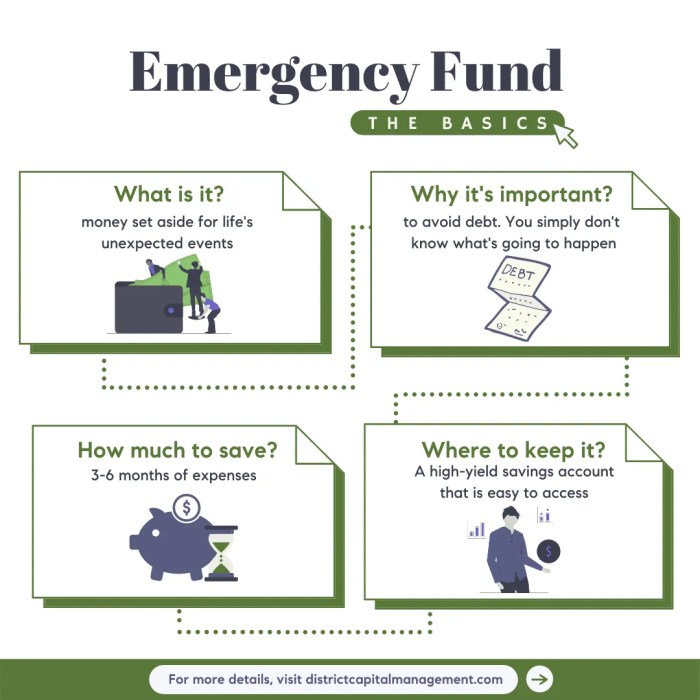

Financial security is paramount, and a well-planned emergency fund is the cornerstone of that security. Unexpected events, from job loss to medical emergencies, can significantly disrupt financial stability. This guide provides a practical framework for building and maintaining an emergency fund, empowering you to navigate life’s uncertainties with confidence and preparedness.

We will explore strategies for determining your ideal fund size, effective saving methods, and securing your savings. We’ll also cover accessing funds during emergencies and maintaining your fund for long-term financial resilience. By the end, you’ll have a clear action plan to safeguard your financial future.

Defining Your Emergency Fund Needs

Building a robust emergency fund is crucial for financial security. The ideal size isn’t a one-size-fits-all figure; it depends on individual circumstances and risk tolerance. Understanding the factors influencing your needs allows for a more realistic and effective savings plan.

Several key factors determine the appropriate size of your emergency fund. These include your income stability, monthly expenses, existing debt, family structure, and health considerations. A higher income generally allows for a larger emergency fund, while significant debt may necessitate a larger fund to cover unexpected expenses and debt repayment. Larger families and individuals with pre-existing health conditions often require a more substantial emergency fund to handle potential medical costs or other unforeseen circumstances.

Calculating Your Emergency Fund Target

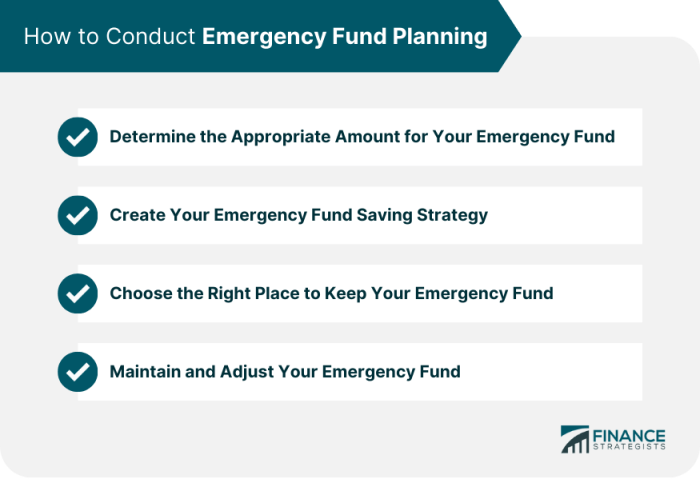

Calculating your target requires a systematic approach. First, meticulously track your monthly expenses for at least three months to establish a realistic baseline. This includes housing, utilities, transportation, food, and other essential costs. Next, consider your income and the proportion you can comfortably allocate to savings each month. Finally, determine your desired emergency fund coverage – commonly three to six months’ worth of expenses, but potentially more depending on your risk profile and circumstances.

