Effective cost management is paramount for any organization’s success, regardless of size or industry. From startups navigating initial growth to established corporations aiming for sustained profitability, understanding and implementing robust cost management strategies is crucial. This guide delves into a comprehensive array of techniques, providing practical insights and actionable steps to optimize spending, enhance efficiency, and ultimately drive greater financial health.

We’ll explore budgeting and forecasting methodologies, examining various approaches tailored to different business needs. We’ll also dissect cost allocation and tracking mechanisms, highlighting the importance of accurate data for informed decision-making. Furthermore, we’ll uncover effective cost reduction strategies, delve into value engineering principles, and showcase the power of technology and automation in streamlining cost management processes. The discussion will also consider the unique challenges and opportunities presented by different business contexts, ensuring a holistic understanding of this critical business function.

Budgeting and Forecasting

Effective budgeting and forecasting are crucial for the financial health of any business, regardless of size. They provide a roadmap for resource allocation, identify potential financial challenges, and inform strategic decision-making. Accurate predictions allow for proactive adjustments, maximizing profitability and minimizing risks.

Budgeting Methods and Suitability

Different budgeting methods cater to the specific needs and complexities of various business sizes. Small businesses often benefit from simpler approaches, while larger corporations may require more sophisticated techniques. For instance, a simple cash budget might suffice for a small startup, whereas a large multinational might utilize activity-based budgeting for greater precision.

- Incremental Budgeting: This method uses the previous year’s budget as a baseline, adjusting it for anticipated changes. It’s straightforward and efficient for stable businesses with predictable growth. However, it can be less effective for businesses undergoing significant changes or experiencing rapid growth.

- Zero-Based Budgeting (ZBB): In contrast to incremental budgeting, ZBB requires each budget item to be justified from scratch each year. Every expense must be analyzed and approved, regardless of past spending patterns. This approach promotes efficiency and cost-consciousness, particularly beneficial for larger organizations with complex operations. However, it can be time-consuming and resource-intensive.

- Activity-Based Budgeting (ABB): This method links budget allocations directly to specific activities or projects. It provides a more detailed understanding of cost drivers and allows for better control over resource allocation. It is particularly useful for businesses with diverse product lines or complex operations, though it requires more data and analysis.

Forecasting Techniques for Cost Prediction

Accurate cost prediction is essential for effective budgeting. Several techniques can be employed, each with its strengths and weaknesses.

- Time Series Analysis: This statistical method analyzes historical cost data to identify trends and patterns, projecting future costs based on these trends. For example, a company might analyze past sales data to predict future demand and associated costs.

- Regression Analysis: This technique establishes relationships between costs and other relevant variables (e.g., sales volume, production levels). It allows for more precise cost prediction by considering multiple factors. For instance, a manufacturing company could use regression analysis to predict production costs based on the quantity of materials used and labor hours.

- Qualitative Forecasting: This approach relies on expert judgment and market research to predict future costs. It’s particularly useful when historical data is limited or unreliable. For example, a company launching a new product might rely on market research and expert opinions to estimate initial production and marketing costs.

Creating a Realistic Budget

Developing a realistic budget involves a systematic process that combines historical data with future projections.

- Gather Historical Data: Collect data on past revenues, expenses, and other relevant financial metrics. This provides a foundation for future projections.

- Analyze Trends and Patterns: Identify trends and patterns in historical data to understand cost drivers and predict future costs.

- Develop Revenue Projections: Forecast future revenues based on market research, sales forecasts, and other relevant factors.

- Estimate Expenses: Project future expenses based on historical data, anticipated changes, and future plans.

- Create a Budget: Combine revenue projections and expense estimates to create a comprehensive budget.

- Monitor and Adjust: Regularly monitor actual performance against the budget and make adjustments as needed.

