Economic forecasting, the art and science of predicting future economic trends, plays a crucial role in shaping governmental policies, business strategies, and individual financial decisions. From predicting short-term market fluctuations to projecting long-term growth trajectories, accurate forecasting is paramount for navigating the complexities of the global economy. This guide delves into the diverse methodologies employed in economic forecasting, exploring both qualitative and quantitative approaches, and examining their strengths and limitations.

We will explore various techniques, from analyzing historical data through time series models and econometric analyses to leveraging qualitative insights gleaned from expert opinions and surveys. The discussion will also cover the critical aspects of evaluating forecast accuracy, understanding inherent uncertainties, and adapting to the evolving landscape of economic data and technological advancements. Ultimately, this exploration aims to provide a clear understanding of the tools and techniques necessary for effective economic forecasting.

Introduction to Economic Forecasting

Economic forecasting involves predicting future economic conditions using various analytical techniques and historical data. Its significance lies in enabling businesses, governments, and individuals to make informed decisions, mitigate risks, and capitalize on opportunities. Accurate forecasts can contribute to more effective policymaking, improved investment strategies, and better resource allocation.

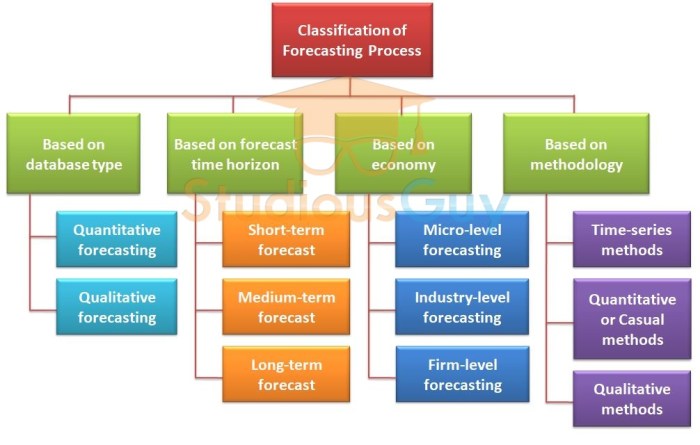

Economic forecasts are categorized by their time horizon, primarily into short-term, medium-term, and long-term forecasts. Short-term forecasts typically cover periods of up to a year, focusing on immediate economic trends. Medium-term forecasts extend from one to five years, providing a broader perspective on economic cycles. Long-term forecasts, often spanning decades, analyze fundamental shifts in economic structures and demographics. The specific time horizon chosen depends on the intended application and the nature of the economic variables being analyzed. For example, a business might use a short-term forecast to manage inventory levels, while a government might utilize a long-term forecast to plan infrastructure projects.

Users of Economic Forecasts

Economic forecasts serve a wide range of users with diverse needs. Governments use forecasts to formulate fiscal and monetary policies, manage budgets, and plan public investments. For instance, a government might use a forecast of inflation to adjust interest rates or predict unemployment rates to implement job creation programs. Businesses rely on economic forecasts to make strategic decisions regarding production, investment, hiring, and pricing. A company might use a forecast of consumer spending to adjust its marketing strategy or predict changes in demand for its products. Individuals can use forecasts to make informed decisions about savings, investments, and major purchases. For example, an individual might use forecasts of interest rates to determine whether to invest in bonds or real estate.

Comparison of Forecasting Horizons

The accuracy and reliability of economic forecasts vary significantly depending on the forecasting horizon. Longer-term forecasts are generally more uncertain due to the increasing number of unpredictable factors that can influence the economy over time.

| Forecasting Horizon | Strengths | Weaknesses | Example Application |

|---|---|---|---|

| Short-Term (up to 1 year) | High accuracy potential; useful for immediate decision-making; relatively less influenced by structural changes. | Limited predictive power for long-term trends; susceptible to short-term shocks; less useful for long-term strategic planning. | Inventory management, short-term investment strategies. |

| Medium-Term (1-5 years) | Balances short-term accuracy with long-term vision; useful for medium-term planning; considers cyclical economic patterns. | Moderate accuracy; more susceptible to unforeseen events; less precise than short-term forecasts. | Capital investment decisions, workforce planning, medium-term budget allocation. |

| Long-Term (5+ years) | Provides strategic direction; considers long-term structural changes; useful for long-term investment and policy planning. | Low accuracy; highly susceptible to unpredictable events; relies heavily on assumptions about technological and demographic changes. | Long-term infrastructure planning, demographic policy decisions, retirement planning. |

