Life throws curveballs. Job loss, unexpected medical bills, home repairs – these events can derail even the most meticulously planned finances. Proactive emergency fund planning isn’t just about saving money; it’s about building a safety net that protects your financial well-being during times of crisis. This guide provides a comprehensive approach to establishing and maintaining a robust emergency fund, empowering you to navigate unforeseen challenges with confidence and stability.

We’ll explore various savings vehicles, budgeting strategies, and practical tips to help you build your emergency fund gradually, regardless of your income level. We’ll also discuss alternative funding options and the importance of replenishing your fund after a withdrawal, ensuring long-term financial security. By the end, you’ll have a clear roadmap to financial resilience.

Defining Emergency Fund Needs

Building a robust emergency fund is a cornerstone of financial security. It provides a safety net to navigate unexpected life events without derailing your long-term financial goals. Understanding your specific needs and building a fund accordingly is crucial. This section will Artikel how to determine the appropriate size and scope of your emergency fund.

Determining the ideal size of an emergency fund is highly personal and depends on several factors, including income, expenses, family structure, and risk tolerance. There’s no one-size-fits-all answer, but general guidelines can help you create a plan that suits your situation.

Emergency Fund Size Based on Income and Family Structure

A common recommendation is to aim for 3-6 months’ worth of essential living expenses. For individuals with stable, high-income jobs and few dependents, 3 months might suffice. However, families with children, fluctuating incomes, or significant debt may need 6 months or even more. For example, a single person earning $5,000 per month might aim for a $15,000 emergency fund (3 months), while a family with two children and a combined monthly income of $10,000 might aim for $60,000 (6 months). These figures are estimates; the actual amount will vary depending on individual spending habits and the cost of living in your area.

Types of Expenses Covered by an Emergency Fund

An emergency fund is designed to cushion against unexpected financial blows. The types of expenses it should cover include: job loss, medical emergencies, unexpected home repairs, and unexpected car repairs. Job loss necessitates covering living expenses until a new job is secured. Medical emergencies, such as hospitalizations or surgeries, can be incredibly costly, regardless of insurance coverage. Unexpected home repairs, like a burst pipe or roof damage, can also quickly deplete savings. Similarly, significant car repairs can lead to unexpected expenses. It’s important to consider the potential cost of each of these events in your calculations.

Calculating Personal Emergency Fund Needs

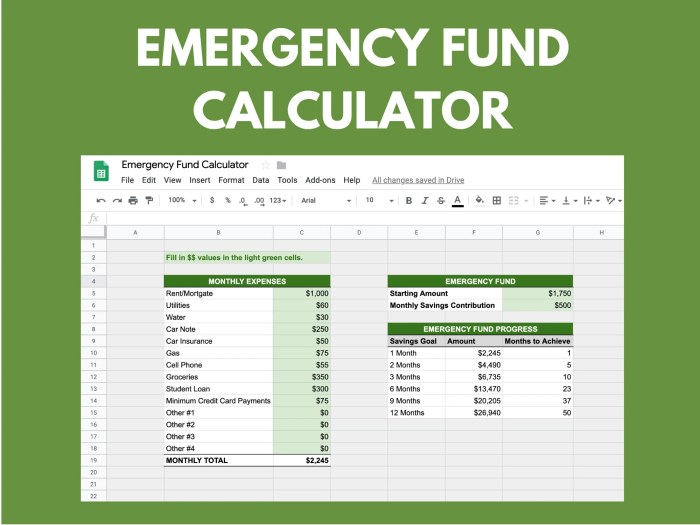

Calculating your personal emergency fund needs involves a step-by-step process.

- List Essential Monthly Expenses: Create a detailed list of all your essential monthly expenses. This includes housing (rent or mortgage), utilities, groceries, transportation, debt payments (minimum payments), and insurance premiums. Avoid including non-essential expenses like dining out or entertainment.

- Calculate Total Monthly Expenses: Add up all the essential monthly expenses from your list. This will give you your total monthly essential spending.

- Determine the Number of Months of Coverage: Decide how many months of expenses you want your emergency fund to cover. As mentioned earlier, 3-6 months is a common range, but you may need more depending on your circumstances.

- Calculate the Emergency Fund Target: Multiply your total monthly expenses by the number of months of coverage you selected. This is your emergency fund target amount.

- Regularly Review and Adjust: Your income, expenses, and life circumstances can change over time. Regularly review your emergency fund and adjust your target amount as needed. Annual reviews are recommended.