Zero-Based Budgeting vs. Incremental Budgeting

Zero-based budgeting (ZBB) and incremental budgeting represent contrasting approaches to budget creation. ZBB demands justification for every expense item, promoting efficiency but requiring significant effort. Incremental budgeting, on the other hand, uses the previous year’s budget as a starting point, making it quicker but potentially less efficient if underlying assumptions change. The choice depends on the organization’s size, complexity, and stability.

Sample Budget for a Small Business

This example illustrates a simplified budget for a small bakery. Note that this is a highly simplified example and a real-world budget would need much more detail.

| Revenue | Projected Amount |

|---|---|

| Sales | $50,000 |

| Total Revenue | $50,000 |

| Expenses | Projected Amount |

| Cost of Goods Sold (Ingredients, Packaging) | $15,000 |

| Rent | $5,000 |

| Utilities | $1,000 |

| Salaries | $10,000 |

| Marketing | $2,000 |

| Other Expenses | $2,000 |

| Total Expenses | $35,000 |

| Net Profit | $15,000 |

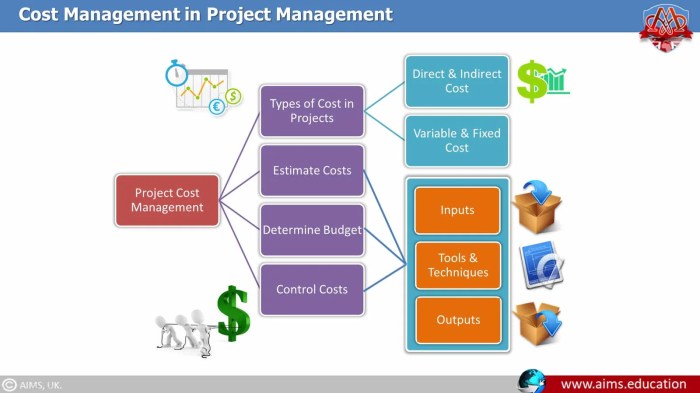

Cost Allocation and Tracking

Effective cost allocation and tracking are crucial for informed decision-making within any organization. Understanding where your resources are being spent allows for better budget control, improved project profitability, and ultimately, enhanced organizational performance. Without accurate cost tracking, organizations risk overspending, underestimating project costs, and making strategic decisions based on incomplete or inaccurate data.

Methods for Allocating Indirect Costs

Indirect costs, such as rent, utilities, and administrative salaries, cannot be directly traced to specific projects. Several methods exist for allocating these costs, each with its own strengths and weaknesses. The choice of method depends on the organization’s specific needs and the level of accuracy required. Common methods include the direct method, step-down method, and reciprocal method. More sophisticated methods, such as activity-based costing (ABC), offer a more granular approach.

Importance of Accurate Cost Tracking and its Impact on Decision-Making

Accurate cost tracking provides a clear picture of an organization’s financial health. This visibility enables timely identification of cost overruns, inefficiencies, and areas for potential savings. Data-driven insights facilitate better resource allocation, improved project management, and more effective pricing strategies. For example, if a project consistently exceeds its budgeted costs, accurate tracking can reveal the root causes and allow for corrective action. Without this information, the organization risks repeating the same mistakes on future projects.

Key Performance Indicators (KPIs) for Monitoring Cost Performance

Several KPIs can be used to monitor cost performance and identify areas needing attention. These metrics provide quantifiable measures to track progress and identify potential problems. Examples include: budget variance, cost per unit, return on investment (ROI), and cost of goods sold (COGS). Regular monitoring of these KPIs allows for proactive adjustments and prevents minor issues from escalating into significant problems. For instance, a consistently high budget variance may signal a need for a reassessment of project scope or resource allocation.

