Economic Trends Forecast 2024 offers a comprehensive analysis of the global economic landscape, examining projected growth rates, inflationary pressures, and potential risks. This forecast delves into the performance of major economic regions – North America, Europe, and Asia – providing insights into key economic indicators and anticipated strengths and weaknesses. The impact of monetary policies, sector-specific forecasts for key industries, and the influence of emerging market trends are also explored.

Furthermore, the report investigates the transformative effects of technological advancements, such as artificial intelligence and automation, and assesses the potential impact of geopolitical events and environmental concerns on economic activity. By considering these interconnected factors, the forecast aims to provide a nuanced and forward-looking perspective on the global economy in 2024.

Global Economic Outlook 2024

The global economic outlook for 2024 presents a mixed picture, characterized by slowing growth compared to the post-pandemic recovery but avoiding a widespread recession. Several factors, including persistent inflation, geopolitical uncertainty, and lingering supply chain issues, contribute to a less optimistic forecast than in previous years. While growth is expected, it will be significantly moderated compared to the robust expansion seen in 2021 and the relatively strong performance in 2022.

Projected Global GDP Growth

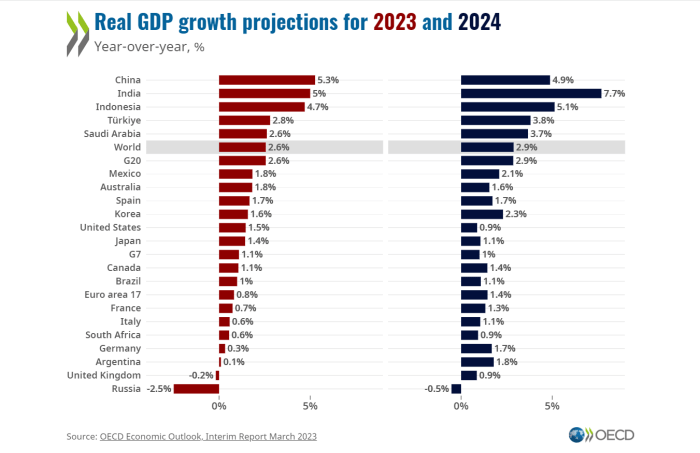

Global GDP growth is projected to be around 2.5% in 2024, a significant slowdown from the 6% growth witnessed in 2021 and the approximately 3.5% growth in 2022. This deceleration reflects a confluence of factors impacting major economies worldwide. The following table illustrates projected growth rates for several key economies:

| Economy | Projected GDP Growth (2024) |

|---|---|

| United States | 1.5% |

| China | 5.0% |

| Eurozone | 0.8% |

| India | 6.0% |

*Note: These figures are illustrative estimates and may vary depending on the source and the specific assumptions used in the forecast. Actual growth rates may differ.*

Inflation’s Impact on Global Economic Activity

Persistent inflation continues to pose a significant headwind to global economic activity. High inflation erodes purchasing power, dampens consumer spending, and forces central banks to maintain tighter monetary policies. This can lead to higher interest rates, slowing investment, and potentially triggering a recession in vulnerable economies. For example, the persistent inflation in the Eurozone in 2023, driven by energy prices and supply chain disruptions, led to a significant slowdown in economic growth and forced the European Central Bank to implement aggressive interest rate hikes. This situation highlights the direct link between inflation and economic performance. The expectation is that while inflation will likely moderate in 2024, it will remain above target levels in many countries, continuing to constrain economic expansion.

Potential Risks to the Global Economy

Several risks could further destabilize the global economy in 2024. Geopolitical instability, particularly the ongoing conflict in Ukraine, continues to disrupt global supply chains, drive up energy prices, and create uncertainty for businesses and investors. Further escalation of the conflict or the emergence of new geopolitical tensions could significantly worsen the outlook. Additionally, lingering supply chain disruptions, although less severe than in previous years, still pose a risk to production and inflation. The potential for further pandemic-related disruptions or natural disasters also adds to the uncertainty. These risks, coupled with the possibility of a sharper-than-expected slowdown in major economies, underscore the need for proactive policy responses and robust risk management strategies.

Major Economic Regions

The global economic landscape in 2024 presents a complex picture, with varying degrees of growth and challenges across major economic regions. Understanding the projected performance of North America, Europe, and Asia is crucial for navigating the year’s economic uncertainties. This section will compare and contrast their predicted economic trajectories, highlighting key influencing factors and indicators.

