Emergency Fund Planning Guide: Let’s face it, life throws curveballs. One minute you’re serenely sipping your latte, the next you’re staring down a broken washing machine and a rapidly dwindling bank account. This guide isn’t just about saving money; it’s about building a financial fortress against the inevitable unexpected expenses that life throws at us. We’ll navigate the sometimes-murky waters of budgeting, savings accounts, and responsible spending, ensuring you’re prepared for whatever financial kraken decides to attack your fiscal tranquility.

We’ll explore various budgeting methods – from the ever-popular 50/30/20 rule to the slightly more intense zero-based budgeting – and help you choose the approach that best suits your unique financial personality. We’ll also delve into the world of savings vehicles, comparing high-yield accounts, money market accounts, and other options to find the perfect home for your emergency fund. Think of this guide as your personal financial sherpa, guiding you to the summit of financial security – one well-planned dollar at a time.

Defining Emergency Fund Needs

Let’s face it, life throws curveballs. And sometimes, those curveballs are less “charmingly unexpected” and more “financially devastating.” That’s where the glorious emergency fund swoops in to save the day (and your credit score). Think of it as your financial superhero cape, ready to deploy when unexpected expenses rear their ugly heads.

An emergency fund is a crucial safety net, a financial cushion designed to absorb the shocks of unforeseen circumstances. Without one, even a minor hiccup can send your finances into a tailspin, potentially leading to debt accumulation and significant stress. We’re talking about the kind of stress that makes you question your life choices while staring blankly at a rapidly depleting bank account. Avoid that. Seriously.

Unexpected Expenses Covered by an Emergency Fund

Unexpected expenses can range from the mildly inconvenient to the downright catastrophic. Examples include unexpected medical bills (because who *actually* enjoys a surprise trip to the emergency room?), car repairs (that mysteriously always seem to happen right before a long road trip), home repairs (a leaky roof is never a good time), job loss (the dreaded “we need to let you go” conversation), or even unexpected travel expenses (that last-minute flight home to see a sick relative). The point is, life is unpredictable, and an emergency fund helps you navigate those unpredictable moments without completely derailing your financial well-being.

Determining the Appropriate Emergency Fund Size

The ideal size of your emergency fund depends on several factors, most importantly your individual financial circumstances. Consider your monthly expenses, income stability, existing debt, and personal risk tolerance. Someone with a stable, high-income job and minimal debt might feel comfortable with a smaller fund, while someone with fluctuating income or significant debt might require a larger cushion. Think of it like this: the more precarious your financial situation, the thicker your safety net should be. This isn’t a one-size-fits-all situation; it’s a personalized financial strategy.

Emergency Fund Strategies Comparison

Below is a table comparing different emergency fund strategies. Remember, this is just a guideline; your specific needs may vary. The goal is to find a balance between security and practicality. Don’t feel pressured to hit a specific number if it’s financially unfeasible; progress is key!

| Strategy | Fund Size | Pros | Cons |

|---|---|---|---|

| 3 Months of Expenses | Enough to cover 3 months of essential living expenses | Provides a solid foundation, relatively achievable for many | May not be sufficient for major emergencies or prolonged unemployment |

| 6 Months of Expenses | Covers 6 months of essential living expenses | Offers greater security, suitable for those with less stable income or higher risk tolerance | Requires significant savings, may take longer to achieve |

| Specific Dollar Amount | A fixed dollar amount (e.g., $10,000, $20,000) | Provides a clear target, useful for those who prefer a numerical goal | May not be sufficient for everyone, requires careful consideration of individual expenses |

Creating a Budget for Emergency Fund Savings

Ah, budgeting. The word itself conjures images of spreadsheets, meticulous calculations, and the faint scent of impending doom… or maybe that’s just me. But fear not, dear reader! Creating a budget for your emergency fund doesn’t have to be a financial Mount Everest. With a little planning and a dash of playful pragmatism, you can conquer this fiscal frontier and secure your financial future. This section will guide you through the process, transforming budget creation from a chore into a surprisingly satisfying adventure.

