Cryptocurrency Trading Tips: Embark on a thrilling, potentially lucrative, and definitely unpredictable journey into the wild west of digital finance! Forget buried treasure; we’re after blockchain gold. This guide navigates the complexities of crypto trading, from understanding market fluctuations (think rollercoaster, but with more potential for both exhilarating highs and stomach-churning lows) to mastering technical analysis (because staring at charts all day is a perfectly acceptable hobby, right?). Buckle up, it’s going to be a volatile ride.

We’ll delve into the nuances of various cryptocurrencies, the importance of risk management (because losing your shirt isn’t fashionable, even in the crypto world), and the art of both technical and fundamental analysis. We’ll explore different trading strategies, emphasizing the crucial role of security and the ever-present need for continuous learning. Think of this as your survival guide in the digital jungle, complete with maps, maybe a machete (metaphorical, of course), and a healthy dose of caution.

Understanding Cryptocurrency Markets

Navigating the wild, wild west of cryptocurrency trading requires more than just a lucky hunch and a caffeine IV drip. Understanding the market’s intricacies is crucial to surviving—and thriving—in this volatile yet potentially lucrative landscape. Think of it as learning to ride a bucking bronco: you need to know its temperament before you even think about mounting it.

Factors Influencing Cryptocurrency Prices

A multitude of factors contribute to the rollercoaster ride that is cryptocurrency pricing. News events, such as regulatory announcements or technological breakthroughs, can send prices soaring or plummeting in a matter of hours. Market sentiment, driven by social media hype, fear, and general investor confidence, plays a significant role. Furthermore, the limited supply of many cryptocurrencies, combined with increasing demand, can lead to price appreciation. Finally, macroeconomic factors, like inflation and global economic uncertainty, can influence investor appetite for riskier assets like cryptocurrencies. Think of it as a complex weather system: a seemingly small change in one area can create a ripple effect across the entire market.

Differences Between Cryptocurrency Types

The cryptocurrency world isn’t a monolith; it’s a diverse ecosystem with different coins serving different purposes. Bitcoin, often called “digital gold,” functions primarily as a store of value, similar to precious metals. Ethereum, on the other hand, is a platform for decentralized applications (dApps) and smart contracts, making it more versatile but also more susceptible to technological shifts. Stablecoins, pegged to fiat currencies like the US dollar, aim for price stability, providing a safer haven during market volatility. Imagine Bitcoin as a solid gold bar, Ethereum as a complex machine, and stablecoins as carefully calibrated weights – each serving a unique purpose in the overall system.

Market Cycles and Their Impact on Trading Strategies

Cryptocurrency markets are cyclical, characterized by periods of explosive growth (bull markets) followed by sharp corrections (bear markets). During bull markets, investors are generally optimistic, leading to higher prices and increased trading volume. Bear markets, conversely, are characterized by pessimism, price declines, and reduced trading activity. Understanding these cycles is vital for developing effective trading strategies. For instance, a long-term investment strategy might be suitable during a bear market, while day trading might be more appealing during a bull market. It’s like knowing when to hold ’em and when to fold ’em in a high-stakes poker game.

Cryptocurrency Volatility Comparison

| Cryptocurrency | Volatility (Illustrative Example – Not Financial Advice) | Description | Risk Level |

|---|---|---|---|

| Bitcoin (BTC) | High | Established, but still subject to significant price swings. | Medium-High |

| Ethereum (ETH) | Very High | Highly volatile due to its use in DeFi and NFTs. | High |

| Tether (USDT) | Low | Stablecoin aiming for a 1:1 peg with the USD. | Low |

| Dogecoin (DOGE) | Extremely High | Highly susceptible to meme-driven price fluctuations. | Very High |

Risk Management in Cryptocurrency Trading

Navigating the wild, wild west of cryptocurrency trading requires more than just a lucky hunch and a caffeine IV drip. It demands a steely-eyed approach to risk management, a strategy as robust as a bitcoin miner’s cooling system. Without it, even the most astute trader can find themselves staring at a portfolio resembling a deflated balloon animal.

