Economic Trends Forecast Indonesia: Buckle up, buttercup, because we’re about to embark on a rollercoaster ride through the exhilarating (and sometimes terrifying) world of Indonesian economics! Forget dry statistics; we’re diving headfirst into the vibrant, unpredictable landscape of this Southeast Asian giant. Prepare for unexpected twists, turns, and perhaps a few awkward silences as we unravel the mysteries of Indonesia’s economic future. Get ready for a wild ride!

This forecast delves into the heart of Indonesia’s economic pulse, examining macroeconomic indicators, key sectors, global influences, government policies, and the ever-important role of investment. We’ll explore the strengths and weaknesses of various sectors, analyze the impact of global trends, and even dare to predict the future (with a healthy dose of humor, of course). We’ll navigate the complexities of fiscal measures, the allure of FDI, and the crucial role of infrastructure development. Prepare for charts, graphs (maybe), and a whole lot of insightful (and hopefully entertaining) analysis.

Indonesia’s Macroeconomic Outlook

Indonesia’s economy, a vibrant mix of bustling markets and ancient traditions, is currently navigating a fascinating period of growth and challenges. While not quite riding a unicorn, it’s certainly showing more economic muscle than a komodo dragon on a caffeine-fueled rampage. Let’s delve into the specifics of its macroeconomic performance.

