Navigating the world of credit scores can feel like deciphering a complex code. A strong credit score unlocks numerous financial opportunities, from securing favorable loan terms to obtaining better insurance rates. Understanding the key factors influencing your credit score is the first step towards improving your financial health. This guide provides practical strategies and actionable insights to help you boost your credit score and achieve your financial goals.

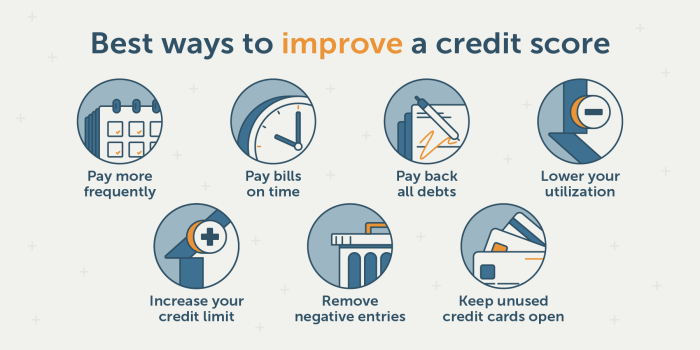

We’ll explore various aspects of credit management, from understanding how credit bureaus calculate scores to implementing effective strategies for paying bills on time and managing credit utilization. We’ll also address common misconceptions and provide clear, concise explanations to empower you to take control of your financial future.

Understanding Your Credit Score

Your credit score is a three-digit number that lenders use to assess your creditworthiness. A higher score indicates a lower risk to lenders, resulting in better loan terms and interest rates. Understanding the factors that influence your score is crucial for improving it.

Factors Contributing to a Credit Score

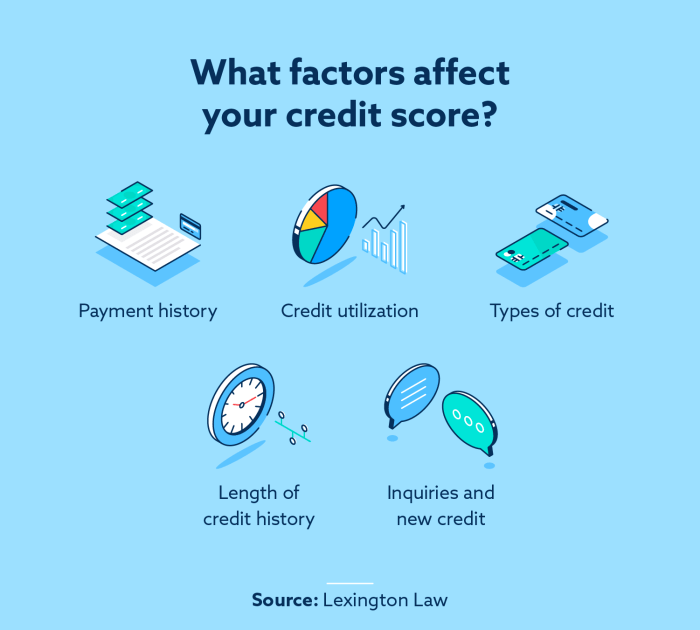

Several key factors contribute to your credit score. These factors are weighted differently by different credit scoring models, but generally include payment history, amounts owed, length of credit history, credit mix, and new credit. Payment history is the most significant factor, accounting for a substantial portion of your score. Consistent on-time payments demonstrate responsible credit management. Amounts owed, or your credit utilization ratio, refers to the percentage of available credit you’re using. Keeping this ratio low is beneficial. The length of your credit history reflects your experience managing credit over time. A diverse credit mix, encompassing various credit types (e.g., credit cards, loans), can also positively impact your score. Finally, applying for numerous new credit accounts within a short period can negatively affect your score.

Credit Score Ranges and Implications

Credit scores typically range from 300 to 850, although the specific range may vary slightly depending on the scoring model used. Scores are generally categorized into ranges with corresponding implications for obtaining credit. For example, a score of 750 or higher is generally considered excellent, indicating a low risk to lenders and access to favorable loan terms. Scores in the 670-739 range are usually considered good, while scores below 670 might indicate a higher risk and potentially lead to higher interest rates or difficulty securing credit.

