Digital Payment Systems Comparison: Prepare yourselves, dear readers, for a whirlwind tour of the fascinating, and occasionally bewildering, world of digital payments! From the sleek simplicity of mobile wallets to the slightly more dramatic tension of online banking transfers, we’ll dissect the intricacies of how we move our money in the digital age. Get ready for a journey filled with surprising fees, surprisingly robust security measures (sometimes), and the occasional existential dread about whether that online purchase will actually go through.

This comprehensive comparison will explore the various types of digital payment systems, delving into their functionalities, security protocols, transaction speeds, associated costs, and the ever-evolving regulatory landscape. We’ll also examine the factors driving user adoption, and peer into the crystal ball (metaphorically speaking, of course) to predict future trends. Buckle up, it’s going to be a wild ride!

Types of Digital Payment Systems

The world of digital payments is a vibrant, ever-evolving ecosystem, a bustling marketplace where money dances a digital jig. Choosing the right payment system can be as tricky as choosing the perfect avocado – too ripe, and it’s mush; too hard, and it’s a chore. Let’s dissect the main players in this financial fiesta.

Mobile Wallets

Mobile wallets, those digital satchels residing on your smartphone, offer a streamlined approach to transactions. Imagine your physical wallet, but without the bulk, the risk of losing it, and the annoying jangling of change. These apps act as a central hub for various payment methods, consolidating credit cards, debit cards, and even loyalty programs into one convenient location. Functionality typically involves linking existing financial accounts, allowing users to make contactless payments at physical stores via near-field communication (NFC) technology, or sending money to other users. The user experience is generally smooth and intuitive, although the initial setup might involve a bit of a learning curve depending on the specific app. Popular examples include Apple Pay, Google Pay, and Samsung Pay, each boasting a slightly different ecosystem and feature set.

Online Banking Transfers

Online banking transfers are the trusty workhorses of the digital payment world – reliable, if sometimes a little less flashy. These systems leverage your existing bank account to send and receive funds directly, offering a secure and generally fee-free (or very low-fee) method of transferring money. The functionality revolves around accessing your bank account through a web browser or dedicated app, initiating a transfer by inputting the recipient’s account details, and confirming the transaction. The user experience can vary significantly depending on the bank’s platform; some are sleek and intuitive, while others… well, let’s just say they could use a bit of a makeover. Major banks worldwide offer online banking transfer services, and their ubiquity makes them a widely accessible option.

Peer-to-Peer (P2P) Payment Apps

Peer-to-peer payment apps are the social butterflies of the digital payment scene – quick, easy, and perfect for splitting bills with friends or sending money to family. These apps typically require linking a bank account or credit/debit card, allowing users to send and request money from other users within the same app. Functionality includes features like request splitting, payment tracking, and often integration with social media for easy contact management. The user experience is usually designed for simplicity and speed, making them ideal for quick transactions. Popular examples include Venmo, PayPal, and Zelle, each with its own unique social features and user interface.

Comparison of Prominent Digital Payment Systems

A comparison table highlighting key features of three prominent examples from each category can provide a clearer picture of their strengths and weaknesses.

| Feature | Apple Pay (Mobile Wallet) | Bank of America Online Banking (Online Banking Transfer) | Venmo (P2P Payment App) |

|---|---|---|---|

| Transaction Fees | Generally none for most transactions | Generally none for transfers between accounts within the same bank; fees may apply for wire transfers or international transactions | Generally none for person-to-person transfers; fees may apply for certain business transactions |

| Security Measures | Tokenization, biometric authentication, encryption | Multi-factor authentication, fraud monitoring, encryption | Two-factor authentication, fraud monitoring, encryption |

| User Base | Millions of users globally | Tens of millions of users in the US (dependent on the specific bank) | Tens of millions of users globally |

| Geographical Availability | Widely available in many countries | Primarily available in the US (dependent on the specific bank) | Widely available in many countries |

Security and Fraud Prevention

The world of digital payments, while incredibly convenient, is a thrilling rollercoaster of technological innovation and, let’s be honest, the occasional near-miss with financial disaster. Security and fraud prevention are not mere afterthoughts; they’re the sturdy safety bars keeping us from plummeting into a digital abyss of stolen funds. This section delves into the fascinating – and sometimes terrifying – ways digital payment systems protect (and sometimes fail to protect) our hard-earned cash.