The first step in building a robust emergency fund is crafting a realistic budget. This involves a thorough examination of your income and expenses, a process that can feel like an archeological dig into your financial past. But don’t despair! The rewards – a healthy emergency fund and a clearer understanding of your financial habits – are well worth the effort. Let’s delve into the specifics.

Budgeting Methods for Emergency Fund Savings

Several established budgeting methods can help you allocate funds effectively towards your emergency fund. The most popular are the 50/30/20 rule and zero-based budgeting. The 50/30/20 rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Zero-based budgeting, on the other hand, requires you to meticulously allocate every dollar of your income, essentially starting from scratch each month. For emergency fund savings, the 50/30/20 rule provides a simpler, more broadly applicable framework, while zero-based budgeting offers greater control but demands more time and effort. The best method depends on your individual financial situation and comfort level with detailed financial tracking. A hybrid approach, combining elements of both methods, might also prove effective. For example, you could use the 50/30/20 rule as a starting point and then employ zero-based budgeting techniques for specific expense categories to identify areas for further savings.

Tracking Expenses and Identifying Savings Opportunities

Once you have a basic budget framework, meticulously tracking your spending is crucial. This involves monitoring every expense, no matter how small. This may involve using budgeting apps, spreadsheets, or even a good old-fashioned notebook. The key is consistency. Regularly reviewing your expenses will reveal spending patterns and highlight areas where you can cut back. For example, you might discover that your daily coffee habit is costing you significantly more than you realized, or that your streaming subscriptions are adding up. Identifying these “stealth expenses” is crucial to freeing up funds for your emergency fund. Consider using a spreadsheet to categorize your expenses. This allows for easy identification of the areas where you spend the most and where potential savings can be found. A simple visual representation of your spending habits can be incredibly insightful.

Creating a Budget Using a Spreadsheet

A spreadsheet provides a powerful and flexible tool for budgeting. Here’s a step-by-step guide:

- Create a Worksheet: Open a new spreadsheet and create columns for “Date,” “Description,” “Category,” “Payment Method,” and “Amount.”

- Record Income: List all sources of income (salary, investments, etc.) and their amounts.

- Categorize Expenses: Group your expenses into categories (housing, food, transportation, entertainment, etc.). This allows you to see where your money is going.

- Track Spending: Record every expense, ensuring accuracy and consistency. This is where the magic happens (or at least, the slightly less chaotic magic of responsible financial planning).

- Calculate Net Income: Subtract your total expenses from your total income to determine your net income. This is the amount available for savings and other financial goals.

- Allocate for Emergency Fund: Dedicate a portion of your net income to your emergency fund. Start small if necessary, and gradually increase the amount as your financial situation improves.

- Regularly Review and Adjust: Review your budget regularly (weekly or monthly) to identify trends and adjust your spending as needed. Remember, a budget is a living document, not a rigid set of rules.

Remember, building an emergency fund is a marathon, not a sprint. Consistency is key!

Choosing a Savings Vehicle for Emergency Funds

Selecting the right savings vehicle for your emergency fund is crucial. Think of it like choosing the right weapon for a zombie apocalypse – you need something reliable, readily accessible, and hopefully, not too dull. The wrong choice could leave you scrambling for cash when disaster strikes, and that’s never a good look (especially if you’re covered in zombie goo).

Different savings accounts offer varying levels of interest, accessibility, and fees. Understanding these nuances will help you make an informed decision, ensuring your hard-earned emergency cash is safe, sound, and easily retrievable when you need it most.

