Emergency Fund Planning Tips: Let’s face it, life throws curveballs. One minute you’re cruising along, the next you’re staring down a surprise medical bill or a leaky roof that threatens to unleash a Niagara of expenses. This isn’t a doom-and-gloom prophecy, friends; it’s a gentle nudge towards financial preparedness. Building an emergency fund isn’t about fearing the worst; it’s about empowering yourself to handle the unexpected with grace (and a healthy bank balance). We’ll explore strategies for building, managing, and—heaven forbid—utilizing your emergency fund, turning potential financial disasters into manageable bumps in the road.

This guide will walk you through the process of determining the right emergency fund size for your unique circumstances, exploring various saving methods (from automatic transfers to high-yield accounts), and crafting a plan to maintain this crucial financial safety net. We’ll even delve into the often-overlooked role of insurance and how it can bolster your emergency preparedness. Prepare to become a financial ninja, ready to deflect any unexpected blow that life throws your way!

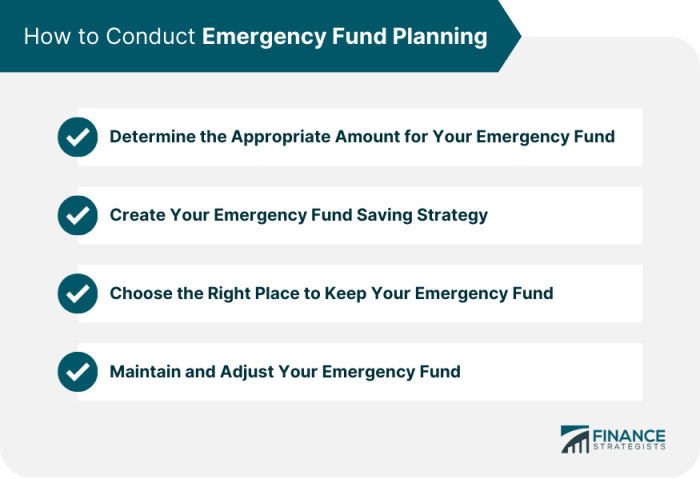

Defining Your Emergency Fund Needs

Building an emergency fund is less about avoiding financial doom and more about creating a delightfully surprising safety net. Think of it as your personal financial superhero cape – stylish and ready to swoop in when unexpected villains (like burst pipes or surprise medical bills) attack. The key is to determine the right size for your cape, which depends entirely on your unique circumstances.

Determining the appropriate size of your emergency fund requires a bit of financial detective work. It’s not a one-size-fits-all situation; a robust fund for a freelancer might look drastically different from that of a tenured professor with excellent health insurance. Factors like job security, existing savings, healthcare coverage, and the number of dependents all play a significant role in deciding how much you need to stash away.

Emergency Fund Size Based on Individual Circumstances

Let’s imagine three different scenarios:

Scenario 1: Amelia, a software engineer with a stable job and comprehensive health insurance, has no dependents. A 3-month emergency fund would likely suffice for her, covering unexpected expenses and providing a cushion during a potential job search.

Scenario 2: Ben, a freelance graphic designer with fluctuating income and a high deductible health plan, has a young child. He’d be wise to aim for a larger emergency fund, perhaps 6-12 months of living expenses, to account for income variability and higher healthcare costs. He needs a bigger safety net to handle unexpected expenses.

Scenario 3: Carlos, a self-employed consultant with a spouse and two children, faces even greater financial uncertainties. He might consider building an emergency fund covering 12-18 months of expenses, providing maximum protection for his family against significant unexpected events.

Comparison of Emergency Fund Strategies

The following table compares various strategies for building an emergency fund. Remember, the “best” strategy is the one that best suits your individual needs and risk tolerance. Don’t get bogged down in the numbers; focus on what feels right and achievable for you.

| Strategy Name | Recommended Fund Size | Advantages | Disadvantages |

|---|---|---|---|

| 3-6 Months of Expenses | 3-6 times your monthly expenses | Relatively achievable, provides a good safety net for most situations. | May not be sufficient for prolonged unemployment or major unexpected expenses. |

| 6-12 Months of Expenses | 6-12 times your monthly expenses | Provides greater security against job loss or extended periods of reduced income. | Requires significant saving, may feel daunting to achieve. |

| Event-Based Fund (e.g., Home Repair Fund) | Variable, depending on the potential cost of the event. | Targeted savings for specific foreseeable expenses, reduces overall emergency fund burden. | Requires careful planning and estimation of potential costs; may not cover unforeseen events. |

Considering Unexpected Expenses Beyond Basic Living Costs

Beyond the usual suspects like rent and groceries, life throws curveballs. A leaky roof, a sudden medical emergency, or an unexpected car repair can quickly deplete even the most carefully planned budget. Therefore, it’s crucial to consider these less predictable expenses when determining the size of your emergency fund. Think of it as adding extra padding to your superhero cape – the more padding, the better the protection against life’s inevitable bumps. Ignoring these potential expenses is like going into battle with a flimsy, ill-fitting cape; you’re asking for trouble!