Successful cryptocurrency trading isn’t about getting rich quick; it’s about consistently managing risk and maximizing long-term gains. Think of it like this: you wouldn’t sail the ocean in a bathtub, would you? Similarly, reckless trading without a proper risk management plan is a recipe for disaster.

Diversification in Cryptocurrency Portfolios

Diversification is the cornerstone of a sound cryptocurrency investment strategy. Imagine putting all your eggs in one basket – a basket labeled “Dogecoin,” perhaps. While Dogecoin might have its moments of glory, a single-asset portfolio leaves you utterly vulnerable to market fluctuations. A diversified portfolio, on the other hand, spreads your risk across multiple cryptocurrencies, reducing the impact of any single asset’s decline. Think of it as a financial safety net woven from various digital threads. For example, a well-diversified portfolio might include a mix of established cryptocurrencies like Bitcoin and Ethereum, alongside promising altcoins with different use cases and market caps. This approach mitigates the risk associated with the volatility inherent in individual cryptocurrencies.

Implementing a Risk Management Strategy

A robust risk management strategy hinges on two key pillars: stop-loss orders and position sizing. Stop-loss orders automatically sell your cryptocurrency when it reaches a predetermined price, limiting potential losses. Think of them as your financial emergency brakes. Position sizing, on the other hand, dictates how much of your capital you allocate to each trade. It’s about carefully determining the appropriate investment amount for each cryptocurrency based on your risk tolerance and market analysis. A sensible approach might involve never investing more than, say, 5% of your total portfolio in any single cryptocurrency, regardless of how enticing the potential gains might seem.

Never invest more than you can afford to lose. This is not just a cliché; it’s the bedrock of responsible investing.

Common Trading Mistakes and Their Avoidance

Many traders fall prey to common pitfalls, often fueled by emotional decision-making. One frequent mistake is “fear of missing out” (FOMO), leading to impulsive trades without proper research or risk assessment. Another is the “confirmation bias,” where traders selectively seek information that confirms their pre-existing beliefs, ignoring contradictory evidence. Avoiding these pitfalls requires discipline and a commitment to objective analysis. Develop a trading plan, stick to it, and avoid making emotional decisions based on market noise. Regularly review your trading performance and identify areas for improvement.

Psychological Aspects of Cryptocurrency Trading and Emotional Control

The cryptocurrency market is an emotional rollercoaster. Sudden price swings can trigger fear, greed, and even panic. Maintaining emotional control is crucial for successful trading. Techniques like mindfulness, meditation, or simply taking breaks from trading when feeling overwhelmed can significantly improve decision-making. Remember, successful trading is a marathon, not a sprint. Patience, discipline, and a long-term perspective are key to navigating the market’s emotional turbulence.

Technical Analysis for Cryptocurrency Trading

Navigating the wild, wild west of cryptocurrency trading requires more than just a lucky hunch and a prayer to Satoshi. Technical analysis, the art of deciphering price charts and indicators, provides a structured approach to identifying potential trading opportunities. While it’s not a crystal ball (sadly, no one has *that* yet), it can significantly improve your chances of making informed decisions and, dare we say, profiting from the market’s rollercoaster rides.

Key Technical Indicators in Cryptocurrency Trading

Technical indicators act as your trusty sidekicks, providing insights into price trends and momentum. Understanding these signals can help you anticipate potential shifts in the market. Let’s explore some of the most popular:

- Moving Averages (MAs): MAs smooth out price fluctuations, revealing underlying trends. A common strategy involves using a combination of short-term (e.g., 50-day MA) and long-term (e.g., 200-day MA) MAs. A “golden cross” (short-term MA crossing above the long-term MA) is often seen as a bullish signal, while a “death cross” (the opposite) suggests bearish sentiment. The interpretation depends heavily on the context of the overall market and other indicators.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Generally, an RSI above 70 is considered overbought (suggesting a potential price correction), while an RSI below 30 suggests an oversold condition (potentially indicating a bounce). However, remember that RSI can also exhibit extended periods above 70 or below 30 during strong trends.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It consists of a MACD line and a signal line. Crossovers between these lines, along with divergence (price movement not matching the MACD’s trend), can signal potential trend reversals. For example, a bullish divergence occurs when the price makes lower lows, but the MACD makes higher lows, suggesting a potential upward trend reversal.