Common Security Threats

Digital payment systems, despite their robust security measures, are vulnerable to various threats. Credit card fraud, for instance, remains a persistent problem, involving the unauthorized use of stolen card details for online purchases or ATM withdrawals. Phishing attacks, cleverly disguised emails or websites designed to steal login credentials, are another significant threat across all digital payment platforms. Furthermore, malware infections can compromise a user’s device, enabling malicious actors to intercept payment information. Finally, man-in-the-middle attacks, where hackers intercept communications between the user and the payment processor, are a constant worry. The sophistication of these attacks continues to evolve, demanding constant vigilance and adaptation from both payment providers and users.

Fraud Prevention Mechanisms

Different payment providers employ a range of fraud prevention mechanisms, each with its strengths and weaknesses. Two-factor authentication (2FA), requiring a second verification step beyond a password, is a common and effective measure. Biometric authentication, using fingerprints or facial recognition, adds another layer of security. Real-time transaction monitoring systems analyze payment patterns to identify suspicious activity, flagging potentially fraudulent transactions for review. Machine learning algorithms are increasingly used to detect anomalies and predict fraudulent behavior. However, no system is foolproof; the cat-and-mouse game between fraudsters and security professionals is an ongoing battle.

The Role of Encryption and Authentication

Encryption and authentication are the twin pillars of secure digital transactions. Encryption scrambles sensitive data, making it unreadable to unauthorized individuals. Think of it as wrapping your financial secrets in an impenetrable digital vault. Authentication verifies the identity of the user and the legitimacy of the transaction. This ensures that only the intended recipient receives the funds. Strong encryption algorithms, coupled with robust authentication protocols, are crucial for preventing unauthorized access and ensuring the integrity of digital payments. The combination of these two is what makes secure online transactions possible.

Hypothetical Fraud Scenario and Prevention

Imagine Sarah, a diligent online shopper, receives a seemingly legitimate email from her bank, urging her to update her account details. Clicking the link, she unwittingly lands on a cleverly designed phishing website. She enters her login credentials and credit card information, which are immediately stolen. However, Sarah’s bank employs robust security protocols, including 2FA and real-time transaction monitoring. The bank detects unusual activity on Sarah’s account – a large purchase from an unfamiliar vendor shortly after the login attempt – and immediately flags it as suspicious. An alert is sent to Sarah, who promptly contacts her bank to report the fraudulent activity. The transaction is blocked, and her account is secured. This scenario illustrates the importance of multi-layered security measures in preventing and mitigating fraud.

Transaction Processing and Speed

The speed at which your digital payment whizzes through the system isn’t just a matter of convenience; it’s a critical factor influencing user satisfaction and merchant adoption. A slow transaction is like watching paint dry, only with less artistic merit. Let’s delve into the fascinating world of transaction processing speeds, where milliseconds matter and patience wears thin.

Transaction processing speed varies wildly depending on the payment system, much like the speed of a snail compared to a cheetah (though hopefully, no payment systems are quite as slow as a snail!). Several factors contribute to this variation, creating a complex interplay of technology and infrastructure. These factors include the robustness of the network infrastructure, the payment processing methods employed (e.g., real-time versus batch processing), and the security protocols in place (security is paramount, but it can sometimes add a few precious milliseconds).

Factors Influencing Transaction Speed

Network infrastructure plays a crucial role. A robust and well-maintained network, with ample bandwidth and low latency, is essential for swift transactions. Think of it like a highway system – a well-designed, multi-lane highway allows for smooth, fast traffic flow, whereas a single-lane, pot-holed road leads to frustrating delays. Payment processing methods also significantly impact speed. Real-time processing, where transactions are confirmed instantly, offers a much faster experience than batch processing, where transactions are grouped and processed periodically. Imagine the difference between getting your coffee immediately versus waiting for a whole pot to brew! Finally, security measures, while vital, can sometimes introduce minor delays as various checks and verifications are performed. It’s a trade-off between security and speed, a balancing act that every payment system must navigate.

