Navigating the complex world of corporate taxation requires a strategic approach. Corporate tax optimization isn’t about skirting the law; it’s about legally minimizing tax liabilities while maximizing profitability. This involves understanding various techniques, from leveraging tax credits and incentives to employing efficient depreciation methods and navigating international tax regulations. The goal is to ensure compliance while optimizing financial performance.

This exploration delves into the multifaceted aspects of corporate tax optimization, examining both the practical strategies and the ethical considerations involved. We’ll cover international tax planning, the nuances of depreciation and amortization, and the importance of robust tax compliance procedures. Ultimately, the aim is to provide a comprehensive understanding of how businesses can effectively manage their tax obligations.

Defining Corporate Tax Optimization

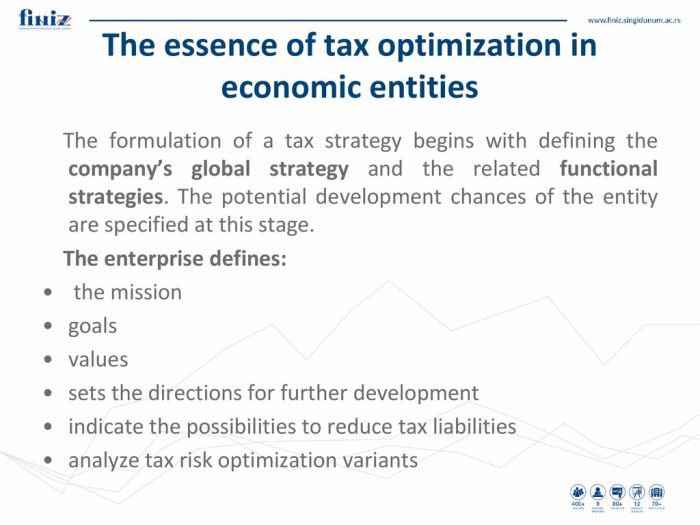

Corporate tax optimization is the strategic planning and implementation of legal methods to minimize a company’s tax liability. The objective is not to evade taxes but to legally reduce the tax burden, freeing up capital for reinvestment, expansion, or increased shareholder returns. This involves a thorough understanding of applicable tax laws and regulations, and leveraging available deductions, credits, and incentives. Effective tax optimization allows businesses to remain competitive while adhering to all legal requirements.

Tax Avoidance versus Tax Evasion

Tax avoidance and tax evasion are often confused, but they represent distinctly different actions. Tax avoidance refers to the legal utilization of tax laws to reduce one’s tax liability. This involves exploiting loopholes or using legitimate deductions and credits. In contrast, tax evasion is the illegal act of deliberately concealing income or falsely claiming deductions to avoid paying taxes. Tax evasion carries significant legal consequences, including hefty fines and potential imprisonment. Tax avoidance, on the other hand, is a perfectly legal and often necessary business practice.

Examples of Legitimate Tax Optimization Strategies

Several legitimate strategies exist for optimizing corporate tax liability. These strategies often involve complex calculations and require expert advice. For example, companies can utilize accelerated depreciation to write off the cost of assets more quickly, reducing taxable income in the early years of an asset’s life. Another common strategy is strategically structuring business transactions to minimize capital gains taxes. International companies may also explore utilizing tax treaties to reduce their foreign tax burden. Careful planning around employee benefits and stock options can also reduce the overall tax liability for both the company and its employees. Finally, charitable donations, within legal limits, offer a tax-deductible way to support community initiatives and reduce a company’s taxable income.