High-Yield Savings Accounts, Emergency Fund Planning Guide

High-yield savings accounts (HYSA) are generally considered excellent options for emergency funds. They offer higher interest rates than traditional savings accounts, allowing your money to grow a little while remaining readily accessible. Most HYSAs allow for easy online access and transfers, making withdrawals a breeze (assuming you’re not battling a horde of the undead). However, some may have limitations on the number of transactions per month, so check the fine print.

Money Market Accounts

Money market accounts (MMAs) provide a bit more flexibility than HYSAs. They often come with debit cards and check-writing capabilities, offering greater convenience for accessing your funds. However, they typically require a higher minimum balance than HYSAs, and interest rates can fluctuate more. Think of them as the Swiss Army knife of savings accounts – versatile, but perhaps slightly more complicated.

Certificates of Deposit (CDs)

CDs offer higher interest rates than savings accounts, but they come with a catch: your money is locked in for a specific period (the term). Withdrawing early usually incurs penalties. CDs are best suited for long-term savings goals, not emergency funds, unless you have an exceptionally well-planned emergency involving a lengthy, pre-determined delay (like a planned trip to Mars).

Comparison of Savings Vehicles

The following table summarizes the key features of these different savings vehicles. Remember, interest rates and fees can vary significantly between institutions, so always shop around for the best deal.

| Feature | High-Yield Savings Account | Money Market Account | Certificate of Deposit (CD) |

|---|---|---|---|

| Interest Rate | Generally higher than traditional savings accounts, but variable | Often competitive with HYSAs, but can fluctuate | Typically higher than savings and MMAs, but fixed for the term |

| Fees | Usually low or nonexistent, but check for monthly maintenance fees | May have higher minimum balance requirements and potential fees | Early withdrawal penalties can be significant |

| Accessibility | Easy access via online banking, ATM, or debit card (if offered) | Easy access via online banking, debit card, checks | Limited accessibility; penalties for early withdrawal |

Strategies for Fast Emergency Fund Accumulation: Emergency Fund Planning Guide

Let’s face it, building an emergency fund can feel like scaling Mount Everest in flip-flops. But fear not, intrepid saver! With the right strategies, you can accelerate your savings and reach your financial summit faster than you think. This section unveils the secrets to turbocharging your emergency fund growth, transforming your savings journey from a marathon to a sprint (well, a slightly less breathless jog).

Building an emergency fund quickly requires a multi-pronged approach: prioritizing savings, automating contributions, and exploring additional income streams. It’s about making small, consistent changes that compound over time to create a significant impact. Think of it like training for a race: small steps daily lead to big results on race day. Your race day is financial security!

Prioritizing Savings Goals Within a Budget

Effective budgeting is crucial for rapid emergency fund accumulation. It’s about consciously allocating funds to your emergency fund before discretionary spending. Imagine your budget as a delicious pie: your emergency fund gets the biggest slice, ensuring you’re prepared for unexpected life events. This doesn’t mean deprivation; it means strategic allocation. For instance, tracking your spending for a month can reveal areas where you can cut back, such as reducing dining out or subscription services. This freed-up cash can then be redirected towards your emergency fund. A simple spreadsheet or budgeting app can make this process surprisingly straightforward and even fun! Consider using the 50/30/20 budgeting rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Prioritizing the 20% for savings, with a larger portion dedicated to the emergency fund, is a powerful strategy.

Automating Savings

Automating your savings is like having a tiny, incredibly responsible financial robot working tirelessly on your behalf. By setting up automatic transfers from your checking account to your savings account each payday, you consistently contribute to your emergency fund without even lifting a finger (except maybe to set it up initially). This removes the temptation to spend that money and ensures consistent progress. Many banks and financial institutions offer this feature, allowing you to schedule recurring transfers for any amount. Even small, regular contributions add up significantly over time. Think of it as a forced savings plan, but one you actually *want* to be forced into.