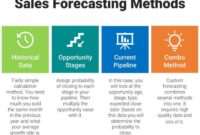

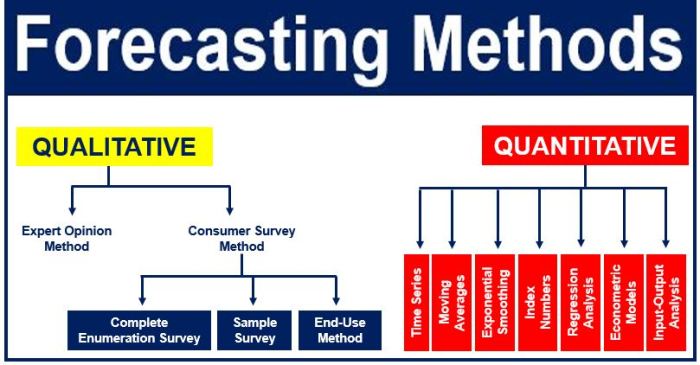

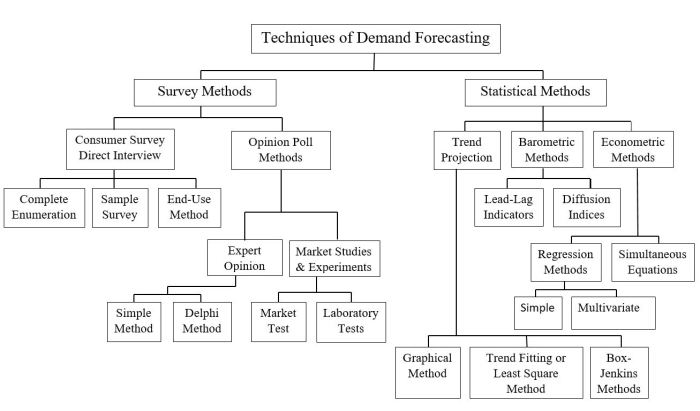

Qualitative Forecasting Methods

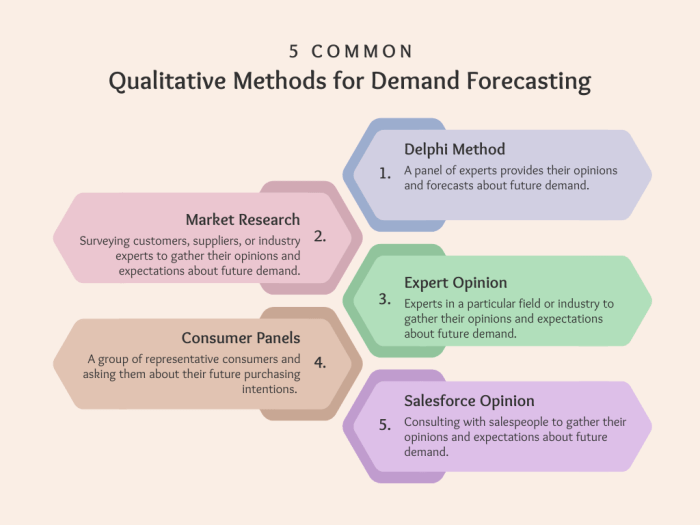

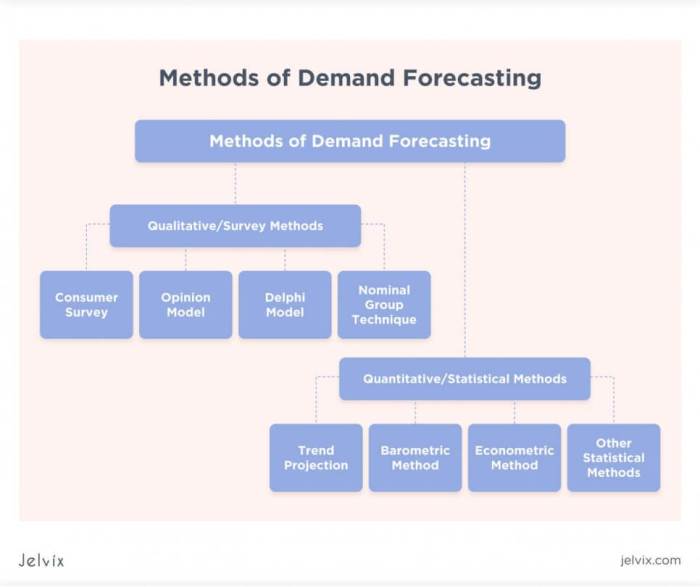

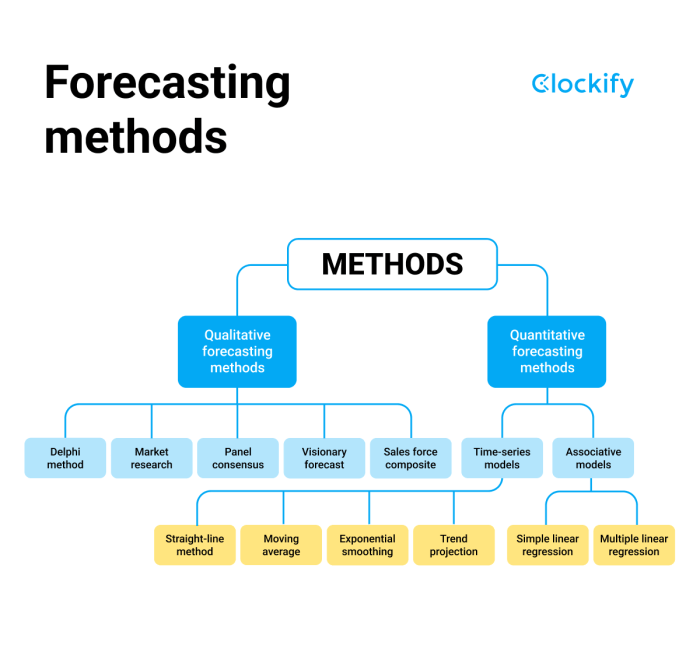

Qualitative forecasting methods rely on expert judgment and subjective opinions rather than purely quantitative data. These methods are particularly useful when historical data is scarce, unreliable, or when dealing with unprecedented events or significant shifts in market dynamics. They offer valuable insights into future trends, especially when dealing with complex economic phenomena that are difficult to model quantitatively.

The Delphi Method

The Delphi method is a structured communication technique used to gather and refine expert opinions on a particular topic. It involves a series of questionnaires distributed to a panel of experts, with feedback provided after each round. The goal is to achieve a consensus forecast by iteratively reducing the range of predictions and highlighting areas of agreement and disagreement. In economic forecasting, the Delphi method can be used to predict future economic growth rates, assess the impact of policy changes, or gauge consumer sentiment. For example, a panel of economists could be surveyed on the potential effects of a new trade agreement on different sectors of the economy. Each round of questionnaires would incorporate the previous round’s feedback, prompting experts to revise their initial predictions based on the collective knowledge of the group. The process continues until a stable consensus or a clear understanding of the range of possibilities emerges.

Expert Opinions and Surveys in Qualitative Forecasting

Expert opinions and surveys are crucial components of various qualitative forecasting techniques. These methods leverage the knowledge and experience of individuals with deep understanding of the relevant economic factors. Surveys can target a broad range of stakeholders, including consumers, businesses, and industry experts, gathering diverse perspectives on future economic trends. For instance, consumer confidence surveys gauge consumer sentiment, providing valuable insights into future spending patterns. Business surveys, focusing on investment plans and hiring intentions, help predict future economic activity. The information gathered from these surveys and expert opinions is then synthesized to form a qualitative forecast. The reliability of these methods depends heavily on the expertise and objectivity of the participants and the design of the survey instruments. Careful consideration of potential biases and limitations is essential.

