Mastering the art of business budgeting is crucial for sustainable growth and profitability. This isn’t about mere number crunching; it’s about strategically allocating resources to achieve ambitious goals, navigating financial uncertainties, and ensuring your business thrives. From defining clear objectives to implementing robust monitoring systems, effective budgeting empowers businesses of all sizes to make informed decisions and optimize their financial performance.

This guide explores a comprehensive framework for effective budgeting, covering key aspects such as revenue forecasting, expense management, cash flow optimization, and the utilization of budgeting software. We’ll delve into practical strategies and tools to help you create a budget that aligns with your business objectives, provides valuable insights, and ultimately contributes to your bottom line.

Defining Business Budgeting Goals

Effective budgeting is the cornerstone of a successful business, regardless of size or industry. Setting clear and achievable goals is the first crucial step in this process. Without well-defined objectives, your budget becomes a mere collection of numbers, lacking direction and ultimately failing to contribute to your business’s overall success. This section will delve into the importance of establishing SMART budgeting goals and provide practical examples.

The SMART goal framework provides a structured approach to defining objectives that are Specific, Measurable, Achievable, Relevant, and Time-bound. This framework ensures that your budgeting goals are not vague aspirations but actionable targets that can be tracked and evaluated.

The SMART Goal Framework for Business Budgeting

The SMART framework ensures that your budgeting goals are clear, concise, and effectively guide your financial decisions. Each element plays a critical role:

- Specific: Your goal should be clearly defined, leaving no room for ambiguity. Instead of “improve profitability,” aim for “increase net profit margin by 15%.”

- Measurable: The goal must be quantifiable, allowing you to track progress and measure success. Use concrete metrics such as revenue, expenses, profit margins, or return on investment (ROI).

- Achievable: The goal should be realistic and attainable given your business’s current resources and market conditions. An overly ambitious goal can be demotivating and unproductive.

- Relevant: The goal should align with your overall business strategy and objectives. It should contribute directly to your company’s long-term success.

- Time-bound: Set a clear deadline for achieving your goal. This creates a sense of urgency and allows for timely adjustments if necessary. For example, “increase sales by 10% within the next fiscal year.”

Examples of SMART Budgeting Goals

Here are five examples of SMART budgeting goals for different business types:

- Startup: Secure $50,000 in seed funding within six months to cover initial operating expenses and product development.

- Established Corporation: Reduce operational expenses by 8% within the next fiscal year by streamlining processes and negotiating better supplier contracts. This could involve shifting to a more efficient cloud-based system, reducing energy consumption, or renegotiating contracts.

- Non-profit: Increase individual donations by 15% in the next quarter through a targeted social media campaign and improved donor engagement strategies. This could involve a new social media strategy, a revamped website, or improved email marketing.

- Small Retail Business: Increase average order value by 10% in the next three months by implementing a targeted upselling and cross-selling strategy. This might involve training staff to suggest complementary products or offering discounts on bundled items.

- E-commerce Business: Reduce customer acquisition cost (CAC) by 12% within the next year by optimizing pay-per-click (PPC) advertising campaigns and improving conversion rates. This could involve A/B testing different ad copy, improving website design, or optimizing landing pages.

Short-Term vs. Long-Term Budgeting Goals

| Feature | Short-Term Goals | Long-Term Goals |

|---|---|---|

| Time Horizon | Typically less than one year | Typically more than one year, often spanning several years |

| Focus | Operational efficiency, immediate revenue generation, specific project completion | Strategic growth, market expansion, major investments, long-term profitability |

| Metrics | Monthly sales, quarterly profits, project milestones | Annual revenue growth, market share, return on investment (ROI) over several years |

| Examples | Increase sales by 5% this quarter, reduce inventory costs by 10% this month. | Increase market share by 15% in five years, expand into a new geographic market in three years. |

Revenue Forecasting and Projection

Accurately forecasting revenue is crucial for effective budgeting. A well-constructed revenue forecast provides a realistic financial picture, enabling businesses to make informed decisions regarding resource allocation, investment strategies, and overall financial planning. It serves as the foundation for setting realistic financial goals and monitoring progress towards those goals. This section will explore various methods for forecasting revenue and provide a practical guide to creating a realistic forecast.