Increasing Income Streams for Faster Savings

While saving diligently is crucial, boosting your income can significantly accelerate your emergency fund growth. This doesn’t necessarily mean taking on a second full-time job; it’s about exploring additional income streams that fit your lifestyle and skillset. Consider freelancing, offering tutoring services, participating in paid online surveys, or selling unused items online. For example, a freelance writer might earn an extra $500-$1000 per month, significantly accelerating their emergency fund savings. Another example is a teacher who tutors students after school, generating an extra $200-$500 monthly. These supplementary income sources, even small ones, can significantly shorten the time it takes to build a substantial emergency fund.

Accessing Emergency Funds Responsibly

So, you’ve diligently built your emergency fund – congratulations, you magnificent money manager! Now, the crucial question isn’t *if* you’ll need it, but *how* you’ll access it without turning your carefully constructed financial fortress into a chaotic demolition derby. Remember, responsible access is key to ensuring your emergency fund remains a reliable safety net, not a one-time parachute.

Accessing your emergency funds should be a carefully considered process, not a frantic scramble. The method will vary depending on where you’ve stashed your savings. Think of it like choosing the right tool for the job – you wouldn’t use a sledgehammer to crack a nut (unless you’re feeling particularly dramatic).

Accessing Funds from Different Savings Vehicles

The speed and ease of accessing your emergency funds depend heavily on where you’ve saved them. A high-yield savings account offers quick access via ATM or online transfer, perfect for those “oh-shoot” moments. Certificates of Deposit (CDs), on the other hand, often involve penalties for early withdrawal, making them less ideal for immediate needs. Similarly, accessing funds from a brokerage account involves selling investments, which can take time and be subject to market fluctuations. Consider the potential penalties and timeframes associated with each vehicle before choosing one for your emergency fund. A well-diversified approach, with some readily accessible funds and some longer-term options, might be the most sensible strategy.

Using Emergency Funds Only for True Emergencies

Let’s be honest, “emergency” gets thrown around like confetti at a parade. A sudden trip to Hawaii to escape the monotony of spreadsheets? Not an emergency. A burst pipe flooding your basement? Absolutely an emergency. The difference lies in the unplanned, unavoidable, and potentially financially devastating nature of a true emergency. Before dipping into your hard-earned savings, ask yourself: Is this a genuine threat to my health, safety, or financial stability? If the answer is “no,” then it’s time to reconsider your spending priorities and explore alternative solutions. Remember, depleting your emergency fund for non-emergencies undermines its purpose and leaves you vulnerable to future unexpected events.

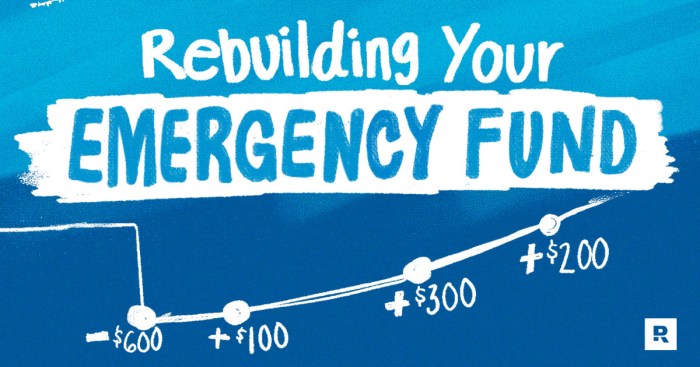

Replenishing Emergency Funds After Use

So, you bravely faced the unexpected, raided your emergency fund, and emerged victorious (or at least, less submerged). Now comes the crucial task of rebuilding your financial fortifications. The speed of replenishment depends on your income, spending habits, and the size of the emergency fund drawdown. Prioritize replenishing the fund as quickly as possible, even if it means making temporary adjustments to your budget. Consider increasing your savings contributions, cutting back on non-essential expenses, or finding additional sources of income. Think of it as a financial workout – the more you exercise your savings muscles, the stronger they become. For example, if you used $2,000, aim to replenish that amount within three to six months, adjusting your budget accordingly. This timeframe will vary depending on your financial situation and the amount used.