Examples of Scenarios and Their Limitations in Qualitative Forecasting

Qualitative forecasting often involves developing different scenarios to represent potential future outcomes. These scenarios can range from optimistic to pessimistic, reflecting various combinations of economic factors. For example, a scenario might assume high oil prices coupled with increased consumer spending, leading to a specific economic growth rate. Another scenario might explore the effects of a global recession on domestic employment. However, the limitations of scenario-based forecasting lie in the subjective nature of scenario development and the difficulty in assigning probabilities to each scenario. Furthermore, unforeseen events can render even the most carefully constructed scenarios irrelevant. The lack of precise numerical projections also presents a challenge for decision-making.

Hypothetical Scenario: Predicting the Impact of Automation on Employment

Let’s consider a hypothetical scenario using qualitative methods to predict the impact of increased automation on employment in the manufacturing sector over the next decade. We could convene a panel of experts (economists, labor market analysts, manufacturing executives) using the Delphi method. The first round of questionnaires would ask experts to estimate the percentage of manufacturing jobs displaced by automation. Subsequent rounds would incorporate feedback, allowing experts to refine their estimates based on the collective insights. Simultaneously, surveys could be conducted among manufacturing workers to gauge their perceptions of automation’s impact on their jobs and their adaptation strategies. The combined results from the Delphi method and the worker surveys would help develop a qualitative forecast, outlining the potential range of job losses, the skills needed for future employment in the sector, and the potential government policies that could mitigate the negative impacts of automation. This approach acknowledges the uncertainties inherent in predicting such a complex phenomenon, offering a nuanced understanding of potential outcomes rather than a single, precise prediction.