Credit Bureau Score Calculation

The three major credit bureaus—Equifax, Experian, and TransUnion—each use their own proprietary algorithms to calculate credit scores. While the specific formulas are confidential, the factors mentioned previously (payment history, amounts owed, length of credit history, credit mix, and new credit) are consistently considered. These bureaus collect data from lenders and other sources to build your credit report, which serves as the foundation for calculating your score. Variations in the data reported to each bureau can result in slightly different scores across the three agencies. It’s important to understand that these are not averages, but rather independent calculations.

Comparison of Credit Bureaus

| Factor | Equifax | Experian | TransUnion |

|---|---|---|---|

| Data Sources | Lenders, public records, etc. | Lenders, public records, etc. | Lenders, public records, etc. |

| Scoring Models | Proprietary models | Proprietary models | Proprietary models |

| Reporting Methods | Provides credit reports and scores to lenders and consumers. | Provides credit reports and scores to lenders and consumers. | Provides credit reports and scores to lenders and consumers. |

Reviewing Your Credit Report

Regularly reviewing your credit reports is crucial for maintaining a healthy credit score. A thorough review allows you to identify and address any errors or inaccuracies that could negatively impact your creditworthiness. This proactive approach can save you time and potential financial hardship in the long run.

Obtaining Your Credit Reports

You are entitled to a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once every 12 months through AnnualCreditReport.com. This is the only official website authorized by the federal government to provide free credit reports. Avoid websites that claim to offer free reports but require payment or personal information beyond what is needed for verification. To obtain your reports, you’ll need to provide your name, address, Social Security number, and date of birth. The process is straightforward and typically takes only a few minutes to complete.

Identifying Errors and Inaccuracies

After receiving your credit reports, carefully review each one for potential errors. Common inaccuracies include incorrect personal information (address, name, Social Security number), outdated accounts (accounts that should be closed but are still listed as open), and accounts that don’t belong to you (accounts opened fraudulently). Pay close attention to account balances, payment histories, and dates of account opening and closing. Discrepancies, even small ones, can affect your credit score. Comparing reports from all three bureaus can highlight inconsistencies that might otherwise be overlooked.

Disputing Inaccurate Information

If you discover inaccuracies on your credit report, you have the right to dispute them. Each credit bureau provides a process for filing a dispute. Typically, this involves submitting a written dispute letter, including documentation supporting your claim. For example, if an account is listed as delinquent but you have proof of on-time payments, include copies of your payment receipts. The credit bureau is obligated to investigate your claim and update your report if the error is verified. Keep copies of all correspondence and documentation for your records. The process can take several weeks, so be patient and persistent.

Credit Report Review Checklist

A structured approach ensures a thorough review. This checklist facilitates the identification of potential issues.

| Item | Action |

|---|---|

| Personal Information | Verify accuracy of name, address, Social Security number, and date of birth. |

| Account Information | Check for accuracy of account balances, payment histories, dates of opening and closing, and account types. |

| Public Records | Review bankruptcies, judgments, and tax liens for accuracy and timeliness. |

| Inquiries | Examine recent credit inquiries and ensure they are legitimate. |

| Negative Marks | Note any late payments, collections, or charge-offs, and verify their accuracy. |

| Account Status | Confirm whether accounts are listed as open or closed correctly. |

Paying Your Bills On Time

Paying your bills on time is arguably the single most impactful factor you can control when it comes to improving your credit score. Lenders view consistent on-time payments as a strong indicator of your reliability and responsible financial behavior. This positive perception directly translates into a higher credit score, opening doors to better interest rates on loans and credit cards.

On-time payments significantly contribute to your payment history, which constitutes a substantial 35% of your FICO score calculation. Even minor delays can negatively affect your score, and multiple late payments can severely damage your creditworthiness. Conversely, a consistent record of on-time payments demonstrates financial responsibility, leading to a higher credit score over time.

Automating Bill Payments

Automating bill payments is a highly effective strategy to ensure timely payments and avoid late fees. Many banks and credit card companies offer online bill pay services that allow you to schedule automatic payments from your checking or savings account. You can set up recurring payments for regular bills like rent, utilities, and loan payments. This eliminates the need to remember payment due dates and reduces the risk of human error. Some services even allow you to set up alerts to notify you when payments are processed. This proactive approach helps maintain a clean payment history and contributes positively to your credit score.