Interpreting Candlestick Patterns

Candlestick charts, with their visual representation of price action, are a staple in technical analysis. Each candlestick reveals a story of price movement within a specific timeframe, providing clues about market sentiment. Some common patterns include:

- Hammer: A small body with a long lower wick, suggesting a potential bullish reversal after a downtrend. Imagine a hammer striking the bottom, halting the fall.

- Hanging Man: Similar to a hammer but appearing at the top of an uptrend, signaling a potential bearish reversal. Think of it as a man hanging precariously, about to fall.

- Engulfing Pattern: A candlestick completely engulfing the previous one. A bullish engulfing pattern occurs when a large green candlestick engulfs a previous red candlestick, while a bearish engulfing pattern is the opposite. These patterns suggest a potential shift in momentum.

Identifying Entry and Exit Points Using Technical Analysis

Combining indicators and candlestick patterns allows for a more comprehensive approach to identifying potential entry and exit points. For example, a bullish engulfing pattern confirmed by a golden cross on the moving averages and an RSI rising from oversold levels could suggest a strong buy signal. Conversely, a bearish engulfing pattern with a death cross and an RSI above 70 might indicate a potential sell signal. However, remember that no single indicator or pattern guarantees success; always consider the broader market context.

A Step-by-Step Guide to Technical Analysis

Let’s assume we want to analyze Bitcoin (BTC) using technical analysis.

- Choose a Charting Platform: Select a reputable platform offering various technical indicators and charting tools. Many free and paid options are available.

- Select Timeframe: Choose a timeframe that suits your trading style. Daily charts are suitable for longer-term strategies, while shorter timeframes (e.g., hourly or 15-minute) are more appropriate for day trading.

- Apply Indicators: Add the indicators you’re comfortable with (e.g., 50-day and 200-day MAs, RSI, MACD).

- Analyze Candlestick Patterns: Look for significant candlestick patterns that align with the indicators’ signals.

- Identify Potential Entry/Exit Points: Based on the combined analysis, identify potential entry points (buy signals) and exit points (sell signals).

- Set Stop-Loss and Take-Profit Orders: To manage risk, always set stop-loss orders to limit potential losses and take-profit orders to secure profits.

Fundamental Analysis for Cryptocurrency Trading

Fundamental analysis, in the thrilling world of cryptocurrency trading, is less about charting candlestick patterns and more about digging deep into the nitty-gritty of a project. Think of it as detective work, but instead of solving murders, you’re trying to uncover the next Bitcoin – or at least avoid the next pump-and-dump scheme. It’s about understanding the underlying value proposition of a cryptocurrency, separate from its market price fluctuations.

Fundamental analysis for cryptocurrencies involves evaluating factors beyond just the price action. It’s a holistic approach that considers the technology behind the coin, the team driving its development, and the overall adoption and community support it enjoys. This detailed assessment helps in identifying potentially undervalued projects with strong long-term growth potential, while avoiding those with shaky foundations likely to crash and burn faster than a Roman candle.

Technology Assessment

Evaluating the technology of a cryptocurrency requires more than just a cursory glance at its whitepaper. It necessitates a deep dive into the underlying blockchain technology, its scalability, security features, and innovation. For example, a coin built on a slow, energy-intensive blockchain might struggle to compete with faster, more efficient alternatives. Conversely, a project leveraging cutting-edge technology like sharding or zero-knowledge proofs could offer significant advantages. Scrutinizing the codebase itself (if possible), or at least examining audits conducted by reputable security firms, is crucial to assess its robustness and security against exploits. Consider the level of decentralization: Is it truly decentralized, or is it controlled by a small group of individuals or entities? This can significantly impact its long-term viability.

Team Assessment

The team behind a cryptocurrency project is arguably just as important as the technology itself. A strong, experienced team with a proven track record in the blockchain space inspires confidence. Researching the team members’ backgrounds, their expertise, and their previous successes (or failures) is crucial. Look for transparency – are the team members publicly identified, and are their credentials verifiable? A secretive or anonymous team should raise a significant red flag. Furthermore, examine the team’s communication strategy; a responsive and engaged team demonstrates commitment and accountability. Conversely, a team that’s silent or evasive can be a sign of trouble.