Building Your Emergency Fund: Emergency Fund Planning Tips

So, you’ve figured out how much emergency cash you need. Congratulations! That’s the hardest part. Now comes the fun (and slightly less terrifying) part: actually building that safety net. Think of it as constructing a financial fortress against life’s inevitable curveballs – because let’s face it, Murphy’s Law is a surprisingly accurate financial advisor.

Building your emergency fund doesn’t require a magic wand or a winning lottery ticket; it just needs a plan and a healthy dose of self-discipline (and maybe a little less impulse-buying). We’ll explore different strategies to help you stockpile those crucial funds, turning your financial anxieties into a comfortable cushion.

Saving Methods for Emergency Fund Building

Several effective methods can help you accumulate your emergency fund. Choosing the right one depends on your personality, financial habits, and level of tech-savviness.

Let’s start with automatic transfers. Imagine setting up a system where a small, predetermined amount is automatically transferred from your checking account to your savings account each month. This is like a financial “pay yourself first” strategy. For example, you could automatically transfer $100 from your checking to your savings account every payday. The beauty of this method? It’s effortless and consistent, ensuring steady growth of your fund. It’s like having a tiny, reliable financial robot working for you, day and night.

Next, a dedicated savings account. Think of this as your emergency fund’s personal VIP lounge. It’s a separate account specifically for emergencies, preventing accidental spending. This is visually clear and emotionally satisfying. For example, naming the account “Emergency Fund: Don’t Touch!” can act as a powerful deterrent against temptation.

Finally, high-yield savings accounts. These accounts offer a higher interest rate than regular savings accounts, making your money grow faster. While the interest might not be life-changing, it’s a welcome bonus. For example, if you consistently save $200 per month in a high-yield account earning 2% interest annually, you’ll see your savings grow steadily over time, adding to the overall cushion.

A Step-by-Step Plan for Building Your Emergency Fund

Building an emergency fund is a marathon, not a sprint. Start small and be consistent.

Step 1: Assess your current financial situation. How much can you realistically save each month? Be honest!

Step 2: Set a realistic savings goal. Don’t aim for the moon; start with a manageable amount. Maybe $500, then $1000, then work your way up.

Step 3: Automate your savings. Set up automatic transfers to your savings account.

Step 4: Track your progress. Monitor your savings regularly to stay motivated.

Step 5: Celebrate milestones! Reward yourself for reaching savings goals, but don’t derail your progress.

Overcoming obstacles like impulse purchases and unexpected expenses requires discipline. Create a budget, track your spending, and identify areas where you can cut back. Unexpected expenses? Build a buffer into your budget for them.

Comparison of Savings Vehicles for Emergency Funds

Choosing the right savings vehicle is crucial. Consider the following factors:

- Interest Rates: High-yield savings accounts typically offer higher interest rates than regular savings accounts or checking accounts. The difference might seem small, but it adds up over time.

- Accessibility: You need easy access to your emergency fund. Avoid accounts with lengthy withdrawal periods or excessive fees.

- Fees: Beware of monthly maintenance fees, transaction fees, or minimum balance requirements. These can eat into your savings.

For example, a high-yield savings account might offer 2% interest, while a regular savings account offers only 0.1%. While that seems minor, the difference compounds over time, benefiting the high-yield account significantly. Similarly, an account with high fees can negate the benefits of a higher interest rate.

Managing Your Emergency Fund

Ah, the emergency fund – that glorious safety net preventing you from having to sell your prized collection of rubber ducks to cover an unexpected plumbing catastrophe. Building it is one thing; keeping it healthy and accessible when needed, without turning it into a personal piggy bank, is a whole different ball game. Let’s tackle the art of emergency fund management with the grace of a seasoned financial ninja.

Successfully managing your emergency fund requires a multi-pronged approach, combining diligent tracking, unwavering discipline, and a healthy dose of foresight. Think of it less as a chore and more as a thrilling financial treasure hunt – the treasure being your financial security, of course.