Quantitative Forecasting Methods

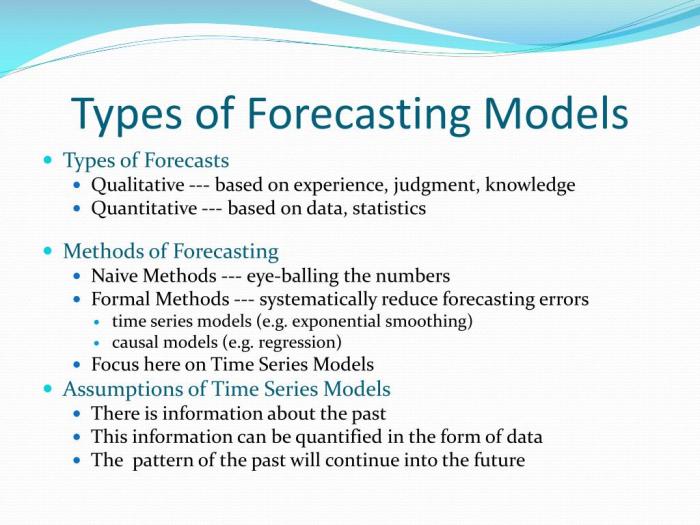

Quantitative forecasting methods utilize mathematical and statistical models to predict future economic outcomes. Unlike qualitative methods relying on expert opinion, these techniques leverage historical data to identify patterns and trends, projecting them into the future. The accuracy of these methods heavily depends on the quality and relevance of the data used, as well as the appropriateness of the chosen model.

Time Series Analysis Principles in Economic Forecasting

Time series analysis is a cornerstone of quantitative economic forecasting. It involves analyzing a sequence of data points collected over time to identify underlying patterns, such as trends, seasonality, and cyclical fluctuations. These patterns are then used to extrapolate the series into the future, generating forecasts. Key techniques within time series analysis include decomposition methods (separating the series into its constituent components), smoothing techniques (reducing noise and highlighting underlying trends), and model building (fitting statistical models to capture the series’ dynamics). The choice of appropriate techniques depends on the characteristics of the specific time series being analyzed and the forecasting horizon.

Comparison of ARIMA and Exponential Smoothing Models

ARIMA (Autoregressive Integrated Moving Average) and Exponential Smoothing are two prominent time series models frequently employed in economic forecasting. ARIMA models are parametric, meaning they assume a specific mathematical form for the underlying process generating the data. They are particularly useful for capturing autocorrelations (relationships between data points at different time lags) within the series. Different ARIMA models are specified by three parameters (p, d, q), representing the order of the autoregressive, integrated, and moving average components, respectively. Model selection often involves iterative testing to find the optimal parameter values.

Exponential smoothing models, in contrast, are non-parametric. They assign exponentially decreasing weights to older observations, giving more importance to recent data. Simple exponential smoothing is suitable for series with no trend or seasonality. More sophisticated variants, such as Holt-Winters exponential smoothing, accommodate trends and seasonality. Exponential smoothing methods are often easier to implement and interpret than ARIMA models, making them attractive for practical applications.

Assumptions Underlying Quantitative Forecasting Methods and Their Implications

Quantitative forecasting methods rely on several key assumptions, the validity of which significantly impacts forecast accuracy. For instance, many models assume stationarity, meaning that the statistical properties of the time series (e.g., mean and variance) remain constant over time. Non-stationary series often require transformations (like differencing) before applying standard time series models. Another common assumption is that the underlying data generating process is linear, implying that changes in the forecast variable are proportional to changes in the predictor variables. Violation of these assumptions can lead to biased and inefficient forecasts. Furthermore, most models assume that the future will resemble the past, which might not always hold true, especially during periods of structural change or economic shocks.

Application of a Simple Moving Average Model

Let’s consider a hypothetical example of monthly sales data for a retail store: [Month: January, February, March, April, May; Sales: $10,000, $12,000, $15,000, $14,000, $16,000]. To forecast June’s sales using a 3-month simple moving average, we average the sales figures for March, April, and May: ($15,000 + $14,000 + $16,000) / 3 = $15,000. Therefore, the forecast for June’s sales is $15,000. This simple method provides a basic forecast, but more sophisticated models are needed to account for trends and seasonality in real-world scenarios. For instance, a longer moving average period might smooth out short-term fluctuations, while a weighted moving average could assign different weights to more recent data points.

Econometric Modeling

Econometric modeling plays a crucial role in forecasting macroeconomic variables by providing a statistically rigorous framework to analyze economic relationships and predict future outcomes. These models utilize historical data and economic theory to quantify the impact of various factors on key economic indicators, enabling more informed and precise forecasts than purely qualitative methods.

