The rapid evolution of technology has fundamentally reshaped how we conduct financial transactions. Digital payment systems, encompassing mobile wallets, online banking, and peer-to-peer transfers, have become integral to modern commerce. This exploration delves into the multifaceted world of digital payments, examining their various types, adoption trends, security implications, regulatory frameworks, and future prospects. We’ll analyze the benefits and challenges for both businesses and consumers, ultimately painting a picture of this dynamic and ever-changing landscape.

From the convenience of contactless payments to the complexities of blockchain technology, digital payment systems offer a range of advantages and disadvantages. Understanding these nuances is crucial for individuals and businesses alike to navigate the digital economy effectively and securely. This analysis will provide a balanced perspective, highlighting the transformative potential while acknowledging the inherent risks.

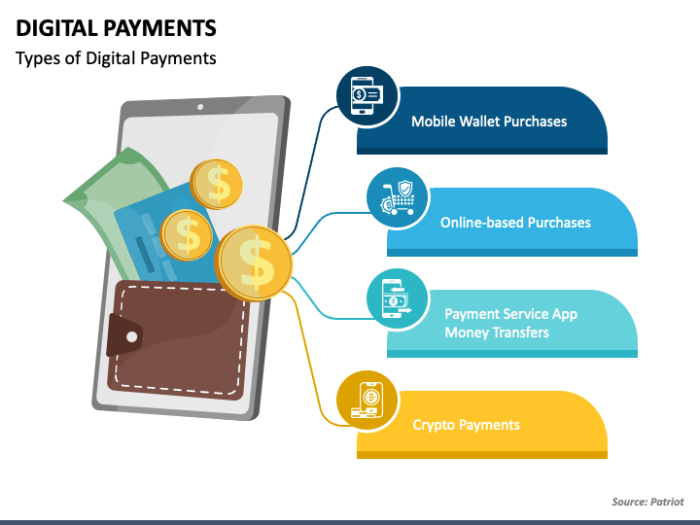

Types of Digital Payment Systems

Digital payment systems have revolutionized how we conduct transactions, offering convenience, speed, and security compared to traditional methods. This section will explore the various types of digital payment systems, their functionalities, advantages, disadvantages, and underlying technologies. Understanding these nuances is crucial for both consumers and businesses navigating the increasingly complex digital landscape.

Categorization of Digital Payment Systems

Digital payment systems can be broadly categorized based on their functionality and underlying technology. The following table summarizes key characteristics of several prominent systems.

| System Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Mobile Wallets | Digital wallets stored on smartphones, allowing users to make payments using various methods (NFC, QR codes). Examples include Apple Pay, Google Pay, Samsung Pay. | Convenience, speed, security features (biometric authentication), integration with other apps. | Requires smartphone access, reliance on mobile network connectivity, potential for device loss or theft leading to compromised funds. |

| Online Banking | Payment systems integrated into online banking platforms, enabling users to transfer funds, pay bills, and make online purchases directly from their accounts. | Widely accessible, secure (with proper authentication), detailed transaction history. | Can be slower than other methods, requires internet access, potential for phishing attacks. |

| Peer-to-Peer (P2P) Transfers | Systems enabling direct money transfers between individuals, often facilitated through apps like Venmo, PayPal, or Zelle. | Instant transfers, convenient for splitting bills or sending small amounts, social features in some apps. | Potential for fraud if not properly secured, limited transaction limits in some cases, reliance on app functionality. |

| Contactless Payments | Payments made using NFC technology, enabling quick transactions by tapping a card or device against a payment terminal. Examples include Apple Pay, Google Pay, contactless credit/debit cards. | Speed and convenience, reduced risk of germ transmission compared to handling cash or cards, often integrated with loyalty programs. | Requires NFC-enabled devices and terminals, potential for skimming if security protocols are not properly implemented, limited transaction amounts in some cases. |

Security Features of Digital Payment Systems

Security is paramount in digital payment systems. Different systems employ various security measures to protect user data and prevent fraud. Mobile wallets often utilize biometric authentication (fingerprint, facial recognition), tokenization (replacing sensitive data with unique identifiers), and encryption to safeguard transactions. Online banking platforms typically rely on multi-factor authentication, strong passwords, and sophisticated fraud detection systems. P2P transfer apps often incorporate two-factor authentication and transaction limits to mitigate risks. Contactless payments benefit from encryption and tokenization, minimizing the exposure of sensitive card details. Despite these measures, vigilance against phishing scams and malware remains crucial for all users.