Cost Allocation Methods: Advantages and Disadvantages

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Direct Method | Allocates indirect costs based on a single cost driver. | Simple and easy to understand. | Can be inaccurate if the chosen cost driver is not strongly correlated with the indirect costs. |

| Step-Down Method | Allocates indirect costs sequentially, with some indirect costs being allocated to other cost centers before final allocation. | More accurate than the direct method. | Can be complex and time-consuming. |

| Reciprocal Method | Simultaneously allocates indirect costs among cost centers, considering the mutual services provided. | Most accurate method, but requires solving simultaneous equations. | Complex and requires specialized software or significant computational effort. |

| Activity-Based Costing (ABC) | Allocates indirect costs based on the activities that consume those costs. | Provides a more accurate picture of the cost of products or services. | Can be complex and expensive to implement. |

Activity-Based Costing (ABC) for Allocating Overhead Costs

Activity-based costing (ABC) offers a more precise method for allocating overhead costs. Unlike traditional methods that use a single cost driver, ABC identifies and assigns costs based on the specific activities that consume resources. For instance, a manufacturing company might track costs associated with machine setup, quality control, and material handling. These costs are then allocated to individual products based on their consumption of each activity. A product requiring frequent machine setups would receive a larger share of setup costs than a product requiring fewer setups. This granular approach provides a more accurate understanding of the true cost of each product, facilitating better pricing decisions and resource allocation. For example, a company using ABC might discover that a seemingly profitable product is actually losing money when all overhead costs are accurately allocated.

Cost Reduction Strategies

Effective cost reduction is crucial for business sustainability and profitability. Implementing well-defined strategies can significantly improve the bottom line and enhance competitiveness. This section explores various approaches to cost reduction, applicable across different business functions and industries.

Cost Reduction Strategies Across Business Functions

Organizations can leverage several cost reduction strategies across various departments. These strategies often involve a combination of operational efficiencies, technological advancements, and strategic negotiations. A holistic approach, considering the interconnectedness of different business functions, is vital for maximizing the impact of cost-cutting measures.

Examples of Cost-Cutting Measures in Various Industries

The manufacturing industry often employs lean manufacturing principles to eliminate waste and streamline processes, reducing material and labor costs. For example, a car manufacturer might implement just-in-time inventory management to minimize storage costs and reduce waste from obsolete parts. In the retail sector, optimizing supply chain logistics through efficient transportation and warehousing can lead to substantial savings. Similarly, the service industry might leverage technology, such as customer relationship management (CRM) systems, to automate tasks and reduce operational expenses. The healthcare industry is exploring telemedicine to reduce travel costs and improve patient access to care.

Negotiation Strategies for Reducing Supplier Costs

Effective negotiation is vital for reducing supplier costs. Strategies include developing strong, long-term relationships with key suppliers, fostering collaboration to identify mutual cost savings opportunities, and leveraging competitive bidding processes to secure favorable pricing. Analyzing supplier costs meticulously and exploring alternative sourcing options are also crucial. For example, negotiating volume discounts or exploring alternative, potentially cheaper, materials can significantly impact overall costs. A “win-win” negotiation approach, where both parties benefit from the agreement, often leads to more sustainable cost reductions than purely adversarial tactics.

Process Improvement for Reducing Operational Costs

Identifying and eliminating inefficiencies in operational processes is critical for cost reduction. This can involve streamlining workflows, automating repetitive tasks, and implementing process optimization techniques like Six Sigma or Lean methodologies. For instance, a company might analyze its order fulfillment process to identify bottlenecks and implement changes to reduce processing time and associated labor costs. Regular process audits and employee feedback can help identify areas for improvement. Investing in technology to automate processes, such as robotic process automation (RPA), can significantly reduce manual labor costs and errors.

Potential Cost Reduction Strategies by Department

Implementing targeted cost reduction strategies within specific departments can yield significant results.

Below is a list of potential cost reduction strategies categorized by department:

| Department | Cost Reduction Strategies |

|---|---|

| Marketing | Optimize digital marketing campaigns, renegotiate advertising contracts, explore cost-effective content creation strategies. |

| Operations | Implement lean manufacturing principles, optimize supply chain logistics, invest in automation technology. |

| Human Resources | Optimize recruitment processes, implement employee training programs focused on efficiency, explore flexible work arrangements. |

| Finance | Negotiate better interest rates on loans, optimize cash flow management, implement robust financial planning and analysis. |

| IT | Consolidate IT infrastructure, optimize software licensing agreements, explore cloud computing solutions. |

Value Engineering and Analysis

Value engineering (VE) is a systematic method for improving the “value” of goods or services by identifying and eliminating unnecessary costs without sacrificing functionality or performance. It’s a proactive approach to cost management, focusing on optimizing design and processes rather than simply cutting expenses. Unlike cost reduction, which often involves trimming existing features, VE seeks to enhance value by improving the relationship between function and cost.

