Life throws curveballs. Unexpected job loss, medical emergencies, car repairs – these unforeseen events can quickly derail even the most meticulous financial plans. An emergency fund acts as your financial safety net, providing a crucial buffer against these unexpected expenses and preventing you from spiraling into debt. This guide provides a comprehensive framework for establishing and managing an emergency fund tailored to your specific needs and circumstances, ensuring financial stability and peace of mind.

We will explore the various types of accounts suitable for emergency funds, methods for calculating the ideal fund size based on your individual risk profile and financial situation, and effective strategies for building and maintaining your fund. We’ll also cover practical tips for accessing your funds when needed and replenishing them afterward, ensuring you’re well-prepared for whatever life throws your way.

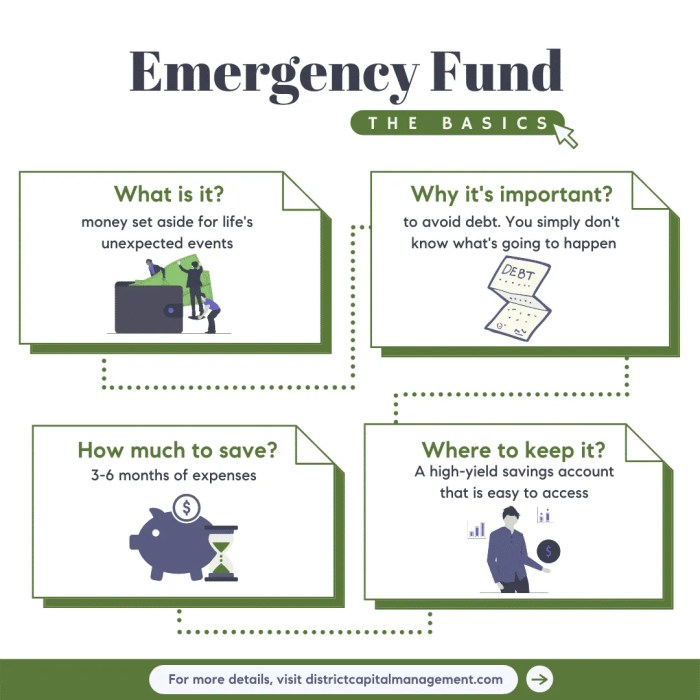

Defining Emergency Funds

An emergency fund is a crucial component of a healthy financial plan, acting as a safety net to protect you from unexpected financial hardships. It provides a readily accessible source of funds to cover unforeseen expenses, preventing you from going into debt or disrupting your long-term financial goals. Building a robust emergency fund is a proactive step towards financial security and peace of mind.

The primary purpose of an emergency fund is to provide a financial cushion against unexpected events that can significantly impact your finances. It’s designed to help you navigate difficult situations without resorting to high-interest debt, such as payday loans or credit card advances. Having this financial buffer allows you to address emergencies calmly and rationally, focusing on solutions rather than immediate panic.

Unexpected Expenses Covered by an Emergency Fund

Unexpected expenses can arise from various sources. Examples include unexpected medical bills (e.g., a sudden illness or injury requiring hospitalization), car repairs (e.g., a major engine failure or accident damage), home repairs (e.g., a burst pipe or roof damage), job loss (covering living expenses until new employment is secured), or natural disasters (e.g., damage to property from a flood or hurricane). These are just a few scenarios where a well-funded emergency account proves invaluable.

Emergency Funds versus Savings Accounts

While both emergency funds and savings accounts involve setting aside money, they serve distinct purposes. A savings account is a broader term encompassing various accounts used for various goals, such as saving for a down payment on a house, a vacation, or retirement. An emergency fund, on the other hand, is a *specific* type of savings account dedicated solely to covering unexpected expenses. The key difference lies in the intended use and accessibility: emergency funds should be easily accessible with minimal restrictions, while other savings accounts might have longer-term goals with potentially less immediate liquidity.