Adoption Rate and Community Engagement

The adoption rate of a cryptocurrency is a crucial indicator of its potential. A high adoption rate suggests a strong network effect, increasing the value and utility of the cryptocurrency. Consider the number of users, exchanges listing the coin, and the volume of transactions. However, merely counting users isn’t enough. Evaluate the quality of the community surrounding the project. An active, engaged community that provides feedback, contributes to development, and promotes the project organically is a positive sign. Conversely, a small, inactive community can indicate a lack of interest and potentially foreshadow future difficulties. Analyzing social media sentiment, participation in forums, and the general level of community enthusiasm can offer valuable insights.

Fundamental Analysis Checklist

Before investing in any cryptocurrency, a thorough fundamental analysis is paramount. Here’s a checklist to guide your investigation:

- Technology: Assess the blockchain technology, scalability, security, and innovation.

- Team: Research the team’s background, experience, and communication.

- Adoption Rate: Examine the number of users, exchanges, and transaction volume.

- Community Engagement: Analyze community activity, sentiment, and overall enthusiasm.

- Tokenomics: Understand the token’s supply, distribution, and utility.

- Whitepaper: Carefully review the project’s whitepaper for clarity, feasibility, and potential risks.

- Competitor Analysis: Compare the project to its competitors in terms of technology, features, and market position.

- Regulatory Landscape: Consider the regulatory environment and potential legal implications.

Remember, conducting thorough fundamental analysis doesn’t guarantee success in cryptocurrency trading, but it significantly increases your chances of making informed investment decisions and minimizing your risk of losing your hard-earned money (or, as we like to call it, “feeding the whales”). Treat this checklist not as a magic formula, but as a helpful guide in your quest for crypto riches.

Trading Strategies and Techniques

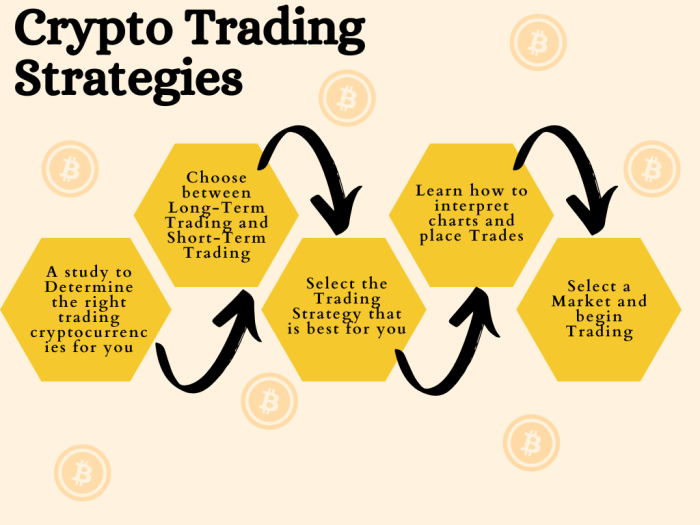

Navigating the thrilling, yet occasionally terrifying, world of cryptocurrency trading requires more than just a healthy dose of caffeine and a prayer. A well-defined strategy is your life raft in the stormy seas of volatile markets. Choosing the right approach depends heavily on your risk tolerance, time commitment, and overall financial goals. Let’s dive into the fascinating (and potentially lucrative) world of trading strategies.

Day Trading, Swing Trading, and Long-Term Investing: A Comparison

These three strategies represent distinct approaches to cryptocurrency trading, each with its own set of advantages and disadvantages. Day trading involves buying and selling cryptocurrencies within the same day, aiming to profit from small price fluctuations. Swing trading, on the other hand, holds positions for a few days or weeks, capitalizing on short-term price swings. Finally, long-term investing focuses on holding cryptocurrencies for extended periods, often years, anticipating significant price appreciation over time. Day trading demands intense focus and quick decision-making, while swing trading allows for a more relaxed approach. Long-term investing, naturally, requires the most patience.

