Data Analytics Finance Tools Review: Prepare to be amazed! We’re diving headfirst into the wild, wonderful world of crunching numbers in finance. Forget dusty spreadsheets – we’re talking cutting-edge tools that can predict the future (almost), detect fraud faster than a ninja, and optimize portfolios with the precision of a Swiss watchmaker. Buckle up, it’s going to be a thrilling ride!

This review explores the landscape of data analytics tools specifically designed for financial professionals. We’ll examine their key features, pricing models, and how they tackle real-world financial challenges. From regression analysis to machine learning, we’ll uncover the techniques driving smarter financial decisions and explore the ethical considerations inherent in this powerful field. Get ready to unlock the secrets of financial success – one algorithm at a time.

Introduction to Data Analytics in Finance

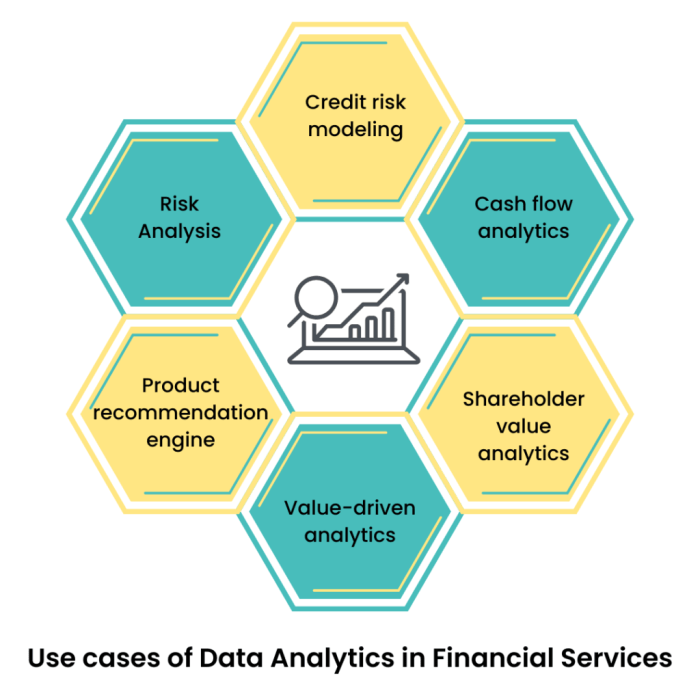

The financial world, once a realm of spreadsheets and gut feelings, is undergoing a thrilling transformation. Data analytics, the superhero of insightful decision-making, is rapidly becoming indispensable, wielding its power to reshape everything from risk management to investment strategies. Gone are the days of relying solely on intuition; now, data-driven decisions are the norm, leading to smarter, more profitable outcomes.

Data analytics tools are revolutionizing the financial sector, offering a plethora of advantages. Imagine having the ability to predict market trends with greater accuracy, identify fraudulent activities before they escalate, or personalize financial products with laser precision. This is the power of data analytics in action. By harnessing the vast amounts of data available, financial institutions can optimize operations, enhance customer experiences, and ultimately, boost their bottom line. It’s not just about crunching numbers; it’s about uncovering hidden patterns, predicting future outcomes, and making informed choices that drive success.

Types of Financial Data Used in Data Analytics

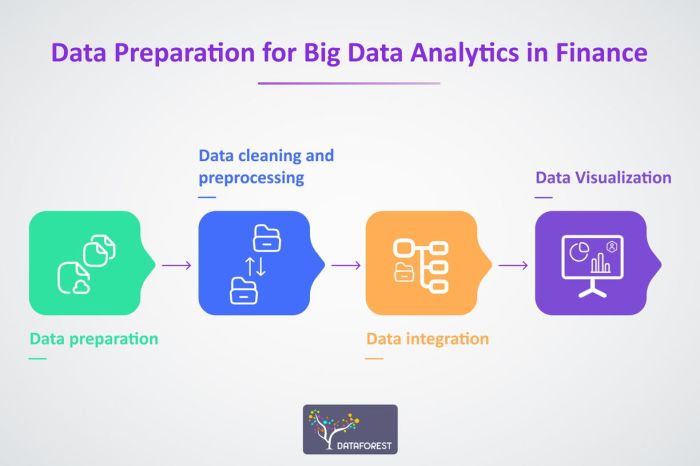

Financial data analytics utilizes a rich tapestry of information sources. These sources provide the raw materials that are transformed into actionable insights. Understanding the different types of data is crucial for effective analysis. The types range from structured, easily digestible information to the more chaotic, unstructured variety. Each type presents unique challenges and opportunities for analysis.

