Navigating the complex world of corporate taxation requires a strategic approach. Effective tax optimization isn’t about avoiding taxes; it’s about legally minimizing tax liabilities to maximize profitability and reinvestment opportunities. This exploration delves into proven techniques, offering insights into structuring, deductions, international planning, and managing risk, ultimately empowering businesses to achieve significant financial gains.

From understanding the nuances of different corporate structures and available tax deductions to mastering international tax planning and navigating mergers and acquisitions, this guide provides a comprehensive overview. We’ll examine the impact of emerging trends, including digitalization and BEPS initiatives, and emphasize the importance of robust compliance strategies to ensure long-term success and avoid potential penalties.

Understanding Corporate Tax Structures

Navigating the complex world of corporate taxation requires a thorough understanding of different tax systems and legal structures. The choice of structure significantly impacts a company’s overall tax liability and can influence strategic decisions regarding expansion, investment, and profitability. This section will explore various corporate tax systems and legal structures, highlighting their implications for tax optimization.

Global Corporate Tax Systems: Territorial vs. Worldwide

Corporate tax systems vary significantly across the globe. Two primary models exist: territorial and worldwide. A territorial system taxes only income sourced within the country’s borders, regardless of where the company is incorporated. A worldwide system, on the other hand, taxes all income earned by a company, irrespective of its geographic source. This distinction profoundly impacts tax planning, as companies operating under a worldwide system often employ strategies to minimize their foreign tax liabilities through tax treaties, foreign tax credits, or the establishment of subsidiaries in low-tax jurisdictions. For instance, a US-based company operating under a worldwide system might establish a subsidiary in Ireland (known for its relatively low corporate tax rates) to reduce its overall tax burden. Conversely, a company operating under a territorial system in Singapore would only be taxed on profits generated within Singapore.

Jurisdictional Impact on Tax Optimization

Different tax jurisdictions offer varying tax rates, incentives, and regulations, influencing corporate tax optimization strategies. Countries with low corporate tax rates, such as Ireland, the Netherlands, or certain jurisdictions in the Caribbean, often attract foreign investment due to their tax-favorable environments. These countries might offer tax holidays, deductions for research and development, or other incentives to encourage businesses to establish operations within their borders. Conversely, countries with high tax rates may necessitate more complex tax planning strategies to minimize the overall tax burden. A company considering expansion into multiple countries must carefully analyze the tax implications of each jurisdiction and tailor its strategy accordingly. This may involve structuring operations to take advantage of tax treaties or utilizing transfer pricing strategies to optimize the allocation of profits across different entities.

Impact of Legal Structure on Tax Liabilities

The choice of legal structure – such as a C-corporation, S-corporation, or Limited Liability Company (LLC) – significantly affects a company’s tax liabilities. A C-corporation is a separate legal entity taxed independently of its owners, leading to double taxation (tax on corporate profits and again on dividends distributed to shareholders). An S-corporation, on the other hand, passes its income directly to its shareholders, avoiding double taxation. LLCs offer flexibility, allowing owners to choose how they want to be taxed (as a sole proprietorship, partnership, S-corp, or C-corp). The optimal structure depends on factors such as the number of owners, the level of income, and the desired level of liability protection. A small business with a single owner might find a sole proprietorship or LLC taxed as a pass-through entity more tax-efficient than a C-corp, while a larger, publicly traded company might prefer the structure and liability protection of a C-corporation.

Comparison of Corporate Structures

| Structure | Taxation | Liability | Complexity |

|---|---|---|---|

| C-Corporation | Double taxation (corporate and shareholder level) | Limited liability for shareholders | High |

| S-Corporation | Pass-through taxation (income passed to shareholders) | Limited liability for shareholders | Moderate |

| LLC | Flexible; can be taxed as sole proprietorship, partnership, S-corp, or C-corp | Limited liability for members | Moderate to High (depending on tax election) |

| Partnership | Pass-through taxation (income passed to partners) | Partners can face personal liability for business debts | Moderate |

Tax Deductions and Credits

Corporations, like individuals, can reduce their taxable income through various deductions and credits. Understanding these provisions is crucial for effective tax planning and minimizing tax liabilities. Properly utilizing these allowances can significantly impact a company’s bottom line.

Common Corporate Tax Deductions

Several common deductions are available to corporations, reducing their taxable income. These deductions are often based on legitimate business expenses incurred during the tax year. Careful record-keeping is essential to substantiate these deductions during an audit.