The performance of these regions will be shaped by a confluence of factors, including inflation rates, interest rate policies, geopolitical instability, and supply chain dynamics. While some regions may experience robust growth, others may face significant headwinds, impacting global trade and investment flows.

North America: Economic Performance and Predictions

North America, particularly the United States, is expected to experience moderate economic growth in 2024. However, this growth will likely be slower than in previous years, primarily due to persistent inflation and the effects of tightening monetary policy by the Federal Reserve.

Key factors influencing North America’s economic performance include:

- Inflationary pressures: High inflation continues to erode consumer purchasing power and impact business investment decisions. The Federal Reserve’s actions to curb inflation, although necessary, could also dampen economic growth.

- Interest rate hikes: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing down investment and consumption.

- Strong labor market: A tight labor market, while positive in some respects, contributes to upward pressure on wages and inflation.

- Geopolitical risks: Global geopolitical uncertainties, such as the ongoing war in Ukraine, impact energy prices and supply chains, creating economic ripple effects.

Key economic indicators to watch include inflation rates (CPI and PCE), interest rates set by the Federal Reserve, unemployment rates, and consumer spending.

Europe: Economic Performance and Predictions

Europe faces a more challenging economic outlook in 2024, largely due to the ongoing energy crisis stemming from the war in Ukraine and persistent inflationary pressures. While some countries may fare better than others, the overall growth is expected to be subdued.

Key factors influencing Europe’s economic performance include:

- Energy crisis: The high cost of energy significantly impacts businesses and households, reducing consumer spending and hindering industrial production. This is particularly acute in energy-intensive industries.

- Inflation: High inflation rates across the Eurozone are eroding purchasing power and impacting consumer confidence.

- Geopolitical instability: The war in Ukraine continues to create uncertainty and negatively impacts economic activity.

- Supply chain disruptions: While easing, supply chain disruptions continue to affect various sectors, adding to inflationary pressures.

Key economic indicators include inflation rates (HICP), GDP growth, unemployment rates, and energy prices.

Asia: Economic Performance and Predictions

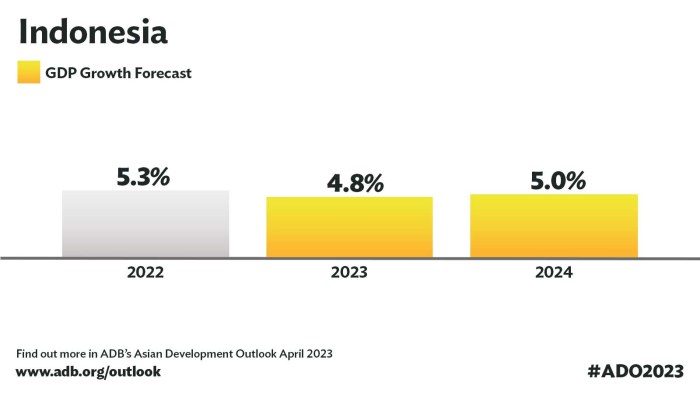

Asia is expected to exhibit a mixed economic performance in 2024. While some Asian economies are anticipated to maintain robust growth, others may face headwinds due to factors such as slowing global demand and domestic challenges.

Key factors influencing Asia’s economic performance include:

- Global demand slowdown: A slowdown in global demand, particularly from the US and Europe, could impact Asian export-oriented economies.

- China’s economic growth: China’s economic performance significantly impacts the region, given its size and influence on trade and investment.

- Domestic policy challenges: Various domestic policy challenges, including those related to property markets and debt levels, could affect individual Asian economies.

- Supply chain resilience: Asia’s role in global supply chains continues to be important, but disruptions and shifts in manufacturing locations could affect its growth trajectory.

Key economic indicators to monitor include GDP growth, inflation rates, export and import volumes, and foreign direct investment.

Comparative Summary of Economic Strengths and Weaknesses

| Region | Strengths | Weaknesses | Key Indicators |

|---|---|---|---|

| North America | Strong labor market, relatively resilient consumer spending | High inflation, rising interest rates | CPI, PCE, interest rates, unemployment |

| Europe | Strong manufacturing base in some countries | Energy crisis, high inflation, geopolitical risks | HICP, GDP growth, unemployment, energy prices |

| Asia | Strong growth potential in some economies, large consumer markets | Global demand slowdown, China’s economic slowdown potential, domestic policy challenges | GDP growth, inflation, trade volumes, FDI |

Impact of Monetary Policy

Central bank monetary policies will play a crucial role in shaping the global economic landscape in 2024. The primary goal remains managing inflation while supporting sustainable economic growth, a delicate balancing act given the persistent uncertainties stemming from geopolitical tensions and supply chain vulnerabilities. The effectiveness of these policies will depend on various factors, including the speed and extent of interest rate adjustments, the responsiveness of inflation to these changes, and the overall resilience of the global economy.