Structured Financial Data

Structured financial data is neatly organized and easily accessible. Think of neatly aligned columns in a spreadsheet, containing information such as transaction details, account balances, and market prices. This data is readily analyzed using traditional statistical methods and machine learning algorithms. Examples include transactional data from point-of-sale systems, customer account information, and historical stock prices. The beauty of this data lies in its ease of use and the ability to perform quick, efficient analyses. For example, a bank might use structured data on loan applications to build a predictive model for assessing credit risk, allowing for faster and more accurate loan approvals.

Unstructured Financial Data

Unstructured financial data is a bit more unruly. It encompasses information like news articles, social media posts, and research reports. Analyzing this type of data requires more sophisticated techniques, such as natural language processing (NLP) and sentiment analysis. While more challenging to work with, unstructured data can provide valuable insights into market sentiment, consumer behavior, and emerging trends. For instance, analyzing news articles and social media posts can help predict shifts in investor sentiment toward a particular company, providing a leading indicator for potential stock price movements. Think of it as mining for gold in a digital river – the process is more complex, but the rewards can be significant.

Alternative Data

The world of alternative data is a fascinating and rapidly expanding field. This category encompasses unconventional data sources that can offer unique perspectives and insights. Examples include satellite imagery used to assess the health of a company’s physical assets or geolocation data used to track consumer mobility and spending patterns. This data can offer a competitive edge by revealing hidden signals that traditional data sources might miss. For example, a hedge fund might use satellite imagery to analyze parking lot occupancy at retail stores to gauge the success of their sales. This unconventional approach adds another layer of complexity and potential for groundbreaking discoveries.

Top Data Analytics Tools for Finance Professionals

The world of finance is increasingly reliant on data, and with that reliance comes a need for powerful tools to analyze it all. Think of it as trying to navigate a labyrinthine bank vault filled with gold – you need the right tools to unlock the riches (and avoid the traps!). This section explores some of the top data analytics tools empowering finance professionals to make smarter, faster, and more profitable decisions. Prepare to be amazed (and maybe a little intimidated by their sheer power).

Data Analytics Tools Comparison

Choosing the right tool depends heavily on your specific needs and budget. This table provides a quick overview of some popular options, highlighting their strengths and weaknesses. Remember, the “best” tool is the one that best fits your workflow and the size of your wallet.

| Name | Key Features | Pricing Model | Target User |

|---|---|---|---|

| Tableau | Data visualization, interactive dashboards, robust data connectivity | Subscription-based, tiered pricing | Business analysts, financial analysts, data scientists |

| Power BI | Data visualization, self-service BI, integration with Microsoft ecosystem | Subscription-based, tiered pricing | Business users, financial analysts, data scientists |

| Python (with libraries like Pandas & Scikit-learn) | Data manipulation, statistical modeling, machine learning | Open-source (free), but may require paid cloud computing resources | Data scientists, quantitative analysts, experienced programmers |

| R (with libraries like dplyr & caret) | Statistical computing, data visualization, machine learning | Open-source (free), but may require paid cloud computing resources | Statisticians, data scientists, quantitative analysts |

| SQL | Data querying, data manipulation, database management | Database-specific licensing, often included with database software | Database administrators, data analysts, financial analysts |

Detailed Tool Functionalities and Financial Applications

Let’s delve deeper into the capabilities of each tool and how they can be used to tackle real-world financial challenges. Think of this as a detailed map of the bank vault, highlighting the most valuable treasures.