Transaction Speed Comparison

The following list ranks hypothetical digital payment systems by processing speed, considering a mix of factors. Note that real-world speeds can fluctuate due to network conditions and other variables. These rankings are for illustrative purposes and should not be taken as definitive benchmarks.

- System A (Hypothetical): Near-instantaneous processing (under 1 second). Utilizes a highly optimized network infrastructure and employs cutting-edge real-time processing technology. Think of it as the Formula 1 of payment systems.

- System B (Hypothetical): Typically processes within 2-5 seconds. Employs a robust network but may utilize some batch processing for certain transactions. A reliable mid-range performer.

- System C (Hypothetical): Average processing time of 10-15 seconds. This system might have older infrastructure or rely more heavily on batch processing. Think of it as a dependable, if somewhat slower, family sedan.

- System D (Hypothetical): Processing times can range from 30 seconds to several minutes, depending on various factors. This system might experience frequent congestion or have less efficient processing methods. It’s the reliable old pickup truck – gets the job done, but it takes a while.

Impact of Transaction Speed on User Experience and Merchant Acceptance

Faster transaction speeds lead to improved user experience, resulting in increased customer satisfaction and loyalty. Nobody likes waiting, especially when paying for something. Conversely, slow transactions can lead to abandoned carts, frustrated customers, and negative reviews. For merchants, faster processing times translate to increased efficiency, reduced operational costs, and improved customer flow. A fast checkout process encourages repeat business and a positive brand image. Conversely, slow transactions can lead to longer queues, lost sales, and damage to the merchant’s reputation. The impact on both users and merchants is substantial, highlighting the importance of prioritizing speed within the bounds of security.

Cost and Fees

Navigating the world of digital payment systems can feel like traversing a minefield of hidden fees. While the convenience is undeniable, understanding the cost structure is crucial, lest you find yourself paying more than you bargained for. This section dissects the often-cryptic pricing models of various digital payment systems, revealing the often-surprising variations in charges.

The cost of using a digital payment system varies wildly depending on several factors. Transaction fees, a common charge, are typically a percentage of the transaction amount, but this percentage can fluctuate based on the payment method (credit card vs. debit card, for example) and the specific service provider. Monthly fees, often levied on businesses with high transaction volumes, add another layer of complexity. Furthermore, some providers charge additional fees for things like international transactions, chargebacks, or even customer support. This intricate web of charges can make comparing systems challenging, but with careful analysis, you can identify the most cost-effective solution for your needs.

Transaction Fee Structures

Transaction fees represent the lion’s share of costs for many digital payment systems. These fees are usually expressed as a percentage of the transaction value, plus a fixed per-transaction fee. For instance, one system might charge 2.9% + $0.30 per transaction, while another might offer a tiered pricing structure with lower percentages for higher transaction volumes. These fees can vary significantly between credit and debit cards, with credit cards often incurring higher processing fees due to the associated risks and higher interchange rates. International transactions generally attract even higher fees, reflecting the increased complexity and currency conversion costs.

Monthly and Annual Fees

Beyond per-transaction charges, many providers impose monthly or annual fees, particularly for businesses. These fees often cover the cost of account maintenance, access to various features, and customer support. The monthly fee might be waived if the business reaches a certain transaction volume threshold, creating a tiered system that incentivizes higher usage. Businesses should carefully evaluate their expected transaction volume to determine whether the potential savings from a lower per-transaction fee outweigh the cost of a monthly subscription.

Comparative Analysis of Cost-Effectiveness

Determining the most cost-effective system requires a nuanced approach. A system with lower per-transaction fees might prove more expensive if you have a high transaction volume and incur significant monthly fees. Conversely, a system with higher per-transaction fees might be cheaper if your transaction volume is low. Consumers should focus on the per-transaction fees and any additional charges, while merchants must consider both per-transaction and monthly fees, alongside features like fraud protection and customer support. A thorough cost-benefit analysis is essential before selecting a system.