The anticipated impact of central bank actions on inflation and economic growth in 2024 is multifaceted. A continued tightening of monetary policy, characterized by further interest rate hikes, is likely in some major economies to combat persistent inflationary pressures. This approach, while potentially curbing inflation, could also dampen economic growth by increasing borrowing costs for businesses and consumers, potentially leading to reduced investment and consumer spending. Conversely, a premature easing of monetary policy, characterized by interest rate cuts, risks reigniting inflation if price pressures remain stubborn. The optimal path forward will necessitate a careful assessment of evolving economic indicators and a nuanced understanding of the transmission mechanisms of monetary policy.

Interest Rate Scenarios and Implications

Several scenarios for interest rate changes are plausible in 2024, depending on the trajectory of inflation and economic growth. For instance, the US Federal Reserve might continue a gradual approach, incrementally raising interest rates if inflation remains above the target, but potentially pausing or even slightly lowering rates if inflation shows a significant and sustained decline. The European Central Bank, facing similar challenges, could follow a comparable strategy, although the specifics would depend on the Eurozone’s economic performance and energy price dynamics. Conversely, economies experiencing slower growth and already low inflation might adopt a more accommodative stance, potentially lowering interest rates to stimulate economic activity. These diverging policy paths could lead to fluctuations in exchange rates and capital flows, influencing international trade and investment. For example, a significant interest rate differential between the US and the Eurozone could strengthen the dollar, impacting US exports and imports.

Monetary Policy’s Sectoral Impact

Different monetary policy approaches will differentially affect various sectors of the economy. For instance, interest rate hikes disproportionately impact interest-rate-sensitive sectors like real estate and construction, leading to reduced investment and potentially a slowdown in housing markets. Similarly, businesses reliant on borrowing for expansion or operational expenses might face higher costs, potentially impacting job creation and overall economic activity. Conversely, sectors less reliant on debt financing, such as essential goods and services, might experience less impact. The impact on consumers will also be varied, with higher borrowing costs affecting those with variable-rate mortgages or significant outstanding debt more significantly than those with fixed-rate loans or minimal debt. A precise assessment of these sectoral impacts requires detailed analysis of individual sectors’ financial structures and their sensitivity to interest rate changes. For example, a detailed analysis of the construction sector in the US, taking into account mortgage rates and construction financing costs, could predict the potential impact of interest rate hikes on new housing starts and the overall real estate market.

Key Industries

The following analysis provides sector-specific forecasts for key industries in 2024, considering macroeconomic trends and specific industry dynamics. These forecasts are based on current market intelligence and expert opinions, acknowledging the inherent uncertainties in economic prediction. Significant variations are possible depending on unforeseen global events.

The performance of these sectors will significantly influence the overall global economic health in 2024. Interdependencies between these sectors are substantial; for instance, the technology sector’s performance impacts manufacturing efficiency and energy consumption patterns.

Technology Sector Forecast

The technology sector is projected to experience moderate growth in 2024, albeit at a slower pace than in previous years. Factors such as persistent inflation, rising interest rates, and reduced consumer spending on discretionary items will contribute to this deceleration. However, continued investment in artificial intelligence (AI), cloud computing, and cybersecurity is expected to drive growth in specific segments. Companies focusing on AI-driven solutions and data analytics are likely to outperform others. For example, the increased adoption of AI in healthcare and finance is expected to fuel significant growth in these sub-sectors.

Energy Sector Forecast

The energy sector faces a complex outlook in 2024. While demand remains strong, particularly for renewable energy sources, the sector is grappling with geopolitical uncertainties and supply chain disruptions. The transition to renewable energy continues to accelerate, driven by government policies and growing environmental concerns. However, volatility in oil and gas prices will likely persist, impacting profitability and investment decisions. For instance, the ongoing conflict in Ukraine has significantly impacted global energy markets, creating price volatility and supply chain issues. This has led to increased investment in alternative energy sources like solar and wind power, while simultaneously causing short-term price spikes for fossil fuels.