Emergency Fund Tracking Strategies

Tracking your progress towards your emergency fund goal is crucial. It’s like watching a plant grow – the satisfaction is immense! Fortunately, we have technology on our side. Several budgeting tools and apps offer streamlined tracking, providing a clear visual representation of your progress and offering insights into your spending habits. This eliminates the tediousness of manual tracking, allowing you to focus on the bigger picture (like finally buying that limited edition rubber duck).

Examples include Mint, Personal Capital, and YNAB (You Need A Budget). Mint offers a comprehensive overview of your finances, including your savings accounts. Personal Capital provides a more in-depth analysis, including investment tracking, while YNAB employs a zero-based budgeting method that helps you allocate every dollar to a specific purpose, including your emergency fund. Each tool has its strengths, so exploring a few to find the best fit for your personality and financial style is advisable. Imagine the satisfaction of seeing that emergency fund bar graph steadily climbing!

Protecting Your Emergency Fund

This is where the true test of willpower begins. Preventing impulsive withdrawals requires a strategic approach. The most effective strategy involves creating distance, both physical and mental. Consider opening a separate high-yield savings account specifically for your emergency fund. This creates a mental barrier, making it harder to access funds for non-emergency purchases.

Further, automating your savings is a game-changer. Setting up automatic transfers from your checking account to your emergency fund account on a regular schedule ensures consistent contributions without requiring conscious effort. It’s like a financial autopilot, steadily building your safety net while you focus on other things – like planning your next rubber duck-themed party.

Emergency Fund Strategy Review, Emergency Fund Planning Tips

Your life is dynamic, and your financial situation should reflect that. Regularly reviewing and adjusting your emergency fund strategy is essential. Major life events, such as job changes, marriage, or the arrival of a fluffy four-legged family member (or even a particularly demanding collection of rubber ducks), will impact your financial needs.

Ideally, conduct a review at least annually, or even more frequently if significant life changes occur. This review should assess your current emergency fund balance against your updated needs. For example, if you’ve recently experienced a significant increase in income, you might increase your emergency fund target. Conversely, if you’ve faced unexpected expenses or a job loss, you may need to adjust your savings rate or withdraw funds strategically. This proactive approach ensures your emergency fund remains a robust and reliable safety net, ready to catch you when life throws you a curveball.

Utilizing Your Emergency Fund

So, you’ve diligently built your emergency fund – congratulations, you magnificent money manager! Now, the burning question (that we won’t actually ask, because we’re sophisticated like that) is: when do you actually *use* the darn thing? Let’s dive into the delicate art of accessing your hard-earned savings without turning your carefully constructed financial fortress into a chaotic, money-less wasteland.

The process of determining when to tap into your emergency fund involves a careful balancing act between immediate needs and long-term financial health. Think of it as a highly dramatic, high-stakes game of financial Jenga – one wrong move and your carefully constructed tower of savings could crumble. But fear not, with the right strategy, you can pull out the right blocks at the right time, leaving your financial Jenga tower strong and secure.

Emergency Fund Access Scenarios and Decision-Making Criteria

This section Artikels scenarios requiring emergency fund access and the criteria to consider when making that crucial decision. Remember, the goal is to protect your financial well-being while minimizing the impact on your long-term savings. We’re not advocating reckless spending; we’re advocating *smart* spending.

Examples of Justified and Unjustified Emergency Fund Access

Let’s illustrate with some real-world scenarios. The following table provides examples of situations where accessing your emergency fund is justified, situations where alternative solutions should be explored first, and the decision-making factors involved.

| Situation | Justification for Using Emergency Fund | Alternatives to Consider | Decision-Making Factors |

|---|---|---|---|

| Unexpected Job Loss | Provides crucial income replacement during the job search. | Unemployment benefits, temporary gigs, selling non-essential assets. | Duration of unemployment expected, availability of other income sources, emergency fund size. |

| Major Home Repair (e.g., burst pipe) | Prevents costly damage escalation and ensures safety. | Homeowner’s insurance, borrowing from family/friends (short-term, with clear repayment plan). | Extent of damage, insurance coverage, ability to repay borrowed funds quickly. |

| Emergency Medical Expenses (uninsured or high deductible) | Covers critical medical costs, preventing crippling debt. | Negotiating payment plans with medical providers, exploring crowdfunding options. | Severity of illness/injury, availability of health insurance, ability to manage debt. |

| Unexpected Car Repair (essential vehicle) | Ensures reliable transportation for work and essential needs. | Using public transport temporarily, seeking a less expensive repair option. | Importance of the vehicle for work/essential needs, cost of repair versus alternative transportation. |

| Luxury Vacation | Absolutely not justified. Save for this separately! | Postponing the vacation, saving for it over time. | Prioritization of financial goals. An emergency fund is for *emergencies*, not extravagant getaways. |