A step-by-step guide follows:

- Track Expenses: Record all spending for three months. Categorize expenses to identify areas for potential savings and understand your average monthly expenditure.

- Calculate Average Monthly Expenses: Sum your total expenses for the three months and divide by three to obtain your average monthly expenses.

- Determine Desired Coverage: Decide on the number of months of expenses you want your emergency fund to cover (e.g., 3, 6, or 12 months).

- Calculate Emergency Fund Target: Multiply your average monthly expenses by your chosen number of months’ coverage. This is your emergency fund goal.

- Adjust for Debt and Other Factors: If you have significant debt or anticipate major expenses (e.g., upcoming medical procedures), increase your target accordingly.

Emergency Fund Approaches Compared

The table below illustrates different approaches to emergency fund building, highlighting the pros and cons of each strategy. Remember, the best approach depends on your individual financial situation and comfort level.

| Approach | Fund Size | Pros | Cons |

|---|---|---|---|

| 3 Months of Expenses | Average monthly expenses x 3 | Provides a good safety net for minor emergencies; relatively achievable for most. | May not be sufficient for major job loss or significant medical expenses. |

| 6 Months of Expenses | Average monthly expenses x 6 | Offers greater security, covering more extensive emergencies. | Requires a larger initial investment and longer savings period. |

| Debt Coverage Plus 3 Months | Total debt + (Average monthly expenses x 3) | Prioritizes debt reduction while still providing emergency coverage. | Requires a larger initial investment and may take longer to achieve. |

| 12 Months of Expenses | Average monthly expenses x 12 | Provides maximum security, allowing for significant unforeseen events. | Requires substantial savings and may take considerable time to achieve. |

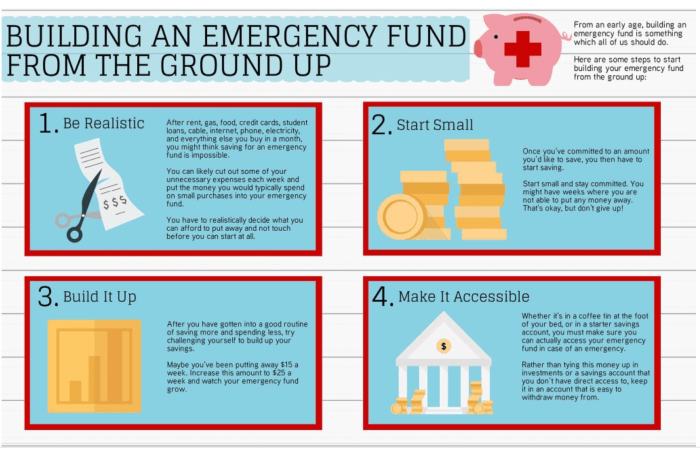

Building Your Emergency Fund

Building an emergency fund is a crucial step towards financial security. It provides a safety net to handle unexpected expenses, preventing debt accumulation and maintaining financial stability during challenging times. This section Artikels practical strategies for effectively building your emergency fund.

Effective Savings Strategies

Building a substantial emergency fund requires a multi-pronged approach encompassing budgeting, expense reduction, and potential income augmentation. Careful budgeting allows you to track your income and expenses, identifying areas where savings can be maximized. Reducing unnecessary expenses, such as dining out or subscription services, frees up funds for your emergency fund. Exploring opportunities to increase income, such as a part-time job or freelancing, can significantly accelerate the fund’s growth. Consistent effort in these areas is key to building a robust emergency fund.

Automating Savings Contributions

Automating your savings is a highly effective strategy to ensure consistent contributions to your emergency fund. Most banks and financial institutions offer automatic transfer options, allowing you to schedule regular transfers from your checking account to your savings account. Setting up automatic transfers, even for small amounts, establishes a disciplined savings habit and minimizes the risk of forgetting to contribute. Consider setting up automatic transfers on payday to maximize the impact of this strategy.