Manufacturing Sector Forecast

The manufacturing sector’s performance in 2024 will be heavily influenced by global economic growth and supply chain resilience. Continued disruptions to global supply chains, alongside persistent inflation and rising labor costs, pose significant challenges. However, the ongoing trend towards automation and reshoring of manufacturing activities may partially offset these negative factors. Companies that can successfully navigate supply chain complexities and adopt advanced manufacturing technologies are likely to experience stronger growth. The automotive industry, for example, is expected to see moderate growth driven by the increasing demand for electric vehicles, despite ongoing supply chain challenges for crucial components like semiconductors.

| Industry | Projected Growth (Percentage) | Key Growth Drivers | Potential Disruptions |

|---|---|---|---|

| Technology | 3-5% | AI, Cloud Computing, Cybersecurity | Reduced consumer spending, talent shortages |

| Energy | 2-4% | Renewable energy investment, rising demand | Geopolitical instability, price volatility |

| Manufacturing | 1-3% | Automation, reshoring | Supply chain disruptions, inflation |

Emerging Market Trends

Emerging markets are poised to play an increasingly significant role in the global economy in 2024. Their diverse growth trajectories, coupled with inherent vulnerabilities, present both substantial opportunities and considerable challenges for investors and policymakers alike. Understanding the key trends shaping these markets is crucial for navigating the complexities of the coming year.

Three significant emerging market trends are likely to impact the global economy in 2024: the continued rise of digitalization, the evolving geopolitical landscape, and the increasing importance of sustainable development.

Digitalization’s Expanding Reach

The rapid expansion of digital technologies across emerging markets continues to transform economies and societies. This trend is driven by increased mobile phone penetration, expanding internet access, and the growing adoption of fintech solutions. This digital revolution is fostering innovation, boosting productivity, and creating new economic opportunities. However, it also presents challenges, including the need for robust digital infrastructure, cybersecurity concerns, and the potential for widening digital divides. For instance, the growth of mobile money services in sub-Saharan Africa has enabled millions to access financial services for the first time, while simultaneously posing regulatory challenges for governments striving to balance financial inclusion with risk mitigation.

Geopolitical Shifts and Economic Interdependence

The evolving geopolitical landscape significantly influences emerging market dynamics. Rising tensions between major global powers, trade disputes, and shifts in alliances are creating both opportunities and risks. Some emerging markets might benefit from strategic realignment, attracting foreign investment and fostering economic growth. Others may face challenges due to trade disruptions, sanctions, or reduced access to global capital markets. The ongoing war in Ukraine, for example, has highlighted the vulnerability of many emerging markets to global commodity price shocks and supply chain disruptions. This has spurred some countries to pursue greater regional economic integration to reduce dependence on global supply chains.

Sustainable Development’s Growing Importance

The growing emphasis on sustainable development presents both opportunities and challenges for emerging markets. Increasing investor interest in ESG (environmental, social, and governance) factors is driving capital flows towards companies and projects that prioritize sustainability. This presents opportunities for emerging markets to attract green investments, develop renewable energy infrastructure, and improve environmental outcomes. However, challenges remain, including the need for effective policy frameworks, access to green financing, and the capacity to implement sustainable development initiatives. Countries in Southeast Asia, for example, are actively investing in renewable energy sources to meet growing energy demands while reducing carbon emissions, attracting significant foreign investment in the process.

Technological Advancements and Economic Impact

Technological advancements, particularly in artificial intelligence (AI) and automation, are poised to significantly reshape the global economic landscape in 2024. Their impact will be felt across various sectors, influencing both economic growth and employment patterns in profound ways. While offering immense opportunities for increased productivity and innovation, these advancements also present challenges that require careful consideration and proactive mitigation strategies.

The integration of AI and automation is expected to boost productivity and efficiency across numerous industries. This will lead to increased output and potentially lower production costs, driving economic growth. However, the displacement of human workers through automation is a major concern. The extent of this displacement will vary across sectors, with some industries experiencing more significant job losses than others. This necessitates a focus on reskilling and upskilling initiatives to prepare the workforce for the changing job market.