- Cost of Goods Sold (COGS): This deduction encompasses the direct costs associated with producing goods sold by the corporation, including raw materials, direct labor, and manufacturing overhead. For example, a clothing manufacturer would deduct the cost of fabric, wages paid to seamstresses, and factory rent.

- Salaries and Wages: Reasonable compensation paid to employees is deductible. This includes wages, salaries, benefits (subject to limitations), and payroll taxes. However, excessive compensation to related parties may be disallowed.

- Rent and Utilities: Payments for office space, factory space, and utilities directly related to business operations are deductible. Proper documentation, such as lease agreements and utility bills, is required.

- Interest Expense: Interest paid on business loans is generally deductible. However, there are limitations on the deductibility of interest expense, particularly for highly leveraged corporations.

- Depreciation and Amortization: The cost of assets with a useful life exceeding one year can be deducted over time through depreciation (tangible assets) or amortization (intangible assets). This allows businesses to recover the cost of these assets gradually, reducing their taxable income.

Research and Development Tax Credits

Research and Development (R&D) tax credits incentivize corporations to invest in innovation. Eligibility criteria often include the qualification of the research activities as original and intended to discover new knowledge or improve existing processes. The credit is typically a percentage of qualified R&D expenses, but limitations exist regarding the types of expenses that qualify and the overall credit amount. For example, a pharmaceutical company investing in developing a new drug might qualify for significant R&D tax credits based on the expenses incurred in research, development, and testing. However, routine testing or marketing expenses generally wouldn’t qualify.

Depreciation Methods and Taxable Income

Different depreciation methods, such as straight-line, declining balance, or MACRS (Modified Accelerated Cost Recovery System), impact the timing of depreciation deductions and consequently affect taxable income. The straight-line method spreads the cost evenly over the asset’s useful life, while accelerated methods allow for larger deductions in the early years. For example, a company purchasing a machine for $100,000 with a 10-year useful life would deduct $10,000 annually under straight-line depreciation, while an accelerated method might allow for significantly higher deductions in the initial years, resulting in lower taxable income during those years but higher taxable income in later years.

Accounting Methods and Tax Liability

The choice of accounting method (cash basis or accrual basis) significantly influences a corporation’s tax liability. The cash basis recognizes income when received and expenses when paid, while the accrual basis recognizes income when earned and expenses when incurred. A company using the cash basis might report lower taxable income in a year where it receives payments slowly, even if it earned the income earlier. Conversely, the accrual basis might report higher taxable income in a year even if cash payments haven’t been received yet. The choice of method depends on factors such as the size and complexity of the business, as well as IRS regulations.

International Tax Planning

International tax planning is crucial for multinational corporations seeking to optimize their global tax burden. Effective strategies leverage international tax laws and treaties to minimize overall tax liabilities while remaining compliant. This involves careful consideration of transfer pricing, foreign tax credits, and the intricacies of cross-border transactions.

Transfer Pricing and Corporate Tax Optimization

Transfer pricing refers to the pricing of goods, services, and intangible assets exchanged between related entities in different jurisdictions. The Organisation for Economic Co-operation and Development (OECD) guidelines aim to ensure that these transactions are conducted at arm’s length, meaning at prices that would be agreed upon between independent parties. Deviation from arm’s length pricing can lead to tax adjustments by tax authorities in various countries, resulting in double taxation or increased tax liabilities. For example, a multinational corporation might transfer intellectual property to a subsidiary in a low-tax jurisdiction at a price that minimizes profits in high-tax jurisdictions. Tax authorities scrutinize such transactions to ensure that profits are not artificially shifted to minimize overall tax obligations. Proper transfer pricing documentation and analysis are therefore essential for demonstrating compliance and mitigating tax risks.

Strategies for Minimizing Foreign Tax Liabilities

Several strategies can help minimize foreign tax liabilities. These include utilizing foreign tax credits to offset taxes paid in foreign jurisdictions against domestic tax liabilities. Companies can also explore tax treaties, which often provide for reduced tax rates or exemptions on certain types of income earned in a foreign country. Furthermore, structuring international operations strategically, such as establishing subsidiaries in tax-efficient locations, can significantly impact the overall tax burden. For instance, a US company might establish a subsidiary in Ireland, known for its relatively low corporate tax rates, to handle European operations. This strategy, if implemented correctly, could reduce the overall tax liability compared to conducting all operations from the US.