Econometric models offer a structured approach to understanding complex economic systems, allowing economists to test hypotheses, quantify relationships between variables, and generate predictions under specific scenarios. This contrasts with simpler forecasting techniques that may rely on less robust statistical foundations.

Common Econometric Models in Economic Forecasting

Several econometric models are commonly employed in economic forecasting, each with its strengths and limitations. The choice of model depends heavily on the specific economic variable being forecast and the available data.

- Linear Regression Models: These are fundamental models that explore the linear relationship between a dependent variable (the variable being forecast, such as GDP growth) and one or more independent variables (factors influencing GDP growth, such as interest rates, inflation, and consumer confidence). The model estimates coefficients that quantify the impact of each independent variable on the dependent variable. For example, a simple model might predict GDP growth as a function of investment and government spending.

- Autoregressive (AR) Models: These models use past values of the variable itself to predict future values. They are particularly useful for forecasting time series data that exhibit autocorrelation (correlation between consecutive observations). For instance, an AR model could forecast monthly unemployment rates based on previous months’ unemployment rates.

- Vector Autoregression (VAR) Models: VAR models extend AR models by considering multiple interrelated variables simultaneously. They are valuable for analyzing the dynamic interactions between several economic variables and forecasting their joint evolution. A VAR model could be used to forecast inflation and interest rates simultaneously, capturing their mutual influence.

- Simultaneous Equation Models: These models address situations where multiple equations are used to represent the relationships between several interdependent variables. They are particularly relevant for modeling complex economic systems with feedback loops, such as the simultaneous determination of prices and quantities in a market.

Building and Validating an Econometric Model

Constructing a reliable econometric model involves a systematic process. Careful consideration of data quality, model specification, and validation is crucial for generating accurate forecasts.

- Data Collection and Preparation: This initial step involves gathering relevant historical data for both the dependent and independent variables. Data cleaning and transformation (e.g., handling missing values, converting data to appropriate units) are essential to ensure data quality.

- Model Specification: This involves selecting the appropriate econometric model based on economic theory and the characteristics of the data. The choice depends on factors such as the nature of the variables (continuous, discrete), the presence of autocorrelation, and the desired level of complexity.

- Model Estimation: This step involves using statistical techniques (such as ordinary least squares for linear regression) to estimate the model’s parameters. This provides the numerical values of the coefficients that quantify the relationships between the variables.

- Model Diagnostics: After estimation, it’s crucial to assess the model’s goodness of fit and diagnostic tests for potential problems such as heteroscedasticity (unequal variances of errors) and autocorrelation. These checks help ensure the model’s reliability.

- Model Validation: This involves evaluating the model’s performance on out-of-sample data (data not used in estimation). This helps assess the model’s ability to generalize to new data and provides a more realistic measure of its forecasting accuracy. Common validation techniques include using a holdout sample or cross-validation.

Interpreting the Results of an Econometric Model

Interpreting the results of an econometric model requires careful consideration of the estimated coefficients, statistical significance, and goodness-of-fit measures.

The estimated coefficients represent the change in the dependent variable associated with a one-unit change in the corresponding independent variable, holding other variables constant (ceteris paribus). Statistical significance tests (e.g., t-tests) indicate the likelihood that the estimated coefficient is different from zero. A high R-squared value suggests a good fit, indicating that the model explains a substantial portion of the variation in the dependent variable. However, a high R-squared alone doesn’t guarantee a good model; diagnostic tests are crucial.

For example, if a regression model predicts GDP growth as a function of investment (X), and the estimated coefficient for X is 0.2 with a p-value of 0.01, it suggests that a one-unit increase in investment is associated with a 0.2-unit increase in GDP growth, and this effect is statistically significant at the 1% level.

Leading Indicators and Economic Indices

Economic forecasting relies heavily on the analysis of various economic indicators, which can be categorized based on their timing relationship with the overall economic cycle. Understanding these indicators and their interrelationships is crucial for accurate predictions. This section delves into the concepts of leading, lagging, and coincident indicators, providing examples and methods for interpreting them within the context of economic forecasting.

Leading, Lagging, and Coincident Indicators

Leading indicators are economic variables that tend to change *before* a change in the overall economy. They provide valuable insights into the future direction of the economy, allowing for anticipatory adjustments in policy and business decisions. Lagging indicators, conversely, change *after* the economy has already shifted, confirming the direction of the change. Coincident indicators move *at the same time* as the overall economy, offering a current snapshot of economic activity. The interplay between these three types of indicators provides a comprehensive view of the economic landscape.