Fee Structure Comparison Table

The following table provides a simplified comparison of the fee structures of three hypothetical digital payment systems (Note: These are illustrative examples and do not represent actual pricing from specific providers):

| Payment System | Transaction Fee (per transaction) | Monthly Fee | International Transaction Fee |

|---|---|---|---|

| PayEasy | 2.5% + $0.20 | $25 | 3.5% + $0.50 |

| QuickPay | 2.9% + $0.30 | $0 (for volumes over $10,000/month) | 4.0% + $0.75 |

| InstaCash | 3.2% + $0.40 | $0 | 4.5% + $1.00 |

User Adoption and Acceptance: Digital Payment Systems Comparison

The rise of digital payment systems has been nothing short of a revolution, transforming how we handle money from a slightly sticky wad of bills to a swift tap on our phones. But this wasn’t a spontaneous combustion; it’s a fascinating story of technological advancement, savvy marketing, and the gradual (sometimes reluctant) embrace of a new normal by users worldwide. Understanding the factors driving adoption is key to predicting future trends and optimizing the systems themselves.

Factors influencing the adoption of digital payment systems are complex and interwoven, varying wildly across demographics and geographical regions. While convenience is a universal driver, cultural norms, technological infrastructure, and levels of trust play equally significant roles. For instance, in regions with robust mobile networks and a younger, tech-savvy population, the transition has been remarkably swift. Conversely, areas with limited internet access or a preference for cash transactions present greater challenges. The level of financial literacy also plays a crucial role; understanding the security measures and benefits of digital payments is essential for widespread adoption.

Demographic and Geographic Variations in Adoption Rates

The global landscape of digital payments is a patchwork quilt of different preferences and adoption rates. In regions like East Asia, mobile payment systems like Alipay and WeChat Pay boast massive market shares, often exceeding those of traditional credit cards. This is driven by high smartphone penetration, government support, and the integration of these systems into everyday life, from paying for groceries to hailing taxis. In contrast, some parts of Africa are witnessing a rapid growth in mobile money services, often bypassing the need for traditional banking infrastructure, providing financial inclusion for previously underserved populations. North America and Europe show a more mixed picture, with a blend of credit/debit card usage, mobile wallets, and newer players vying for market share. These variations highlight the importance of tailoring marketing strategies to specific regional and demographic contexts.

Market Share Comparison Across Countries

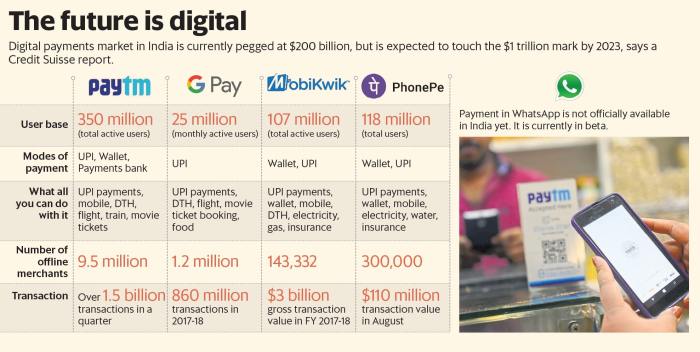

A direct comparison of market shares requires extensive data analysis across various payment methods and countries. However, we can observe some broad trends. China, for example, demonstrates the dominance of mobile payment systems, with Alipay and WeChat Pay holding significant shares. In the United States, credit and debit cards remain dominant, though mobile payment usage is steadily increasing. India presents a unique case, with the rapid growth of Unified Payments Interface (UPI) driving a surge in digital transactions. These examples show the diverse nature of the market, making it impossible to present a single, universally applicable market share figure. The competition is fierce, and the landscape is constantly shifting.

Challenges and Opportunities in Increasing User Adoption

Increasing user adoption presents both significant opportunities and hurdles. Addressing concerns about data security and privacy is paramount. Building trust through robust security measures and transparent data handling practices is crucial. Furthermore, bridging the digital divide by improving internet access and digital literacy in underserved communities is essential for achieving inclusive growth. Opportunities lie in developing innovative payment solutions tailored to specific needs, such as micro-transactions or payments for underserved populations. Expanding partnerships with businesses and integrating digital payment systems into everyday services can further boost adoption. For example, integrating digital payments into public transportation systems or government services can significantly increase usage.