Value engineering plays a crucial role in cost management by identifying areas where functions can be achieved more efficiently and cost-effectively. By systematically evaluating all aspects of a product or service, VE helps organizations achieve better value for money, leading to increased profitability and competitive advantage. It fosters innovation and creative problem-solving, resulting in improved designs and processes.

Steps in Conducting a Value Analysis Study

A value analysis study typically follows a structured approach to ensure thoroughness and effectiveness. The process involves a team of individuals with diverse expertise, bringing different perspectives to the analysis. This multidisciplinary approach is vital for identifying innovative solutions.

- Information Gathering: This initial phase involves collecting comprehensive data about the product or service under review, including its function, cost, and performance. This may involve reviewing blueprints, specifications, and market research.

- Function Analysis: The team identifies the basic functions of the product or service and analyzes how each function contributes to the overall value. This helps prioritize areas for improvement.

- Idea Generation: Brainstorming sessions are held to generate creative ideas for improving the product or service’s function, cost, or both. Techniques such as brainstorming, lateral thinking, and benchmarking are often employed.

- Evaluation and Selection: The generated ideas are evaluated based on criteria such as cost, performance, and feasibility. A cost-benefit analysis is often conducted to determine the most promising options.

- Implementation and Follow-up: The selected ideas are implemented, and the results are monitored to ensure that the expected cost savings and performance improvements are achieved. Regular follow-ups are crucial for evaluating the long-term impact of the VE study.

Examples of Value Engineering Projects

Numerous successful value engineering projects have demonstrated significant cost savings. For example, the construction of a large-scale infrastructure project might involve substituting expensive materials with equally effective but less costly alternatives, without compromising structural integrity or safety. Similarly, in the automotive industry, VE might lead to the redesign of a component to reduce the number of parts, simplifying manufacturing and lowering costs. A redesign of a packaging system for a consumer product could reduce material usage and shipping costs, boosting profit margins.

Comparison of Value Engineering with Other Cost Reduction Methods

While value engineering focuses on improving the value proposition, other cost reduction methods often target specific areas like streamlining processes or negotiating better prices with suppliers. Value engineering offers a more holistic and proactive approach, while other methods may be more reactive and less innovative. For example, simple cost-cutting measures may reduce short-term expenses but could compromise long-term quality or functionality. Value engineering aims for long-term value optimization.

Value Engineering Analysis Framework for a Smartphone

Let’s consider a smartphone as an example. A value engineering analysis framework for this product could focus on several key areas:

- Materials: Analyzing the cost and availability of different materials used in the phone’s construction (e.g., exploring alternatives to rare earth elements in the manufacturing of certain components).

- Manufacturing Process: Evaluating the efficiency of the manufacturing process and identifying opportunities for automation or simplification (e.g., exploring 3D printing for specific parts).

- Design: Examining the design of the phone to identify areas where functionality can be maintained or enhanced while reducing material usage or manufacturing complexity (e.g., simplifying the internal design without compromising performance).

- Packaging: Optimizing the packaging to reduce material usage and transportation costs (e.g., using more eco-friendly and compact packaging).

- Software: Assessing the software features and identifying any unnecessary or redundant functionalities that can be removed or simplified without affecting the user experience.

By systematically analyzing these areas, a value engineering study can identify opportunities to improve the smartphone’s value proposition, potentially leading to significant cost savings without compromising its performance or features.