Examples of Successful Cryptocurrency Trading Strategies

While past performance is never a guarantee of future success (a crucial point!), analyzing successful strategies can offer valuable insights. One example is the “Dollar-Cost Averaging” strategy, where investors consistently invest a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak. Another successful approach is the “Trend Following” strategy, which involves identifying and capitalizing on established market trends. This strategy relies on technical analysis and requires a keen eye for spotting patterns. A third strategy, less common but potentially lucrative, is “Arbitrage,” exploiting price differences of the same cryptocurrency across different exchanges. This requires quick action and often sophisticated software.

Leverage and Margin Trading: Risks and Rewards

Leverage and margin trading amplify both profits and losses. Leverage allows traders to borrow funds to increase their trading positions, potentially magnifying returns. Margin trading is a similar concept, using borrowed funds as collateral. While these techniques can significantly boost profits, they also carry substantial risks. A small market movement against your position can lead to substantial losses, potentially exceeding your initial investment (a phenomenon known as liquidation). Think of it like this: leverage is a double-edged sword; it can make you a hero or a zero. Proceed with extreme caution.

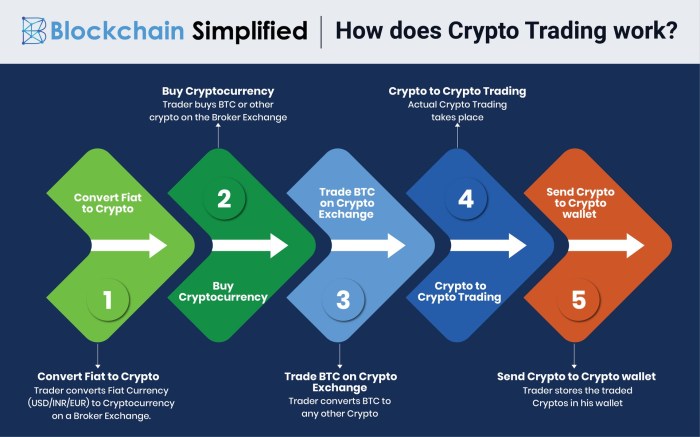

Setting Up and Managing a Cryptocurrency Trading Account

Establishing a cryptocurrency trading account involves several steps. First, choose a reputable exchange platform, considering factors like security, fees, and available cryptocurrencies. Then, complete the registration process, providing the necessary identification documents. Next, secure your account with robust two-factor authentication (2FA). Finally, familiarize yourself with the platform’s interface and trading tools before making any trades. Managing your account involves regularly monitoring your portfolio, adjusting your strategies based on market conditions, and adhering to a strict risk management plan. Remember, security is paramount. Never share your private keys or seed phrases with anyone. Treat your cryptocurrency trading account like Fort Knox – heavily guarded and meticulously monitored.

Security and Best Practices: Cryptocurrency Trading Tips

Navigating the wild west of cryptocurrency requires more than just a lucky gut feeling; it demands a healthy respect for security. Losing your digital assets to a cunning hacker or a simple oversight is about as fun as watching your portfolio plummet faster than a lead balloon. So, buckle up, buttercup, and let’s explore how to keep your crypto safe and sound. We’ll cover secure wallet management, common threats, and best practices – because your financial well-being deserves a fortress, not a flimsy shack.

Secure Wallet Management

The cornerstone of cryptocurrency security is your wallet. Think of it as Fort Knox for your digital gold. Choosing the right type of wallet – hardware, software, or paper – is crucial, depending on your needs and risk tolerance. Hardware wallets, resembling USB drives, offer the highest level of security by storing your private keys offline. Software wallets, downloaded onto your computer or phone, are convenient but present higher risks if your device is compromised. Paper wallets, essentially printed QR codes containing your keys, offer offline storage but are vulnerable to physical damage or theft. Consider the trade-offs carefully; a misplaced paper wallet can be a heart-stopping experience.

Common Security Threats and Mitigation Strategies

The cryptocurrency world is not immune to nefarious activities. Phishing scams, designed to trick you into revealing your private keys, are distressingly common. Malware, lurking on your computer, can silently steal your information. Exchange hacks, though less frequent due to improved security measures, still represent a significant risk. To mitigate these threats, always verify the legitimacy of websites and emails, install robust antivirus software, and enable two-factor authentication (2FA) wherever possible. Remember, vigilance is your best weapon against digital bandits.