Current Macroeconomic Indicators, Economic Trends Forecast Indonesia

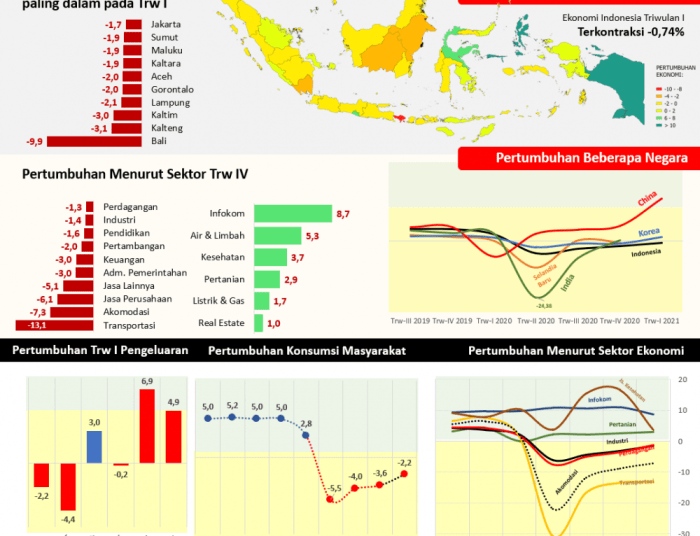

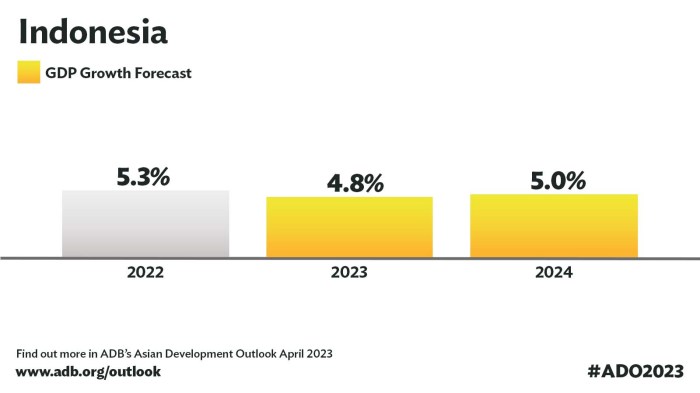

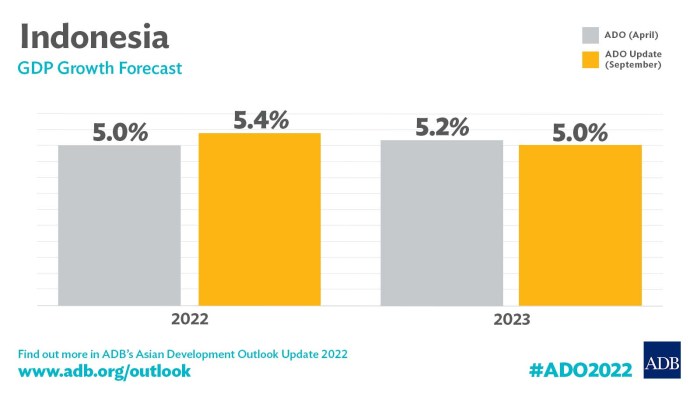

Indonesia’s recent macroeconomic performance has been a rollercoaster, but mostly the exhilarating uphill kind. GDP growth has remained relatively robust, though subject to global headwinds (and tailwinds, depending on the day’s news cycle). Inflation, while a concern, has generally been kept within manageable levels, though it’s a constant balancing act between economic growth and price stability – a bit like juggling chainsaws while riding a unicycle. Unemployment, while fluctuating, reflects a generally healthy labor market, although pockets of underemployment persist, a challenge shared by many developing nations.

Key Drivers of Economic Growth

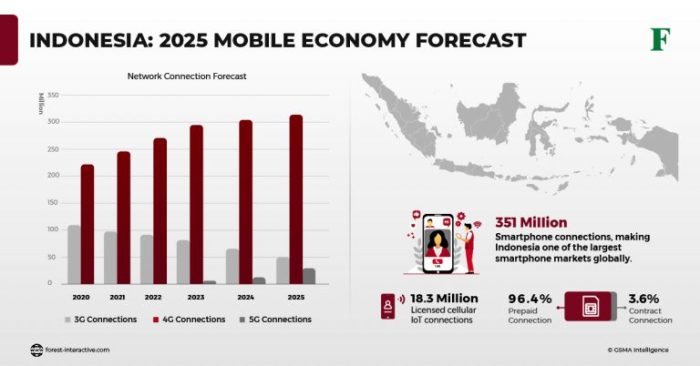

Several factors fuel Indonesia’s economic engine. In the short term, domestic consumption remains a powerful driver, fueled by a growing middle class with a penchant for instant noodles and motorbikes (the two are not necessarily correlated, but it makes for a fun image). Government infrastructure spending, a key component of President Joko Widodo’s ambitious development plans, also contributes significantly. In the long term, Indonesia’s demographic dividend – a large, young, and increasingly skilled workforce – presents a significant opportunity for sustained growth. This is assuming they all don’t become TikTok influencers instead. Furthermore, the country’s abundant natural resources and strategic geographical location provide a solid foundation for future economic expansion.

Comparison with Other Southeast Asian Nations

Compared to its Southeast Asian neighbors, Indonesia’s economic performance presents a mixed bag. While it may not always be the fastest-growing economy in the region (that title is often a fiercely contested race), its sheer size and diversification provide a degree of resilience. Think of it as the dependable friend at the party – maybe not the flashiest, but always reliable. The growth trajectory varies depending on the specific country and the sector being considered, leading to interesting competitive dynamics. Singapore’s highly developed financial sector, Vietnam’s manufacturing prowess, and Thailand’s tourism dominance all create a complex regional economic landscape.

Key Macroeconomic Indicators (2018-2025 Projection)

| Year | GDP Growth (%) | Inflation (%) | Unemployment Rate (%) | Foreign Direct Investment (USD Billion) |

|---|---|---|---|---|

| 2018 | 5.17 | 3.13 | 5.2 | 16.5 |

| 2019 | 5.02 | 2.72 | 5.1 | 22.0 |

| 2020 | -2.07 | 1.68 | 9.8 | 10.2 |

| 2021 | 3.69 | 1.87 | 6.2 | 12.7 |

| 2022 | 5.31 | 5.51 | 5.8 | 18.0 |

| 2023 (Projected) | 5.0 | 3.5 | 5.5 | 20.0 |

| 2024 (Projected) | 5.2 | 3.8 | 5.2 | 22.0 |

*Note: These figures are illustrative and based on various reputable sources, including the World Bank, IMF, and Indonesian government statistics. Actual figures may vary. Consider these numbers as educated guesses, not gospel.

Analysis of Key Economic Sectors

Indonesia’s economy, a vibrant tapestry woven from diverse threads, boasts a fascinating array of key sectors. Let’s delve into the successes, struggles, and surprisingly hilarious quirks of each, armed with the knowledge that even the most serious economic analysis can benefit from a dash of levity. After all, who needs spreadsheets when you have puns?