Accurate revenue forecasting involves a blend of quantitative analysis and qualitative judgment. It’s not simply about extrapolating past performance; it requires incorporating insights into market trends, competitive pressures, and anticipated changes in consumer behavior. The reliability of the forecast directly impacts the accuracy of the entire budget, making it a critical component of the budgeting process.

Methods for Revenue Forecasting

Several methods can be employed to forecast revenue, each with its own strengths and weaknesses. Choosing the most appropriate method depends on factors such as the nature of the business, the availability of data, and the desired level of accuracy. Combining different methods often yields a more robust and reliable forecast.

- Historical Data Analysis: This method involves analyzing past sales data to identify trends and patterns. For example, a business might examine sales figures over the past three to five years to identify seasonal variations or growth rates. This approach is relatively simple and requires minimal data collection, but it assumes that past trends will continue into the future, which may not always be the case.

- Market Research: This involves gathering information about the market, including market size, growth rate, and competitive landscape. This information can be used to estimate future sales potential. For example, a company launching a new product might conduct market research to determine the potential market size and expected market share. While providing valuable insights, market research can be expensive and time-consuming.

- Sales Projections: This involves using sales force estimates or expert opinions to forecast future sales. Sales representatives often have valuable insights into customer needs and buying patterns, making their projections a valuable input. This approach is subjective, and the accuracy of the forecast depends on the expertise and experience of the sales team.

Building a Realistic Revenue Forecast Using Spreadsheet Software

Creating a realistic revenue forecast using spreadsheet software like Microsoft Excel or Google Sheets is a straightforward process. The following steps provide a structured approach:

- Gather Data: Collect historical sales data, market research findings, and sales projections.

- Choose a Forecasting Method: Select the most appropriate forecasting method based on data availability and business needs. This might involve a combination of methods.

- Develop a Spreadsheet: Create a spreadsheet with columns for time periods (e.g., months or quarters), product categories, sales units, and revenue. Include rows for each product or service.

- Input Data: Enter historical sales data into the spreadsheet. Use formulas to calculate growth rates and other relevant metrics.

- Apply Forecasting Method: Apply the chosen forecasting method to project future sales. This might involve extrapolating historical trends, applying regression analysis, or incorporating sales projections.

- Review and Adjust: Review the forecast for reasonableness and make adjustments as needed based on market insights and expert judgment. Consider potential risks and opportunities.

- Document Assumptions: Clearly document the assumptions underlying the forecast, including market growth rates, pricing strategies, and competitive factors.

Comparison of Revenue Forecasting Models

Three common revenue forecasting models are:

| Model | Strengths | Weaknesses | Example |

|---|---|---|---|

| Simple Linear Regression | Easy to understand and implement; requires minimal data. | Assumes a linear relationship between variables, which may not always hold true; sensitive to outliers. | A company uses past sales data to project future sales assuming a constant growth rate. |

| Moving Average | Smooths out short-term fluctuations; relatively easy to calculate. | Lags behind recent trends; gives equal weight to all data points, regardless of their relevance. | A restaurant uses the average sales of the past three months to forecast sales for the next month. |

| Exponential Smoothing | Gives more weight to recent data points; adapts to changing trends. | Requires more sophisticated calculations; the choice of smoothing parameter can significantly impact the forecast. | An e-commerce company uses exponential smoothing to forecast sales, giving more weight to recent sales data to account for seasonality and promotional effects. |

Expense Management and Control

Effective expense management is crucial for a business’s financial health. Controlling expenses ensures profitability, allows for strategic investment, and provides a clearer picture of the business’s overall financial performance. Understanding where money is being spent and implementing strategies to optimize these expenditures is paramount to long-term success.

Categorizing Common Business Expenses

Businesses incur various expenses, which can be categorized for better analysis and control. Accurate categorization facilitates budgeting, forecasting, and identifying areas for potential cost savings. A clear understanding of expense types allows for more effective monitoring and informed decision-making.