Performance Measurement and Reporting

Effective cost performance measurement and reporting are crucial for understanding the financial health of a business and making informed strategic decisions. By tracking key metrics and visualizing cost data, organizations can identify areas for improvement, optimize resource allocation, and ultimately enhance profitability. This section details the key aspects of establishing a robust cost performance measurement and reporting system.

Key Metrics for Evaluating Cost Performance and Efficiency

Several key metrics provide insights into cost performance and efficiency. These metrics should be tailored to the specific goals and context of the organization, but some common examples include: Cost Variance (actual cost minus budgeted cost), which highlights deviations from planned spending; Cost per Unit, indicating the efficiency of production or service delivery; Return on Investment (ROI), measuring the profitability of a project or initiative relative to its cost; and Budget Adherence Rate, demonstrating the degree to which the organization stays within its budget. Analyzing these metrics in conjunction allows for a comprehensive understanding of cost management effectiveness.

Cost Reports and Dashboards for Visualizing Cost Data

Cost reports and dashboards translate complex financial data into easily digestible formats. Reports can be tailored to various audiences and purposes. For instance, a high-level summary report might show overall budget performance, while a more detailed report could analyze costs by department or project. Dashboards, often interactive, provide a visual representation of key metrics, using charts, graphs, and key performance indicators (KPIs). A well-designed dashboard allows stakeholders to quickly grasp the financial situation and identify potential problems. For example, a dashboard might display the budget versus actual spending for each department using a bar chart, highlighting overspending or underspending at a glance.

Potential Reporting Challenges and Solutions

Several challenges can hinder effective cost reporting. Data accuracy is paramount; inconsistent data entry or flawed data collection methods can lead to inaccurate reports. Another challenge is ensuring timely reporting; delays can render data obsolete and impede timely decision-making. Finally, integrating data from various sources can be complex, requiring robust systems and processes. Solutions include implementing standardized data collection procedures, investing in reliable reporting software, and establishing clear reporting timelines. Regular data validation and reconciliation procedures can also improve accuracy.

Sample Cost Performance Report

The following table presents a sample cost performance report. This is a simplified example and should be adapted to specific organizational needs.

| Department | Budgeted Cost | Actual Cost | Variance |

|---|---|---|---|

| Sales | $100,000 | $95,000 | -$5,000 (Favorable) |

| Marketing | $50,000 | $55,000 | $5,000 (Unfavorable) |

| Operations | $75,000 | $78,000 | $3,000 (Unfavorable) |

| Total | $225,000 | $228,000 | $3,000 (Unfavorable) |

Importance of Regular Cost Performance Reviews and Their Impact on Strategic Decision-Making

Regular cost performance reviews are essential for proactive cost management. These reviews, conducted at predetermined intervals (e.g., monthly, quarterly), provide opportunities to analyze trends, identify deviations from the budget, and adjust strategies as needed. By identifying and addressing cost overruns or inefficiencies early on, organizations can mitigate potential financial risks and improve overall profitability. The insights gained from these reviews directly inform strategic decision-making, enabling organizations to allocate resources effectively, prioritize initiatives, and make data-driven choices to achieve their financial goals. For example, consistent monitoring might reveal that a specific marketing campaign is underperforming relative to its cost, prompting a reallocation of resources to a more effective strategy.

Technology and Automation in Cost Management

The integration of technology is revolutionizing cost management, moving it beyond manual processes and spreadsheets to a more efficient, data-driven approach. Automation streamlines operations, improves accuracy, and provides valuable insights for better decision-making. This allows businesses to gain a more comprehensive understanding of their costs and proactively manage them.

Automating Cost Tracking and Reporting Processes

Technology plays a crucial role in automating the often tedious tasks associated with cost tracking and reporting. Automated systems can collect data from various sources, such as accounting software, project management tools, and expense reports, consolidating this information into a central repository. This eliminates manual data entry, reducing the risk of human error and significantly speeding up the reporting process. Real-time dashboards and reporting tools provide instant access to key cost metrics, enabling faster identification of cost overruns or areas needing improvement. For example, a construction company might use software that automatically tracks labor costs, material expenses, and equipment usage, generating detailed reports on project profitability in real-time.