Best Practices for Protecting Cryptocurrency Investments

Protecting your cryptocurrency isn’t a one-size-fits-all affair; it’s a layered approach. Diversify your holdings across multiple exchanges and wallets to minimize risk. Regularly back up your wallets and keep your software updated. Use strong, unique passwords and consider a password manager to keep track of them all. Avoid clicking on suspicious links or downloading files from untrusted sources. Treat your private keys like the crown jewels – protect them fiercely and never share them with anyone. A little paranoia in this context can be a very good thing.

Reputable Cryptocurrency Exchanges and Their Security Features

Choosing a reputable exchange is paramount. Security features vary widely, so research is key.

- Binance: Known for its large trading volume and advanced security features, including 2FA and cold storage for a significant portion of user funds. However, remember that even large exchanges are not immune to vulnerabilities.

- Coinbase: A user-friendly platform with robust security measures, including 2FA and insurance for certain assets. It prioritizes regulatory compliance, which can be a plus or minus depending on your perspective.

- Kraken: A well-established exchange with a strong reputation for security, offering 2FA, and a focus on regulatory compliance. It often boasts a relatively lower fee structure compared to others.

- Gemini: Known for its regulatory compliance and security features, including 2FA and cold storage. Its user interface is considered user-friendly, even for beginners.

Remember that the security landscape is constantly evolving. Stay informed about the latest threats and best practices to keep your crypto safe. The goal is not to be paranoid, but to be proactively prepared.

Staying Informed and Educated

Navigating the wild, wild west of cryptocurrency requires more than just a lucky gut feeling and a penchant for risk. Think of it like this: you wouldn’t try to conquer Everest wearing flip-flops and a blindfold, would you? Similarly, successful crypto trading hinges on staying consistently informed and continuously learning. Ignoring this crucial aspect is akin to attempting to predict the weather by throwing darts at a map – you might get lucky once, but don’t expect consistent results.

The cryptocurrency market is a dynamic beast, constantly shifting and evolving. New projects emerge daily, regulations change faster than you can say “blockchain,” and market sentiment can swing wildly in a matter of hours. Therefore, continuous learning is not merely advisable; it’s absolutely essential for survival (and ideally, prosperity) in this exciting, yet volatile, landscape.

Reliable Resources for Cryptocurrency News and Trends, Cryptocurrency Trading Tips

Staying abreast of the latest market developments requires access to trustworthy information sources. Relying solely on social media chatter or unverified online forums is a recipe for disaster. Instead, consider reputable news outlets dedicated to cryptocurrency and blockchain technology. These sources often provide in-depth analysis, expert opinions, and well-researched articles. Furthermore, following influential figures in the cryptocurrency space, such as established analysts and developers, can offer valuable insights. Remember to always cross-reference information from multiple sources to avoid bias and misinformation.

The Importance of Continuous Learning in Cryptocurrency Trading

The cryptocurrency market is not static; it’s constantly evolving. New technologies, regulatory changes, and market trends emerge regularly. To remain competitive and avoid costly mistakes, continuous learning is paramount. This involves regularly updating your knowledge of blockchain technology, understanding emerging trends, and adapting your trading strategies accordingly. For example, the rise of decentralized finance (DeFi) fundamentally altered the market landscape, creating new opportunities and risks that traders needed to understand to adapt successfully. Ignoring these changes could lead to significant losses.

Benefits of Joining Cryptocurrency Communities and Forums

While caution is advised regarding the reliability of information found online, joining reputable cryptocurrency communities and forums can provide numerous benefits. These platforms offer opportunities to network with other traders, share insights, and learn from experienced individuals. However, remember that not all information found in these forums is accurate or unbiased. Always critically evaluate the information you receive and cross-reference it with other credible sources. The ability to discuss strategies, analyze market trends, and learn from both successes and failures of others is invaluable. Think of it as a collective brain trust, but always bring your own critical thinking skills.