Comparison of Emergency Fund Account Types

The best type of emergency fund account depends on individual needs and priorities. Here’s a comparison of common options:

| Account Type | Interest Rate | Accessibility | Fees |

|---|---|---|---|

| High-Yield Savings Account | Generally higher than regular savings accounts | Easy access via ATM, debit card, online transfers | Typically low or nonexistent |

| Money Market Account (MMA) | Often higher than savings accounts, may fluctuate | Easy access, may have limited number of transactions per month | May have minimum balance requirements |

| Certificates of Deposit (CD) | Generally higher than savings and MMA, but with penalties for early withdrawal | Limited access, funds locked in for a specific term | Penalties for early withdrawal |

| Checking Account (with limited overdraft protection) | Typically low or no interest | Immediate access | Overdraft fees if balance falls below zero |

Determining Your Emergency Fund Needs

Building a robust emergency fund is crucial for financial security. Understanding how much you need and the factors influencing that amount is the first step towards achieving financial peace of mind. This section will guide you through calculating your personal emergency fund goal, considering various individual circumstances.

Methods for Calculating Emergency Fund Size

Several methods exist for determining the appropriate size of your emergency fund. A common approach is to aim for covering 3-6 months of essential living expenses. This provides a buffer for unexpected job loss, medical emergencies, or significant home repairs. Another approach focuses on a specific dollar amount, such as $1,000 or $5,000, which might be suitable for individuals with more stable income streams and lower living expenses. The best method depends on your individual circumstances and risk tolerance.

Factors Influencing Emergency Fund Size

The ideal size of your emergency fund is highly personalized and depends on several key factors. Income stability plays a crucial role; individuals with consistent, high incomes might feel comfortable with a smaller emergency fund relative to their expenses compared to those with fluctuating or lower incomes. Job security is another critical factor; those in industries with high turnover or those employed on a contract basis may require a larger emergency fund to bridge periods of unemployment. The number of dependents significantly impacts emergency fund needs. Supporting a family increases the financial burden of unexpected events, necessitating a larger safety net. Pre-existing health conditions or significant debt obligations can also necessitate a larger emergency fund. For example, a single individual with a stable job might feel comfortable with 3 months’ worth of expenses, while a family with young children and one parent’s fluctuating income might aim for 6 months or even more.

Risks of Insufficient Emergency Funds

An inadequate emergency fund exposes you to significant financial risks. Unexpected job loss can lead to difficulty meeting essential living expenses, potentially resulting in debt accumulation or foreclosure. Major medical emergencies can create crippling debt if you lack sufficient savings to cover medical bills and lost income. Unforeseen home repairs, such as a burst pipe or roof damage, can quickly drain your resources if you are unprepared. These situations can cause significant stress and negatively impact your overall financial well-being. For instance, consider a family facing a $5,000 unexpected medical bill; without an adequate emergency fund, they might resort to high-interest credit cards, further exacerbating their financial situation.

Step-by-Step Guide to Calculating Your Emergency Fund Goal

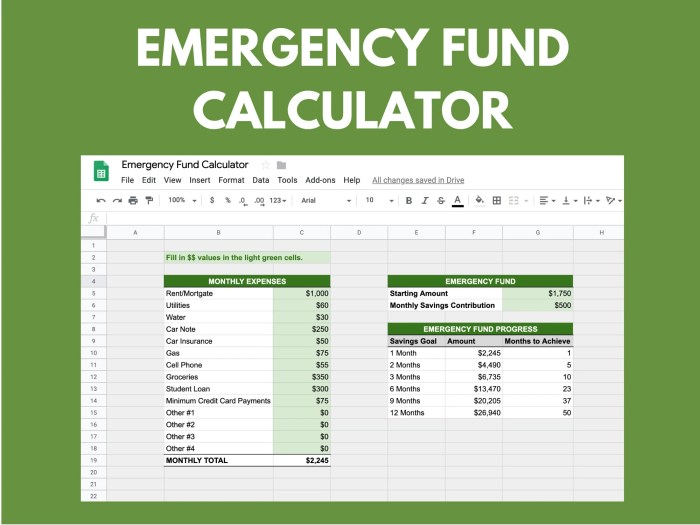

Calculating your personal emergency fund goal involves a structured approach.