Underlying Technologies

Various technologies underpin different digital payment systems. Near Field Communication (NFC) is crucial for contactless payments, enabling short-range wireless communication between devices. QR codes provide a visual interface for initiating payments, often used in mobile wallets and P2P transfers. Blockchain technology, while less prevalent in everyday transactions, is gaining traction for its potential to enhance security and transparency in cross-border payments and cryptocurrencies. The choice of technology often depends on the specific requirements of the payment system, balancing factors such as security, speed, and cost-effectiveness.

Adoption and Usage of Digital Payment Systems

The global shift towards digital payment systems is undeniable, impacting economies, businesses, and individuals alike. This transition is characterized by varying rates of adoption across different demographics and geographic regions, driven by a confluence of factors and challenged by significant obstacles. Understanding these trends and their underlying causes is crucial for policymakers, businesses, and individuals navigating this evolving financial landscape.

Global trends in digital payment adoption paint a picture of rapid expansion, although unevenly distributed. While some regions boast near-universal adoption, others lag behind due to various socio-economic factors. This section details these trends and the forces shaping them.

Global Trends in Digital Payment Adoption

The growth of digital payments is not uniform across the globe. Several key factors influence adoption rates, including technological infrastructure, economic development, and cultural preferences. The following points highlight some notable trends:

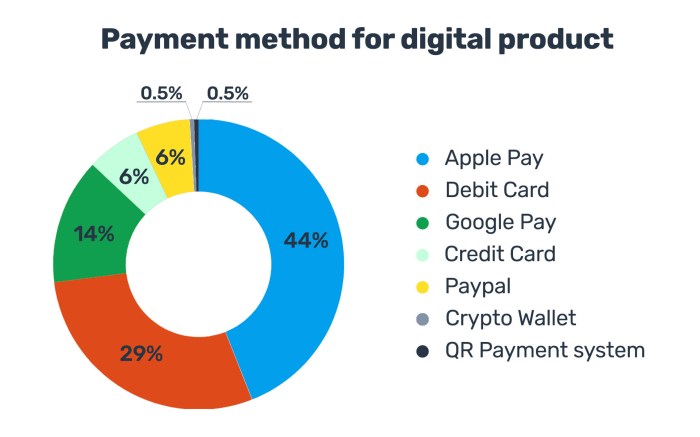

- Developed Economies: High levels of smartphone penetration and internet access have fueled rapid adoption in countries like the US, UK, and Japan, with contactless payments and mobile wallets becoming increasingly prevalent. For example, the widespread use of Apple Pay and Google Pay in the US demonstrates this trend.

- Developing Economies: Mobile money platforms, such as M-Pesa in Kenya, have revolutionized financial inclusion in many developing nations, bypassing traditional banking systems and enabling access to financial services for previously underserved populations. This highlights the potential of digital payments to bridge the financial divide.

- Demographic Differences: Younger generations generally exhibit higher adoption rates than older generations, reflecting their greater familiarity with technology. However, this gap is gradually closing as older populations become more comfortable with digital tools. Initiatives promoting digital literacy among older adults are playing a significant role in this shift.

- Regional Variations: Adoption rates vary significantly across regions. Asia-Pacific, driven by countries like China and India, shows exceptionally high growth, while some regions in Africa and Latin America are experiencing slower, yet significant progress, often linked to specific mobile money initiatives.

Factors Driving the Growth of Digital Payment Systems

Several key factors contribute to the escalating popularity of digital payment systems. These range from technological advancements to evolving consumer preferences and security concerns.

- Increased Smartphone Penetration: The proliferation of smartphones has created a ubiquitous platform for accessing digital payment apps and services, making transactions simpler and more accessible.

- Convenience and Speed: Digital payments offer unparalleled convenience, enabling users to make transactions anytime, anywhere, without the need for physical cash or checks. The speed of transactions is also a major advantage.

- Enhanced Security Features: While security concerns exist, many digital payment systems incorporate robust security measures, such as biometrics and encryption, to protect user data and prevent fraud. This improved security, while not perfect, is often seen as superior to carrying large amounts of cash.

- Government Initiatives: Government policies promoting cashless transactions and digital financial inclusion are driving adoption in many countries. Incentives and regulations often encourage the use of digital payment methods.

Challenges Hindering Wider Adoption of Digital Payment Systems

Despite the significant growth, several challenges impede the widespread adoption of digital payment systems. Addressing these obstacles is crucial for realizing the full potential of a cashless society.