- Cost of Goods Sold (COGS): This includes the direct costs associated with producing goods or services. Examples include raw materials, direct labor, and manufacturing overhead for a manufacturing company, or inventory costs for a retail business.

- Operating Expenses: These are the ongoing costs necessary to run the business. Examples include rent, utilities, salaries, marketing and advertising, insurance, and office supplies.

- Selling, General, and Administrative (SG&A) Expenses: These cover expenses related to sales, administration, and general business operations. Examples include sales commissions, marketing, legal fees, accounting fees, and executive salaries.

- Research and Development (R&D) Expenses: Costs incurred in developing new products or services or improving existing ones. Examples include salaries of R&D personnel, laboratory equipment, and materials.

- Interest Expenses: Costs associated with borrowing money. This includes interest paid on loans and credit lines.

Negotiating Better Deals with Vendors and Suppliers

Negotiating favorable terms with vendors and suppliers is a key strategy for reducing business expenses. Leveraging purchasing power, exploring alternative suppliers, and building strong relationships can significantly impact the bottom line.

Strategies for effective negotiation include:

- Volume Discounts: Negotiating lower prices per unit by committing to larger order quantities.

- Early Payment Discounts: Securing discounts for paying invoices promptly.

- Bundling Purchases: Combining multiple purchases to obtain a better overall price.

- Competitive Bidding: Soliciting bids from multiple vendors to compare pricing and terms.

- Building Strong Relationships: Cultivating long-term relationships with reliable vendors can lead to preferential pricing and terms.

Effective Expense Tracking and Management Tools

Utilizing appropriate tools significantly enhances the efficiency and accuracy of expense tracking and management. These tools provide real-time visibility into spending patterns, enabling proactive cost control and informed financial decisions.

Here are five effective expense tracking and management tools:

- Xero: A cloud-based accounting software offering features like invoice management, expense tracking, bank reconciliation, and financial reporting. It provides a comprehensive overview of financial health.

- QuickBooks Online: Another popular cloud-based accounting software with similar features to Xero, including expense tracking, invoicing, and financial reporting. It offers various plans to suit different business sizes.

- Zoho Expense: Specifically designed for expense management, this tool simplifies the process of capturing, tracking, and approving expenses. It integrates with other Zoho applications for a streamlined workflow.

- Expensify: A mobile-first expense reporting tool that automates receipt scanning and expense tracking. It simplifies the process of submitting expense reports and integrates with various accounting software.

- FreshBooks: A cloud-based accounting software primarily aimed at small businesses. It offers features like expense tracking, invoicing, time tracking, and client management. It focuses on ease of use and simplicity.

Cash Flow Management

Maintaining a healthy cash flow is paramount for business survival and growth. A positive cash flow indicates that your business is generating more cash than it’s spending, providing the financial flexibility to meet obligations, invest in opportunities, and weather economic downturns. Conversely, negative cash flow can quickly lead to insolvency, hindering expansion and potentially forcing closure.

Positive cash flow fuels business sustainability by providing the necessary resources for day-to-day operations, debt repayment, and strategic investments. It acts as a buffer against unexpected expenses and allows businesses to seize advantageous opportunities as they arise. A consistent positive cash flow instills confidence in investors, lenders, and suppliers, strengthening the overall financial health of the business.

Optimizing Accounts Receivable and Payable

Effective management of accounts receivable and payable is crucial for improving cash flow. Accounts receivable represents money owed to your business by customers, while accounts payable represents money your business owes to suppliers and other creditors. Optimizing both can significantly impact your cash position.

Improving accounts receivable involves implementing strategies to expedite payments from customers. This could include offering early payment discounts, using online payment systems, sending timely and clear invoices, and proactively following up on overdue payments. For example, a business could offer a 2% discount for payments received within 10 days, incentivizing quicker settlements.

Managing accounts payable involves strategically negotiating payment terms with suppliers to extend payment deadlines, thereby freeing up cash for other needs. This could include exploring options like longer payment periods or establishing strong relationships with vendors to negotiate favorable terms. For instance, negotiating a 30-day payment term instead of a 15-day term can provide valuable breathing room.