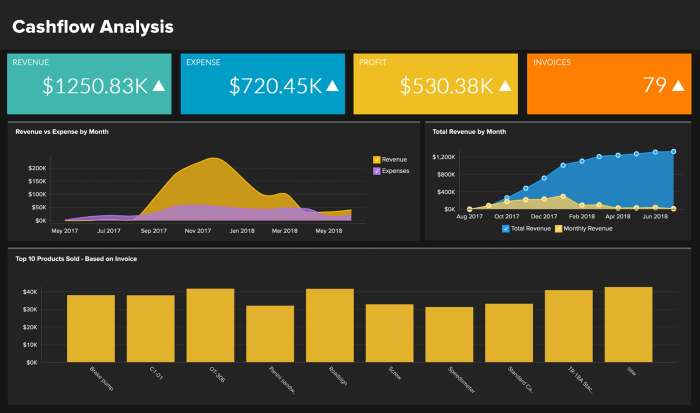

Tableau, for example, excels at creating interactive dashboards that display key financial metrics in a clear and concise manner. Imagine a dashboard showing real-time portfolio performance, instantly highlighting potential risks or opportunities. This allows for quicker decision-making and more efficient portfolio management.

Power BI, with its seamless integration with the Microsoft ecosystem, simplifies the process of connecting to various data sources and creating compelling visualizations. This is particularly useful for analyzing sales data to predict future revenue streams or identifying trends in customer behavior impacting financial performance.

Python, with its powerful libraries, is a data scientist’s best friend. It can be used for sophisticated modeling tasks such as fraud detection. By training a machine learning model on historical transaction data, Python can identify unusual patterns indicative of fraudulent activity, significantly reducing financial losses.

R, similar to Python, provides a robust environment for statistical analysis and machine learning. It is frequently used in risk management to model various financial risks, such as credit risk or market risk, helping institutions make informed decisions about risk exposure.

Finally, SQL is the backbone of many financial databases. Its power lies in its ability to efficiently retrieve and manipulate vast amounts of data. Imagine using SQL to analyze historical market data to identify profitable trading strategies or to perform detailed audits of financial transactions.

Data Analytics Techniques in Finance

The world of finance, once a realm of gut feelings and dusty ledgers, is now a vibrant playground for data analytics. These techniques, far from being mere number-crunching exercises, are the secret weapons that allow financial professionals to predict the unpredictable, navigate the chaotic, and, let’s be honest, make a lot more money. From forecasting market trends to assessing credit risk, data analytics is transforming the financial landscape at a breakneck speed. Let’s dive into some of the most impactful techniques.

Regression Analysis in Financial Forecasting

Regression analysis, in its simplest form, is about finding relationships between variables. In finance, this translates to predicting future values (like stock prices or interest rates) based on historical data and other relevant factors. For instance, a financial analyst might use regression to predict a company’s future earnings based on factors such as past earnings, revenue growth, and industry trends. A multiple linear regression model might look something like this:

Earnings = β0 + β1(Past Earnings) + β2(Revenue Growth) + β3(Industry Trend) + ε

where β0 represents the intercept, β1, β2, and β3 are the coefficients representing the impact of each factor, and ε represents the error term. The accuracy of the forecast hinges on the quality of the data and the selection of relevant variables. A poorly chosen model could lead to predictions that are less accurate than a well-informed guess. Think of it as trying to predict the weather based solely on the color of your socks—not very reliable. However, a robust model, built with carefully selected variables and validated through rigorous testing, can provide valuable insights for investment decisions. Consider the case of a fund manager using regression analysis to predict the performance of a particular sector based on macroeconomic indicators. This allows for proactive portfolio adjustments and potentially higher returns.

