Financial security is a cornerstone of a stable life, and a well-planned emergency fund is the bedrock of that security. Unexpected events, from job loss to medical emergencies, can quickly destabilize even the most carefully crafted budgets. This guide explores the crucial aspects of building and maintaining an emergency fund, providing practical strategies and insightful advice to help you navigate unforeseen circumstances with confidence and resilience. We will delve into determining the appropriate fund size, effective saving methods, and strategies for accessing and protecting your savings.

From understanding the differences between various savings accounts to developing a personalized budget and exploring additional income streams, we’ll equip you with the knowledge and tools to create a robust financial safety net. We’ll also examine the relationship between emergency funds and insurance, highlighting when each is most effective. By the end, you’ll have a comprehensive plan to safeguard your financial well-being.

Defining Emergency Funds

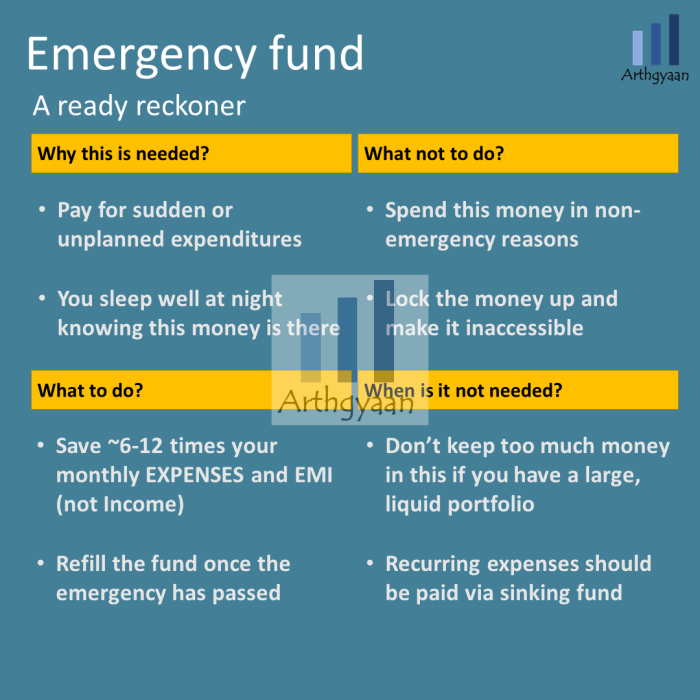

An emergency fund is a crucial component of a healthy financial plan, acting as a safety net for unexpected life events. It provides a readily accessible source of funds to cover unforeseen expenses, preventing you from resorting to high-interest debt or depleting your long-term savings. Building and maintaining an emergency fund is a proactive step towards financial security and peace of mind.

The primary difference between an emergency fund and other savings accounts lies in its intended purpose and accessibility. While other savings accounts might be earmarked for specific goals like a down payment on a house or a future vacation, an emergency fund is exclusively for unexpected and urgent expenses. This often necessitates keeping the funds in a highly liquid account, prioritizing ease of access over potentially higher interest rates. Furthermore, the amount saved in an emergency fund is generally considered a minimum level of financial security, rather than a target to be reached and then invested elsewhere.

Unexpected Expenses Covered by Emergency Funds

Emergency funds are designed to handle a wide array of unforeseen circumstances. Examples include unexpected medical bills (such as a high deductible or out-of-pocket expense), urgent home repairs (a burst pipe, roof damage), unexpected job loss, major car repairs or replacement, or even unexpected travel expenses due to family emergencies. These events often require immediate financial intervention, and having an emergency fund readily available can mitigate the stress and financial burden associated with them. For instance, a sudden job loss might necessitate covering several months of living expenses until a new job is secured. Similarly, a significant home repair could cost thousands of dollars, and without an emergency fund, it might force individuals into debt.