Cash Flow Projection Example

A cash flow projection is a forecast of your business’s expected cash inflows and outflows over a specific period. This allows you to anticipate potential cash shortages or surpluses and make proactive adjustments. A simple example using a monthly projection is shown below.

| Month | Cash Inflow | Cash Outflow | Net Cash Flow |

|---|---|---|---|

| January | $10,000 | $8,000 | $2,000 |

| February | $12,000 | $9,000 | $3,000 |

| March | $9,000 | $11,000 | -$2,000 |

| April | $15,000 | $10,000 | $5,000 |

This simple projection highlights the importance of monitoring cash flow on a regular basis. The negative cash flow in March indicates a potential need for adjustments, such as delaying non-essential expenses or securing a short-term loan. By regularly creating and reviewing cash flow projections, businesses can proactively manage their finances and avoid potential cash flow crises.

Budgeting Software and Tools

Effective budgeting relies heavily on efficient tools. Choosing the right budgeting software can significantly streamline the process, improving accuracy and freeing up valuable time for strategic decision-making. This section explores various software options and factors to consider when making your selection.

Choosing the right budgeting software is crucial for efficient financial management. Several options exist, each with its own strengths and weaknesses, catering to different business needs and sizes. Understanding the features, pricing models, and deployment options is vital for informed decision-making.

Comparison of Budgeting Software Options

This section provides a comparative analysis of three popular budgeting software options: Xero, QuickBooks Online, and Zoho Books. These are frequently used by small and medium-sized businesses due to their user-friendliness and comprehensive features.

| Feature | Xero | QuickBooks Online | Zoho Books |

|---|---|---|---|

| Pricing | Starts at $12 per month, varying based on features and users. | Starts at $25 per month, offering various plans with increasing capabilities. | Starts at $9 per month, providing scalable options for growing businesses. |

| Invoicing | Robust invoicing features, including customizable templates and automated reminders. | Comprehensive invoicing capabilities with various payment gateway integrations. | Simple and efficient invoicing with options for recurring invoices and online payments. |

| Expense Tracking | Allows for automated expense tracking via bank feeds and credit card integration. | Offers similar expense tracking capabilities, including receipt capture and categorization. | Provides expense tracking features, although integration with bank accounts may be less seamless. |

| Reporting | Provides a wide range of customizable reports, including profit and loss, balance sheet, and cash flow statements. | Offers a comprehensive suite of reports, allowing for in-depth financial analysis. | Provides basic reporting features, with options for customization but potentially less advanced than Xero or QuickBooks. |

| Customer Support | Offers various support channels, including online help, phone support, and email support. | Provides similar support options, with readily available online resources and customer service channels. | Offers support via email and online resources, potentially with less extensive phone support. |

Cloud-Based versus On-Premise Budgeting Software

The choice between cloud-based and on-premise budgeting software depends on various factors, including budget, technical expertise, and security concerns. Cloud-based software offers accessibility from anywhere with an internet connection, automatic updates, and reduced IT infrastructure costs. On-premise solutions, however, offer greater control over data security and customization but require significant upfront investment and ongoing maintenance.

- Cloud-Based Advantages: Accessibility, automatic updates, cost-effectiveness, scalability.

- Cloud-Based Disadvantages: Reliance on internet connectivity, potential security concerns, limited customization options.

- On-Premise Advantages: Greater control over data, enhanced security, higher customization potential.

- On-Premise Disadvantages: High initial investment, ongoing maintenance costs, limited accessibility.

Essential Features for Small Business Budgeting Software

Selecting budgeting software for a small business requires careful consideration of specific needs. Prioritizing essential features ensures the software effectively supports financial management.

- Intuitive Interface: Ease of use is crucial for efficient data entry and report generation. A user-friendly interface minimizes the learning curve and improves overall productivity.

- Expense Tracking Capabilities: Automated expense tracking, bank feeds, and receipt capture significantly reduce manual data entry and improve accuracy.