Comparison of Tax Optimization Techniques

The following table compares and contrasts various corporate tax optimization techniques:

| Technique | Description | Advantages | Disadvantages |

|---|---|---|---|

| Accelerated Depreciation | Writing off the cost of assets more quickly than straight-line depreciation. | Reduces taxable income in early years, improves cash flow. | Higher taxable income in later years. Requires accurate asset valuation. |

| Tax Credits | Reductions in tax liability based on specific activities (e.g., research and development, investment in renewable energy). | Direct reduction in tax owed, can significantly lower overall tax burden. | Eligibility requirements can be complex and vary by jurisdiction. |

| Transfer Pricing | Setting prices for transactions between related entities (e.g., parent company and subsidiary). | Optimizes profits in lower-tax jurisdictions, reduces overall tax liability. | Complex regulations, potential for scrutiny from tax authorities. Requires careful documentation and justification. |

| Foreign Tax Credits | Offsetting foreign taxes paid against U.S. (or other relevant country) tax liability. | Reduces double taxation on foreign income. | Complex calculations, requires detailed record-keeping of foreign tax payments. |

International Tax Planning

Navigating the complex landscape of international taxation is a significant challenge for multinational corporations (MNCs). Effective international tax planning requires a deep understanding of various tax jurisdictions, applicable treaties, and evolving global regulations to minimize overall tax liabilities while maintaining compliance. Failure to do so can result in substantial penalties and reputational damage.

International tax planning presents numerous complexities for multinational corporations. These challenges stem from differing tax rates and regulations across countries, the need to comply with multiple jurisdictions’ legal frameworks, and the potential for double taxation. Furthermore, the increasing sophistication of tax authorities in detecting aggressive tax planning strategies adds another layer of difficulty. The constant evolution of international tax laws and regulations necessitates ongoing monitoring and adaptation of tax strategies.

Challenges of International Tax Planning for Multinational Corporations

MNCs face a multifaceted array of challenges in international tax planning. These include navigating varying tax rates and structures across different countries, ensuring compliance with complex and often conflicting tax laws, managing transfer pricing complexities, and mitigating the risks associated with double taxation. Additionally, the increasing scrutiny from tax authorities worldwide necessitates proactive and transparent tax strategies. The sheer volume of transactions and the need for detailed record-keeping add to the operational complexity.

Tax Treaties and Their Impact on Corporate Tax Optimization

Tax treaties, also known as double taxation agreements (DTAs), are bilateral agreements between countries designed to prevent double taxation of the same income. These treaties typically establish rules for determining the taxing rights of each country involved, often employing methods like the credit method or exemption method. For example, a DTA between the United States and Canada might specify that dividends paid by a Canadian subsidiary to its US parent company are taxed only in Canada, or that the US parent can claim a credit for Canadian taxes paid against its US tax liability. This reduces the overall tax burden for MNCs operating in multiple jurisdictions covered by such agreements. The specific provisions of each treaty vary, requiring careful analysis to determine their impact on a particular corporation’s tax optimization strategy.

The Role of Transfer Pricing in International Tax Optimization

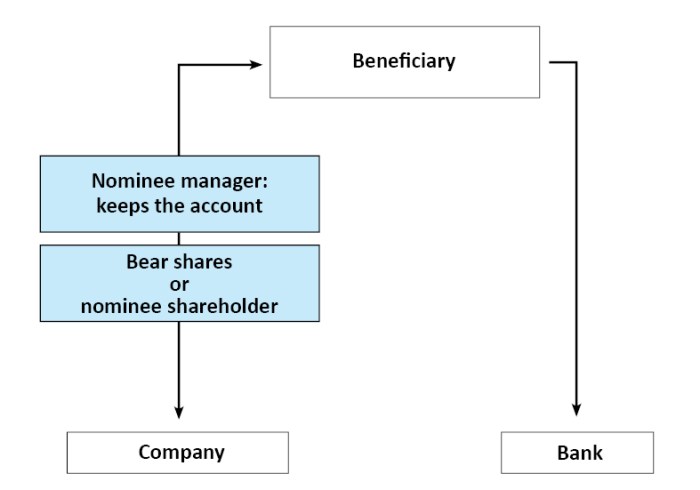

Transfer pricing refers to the pricing of goods, services, and intangible assets transferred between related entities within a multinational group. The Organization for Economic Co-operation and Development (OECD) provides guidelines on establishing arm’s length pricing, meaning prices that would be agreed upon between independent parties in comparable transactions. Accurate transfer pricing is crucial for international tax optimization because it directly impacts the allocation of profits and therefore the tax liability in each jurisdiction. MNCs must ensure their transfer pricing policies align with OECD guidelines and local tax regulations to avoid penalties for transfer mispricing, which is often perceived as tax avoidance.

