Navigating the complexities of debt can feel overwhelming, but understanding your options is the first step towards financial freedom. Debt consolidation offers a potential pathway to simplify repayments, potentially lower interest rates, and regain control of your finances. This guide explores various strategies, from loans and balance transfers to debt management plans and settlement, helping you make informed decisions based on your unique circumstances.

We will delve into the specifics of each method, examining eligibility requirements, associated costs, and long-term implications for your credit score. Understanding the pros and cons of each approach is crucial for choosing the best path towards debt reduction and improved financial health.

Understanding Debt Consolidation

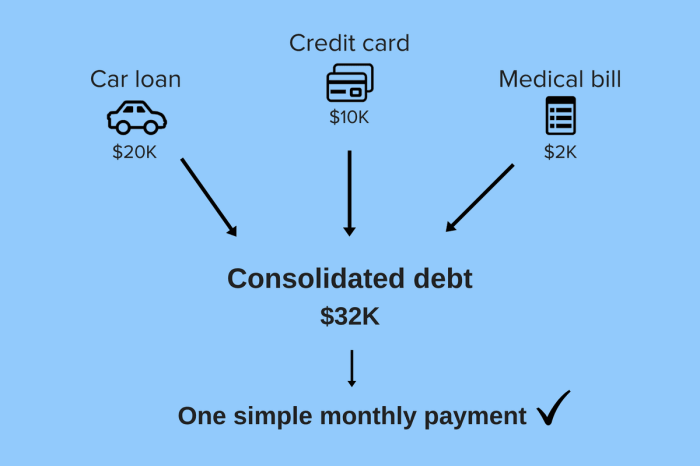

Debt consolidation simplifies your finances by combining multiple debts into a single, manageable payment. This can lead to significant benefits, particularly for individuals struggling to keep track of numerous due dates and interest rates. Understanding the various methods and their implications is crucial before making a decision.

Benefits of Debt Consolidation

Debt consolidation offers several key advantages. Lower interest rates are a common benefit, potentially saving you a considerable amount of money over the life of the loan. Simplified repayment, with one monthly payment instead of many, improves budgeting and reduces the risk of missed payments. Improved credit score is another potential outcome, as responsible management of a consolidated loan can positively impact your credit report. Reduced stress from managing multiple debts is a significant non-financial benefit. Finally, it can provide a clear path towards becoming debt-free faster.

Types of Debt Consolidation Loans

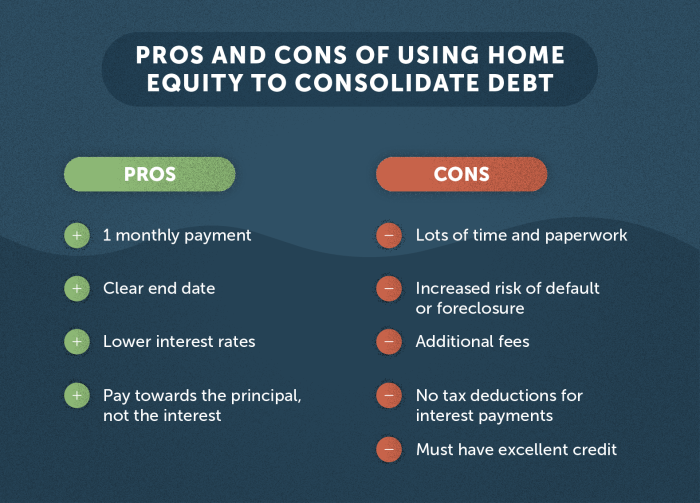

Several options exist for consolidating debt. Balance transfer credit cards allow you to transfer existing credit card balances to a new card with a lower interest rate, often offering a promotional period with 0% APR. Debt consolidation loans, offered by banks and credit unions, provide a lump sum to pay off existing debts, creating a single monthly payment with a fixed interest rate and repayment term. Home equity loans or lines of credit (HELOCs) use your home’s equity as collateral to secure a loan for debt consolidation. Finally, government programs, such as those offered through the Department of Education for student loan consolidation, may be available depending on your specific circumstances.