Accessing Emergency Funds: A Flowchart

Imagine a flowchart:

[Descriptive text of a flowchart. The flowchart would visually represent the decision-making process. It would start with “Emergency?” Yes would lead to “Assess Severity,” which branches to “Can it be handled without emergency funds?” No leads to “Access Funds (Choose appropriate method based on savings vehicle),” then to “Resolve Emergency.” Yes (to “Can it be handled…”) leads to “Explore alternative solutions.” Both branches then lead to “Replenish Emergency Fund.”]

Regular Review and Adjustment

Maintaining a robust emergency fund isn’t a “set it and forget it” kind of affair; it’s more like a mischievous pet hamster – it needs regular attention and occasional adjustments to ensure it doesn’t gnaw through your financial security. Regular reviews and adjustments are crucial for keeping your emergency fund aligned with your ever-changing life circumstances. Failing to do so could leave you scrambling for cash when unexpected expenses, like a rogue plumber’s bill or a sudden trip to the vet for your beloved iguana, rear their ugly heads.

Regularly reviewing your emergency fund plan allows you to proactively address potential vulnerabilities and capitalize on opportunities to bolster your savings. Think of it as a financial tune-up – a small amount of effort now prevents a much larger headache down the road. By adapting your plan to changing circumstances, you can maintain a comfortable safety net and avoid the stress of financial uncertainty. This involves monitoring your savings progress, evaluating your spending habits, and adjusting your savings goals as needed. The key is flexibility; life throws curveballs, and your emergency fund strategy needs to be nimble enough to catch them.

Adapting to Changing Circumstances

Life, as they say, is what happens when you’re busy making other plans. Job loss, unexpected medical expenses, or even a sudden surge in inflation can significantly impact your financial stability. Therefore, your emergency fund plan should be dynamic, not static. For instance, a job loss necessitates a reassessment of your monthly expenses and savings goals. You might need to temporarily reduce your savings contributions or explore alternative income sources while simultaneously tightening your belt (perhaps swapping that daily latte for instant coffee – we understand the pain). Conversely, an unexpected windfall, such as an inheritance or a bonus, provides an excellent opportunity to supercharge your emergency fund contributions. This allows you to build a larger cushion and improve your overall financial resilience. Consider creating a buffer zone within your emergency fund for such unplanned events.

Examples of Scenarios Requiring Plan Adjustments

Let’s paint some vivid (and slightly terrifying) scenarios. Imagine this: you’re enjoying a perfectly good Tuesday when your car decides to stage a dramatic breakdown, requiring a costly repair. This scenario requires an immediate adjustment to your spending plan. You might need to temporarily reduce contributions to other savings goals to cover the repair costs, ensuring you replenish the depleted funds as soon as possible. Another example: a sudden, unexpected medical bill can quickly drain your savings. This necessitates a reevaluation of your health insurance coverage and a potential increase in your emergency fund target to accommodate future health-related expenses. The key is to act swiftly and decisively, minimizing the disruption to your financial stability.

Annual Emergency Fund Plan Review Checklist

A yearly review is like a financial check-up for your emergency fund. It ensures everything is running smoothly and you’re prepared for any unexpected situations. This isn’t about rigorous calculations, but about ensuring your fund remains relevant and sufficient.

- Review Current Emergency Fund Balance: Check your account balance and compare it to your target savings goal. Are you on track? Do you need to adjust your savings rate?

- Assess Recent Expenses: Examine your spending habits over the past year. Have there been any unexpected or significant expenses? Do you need to adjust your emergency fund target to account for these?

- Evaluate Income and Employment Stability: Consider your job security and potential income fluctuations. If your income has decreased or your job security is uncertain, you may need to increase your emergency fund target.

- Review Savings Vehicle Performance: Are you satisfied with the interest rate and fees associated with your chosen savings vehicle? Consider exploring alternative options if necessary.