For example: If your total monthly essential expenses are $3,000 and you aim for 6 months of coverage, your emergency fund target would be $18,000 ($3,000 x 6).

Methods for Saving

Building your emergency fund requires a strategic approach to saving. Understanding the various savings vehicles available and implementing effective saving strategies are crucial for achieving your financial goals. This section will explore different methods for saving for emergencies, highlighting their advantages and disadvantages to help you make informed decisions.

High-Yield Savings Accounts, Money Market Accounts, and Certificates of Deposit (CDs): A Comparison

High-yield savings accounts, money market accounts, and certificates of deposit (CDs) each offer distinct features suitable for different financial needs and risk tolerances. High-yield savings accounts generally provide easy access to your funds with competitive interest rates, making them ideal for emergency funds. Money market accounts often offer slightly higher interest rates but may have minimum balance requirements and limited transaction numbers. CDs, on the other hand, provide higher interest rates but lock your money in for a specified term, making them less liquid. The best choice depends on your individual circumstances and priorities. For emergency funds, the priority is liquidity, so a high-yield savings account is often the most suitable option, balancing accessibility and earning potential.

Automating Savings Contributions

Automating your savings contributions is a powerful tool for consistently building your emergency fund. Most banks and financial institutions offer features that allow you to automatically transfer a predetermined amount from your checking account to your savings account on a regular schedule (e.g., weekly, bi-weekly, or monthly). This removes the need for manual transfers, reducing the risk of forgetting to save and ensuring consistent progress towards your goal. Setting up automatic transfers can be easily done through online banking platforms or by contacting your financial institution directly. For example, you could schedule a weekly transfer of $50 or a monthly transfer of $200, depending on your budget and savings goals. This consistent approach simplifies saving and helps you achieve your target emergency fund balance much faster.

Benefits and Drawbacks of a Dedicated Emergency Fund Account

Maintaining a separate savings account solely for emergencies offers several advantages. Firstly, it provides a clear visual representation of your progress and helps avoid accidentally spending emergency funds. Secondly, it simplifies budgeting and tracking of your emergency savings. The dedicated account ensures that the money is specifically earmarked for unexpected expenses, minimizing the temptation to use it for other purposes. However, a drawback is the potential for slightly lower interest rates compared to other savings options if you choose a basic savings account. This should be weighed against the benefits of the improved financial discipline and clarity it offers.

Sample Budget Incorporating Emergency Fund Savings

A sample budget could allocate 10-20% of monthly income towards the emergency fund. For instance, someone earning $5,000 per month might allocate $500-$1000 to their emergency fund. This amount can be adjusted based on individual financial situations and the desired emergency fund size (typically 3-6 months of living expenses).

| Income | Expense Category | Amount |

|---|---|---|

| $5000 | Housing | $1500 |

| Transportation | $500 | |

| Food | $700 | |

| Utilities | $300 | |

| Emergency Fund | $1000 | |

| Other Expenses | $1000 |

This is a simplified example; a real budget would require more detailed categorization of expenses. The key is to prioritize the emergency fund savings within the overall budget to ensure consistent progress towards financial security.

Building the Fund

Building an emergency fund doesn’t require a windfall; it’s achievable through consistent, even small, contributions over time. The key is establishing a realistic plan and sticking to it. This section Artikels a practical approach, focusing on gradual accumulation and providing strategies for maintaining momentum.

A successful emergency fund strategy begins with a manageable starting point. Don’t feel pressured to contribute a large sum initially. Even a small initial deposit, followed by regular contributions, will build momentum and instill a sense of accomplishment. This approach fosters consistency, a crucial element in long-term savings success.

A Gradual Accumulation Plan

Begin by determining your desired emergency fund target. A common recommendation is three to six months’ worth of essential living expenses. Once you’ve established this target, make an initial deposit, however small. Then, commit to regular contributions, perhaps weekly or monthly, based on your budget. Automate these contributions if possible; many banks and financial institutions offer automatic transfers from checking to savings accounts. As your income increases, gradually increase your contributions. This strategy ensures steady growth while avoiding financial strain. For example, if your target is $6000, start with $100, then add $50-$100 each month until you reach your goal.

Practical Tips for Maintaining Consistency

Maintaining consistency in your emergency fund savings plan can be challenging. Here are some practical tips to stay on track:

These strategies emphasize the importance of proactive planning and consistent effort in building a robust emergency fund.