Secured vs. Unsecured Debt Consolidation Loans

Secured loans, such as home equity loans, require collateral (your home, in this case). This typically results in lower interest rates because the lender has less risk. However, defaulting on a secured loan can lead to the loss of your collateral. Unsecured loans, such as personal loans or balance transfer credit cards, don’t require collateral. They are generally easier to obtain but typically come with higher interest rates due to the increased risk for the lender. The choice depends on your risk tolerance and available assets.

Situations Where Debt Consolidation is Beneficial

Debt consolidation is particularly beneficial when dealing with high-interest debts, multiple creditors, or difficulty managing multiple payments. For example, someone with several credit cards carrying high interest rates could significantly reduce their monthly payments and overall interest paid by consolidating their debt into a lower-interest loan. Similarly, individuals struggling to keep track of various due dates and payment amounts can benefit from the simplification offered by a single monthly payment. Those facing potential bankruptcy might find debt consolidation a viable option to regain control of their finances.

Comparison of Debt Consolidation Methods

| Method | Pros | Cons | Suitable For |

|---|---|---|---|

| Balance Transfer Credit Card | Lower interest rate (initially), simplified payments | Potential for high interest rates after promotional period, balance transfer fees | Individuals with good credit and manageable debt |

| Debt Consolidation Loan | Fixed interest rate, predictable payments, improved credit score (with responsible repayment) | Requires creditworthiness, may not offer the lowest interest rate | Individuals with good or fair credit |

| Home Equity Loan/HELOC | Lower interest rates, tax deductibility (in some cases) | Risk of foreclosure if unable to repay, requires home equity | Homeowners with significant equity |

| Government Programs | Potentially lower interest rates, flexible repayment options | Eligibility requirements, limited availability | Individuals who meet specific eligibility criteria |

Debt Consolidation Loan Options

Debt consolidation loans offer a streamlined approach to managing multiple debts by combining them into a single, more manageable monthly payment. This can simplify your finances, potentially lower your overall interest rate, and improve your credit score over time. However, it’s crucial to understand the various loan options available and their associated implications before making a decision.

Eligibility Requirements for Debt Consolidation Loans

Eligibility criteria for debt consolidation loans vary depending on the lender and the type of loan. Generally, lenders assess your creditworthiness, income, debt-to-income ratio (DTI), and the amount of debt you wish to consolidate. A higher credit score typically leads to more favorable loan terms. Lenders often require a minimum credit score, usually around 660 or higher, for the best interest rates. They also examine your income to ensure you can comfortably afford the monthly payments. Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, plays a crucial role; a lower DTI indicates a lower risk to the lender. Finally, the amount of debt you need to consolidate will influence the loan amount you can obtain.

Interest Rates and Fees Associated with Debt Consolidation Loans

Interest rates and fees for debt consolidation loans vary significantly depending on several factors, including your credit score, the loan type, and the lender. Secured loans, such as those backed by collateral like a home or car, generally offer lower interest rates than unsecured loans. Unsecured loans, while more accessible, typically come with higher interest rates to compensate for the increased risk to the lender. Fees associated with debt consolidation loans can include origination fees, which are typically a percentage of the loan amount, and prepayment penalties, which may be charged if you pay off the loan early. It’s essential to compare interest rates and fees from multiple lenders before making a decision. For example, a personal loan might have an interest rate ranging from 6% to 36%, while a home equity loan could offer rates as low as 4% but carries the risk of losing your home if you default.

Key Factors to Consider When Choosing a Debt Consolidation Loan

Choosing the right debt consolidation loan involves careful consideration of several key factors. First, compare interest rates and fees from multiple lenders to find the most favorable terms. Second, evaluate the loan’s repayment term; a longer term lowers monthly payments but increases the total interest paid, while a shorter term results in higher monthly payments but reduces the overall interest cost. Third, assess the lender’s reputation and customer service. Finally, understand the loan’s terms and conditions thoroughly before signing any agreement. For instance, a balance transfer credit card might offer a 0% introductory APR for a limited time, but the rate will increase significantly after the introductory period.