AI and Automation’s Reshaping of Industries

The transformative potential of AI and automation is evident across various sectors. For example, in manufacturing, robotic process automation (RPA) is already streamlining production lines, leading to increased output and reduced labor costs. In the financial sector, AI-powered algorithms are enhancing fraud detection and risk management, improving efficiency and reducing operational expenses. The healthcare industry is witnessing the application of AI in diagnostics, drug discovery, and personalized medicine, leading to improved patient outcomes and potentially reduced healthcare costs. The rise of e-commerce and the gig economy, facilitated by technological advancements, is also creating new economic opportunities, albeit often with different employment structures and worker protections. For instance, the growth of online marketplaces provides opportunities for small businesses and entrepreneurs, while also creating demand for logistics and delivery services.

Challenges Posed by Technological Advancements

The rapid advancement of AI and automation presents several challenges. Job displacement is a primary concern, particularly for workers in sectors heavily reliant on manual labor or routine tasks. This requires proactive measures, such as investing in education and training programs to equip workers with the skills needed for the jobs of the future. Ethical considerations surrounding AI, such as algorithmic bias and data privacy, also require careful attention. Ensuring fairness and transparency in the development and deployment of AI systems is crucial to avoid exacerbating existing inequalities. Furthermore, the potential for increased economic inequality, as the benefits of technological advancements may not be evenly distributed, needs to be addressed through appropriate policy interventions. For instance, the widening gap between high-skilled and low-skilled workers could be mitigated through initiatives that support education, training, and social safety nets. The potential for misuse of AI, such as in autonomous weapons systems, also poses significant ethical and security challenges that demand global cooperation and regulation.

Geopolitical Factors and Economic Uncertainty

The global economic landscape in 2024 will be significantly shaped by ongoing geopolitical tensions and uncertainties. The interconnected nature of the modern economy means that events in one region can quickly ripple outwards, impacting trade, investment, and overall growth. Understanding these potential impacts and developing strategies for mitigation is crucial for businesses and governments alike.

Geopolitical events, such as protracted conflicts, escalating trade wars, or sudden shifts in international alliances, can create significant volatility in global markets. These events disrupt supply chains, increase commodity prices, and trigger uncertainty about future investment opportunities. The resulting economic consequences can range from minor slowdowns to full-blown recessions, depending on the severity and duration of the geopolitical disruption and the resilience of affected economies.

Potential Impacts of Geopolitical Events on the Global Economy

The ongoing conflict in Ukraine, for example, has already had a profound impact on global energy markets, driving up inflation and impacting economic growth worldwide. A further escalation of this conflict, or the emergence of new conflicts in other regions, could exacerbate these effects. Similarly, persistent trade tensions between major economic powers could lead to fragmentation of global supply chains, hindering efficiency and raising costs for businesses and consumers. The imposition of new tariffs or sanctions can severely disrupt established trade relationships and create significant uncertainty for businesses engaged in international trade. Furthermore, cyberattacks targeting critical infrastructure could also cause widespread economic disruption, impacting financial markets, energy grids, and essential services.

Scenarios and Their Consequences for Different Economic Regions

Several scenarios could unfold in 2024, each with varying consequences for different regions. A scenario involving a prolonged conflict in a major resource-producing region, for instance, could lead to significant price increases for energy and raw materials, disproportionately affecting economies heavily reliant on imports. Conversely, a scenario characterized by de-escalation of existing conflicts and increased international cooperation could stimulate economic growth and investment, particularly in regions that benefit from increased trade and reduced uncertainty. Regions with strong domestic demand and diversified economies are likely to be more resilient to geopolitical shocks compared to those with heavily export-oriented economies or those heavily reliant on specific geopolitical partners. For example, the European Union’s dependence on Russian energy prior to the Ukraine conflict highlighted the vulnerability of regions with concentrated supply chains.

Mitigating Risks Associated with Geopolitical Uncertainty

Businesses and governments can adopt several strategies to mitigate the risks associated with geopolitical uncertainty. For businesses, diversification of supply chains, investment in risk management strategies, and robust contingency planning are crucial. This could involve establishing alternative sourcing options, hedging against commodity price fluctuations, and developing robust cybersecurity measures. Governments, on the other hand, can play a critical role in fostering international cooperation, promoting stable trade relationships, and investing in infrastructure resilience. Strengthening diplomatic ties, promoting conflict resolution mechanisms, and investing in cybersecurity infrastructure are vital steps in reducing geopolitical risks. Furthermore, promoting economic diversification within individual nations and fostering regional economic integration can enhance resilience to global shocks. The implementation of effective regulatory frameworks that address risks associated with cyberattacks and supply chain vulnerabilities is also essential.