- Digital Literacy: A lack of digital literacy, particularly among older populations and in less developed regions, hinders adoption. Education and training programs are essential to bridge this gap.

- Infrastructure Limitations: Reliable internet connectivity and robust technological infrastructure are crucial for seamless digital payments. Limited access to these resources, particularly in rural areas, poses a significant challenge.

- Security Breaches and Fraud: Concerns about data security and the potential for fraud remain a significant barrier. While security measures are improving, the risk of cyberattacks and scams continues to deter some users.

- Cost and Fees: Transaction fees associated with digital payments can be a deterrent, particularly for low-income individuals. Finding ways to make these systems more affordable is important for wider adoption.

Security and Fraud Prevention in Digital Payment Systems

Digital payment systems, while offering unparalleled convenience, are unfortunately vulnerable to various security threats. The seamless integration of technology into our financial lives necessitates robust security measures to protect both consumers and businesses from potential financial losses and data breaches. Understanding these threats and the preventative measures in place is crucial for fostering trust and ensuring the continued growth of this vital sector.

Common security threats targeting digital payment systems range from sophisticated attacks to more commonplace scams. These threats exploit vulnerabilities in both the systems themselves and user behavior. Effective security measures, however, are constantly evolving to counteract these risks, leveraging technological advancements and best practices to create a more secure digital financial landscape.

Common Security Threats

Several threats significantly impact the security of digital payment systems. These threats necessitate a multi-layered approach to security, combining technological solutions with user education and awareness.

- Phishing: This involves deceptive attempts to acquire sensitive information such as usernames, passwords, and credit card details by masquerading as a trustworthy entity in electronic communication. Phishing attacks often use convincing emails, text messages, or websites that mimic legitimate organizations to trick users into revealing their credentials.

- Malware: Malicious software, such as keyloggers and spyware, can be installed on a user’s device to steal financial information or control their online activities. This can include capturing keystrokes to obtain login details or monitoring online transactions to intercept sensitive data.

- Data Breaches: These incidents involve unauthorized access to sensitive data stored by payment processors or financial institutions. A data breach can expose a large amount of customer information, including payment details and personal identification information, leading to significant financial and reputational damage.

Security Measures to Mitigate Risks

A robust security strategy incorporates a variety of measures to protect against the aforementioned threats. These measures are designed to work in concert, creating multiple layers of defense against attacks.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring users to verify their identity using two different methods, such as a password and a one-time code sent to their mobile phone. This makes it significantly harder for attackers to gain unauthorized access even if they obtain a password.

- Encryption: This involves converting data into an unreadable format, protecting sensitive information during transmission and storage. Strong encryption algorithms ensure that even if data is intercepted, it remains inaccessible without the correct decryption key.

- Fraud Detection Systems: These systems use advanced algorithms and machine learning to analyze transaction data in real-time, identifying suspicious patterns and flagging potentially fraudulent activities. This allows for prompt intervention and prevention of fraudulent transactions.

Hypothetical Security Breach Scenario and Prevention

Imagine a scenario where a large online retailer suffers a data breach due to a vulnerability in their payment gateway. Attackers gain access to customer credit card information and personal details. This could lead to widespread identity theft and financial losses for affected customers, as well as significant reputational damage for the retailer.

To prevent such a breach, the retailer could have implemented several measures. Firstly, regular security audits and penetration testing could identify and address vulnerabilities before they are exploited. Secondly, employing strong encryption for all data at rest and in transit would make it much harder for attackers to decrypt the stolen information, even if they gained access. Thirdly, implementing robust fraud detection systems would allow for the immediate identification and blocking of suspicious transactions, limiting the damage caused by the breach. Finally, rigorous employee training on security best practices and awareness of phishing and social engineering tactics would help prevent insider threats and user error.

The Regulatory Landscape of Digital Payment Systems

The global landscape of digital payments is increasingly complex, shaped by a patchwork of national and international regulations. These frameworks aim to balance innovation with consumer protection, financial stability, and the prevention of illicit activities. The specific regulatory approaches vary significantly across jurisdictions, reflecting differing economic priorities and technological readiness.

The regulatory environment for digital payments is dynamic, constantly adapting to technological advancements and evolving risks. This necessitates a collaborative approach between governments, central banks, and private sector stakeholders to ensure a secure and efficient payment ecosystem.