Examples of Key Economic Indicators

Several key economic indicators are widely used in forecasting. Gross Domestic Product (GDP) measures the total value of goods and services produced within a country’s borders, providing a comprehensive measure of economic output. Inflation, typically measured by the Consumer Price Index (CPI) or Producer Price Index (PPI), reflects the rate of increase in prices of goods and services. Unemployment rate, calculated as the percentage of the labor force that is unemployed and actively seeking employment, signifies the health of the labor market. Other important indicators include consumer confidence, manufacturing activity (measured by indices like the Purchasing Managers’ Index – PMI), housing starts, and durable goods orders. These indicators, when analyzed together, paint a more nuanced picture of the economy’s performance and trajectory.

Interpreting Economic Indices and Their Implications for Forecasting

Interpreting economic indices involves analyzing their trends, magnitudes of change, and relationships with other indicators. For instance, a sustained upward trend in leading indicators like consumer confidence and manufacturing PMI might suggest an impending economic expansion. Conversely, a sharp decline in these indicators could signal a potential recession. It is crucial to consider the context of the data, accounting for factors such as seasonal variations and external shocks. Sophisticated statistical methods, including time series analysis and econometric modeling, are often employed to analyze these indicators and generate forecasts. The interpretation of these indices should not be done in isolation; a holistic approach, considering multiple indicators and their interrelationships, is essential for robust forecasting. For example, a rise in inflation coupled with a decline in consumer confidence could suggest a weakening economy despite strong employment numbers.

Leading Indicators and Their Predictive Power

The predictive power of leading indicators varies, and their effectiveness depends on the specific economic context and the accuracy of the underlying data. The following table illustrates some common leading indicators and their general predictive power. Note that the predictive power can fluctuate over time.

| Indicator | Description | Predictive Power | Example of Use in Forecasting |

|---|---|---|---|

| Manufacturing New Orders | Orders placed for manufactured goods. | High | A surge in new orders often precedes increased production and economic growth. |

| Building Permits | Permits issued for new construction projects. | Moderate | Indicates future investment and economic activity in the construction sector. |

| Consumer Confidence Index | Measures consumer sentiment regarding the economy. | Moderate to High | High consumer confidence often translates to increased spending and economic growth. |

| Yield Curve (Spread between long-term and short-term interest rates) | Difference between long-term and short-term interest rates. | High | An inverted yield curve (short-term rates higher than long-term rates) is often considered a predictor of recession. |

Forecasting Accuracy and Evaluation

Accurately assessing the performance of economic forecasts is crucial for improving forecasting methodologies and informing decision-making. Several methods exist to evaluate forecast accuracy, each with its strengths and weaknesses. Understanding these methods, along with the inherent uncertainty in economic forecasting, is vital for responsible and effective use of economic predictions.

Evaluating the accuracy of economic forecasts relies on comparing predicted values to actual observed values. This comparison allows for a quantitative assessment of the forecast’s performance and helps identify areas for improvement. The inherent uncertainty in economic forecasts, however, needs to be carefully considered and communicated alongside the point estimates.

Methods for Evaluating Forecast Accuracy

Several statistical measures quantify the difference between predicted and actual values. These metrics provide a numerical representation of forecast accuracy, allowing for comparisons across different models and time periods. Commonly used methods include Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), and Mean Absolute Percentage Error (MAPE).

MAE = (1/n) * Σ|Actuali – Forecasti|

The MAE calculates the average absolute difference between actual and forecasted values. A lower MAE indicates higher accuracy. The RMSE, on the other hand, squares the differences before averaging, giving greater weight to larger errors.

RMSE = √[(1/n) * Σ(Actuali – Forecasti)2]

RMSE is more sensitive to outliers than MAE. MAPE expresses the error as a percentage of the actual value, providing a relative measure of accuracy. Choosing the appropriate metric depends on the specific application and the nature of the data. For instance, if large errors are particularly problematic, RMSE might be preferred. If the relative magnitude of errors is important, MAPE might be more suitable.

Forecast Uncertainty and its Communication

Economic forecasts are inherently uncertain due to the complexity of economic systems and the multitude of factors influencing them. This uncertainty should not be ignored; instead, it should be explicitly acknowledged and communicated. Presenting only a point forecast (a single predicted value) can be misleading, as it doesn’t reflect the range of possible outcomes. Therefore, providing a range or interval forecast, along with probability statements, is crucial for transparent and responsible communication. For example, instead of stating “GDP growth will be 2% next year,” a more informative statement would be “We forecast GDP growth to be between 1.5% and 2.5% next year, with a 68% probability.”