Sustainability and the Economy

The increasing global awareness of environmental issues is profoundly reshaping economic activity. In 2024, we expect to see a continued, and possibly accelerated, integration of sustainability concerns into mainstream business practices and government policies. This shift will present both challenges and opportunities for various sectors, driving innovation and potentially altering traditional economic models.

The growing focus on sustainability will significantly impact economic activity in 2024, influencing investment decisions, consumer behavior, and regulatory frameworks. Businesses that fail to adapt risk facing reputational damage, decreased consumer demand, and increased regulatory scrutiny. Conversely, companies that proactively embrace sustainable practices may gain a competitive advantage, attracting investors and customers who prioritize environmental responsibility.

Impact on Key Industries

The transition to a more sustainable economy will differentially affect various industries. Some sectors will experience significant disruption, while others will thrive on the opportunities presented by the growing demand for environmentally friendly products and services.

- Renewable Energy: The renewable energy sector is poised for substantial growth. Increased investment in solar, wind, and other renewable energy technologies is expected, driven by government policies aimed at reducing carbon emissions and increasing energy independence. Examples include the expansion of offshore wind farms in Europe and the continued growth of solar power installations in Asia.

- Sustainable Agriculture: The agricultural sector faces increasing pressure to adopt sustainable practices to reduce its environmental footprint. This includes reducing pesticide and fertilizer use, improving water management, and adopting climate-smart agriculture techniques. The rise of organic farming and plant-based alternatives to meat are indicative of this trend.

- Green Building and Construction: The construction industry is undergoing a transformation towards more sustainable building practices. This includes using eco-friendly materials, improving energy efficiency, and reducing waste. The adoption of LEED (Leadership in Energy and Environmental Design) certification and similar green building standards is becoming increasingly common.

- Transportation: The transportation sector is facing significant pressure to decarbonize. The growing adoption of electric vehicles, the development of alternative fuels, and investments in public transportation are key aspects of this shift. Government regulations, such as stricter emission standards and incentives for electric vehicle purchases, are driving this transition.

Influence of Sustainability Policies

Government policies play a crucial role in shaping the trajectory of sustainability initiatives. In 2024, we anticipate a strengthening of regulations and incentives aimed at promoting sustainable practices across various sectors.

- Carbon Pricing Mechanisms: Carbon taxes and emissions trading schemes are becoming increasingly common tools used by governments to incentivize emissions reductions. The European Union’s Emissions Trading System (ETS) and similar initiatives in other regions are expected to continue to influence industrial activity and investment decisions.

- Renewable Energy Subsidies and Mandates: Many governments continue to provide subsidies and tax breaks for renewable energy projects, along with mandates for renewable energy use in electricity generation. These policies are crucial for driving investment in the renewable energy sector.

- Sustainable Procurement Policies: Governments are increasingly incorporating sustainability criteria into their procurement processes, requiring suppliers to meet specific environmental standards. This creates a market for sustainable goods and services, further incentivizing their development and adoption.

- Investment in Green Infrastructure: Government investment in green infrastructure, such as public transportation, energy-efficient buildings, and renewable energy grids, is expected to continue to grow. This investment not only improves sustainability but also creates jobs and stimulates economic activity.

Closing Notes

In conclusion, the Economic Trends Forecast 2024 paints a complex yet insightful picture of the year ahead. While opportunities exist for growth and innovation across various sectors, significant challenges remain, including persistent inflation, geopolitical uncertainty, and the need for sustainable economic practices. Navigating this dynamic environment requires careful consideration of the factors Artikeld in this forecast, allowing businesses and policymakers to make informed decisions and adapt to the evolving global economic landscape.

FAQ

What is the projected global GDP growth rate for 2024?

The exact projected global GDP growth rate will vary depending on the source and underlying assumptions, but forecasts generally range within a specific percentage band, reflecting uncertainty.

How might the war in Ukraine affect the global economy in 2024?

The ongoing conflict in Ukraine presents significant risks to the global economy, potentially impacting energy prices, supply chains, and investor confidence. The severity of the impact will depend on the duration and evolution of the conflict.

What are the biggest risks to the global economy in 2024?

Major risks include persistent inflation, geopolitical instability (including conflicts and trade wars), supply chain disruptions, and the potential for a global recession.

How will technological advancements impact employment in 2024?

Technological advancements are likely to displace some jobs while creating new opportunities in other sectors. The net effect on employment will depend on factors such as the pace of technological adoption, retraining initiatives, and the adaptability of the workforce.