Regulations Surrounding Cross-Border Transactions and Their Tax Implications

Cross-border transactions, such as the import and export of goods or services, are subject to various regulations and tax implications. These transactions often involve Value Added Tax (VAT) or Goods and Services Tax (GST) in the importing country, as well as withholding taxes on payments made to foreign entities. Understanding and complying with these regulations are vital to avoid penalties and disputes with tax authorities. For example, a company exporting goods to the European Union must comply with EU VAT regulations, which may involve registering for VAT in the EU and collecting VAT on sales to EU customers. Failure to comply can result in significant penalties. Similarly, payments made to foreign contractors or suppliers may be subject to withholding taxes, requiring careful planning to minimize the tax burden.

Comparison of International Tax Treaties and Their Impact on Corporate Tax Burdens

International tax treaties aim to avoid double taxation and promote cross-border investment. These treaties typically provide for reduced tax rates or exemptions on certain types of income earned in a foreign country. The specific provisions vary significantly depending on the countries involved. For instance, a tax treaty between the United States and Canada might provide for a reduced tax rate on dividends paid from a Canadian subsidiary to a US parent company. Comparing the provisions of different tax treaties is crucial for identifying the most tax-efficient structure for international operations. A company with operations in multiple countries should carefully analyze the relevant tax treaties to determine the optimal structure to minimize its global tax liability. Failure to leverage these treaties effectively could result in higher overall tax costs.

Mergers, Acquisitions, and Restructuring

Mergers, acquisitions, and corporate restructuring offer significant opportunities for tax optimization, but careful planning is crucial to minimize liabilities and maximize benefits. Understanding the tax implications of different structures and strategies is paramount for businesses aiming to leverage these transactions for financial advantage. This section will explore the tax implications of various scenarios, highlighting key considerations and providing illustrative examples.

Tax Implications of Mergers and Acquisitions: Asset vs. Stock Purchases

The choice between an asset purchase and a stock purchase significantly impacts the tax consequences for both the buyer and the seller. In an asset purchase, the buyer acquires the target company’s assets individually, while in a stock purchase, the buyer acquires the target company’s stock. Asset purchases allow the buyer to step up the basis of the acquired assets, potentially leading to larger depreciation deductions in the future. Conversely, stock purchases generally preserve the target company’s existing tax basis, limiting immediate depreciation benefits but potentially offering advantages in certain circumstances related to net operating losses (NOLs). The seller’s tax implications also differ; asset sales generally trigger capital gains taxes on the sale of individual assets, while stock sales trigger capital gains taxes on the sale of the entire company. Careful consideration of these differences is vital in determining the most tax-efficient approach.

Corporate Restructuring for Tax Liability Optimization

Corporate restructuring encompasses a range of activities designed to improve a company’s financial structure and tax position. This can involve reorganizing the company’s legal structure, shifting assets between subsidiaries, or altering capital structures. Strategies like forming holding companies to consolidate operations or separating profitable and unprofitable divisions can significantly impact tax liabilities. For instance, separating a loss-making division from a profitable one allows the losses to be offset against the profits of the other division, potentially reducing overall tax burden. The complexities of these restructurings necessitate careful planning and adherence to specific tax regulations to avoid penalties.

Tax-Efficient Strategies for Spin-offs and Divestitures

Spin-offs involve separating a subsidiary from a parent company, creating a new independent entity. Divestitures involve selling off a portion of a business, such as a division or subsidiary. Tax-efficient strategies for these transactions often focus on minimizing capital gains taxes and ensuring a smooth transition for both the parent company and the newly independent entity or buyer. Careful consideration of the allocation of assets and liabilities is crucial, as is the choice of transaction structure (e.g., a tax-free spin-off versus a taxable sale). Proper planning can significantly reduce the overall tax burden associated with these transactions.

Hypothetical Scenario: Corporate Acquisition and Tax Optimization

Let’s consider a hypothetical scenario where Company A acquires Company B. Company B has accumulated significant net operating losses (NOLs) and owns valuable intellectual property with a low tax basis. Company A chooses to acquire Company B’s assets rather than its stock. This allows Company A to step-up the basis of the intellectual property, enabling higher depreciation deductions and reducing future tax liabilities. Furthermore, the acquisition structure allows Company A to utilize Company B’s NOLs to offset its own taxable income, further minimizing its overall tax burden. This strategy is significantly more tax-efficient than a stock purchase, which would not allow for the immediate step-up in basis and might limit the utilization of NOLs. The complexity of such transactions requires the expertise of tax professionals to navigate the legal and regulatory requirements.