Hypothetical Scenario: Transfer Pricing Strategies and Tax Implications

Let’s consider a hypothetical scenario: “TechGlobal,” a US-based technology company, has a manufacturing subsidiary in Ireland (“TechGlobal Ireland”) and a sales subsidiary in the UK (“TechGlobal UK”). TechGlobal Ireland manufactures computer components and sells them to TechGlobal UK, which then sells the finished products to customers. If TechGlobal sets a low transfer price for the components sold from Ireland to the UK, profits will be shifted to the UK, benefiting from potentially lower UK corporate tax rates. However, this strategy could attract scrutiny from tax authorities in both countries, who might argue that the transfer price is not arm’s length and adjust the profits accordingly, resulting in higher tax liabilities and penalties. Conversely, a higher transfer price could lead to higher taxes in Ireland, but lower taxes in the UK. The optimal transfer price needs to reflect the actual market value of the components and comply with international tax regulations. This example highlights the delicate balance MNCs must strike when employing transfer pricing strategies to optimize their tax position.

Tax Incentives and Credits

Corporations can significantly reduce their tax burden by leveraging various tax incentives and credits offered by governments at the federal, state, and even local levels. These incentives are designed to stimulate economic growth, encourage investment in specific sectors, and support socially beneficial activities. Understanding and effectively utilizing these provisions is crucial for corporate tax optimization.

Tax incentives and credits are often industry-specific, reflecting government priorities and the needs of particular sectors. The availability and specifics of these incentives can change frequently, so staying updated on current regulations is essential. This section will explore some common examples and demonstrate how to calculate the tax savings they offer.

Types of Corporate Tax Incentives

Many tax incentives are available, including deductions for research and development (R&D), investment tax credits for purchasing new equipment, and tax-exempt bonds for financing infrastructure projects. These incentives can take the form of direct reductions in tax liability or indirect benefits such as accelerated depreciation. Specific incentives vary widely based on location and industry.

Industries Commonly Utilizing Tax Incentives

Several industries frequently benefit from tax incentives. The renewable energy sector, for example, often receives substantial tax credits for investing in solar, wind, or geothermal energy projects. Manufacturing companies may qualify for incentives related to capital investments or job creation in designated areas. Similarly, technology companies might benefit from R&D tax credits, encouraging innovation and technological advancement. The agricultural sector can also access incentives for sustainable farming practices and rural development.

Examples of Tax Credits and Eligibility Criteria

Below is a list of common tax credits and their general eligibility criteria. Note that specific requirements can vary by jurisdiction and are subject to change. It’s crucial to consult relevant tax authorities for the most up-to-date information.

| Tax Credit | Eligibility Criteria (General) |

|---|---|

| Research and Development (R&D) Tax Credit | Expenses incurred for qualified research activities, including experimentation, design, and development of new products or processes. Specific definitions of qualified expenses vary. |

| Work Opportunity Tax Credit (WOTC) | Hiring individuals from targeted groups, such as veterans, ex-offenders, and long-term unemployment recipients. Specific requirements for employee eligibility apply. |

| Energy Tax Credits | Investments in renewable energy technologies, energy efficiency improvements, and other qualifying energy-related projects. Credit amounts and eligibility vary based on the type of investment. |

| Low-Income Housing Tax Credit (LIHTC) | Developing or rehabilitating affordable rental housing for low-income families. Specific requirements related to rent levels and tenant income limits apply. |

Calculating Tax Savings from a Tax Credit

Let’s illustrate how to calculate tax savings using a hypothetical example. Assume a company is eligible for a $100,000 energy tax credit. If the company’s corporate tax rate is 21%, the tax savings would be calculated as follows:

Tax Savings = Tax Credit Amount x Corporate Tax Rate = $100,000 x 0.21 = $21,000

This means the company would reduce its tax liability by $21,000. This calculation is simplified and doesn’t account for potential complexities, such as limitations on the amount of credit that can be claimed or interactions with other tax provisions. Professional tax advice is always recommended to ensure accurate calculations and compliance.