Machine Learning for Credit Scoring, Data Analytics Finance Tools Review

Imagine a world where credit scoring is not solely based on traditional factors like credit history and income. Enter machine learning, a powerful tool capable of analyzing vast datasets to identify complex patterns and predict creditworthiness with greater accuracy. In a hypothetical scenario, a bank uses machine learning algorithms to analyze data from a variety of sources, including social media activity, online purchasing behavior, and even geolocation data (with appropriate privacy safeguards, of course!). This allows the algorithm to identify subtle indicators of credit risk that might be missed by traditional methods. For example, the algorithm might find a correlation between frequent late-night online purchases and a higher likelihood of loan defaults. While seemingly trivial, these patterns, when aggregated and analyzed by a machine learning model, can contribute to a more comprehensive and accurate credit score. This leads to fairer lending practices, as it allows the bank to extend credit to individuals who might have been unfairly rejected under traditional systems, while also minimizing risk. This represents a significant advancement over the traditional credit scoring methods, which are often limited by their reliance on historical data alone.

Time Series Analysis and Sentiment Analysis in Finance: A Comparison

Time series analysis focuses on analyzing data points collected over time, identifying trends, seasonality, and other patterns. In finance, this is invaluable for forecasting stock prices, interest rates, and other financial variables. Sentiment analysis, on the other hand, analyzes text data (like news articles, social media posts, or financial reports) to determine the overall sentiment—positive, negative, or neutral. Both techniques are incredibly useful but serve different purposes. Time series analysis provides quantitative insights into historical trends and future projections, while sentiment analysis offers qualitative insights into market sentiment and public opinion. For example, a time series analysis of a company’s stock price might reveal a consistent upward trend over the past year. However, a simultaneous sentiment analysis of news articles about the company might reveal a growing negative sentiment due to concerns about a new competitor. This conflicting information highlights the importance of using both techniques in tandem to gain a more complete understanding of the market. Combining the quantitative forecasts from time series analysis with the qualitative insights from sentiment analysis allows for a more nuanced and informed investment strategy.

Case Studies

Let’s ditch the theoretical mumbo-jumbo and dive headfirst into the exhilarating world of real-world data analytics in finance. We’ll explore how these tools aren’t just dusty textbooks but vibrant, money-making machines (metaphorically speaking, of course – no guarantees!).

A successful implementation of data analytics isn’t just about buying the shiniest software; it’s about strategically integrating it into your existing financial ecosystem. Think of it like adding a turbocharger to a perfectly good car – you need the right setup to avoid blowing a gasket.

Fraud Detection at a Major Bank

This case study focuses on a large international bank that implemented a sophisticated machine learning model to detect fraudulent transactions. Previously, their fraud detection relied heavily on rule-based systems, which were slow, inefficient, and easily bypassed by increasingly clever fraudsters. The bank decided to leverage advanced algorithms to analyze massive datasets encompassing transaction history, customer demographics, and geolocation data. The challenges included integrating disparate data sources, training the model on imbalanced datasets (far more legitimate than fraudulent transactions), and ensuring regulatory compliance. The solution involved developing a robust data pipeline, employing techniques like oversampling and SMOTE to address data imbalance, and implementing rigorous validation procedures. The results were astonishing: a significant reduction in fraudulent transactions and a substantial increase in the accuracy of fraud detection, leading to millions of dollars saved annually. The implementation also freed up human analysts to focus on more complex investigations, increasing their efficiency and job satisfaction.

Key Performance Indicators (KPIs) for Data Analytics Initiatives

The success of any data analytics initiative hinges on the right metrics. Simply put, you need to know if your fancy new tools are actually making a difference. Choosing the wrong KPIs is like navigating by the stars while wearing a blindfold.

- Return on Investment (ROI): This classic metric measures the financial return generated by the data analytics initiative. For example, a fraud detection system that saves $1 million annually while costing $200,000 to implement has a strong ROI.

- Accuracy of Predictions: This measures how well the models predict future outcomes, such as customer churn or loan defaults. Higher accuracy translates to better decision-making.

- Improved Efficiency: Data analytics should streamline processes and automate tasks. KPIs could include reduced processing time, fewer manual errors, or increased throughput.

- Enhanced Customer Experience: Data-driven insights can lead to personalized services and improved customer satisfaction. KPIs could include customer satisfaction scores or net promoter scores.

- Risk Reduction: Data analytics can identify and mitigate risks across various financial operations. KPIs could include reduced loan defaults or lower operational risk.