- List Essential Expenses: Document all essential monthly expenses, including housing, utilities, food, transportation, debt payments (minimum payments), and healthcare premiums.

- Calculate Total Monthly Expenses: Sum up all your essential monthly expenses from step 1.

- Determine Desired Emergency Fund Coverage: Decide on the number of months of expenses you want to cover (3-6 months is a common range).

- Calculate Emergency Fund Goal: Multiply your total monthly expenses by the number of months of coverage you selected (e.g., $2,000/month x 6 months = $12,000).

- Adjust for Additional Factors: Consider any additional factors, such as potential medical expenses, job insecurity, or dependents, and adjust your goal accordingly. This might involve increasing the number of months of coverage or adding a buffer amount.

Example: If your monthly expenses are $3,000 and you aim for 6 months of coverage, your emergency fund goal is $18,000. If you have a pre-existing health condition, you might consider increasing this goal to 9 or 12 months.

Building Your Emergency Fund

Building a robust emergency fund is a crucial step towards financial security. This involves strategically saving money, effectively budgeting, and potentially exploring additional income streams to accelerate the process. Consistent effort and a well-defined plan are key to achieving your savings goal.

Strategies for Effective Saving

Effective saving requires a multi-pronged approach. First, identify areas where you can reduce unnecessary spending. This might involve cutting back on subscriptions, eating out less frequently, or finding cheaper alternatives for everyday expenses. Second, automate your savings. Setting up automatic transfers from your checking account to your savings account, even small amounts regularly, ensures consistent contributions without requiring constant manual effort. This creates a “pay yourself first” mentality. Finally, leverage the power of compounding interest by keeping your savings in a high-yield savings account or similar interest-bearing account. Even small interest gains accumulate over time, helping you reach your goal faster.

Budgeting Techniques for Emergency Fund Allocation

Budgeting is essential for allocating funds towards your emergency fund. The 50/30/20 budget rule is a popular method. This involves allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Prioritizing the 20% for your emergency fund is crucial. Alternatively, the zero-based budget method involves meticulously tracking every dollar of income and assigning it a specific purpose, ensuring that all income is accounted for, leaving no room for unplanned spending. This allows for precise allocation towards your emergency fund goal. A combination of these approaches, tailored to your individual circumstances, can be highly effective.

Resources for Finding Extra Income

Supplementing your income can significantly accelerate your emergency fund building. Consider freelancing or gig work using platforms that connect individuals with short-term projects. Selling unused items online or through consignment shops can generate extra cash. Part-time employment, even for a few hours a week, can provide a consistent income stream. Renting out a spare room or parking space can also contribute significantly. Finally, exploring opportunities for passive income, such as investing in dividend-paying stocks (after sufficient research and understanding of the risk involved), can provide a steady stream of income over time.

Tracking Progress Towards Your Emergency Fund Goal

Regularly monitoring your progress is vital. Using a spreadsheet or a budgeting app allows you to visualize your savings journey and stay motivated. A simple spreadsheet can track your initial goal, monthly contributions, interest earned, and the remaining amount needed. Many budgeting apps offer features to categorize expenses, track income, and automatically calculate your progress towards savings goals. Regularly reviewing your progress—weekly or monthly—helps you stay on track and make adjustments as needed. For example, if you set a goal of $10,000 and contribute $500 monthly, you can easily track the remaining balance on a spreadsheet. A visual representation of your progress can be motivating and keeps you accountable.

Managing Your Emergency Fund

Maintaining your emergency fund isn’t a one-time task; it’s an ongoing process requiring consistent attention and strategic management. Proper management ensures your financial safety net remains effective when unexpected events occur. This section details key strategies for keeping your emergency fund readily available and growing over time.