Impact of Missed Payments

Even a single missed payment can have a noticeable negative impact on your credit score. The severity of the impact depends on factors such as your overall credit history and the type of account with the missed payment. For example, missing a credit card payment can result in a significant drop in your score, especially if you already have a less-than-perfect credit history. Similarly, late mortgage payments can have a more substantial negative impact than late utility payments. While the exact impact varies, it’s crucial to understand that any late payment leaves a negative mark on your credit report that remains for several years. For instance, a missed payment on a credit card might lower your score by 50-100 points, depending on your credit profile and the severity of the delinquency.

Sample Monthly Budget for Effective Bill Management

A well-organized budget is essential for ensuring timely bill payments. The following is a sample budget demonstrating effective bill management. Remember that your budget should be tailored to your specific income and expenses.

| Income | Amount |

|---|---|

| Net Monthly Salary | $3000 |

| Expenses | Amount |

| Rent/Mortgage | $1200 |

| Utilities (Electricity, Water, Gas) | $200 |

| Credit Card Payment | $150 |

| Auto Loan Payment | $300 |

| Groceries | $400 |

| Transportation | $150 |

| Other Expenses (Entertainment, etc.) | $200 |

| Savings | $400 |

This sample budget allocates funds for all essential expenses, including bill payments, while also incorporating savings. By meticulously tracking your income and expenses, you can create a personalized budget that facilitates on-time payments and responsible financial management. This proactive approach not only prevents late payments but also contributes significantly to a healthy credit score.

Managing Your Credit Utilization

Credit utilization is a crucial factor influencing your credit score. It represents the proportion of your available credit you’re currently using. Understanding and managing this ratio is key to maintaining a healthy credit profile. Lenders closely examine this metric to assess your creditworthiness, as high utilization suggests potential financial strain.

Credit utilization is calculated by dividing your total credit card balances by your total available credit. For example, if you have $10,000 in available credit across all your cards and owe $3,000, your credit utilization is 30%.

Credit Utilization’s Impact on Credit Scores

High credit utilization negatively impacts your credit score. Lenders view high utilization as a riskier proposition, suggesting you may be overextended financially. Conversely, maintaining low credit utilization demonstrates responsible credit management and improves your creditworthiness. The specific impact varies across credit scoring models, but generally, a lower utilization ratio is always preferable. A significant increase in utilization can lead to a noticeable drop in your credit score, potentially impacting your ability to secure loans or obtain favorable interest rates. Conversely, consistently low utilization can contribute positively to your score over time.

Best Practices for Low Credit Utilization

Keeping your credit utilization low requires proactive management. A good strategy involves regularly monitoring your credit card balances and aiming to keep your utilization below 30%, ideally below 10%. This can involve paying your balances in full each month or scheduling regular payments to reduce your outstanding balance. Consider setting up automatic payments to ensure timely repayments and prevent unintentional late payments, which further negatively impact credit scores. If you have multiple credit cards, spreading your spending across them can also help keep your utilization on each card lower. Avoid opening multiple new credit cards within a short period, as this can temporarily lower your available credit and artificially inflate your utilization.

High vs. Low Credit Utilization: A Comparison

High credit utilization (above 30%) signals to lenders a potential inability to manage debt effectively. This can result in lower credit scores, higher interest rates on future loans, and difficulties obtaining credit altogether. Conversely, low credit utilization (below 30%, ideally below 10%) demonstrates responsible financial behavior. This is often rewarded with higher credit scores, better interest rates, and easier access to credit. For instance, someone with a utilization rate of 70% might face significantly higher interest rates on a mortgage than someone with a 10% utilization rate, even if both have otherwise similar credit profiles.

Ideal Credit Utilization Ratio Visualization

Imagine a circle representing your total available credit. The ideal scenario is a small segment of that circle filled, representing your outstanding balance. For example, if the circle represents $10,000 of available credit, a 10% utilization would show a small segment filled, representing $1,000. A significantly larger portion filled would illustrate high utilization (e.g., $7,000 for 70% utilization), indicating a much higher risk for lenders. The smaller the filled segment, the better your credit utilization ratio. The goal is to keep this filled segment small, ideally within the 10% range.

Maintaining a Diverse Credit Mix

A diverse credit mix, meaning having a variety of different types of credit accounts, can significantly benefit your credit score. Lenders view a balanced credit portfolio as a sign of responsible financial management, suggesting a lower risk of default. This is because it demonstrates your ability to handle different types of credit obligations successfully.