Examples of Cost Management Software and Tools

Several software solutions and tools are available to support various aspects of cost management. Enterprise Resource Planning (ERP) systems, such as SAP and Oracle, offer comprehensive cost management modules integrating financial, operational, and supply chain data. Specialized cost management software, like Anaplan or BlackLine, provide advanced functionalities for budgeting, forecasting, and cost allocation. Furthermore, project management tools, such as Asana or Monday.com, can integrate with cost tracking systems to provide a holistic view of project costs and performance. These tools often include features for expense tracking, invoice processing, and reporting, all designed to improve efficiency and accuracy.

Benefits of Cloud-Based Cost Management Solutions

Cloud-based cost management solutions offer several advantages over on-premise systems. Scalability is a key benefit; cloud solutions can easily adapt to changing business needs, accommodating growth or fluctuations in data volume without significant infrastructure investments. Accessibility is another crucial advantage; authorized personnel can access cost data from anywhere with an internet connection, improving collaboration and decision-making. Cloud solutions also often benefit from automatic updates and enhanced security features, reducing the burden on IT departments and mitigating security risks. Finally, cloud solutions typically offer a subscription-based pricing model, eliminating large upfront capital expenditures. A company experiencing rapid growth could easily scale its cloud-based cost management system to accommodate increased data volume and user needs, without needing to purchase and install new hardware.

Cost and Benefits of Implementing Cost Management Technologies

The cost of implementing cost management technologies varies depending on the chosen solution, the size of the organization, and the complexity of its needs. Cloud-based solutions generally have lower upfront costs than on-premise systems, but may involve recurring subscription fees. The benefits, however, often outweigh the costs. Improved accuracy in cost tracking and reporting, reduced manual effort, faster decision-making, and enhanced visibility into cost drivers all contribute to significant cost savings and increased efficiency. A company might invest in a new cost management system with an initial cost of $50,000 but realize annual savings of $20,000 through improved efficiency and reduced errors, resulting in a positive return on investment within a few years.

Impact of Automation on Cost Reduction and Efficiency

Automation significantly impacts cost reduction and efficiency by minimizing manual intervention in cost-related processes. This reduces human error, leading to more accurate cost data and better informed decisions. Automation also streamlines workflows, freeing up staff to focus on more strategic tasks. Furthermore, improved data visibility allows for proactive identification and mitigation of cost overruns, leading to significant cost savings. For example, automated invoice processing can reduce processing time by 80%, freeing up accounting staff to focus on higher-value tasks while simultaneously reducing the risk of payment errors. The increased efficiency and cost savings can directly contribute to improved profitability and a stronger competitive advantage.

Managing Costs in Different Business Contexts

Effective cost management is crucial for business success, but the strategies employed vary significantly depending on the specific context. Factors such as company size, industry, and economic climate all play a vital role in shaping a company’s approach to cost control. Understanding these nuances is essential for optimizing resource allocation and achieving sustainable profitability.

Cost Management Strategies: Startups versus Established Companies

Startups and established companies face fundamentally different cost management challenges. Startups, often operating with limited resources, prioritize lean operations and rapid growth. This often involves bootstrapping, seeking external funding strategically, and focusing on cost-effective solutions, even if it means sacrificing some features or immediate comforts. Established companies, on the other hand, usually have more established revenue streams and can afford to invest in more sophisticated cost management systems and technologies. Their focus shifts towards optimizing existing processes, enhancing efficiency, and maintaining a competitive edge through strategic cost reduction initiatives. While both prioritize profitability, their approaches differ considerably in terms of risk tolerance and long-term investment strategies. Startups might favor short-term cost savings, while established firms might embrace long-term investments that yield greater efficiency in the long run.