Savings Account Options

Several savings account options cater to different needs and preferences. High-yield savings accounts typically offer higher interest rates compared to traditional savings accounts, allowing your money to grow faster. Money market accounts often provide slightly higher interest rates than high-yield savings accounts but may come with minimum balance requirements. Choosing the right account depends on your individual financial goals and risk tolerance. It’s recommended to research and compare different accounts before making a decision. For example, a high-yield savings account might be suitable for someone prioritizing higher interest rates, while a money market account could be better for someone who wants a slightly higher return with a larger balance.

Financial Tools for Building an Emergency Fund

Utilizing various financial tools can significantly streamline the process of building an emergency fund. These tools can provide budgeting assistance, expense tracking, and savings goal setting.

- Budgeting Apps: Mint, YNAB (You Need A Budget), Personal Capital – These apps help track income and expenses, providing insights into spending habits and assisting in creating a budget.

- Expense Tracking Apps: PocketGuard, Goodbudget – These apps monitor spending and help identify areas where expenses can be reduced.

- Savings Goal Setting Apps: Acorns, Stash – These apps automate investing and savings, assisting in reaching financial goals.

- Spreadsheet Software: Microsoft Excel, Google Sheets – These provide a customizable platform for creating detailed budgets and tracking progress towards savings goals.

Protecting Your Emergency Fund

Building a robust emergency fund is only half the battle; protecting it is equally crucial. Keeping your emergency savings secure and readily accessible requires careful planning and proactive measures to safeguard against unforeseen circumstances. This section Artikels strategies to ensure your emergency fund remains a reliable safety net.

The most fundamental step in protecting your emergency fund is to maintain its separation from your everyday spending accounts. Commingling funds increases the risk of accidental depletion. Imagine needing emergency funds for an unexpected car repair, only to find your savings depleted due to impulsive purchases. Keeping your emergency fund in a distinct account, such as a high-yield savings account or money market account, creates a psychological and practical barrier against unauthorized access.

Potential Risks and Mitigation Strategies

Several factors can threaten the integrity of your emergency fund. Understanding these risks and implementing appropriate mitigation strategies is essential for preserving your financial security.

Unexpected expenses, such as medical bills or home repairs, can quickly deplete savings. Comprehensive health insurance and home maintenance plans can help mitigate these risks. Additionally, building a larger emergency fund than initially planned provides a buffer against larger-than-expected expenses. For instance, instead of aiming for three months’ worth of expenses, consider six months or even a year, depending on your individual circumstances and risk tolerance. A family with young children might consider a larger fund to account for potential childcare costs.

Market fluctuations can also impact the value of your emergency fund, especially if invested in stocks or bonds. While investing a portion of your long-term savings is generally advisable, emergency funds should primarily be held in low-risk, liquid assets like savings accounts or money market accounts. This minimizes the impact of market volatility on your readily accessible funds. A real-life example is the 2008 financial crisis, where many individuals saw their investment accounts plummet, highlighting the importance of keeping emergency funds separate and in low-risk accounts.

Creating a Secure and Accessible Emergency Fund

Accessibility and security are equally important when it comes to your emergency fund. The account should be easily accessible in case of an emergency, but also protected from unauthorized access or theft.

Consider using a high-yield savings account or money market account offered by reputable financial institutions. These accounts generally offer FDIC insurance (up to $250,000 per depositor, per insured bank, for single accounts) protecting your funds from bank failure. Avoid accounts with high fees that can erode your savings over time. Regularly review your account statements to monitor your balance and ensure there are no unauthorized transactions. Using strong passwords and enabling two-factor authentication adds an extra layer of security.

Accessing Your Emergency Fund

Having a well-stocked emergency fund is only half the battle; knowing how to access it quickly and efficiently during a crisis is equally crucial. This section details a step-by-step process for accessing your funds, considers various scenarios requiring emergency fund use, and provides guidance on managing the emotional toll such situations can create.

Accessing your emergency fund should be a straightforward process, planned in advance to minimize stress during a crisis. Remember, the goal is to alleviate financial pressure, not add to it.

Emergency Fund Access Process

Before an emergency arises, it’s essential to familiarize yourself with your chosen account’s access methods. This will ensure a smooth process when you need the money urgently. The steps Artikeld below provide a general framework; specifics may vary slightly depending on your chosen financial institution and account type.