Tax Compliance and Risk Management

Effective tax compliance and robust risk management are crucial for the long-term financial health and stability of any corporation. Ignoring these aspects can lead to significant financial penalties, reputational damage, and even legal repercussions. A proactive approach, emphasizing accurate record-keeping and a thorough understanding of relevant tax laws, is essential for minimizing these risks.

Accurate Tax Record-Keeping and Documentation

Maintaining meticulous and accurate tax records is paramount for successful tax compliance. Comprehensive documentation provides a verifiable audit trail, simplifying the tax preparation process and reducing the likelihood of errors or omissions. This includes meticulously tracking all financial transactions, invoices, receipts, and supporting documentation related to income, expenses, deductions, and credits. The importance of organized records cannot be overstated; they serve as the foundation for accurate tax reporting and provide a strong defense against potential audits. Furthermore, well-maintained records facilitate efficient internal financial analysis, supporting informed business decisions. A robust record-keeping system should be in place, ideally utilizing both physical and digital storage methods with appropriate security measures.

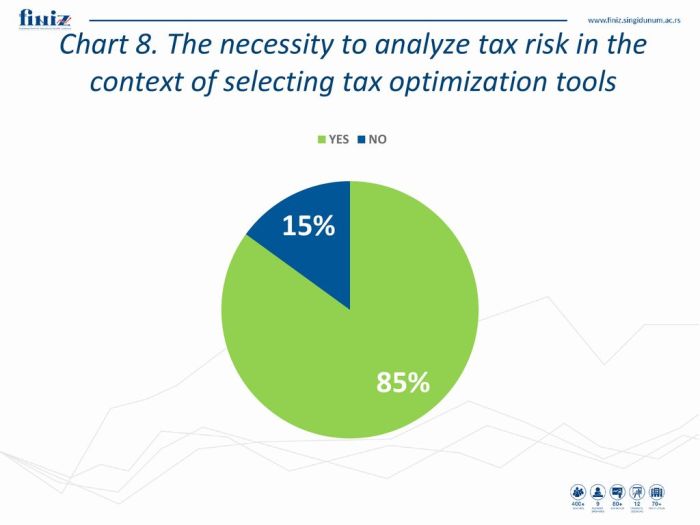

Potential Risks of Aggressive Tax Optimization Strategies

While tax optimization is a legitimate business practice, pursuing overly aggressive strategies carries substantial risks. Aggressive tax strategies often involve pushing the boundaries of tax laws, relying on interpretations that may be challenged by tax authorities. These strategies can lead to penalties, interest charges, and even legal action if deemed to be fraudulent or deliberately evasive. The reputational damage associated with aggressive tax practices can also be significant, impacting investor confidence and business relationships. For example, a company employing an aggressive transfer pricing strategy might face extensive audits and penalties if the tax authorities deem the pricing arrangements to be artificial and designed to minimize tax liability. A balanced approach, prioritizing compliance alongside optimization, is always recommended.

The Role of Internal Controls in Mitigating Tax Risks

Strong internal controls are essential for mitigating tax risks. These controls encompass a range of processes and procedures designed to ensure the accuracy and reliability of financial information, prevent fraud, and promote compliance with tax regulations. Internal controls should cover all aspects of the tax function, from data entry and processing to the final filing of tax returns. Regular internal audits, segregation of duties, and robust authorization procedures are all vital components of an effective internal control system. For example, separating the responsibilities of recording transactions from those of preparing tax returns helps to prevent errors and potential fraud. A well-defined approval process for all significant tax-related decisions further enhances control and accountability.

Best Practices for Ensuring Tax Compliance

Implementing best practices is key to ensuring consistent tax compliance. This involves staying updated on current tax laws and regulations, utilizing reliable tax software and professional advice, and conducting regular internal reviews of tax procedures. Proactive engagement with tax authorities, including responding promptly to inquiries and requests for information, is also crucial. Establishing a culture of compliance within the organization, through training and clear communication of tax policies, is essential. Regularly reviewing and updating tax policies and procedures to reflect changes in legislation and best practices ensures the organization remains compliant and minimizes potential risks. Finally, engaging independent tax professionals for periodic reviews and advice provides an external perspective and can help identify potential weaknesses in the organization’s tax processes.