Challenges Associated with Accurate Economic Forecasting

Accurate economic forecasting is notoriously difficult. Several factors contribute to this challenge. The inherent complexity of economic systems, with their numerous interacting variables and feedback loops, makes precise prediction extremely difficult. Unforeseen events, such as natural disasters, political upheavals, or technological breakthroughs, can significantly impact economic outcomes and render even the most sophisticated models inaccurate. Furthermore, data limitations and biases can affect the reliability of forecasts. Data revisions, for example, are common, and these revisions can significantly alter the accuracy assessments of past forecasts. Finally, the inherent difficulty in predicting human behavior, which significantly impacts economic decisions, adds another layer of complexity.

Framework for Presenting Forecast Results

A robust framework for presenting forecast results should include both point estimates and measures of uncertainty. This could involve presenting a range forecast (e.g., a confidence interval), probability distributions, or scenario analysis. For example, a forecast for inflation could include a point estimate of 3%, a 95% confidence interval of 2% to 4%, and a discussion of potential scenarios (e.g., a high-inflation scenario and a low-inflation scenario). Clear and concise communication of assumptions, limitations, and potential sources of error is also essential for responsible presentation of forecast results. Visual aids, such as charts and graphs, can enhance the clarity and understanding of the forecast and its associated uncertainty. For instance, a fan chart could visually represent the forecast and its uncertainty over time. A fan chart displays a central forecast line alongside bands representing increasing uncertainty as the forecast horizon extends.

Applications of Economic Forecasting

Economic forecasting plays a crucial role in various sectors, informing critical decisions across governments and businesses. Accurate predictions about future economic conditions allow policymakers to implement effective strategies and businesses to make informed choices that enhance profitability and sustainability. The following sections detail the diverse applications of economic forecasting in different contexts.

Economic Forecasting in Monetary Policy Decisions

Central banks utilize economic forecasts extensively to guide monetary policy decisions. These forecasts, often incorporating models that predict inflation, unemployment, and economic growth, inform decisions about interest rates and other monetary instruments. For example, if a forecast predicts high inflation, a central bank might raise interest rates to cool down the economy and curb price increases. Conversely, during an economic recession, a forecast indicating low growth and high unemployment might lead to interest rate cuts to stimulate economic activity. The Federal Reserve in the United States, for instance, regularly publishes economic projections that directly influence its decisions on the federal funds rate. These projections are based on a complex interplay of various economic indicators and models, and their accuracy significantly impacts the effectiveness of monetary policy.

Economic Forecasting in Fiscal Policy Planning

Governments rely on economic forecasts to develop and implement fiscal policies. These forecasts provide estimates of future tax revenues and government spending needs, which are crucial for creating balanced budgets and making informed decisions about public investments. For instance, a forecast predicting strong economic growth might lead to increased government spending on infrastructure projects or social programs. Conversely, a forecast suggesting a recession might necessitate spending cuts or tax increases to maintain fiscal stability. The government’s budget process, therefore, is deeply intertwined with economic forecasting, with predictions shaping decisions on taxation, government spending, and overall economic strategy. The impact of these decisions is wide-ranging, affecting everything from social welfare programs to infrastructure development.

Economic Forecasting in Business Decision-Making

Businesses use economic forecasts to inform various strategic decisions, particularly in investment and production planning. Forecasts about future demand, interest rates, and economic growth influence investment decisions related to new plants, equipment, and research and development. For example, a company expecting strong sales growth might invest heavily in expanding its production capacity. Conversely, a forecast predicting a recession might lead to a reduction in capital expenditures and a focus on cost-cutting measures. Production planning is also influenced by economic forecasts. Accurate predictions about future demand allow businesses to optimize production levels, minimizing waste and maximizing efficiency. Companies like automobile manufacturers often use economic forecasts to anticipate changes in consumer demand and adjust their production schedules accordingly.

Economic Forecasting’s Impact on Consumer Behavior and Market Trends

Economic forecasts significantly impact consumer behavior and market trends. Positive economic forecasts, suggesting strong growth and low unemployment, can boost consumer confidence, leading to increased spending and investment. This increased demand can stimulate economic activity further, creating a positive feedback loop. Conversely, negative forecasts, predicting recession or high unemployment, can dampen consumer confidence, resulting in decreased spending and investment. This can lead to a decline in economic activity, reinforcing the negative outlook. The media often plays a crucial role in disseminating these forecasts, shaping public perception and influencing market trends. For example, widespread reports of an impending recession can lead to a sell-off in the stock market, even before the recession officially begins.

Future Trends in Economic Forecasting

Economic forecasting is undergoing a significant transformation, driven by advancements in data analytics, computational power, and a deeper understanding of complex economic systems. The integration of new technologies and methodologies promises to enhance forecasting accuracy and provide more nuanced insights into future economic trends. However, challenges remain, particularly in navigating the increasing complexity of the global economy and incorporating the unpredictable nature of human behavior.