Accessibility of Emergency Funds

Keeping your emergency fund readily accessible is paramount. The entire purpose of an emergency fund is to provide quick access to funds during unforeseen circumstances, such as job loss, medical emergencies, or home repairs. Therefore, tying up your emergency fund in investments that are difficult to liquidate quickly defeats its purpose. Ideally, your emergency fund should be held in a high-yield savings account, money market account, or a readily accessible certificate of deposit (CD) that allows for early withdrawal without significant penalties. The ease of access outweighs any potential for slightly higher returns from more complex investments.

Risks of Investing Emergency Funds in Volatile Assets

Investing your emergency fund in volatile assets like stocks, bonds, or cryptocurrency carries significant risk. While these assets can offer higher returns over the long term, their values fluctuate significantly, potentially leaving you with less money available when you need it most. For example, a sudden market downturn could drastically reduce the value of your investment, leaving you short of the funds necessary to cover an unexpected expense. The unpredictability of these markets makes them unsuitable for funds intended for immediate and reliable access. The primary goal of an emergency fund is liquidity, not maximizing returns.

Strategies for Maintaining the Emergency Fund

Maintaining your emergency fund over time requires a proactive approach. Regular contributions are key. Consider automating regular transfers from your checking account to your emergency fund savings account. Even small, consistent contributions add up over time. Additionally, review your budget regularly to identify areas where you can save more and allocate those savings to your emergency fund. Consider setting a goal to increase your emergency fund balance by a specific percentage each year. For instance, aiming to increase your fund by 10% annually ensures it keeps pace with inflation and your growing needs.

Regular Review and Adjustment Checklist

Regularly reviewing and adjusting your emergency fund plan is crucial to ensure it remains effective. This checklist can help:

- Review your emergency fund balance: Check your balance monthly to ensure it’s on track.

- Assess your current expenses: Update your budget to reflect any changes in your spending habits.

- Re-evaluate your emergency fund goal: Consider if your current goal still aligns with your needs and circumstances (e.g., job change, family growth).

- Review your savings rate: Determine if you’re saving enough to reach your goal within a reasonable timeframe.

- Check for better savings options: Explore options with higher interest rates without compromising accessibility.

- Document any changes: Keep a record of all adjustments made to your emergency fund plan.

By following these steps, you can ensure your emergency fund remains a reliable safety net, providing financial security during unexpected life events.

Accessing Your Emergency Fund

Accessing your emergency fund should be a straightforward process, designed for speed and efficiency during times of unexpected financial hardship. The goal is to minimize stress and maximize the fund’s effectiveness in resolving your immediate crisis. Understanding when and how to access these funds is crucial for their successful application.

Accessing your emergency fund is a crucial step in navigating financial emergencies. Several scenarios justify utilizing these funds, and a clear understanding of these scenarios, along with a plan for accessing the money quickly, is vital. Improper management can lead to depleting the fund, thus negating its protective function.

Scenarios Warranting Emergency Fund Use

Unexpected job loss, significant medical expenses, major home repairs, and unforeseen car troubles are common reasons to access emergency funds. These situations often require immediate financial intervention, exceeding the capacity of regular budgeting. For example, a sudden job loss might necessitate covering several months of living expenses until new employment is secured. Similarly, a serious medical emergency, even with health insurance, could result in substantial out-of-pocket costs. A burst pipe requiring extensive plumbing repairs or a major car accident needing immediate repairs are further examples of situations demanding quick access to readily available funds.

Methods for Quick and Efficient Fund Access

The speed and ease of accessing your emergency fund directly impacts its effectiveness. Ideally, the chosen method should prioritize swift access without incurring significant fees or penalties. Options include direct transfer from a high-yield savings account, readily accessible checking account, or a money market account. Credit cards, while offering quick access, should be used as a last resort due to the high interest rates. Avoid loans whenever possible, as they introduce additional debt that can compound financial stress. Consider establishing a dedicated emergency fund debit card linked to your savings account for even faster access.