Depreciation and Amortization

Depreciation and amortization are crucial accounting methods that systematically allocate the cost of tangible and intangible assets, respectively, over their useful lives. Understanding these methods is vital for accurate financial reporting and effective corporate tax optimization. Properly utilizing depreciation and amortization can significantly impact a company’s taxable income and overall tax liability.

Depreciation Methods

Several methods exist for calculating depreciation. The choice of method can influence the timing of tax deductions and, consequently, a company’s tax burden. Common methods include the straight-line method, declining balance method (an accelerated method), and the sum-of-the-years’-digits method (another accelerated method). Each method distributes the asset’s cost differently over its useful life.

Straight-Line Depreciation vs. Accelerated Depreciation

The straight-line method evenly spreads the asset’s cost over its useful life. This results in consistent depreciation expense each year. In contrast, accelerated depreciation methods, such as the declining balance method, allocate a larger portion of the asset’s cost to the earlier years of its useful life. This leads to higher depreciation expense in the initial years and lower expense in later years. The accelerated approach offers greater tax benefits in the early years due to higher deductions, resulting in lower taxable income during those periods. However, the total depreciation expense over the asset’s life remains the same regardless of the method used.

Impact on Corporate Taxable Income

Depreciation and amortization are non-cash expenses; they don’t represent actual cash outflows. However, they directly reduce a company’s taxable income. By deducting depreciation and amortization expenses, companies lower their reported profits, thereby reducing their overall tax liability. The choice of depreciation method significantly affects the timing of these deductions, influencing the company’s cash flow and tax burden across different years. Accelerated methods provide larger deductions initially, leading to lower taxes in the early years but higher taxes in later years. Conversely, straight-line depreciation offers a more even distribution of tax benefits over the asset’s life.

Depreciation Schedule Example

Let’s consider an asset with a cost of $100,000, a useful life of 5 years, and no salvage value. The following table illustrates the depreciation schedule using both straight-line and a double-declining balance (an accelerated method) method.

| Year | Straight-Line Depreciation | Double-Declining Balance Depreciation | Remaining Book Value (Straight-Line) |

|---|---|---|---|

| 1 | $20,000 | $40,000 | $80,000 |

| 2 | $20,000 | $24,000 | $60,000 |

| 3 | $20,000 | $14,400 | $40,000 |

| 4 | $20,000 | $8,640 | $20,000 |

| 5 | $20,000 | $6,960 | $0 |

Tax Audits and Compliance

Maintaining meticulous tax records and adhering to tax regulations are crucial for any corporation. Non-compliance can lead to significant financial penalties, reputational damage, and even legal repercussions. Understanding the tax audit process and implementing best practices for compliance are therefore essential for long-term financial health and stability.

Corporate tax audits are a formal examination of a company’s tax records by the relevant tax authority. These audits aim to verify the accuracy and completeness of tax returns, ensuring that the company has correctly calculated and paid its taxes. The scope of an audit can vary depending on factors such as the company’s size, industry, and prior tax history. A thorough understanding of the audit process can help businesses prepare effectively and minimize disruptions.

The Importance of Accurate Tax Record Keeping

Maintaining accurate and complete tax records is paramount. These records serve as the foundation for accurate tax reporting and provide crucial support during a tax audit. Comprehensive documentation includes invoices, receipts, bank statements, payroll records, and any other relevant financial documents. A well-organized system simplifies the tax preparation process and minimizes the risk of errors or omissions, significantly reducing the likelihood of an audit and potential penalties. Regular reconciliation of accounts ensures that all financial information is consistent and accurate.