Comparison of Savings Accounts for Emergency Funds

Choosing the right savings account is crucial for maximizing accessibility and minimizing fees while still earning some interest. The following table compares several options:

| Account Type | Interest Rate | Accessibility | Fees |

|---|---|---|---|

| High-Yield Savings Account | Variable, generally higher than traditional savings | Easy access via ATM, online banking, debit card | May have monthly maintenance fees if balance falls below a certain threshold |

| Money Market Account (MMA) | Variable, often slightly higher than savings accounts | Easy access, often with check-writing capabilities | May have minimum balance requirements and fees for falling below them |

| Checking Account with High Interest | Lower interest rates than savings or MMAs | Immediate access via debit card, checks, online transfers | May have monthly maintenance fees or per-transaction fees |

| Savings Account | Generally low interest rates | Easy access via ATM, online banking | May have monthly maintenance fees if balance falls below a certain threshold |

Determining the Right Emergency Fund Size

Building a robust emergency fund is crucial for financial security. The ideal size, however, isn’t a one-size-fits-all number; it depends on various personal factors. Understanding these factors and employing suitable saving strategies are key to establishing a comfortable safety net.

Determining the appropriate size of your emergency fund involves considering several key aspects of your financial life. These factors influence how much money you need to comfortably weather unexpected events without jeopardizing your long-term financial goals.

Factors Influencing Emergency Fund Size

Several factors significantly influence the ideal size of your emergency fund. Income stability plays a crucial role; those with inconsistent income streams might need a larger fund to cover potential periods without earnings. Similarly, higher monthly expenses necessitate a larger emergency fund to cover those costs during an emergency. Family size also impacts the fund’s size, as larger families typically have higher living expenses. Existing debt burdens should also be factored in, as unexpected events can exacerbate financial difficulties if substantial debt is already present. For example, a family with a high mortgage and several credit card debts might require a larger emergency fund than a family with a paid-off home and minimal debt.

The 3-6 Month Expense Rule and Its Variations

A common guideline is to aim for an emergency fund covering 3-6 months’ worth of essential living expenses. This rule provides a buffer against job loss, unexpected medical bills, or home repairs. However, this is just a starting point. Individuals with higher levels of debt or less stable income might benefit from having 6-12 months’ worth of expenses saved. Conversely, those with stable, high-income jobs and minimal debt might feel comfortable with a smaller fund, perhaps 3 months’ worth of expenses. The 3-6 month rule should be seen as a flexible guideline rather than an absolute requirement.

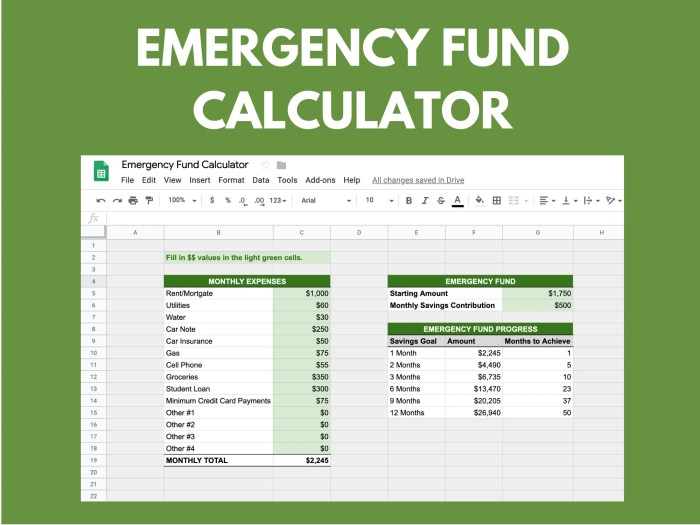

Scenario: Calculating Emergency Fund Amount

Let’s consider Sarah, a single professional with a stable job. Her monthly essential expenses (rent, utilities, groceries, transportation) total $2,500. Using the 3-month rule, her ideal emergency fund would be $2,500 x 3 = $7,500. If she opted for the 6-month rule, her target would be $2,500 x 6 = $15,000. However, Sarah also has $5,000 in credit card debt. Considering this debt, she might choose to aim for the higher $15,000 target to provide a more substantial safety net.

Emergency Fund Saving Strategies

Several strategies can be employed to build an emergency fund. A lump-sum approach involves saving a significant amount upfront, perhaps from a bonus or tax refund. This is a faster method but may not be feasible for everyone. Gradual saving involves consistently setting aside a smaller amount each month until the target is reached. This approach is more sustainable for individuals with limited funds. Another strategy is to automate savings by setting up automatic transfers from a checking account to a dedicated savings account. This ensures regular contributions without requiring constant manual effort. The best approach depends on individual financial circumstances and preferences.

Building Your Emergency Fund

Building an emergency fund is a crucial step towards financial security. It provides a safety net to handle unexpected expenses, preventing you from falling into debt or disrupting your financial goals. This section Artikels a practical approach to building your emergency fund, from creating a budget to exploring ways to increase your income.