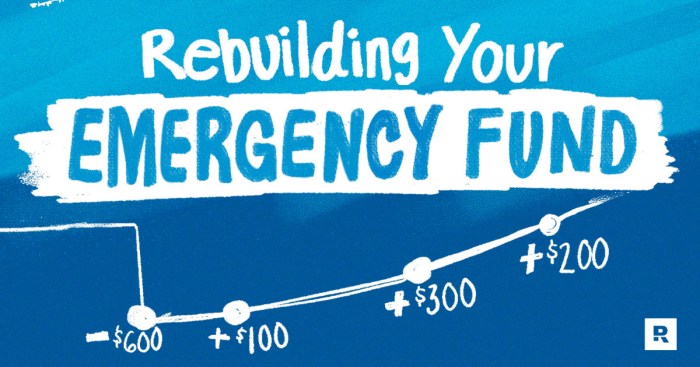

Implications of Depleting Your Emergency Fund

While emergency funds are meant to be used, depleting them completely without a plan for replenishment leaves you vulnerable to future unexpected events. This can lead to a cycle of debt and financial instability, negating the purpose of having an emergency fund in the first place. It is crucial to immediately begin rebuilding your emergency fund after using it, even if it’s in small increments. Failing to do so increases your financial risk significantly, making you more susceptible to severe financial hardship from subsequent unexpected events. Consider setting a realistic rebuilding timeline, factoring in your income and expenses, to ensure the fund is adequately replenished.

Decision-Making Process for Using Emergency Funds

This flowchart illustrates the decision-making process:

[Imagine a flowchart here. The flowchart would start with a “Financial Emergency?” Yes/No decision point. A “Yes” branch would lead to “Is the emergency covered by insurance or other resources?” Yes/No. A “No” would lead to “Access Emergency Funds.” A “Yes” would lead to “Explore alternative solutions.” From “Access Emergency Funds,” there would be a branch to “Replenish Emergency Fund.” The “Explore alternative solutions” branch could lead to “Seek financial assistance” or “Re-evaluate budget.”]

Replenishing Your Emergency Fund

Maintaining a robust emergency fund is a cornerstone of sound financial planning. After utilizing your emergency fund, replenishing it swiftly is crucial to ensure you’re prepared for future unforeseen circumstances. Failing to rebuild your emergency fund leaves you vulnerable and potentially facing significant financial hardship if another emergency arises.

Replenishing your emergency fund after a withdrawal involves strategically allocating funds to rebuild your savings to the desired level. The speed of this process depends on several factors, including the size of the initial withdrawal, your income, existing debts, and lifestyle choices. A consistent and proactive approach is key to ensuring your financial security.

Strategies for Quickly Rebuilding the Emergency Fund

Rebuilding your emergency fund after an emergency requires a focused approach. Prioritize this goal, potentially adjusting your budget and lifestyle temporarily to accelerate the process. Consider increasing your savings rate, identifying areas where you can cut back on spending, or exploring additional income streams. For instance, taking on a part-time job, selling unused items, or freelancing can provide extra funds to quickly replenish your emergency savings. Tracking your progress regularly will maintain motivation and highlight your success.

Lifestyle Changes and Replenishment Speed

Lifestyle changes significantly influence the speed of emergency fund replenishment. Reducing discretionary spending, such as dining out or entertainment, can free up substantial funds for savings. Similarly, adopting cost-saving measures like switching to a cheaper phone plan or reducing energy consumption can contribute to faster rebuilding. Conversely, lifestyle inflation – increasing spending as income rises – can hinder the process. Maintaining mindful spending habits is crucial for effective and timely replenishment. For example, a family that consistently eats out might find that preparing meals at home significantly increases the amount they can allocate to their emergency fund each month.