- Assess the Situation: Carefully evaluate the nature and severity of the emergency. Ensure it truly warrants using your emergency fund.

- Determine the Required Amount: Calculate the precise amount needed to address the emergency. Avoid withdrawing more than necessary.

- Choose Your Access Method: Select the fastest and most convenient method based on your account type and the urgency of the situation (detailed in the table below).

- Initiate the Withdrawal: Follow the instructions provided by your financial institution to initiate the withdrawal. This might involve online banking, visiting a branch, or contacting customer service.

- Document the Transaction: Keep a record of the withdrawal, including the date, amount, and reason for the withdrawal. This will aid in tracking your fund’s balance and help with future budgeting.

- Replenish the Fund: As soon as possible after the emergency subsides, begin replenishing your emergency fund to restore its previous level.

Emergency Scenarios and Emotional Management

Facing a financial emergency can be emotionally challenging. Unexpected job loss, a serious medical issue, or home repairs can trigger stress, anxiety, and even feelings of helplessness. It’s crucial to acknowledge these feelings and develop coping mechanisms.

Examples of scenarios where accessing the emergency fund might be necessary include: unexpected medical bills (e.g., a sudden illness requiring hospitalization), job loss (requiring funds for living expenses while seeking new employment), car repairs (e.g., a major engine failure requiring significant repairs), or home emergencies (e.g., burst pipes causing water damage).

To manage the emotional impact, consider these strategies:

* Seek Support: Talk to family, friends, or a therapist about your feelings. Sharing your burden can significantly reduce stress.

* Create a Budget: After addressing the immediate emergency, create a detailed budget to manage your finances effectively going forward.

* Practice Self-Care: Engage in activities that promote relaxation and well-being, such as exercise, meditation, or spending time in nature.

Emergency Fund Access Methods

The table below compares different methods for accessing emergency funds, highlighting their associated fees and processing speeds. These are general examples, and specific fees and processing times can vary depending on your financial institution and account type.

| Method | Speed | Fees | Description |

|---|---|---|---|

| ATM Withdrawal | Immediate | Potentially ATM fees, depending on your bank and ATM network. | Convenient for immediate cash needs, but limited withdrawal amounts may apply. |

| Debit Card Purchase | Immediate | No direct fees, but merchant fees may apply depending on the transaction. | Allows for purchases using your emergency fund directly. |

| Online Transfer | Typically within 1-2 business days | Usually no fees, but may depend on your bank and receiving institution. | Flexible and convenient, suitable for transferring funds to another account. |

| Bank Branch Withdrawal | Immediate | Usually no fees, but potential waiting times may apply depending on branch traffic. | Allows for large withdrawals and direct assistance from bank staff. |

Maintaining Your Emergency Fund

Maintaining your emergency fund isn’t a one-time task; it’s an ongoing process crucial for ensuring financial security. After an emergency withdrawal, replenishing your fund swiftly is key to restoring your safety net. Consistent contributions and periodic reviews will help you adapt your plan to changing circumstances and maintain the appropriate level of savings.

Regularly replenishing your emergency fund after a withdrawal is essential. Think of it like refilling a water bottle after you’ve taken a drink. The goal is to get back to your target amount as quickly as possible. The speed of replenishment will depend on your individual financial situation and the size of the withdrawal. Prioritizing this replenishment over other financial goals, such as discretionary spending or non-essential investments, is often necessary.

Replenishing the Emergency Fund After a Withdrawal

The process of replenishing your emergency fund involves prioritizing the rebuilding of your savings. This may necessitate adjustments to your budget, focusing on reducing non-essential expenses. For example, if you used $1000 from your emergency fund to repair your car, you might aim to save $100-$200 per month until the fund is replenished. This disciplined approach ensures that you’re not just replacing the immediate loss, but also maintaining a robust buffer against future unexpected events. Tracking your progress and celebrating milestones can help you stay motivated.