The Corporate Tax Audit Process

A corporate tax audit typically begins with a notification from the tax authority. This notification will specify the tax years under review and the documents required. The audit itself may involve various steps, including a review of financial statements, supporting documentation, and potentially interviews with company personnel. The tax authority may request clarification on specific transactions or accounting practices. Companies should cooperate fully with the auditors and provide all requested information in a timely manner. Engaging a qualified tax professional can significantly aid in navigating this process.

Best Practices for Ensuring Tax Compliance

Implementing robust tax compliance procedures is essential for mitigating risks. This includes establishing clear internal controls for financial record-keeping, regular review of tax regulations and updates, and employing qualified tax professionals for advice and tax preparation. Proactive tax planning, including strategies for minimizing tax liabilities within legal boundaries, can significantly benefit the company’s financial position. Staying informed about changes in tax laws and regulations is crucial for maintaining compliance. Regular internal audits can help identify potential issues before they escalate.

Potential Penalties for Non-Compliance

Non-compliance with tax regulations can result in severe consequences. These can include significant financial penalties, interest charges on unpaid taxes, and potential legal action. In some cases, criminal charges may be filed for willful tax evasion. The severity of the penalties depends on factors such as the nature and extent of the non-compliance, and whether it was intentional or unintentional. Reputational damage can also significantly impact a company’s ability to attract investors and maintain client relationships. The cost of non-compliance often far outweighs the potential benefits of non-compliance.

The Ethical Considerations of Corporate Tax Optimization

Corporate tax optimization, while a legitimate business practice, treads a fine line between aggressive tax avoidance and outright evasion. The ethical considerations involved are complex and multifaceted, demanding a careful balancing act between maximizing shareholder value and upholding societal responsibilities. The strategies employed can significantly impact not only the company’s bottom line but also the broader community and the integrity of the tax system itself.

The societal impact of aggressive tax optimization strategies can be substantial. Reduced tax revenue can lead to underfunding of essential public services like education, healthcare, and infrastructure. This can exacerbate inequalities and hinder economic growth. Furthermore, the perception of large corporations exploiting loopholes to minimize their tax burden can erode public trust in institutions and foster resentment towards both the corporations themselves and the tax system. Aggressive tax planning can also create an uneven playing field for smaller businesses that lack the resources to engage in complex tax strategies.

Societal Impact of Aggressive Tax Optimization

Aggressive tax optimization strategies employed by multinational corporations can significantly reduce government revenue, leading to cuts in public services and increased national debt. For example, the use of transfer pricing to shift profits to low-tax jurisdictions deprives governments of much-needed tax revenue. This can lead to a reduction in funding for essential public services, impacting areas like education, healthcare, and infrastructure. Furthermore, the perception that large corporations are avoiding their fair share of taxes can damage public trust and contribute to social unrest. The resulting inequality can further destabilize the social fabric and lead to a decline in overall economic well-being. This effect is particularly pronounced in developing countries with limited tax bases, where even small reductions in tax revenue can have a disproportionately negative impact.

Ethical Dilemmas Faced by Corporate Tax Professionals

Corporate tax professionals often face difficult ethical dilemmas. They may be pressured by senior management to implement aggressive tax strategies that push the boundaries of legality and ethics. This creates a conflict between their professional obligations to comply with tax laws and their loyalty to their employer. For instance, a tax professional might be asked to utilize a complex tax shelter that, while technically legal, exploits a loophole intended to benefit smaller businesses, not large corporations. Choosing to comply with the request could be seen as unethical, even if not illegal. Conversely, refusing could lead to professional repercussions. The pressure to maximize profits can often overshadow the ethical considerations involved in tax planning.