Applying for a Debt Consolidation Loan: A Step-by-Step Guide

Applying for a debt consolidation loan typically involves these steps: 1. Check your credit report and score. 2. Shop around and compare offers from multiple lenders. 3. Gather necessary documents, including proof of income, identification, and debt information. 4. Complete the loan application online or in person. 5. Provide the lender with the necessary documentation. 6. Wait for the lender’s decision. 7. Once approved, sign the loan agreement and receive the funds. Remember, maintaining open communication with the lender throughout the process is crucial.

Debt Consolidation Loan Application Process Flowchart

A flowchart depicting the application process would visually represent the steps Artikeld above. The flowchart would begin with “Check Credit Report,” branch to “Compare Lender Offers,” then to “Gather Documents,” followed by “Complete Application,” “Provide Documentation,” “Lender Decision,” and finally “Sign Agreement/Receive Funds.” Each step would be represented by a box, with arrows indicating the flow of the process. The flowchart would clearly illustrate the sequential nature of the application process, aiding in better understanding and organization.

Balance Transfer Options

Debt consolidation often involves choosing between a balance transfer credit card and a personal loan. Both offer ways to combine multiple debts into a single payment, but they differ significantly in their structure, fees, and overall suitability. Understanding these differences is crucial for making an informed decision that aligns with your financial situation.

Balance Transfer Credit Cards versus Personal Loans

Balance transfer credit cards and personal loans both consolidate debt, but they do so in different ways. A balance transfer card allows you to move existing credit card balances onto a new card, often with a promotional 0% APR period. A personal loan, on the other hand, provides a lump sum of money that you use to pay off your existing debts. The key difference lies in the secured versus unsecured nature of the debt; personal loans are often unsecured (not backed by collateral), while credit card debt is secured by the credit limit. Choosing between the two depends on your credit score, the amount of debt, and your repayment strategy. A higher credit score might qualify you for better terms on both options, while a larger debt might make a personal loan more manageable due to its fixed repayment schedule.

Fees and Interest Rates Associated with Balance Transfer Credit Cards

Balance transfer credit cards typically charge fees and interest. A common fee is a balance transfer fee, usually a percentage of the amount transferred (e.g., 3-5%). After the introductory 0% APR period expires, a much higher standard APR will apply, often exceeding 20%. Additionally, some cards may charge annual fees, late payment fees, or cash advance fees. These fees can significantly impact the overall cost of consolidation if not carefully considered. For example, a $10,000 balance transfer with a 3% fee would incur a $300 immediate cost.

Understanding the Balance Transfer APR and Introductory Period

The APR (Annual Percentage Rate) represents the annual interest rate charged on the outstanding balance. The introductory period, often ranging from 6 to 21 months, is a crucial factor. During this period, the interest rate is typically 0%, allowing you to focus on paying down the principal balance. However, it’s vital to understand that this is temporary. Once the introductory period ends, the standard APR kicks in, and interest charges will begin accruing. Failing to pay off the balance before the introductory period ends can negate the benefits of the balance transfer and potentially increase your overall debt. For example, if you transfer $5,000 with a 12-month 0% APR, you must pay it off within that year to avoid accruing high interest charges.

Situations Where a Balance Transfer is a Better Option Than a Loan

A balance transfer card is often a better choice than a personal loan when you have relatively low debt with a good credit score, allowing you to qualify for a card with a lengthy 0% APR introductory period. This gives you ample time to pay off the debt without accruing interest. This strategy is particularly effective for high-interest credit card debt. If you have multiple high-interest credit cards, consolidating them onto a single 0% APR card can save you a substantial amount on interest payments.

Factors to Consider Before Transferring a Balance

Before initiating a balance transfer, carefully consider several factors.

- Your credit score: A higher score qualifies you for better terms.

- The balance transfer fee: Weigh the fee against the potential interest savings.

- The introductory APR period: Ensure you can pay off the balance before the standard APR applies.

- The standard APR: Understand the interest rate after the introductory period ends.

- Any additional fees: Consider annual fees, late payment fees, etc.

- Your repayment plan: Develop a realistic budget to ensure timely payments.