Creating a Budget for Emergency Fund Contributions

Developing a realistic budget is the cornerstone of successful emergency fund building. Begin by tracking your income and expenses for a month or two to gain a clear picture of your financial situation. Categorize your expenses (housing, transportation, food, entertainment, etc.) to identify areas where you can reduce spending. Allocate a specific amount each month, even if it’s small, towards your emergency fund. Consider using budgeting apps or spreadsheets to simplify this process. For example, if your monthly income is $3000 and your expenses are $2500, allocating $100-$200 monthly towards your emergency fund is a feasible starting point. Remember to adjust this amount based on your individual financial situation and goals.

Saving Methods for Emergency Fund Growth

Several effective methods can help accelerate your emergency fund growth. Automatic transfers are highly recommended. Many banks and financial institutions allow you to set up automatic transfers from your checking account to your savings account on a regular schedule. This ensures consistent contributions without requiring manual effort. Budgeting apps can further streamline the process by tracking your spending, helping you identify areas for savings, and automatically allocating funds to your emergency fund. Mint, YNAB (You Need A Budget), and Personal Capital are popular examples of budgeting apps that offer this functionality. The convenience and automation of these methods greatly improve the likelihood of consistent savings.

Strategies for Increasing Income to Accelerate Emergency Fund Building

While budgeting and saving are crucial, increasing your income can significantly speed up the process of building your emergency fund. Consider taking on a part-time job, freelancing, or selling unused items. Exploring opportunities for professional development, such as taking online courses or pursuing certifications, can also lead to higher-paying jobs in the future. A side hustle, even if it only generates a few hundred dollars extra per month, can substantially reduce the time it takes to reach your emergency fund goal. For example, a part-time job earning $500 per month could significantly shorten the time needed to build a $3,000 emergency fund.

Potential Sources for Additional Income

Numerous avenues exist for generating additional income. These include:

- Part-time jobs (retail, customer service, food service)

- Freelancing (writing, graphic design, virtual assistance)

- Selling unused items (online marketplaces, consignment shops)

- Renting out assets (spare room, car)

- Participating in online surveys or gig work (driving, delivery services)

- Investing in dividend-paying stocks or bonds (requires initial capital)

The selection of the best option depends on individual skills, time availability, and risk tolerance. Carefully evaluate the potential income against the time and effort required before committing to any additional income strategy.

Accessing and Managing Your Emergency Fund

Having established your emergency fund, understanding how to access it efficiently and manage it effectively is crucial. This section Artikels the processes involved in accessing funds from different account types and provides best practices for tracking progress and maintaining a healthy emergency fund. Regular review and adjustments are also key to ensuring your plan remains relevant to your evolving financial circumstances.

Accessing funds from your emergency fund should be a straightforward process, designed for speed and ease during unexpected events. However, the specific method depends on the type of account you’ve chosen.

Accessing Funds from Different Account Types

The speed and ease of accessing your emergency fund varies depending on the account type. For example, a readily accessible checking account allows for immediate withdrawals, either via ATM, debit card, or online transfer. Savings accounts offer similar accessibility, though some institutions may have daily withdrawal limits. Money market accounts often provide check-writing capabilities, offering flexibility in accessing funds. Certificates of Deposit (CDs), however, typically involve penalties for early withdrawal, making them less suitable for emergency funds unless a portion is held in a more liquid account. Finally, high-yield savings accounts, while offering potentially better interest rates, generally allow for easy access via online banking or ATM cards.

Managing and Tracking Emergency Fund Progress

Effective management involves regular monitoring and tracking of your emergency fund’s growth. This ensures you’re on track to reach your savings goal and can help identify any potential issues early on.

Many budgeting apps and online banking platforms offer tools to track your savings progress automatically. Alternatively, you can maintain a simple spreadsheet or notebook to record deposits and withdrawals. Regularly reviewing your progress – perhaps monthly or quarterly – allows you to stay informed and adjust your saving strategy if needed. For example, if you fall behind schedule, you can explore ways to increase your savings rate or reduce expenses.

Reviewing and Adjusting the Emergency Fund Plan

Your life circumstances and financial goals evolve over time. Therefore, periodically reviewing and adjusting your emergency fund plan is essential. Major life events such as marriage, childbirth, job changes, or unexpected medical expenses may necessitate a reassessment of your savings target. Similarly, changes in your income or expenses may require adjustments to your savings rate. A yearly review, or more frequently if significant changes occur, is recommended.