Cost Management in Different Industries

The nature of an industry significantly impacts cost management priorities. Manufacturing companies, for example, face substantial costs associated with raw materials, production processes, and inventory management. Their cost management strategies often involve optimizing supply chains, implementing just-in-time inventory systems, and investing in automation to reduce labor costs. Service industries, conversely, focus on managing labor costs, customer acquisition, and operational efficiency. Technology companies, characterized by rapid innovation and high research and development expenses, emphasize efficient resource allocation for projects with high potential returns, while carefully managing the costs associated with software development, marketing, and talent acquisition. Each industry necessitates a tailored approach to cost management that aligns with its unique cost drivers and operational characteristics.

Impact of Economic Conditions on Cost Management Strategies

Economic downturns necessitate a more aggressive approach to cost management. Companies often implement cost-cutting measures such as layoffs, reduced marketing budgets, and renegotiation of contracts with suppliers. During periods of economic expansion, however, companies might prioritize investments in growth and innovation, even if it means incurring higher costs in the short term. The prevailing economic climate dictates the risk tolerance and strategic focus of cost management strategies, with a shift towards conservatism during recessions and a greater willingness to take risks during booms. For example, during the 2008 financial crisis, many companies drastically reduced their operational costs, while during the subsequent recovery, investment in expansion and new technologies increased.

Challenges of Managing Costs in Global Organizations

Managing costs in global organizations presents unique complexities. Differences in labor costs, regulatory environments, and currency exchange rates necessitate sophisticated cost allocation and tracking systems. Maintaining consistent cost management practices across different geographical locations requires effective communication, standardized procedures, and robust reporting mechanisms. Furthermore, managing cultural differences and logistical challenges associated with global operations can significantly impact cost efficiency. For example, a company with operations in multiple countries must account for varying tax laws, labor regulations, and import/export tariffs, all of which affect overall cost management.

Cost Management Strategies Across Contexts

| Business Context | Primary Cost Drivers | Key Cost Management Strategies | Example Initiatives |

|---|---|---|---|

| Startup | Personnel, marketing, R&D | Lean operations, bootstrapping, strategic fundraising | Outsourcing non-core functions, utilizing free/open-source software, focusing on high-impact marketing campaigns |

| Established Company | Operations, overhead, marketing | Process optimization, automation, strategic sourcing | Implementing Six Sigma methodologies, investing in automation technologies, negotiating favorable contracts with suppliers |

| Manufacturing | Raw materials, production, labor | Supply chain optimization, JIT inventory, automation | Negotiating bulk discounts, implementing lean manufacturing principles, investing in robotics |

| Service | Labor, customer acquisition, marketing | Improving service delivery efficiency, targeted marketing, employee training | Implementing CRM systems, optimizing customer service processes, investing in employee skill development |

Epilogue

Mastering cost management is not merely about cutting expenses; it’s about strategically allocating resources to maximize value and achieve sustainable growth. By understanding and applying the techniques Artikeld in this guide, businesses can gain a competitive edge, improve profitability, and build a stronger financial foundation. From meticulous budgeting and forecasting to leveraging technology for automation and insightful reporting, a proactive approach to cost management empowers organizations to navigate economic fluctuations, seize opportunities, and ultimately thrive in a dynamic business landscape. The journey to financial success begins with a commitment to effective cost control.

User Queries

What is the difference between fixed and variable costs?

Fixed costs remain constant regardless of production volume (e.g., rent), while variable costs fluctuate with production (e.g., raw materials).

How can I improve my budgeting accuracy?

Use historical data, industry benchmarks, and incorporate contingency planning to account for unforeseen circumstances.

What are some common pitfalls to avoid in cost management?

Inaccurate forecasting, neglecting indirect costs, insufficient monitoring, and lack of regular review are common pitfalls.

How can I choose the right cost management software?

Consider factors such as your business size, budget, specific needs (e.g., reporting features), and ease of integration with existing systems.

What is the role of a cost accountant in cost management?

Cost accountants are responsible for tracking, analyzing, and reporting on costs, providing crucial insights for informed decision-making.