Debt Management Plans (DMPs)

Debt Management Plans (DMPs) offer a structured approach to tackling overwhelming debt. They involve working with a reputable credit counseling agency to create a single, manageable monthly payment plan to pay off multiple creditors. This approach can provide relief from harassing calls and potentially lower interest rates, although it does come with its own set of considerations.

Debt Management Plans and the Role of Credit Counseling Agencies

Credit counseling agencies play a central role in developing and administering DMPs. These agencies negotiate with your creditors on your behalf to reduce interest rates, waive late fees, and consolidate your payments into a single monthly payment. They provide budgeting guidance and financial education to help you manage your finances effectively and avoid future debt accumulation. Choosing a reputable, non-profit agency is crucial to ensure you’re working with a qualified and ethical organization.

How a DMP Works and Its Impact on Credit Score

A DMP works by consolidating your debts into a single monthly payment managed by the credit counseling agency. You make this payment to the agency, and the agency then distributes the funds to your creditors according to the agreed-upon plan. While a DMP can offer significant relief, it’s important to understand its impact on your credit score. Because the DMP will appear on your credit report as an account in collections, your credit score will likely take a temporary hit. However, consistent adherence to the DMP’s terms can positively influence your credit score over time, as it demonstrates improved debt management and repayment behavior. The initial negative impact is often offset by the positive effect of consistently making on-time payments according to the DMP.

Comparing DMPs with Other Debt Consolidation Methods

DMPs differ from other debt consolidation methods, such as debt consolidation loans and balance transfers. Unlike loans, DMPs don’t involve taking out a new loan; instead, they rely on negotiation with creditors. Compared to balance transfers, DMPs are typically better suited for individuals with multiple debts and lower credit scores, as balance transfers often require good credit. DMPs also offer the benefit of professional guidance and support from credit counselors, which is absent in other methods. However, DMPs generally take longer to pay off debts than other methods.

Benefits and Drawbacks of Using a DMP

Using a DMP presents several potential benefits. It simplifies debt management with a single monthly payment, often reduces interest rates and fees, and provides professional financial guidance. However, there are drawbacks to consider. A DMP will negatively impact your credit score initially, and it can take several years to complete the plan. Furthermore, access to new credit might be limited during the DMP period. The closing of existing accounts, while part of the plan, can also negatively impact your credit utilization ratio in the short term.

Questions to Ask a Credit Counseling Agency Before Enrolling in a DMP

Before enrolling in a DMP, it’s crucial to ask thorough questions to ensure the agency is reputable and the plan suits your financial situation. Consider the following:

- What are your fees and how are they structured?

- What is your success rate in negotiating with creditors?

- How long will the DMP typically take to complete?

- What is your process for handling unexpected financial emergencies?

- What is your policy regarding missed payments?

- Can you provide references from past clients?

- Are you a non-profit organization?

- What is the total cost of the DMP, including all fees and interest?

Debt Settlement

Debt settlement is a strategy used to resolve outstanding debts by negotiating a lower payoff amount with creditors. It’s a last resort option, often considered when other debt relief methods have failed, and should be approached with caution due to its significant potential drawbacks. The process involves working with a debt settlement company or negotiating directly with creditors to reduce the total amount owed.

The Debt Settlement Process and Potential Consequences

The debt settlement process typically involves several steps. First, you’ll need to determine which debts are suitable candidates for settlement. This usually involves debts that are significantly delinquent and for which you’re unable to make consistent payments. Next, you’ll either work with a debt settlement company, which will negotiate with your creditors on your behalf, or negotiate directly with your creditors yourself. This negotiation often involves temporarily ceasing payments on the targeted debts while building up funds in a dedicated settlement account. Once sufficient funds are accumulated, the debt settlement company or you will propose a lump-sum payment to the creditor, representing a significant discount on the original debt. The creditor may accept this offer, settling the debt for less than the full amount owed. However, creditors are not obligated to accept a settlement offer, and the process can be lengthy and stressful. A major consequence is the significant negative impact on your credit score. Furthermore, settled debts often remain on your credit report for seven years, and the settlement itself will be recorded, negatively affecting your creditworthiness. Finally, any unpaid taxes on forgiven debt will become your responsibility.