Successful Marketing Campaigns for Digital Payment Systems

Successful marketing campaigns often focus on simplicity, convenience, and security. Many campaigns utilize catchy slogans, user-friendly interfaces, and attractive rewards programs to incentivize adoption. For example, early adopters of mobile payment systems were often offered cashback rewards or discounts on purchases. Some campaigns highlight the speed and convenience of digital payments, emphasizing the time saved compared to traditional methods. Others focus on security features, reassuring users about the safety of their transactions. Ultimately, effective campaigns resonate with the target audience by addressing their specific needs and concerns, demonstrating the value proposition of the digital payment system in a clear and compelling way.

Regulatory Landscape and Compliance

Navigating the world of digital payments isn’t just about speed and convenience; it’s also a thrilling rollercoaster ride through a complex regulatory landscape. Think of it as a global game of regulatory whack-a-mole, where each country has its own set of rules, and the mole (that’s your digital payment system) needs to dodge them all. This section delves into the fascinating (and sometimes frustrating) world of regulations governing digital payment systems.

The regulatory frameworks governing digital payment systems vary wildly across the globe, creating a patchwork quilt of compliance requirements. In some countries, the rules are as clear as a bell, while in others, they’re as murky as a swamp. This disparity leads to significant challenges for digital payment providers aiming for international expansion – it’s like trying to assemble IKEA furniture with instructions written in a dozen different languages, all slightly out of date. This creates an uneven playing field, impacting innovation and competition.

Regulatory Differences Across Jurisdictions

Different countries adopt diverse approaches to regulating digital payments. For instance, the European Union boasts the Payment Services Directive (PSD2), a comprehensive framework aiming to increase competition and consumer protection. Meanwhile, the United States employs a more fragmented approach, with regulations overseen by various agencies like the Federal Reserve, the Consumer Financial Protection Bureau (CFPB), and state-level authorities. This fragmented approach, while offering some flexibility, can also lead to inconsistencies and complexities for businesses operating across state lines. Imagine trying to comply with 50 different sets of rules – it’s enough to make anyone’s head spin! Contrast this with a more unified approach like that of the EU, where the goal is to create a single market for payment services.

Key Regulatory Challenges for Digital Payment Providers

Digital payment providers face a multitude of regulatory hurdles, including keeping up with constantly evolving legislation, navigating differing data privacy rules (GDPR in Europe, CCPA in California, etc.), and ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. These regulations, while crucial for protecting consumers and preventing financial crime, can be costly and time-consuming to implement. The cost of compliance can be particularly burdensome for smaller fintech startups, potentially hindering innovation and competition. It’s like trying to run a marathon while carrying a heavy backpack filled with legal documents.

Impact of Regulations on Innovation and Competition

Regulations can act as both a catalyst and a constraint on innovation. While stringent rules can stifle creativity by imposing significant compliance burdens, they also provide a level playing field, protecting consumers and fostering trust. Overly burdensome regulations can disproportionately impact smaller companies, potentially stifling competition and leading to market consolidation. On the other hand, well-designed regulations can encourage innovation by providing a stable and predictable environment for businesses to operate. Finding the right balance is crucial, akin to finding the perfect seasoning for a dish – too much, and it’s overpowering; too little, and it’s bland.

Data Privacy and Security Compliance Requirements

Data privacy and security are paramount in the digital payments industry. Regulations like GDPR and CCPA impose strict requirements on how personal data is collected, processed, and protected. Non-compliance can result in hefty fines and reputational damage. Digital payment providers must invest heavily in robust security measures, including encryption, multi-factor authentication, and regular security audits. Think of it as building a digital fortress to protect sensitive customer information – a fortress that needs constant maintenance and upgrades to withstand the ever-evolving threats of cybercrime. This necessitates significant investment in cybersecurity infrastructure and personnel, adding to the overall cost of operating a digital payment system.

Future Trends in Digital Payments

The world of digital payments is a whirlwind of innovation, constantly evolving at a pace that would make a caffeinated hummingbird jealous. Forget rotary phones – we’re talking about a future where your thoughts might directly authorize transactions (though hopefully with a bit more security than that sounds). Let’s delve into the exciting, slightly terrifying, and undeniably fascinating trends shaping the future of how we pay.