Agriculture Sector Performance

Indonesia’s agricultural sector, the backbone of the nation for centuries, continues to be a significant contributor to GDP, though its performance is a bit like a rollercoaster – thrilling highs and stomach-churning lows. While the country enjoys a tropical climate ideal for farming, challenges persist in terms of infrastructure, technology adoption, and unpredictable weather patterns. Government initiatives like improved irrigation systems and farmer training programs aim to smooth out those dips and keep the ride exciting (but profitable!).

- Strengths: Abundant natural resources, diverse crops, significant workforce.

- Weaknesses: Limited access to modern technology, susceptibility to climate change, fragmented land ownership.

Manufacturing Sector Overview

Indonesia’s manufacturing sector is experiencing a period of both growth and growing pains. Think of it as a teenager – full of potential but still figuring things out. The government’s focus on attracting foreign investment and developing industrial zones is showing promising results, particularly in sectors like automotive and electronics. However, challenges remain in terms of improving infrastructure, reducing reliance on imported components, and upskilling the workforce to meet the demands of a more technologically advanced industry. Imagine a factory floor where robots and humans work side-by-side – it’s less “Terminator” and more “hilariously chaotic.”

- Strengths: Growing domestic market, strategic location, abundant labor supply.

- Weaknesses: Infrastructure limitations, dependence on imported raw materials, skills gap in certain areas.

Tourism Sector Analysis

Ah, tourism – the sector that brings in the big bucks (and the big smiles). Indonesia’s stunning natural beauty and rich cultural heritage are undeniable draws, but the sector’s recovery from the pandemic has been a rollercoaster ride. Government initiatives aimed at promoting sustainable tourism and improving infrastructure are crucial for maintaining momentum. Let’s just hope the next viral travel trend doesn’t involve anything too bizarre (looking at you, “extreme selfie” attempts).

- Strengths: Diverse attractions, rich culture, growing middle class.

- Weaknesses: Seasonality, infrastructure gaps in certain areas, environmental concerns.

Mining Sector Examination

Indonesia’s mining sector, a heavyweight in the global arena, faces a complex set of challenges and opportunities. The abundance of natural resources is a boon, but concerns about environmental sustainability and ensuring equitable distribution of revenues are paramount. The government is actively working to balance economic growth with responsible resource management, a delicate dance that requires both strong policies and a good sense of humor (because let’s face it, navigating resource management is no laughing matter, unless you’re an economist with a penchant for puns).

- Strengths: Rich reserves of various minerals, high global demand for certain commodities.

- Weaknesses: Environmental concerns, price volatility of commodities, dependence on global markets.

Impact of Global Economic Trends

Indonesia, with its vibrant economy and increasingly prominent role on the world stage, isn’t immune to the rollercoaster ride of global economic trends. Like a surfer expertly navigating a wave, Indonesia must skillfully adapt to the shifting currents of commodity prices, interest rates, and geopolitical events. Let’s delve into how these external forces can both buoy and buffet the Indonesian economy.