Improved Loan Application Processing

Consider a scenario where a bank utilizes data analytics to improve its loan application processing. Traditionally, loan officers relied heavily on intuition and limited data points when assessing applications. This often led to inconsistent decisions and potentially missed opportunities. By implementing a data analytics solution, the bank analyzed historical loan data, credit scores, and other relevant factors to build a predictive model that accurately assesses the risk of loan default. This allowed the bank to automate the pre-approval process, significantly reducing processing time and freeing up loan officers to focus on more complex cases. The result was a faster, more efficient, and more consistent loan application process, ultimately leading to increased customer satisfaction and improved profitability. The model also helped identify previously overlooked segments of borrowers with a lower risk profile, expanding the bank’s lending capacity. This is a clear example of how data-driven insights can lead to improved decision-making, resulting in tangible business benefits.

Future Trends in Financial Data Analytics

The world of finance is hurtling towards a future where data isn’t just king – it’s the entire royal court, complete with AI advisors and blockchain bodyguards. Prepare yourself for a whirlwind tour of the exciting, slightly terrifying, and definitely data-driven future of financial analytics. We’ll explore how artificial intelligence, big data, and emerging technologies are poised to revolutionize how we understand, predict, and manage financial markets. Buckle up, it’s going to be a wild ride!

The impact of artificial intelligence (AI) and big data on financial data analytics is nothing short of transformative. No longer are we limited to analyzing neat, tidy spreadsheets. AI algorithms can now sift through mountains of unstructured data – think social media sentiment, news articles, and even satellite imagery – to identify subtle patterns and predict market movements with a level of accuracy that would have seemed like science fiction just a few years ago. Big data provides the fuel, and AI provides the engine, driving a new era of predictive analytics and risk management. This isn’t just about automating existing tasks; it’s about unlocking entirely new insights that were previously inaccessible.

The Rise of Artificial Intelligence in Finance

AI is rapidly changing the landscape of financial data analytics. Machine learning algorithms, for instance, are used extensively for fraud detection, identifying unusual transaction patterns that might indicate fraudulent activity. Deep learning models are being employed to predict credit risk more accurately, reducing the likelihood of loan defaults. Natural language processing (NLP) is used to analyze news articles and social media sentiment to gauge market sentiment and predict stock price movements. For example, a company like Kensho uses AI to analyze vast quantities of financial data and provide investment insights to its clients. Their AI-powered platform can process complex queries and deliver actionable insights far faster than any human analyst could.

Blockchain Technology and its Financial Implications

Blockchain technology, initially famous for its association with cryptocurrencies, is finding its way into mainstream finance, offering unprecedented transparency and security. Its decentralized, immutable ledger provides a reliable source of truth for tracking transactions, streamlining processes, and reducing fraud. In the context of data analytics, blockchain enables secure and auditable data sharing, which is crucial for regulatory compliance and collaboration between financial institutions. Imagine a future where regulatory reporting is automated and verified on a blockchain, eliminating the need for lengthy manual processes and reducing the risk of errors. This is not science fiction; several financial institutions are already exploring the use of blockchain for various applications, from trade finance to KYC/AML compliance.

The Evolution of Data Analytics Tools

The tools of the trade are also evolving at a breakneck pace. We’re moving beyond simple spreadsheet software towards sophisticated platforms that integrate AI, machine learning, and visualization capabilities. Expect to see more user-friendly interfaces that allow non-technical users to access and interpret complex data. Cloud-based solutions will continue to dominate, offering scalability and cost-effectiveness. The integration of different data sources – from traditional financial data to alternative data sources like social media and sensor data – will become increasingly seamless, allowing for a more holistic view of the financial landscape. Consider the development of platforms like Alteryx and Tableau, which have made data visualization and analysis accessible to a wider range of users, regardless of their technical expertise. The future will likely see even more intuitive and powerful tools emerge, further democratizing access to advanced data analytics capabilities.