- Update Your Plan: Based on your review, update your emergency fund plan to reflect any changes in your circumstances or goals. This might involve adjusting your savings rate, target amount, or savings vehicle.

Illustrative Examples of Emergency Situations

Let’s face it, life throws curveballs. Sometimes those curveballs are gentle, slightly off-center pitches. Other times, they’re knuckleballs that defy all logic and end up cracking your windshield (metaphorically speaking, of course. Unless…). Having an emergency fund isn’t about predicting the future; it’s about having a financial safety net when the unexpected – and often expensive – inevitably happens. These examples illustrate the importance of preparedness.

Job Loss

The dreaded pink slip. Let’s say Brenda, a graphic designer, loses her job unexpectedly. Her monthly expenses include $1,500 in rent, $300 for groceries, $200 for utilities, $100 for transportation, and $200 for loan repayments. That’s $2,300 a month. Without income, Brenda’s savings quickly dwindle. The emotional toll is immense: anxiety, uncertainty, and a gnawing fear of financial ruin. However, if Brenda had a robust emergency fund of, say, six months’ expenses ($13,800), she could breathe easier, focus on her job search, and avoid drastic measures like depleting her retirement savings or accumulating high-interest debt. She could use the fund to cover her living expenses while she finds a new position, significantly reducing stress and allowing a more strategic job search.

Unexpected Medical Emergency

Picture this: Bob, a seemingly healthy individual, experiences a sudden, severe allergic reaction requiring immediate hospitalization. The medical bills – including ambulance fees, emergency room visits, tests, and medication – quickly climb to $10,000. Even with health insurance, Bob faces a substantial out-of-pocket expense due to deductibles and co-pays. The emotional impact is significant: pain, fear, and the added stress of managing a hefty medical bill. An emergency fund could alleviate this financial burden, allowing Bob to focus on his recovery instead of worrying about mounting debt. The fund would cover the unexpected costs, preventing him from falling into financial hardship.

Home Repair Catastrophe

Imagine Sarah, a homeowner, discovers a major plumbing leak in her basement. The damage is extensive, requiring urgent repairs to prevent further structural damage and mold growth. The cost of repairs and remediation? A staggering $8,000. This unexpected expense could be financially devastating without a safety net. The emotional impact is equally significant: stress, frustration, and the fear of potential financial ruin. An emergency fund of sufficient size could cover these significant repair costs, preventing Sarah from taking out high-interest loans or facing foreclosure. It allows her to address the problem swiftly and efficiently, minimizing long-term financial consequences and reducing the emotional strain.

End of Discussion

Building an emergency fund isn’t about depriving yourself of life’s little luxuries; it’s about securing your financial future and providing a safety net for those unexpected life events. By following the strategies Artikeld in this Emergency Fund Planning Guide, you’ll not only create a robust emergency fund but also cultivate sound financial habits that will serve you well for years to come. So, ditch the financial anxiety and embrace the peace of mind that comes with knowing you’re prepared for whatever life throws your way. Now go forth and conquer (your finances!).

Detailed FAQs

What if I already have some debt? How do I prioritize saving for an emergency fund?

Prioritize paying down high-interest debt first, like credit cards. Once that’s under control, even small contributions to an emergency fund are better than none. Aim for a small, manageable amount initially, and gradually increase your contributions as your debt decreases.

How often should I review my emergency fund plan?

At least annually, or more frequently if your circumstances change significantly (job loss, major life event, etc.).

What if I lose my job and need to use my emergency fund? How do I replenish it?

Focus on finding new employment immediately. Adjust your budget to maximize savings, consider a side hustle, and prioritize replenishing your emergency fund as quickly as possible.

Can I use my emergency fund for a vacation?

Absolutely not. Vacations are discretionary spending, not emergencies. Sticking to the purpose of the fund ensures it’s there when you truly need it.