Evaluating Cryptocurrency Projects and Identifying Potential Scams

The cryptocurrency space, unfortunately, attracts its fair share of scams and fraudulent projects. Thoroughly researching any cryptocurrency project before investing is crucial. This involves scrutinizing the project’s whitepaper, examining the team’s background and experience, and assessing the project’s technology and its potential for long-term success. Be wary of projects promising unrealistic returns or those lacking transparency. Remember, if something sounds too good to be true, it probably is. Consider the infamous OneCoin scam, which defrauded investors of billions of dollars, as a stark reminder of the importance of due diligence. Always check for red flags, such as anonymous development teams, unrealistic roadmaps, and a lack of verifiable information.

Illustrative Examples of Successful Trades

Let’s delve into the thrilling, albeit sometimes terrifying, world of successful cryptocurrency trades. We’ll examine hypothetical scenarios, highlighting the strategic thinking and calculated risks that can lead to profitable outcomes. Remember, these are examples for illustrative purposes only and past performance is not indicative of future results. The cryptocurrency market is notoriously volatile!

Successful Ethereum Trade

Imagine a trader, let’s call him Barry, who identified a bullish trend in Ethereum (ETH) based on strong fundamental analysis – the release of a major upgrade to the Ethereum network, promising increased scalability and efficiency. He noticed a consolidation pattern forming on the price chart, indicating a potential breakout. Barry’s technical analysis confirmed this, showing positive RSI and MACD indicators. He entered a long position (buying ETH) at $1,500 per coin. His rationale was based on the expectation that the network upgrade would drive increased demand and consequently, a price surge. The upgrade was indeed successful, boosting investor confidence. The price of ETH steadily climbed, reaching $2,000 within a month. Barry set a take-profit order at $2,000, securing a healthy profit. His initial investment of $15,000 (10 ETH) yielded a profit of $5,000, representing a 33.33% return. This success was a result of combining fundamental and technical analysis, identifying a strong trend, and setting a clear exit strategy.

Utilizing Stop-Loss Orders to Mitigate Losses

Now, let’s consider a different scenario, where a trader, let’s call her Anya, invested in a lesser-known altcoin, “DogeCoinPlus” (DCP), based on optimistic predictions circulating online. Anya bought 500 DCP at $0.50 each, investing a total of $250. However, the market sentiment shifted unexpectedly, and the price of DCP began to plummet. Recognizing the risk, Anya had prudently set a stop-loss order at $0.40. This meant that if the price fell below $0.40, her order would automatically sell her DCP holdings, limiting her potential losses. The price did indeed fall below $0.40, triggering the stop-loss order. While Anya still experienced a loss ($50), the stop-loss order prevented a far more significant loss had she held onto the asset as the price continued its downward trajectory to $0.20. The stop-loss order acted as a safety net, protecting a substantial portion of her initial investment. This highlights the crucial role of risk management in cryptocurrency trading.

Epilogue

So, there you have it – a whirlwind tour of the exciting (and sometimes terrifying) world of cryptocurrency trading. Remember, while the potential for profit is significant, so are the risks. This guide provides a framework, but successful trading requires discipline, research, and a healthy dose of luck. Don’t treat this as a get-rich-quick scheme; consider it a sophisticated, potentially rewarding, and definitely educational adventure. Now go forth and conquer… or at least, don’t lose everything.

Helpful Answers

What is a “stablecoin”?

A stablecoin is a cryptocurrency designed to minimize volatility by pegging its value to a stable asset, like the US dollar or gold. Think of it as a calmer cousin in the chaotic crypto family.

How often should I check my cryptocurrency portfolio?

It depends on your trading strategy. Day traders check constantly, while long-term investors might only check periodically. However, regular monitoring for security breaches is always recommended.

What are the tax implications of cryptocurrency trading?

Tax laws vary significantly by jurisdiction. Consult a tax professional to understand your specific obligations. This is crucial; don’t end up owing Uncle Sam (or your equivalent) more than your crypto gains!

Is it possible to lose more money than I invest in cryptocurrency trading?

Yes, especially with leverage and margin trading. These techniques amplify both profits and losses. Proceed with extreme caution.