- Automate your savings: Set up automatic transfers from your checking account to your savings account. This ensures consistent contributions without requiring constant manual effort.

- Track your progress: Regularly monitor your savings progress to stay motivated and identify any potential issues. Using a budgeting app or spreadsheet can be beneficial.

- Adjust your budget: If unexpected expenses arise, temporarily reduce your contributions to avoid overspending. Remember, it’s better to slightly delay your goal than to compromise your financial stability.

- Find additional income streams: Explore opportunities to increase your income, such as freelancing, part-time work, or selling unused items. This allows for faster accumulation of your emergency fund.

- Reward yourself (appropriately): Celebrate milestones by rewarding yourself with small, affordable treats. This helps maintain motivation without jeopardizing your savings progress.

Emergency Fund Build Time Comparison

The time it takes to build your emergency fund depends on your savings rate and initial deposit. The table below illustrates this relationship. These are illustrative examples and actual times may vary based on individual circumstances.

| Initial Deposit | Monthly Savings Rate | Time to Reach $3,000 | Time to Reach $6,000 |

|---|---|---|---|

| $0 | $250 | 12 months | 24 months |

| $0 | $500 | 6 months | 12 months |

| $500 | $250 | 10 months | 20 months |

| $1000 | $500 | 4 months | 8 months |

Accessing Funds

Accessing your emergency fund should be a straightforward process, designed to provide quick relief during unexpected financial hardship. The ease of access, however, depends heavily on the type of account you’ve chosen to house your savings. Understanding the nuances of each vehicle is crucial for effective emergency fund management.

The process of accessing funds varies depending on where you’ve saved them. High-yield savings accounts and checking accounts offer immediate access via ATM withdrawals, online transfers, or debit card purchases. Money market accounts might have slight limitations, potentially restricting the number of withdrawals per month, but generally provide easy access. Certificates of Deposit (CDs) present a different scenario; early withdrawals often incur penalties, negating the interest earned and potentially leaving you with less than you initially deposited. Therefore, CDs are generally not recommended as a primary emergency fund vehicle unless the funds are earmarked for a specific, longer-term emergency with a known timeline.

Accessing Funds from Different Account Types

High-yield savings accounts and checking accounts provide the most convenient access to emergency funds. These accounts typically allow for immediate withdrawals via ATM, online banking, or debit card transactions. Money market accounts may have some minor restrictions, such as a limited number of withdrawals per month, but generally offer relatively quick access. Conversely, accessing funds from a Certificate of Deposit (CD) before maturity usually results in penalties that reduce the overall return. Retirement accounts, such as 401(k)s and IRAs, should only be accessed as a last resort due to potential tax implications and penalties.

Consequences of Withdrawing from Retirement Accounts

Withdrawing from retirement accounts, such as 401(k)s and IRAs, before retirement age typically incurs significant penalties and taxes. For example, withdrawing from a traditional IRA before age 59 1/2 usually results in a 10% early withdrawal penalty, in addition to income taxes on the withdrawn amount. Roth IRAs generally avoid the early withdrawal penalty for qualified withdrawals, but these rules have specific conditions. These penalties can significantly reduce the amount of money available to address the emergency and could severely impact your long-term retirement savings. The financial repercussions can be substantial and should be carefully considered before taking such action. A qualified financial advisor can help determine if this is a viable option given your circumstances and the specific details of your retirement accounts.

Justified Scenarios for Emergency Fund Access

Accessing your emergency fund is justified in situations involving unforeseen and significant financial burdens. Examples include unexpected medical expenses (such as a serious illness or accident), major home repairs (like a burst pipe or roof damage), job loss, or unexpected travel costs due to a family emergency. These scenarios represent genuine financial crises that necessitate the use of emergency savings to prevent further hardship. The critical factor is that the expense is both unexpected and substantial enough to disrupt your normal financial stability. Smaller, predictable expenses, like routine car maintenance or planned holiday travel, should be budgeted for separately and not drawn from the emergency fund.

Maintaining the Fund

Building an emergency fund is only half the battle; maintaining it requires consistent effort and strategic planning. This section explores strategies for replenishing your fund after a withdrawal, potential obstacles you might encounter, and how to adjust its size to reflect your changing financial landscape.