Strategies for Maintaining the Emergency Fund Over Time

Maintaining your emergency fund requires a proactive approach involving consistent contributions and periodic adjustments. Consider automating regular contributions from your checking account to your emergency fund savings account. Even small, consistent contributions can accumulate significantly over time. Adjusting your contributions to align with changes in your income or expenses is also crucial. For instance, if you receive a raise, you could increase your monthly contribution to your emergency fund. Conversely, if you experience a temporary reduction in income, you might temporarily reduce your contributions while focusing on maintaining the existing balance.

The Importance of Reviewing and Adjusting the Emergency Fund Plan Periodically

Regular review of your emergency fund plan is essential to ensure it remains relevant to your current financial situation and evolving needs. At least once a year, or even more frequently if significant life changes occur (like job changes, marriage, or having a child), reassess your emergency fund’s adequacy. Consider factors such as your current expenses, outstanding debts, health insurance coverage, and potential future financial obligations. This review allows you to make necessary adjustments to your savings goal and contribution schedule. For instance, if your expenses have increased significantly, you might need to increase your emergency fund target.

Illustrating Emergency Fund Scenarios

Real-life situations best illustrate the value of an emergency fund. Seeing how a well-planned fund can mitigate the devastating effects of unexpected events highlights its importance. The following scenarios demonstrate the practical application of an emergency fund in different circumstances.

Job Loss and Family Support

The Miller family, consisting of John (a software engineer), Mary (a teacher), and their two young children, experienced an unexpected upheaval when John was laid off from his job. While Mary’s income provided some stability, the loss of John’s significantly higher salary created immediate financial stress. The Millers, however, had diligently built an emergency fund equivalent to six months of their combined expenses. This fund allowed them to cover their mortgage, utilities, groceries, and childcare without immediate financial panic. The emotional impact was still significant; John experienced anxiety and uncertainty about the future, while Mary felt the pressure of supporting the family alone. However, the financial cushion provided by their emergency fund gave them the breathing room to navigate this challenging period. They used the time to actively search for new employment opportunities, attend job fairs, and network professionally, without the added stress of immediate financial ruin. John eventually found a comparable position after three months, and the family gradually rebuilt their savings. The experience underscored the importance of having a financial safety net to handle unforeseen circumstances.

Significant Medical Emergency

Sarah, a single graphic designer, faced a serious medical emergency when she was diagnosed with appendicitis requiring immediate surgery. The medical bills quickly mounted, including the cost of the surgery, hospital stay, anesthesia, medications, and follow-up appointments. These expenses totaled approximately $15,000. Sarah, however, had proactively saved a substantial emergency fund. While the experience was undoubtedly stressful and emotionally draining, her emergency fund covered the majority of the medical expenses, preventing her from accumulating significant debt. The remaining balance was manageable through her health insurance and a small personal loan. The financial stability provided by her emergency fund allowed her to focus on her recovery without the added burden of overwhelming financial worry. She could concentrate on her health, allowing for a quicker and less stressful recovery process. This scenario clearly illustrates the critical role of an emergency fund in mitigating the financial impact of unexpected and potentially costly medical events.

Final Summary

Building a robust emergency fund isn’t just about accumulating savings; it’s about cultivating peace of mind. By implementing the strategies Artikeld in this guide – from calculating your target amount to creating a secure and accessible fund – you’ll be well-equipped to handle unexpected events. Remember, consistent effort and proactive planning are key to achieving lasting financial security. Start building your emergency fund today and secure a more stable tomorrow.

Top FAQs

What if my emergency fund is depleted after a major event?

Prioritize rebuilding your emergency fund as soon as possible. Re-evaluate your budget, explore additional income streams, and gradually replenish your savings to reach your target amount.

How often should I review my emergency fund plan?

Review your plan at least annually, or more frequently if your income, expenses, or family circumstances change significantly. This ensures your fund remains aligned with your current needs and risk profile.

Can I use my emergency fund for non-emergency expenses?

While tempting, using your emergency fund for non-emergencies undermines its purpose. Doing so could leave you vulnerable during a true crisis. Stick to its intended use to maintain financial stability.

What types of accounts are best for an emergency fund?

High-yield savings accounts and money market accounts offer both accessibility and competitive interest rates, making them suitable options for emergency funds. Consider factors like interest rates, fees, and accessibility when choosing an account.