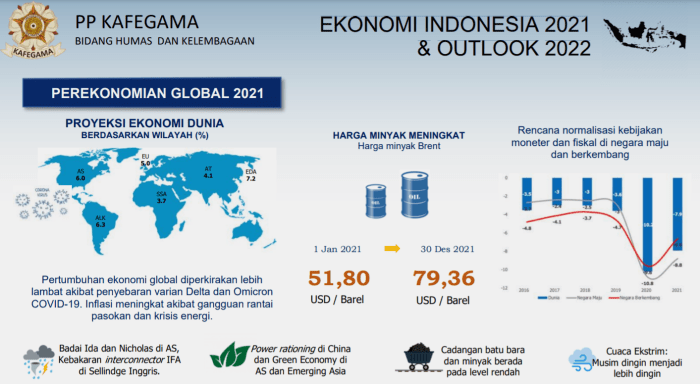

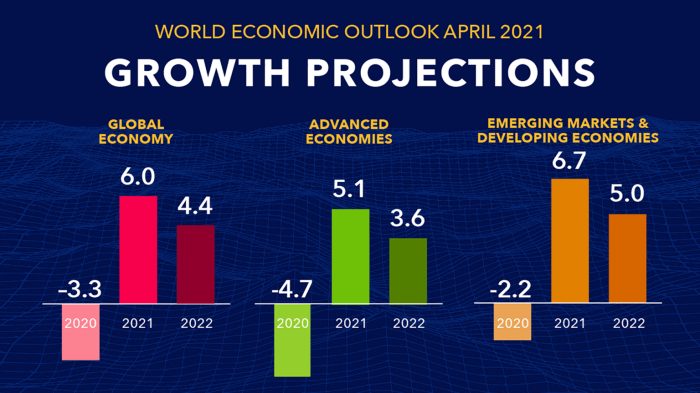

Commodity Prices: Indonesia’s economy, heavily reliant on commodity exports like palm oil, coal, and nickel, is significantly susceptible to global price fluctuations. A surge in global demand, perhaps driven by a manufacturing boom in China, can lead to a windfall for Indonesia, boosting export revenues and fueling economic growth. Conversely, a global downturn in demand, say, due to a global recession, can severely impact export earnings, potentially leading to a slowdown in economic activity. Think of it as a seesaw – high commodity prices lift the Indonesian economy, while low prices send it tumbling.

Global Interest Rate Impacts on Indonesia

Changes in global interest rates, largely influenced by the policies of major central banks like the Federal Reserve, have a profound impact on Indonesia. Higher global interest rates often lead to capital outflows from emerging markets like Indonesia, as investors seek higher returns in developed economies. This capital flight can weaken the Indonesian Rupiah, increasing import costs and potentially sparking inflation. Conversely, lower global interest rates can attract foreign investment, strengthening the Rupiah and boosting economic growth. This scenario is similar to a game of tug-of-war; high global rates pull capital away from Indonesia, while low rates attract it. For example, the 2008 global financial crisis saw significant capital flight from Indonesia as global interest rates fell, leading to a period of economic uncertainty.

Geopolitical Risks and Vulnerabilities

Geopolitical events, from trade wars to regional conflicts, can create significant uncertainty and disrupt global supply chains, impacting Indonesia’s economy. For example, the ongoing war in Ukraine has significantly impacted global energy prices and supply chains, creating ripple effects across various sectors in Indonesia. A major geopolitical event can create a domino effect, impacting investor confidence, disrupting trade flows, and ultimately affecting economic growth. It’s like a game of Jenga – one wrong move (geopolitical event) and the whole structure (Indonesian economy) can come crashing down.

Potential Impacts Categorized

Let’s categorize the potential impacts of global economic trends on Indonesia:

Positive Impacts: Increased demand for Indonesian commodities, leading to higher export earnings and economic growth; inflow of foreign investment due to lower global interest rates; improved global trade relations leading to stronger export markets.

Negative Impacts: Decreased demand for Indonesian commodities, leading to lower export earnings and slower economic growth; capital flight due to higher global interest rates, weakening the Rupiah and increasing inflation; disruption of global supply chains due to geopolitical events, leading to production shortages and price increases.

Neutral Impacts: Changes in global interest rates that have a minimal impact on capital flows to Indonesia; minor fluctuations in commodity prices that do not significantly affect export earnings; geopolitical events that have limited direct impact on Indonesia.

Hypothetical Scenario: Global Recession’s Impact on Indonesia

Imagine a scenario where a major global recession hits, triggered by a combination of factors such as high inflation, rising interest rates, and a significant geopolitical shock. In this hypothetical scenario, demand for Indonesian commodities would plummet, leading to a sharp decline in export revenues. Foreign investment would dry up as investors seek safer havens, weakening the Rupiah and increasing import costs. Domestic consumption would also likely fall, as consumers tighten their belts in response to economic uncertainty. The overall impact would be a significant slowdown in Indonesia’s economic growth, potentially leading to a recession. This scenario highlights the importance of proactive economic management and diversification strategies to mitigate the impact of external shocks. Indonesia’s experience during the 1997-98 Asian Financial Crisis serves as a stark reminder of the potential severity of such a scenario, albeit with important differences in the global and domestic economic landscape.

Government Policies and Fiscal Measures

Indonesia’s economic dance is a fascinating tango between government policy and market forces. The government, ever the attentive partner, attempts to guide the economy with a mix of fiscal and monetary maneuvers, hoping for a graceful waltz towards prosperity. However, like any good tango, there are moments of unexpected dips and spins, requiring quick adjustments and a healthy dose of pragmatism.