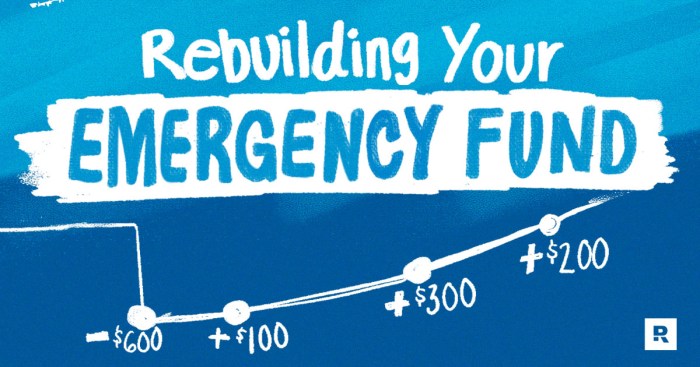

After tapping into your emergency fund, rebuilding it quickly is crucial to regain your financial security. A proactive approach ensures you’re prepared for future unforeseen events.

Replenishing the Emergency Fund

The speed at which you replenish your emergency fund depends largely on your income and spending habits. Prioritize rebuilding it as soon as possible, even if it means making small, incremental contributions. Consider increasing your savings rate temporarily, cutting back on non-essential expenses, or identifying additional income streams. For example, someone who withdrew $2,000 might aim to save $200 per month, rebuilding the fund within ten months. Alternatively, they could identify a side hustle to accelerate the process. Successful replenishment relies on disciplined saving and a clear plan.

Obstacles to Maintaining a Consistent Emergency Fund

Several factors can hinder your ability to maintain a consistent emergency fund. Unexpected expenses, such as car repairs or medical bills, can deplete your savings. Lifestyle inflation, where spending increases with income, can also prevent growth. Unforeseen job loss or reduced income can severely impact savings. Debt repayment obligations can also divert funds intended for the emergency fund. Effective budgeting and financial planning are key to overcoming these obstacles. For instance, creating a detailed budget can highlight areas where spending can be reduced, while actively seeking to pay down high-interest debt can free up more money for savings.

Adjusting Emergency Fund Size

The ideal size of your emergency fund isn’t static; it should evolve with your life circumstances. Significant life events, such as marriage, having children, buying a house, or changing jobs, will influence your emergency fund needs. For example, a single individual might need three to six months’ worth of expenses, while a family with children and a mortgage might aim for six to twelve months, or even more. Regularly reviewing your budget and financial situation, at least annually, will help determine if adjustments are needed. Consider factors such as your job security, existing debt, and the cost of living in your area. A periodic review ensures your emergency fund remains adequately sized to meet your changing needs.

Alternative Emergency Funding Options

While building a robust emergency fund is the ideal approach to handling unexpected financial setbacks, circumstances may arise where accessing alternative funding becomes necessary. This section explores some options, weighing their advantages and disadvantages to help you make informed decisions. It’s crucial to remember that these alternatives generally come with higher costs than simply drawing from your savings.

Credit cards, personal loans, and loans from family or friends represent common alternative sources of emergency funds. Each option carries a unique set of financial implications, impacting your budget and long-term financial health differently. Understanding these differences is key to making the best choice in a crisis.

Credit Card Use for Emergencies

Using a credit card for emergency expenses can provide immediate access to funds, but it’s vital to understand the associated costs. High interest rates can quickly escalate debt if not managed carefully. The cost depends heavily on your credit card’s Annual Percentage Rate (APR), the amount borrowed, and the repayment period.

For example, let’s say you charge $1,000 to a credit card with a 20% APR and make minimum payments. The minimum payment is typically around 2% of the balance. This means you’ll pay significantly more than the initial $1,000 over time due to accumulated interest. You might end up paying hundreds, even thousands, more in interest alone depending on how long it takes to repay the balance.

Calculating the cost: Total cost = Principal + (Principal x APR x Time)

To accurately calculate the total cost, you can use online credit card calculators or consult your credit card statement for details on interest charges. Always aim to pay off the balance as quickly as possible to minimize interest accumulation. Failing to do so can lead to a debt cycle that’s difficult to break.

Personal Loans as Emergency Funding

Personal loans offer a structured repayment plan with fixed monthly payments and a predetermined interest rate. This predictability can be advantageous compared to credit cards, offering a clearer understanding of the total cost. However, securing a personal loan often involves a credit check, and those with poor credit may face higher interest rates or loan denial.

Unlike credit cards where interest accrues daily, personal loans typically have a fixed interest rate and payment schedule. This provides greater transparency in terms of total repayment costs. However, the approval process may take longer than using a credit card, and there may be fees associated with loan origination or early repayment.