Visual Representation of Emergency Fund Growth

A visual representation of your progress can be motivating and provide a clear picture of your savings journey. A simple chart or graph can effectively illustrate your fund’s growth over time.

| Month | Starting Balance | Deposits | Withdrawals | Ending Balance |

|---|---|---|---|---|

| January | $0 | $200 | $0 | $200 |

| February | $200 | $250 | $0 | $450 |

| March | $450 | $300 | $0 | $750 |

| April | $750 | $200 | $100 | $850 |

This table shows a hypothetical example of emergency fund growth over four months. You can easily adapt this format to track your own progress, updating it regularly. The visual representation helps you to see your progress clearly and stay motivated.

Protecting Your Emergency Fund

Building a robust emergency fund is only half the battle; protecting it from depletion or loss is equally crucial. Unexpected events and poor financial habits can easily erode the carefully saved funds intended for genuine emergencies. This section Artikels strategies to safeguard your emergency fund and maintain its integrity.

Threats to Emergency Funds

Several factors can threaten the stability of your emergency fund. Overspending, driven by impulsive purchases or lifestyle inflation, is a common culprit. Unexpected events such as medical emergencies, job loss, or home repairs can quickly deplete savings. Furthermore, the account type chosen to hold the emergency fund can introduce its own set of risks.

Strategies for Preventing Impulsive Spending

Protecting your emergency fund from impulsive spending requires a proactive approach. A budget meticulously tracking income and expenses is fundamental. This allows you to identify areas of overspending and adjust your habits accordingly. Additionally, automating transfers to your emergency fund each month ensures consistent growth without relying on willpower alone. Consider linking your emergency fund to a separate, less accessible account to create a psychological barrier against impulsive withdrawals. Setting clear financial goals and regularly reviewing your progress can further reinforce disciplined spending habits.

Risks Associated with Different Account Types

The choice of account for your emergency fund directly impacts its safety and accessibility. While high-yield savings accounts offer better returns, they may be subject to interest rate fluctuations. Checking accounts offer easy access but may provide minimal interest. Investing your emergency fund in the stock market, while potentially lucrative, introduces significant risk, particularly in the short term, making it unsuitable for emergency funds. Keeping funds in a readily accessible but low-interest-bearing account balances the need for liquidity with the risk of losing purchasing power due to inflation.

Safeguarding Against Fraud and Theft

Protecting your emergency fund from fraud and theft necessitates several precautionary measures. Regularly reviewing your account statements for any unauthorized transactions is paramount. Strong, unique passwords and multi-factor authentication provide an extra layer of security. Choosing reputable financial institutions with robust security measures is crucial. Be wary of phishing scams and avoid clicking on suspicious links or providing personal information over the phone or email. Consider using fraud alerts provided by your bank or credit card company. In case of suspected fraud, report it immediately to the relevant authorities and your financial institution.

Emergency Fund and Insurance

An emergency fund and insurance serve distinct but complementary roles in safeguarding your financial well-being. While both protect against unexpected expenses, they differ significantly in their approach and application. Understanding these differences is crucial for building a robust financial safety net. An emergency fund provides immediate access to funds for unforeseen events, while insurance acts as a longer-term safety net, often requiring a claim process and potentially involving deductibles and co-pays.

The Roles of Emergency Funds and Insurance in Financial Protection

Emergency funds and insurance are both vital components of a comprehensive financial plan, offering different levels and types of protection. An emergency fund acts as a first line of defense against unexpected expenses, providing readily available cash to cover immediate needs. Insurance, on the other hand, protects against larger, potentially catastrophic events, but typically involves a deductible and a claims process. This means there’s a delay between the event and receiving financial assistance. The ideal scenario utilizes both, creating a robust system where the emergency fund handles smaller, more frequent events, and insurance covers larger, less frequent ones.

Emergency Funds Complementing Different Insurance Types

An emergency fund effectively complements various types of insurance. For example, while health insurance covers significant medical expenses, it often leaves a gap for deductibles, co-pays, and other out-of-pocket costs. An emergency fund can readily cover these expenses, preventing debt accumulation. Similarly, auto insurance may not cover all repair costs, especially if the damage is minor but still expensive. An emergency fund can bridge this gap. Homeowners insurance protects against major property damage, but an emergency fund can cover smaller repairs or temporary living expenses while repairs are underway.

