical sourcing of information is paramount. Always respect intellectual property rights and avoid engaging in activities like scraping data without permission or misrepresenting yourself to obtain confidential information. Publicly available information such as websites, social media profiles, press releases, and marketing materials are acceptable sources. However, accessing private or confidential data is unethical and possibly illegal. Sticking to publicly available resources ensures that your analysis remains both informative and legally sound. Remember, integrity is a powerful competitive advantage.

Presenting Findings

The culmination of our meticulous competitive analysis has arrived, a moment akin to unveiling a meticulously crafted soufflé – the suspense is palpable, the potential for glorious success (or a spectacular collapse) is high. Let’s hope for the former, shall we? The following sections present our findings in a clear, concise, and hopefully, entertaining manner. Prepare to be amazed (or at least mildly intrigued).

Our analysis doesn’t just present data; it tells a story. A story of market dominance, fierce competition, and perhaps, a few unexpected plot twists. We’ve unearthed valuable insights, ready to be transformed into actionable strategies that will propel your business to new heights (or at least to a slightly higher altitude).

Competitor Market Share Visualization

Behold! A bar chart, a visual masterpiece illustrating the relative market share of our competitors. Imagine a vibrant, multicolored landscape, each bar a towering peak representing a competitor’s portion of the market. One bar, a majestic Everest, dominates the skyline, representing the clear market leader. Its sheer size speaks volumes about their entrenched position and extensive market penetration. Another bar, a sturdy K2, shows a strong contender, consistently challenging the leader with innovative strategies and aggressive marketing. Several smaller peaks represent other competitors, each with its own unique characteristics and market niche. Some are mere foothills, indicating smaller market shares and limited influence. The overall picture paints a dynamic market landscape, with opportunities for growth and disruption.

Narrative Summary of Competitive Analysis Findings

Our analysis reveals a fiercely competitive market characterized by established players and emerging disruptors. The market leader maintains a commanding presence, leveraging its brand recognition and extensive resources. However, the landscape is not static; several competitors are aggressively challenging the status quo through innovative product offerings and targeted marketing campaigns. We’ve identified key opportunities for differentiation and growth, particularly in underserved market segments. Furthermore, the analysis highlights potential threats, including the increasing prevalence of disruptive technologies and the emergence of new competitors. This presents both challenges and exciting possibilities for strategic maneuvering.

Key Findings: Competitive Advantages and Disadvantages

The following bullet points summarize our key findings, highlighting both the strengths and weaknesses of our competitors. This information is crucial for developing effective strategies and capitalizing on market opportunities. Remember, knowledge is power, and in this case, it’s the kind of power that can lead to increased market share and profitability.

- Competitor A (Everest): Possesses significant brand recognition and extensive distribution networks. However, their innovation rate is perceived as slower compared to some competitors.

- Competitor B (K2): Demonstrates strong innovation capabilities and a highly effective marketing strategy. However, their pricing structure might be less competitive in certain segments.

- Competitor C (smaller peak): Occupies a niche market with a loyal customer base. However, their limited resources may hinder their ability to expand significantly.

Template Design and Functionality

Crafting the perfect competitive analysis template is like designing the ultimate weapon in a business battle – sleek, efficient, and utterly devastating to the competition. A well-designed template isn’t just a pretty face; it’s the engine that drives insightful analysis and informed strategic decisions. Let’s dive into the nitty-gritty of creating a template that’s both powerful and user-friendly.

A successful competitive analysis template needs to be more than just a spreadsheet; it needs to be a dynamic tool that adapts to your needs. It should seamlessly integrate competitor identification, strategic analysis, and data visualization, allowing you to move effortlessly between these crucial aspects of competitive intelligence. The key is to strike a balance between comprehensive data capture and effortless navigation – think of it as the Swiss Army knife of business analysis.