- Reporting and Analytics: Access to key financial reports (profit & loss, cash flow) is vital for informed decision-making. Customizable reporting allows for tailored analysis.

- Invoicing and Payment Processing: Streamlined invoicing and integrated payment processing features improve cash flow management and reduce administrative burden.

- Scalability: The software should be able to adapt to the business’s growth, accommodating increasing data volume and complexity.

- Security Features: Robust security measures protect sensitive financial data from unauthorized access and breaches. Consider data encryption and access controls.

- Integration with Other Tools: Compatibility with existing accounting software or CRM systems enhances efficiency and data consistency.

Budget Monitoring and Analysis

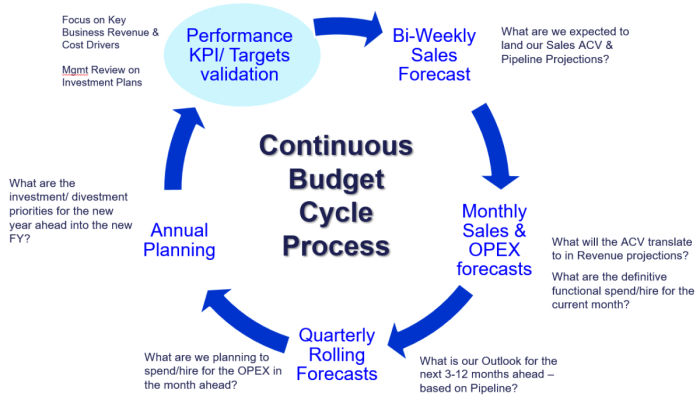

Effective budget monitoring and analysis are crucial for ensuring a business operates within its financial plan and achieves its objectives. Regularly reviewing budget performance against forecasts allows for proactive adjustments and prevents potential financial issues. This process involves comparing actual results with planned figures, identifying variances, and implementing corrective actions.

Budget monitoring involves the regular comparison of actual financial performance against the pre-determined budget. This comparison should be done frequently, ideally on a monthly or even weekly basis, depending on the business’s size and complexity. This allows for early detection of potential problems, enabling timely intervention before they escalate. The frequency of monitoring should be aligned with the business’s reporting cycle and the volatility of its revenue streams and expenses.

Budget Variance Analysis

Identifying and addressing budget variances is a critical step in effective budget management. Variances are the differences between budgeted and actual figures. Analyzing these variances helps pinpoint areas where the business is performing better or worse than anticipated. Understanding the *reasons* behind these variances is key to implementing corrective actions. For example, a positive variance in revenue could be due to increased sales, while a negative variance in expenses could be due to unforeseen costs. A thorough investigation into the root cause of each variance is essential for informed decision-making. This might involve reviewing sales data, analyzing expense reports, and consulting with relevant departments. For instance, if marketing expenses are exceeding the budget, an analysis might reveal that a specific campaign was less effective than anticipated, prompting a reassessment of future marketing strategies.

Budget Performance Dashboard

A visual representation of key budgeting metrics is invaluable for quick and easy comprehension of financial health. Imagine a dashboard displaying several key indicators. The top section could show overall budget performance, represented by a simple bar graph comparing actual revenue against budgeted revenue. A color-coded system could be implemented; green indicating performance above budget, yellow for near-budget performance, and red for under-budget performance. Below this, separate sections could focus on individual expense categories (e.g., marketing, salaries, rent). Each category would have its own mini-bar graph showing actual versus budgeted spending, alongside a percentage variance. A further section could display key cash flow metrics, such as cash on hand and projected cash flow for the next quarter, represented numerically with color-coded indicators (green for positive cash flow, red for negative). Finally, a summary table at the bottom could present a concise overview of key variances, categorized by type (e.g., favorable revenue variance, unfavorable expense variance), with brief explanations of the reasons behind the variances. This dashboard would provide a clear and comprehensive picture of the business’s financial performance, allowing for quick identification of areas requiring attention. For example, a consistently negative variance in a particular expense category might highlight the need for process improvements or cost-cutting measures.