Emerging technologies are not just tweaking the edges of digital payments; they’re fundamentally reshaping the entire system. We’re witnessing a convergence of forces that promises both incredible efficiency and unprecedented challenges.

Emerging Technologies and Their Impact, Digital Payment Systems Comparison

The integration of blockchain technology, artificial intelligence, and biometrics is poised to revolutionize the digital payments landscape. Blockchain’s decentralized nature promises enhanced security and transparency, reducing reliance on centralized intermediaries. AI, meanwhile, is enhancing fraud detection and personalization, leading to smoother, more tailored user experiences. Biometric authentication, from fingerprint scans to facial recognition, offers a more secure and convenient alternative to passwords, though privacy concerns remain a significant hurdle. Imagine a future where your payment is authorized simply by the unique rhythm of your heartbeat – a future both exciting and slightly unsettling.

Predictions for the Future Evolution of Digital Payment Systems

Predicting the future is, of course, a risky business (especially in tech!), but based on current trends and emerging technologies, we can make some educated guesses.

The following predictions are based on observed technological advancements, market trends, and expert analyses from reputable sources in the fintech industry. These predictions aren’t crystal balls, but rather informed extrapolations of current trajectories.

- Rise of Decentralized Finance (DeFi) Payments: DeFi platforms, leveraging blockchain technology, are expected to become increasingly prominent, offering faster, cheaper, and more transparent cross-border transactions. Examples like stablecoins pegged to fiat currencies already demonstrate the potential for increased efficiency and reduced reliance on traditional banking systems. Imagine sending money internationally without the hefty fees and delays currently associated with traditional banking channels.

- Increased Adoption of Biometric Authentication: The convenience and security of biometric authentication are likely to drive widespread adoption. We can expect to see more seamless integration of fingerprint, facial, and even voice recognition into payment systems, potentially eliminating the need for passwords altogether. However, concerns regarding data privacy and potential misuse will need to be addressed proactively. Think of the Apple Pay or Google Pay systems, but even more sophisticated and less reliant on physical devices.

- AI-Powered Fraud Prevention: Artificial intelligence will play a crucial role in enhancing security. AI algorithms can analyze vast amounts of data in real-time to identify and prevent fraudulent transactions with far greater accuracy than traditional methods. This will lead to a significant reduction in financial losses and improved trust in digital payment systems. Consider the sophisticated fraud detection systems already used by major credit card companies, but imagine these systems enhanced by the power of machine learning to anticipate and prevent fraud before it even happens.

- Hyper-Personalization of Payment Experiences: AI will also enable hyper-personalization of payment experiences. Payment systems will adapt to individual user preferences, offering tailored recommendations and services. This could include customized rewards programs, personalized spending insights, and proactive fraud alerts based on individual spending patterns. Think of Netflix recommending shows based on your viewing history; similar personalization will be applied to financial management and payment options.

End of Discussion

So, there you have it – a comprehensive, if slightly irreverent, look at the digital payment systems shaping our financial lives. While the technology might seem complex, the core principle remains surprisingly simple: moving money electronically. However, the nuances of security, speed, and cost vary wildly, making the choice of your preferred payment method a surprisingly strategic decision. We hope this comparison has shed light on the options available, empowering you to navigate the digital financial landscape with confidence (and maybe a slightly less anxious heart the next time you hit “buy”).

Question Bank

What is the biggest risk associated with using digital payment systems?

The biggest risk is often fraud, encompassing phishing scams, data breaches, and unauthorized transactions. However, robust security measures implemented by reputable providers significantly mitigate these risks.

Are all digital payment systems equally secure?

No, security measures vary widely depending on the provider and the specific system. Some offer stronger encryption and authentication than others. It’s crucial to choose reputable providers with proven security protocols.

How do I choose the right digital payment system for me?

Consider your needs and priorities: transaction fees, security requirements, convenience, and the availability of the system in your region. There’s no one-size-fits-all answer, and careful research is key.

What are the future implications of blockchain technology on digital payments?

Blockchain has the potential to revolutionize digital payments by enhancing security, transparency, and efficiency through decentralized transaction processing and reduced reliance on intermediaries. However, scalability and regulatory hurdles remain challenges.