Having a diverse credit mix shows credit bureaus that you’re capable of managing various credit products responsibly, which can positively influence your credit score calculations. While the exact weight given to credit mix varies among scoring models, it’s a factor considered alongside other crucial elements like payment history and credit utilization.

Types of Credit Accounts and Their Impact

Different types of credit accounts contribute differently to your credit mix. For example, installment loans (like auto loans or personal loans) show your ability to manage scheduled payments over a longer period. Revolving credit (like credit cards) demonstrates your capacity to manage debt responsibly and pay it down over time. Mortgage loans, if you have one, further diversify your credit profile. A well-balanced mix of these credit types generally leads to a better credit score than having only one type of account.

The Effect of a Limited Credit Mix

Having only one type of credit account, such as solely credit cards or only installment loans, can negatively impact your credit score. Credit scoring models look for a variety of accounts to assess your overall creditworthiness. A limited credit mix suggests less experience managing different types of credit, which can be interpreted as a higher risk by lenders. For instance, someone with only a single credit card might be viewed differently than someone with a credit card, an auto loan, and a student loan, even if their payment history on the single card is perfect. The diverse borrower demonstrates broader financial responsibility.

Avoiding Opening Too Many New Accounts

Opening numerous credit accounts within a short period can negatively impact your credit score. Lenders view this activity as a potential sign of financial instability or increased risk. This is because multiple applications suggest a higher likelihood of accumulating debt that you might struggle to manage.

Credit bureaus track your credit applications, and each application typically results in a “hard inquiry” on your credit report. These hard inquiries indicate that a lender has checked your credit history to assess your creditworthiness. While a single hard inquiry has a relatively small impact, multiple inquiries within a short timeframe (usually 12 months) can significantly lower your credit score. This is because it signals to lenders that you are actively seeking new credit, possibly due to financial difficulties.

Credit Inquiries and Their Effect on Credit Scores

Each hard inquiry slightly reduces your credit score. The effect is temporary, usually lasting for about two years, but multiple inquiries within a short period compound this effect, leading to a more substantial drop. The exact impact depends on several factors, including your existing credit history and the scoring model used. The algorithms used by credit scoring agencies like FICO and VantageScore weigh hard inquiries differently, but the general principle remains: fewer inquiries are better for your score.

Strategies for Minimizing Hard Inquiries

To avoid unnecessary hard inquiries, carefully consider your need for new credit. Avoid applying for multiple credit cards or loans simultaneously. Instead, focus on building your credit history responsibly with existing accounts. Pre-qualifying for credit cards or loans can also help; this process checks your creditworthiness without leaving a hard inquiry on your report, allowing you to shop around for the best offers without harming your score. Finally, consolidate your debts into a single account to simplify your financial profile and reduce the number of accounts you manage.

Impact of Multiple Hard Inquiries Over a Short Period

The following table illustrates the potential impact of multiple hard inquiries on your credit score. Note that these are illustrative examples and the actual impact can vary depending on individual circumstances and credit scoring models.

| Number of Hard Inquiries (within 12 months) | Potential Score Drop (points) | Impact on Creditworthiness | Example Scenario |

|---|---|---|---|

| 1-2 | 5-10 | Minor, usually temporary | Applying for a new credit card and a car loan within a year. |

| 3-5 | 10-25 | Moderate, can affect loan approvals | Applying for several credit cards, a personal loan, and a store credit card in six months. |

| 6 or more | 25+ | Significant, may hinder loan applications and increase interest rates | Applying for numerous credit cards and loans over a short period, suggesting potential financial strain. |

Increasing Your Credit Limit

Increasing your credit limit can be a strategic move to improve your credit score, but it’s crucial to do so responsibly. A higher credit limit, when managed correctly, can significantly reduce your credit utilization ratio, a key factor in your creditworthiness. However, indiscriminate pursuit of higher limits can backfire, so understanding the process and its implications is vital.

Increasing your credit limit lowers your credit utilization ratio, which is the percentage of your available credit that you’re using. A lower utilization ratio generally translates to a better credit score. For example, if you have a $1,000 credit limit and carry a $500 balance, your utilization is 50%. Increasing your limit to $2,000 while maintaining the $500 balance reduces your utilization to 25%, a considerable improvement. This demonstrates the positive impact a higher credit limit can have on your credit score.