Adapting Budgets to Changing Circumstances

Maintaining a rigid budget in the face of a dynamic business environment is rarely a successful strategy. Businesses must be agile and responsive, adapting their financial plans to accommodate unexpected challenges and opportunities. This requires proactive planning, regular monitoring, and a willingness to adjust course as needed.

Successful budget adaptation relies on a combination of foresight and flexibility. Foresight comes from anticipating potential disruptions – economic downturns, shifts in consumer demand, or increased competition – and developing contingency plans to mitigate their impact. Flexibility ensures that the budget can be easily adjusted when the unexpected occurs, preventing significant financial strain or missed opportunities.

Contingency Planning for Financial Risks

Effective contingency planning involves identifying potential risks, assessing their likelihood and potential impact, and developing specific actions to address them. For example, a company anticipating a potential economic slowdown might build a reserve fund to cover operating expenses during a period of reduced revenue. This reserve acts as a buffer, allowing the business to weather the storm without drastic cost-cutting measures. Another example might involve a business diversifying its product offerings to reduce reliance on a single revenue stream, thus mitigating the risk associated with declining demand for a specific product. A well-defined contingency plan should Artikel specific trigger points for activating different responses, ensuring a proactive and measured approach to managing risk.

Budget Review and Adjustment Processes

Regular budget reviews are crucial for identifying variances between planned and actual performance. These reviews should not be infrequent, annual exercises, but rather integrated into the business’s operational rhythm. Monthly or quarterly reviews allow for the early detection of potential problems, enabling timely corrective actions. The frequency of reviews depends on the business’s size, industry, and the volatility of its operating environment. A company in a rapidly changing market might require more frequent reviews than one operating in a stable industry. During these reviews, key performance indicators (KPIs) are compared to the budgeted figures. Any significant deviations should trigger a deeper investigation to identify the root causes and determine appropriate adjustments. This might involve cutting expenses in less critical areas, reallocating resources to higher-priority initiatives, or revising revenue projections based on updated market data.

Responding to Economic Downturns

An economic downturn can significantly impact a business’s revenue and profitability. Companies facing such challenges might need to implement cost-cutting measures, such as reducing discretionary spending, negotiating better terms with suppliers, or temporarily reducing staff. However, cost-cutting should be strategic, focusing on areas that have minimal impact on core business operations and long-term growth. It’s important to avoid drastic cuts that could harm the company’s reputation or long-term competitiveness. For instance, a restaurant might reduce its marketing budget during a downturn, but maintain its focus on food quality and customer service to retain its loyal customer base.

Adapting to Increased Competition

Increased competition can necessitate adjustments to pricing strategies, marketing efforts, and product development. Businesses might need to invest in innovation to differentiate their offerings or enhance their marketing campaigns to attract and retain customers. This may involve increasing marketing expenditure or investing in new technologies to improve efficiency and productivity. A software company, facing intense competition, might increase its R&D budget to develop new features and functionalities, while simultaneously streamlining its sales process to improve efficiency and reduce costs.

Last Point

By implementing the effective budgeting strategies Artikeld in this guide, businesses can transform their financial management from a reactive process to a proactive driver of growth. From setting SMART goals and forecasting revenue realistically to optimizing expenses and monitoring performance diligently, a well-structured budget is the cornerstone of financial stability and long-term success. Remember that regular review and adaptation are key to navigating the dynamic business landscape and ensuring your financial plan remains relevant and effective.

Essential FAQs

What is the difference between a budget and a forecast?

A budget is a plan for how you will spend your money, while a forecast is a prediction of future revenue and expenses. A budget is prescriptive (what you *will* do), while a forecast is predictive (what you *expect* to happen).

How often should I review my budget?

Ideally, you should review your budget monthly, or at least quarterly, to track progress, identify variances, and make necessary adjustments. More frequent reviews are beneficial for smaller businesses or those experiencing rapid growth or significant changes.

What if my actual expenses exceed my budgeted amounts?

Analyze the reasons for the variance. Were there unexpected costs? Did you underestimate certain expenses? Once you understand the cause, you can develop strategies to correct the issue, potentially by cutting back on non-essential spending or increasing revenue.