Tips for Preventing Future Emergencies

Proactive measures can significantly reduce the likelihood of future emergencies and the need for frequent emergency fund withdrawals. Regular maintenance and preventative care for your vehicle and home can help avoid costly repairs. Building a strong credit score can help secure better interest rates on loans, reducing financial strain in unexpected situations. Furthermore, having adequate insurance coverage, including health, home, and auto insurance, can mitigate the financial impact of various events. Regularly reviewing and updating your insurance policies ensures you have the right coverage for your needs. Finally, creating a detailed budget and tracking your spending helps you identify potential areas of overspending and enables better financial planning. This proactive approach minimizes financial surprises and helps maintain a healthy emergency fund.

Illustrative Examples

Illustrative examples can help solidify understanding of emergency fund principles and their practical application in diverse financial situations. These examples demonstrate both the process of building an emergency fund from limited resources and the crucial role an emergency fund plays in mitigating financial hardship.

Building an Emergency Fund on a Low Income

Maria, a single mother working part-time earning $2000 per month, aimed to build a three-month emergency fund. After accounting for rent, utilities, and groceries, she had approximately $500 left each month. She decided to automate a $100 monthly transfer into a high-yield savings account. It took her five months to save the first $500, but by consistently saving $100 each month, she steadily increased her emergency fund. After a year, she had saved $1200, surpassing her initial goal. She continued to save, eventually reaching her target of a three-month emergency fund. While it took time and discipline, her consistent contributions, even with limited funds, allowed her to build a crucial safety net.

Using an Emergency Fund for Unexpected Expenses

John, a freelance graphic designer, had diligently saved six months’ worth of living expenses in his emergency fund. Unexpectedly, his car’s engine failed, requiring a $3,000 repair. Instead of going into debt or sacrificing essential expenses, John was able to cover the repair cost entirely from his emergency fund. This prevented a significant financial setback and allowed him to maintain his financial stability without disrupting his work or lifestyle. The peace of mind provided by having readily available funds proved invaluable during a stressful situation.

Benefits of an Emergency Fund: Scenario 1 – Job Loss

A sudden job loss can create significant financial anxiety. However, individuals with a robust emergency fund can weather such storms more effectively. They can use the saved funds to cover living expenses while searching for a new job, avoiding the stress and potential debt associated with unemployment. This allows them to focus on their job search rather than immediate financial worries.

Benefits of an Emergency Fund: Scenario 2 – Unexpected Medical Bills

High medical bills are a common source of financial distress. A well-funded emergency fund can significantly alleviate the burden of unexpected medical expenses, preventing the accumulation of debt from costly treatments or procedures. This allows individuals to prioritize their health without compromising their financial well-being.

Benefits of an Emergency Fund: Scenario 3 – Home Repair

Unforeseen home repairs, such as a leaky roof or malfunctioning appliance, can lead to significant expenses. Having an emergency fund allows individuals to address these issues promptly and prevent minor problems from escalating into larger, more costly ones. This minimizes disruption to daily life and avoids the need for high-interest loans.

Final Thoughts

Building and maintaining an emergency fund is not just about saving money; it’s about securing your financial future and fostering a sense of preparedness. By following the strategies Artikeld in this guide, you’ll gain the confidence to navigate unexpected challenges without compromising your financial stability. Remember, a well-planned emergency fund is an investment in your peace of mind and a testament to your proactive approach to financial well-being. Take control of your financial future – start planning your emergency fund today.

FAQ

What is the ideal amount to save in my emergency fund?

Generally, aiming for 3-6 months’ worth of living expenses is recommended. However, the ideal amount depends on individual circumstances, such as job security and family responsibilities.

Where should I keep my emergency fund?

High-yield savings accounts or money market accounts offer accessibility and a slightly better return than standard savings accounts. Avoid investments that carry risk, as emergency funds need to be readily available.

What if I experience multiple emergencies in a short time?

Having a larger emergency fund acts as a buffer against this. If your fund is depleted, prioritize essential expenses, seek financial assistance if needed, and aggressively rebuild your fund once the immediate crisis subsides.

Can I use my emergency fund for non-emergencies?

It’s strongly discouraged. Using your emergency fund for non-emergencies defeats its purpose and leaves you vulnerable to future unexpected expenses. Consider alternative solutions for non-essential spending.