National Regulatory Frameworks for Digital Payments

Different countries have adopted diverse approaches to regulating digital payment systems. Some countries have comprehensive laws specifically addressing digital payments, while others rely on existing financial regulations adapted to this new context. For example, the European Union’s Payment Services Directive (PSD2) provides a unified regulatory framework for payment services across member states, covering aspects like strong customer authentication and data sharing. In contrast, the United States utilizes a more fragmented approach, with regulations emanating from various agencies like the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Consumer Financial Protection Bureau (CFPB), leading to a more complex regulatory environment. Countries like Singapore and the UK have adopted a more proactive approach, establishing regulatory sandboxes to encourage innovation while managing risks associated with new payment technologies.

The Role of Central Banks and Regulatory Bodies

Central banks play a crucial role in overseeing digital payment systems, focusing primarily on maintaining financial stability and mitigating systemic risks. Their responsibilities often include setting licensing requirements for payment providers, ensuring compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, and promoting the interoperability of payment systems. Other regulatory bodies, such as consumer protection agencies and data privacy authorities, also have significant involvement, focusing on consumer rights, data security, and the ethical use of personal information in digital transactions. For instance, the Bank of England actively monitors the risks associated with the growing adoption of cryptocurrencies and other digital assets, while the Federal Reserve works to maintain the stability of the US payment system and promotes innovation in the space.

Regulatory Approaches towards Digital Currencies and Traditional Payment Systems

The regulatory treatment of digital currencies (cryptocurrencies and stablecoins) often differs significantly from that of traditional payment systems. Traditional payment systems, such as credit and debit cards and bank transfers, are generally subject to well-established regulatory frameworks designed to protect consumers and maintain financial stability. Digital currencies, however, present unique challenges due to their decentralized nature, volatility, and potential for use in illicit activities. Many jurisdictions are still developing comprehensive regulatory frameworks for digital currencies, grappling with issues such as consumer protection, AML/CTF compliance, and the potential impact on monetary policy. Some countries have adopted a cautious approach, imposing strict regulations or even outright bans, while others are experimenting with regulatory sandboxes to foster innovation while mitigating risks. This divergence in regulatory approaches reflects the ongoing debate about the appropriate level of oversight for this rapidly evolving asset class.

The Future of Digital Payment Systems

The rapid evolution of technology continues to reshape the landscape of digital payments. We’re moving beyond simply transferring funds; the future involves seamless, secure, and personalized experiences deeply integrated into our daily lives. This section explores potential advancements and their impact on how we transact.

Predicted Developments in Digital Payment Technology

The future of digital payments is characterized by several key technological advancements. These innovations will significantly alter user experience, security protocols, and the overall efficiency of the system.

| Development | Expected Impact |

|---|---|

| Advancements in Biometric Authentication (e.g., vein recognition, behavioral biometrics) | Increased security and reduced fraud; more convenient and user-friendly authentication processes, eliminating the need for passwords and PINs. This could lead to wider adoption, particularly amongst users hesitant due to security concerns. For example, the use of vein recognition in ATMs could significantly reduce card cloning and skimming. |

| Rise of Cryptocurrencies and Decentralized Finance (DeFi) | Increased financial inclusion, particularly in underserved regions; potential for lower transaction fees and faster processing times; however, regulatory challenges and volatility remain significant hurdles. The increasing adoption of stablecoins, pegged to fiat currencies, could mitigate some of the volatility concerns. |

| Integration with the Internet of Things (IoT) | Enabling automated payments for everyday purchases and services; increased convenience and efficiency in areas like smart homes and connected vehicles. Imagine paying for groceries automatically as they’re delivered via a smart refrigerator’s integration with your digital wallet. |

| Increased Use of Artificial Intelligence (AI) and Machine Learning (ML) in Fraud Detection | More sophisticated and proactive fraud prevention; real-time identification and blocking of suspicious transactions; personalized security measures based on individual user behavior. AI-powered systems can analyze vast datasets to identify patterns indicative of fraudulent activity far more efficiently than human analysts. |

| Further Development of Open Banking and APIs | Enhanced interoperability between different payment systems and financial institutions; greater flexibility and choice for consumers; potential for innovative new financial products and services. Open banking allows third-party providers to access customer financial data with consent, leading to personalized financial management tools and tailored payment options. |

Impact of Emerging Technologies on Digital Payment Systems

Artificial intelligence and machine learning are poised to revolutionize digital payment systems. Their application extends beyond fraud detection; AI can personalize payment experiences, optimize transaction routing for speed and cost-effectiveness, and even predict future spending patterns to provide users with valuable financial insights. Machine learning algorithms, for instance, can analyze vast amounts of transaction data to identify anomalies and predict potential points of failure, allowing for proactive system maintenance and enhanced resilience. This proactive approach significantly reduces downtime and enhances the overall reliability of the payment system.