The Role of Corporate Social Responsibility in Tax Planning

Corporate social responsibility (CSR) plays a crucial role in shaping ethical tax planning. Companies that prioritize CSR integrate ethical considerations into their business strategies, including tax planning. This involves a commitment to paying their fair share of taxes, supporting local communities, and acting transparently. A company demonstrating strong CSR might proactively choose a tax strategy that, while less beneficial financially, aligns with its ethical principles and contributes to the common good. For instance, a company might choose to voluntarily pay a higher effective tax rate in a jurisdiction where it operates, contributing to the local economy and demonstrating a commitment to social responsibility. This approach can enhance a company’s reputation, strengthen relationships with stakeholders, and attract investors who prioritize ethical investing.

Future Trends in Corporate Tax Optimization

The landscape of corporate tax optimization is constantly evolving, driven by globalization, technological advancements, and shifting regulatory environments. Understanding these emerging trends is crucial for businesses to maintain tax efficiency and compliance. This section will explore key future trends and their impact on corporate tax strategies.

Globalization’s Impact on Corporate Tax Strategies

Globalization significantly impacts corporate tax strategies, creating both opportunities and challenges. Multinational corporations (MNCs) navigate complex international tax laws and regulations, leading to increased complexity in tax planning. The rise of digital businesses further complicates matters, as traditional tax residency rules struggle to keep pace with the borderless nature of online transactions. For example, the OECD’s Base Erosion and Profit Shifting (BEPS) project aims to address these challenges by promoting greater tax transparency and consistency in international tax rules. This necessitates a proactive approach to international tax planning, including careful consideration of transfer pricing, permanent establishment issues, and the implications of various tax treaties.

Predictions for Future Changes in Tax Laws and Regulations

Predicting future changes in tax laws and regulations requires careful analysis of current trends. There is a global movement towards greater tax transparency, driven by initiatives like the Common Reporting Standard (CRS) and the BEPS project. We can anticipate further tightening of regulations around tax havens and aggressive tax planning schemes. For instance, the implementation of digital services taxes (DSTs) in various countries demonstrates a shift towards taxing the digital economy more effectively. Additionally, increasing pressure for higher corporate tax rates in several jurisdictions may lead companies to reassess their global tax footprint and optimize their structures accordingly. This could include a focus on tax jurisdictions with competitive tax rates and robust investment incentives.

Technological Advancements Influencing Corporate Tax Optimization

Technological advancements are profoundly reshaping corporate tax optimization. Artificial intelligence (AI) and machine learning (ML) are being used to automate tax processes, analyze large datasets, and identify potential tax savings opportunities. Blockchain technology offers the potential for increased transparency and security in tax reporting and compliance. Cloud-based tax software platforms provide real-time access to tax information and facilitate collaboration between businesses and their tax advisors. For example, AI-powered tools can analyze financial transactions to identify potential tax deductions or credits that might be overlooked using traditional methods. This enhances efficiency and reduces the risk of errors, leading to better tax optimization outcomes.

Wrap-Up

Effective corporate tax optimization is a dynamic process requiring continuous monitoring and adaptation. Staying abreast of evolving tax laws and regulations, coupled with proactive planning and ethical considerations, is crucial for long-term success. By implementing sound strategies and maintaining meticulous records, corporations can significantly reduce their tax burden and enhance their overall financial health, fostering sustainable growth and responsible business practices.

FAQs

What is the difference between tax avoidance and tax evasion?

Tax avoidance involves legally minimizing tax liability through permitted strategies. Tax evasion, conversely, is the illegal non-payment or underpayment of taxes.

How often should a corporation review its tax optimization strategies?

Regular reviews, ideally annually, are recommended to adapt to changes in tax laws, business operations, and market conditions.

What are the potential consequences of non-compliance with tax regulations?

Penalties can include significant fines, interest charges, legal action, and reputational damage.

Can small businesses benefit from corporate tax optimization?

Yes, even small businesses can utilize many tax optimization strategies to reduce their tax burden.