Impact of Debt Settlement on Credit Score

Debt settlement severely damages your credit score. The act of ceasing payments on your debts results in a significant drop in your credit score, and the eventual settlement, even if successful, is recorded as a negative mark on your credit report. For example, a consumer with a 700 credit score might see their score drop to the 500s or even lower after a debt settlement. The length of time it takes to recover from this damage varies depending on individual circumstances and credit habits, but it can take several years to rebuild your creditworthiness after a debt settlement. This negative impact can make it difficult to obtain loans, rent an apartment, or even secure certain jobs in the future.

Advantages and Disadvantages of Debt Settlement

Debt settlement offers the advantage of potentially resolving overwhelming debt at a significantly reduced cost. This can provide immediate relief from the stress and burden of high debt payments. However, the disadvantages are substantial. The severe and lasting damage to your credit score is a major drawback. Moreover, debt settlement companies often charge high fees, sometimes exceeding the amount saved through the settlement itself. The process is also complex, time-consuming, and emotionally taxing. Furthermore, the IRS may consider the forgiven debt as taxable income, leading to unexpected tax liabilities.

Situations Where Debt Settlement Might Be Viable

Debt settlement might be a viable option for individuals facing insurmountable debt who have exhausted other options like debt consolidation loans or DMPs. For example, someone facing medical debt exceeding their ability to repay, or someone who has lost their job and is struggling to meet minimum payments, might consider this route. However, it’s crucial to weigh the long-term consequences carefully and explore all other possibilities first. It is generally only considered a viable option as a last resort.

Long-Term Financial Implications of Debt Settlement

The long-term financial implications of debt settlement can be severe. The damage to your credit score can make it difficult to secure loans with favorable interest rates for years to come, potentially impacting major financial decisions such as buying a house or a car. Furthermore, the fees associated with debt settlement can significantly impact your finances. The inability to obtain credit at favorable rates can lead to higher costs in the future, hindering your ability to build wealth and achieve long-term financial goals. It’s crucial to thoroughly understand these implications before pursuing this course of action.

Debt Consolidation and Your Credit Score

Debt consolidation can significantly impact your credit score, both positively and negatively. The ultimate effect depends on several factors, including your current credit situation, the chosen consolidation method, and your subsequent financial behavior. Understanding these dynamics is crucial for making informed decisions.

Factors Influencing Credit Score Impact

Several key factors determine how debt consolidation affects your credit score. Your credit utilization ratio (the percentage of available credit you’re using) plays a major role. A lower utilization ratio generally improves your score, while a high ratio can negatively impact it. The age of your accounts also matters; closing older accounts, even as part of consolidation, can slightly lower your average account age, a factor considered in credit scoring. Finally, the type of debt consolidation method employed directly influences the effect on your credit score.

Mitigation Strategies for Negative Impacts

To minimize the potential negative effects of debt consolidation on your credit score, focus on responsible financial habits. Maintain a low credit utilization ratio by keeping your balances well below your credit limits. Pay all your bills on time and consistently, as payment history is a critical factor in credit scoring. Avoid opening new credit accounts unnecessarily during and immediately after the consolidation process, as this can temporarily lower your score. Carefully review your credit report after consolidation to ensure accuracy and promptly address any discrepancies.

Impact of Different Debt Consolidation Methods

Different debt consolidation methods have varying effects on your credit score. For instance, a debt consolidation loan typically involves a hard credit inquiry, which can temporarily lower your score by a few points. However, if the loan successfully lowers your credit utilization and simplifies your payments, the long-term impact can be positive. Balance transfers, on the other hand, may or may not involve a hard inquiry depending on the credit card issuer. They can improve your credit utilization if you pay down the transferred balance quickly. Debt management plans (DMPs) often involve closing existing accounts, which can negatively impact your average account age and credit score, but the improved payment history can eventually outweigh this. Debt settlement, while potentially resulting in a lower overall debt, severely damages your credit score due to the negative marks associated with late or missed payments and accounts sent to collections.