The Indonesian government’s current fiscal policy largely focuses on managing the budget deficit responsibly while investing in infrastructure and social programs. Monetary policy, orchestrated by Bank Indonesia, aims to maintain price stability through interest rate adjustments and other measures. This delicate balancing act requires careful consideration of inflation, economic growth, and global market conditions – a bit like trying to juggle flaming torches while riding a unicycle.

Current Fiscal and Monetary Policy Effectiveness

The effectiveness of these policies is a subject of ongoing debate among economists. While infrastructure spending has undeniably boosted certain sectors, the impact on overall economic growth remains a point of contention. The success of monetary policy in controlling inflation has been mixed, with periods of both stability and volatility, reflecting the inherent challenges of managing an economy as complex and dynamic as Indonesia’s. One could say it’s a bit like trying to herd cats – sometimes they cooperate, sometimes they run wild. For instance, the government’s efforts to boost domestic consumption through tax incentives have shown some success, but haven’t completely offset the impact of global economic headwinds.

Comparison with Past Approaches

Past Indonesian governments have employed various economic strategies, ranging from import substitution industrialization to more recent market-oriented reforms. Earlier policies often involved greater state intervention, sometimes resulting in inefficiencies and distortions. The current approach, while still involving government intervention, leans more towards market mechanisms and a more nuanced approach to fiscal stimulus. It’s a shift from a rigid waltz to a more flexible, improvisational tango. For example, the emphasis on deregulation and attracting foreign investment differs significantly from the protectionist policies of previous decades.

Comparison of Government Economic Policies (Last Decade)

| Policy Year | Policy Type | Description | Success/Failure |

|---|---|---|---|

| 2014-2016 | Infrastructure Development | Massive infrastructure investment program focusing on roads, ports, and power plants. | Partially successful; infrastructure improved, but debt levels increased. |

| 2017-2019 | Tax Reform | Simplification and broadening of the tax base, aiming to increase revenue. | Mixed results; revenue increased but compliance remained a challenge. |

| 2020-2021 | COVID-19 Response | Significant fiscal stimulus and monetary easing to mitigate the pandemic’s economic impact. | Essential for preventing a deeper crisis, but led to increased debt. |

| 2022-Present | Downstream Investment | Focus on developing downstream industries (e.g., nickel processing) to add value to natural resources. | Early stages, potential for significant long-term benefits but faces challenges in terms of environmental sustainability and community impact. |

Investment and Foreign Direct Investment (FDI)

Indonesia’s investment landscape is a rollercoaster ride – thrilling highs and stomach-churning lows. Understanding the trends in foreign direct investment (FDI) is crucial to predicting the nation’s economic trajectory, and let’s just say, it’s not always a smooth ride. This section delves into the exciting (and sometimes slightly terrifying) world of Indonesian FDI.

FDI inflows into Indonesia have shown a fascinating pattern, a bit like a stock market chart after a particularly strong cup of kopi tubruk. While experiencing periods of robust growth, fueled by optimism and lucrative opportunities, it’s also faced dips influenced by global economic headwinds and domestic policy shifts. The picture isn’t entirely clear, but the story is certainly engaging.

Trends in Foreign Direct Investment (FDI)

Indonesia’s FDI journey is a tale of two halves (or maybe more, depending on how you slice it). While experiencing significant inflows in sectors like manufacturing and infrastructure, attracting significant investments from countries such as Singapore, Japan, and China, certain periods have seen a slowdown, often linked to global uncertainties. For instance, the global financial crisis of 2008 significantly impacted FDI inflows. However, subsequent recovery periods showcased Indonesia’s resilience, with a renewed surge in investment. This demonstrates that while external factors influence the flow, Indonesia’s inherent strengths continue to draw investment. The data shows a fluctuating yet ultimately upward trend, a testament to the nation’s long-term economic potential. Think of it as a determined climber scaling a mountain – some days are easier than others, but the summit remains the ultimate goal.