Situations Where an Emergency Fund Is More Effective Than Insurance

In certain situations, an emergency fund proves more effective than insurance. For instance, a sudden job loss might leave you without income for several months. While unemployment insurance exists, it typically doesn’t replace your entire income. An adequately sized emergency fund can provide a financial buffer during this period. Similarly, unexpected home repairs costing less than your insurance deductible are better handled by an emergency fund, avoiding the complexities and potential delays of an insurance claim. Consider the cost of replacing a broken washing machine. Insurance may not be worth the claim process, while your emergency fund readily covers it.

Scenarios Requiring Both an Emergency Fund and Insurance

Many situations necessitate both an emergency fund and insurance for comprehensive protection. A serious illness, for instance, might involve substantial medical bills, even with health insurance. The emergency fund can handle immediate expenses, such as deductibles and co-pays, while insurance covers the larger, long-term costs. Similarly, a major car accident might result in extensive repairs and medical expenses. The emergency fund can cover immediate needs, such as transportation and medical co-pays, while insurance handles the more significant repair and potential liability costs. A house fire requiring relocation illustrates a similar scenario, where an emergency fund provides temporary housing and living expenses while insurance covers rebuilding.

Illustrating Emergency Fund Scenarios

Visual representations can effectively demonstrate the value and impact of an emergency fund. Seeing the growth of savings over time, and the protection it offers during difficult financial situations, can be far more compelling than simply reading about it. Below are two visual examples illustrating different scenarios.

Emergency Fund Growth Over 12 Months

Imagine a bar graph. The horizontal axis represents the twelve months, from January to December. The vertical axis represents the amount of money saved, increasing incrementally. The bars show a steady, although not necessarily linear, upward trend. For example, the bar for January might be short, representing a small initial deposit. Subsequent months show progressively taller bars, reflecting consistent contributions. Perhaps there are slight variations in bar height, reflecting occasional months with slightly higher or lower contributions due to fluctuating income or unexpected expenses. By December, the bar is significantly taller, illustrating the substantial growth of the emergency fund over the year. This visual clearly demonstrates the power of consistent saving, even with small amounts, over time.

Impact of an Emergency Fund During Job Loss

This visual would be a line graph. The horizontal axis represents time, showing months before and after a job loss. The vertical axis represents the family’s financial resources. Before the job loss, the line would be relatively stable and high, representing the family’s financial security with their emergency fund. The point of job loss is marked by a sharp drop in the line, reflecting the immediate decrease in income. However, because of the existing emergency fund, the line doesn’t plummet to zero. Instead, it descends gradually, representing the family’s ability to utilize their savings to cover expenses while searching for new employment. The line remains above the zero line throughout this period. After securing new employment, the line begins to climb again, illustrating the family’s return to financial stability, thanks to the buffer provided by their emergency fund. This visual powerfully demonstrates how an emergency fund can mitigate the devastating financial impact of unexpected unemployment, providing a crucial lifeline during a challenging time. The contrast between a family without an emergency fund (whose line would sharply drop to zero and stay there for an extended period) and the family with a fund is stark and illustrative of its importance.

Conclusive Thoughts

Building an emergency fund is not merely about saving money; it’s about cultivating peace of mind and financial independence. By diligently following the strategies Artikeld in this guide, you can transform unexpected challenges into manageable situations. Remember, a robust emergency fund is not a luxury, but a vital component of responsible financial planning. Regularly review and adjust your plan as your circumstances evolve, ensuring your emergency fund remains a steadfast protector of your financial future.

Questions Often Asked

What if I already have some savings? How do I incorporate that into my emergency fund?

Assess your existing savings and determine how much aligns with your emergency fund goals. You can either directly allocate those funds or gradually transition them into your emergency fund account.

How often should I review my emergency fund plan?

At least annually, or more frequently if there are significant life changes (job change, marriage, children, etc.).

What if I experience a major unexpected expense that depletes my emergency fund?

Rebuild your emergency fund as quickly as possible, prioritizing it over other financial goals until it reaches the desired level. Consider adjusting your budget or exploring additional income sources.

Are there tax implications for emergency funds?

Generally, the interest earned on emergency funds in most savings accounts is taxable income. Consult a tax professional for personalized advice.