Comparative Table of Credit Score Impacts

| Debt Consolidation Method | Initial Credit Score Impact | Long-Term Credit Score Impact (with responsible management) | Potential Negative Consequences |

|---|---|---|---|

| Debt Consolidation Loan | Temporary slight decrease (due to hard inquiry) | Potential increase (due to lower utilization and improved payment history) | Higher interest rates if credit score is low |

| Balance Transfer | Potentially no impact or slight decrease (depending on hard inquiry) | Potential increase (due to lower utilization and improved payment history) | Balance transfer fees, potential interest rate increases after introductory period |

| Debt Management Plan (DMP) | Potential decrease (due to account closures) | Potential increase (due to improved payment history) | Lower credit limits, potential impact on average account age |

| Debt Settlement | Significant decrease (due to negative marks on credit report) | Long-term negative impact (difficult to rebuild credit) | Significant negative impact on credit score, potential for collection agency involvement |

Visual Representation: Debt Consolidation Journey

Understanding the process of debt consolidation can be made clearer through a visual representation. This section illustrates a successful debt consolidation journey, highlighting the key steps and positive outcomes. We’ll also provide a description that could be used to create a visual aid depicting the stages involved.

A successful debt consolidation journey often begins with feeling overwhelmed by multiple debts with high interest rates. Imagine Sarah, a young professional juggling three credit cards with high balances, a student loan, and a car loan. Each month, the minimum payments barely made a dent, and the interest charges felt insurmountable. This led to significant stress and anxiety. However, after researching her options, Sarah decided to pursue a debt consolidation loan.

Debt Consolidation Journey Stages

This section describes a visual representation of Sarah’s journey. Imagine a flowchart or a timeline, progressing from left to right.

The first stage, represented by a dark, stormy cloud, symbolizes Sarah’s initial state of high debt and stress. The cloud is labeled “Overwhelmed by Debt.” Arrows point from this cloud towards three separate smaller clouds, each representing a different debt (credit cards, student loan, and car loan). Each smaller cloud is labeled with the type of debt and a representative high interest rate.

The next stage depicts Sarah researching and comparing debt consolidation options. This is represented by a brightly lit lightbulb, labeled “Researching Solutions.” Arrows point from the three smaller clouds to the lightbulb.

The third stage shows Sarah choosing a debt consolidation loan. This is illustrated by a large, open strongbox labeled “Debt Consolidation Loan,” with smaller clouds representing the debts being absorbed into the strongbox. The interest rate on the strongbox is significantly lower than the rates on the individual clouds.

The fourth stage shows the steady reduction of the consolidated debt. This is represented by a steadily decreasing bar graph, showing the debt balance dropping over time. The x-axis represents time (months), and the y-axis represents the debt amount. The graph’s line should show a consistent downward trend.

The final stage illustrates Sarah’s success. This is represented by a bright, sunny sky with a bird flying freely, labeled “Debt-Free and Financially Secure.” An arrow points from the decreasing bar graph to the sunny sky. This visually represents the positive outcome of lower monthly payments, reduced stress, and improved financial stability.

Final Review

Ultimately, the most effective debt consolidation strategy depends on your individual financial situation and goals. By carefully considering the information presented, you can confidently assess your options and choose the method best suited to help you achieve your financial objectives. Remember to seek professional financial advice if needed to ensure you make the most informed decision for your long-term financial well-being.

FAQ Corner

What is the impact of debt consolidation on my credit score?

The impact varies depending on the method. While it can improve your score by simplifying payments and reducing utilization, it can also temporarily lower it due to new credit inquiries or increased debt. Careful planning is key.

How long does the debt consolidation process typically take?

The timeframe depends on the chosen method. Loans can take several weeks, while balance transfers are often quicker. Debt management plans can take several months or years.

Can I consolidate all types of debt?

Generally, yes, but some lenders may have restrictions. Credit card debt, medical bills, and personal loans are commonly consolidated. However, certain types of debt, such as student loans, may require separate consolidation programs.

What are the hidden fees I should watch out for?

Be wary of origination fees, prepayment penalties, and annual fees, especially with loans and balance transfers. Carefully review all terms and conditions before committing.