Key Factors Driving FDI Inflows and Outflows

Several factors act as both magnets and repellents for FDI. Positive factors include Indonesia’s large and growing consumer market, its strategic geographic location, and the government’s efforts to improve the investment climate. However, challenges remain. Bureaucracy, infrastructure gaps, and inconsistent regulatory environments can deter potential investors. Imagine it as a game of tug-of-war: the attractive market and government incentives pull investors in, while bureaucratic hurdles and infrastructure issues pull them back. The net result is a dynamic balance, constantly shifting depending on which side gains more traction. The recent improvements in ease of doing business rankings indicate a positive shift in the balance, signaling a more favorable investment climate.

Government Strategies to Attract More FDI

The Indonesian government employs a multi-pronged approach to lure foreign investors, much like a skilled angler using various lures to attract different fish. This includes streamlining regulations, improving infrastructure, and promoting specific sectors like tourism and renewable energy. Tax incentives, deregulation efforts, and the development of special economic zones are all part of the strategy. The government is actively promoting Indonesia as a reliable and attractive investment destination, emphasizing its potential for high returns and sustainable growth. These strategies, if successful, could transform Indonesia into an even more attractive investment hub in the region. The effectiveness of these measures will be crucial in determining the future trajectory of FDI inflows.

Potential Impact of FDI on Indonesia’s Economic Development

FDI’s potential impact on Indonesia is immense, potentially acting as a significant catalyst for economic growth. Increased investment can lead to job creation, technology transfer, and improved productivity. Furthermore, FDI can contribute to the diversification of the Indonesian economy, reducing its reliance on certain sectors and making it more resilient to external shocks. Think of it as adding diverse, strong muscles to an already robust body. However, it’s important to ensure that FDI benefits all segments of society and contributes to sustainable and inclusive development. This requires careful planning, effective regulation, and a commitment to equitable distribution of the benefits. The potential is undeniably high, but realizing it requires strategic management and careful consideration of potential downsides.

Infrastructure Development and its Economic Impact

Indonesia’s economic engine, much like a finely tuned Formula 1 car, needs top-notch infrastructure to truly roar. Without it, even the most promising sectors sputter and stall. Investing in infrastructure isn’t just about building roads and bridges; it’s about laying the foundation for sustainable, inclusive growth, transforming Indonesia into a regional powerhouse.

The role of infrastructure development in bolstering Indonesia’s economic growth is multifaceted and undeniably crucial. Improved infrastructure directly reduces logistical costs, enhances connectivity, and attracts both domestic and foreign investment. Think of it as the circulatory system of the Indonesian economy: efficient infrastructure ensures the smooth flow of goods, services, and capital. Without this efficient system, businesses struggle, consumers suffer, and the overall economic potential remains untapped. This isn’t just theoretical; studies consistently show a strong correlation between infrastructure quality and economic growth rates.

Government Plans for Infrastructure Investment

The Indonesian government has embarked on an ambitious infrastructure development program, aiming to modernize and expand the nation’s infrastructure network. This involves substantial investments across various sectors, including transportation (roads, railways, ports, airports), energy, telecommunications, and water management. The government’s strategy involves a mix of public funding, private sector partnerships (Public-Private Partnerships or PPPs), and foreign investment. For example, the ongoing development of the Trans-Java Toll Road is a prime example of a large-scale infrastructure project designed to improve connectivity and facilitate trade across the island. The government also actively seeks foreign investment through various incentives and streamlined regulatory processes, attracting billions of dollars in commitments.

Infrastructure Improvements and Investment Attraction

Improvements in infrastructure act as a powerful magnet for both domestic and foreign investment. Reduced transportation costs, improved logistics, and enhanced connectivity make Indonesia a more attractive destination for businesses. Consider a hypothetical scenario: a foreign manufacturer is considering setting up a factory in Indonesia. If the country boasts excellent port facilities, efficient road networks, and reliable energy supply, the manufacturer is more likely to choose Indonesia over a competitor with inferior infrastructure. This translates into job creation, increased tax revenue, and a positive impact on the balance of payments. The ease of doing business is directly correlated to the quality of infrastructure.