Data Security and Ethical Considerations

In the thrilling world of financial data analytics, where algorithms dance and numbers sing, it’s easy to get swept away by the sheer power of predictive modeling and insightful visualizations. However, amidst this dazzling spectacle, we must remember the unsung heroes: data security and ethical considerations. These aren’t mere afterthoughts; they’re the bedrock upon which responsible financial data analysis is built. Without them, our elegant models become ticking time bombs, ready to explode in a shower of regulatory fines and reputational damage.

The importance of robust data security and privacy in financial data analytics cannot be overstated. We’re dealing with sensitive information – personal details, transaction histories, investment strategies – the stuff of nightmares for identity thieves and unscrupulous actors. A single breach can have devastating consequences, not just financially, but also in terms of public trust. Imagine the chaos if a competitor gained access to your firm’s proprietary trading algorithms – a scenario that would make even the most seasoned Wall Street veteran break out in a cold sweat.

Algorithmic Bias and Fairness

Algorithmic bias, a sneaky villain often lurking within seemingly objective data, poses a significant ethical challenge. These algorithms, trained on historical data, can inadvertently perpetuate existing societal biases, leading to discriminatory outcomes. For example, a loan application algorithm trained on data reflecting historical lending practices might unfairly discriminate against certain demographic groups, even if the algorithm itself isn’t explicitly programmed to do so. This isn’t just ethically problematic; it can also lead to significant legal and reputational risks. Consider the case of a credit scoring model that consistently undervalues applications from women-owned businesses, leading to missed opportunities and potential lawsuits. Such situations highlight the urgent need for rigorous testing and ongoing monitoring of algorithms to mitigate bias and ensure fair and equitable outcomes.

Best Practices for Responsible Data Analytics

Ensuring responsible and ethical use of data analytics requires a multi-faceted approach, combining technical safeguards with strong ethical guidelines. This isn’t a one-size-fits-all solution; it demands a thoughtful, iterative process tailored to the specific context.

The importance of establishing clear data governance policies cannot be overstated. These policies should define roles, responsibilities, and processes for data access, usage, and security. Regular audits and independent reviews of data analytics processes are also crucial to ensure compliance with these policies and identify potential biases or ethical concerns. Furthermore, incorporating privacy-enhancing technologies, such as differential privacy or federated learning, can help protect sensitive data while still enabling valuable analysis.

- Implement robust data encryption and access control measures to protect sensitive data from unauthorized access.

- Conduct regular security audits and penetration testing to identify and address vulnerabilities.

- Establish clear data governance policies that define roles, responsibilities, and processes for data handling.

- Develop and implement procedures for detecting and mitigating algorithmic bias.

- Promote transparency and explainability in data analytics models to build trust and accountability.

- Provide regular training to employees on data security and ethical considerations.

Implementing these best practices isn’t just about avoiding legal trouble; it’s about building a culture of responsible innovation. It’s about ensuring that the power of data analytics is used to create a fairer, more equitable, and ultimately, more profitable future. Ignoring these considerations isn’t just reckless; it’s bad business.

Ending Remarks

So, there you have it – a whirlwind tour through the exciting world of data analytics in finance. We’ve seen how these tools are transforming the industry, empowering professionals to make data-driven decisions with unprecedented accuracy and efficiency. While challenges remain, particularly concerning data security and ethical considerations, the future of financial data analytics is undeniably bright, promising even more sophisticated tools and innovative applications. The only question is: are you ready to ride the wave?

Top FAQs: Data Analytics Finance Tools Review

What are the biggest risks associated with using data analytics in finance?

The biggest risks include data breaches, algorithmic bias leading to unfair outcomes, and the misuse of sensitive financial information. Robust security measures and ethical guidelines are crucial to mitigate these risks.

How can I choose the right data analytics tool for my needs?

Consider your budget, the specific financial problems you’re trying to solve, the size and complexity of your data, and the technical skills of your team. Start with a free trial or demo if available to test compatibility.

Is data analytics in finance only for large institutions?

No, even small financial firms can benefit from data analytics. Many affordable and user-friendly tools are available that cater to businesses of all sizes.