Methods for Requesting a Credit Limit Increase

There are several ways to request a credit limit increase. You can typically do this through your credit card issuer’s online portal, mobile app, or by contacting their customer service department. Many issuers automatically review accounts for potential limit increases periodically, so you might even receive an offer without actively requesting one. Submitting a formal request often involves providing updated financial information, such as income details and employment history, to demonstrate your improved financial standing. It’s also wise to review your credit report beforehand to ensure there are no errors that could negatively impact your request.

Drawbacks of Frequent Credit Limit Increase Requests

While increasing your credit limit can benefit your credit score, requesting increases too frequently can have negative consequences. Credit bureaus might interpret numerous requests as a sign of financial instability or a desperate attempt to manage debt. This could potentially lower your credit score. Furthermore, each credit limit increase request results in a hard inquiry on your credit report, which can temporarily lower your score. It’s generally recommended to wait at least six months to a year between requests to avoid these potential drawbacks. Focusing on responsible credit management and demonstrating consistent, on-time payments is far more effective for long-term credit score improvement than repeatedly seeking higher credit limits.

Becoming an Authorized User

Adding another person to your credit card as an authorized user can be a strategic move with potential benefits for both the primary account holder and the authorized user. It’s a relationship where the authorized user gains access to the credit card account but doesn’t own the debt. Understanding the implications is crucial before taking this step.

Becoming an authorized user means you’re granted permission to use a credit card account held by someone else, the primary account holder. You’ll receive a card with your name on it, allowing you to make purchases and build credit history. However, the primary account holder remains solely responsible for paying the credit card bill. The authorized user’s credit report will reflect the account’s payment history, potentially impacting their credit score.

Benefits of Becoming an Authorized User

The primary benefit is the potential for credit score improvement. If the primary account holder maintains a good payment history, this positive activity is reflected on the authorized user’s credit report. This can be especially beneficial for individuals with limited or damaged credit histories. Additionally, having access to credit can help establish a credit history, a crucial step for securing loans, mortgages, or even renting an apartment in the future.

Risks of Becoming an Authorized User

While the benefits can be significant, it’s important to understand the risks. If the primary account holder fails to make timely payments or defaults on the debt, this negative information will also appear on the authorized user’s credit report, potentially harming their credit score. Furthermore, any debt incurred by the primary account holder is their responsibility, even if the authorized user made the purchases. It’s crucial to choose a responsible primary account holder to mitigate these risks.

Selecting a Responsible Primary Account Holder

Choosing the right primary account holder is paramount. Look for someone with a strong credit history, consistently making on-time payments, and maintaining a low credit utilization ratio. Ideally, this individual should be someone you trust implicitly and have a stable financial situation. Consider their financial habits and their willingness to communicate openly about the account. A close relative with a proven track record of responsible credit management is often a good choice.

Questions to Ask Before Becoming an Authorized User

Before accepting an invitation to become an authorized user, it’s vital to clarify several aspects of the arrangement. This includes understanding the terms of the credit card agreement, including interest rates, fees, and payment due dates. It is also important to know how the primary account holder plans to manage the account and how this will affect the authorized user’s credit. Finally, it is advisable to clarify the communication protocol in case of disputes or unexpected circumstances.

Ultimate Conclusion

Improving your credit score is a journey, not a sprint. By consistently implementing the strategies Artikeld in this guide – understanding your credit report, managing your debt responsibly, and maintaining a healthy credit utilization ratio – you can steadily improve your financial standing. Remember, consistent effort and responsible financial behavior are key to achieving a strong and healthy credit score, paving the way for a more secure financial future.

FAQ Corner

What is a good credit score?

Generally, a credit score above 700 is considered good, while scores above 800 are excellent. However, the specific thresholds vary slightly depending on the credit scoring model used.

How often should I check my credit report?

You are entitled to a free credit report from each of the three major bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com. Checking regularly helps you identify and address any potential errors or fraudulent activity.

What’s the difference between a hard and soft credit inquiry?

A hard inquiry occurs when a lender checks your credit report to assess your creditworthiness for a loan or credit card application. Soft inquiries, such as those made by yourself or for pre-approved offers, don’t impact your score.

How long do negative items stay on my credit report?

Most negative marks, such as late payments or bankruptcies, remain on your credit report for seven years from the date of the incident. Bankruptcies can stay for up to 10 years.