Impact of Improved Infrastructure on Logistics

Imagine a vibrant illustration: Before infrastructure improvements, a shipment of goods from Jakarta to Surabaya might take several days, involving multiple transfers and significant delays. This translates to higher transportation costs, increased risk of damage, and reduced product freshness (for perishable goods). The visual representation would show a congested port with long lines of trucks, overloaded containers, and inefficient cargo handling. After infrastructure upgrades – new, wider roads, improved port facilities, and a modernized railway system – the same shipment can be delivered much faster, with less damage and at a lower cost. The improved visual would depict a streamlined process, with automated cargo handling, efficient truck routes, and swift delivery to warehouses. This leads to reduced logistics costs, increased efficiency, and improved competitiveness for Indonesian businesses in both domestic and international markets. The overall effect is a significant boost to the country’s GDP.

Social and Demographic Factors

Indonesia’s burgeoning population and its increasingly urban landscape are not just interesting demographic trends; they’re powerful forces shaping the nation’s economic destiny. Understanding these shifts is crucial for navigating the opportunities and challenges ahead, much like predicting the next big wave in a particularly unpredictable surf competition.

Indonesia’s demographic dividend, a period where a large working-age population fuels economic growth, is a double-edged sword. While a large workforce can boost productivity and drive economic expansion, it also demands significant investment in education, healthcare, and infrastructure to fully capitalize on this potential. Imagine a massive, highly skilled surf team – the potential is enormous, but you need the right boards and training to win the competition.

Population Growth and Urbanization

Rapid population growth and urbanization are simultaneously creating both opportunities and challenges. The expanding urban centers, particularly Jakarta, present immense potential for economic activity, driving demand for housing, transportation, and services. However, this rapid growth also strains infrastructure, leading to congestion, pollution, and a higher demand for resources, much like a sudden influx of surfers overwhelming a small beach town. The government’s efforts to develop infrastructure outside of Java are vital to manage this growth effectively and prevent a further concentration of population and economic activity in already congested areas. For example, the development of new industrial zones in Kalimantan and Sulawesi aims to decentralize economic activity and provide employment opportunities outside of Java.

Income Inequality and Poverty

Income inequality and poverty significantly hinder Indonesia’s economic growth. A large portion of the population lacking access to education, healthcare, and economic opportunities limits overall productivity and consumer spending. This disparity also creates social instability, potentially hindering investment and economic development. Imagine a surf team where only a few members have access to high-quality equipment and training – the team’s overall performance suffers. Government initiatives like the Kartu Indonesia Pintar (KIP) program, aimed at providing education assistance to underprivileged children, represent attempts to address this inequality and unlock the potential of a wider segment of the population.

Impact of Changing Age Demographics on the Labor Force

Indonesia’s age structure is shifting, with a growing proportion of its population entering middle age. This demographic transition presents both challenges and opportunities for the labor force. A larger middle-aged population could lead to a decline in the overall labor force participation rate, potentially slowing economic growth if not managed properly. However, this same group represents a wealth of experience and expertise, which can be leveraged through policies that encourage entrepreneurship and facilitate knowledge transfer to younger generations. Think of it as having a team of experienced surfers mentoring younger talent – the key is effective communication and knowledge sharing. The government’s focus on skills development and lifelong learning programs is crucial to adapt to these changing demographics and maintain a productive and adaptable workforce. Furthermore, encouraging entrepreneurship among this age group can create new jobs and stimulate economic growth.

Conclusive Thoughts: Economic Trends Forecast Indonesia

So, there you have it – a whirlwind tour of Indonesia’s economic prospects. While predicting the future is about as reliable as a three-legged stool, we’ve attempted to illuminate the path ahead with a blend of data-driven analysis and good old-fashioned speculation. Remember, this isn’t your grandpa’s economics textbook; it’s a thrilling adventure into the heart of a dynamic and rapidly evolving economy. Stay tuned for further updates, and may your investments always be fruitful (and your laughter plentiful!).

FAQ Compilation

What are the biggest risks facing the Indonesian economy?

External shocks, like global recessions and commodity price fluctuations, pose significant risks. Internal challenges include infrastructure gaps and income inequality.

How does Indonesia compare to other ASEAN countries economically?

Indonesia is generally a strong performer in ASEAN, but its growth trajectory varies compared to neighbors like Singapore and Vietnam, influenced by different economic structures and development stages.

What role does tourism play in the Indonesian economy?

Tourism is a significant contributor to Indonesia’s GDP and employment, particularly in Bali and other popular destinations. However, its vulnerability to global events is a major concern.