Impact on Businesses and Consumers

The shift towards digital payment systems has profoundly altered the financial landscape, impacting both businesses and consumers in numerous ways. This section will explore the advantages and disadvantages of this transformation for both parties, highlighting the key changes brought about by the widespread adoption of digital payment methods.

Digital payment systems have reshaped how transactions occur, offering a range of benefits and drawbacks that need careful consideration. The overall impact depends on various factors, including the specific industry, business size, and consumer demographics. Understanding these impacts is crucial for navigating the evolving financial ecosystem.

Benefits for Businesses

The adoption of digital payment systems offers numerous advantages for businesses, leading to increased efficiency, reduced costs, and improved customer satisfaction. These benefits contribute significantly to a business’s overall profitability and competitiveness in the marketplace.

- Reduced Transaction Costs: Digital payments often eliminate or significantly reduce the costs associated with processing traditional payments, such as credit card fees, check processing, and cash handling. For example, a small online retailer can save substantially on processing fees compared to a business relying solely on physical credit card payments.

- Improved Efficiency: Automating payment processes streamlines operations, freeing up staff time for other tasks. Real-time transaction tracking and reconciliation also improve accuracy and reduce administrative overhead. A restaurant using a point-of-sale system with integrated digital payment processing can significantly reduce wait times and errors compared to manual cash handling.

- Enhanced Customer Experience: Offering multiple digital payment options, such as mobile wallets, online banking transfers, and various card types, enhances customer convenience and satisfaction. Faster checkout processes and personalized payment options contribute to a positive customer journey. Imagine a customer ordering online and seamlessly completing the purchase through their preferred mobile wallet – this smooth experience fosters loyalty.

- Increased Sales and Reach: Digital payments enable businesses to reach a wider customer base, both geographically and demographically. Online businesses, in particular, rely heavily on digital payments to conduct transactions with customers worldwide.

- Improved Data Collection and Analysis: Digital payment systems provide valuable data on customer purchasing habits, preferences, and spending patterns. This data can be used to improve marketing strategies, personalize offers, and optimize inventory management. Analyzing transaction data can reveal peak sales periods and popular products, enabling businesses to adjust their strategies accordingly.

Benefits for Consumers

Consumers also experience numerous benefits from the widespread adoption of digital payment systems, ranging from enhanced convenience to increased security and a broader choice of payment methods.

- Convenience: Digital payments offer unparalleled convenience, allowing consumers to make purchases anytime, anywhere, without the need for physical cash or checks. Online shopping, bill payments, and peer-to-peer transfers are all facilitated by digital payment systems.

- Increased Security: Many digital payment systems incorporate robust security features, such as encryption and fraud detection mechanisms, to protect consumer data and prevent unauthorized transactions. Tokenization and biometric authentication enhance the security of online payments, reducing the risk of credit card theft or identity fraud.

- Wider Range of Payment Options: Consumers have access to a wider variety of payment options, including mobile wallets, online banking transfers, buy now, pay later services, and various types of credit and debit cards. This flexibility allows consumers to choose the payment method that best suits their needs and preferences.

- Improved Tracking and Budgeting: Digital payment systems often provide detailed transaction history, making it easier for consumers to track their spending and manage their budgets effectively. Many banking apps offer features that categorize transactions and provide insights into spending patterns.

- Rewards and Loyalty Programs: Many digital payment platforms offer rewards programs and cashback incentives, providing consumers with additional benefits for using these services. These programs can incentivize consumers to use specific payment methods and encourage loyalty to particular brands or platforms.

Disadvantages for Businesses and Consumers

While digital payment systems offer significant advantages, it’s crucial to acknowledge potential drawbacks for both businesses and consumers.

- Security Risks and Fraud: Despite enhanced security measures, digital payment systems remain vulnerable to cyberattacks and fraud. Businesses and consumers need to be vigilant and take precautions to protect their data and financial information. Phishing scams, malware, and data breaches remain significant threats.

- Transaction Fees: While digital payments can reduce certain transaction costs, some platforms charge fees for processing payments, particularly for businesses. These fees can eat into profits, especially for small businesses with limited resources.

- Technical Issues and System Outages: Reliance on technology introduces the risk of technical glitches, system outages, and connectivity problems, which can disrupt business operations and frustrate consumers. A system failure can lead to significant delays and lost revenue for businesses.