Family Loans for Emergency Situations

Borrowing from family or friends can sometimes be the most accessible option, potentially offering more favorable terms than traditional lenders. However, it’s crucial to approach such loans formally, documenting the agreement in writing to avoid misunderstandings and potential damage to personal relationships. Interest rates may be lower or nonexistent, but clear repayment terms are essential.

While interest may be waived or significantly lower than formal loans, failing to repay the loan on time can strain relationships. A written agreement outlining repayment terms, interest (if any), and a repayment schedule protects both the lender and borrower. This formalized approach ensures clarity and minimizes the potential for conflict.

Situations Requiring Alternative Funding

Situations requiring alternative funding can range from unexpected medical bills and car repairs to job loss and home emergencies. These situations often demand immediate financial intervention, making it difficult to rely solely on an emergency fund, particularly if the fund is insufficient or takes time to build.

For example, a sudden medical emergency requiring immediate surgery might necessitate using a credit card or taking out a personal loan before insurance reimbursements are processed. Similarly, a major home repair, like a burst pipe, might require quick action, potentially exceeding the funds available in an emergency fund.

Illustrative Scenarios

Understanding the impact of an emergency fund is best illustrated through real-world examples. These scenarios highlight the stark contrast between financial security provided by a well-funded emergency fund and the devastating consequences of lacking one.

Emergency Fund Prevents Financial Hardship

Imagine Sarah, a single mother of two, who diligently saved three months’ worth of living expenses in an emergency fund. Unexpectedly, her car’s transmission failed, requiring a costly repair estimated at $3,000. Without the emergency fund, Sarah would have faced a difficult choice: potentially taking out a high-interest loan, falling behind on rent and bills, or even foregoing the repair altogether, jeopardizing her ability to get to work and care for her children. Instead, she used her savings to cover the repair, avoiding significant financial stress and maintaining her financial stability. This allowed her to continue providing for her family without interruption.

Lack of Emergency Fund Leads to Significant Financial Difficulty

Conversely, consider Mark, a young professional who hadn’t established an emergency fund. He experienced an unexpected job loss, leaving him without income. Without savings, he quickly fell behind on rent, utilities, and credit card payments. The stress of mounting debt led to significant anxiety and impacted his ability to find a new job effectively. He was forced to rely on high-interest loans and deplete his retirement savings, setting back his long-term financial goals considerably. This scenario demonstrates how the absence of an emergency fund can create a domino effect of financial problems.

Job Loss and the Impact of an Emergency Fund

David, a graphic designer, lost his job due to company restructuring. He had proactively built an emergency fund equivalent to six months’ worth of living expenses. Upon losing his job, David didn’t panic. He immediately began actively searching for a new position, knowing he had a financial cushion. The six months of savings provided him with the time and peace of mind to focus on his job search without the added pressure of immediate financial worries. He used the time to update his portfolio, network effectively, and strategically apply for roles that aligned with his skills and career aspirations. This allowed him to secure a new, even better-paying job after four months, minimizing the negative impact of job loss and demonstrating the value of a well-planned emergency fund in navigating unforeseen circumstances.

Conclusion

Building an emergency fund is a journey, not a destination. It requires discipline, planning, and a commitment to securing your financial future. By understanding your needs, choosing appropriate savings vehicles, and developing a consistent savings plan, you can create a powerful buffer against life’s uncertainties. Remember, a well-funded emergency fund isn’t just about weathering financial storms; it’s about fostering peace of mind and empowering you to face the future with confidence. Start building your safety net today.

FAQ Overview

What if I already have some savings? How do I incorporate that into my emergency fund?

Great! Use your existing savings as a foundation. Assess the amount and determine how it contributes to your desired emergency fund target. Adjust your savings plan accordingly to reach your goal faster.

How often should I review and adjust my emergency fund?

At least annually, review your emergency fund in light of changes in your income, expenses, and life circumstances (marriage, children, job change). Adjust the target amount as needed to maintain adequate coverage.

What’s the difference between an emergency fund and a general savings account?

An emergency fund is specifically for unexpected expenses like job loss or medical bills. A general savings account can be used for various purposes, including vacations or larger purchases. Keeping them separate improves financial discipline.

Can I use my emergency fund for planned expenses like a down payment?

While tempting, it’s generally best to avoid using your emergency fund for planned expenses. Its purpose is for unexpected events. Instead, save for planned expenses separately.