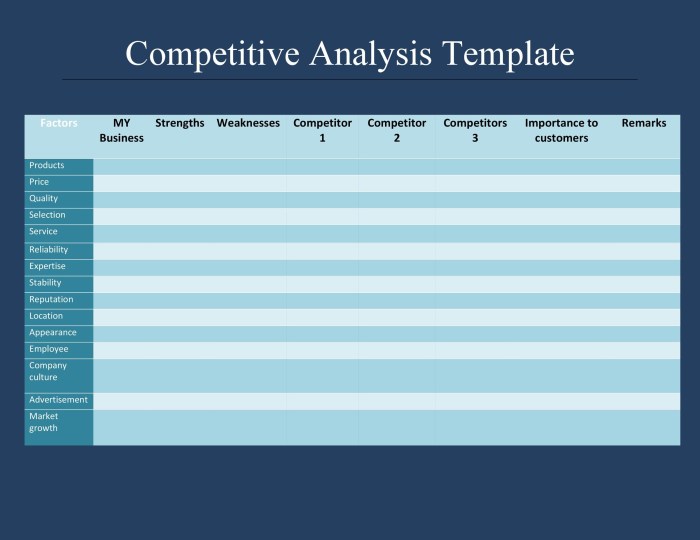

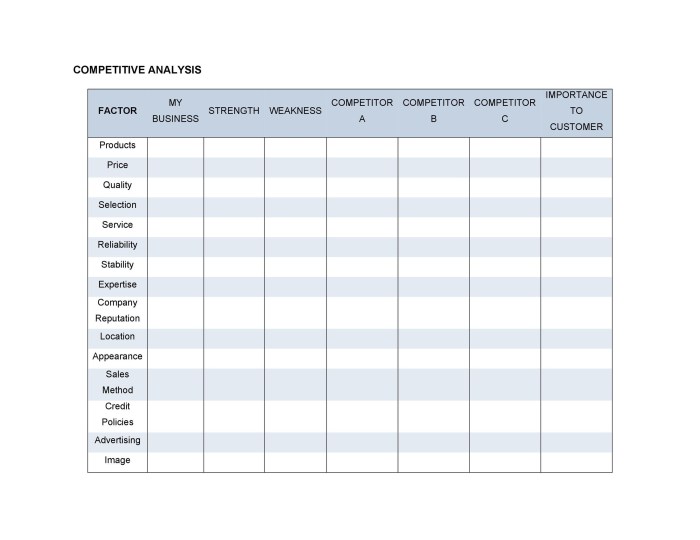

Template Structure and Sections

The template should be structured logically to ensure a smooth workflow. A suggested structure includes clearly defined sections for competitor identification (with space for company name, website, market share estimates, etc.), a dedicated area for analyzing competitor strategies (covering their marketing tactics, pricing models, product differentiation, etc.), and a final section for data visualization (using charts, graphs, and tables to represent key findings). Imagine a beautifully organized battlefield map – clear, concise, and strategically advantageous. Each section should have ample space for notes and observations, allowing for rich qualitative data alongside quantitative metrics. Consider using color-coding to highlight key strengths and weaknesses for a quick, visual assessment.

User-Friendly Features for Data Input and Ease of Use

A truly user-friendly template prioritizes ease of data input and intuitive navigation. This means minimizing unnecessary fields, employing clear labeling, and using a consistent format throughout. Think drop-down menus for pre-defined options, auto-calculating fields for metrics like market share, and pre-formatted tables for consistent data entry. The goal is to make the process as streamlined as possible, so you spend less time wrestling with the template and more time analyzing the competition. Consider incorporating helpful prompts or tooltips to guide users through the process. For example, a tooltip might suggest relevant data sources when entering market share information.

Incorporating Interactive Elements for Enhanced Data Analysis

Interactive elements can significantly boost the analytical power of your template. For instance, dynamic charts and graphs that update automatically when data is changed offer a real-time view of competitive dynamics. Consider incorporating features like data filtering and sorting to allow for focused analysis on specific aspects of the competition. Interactive dashboards, although requiring more advanced template design skills, can provide a powerful centralized view of all gathered data, allowing for quick comparisons and trend identification. Imagine being able to instantly see the impact of a competitor’s price change on your own market position – that’s the power of interactive analysis. Even simple features like conditional formatting (e.g., highlighting cells based on specific criteria) can improve data interpretation significantly.