- Lack of Financial Literacy: Not all consumers are equally comfortable or familiar with digital payment systems. This digital divide can exclude certain demographics from accessing these services and participating in the digital economy. Older generations or those in underserved communities might face challenges adapting to new technologies.

- Data Privacy Concerns: The collection and use of consumer data by digital payment platforms raise privacy concerns. Consumers need to be aware of how their data is being used and ensure that their privacy is protected. Data breaches can expose sensitive personal and financial information, leading to identity theft and financial loss.

Case Studies of Successful Digital Payment Systems

This section examines three prominent examples of successful digital payment systems, analyzing their key features, adoption strategies, and the challenges they overcame to achieve widespread use. Understanding these case studies provides valuable insights into the factors contributing to the success of digital payment systems and the broader evolution of the financial technology landscape.

PayPal

PayPal, founded in 1998, revolutionized online payments by providing a secure and convenient platform for transferring money between individuals and businesses. Its key features include buyer and seller protection, a wide range of supported currencies, and integration with major e-commerce platforms. PayPal’s adoption strategy focused on establishing strong partnerships with online marketplaces like eBay, creating a network effect that drove rapid user growth. Early challenges included concerns about security and fraud, which PayPal addressed through robust security measures and proactive fraud prevention initiatives. The system’s impact is undeniable; it significantly facilitated the growth of e-commerce globally and established a new standard for online transactions. Its relevance to the overall discussion lies in its demonstration of how a well-designed system with strong partnerships can overcome initial hurdles and achieve market dominance.

Alipay

Alipay, launched in 1999 as a payment system for Alibaba’s e-commerce platform Taobao, quickly became a dominant force in China’s digital payments market. Key features include QR code payments, peer-to-peer transfers, and extensive integration with various services, including ride-hailing apps and utility bill payments. Alipay’s adoption strategy leveraged China’s burgeoning mobile phone market and the widespread use of smartphones. The company also focused on building trust through user-friendly interfaces and robust customer support. Challenges included navigating a complex regulatory environment and ensuring security in a rapidly growing market. Alipay’s impact is evident in its transformation of China’s financial landscape, enabling cashless transactions on a massive scale. Its relevance stems from its successful adaptation to a unique market context and its demonstration of the potential for digital payments to drive financial inclusion.

Apple Pay

Apple Pay, introduced in 2014, represents a successful example of a mobile payment system integrated into a popular mobile device ecosystem. Key features include contactless payments using Near Field Communication (NFC) technology, tokenization for enhanced security, and seamless integration with Apple devices. Apple Pay’s adoption strategy focused on leveraging the existing Apple user base and its strong brand recognition. The company emphasized ease of use and security as key selling points. Challenges included overcoming consumer concerns about security and privacy, and gaining acceptance from merchants who needed to upgrade their point-of-sale systems. Apple Pay’s impact is seen in its contribution to the growth of contactless payments and its influence on the design and adoption of mobile payment systems. Its relevance highlights the power of integrating digital payments into a pre-existing, widely adopted ecosystem.

Concluding Remarks

In conclusion, the global shift towards digital payment systems is undeniable, driven by technological advancements, evolving consumer preferences, and increasing regulatory oversight. While security concerns and infrastructure limitations remain challenges, ongoing innovations in areas like biometric authentication and artificial intelligence promise to further enhance both security and user experience. The future of digital payments is poised for continued growth and evolution, shaping the financial landscape in profound ways for years to come. Understanding the intricacies of this system is vital for navigating the complexities of the modern financial world.

Common Queries

What are the risks associated with using digital wallets?

Risks include unauthorized access due to lost or stolen devices, phishing scams, and vulnerabilities in the wallet’s security protocols. Choosing reputable providers and employing strong passwords and two-factor authentication minimizes these risks.

How do digital payment systems protect user data?

Data protection varies across systems, but common measures include encryption, tokenization (replacing sensitive data with unique identifiers), and robust security protocols to prevent unauthorized access and data breaches.

Are digital payments more secure than traditional methods?

Security depends on the specific system and user practices. While digital payments offer features like encryption and fraud detection, they can also be vulnerable to hacking and phishing. Proper security practices are crucial regardless of payment method.

What is the role of central banks in regulating digital payments?

Central banks play a critical role in overseeing the stability and security of digital payment systems, setting regulatory frameworks, and ensuring consumer protection. They often work to mitigate risks associated with fraud and financial crime.