Emerging Trends in Corporate Tax Optimization

The landscape of corporate tax optimization is constantly evolving, driven by technological advancements, global regulatory changes, and the increasing complexity of international business operations. Understanding these emerging trends is crucial for businesses to maintain tax compliance while maximizing their profitability. This section will explore key trends impacting corporate tax strategies.

Digitalization’s Impact on Corporate Tax Strategies

The digital economy presents both opportunities and challenges for corporate tax planning. The rise of e-commerce, digital platforms, and the increasing reliance on data have significantly altered how businesses operate and, consequently, how their tax liabilities are determined. For example, the location of digital assets and the attribution of profits from digital transactions across jurisdictions are complex issues that are currently under significant debate and revision by tax authorities worldwide. This necessitates a more sophisticated approach to tax planning, involving the use of advanced data analytics and technology to accurately track and report transactions in the digital realm. Furthermore, digital tax audits are becoming increasingly common, requiring businesses to maintain meticulous digital records and implement robust data governance frameworks.

Challenges Posed by BEPS Initiatives

The OECD’s Base Erosion and Profit Shifting (BEPS) project aims to address aggressive tax planning strategies employed by multinational corporations. BEPS initiatives, such as the introduction of country-by-country reporting and the development of new transfer pricing guidelines, have significantly increased the scrutiny of multinational enterprises’ tax practices. These initiatives challenge traditional tax optimization strategies that rely on shifting profits to low-tax jurisdictions. Compliance with BEPS requirements necessitates a thorough review of existing tax structures and the adoption of more transparent and sustainable tax planning approaches. The increased complexity and potential penalties associated with BEPS non-compliance significantly raise the stakes for businesses.

Innovative Tax Optimization Techniques Used by Multinational Corporations

Multinational corporations are increasingly adopting innovative tax optimization techniques to navigate the complexities of the global tax system while remaining compliant. One example is the strategic use of tax credits and incentives offered by various jurisdictions to attract foreign investment. Another involves sophisticated transfer pricing strategies that align with OECD guidelines while optimizing the allocation of profits within the corporate group. Furthermore, some corporations are exploring the use of blockchain technology to enhance transparency and traceability in cross-border transactions, thereby simplifying tax compliance processes. These techniques, however, must be carefully implemented to ensure compliance with all relevant regulations and to avoid accusations of tax avoidance.

Influence of Changes in Global Tax Regulations on Corporate Tax Planning

Changes in global tax regulations, such as the introduction of digital services taxes and the ongoing discussions surrounding a global minimum corporate tax rate, significantly impact corporate tax planning. Businesses must adapt their strategies to account for these evolving regulations. For instance, the implementation of a global minimum tax rate would require multinational corporations to reassess their global tax structures and potentially increase their overall tax burden in jurisdictions with lower tax rates. Staying informed about these changes and proactively adapting tax strategies is essential for maintaining compliance and minimizing potential tax liabilities. Companies must engage in continuous monitoring of global tax developments and engage with tax professionals to navigate the complexities of the evolving regulatory landscape.

Final Summary

Successfully optimizing corporate tax strategies requires a holistic understanding of various legal structures, available deductions, international regulations, and emerging trends. By implementing the techniques discussed, businesses can significantly reduce their tax burden, improve financial performance, and foster sustainable growth. Remember, proactive planning and adherence to best practices are paramount to achieving both tax efficiency and compliance.

Essential FAQs

What are the penalties for non-compliance with corporate tax regulations?

Penalties vary by jurisdiction but can include significant fines, interest charges, and even legal repercussions. The severity often depends on the nature and extent of the non-compliance.

How often should a corporation review its tax optimization strategy?

Regular reviews, ideally annually or whenever significant business changes occur (e.g., mergers, acquisitions, expansion into new markets), are crucial to ensure the strategy remains effective and compliant with evolving regulations.

Can small businesses utilize corporate tax optimization techniques?

Absolutely. While the complexity might differ, many principles of tax optimization apply to businesses of all sizes. Understanding basic deductions and choosing the appropriate legal structure are key starting points.