Using the Template for Strategic Planning

So, you’ve painstakingly filled out your competitive analysis template – congratulations! Now comes the fun part: wielding that hard-earned knowledge like a strategic ninja star to decimate the competition (metaphorically, of course. We don’t endorse actual ninja-star-related violence). This section details how your analysis transforms from data points into actionable strategic plans. Think of it as competitive analysis alchemy, turning lead (data) into gold (profit).

The insights gleaned from a well-executed competitive analysis are not just pretty charts and graphs; they’re the roadmap to strategic dominance. By understanding your competitors’ strengths, weaknesses, and market positioning, you can make informed decisions about resource allocation, product development, and marketing campaigns that give you a decisive edge. It’s less about beating them at their game, and more about creating a game they can’t even play.

Strategic Decision-Making Informed by Competitive Analysis

Competitive analysis informs crucial strategic decisions by providing a clear picture of the competitive landscape. For example, identifying a competitor’s weak market penetration in a specific niche could indicate an opportunity for focused market entry. Conversely, understanding a competitor’s highly successful marketing strategy can inform your own, perhaps prompting adaptation or innovation to differentiate your offering. Imagine you’re analyzing the soda market; discovering that a competitor is struggling with distribution in a particular region might suggest a prime location for your own expansion, capitalizing on their weakness. Alternatively, noting their successful social media campaign could inspire you to develop a similar, but uniquely branded, strategy.

Identifying Opportunities for Market Entry and Expansion

Your competitive analysis template acts as a powerful market intelligence tool. By pinpointing gaps in the market, underserved customer segments, or weaknesses in competitor offerings, you can identify promising opportunities for market entry and expansion. For instance, if your analysis reveals a lack of eco-friendly options within a specific product category, it could signify a lucrative opportunity to develop and launch a sustainable alternative, capturing a previously untapped market segment. Similarly, a competitor’s overextension into multiple, unrelated markets might highlight an opportunity to focus on a niche they’ve neglected, allowing you to build a strong presence in a less-competitive environment. This is essentially finding the cracks in the wall and building your castle there.

Refining Marketing and Product Development Strategies

The insights gained from your competitive analysis directly impact both marketing and product development. For example, understanding a competitor’s pricing strategy can help you optimize your own, ensuring your product is competitively priced while still maintaining profitability. Similarly, identifying a competitor’s marketing message that resonates particularly well with consumers can guide the development of your own messaging, possibly refining it to better target your ideal customer base. Let’s say your analysis shows a competitor is successful using influencer marketing. You could then adapt this approach, perhaps focusing on micro-influencers to reach a more niche audience or employing a different platform to reach a new demographic. Alternatively, discovering a competitor’s product weakness, such as poor durability, could inspire you to develop a superior product with improved longevity and reliability, thus creating a strong competitive advantage.

Closing Notes

Mastering the art of competitive analysis is no longer a luxury, but a necessity. By utilizing a well-structured Competitive Analysis Template and ethically gathering data, you can transform your understanding of the market landscape. This isn’t just about identifying competitors; it’s about uncovering hidden opportunities, refining your strategies, and ultimately, achieving sustainable success. So, sharpen your pencils (or your keyboards!), and let’s conquer the competition!

FAQ Explained

What if I have limited resources for competitive analysis?

Focus on your key direct competitors first. Prioritize publicly available information and free tools before investing in premium resources.

How often should I update my competitive analysis?

Regular updates are crucial. Aim for at least quarterly reviews, or more frequently if your industry is particularly dynamic.

Can I use this template for any type of business?

Yes, the core principles are adaptable. While examples might focus on SaaS, the framework can be tailored to various industries with minor adjustments.

What if a competitor doesn’t publicly share information?

Ethical observation and analysis of their product, marketing, and customer interactions can still yield valuable insights.