The impact of big data and machine learning on economic forecasting is profound. The sheer volume of data now available – from transactional records and social media sentiment to satellite imagery and sensor data – provides a richer and more granular picture of economic activity than ever before. Machine learning algorithms, particularly deep learning models, can identify complex patterns and relationships within these datasets that traditional econometric methods might miss. This allows for more accurate predictions and the identification of previously unseen economic signals. For instance, analyzing social media sentiment around consumer spending can provide early warnings of shifts in consumer confidence, which can then be incorporated into macroeconomic forecasts.

Big Data and Machine Learning in Economic Forecasting

Machine learning algorithms, such as neural networks and support vector machines, excel at identifying non-linear relationships and complex patterns within large datasets. This capability is particularly valuable in economic forecasting, where relationships between variables are often non-linear and influenced by numerous interacting factors. For example, a neural network could be trained on a massive dataset of macroeconomic indicators, consumer behavior, and geopolitical events to predict future GDP growth with greater accuracy than traditional regression models. Furthermore, the ability of machine learning to handle high-dimensional data allows for the inclusion of a wider range of variables in forecasting models, potentially improving predictive power. The application of machine learning also allows for the development of more sophisticated nowcasting techniques, providing real-time estimates of current economic conditions.

Challenges of Increasing Economic Complexity and Globalization

The increasing interconnectedness of the global economy and the rise of complex financial instruments pose significant challenges to economic forecasting. Globalization introduces new sources of uncertainty, such as international trade disputes, geopolitical instability, and the rapid spread of economic shocks across borders. The complexity of modern financial markets, with their intricate web of derivatives and other instruments, makes it difficult to accurately model financial risks and their impact on the real economy. For example, accurately predicting the ripple effects of a sudden increase in interest rates across multiple interconnected economies requires sophisticated modeling techniques that account for the complex interactions between different markets and sectors. The unpredictability of technological disruptions and their impact on industries and employment also adds to the forecasting challenges.

Areas for Improvement in Economic Forecasting Methodologies

Several areas require improvement to enhance the accuracy and reliability of economic forecasts. One key area is the incorporation of behavioral economics into forecasting models. Traditional models often assume rational economic agents, but behavioral biases and heuristics significantly influence economic decisions. Integrating insights from behavioral economics can lead to more realistic and accurate predictions. Another crucial area is the development of more robust methods for handling uncertainty and incorporating qualitative information, such as expert opinions and geopolitical assessments, into quantitative models. Improving data quality and addressing data biases is also essential. Finally, greater transparency and rigorous validation of forecasting methodologies are needed to build trust and improve the credibility of economic forecasts.

Artificial Intelligence and Improved Forecasting Accuracy

Artificial intelligence (AI) offers the potential to significantly improve the accuracy of economic forecasts. AI-powered systems can process vast amounts of data from diverse sources, identify complex patterns and relationships, and adapt to changing economic conditions more effectively than traditional methods. For instance, AI algorithms can be used to develop more sophisticated early warning systems for economic crises by analyzing real-time data streams from multiple sources, such as financial markets, social media, and news reports. AI can also be used to personalize economic forecasts for specific industries or regions, taking into account their unique characteristics and vulnerabilities. Furthermore, AI-powered systems can automate many aspects of the forecasting process, reducing the time and resources required to produce accurate and timely forecasts. The development of explainable AI (XAI) methods is crucial to ensure transparency and understanding of the reasoning behind AI-driven forecasts.

Outcome Summary

In conclusion, mastering economic forecasting requires a nuanced understanding of both qualitative and quantitative methods, a critical eye for data analysis, and a realistic assessment of inherent uncertainties. While challenges persist, particularly with increasing economic complexity and globalization, advancements in data analytics and machine learning offer exciting possibilities for improving forecast accuracy and informing more effective economic decision-making. By embracing a multi-faceted approach and continuously refining methodologies, we can enhance our ability to navigate the dynamic world of economics and make informed predictions for the future.

User Queries

What is the difference between leading, lagging, and coincident indicators?

Leading indicators precede economic changes, lagging indicators follow them, and coincident indicators occur simultaneously with economic shifts.

How can I improve the accuracy of my economic forecasts?

Improving accuracy involves using diverse data sources, employing multiple forecasting methods, rigorously validating models, and acknowledging forecast uncertainty.

What are some common pitfalls to avoid in economic forecasting?

Common pitfalls include overreliance on single models, neglecting qualitative factors, failing to account for uncertainty, and misinterpreting data.

What is the role of qualitative forecasting in a predominantly quantitative field?

Qualitative methods provide crucial context and insights that quantitative models often miss, particularly in considering unforeseen events and shifts in market sentiment.