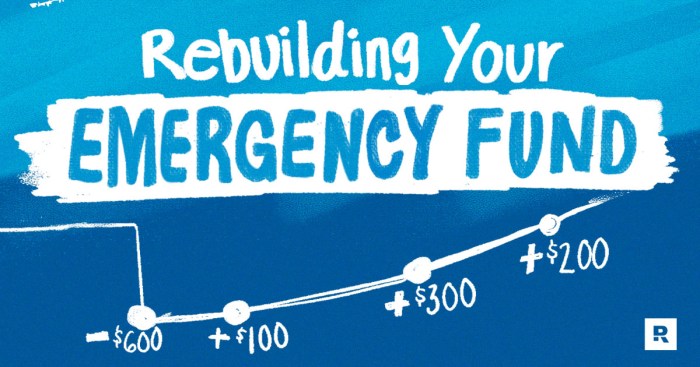

Replenishing Your Emergency Fund

Once you’ve accessed your emergency fund, the priority is to rebuild it. Think of it as a financial phoenix – rising from the ashes (of your emergency, naturally). This requires disciplined saving and a renewed commitment to financial stability. Strategies for efficient rebuilding include increasing your savings rate, identifying areas to cut expenses, and exploring additional income streams (like a side hustle – think of it as a financial superpower). The speed of replenishment depends on your income, expenses, and the amount withdrawn. A realistic timeframe is crucial, preventing further financial stress. Remember, consistency is key. Small, regular contributions are far more effective than sporadic, large ones. Think of it as a marathon, not a sprint.

Additional Considerations

So, you’ve diligently built your emergency fund – congratulations, you magnificent money manager! But the journey doesn’t end there. Think of your emergency fund as the sturdy life raft on your financial ship; it’s essential, but other safety measures significantly boost your chances of weathering any storm. This section explores crucial supplemental strategies and potential pitfalls to navigate the choppy waters of unexpected events.

The role of insurance in supplementing an emergency fund is akin to having a highly-trained financial lifeguard on standby. While your emergency fund is your first line of defense, insurance acts as a powerful backup, significantly reducing the financial impact of specific catastrophes.

The Protective Power of Insurance

Insurance policies act as safety nets, catching you before you plummet into a financial abyss. Health insurance, for instance, can prevent crippling medical bills from wiping out your savings after a serious illness or accident. Imagine a scenario where a sudden illness requires a $50,000 hospital stay. Without health insurance, your emergency fund might be completely depleted, leaving you vulnerable. With comprehensive coverage, the financial burden is significantly lessened. Similarly, auto insurance protects against the costs associated with accidents, from repairs to legal fees. Homeowner’s or renter’s insurance safeguards your possessions and provides liability coverage, preventing devastating financial losses from theft, fire, or other unforeseen events. These policies essentially act as specialized emergency funds for specific risks, allowing your general emergency fund to remain intact for broader unforeseen circumstances.

The Importance of a Written Emergency Plan

Having a well-defined emergency plan isn’t just about having money stashed away; it’s about having a clear roadmap to navigate chaos. A written plan provides a structured approach to accessing and utilizing your emergency funds, ensuring calm and efficient action when panic might otherwise set in. This plan should include contact information for essential services, such as your bank, insurance providers, and trusted family members. It should also detail how you’ll access your emergency funds (e.g., online banking, ATM locations, etc.), and Artikel specific steps to take in various emergency situations (job loss, medical emergency, natural disaster).

Here’s a template for a personal emergency plan:

| Emergency Situation | Steps to Take | Contact Information | Financial Resources |

|---|---|---|---|

| Job Loss | Update resume, begin job search, contact unemployment office | Employment agency, friends in relevant industries | Emergency fund access details |

| Medical Emergency | Contact emergency services, notify insurance provider | Doctor’s office, hospital, insurance provider | Health insurance details, emergency fund access details |

| Natural Disaster | Evacuate if necessary, contact emergency services, secure important documents | Emergency services, local authorities, family/friends | Emergency fund access details, insurance policy information |

Common Pitfalls to Avoid

Failing to adequately plan for emergencies can lead to significant financial stress and hardship. Avoid these common pitfalls:

- Underestimating Emergency Fund Needs: Many people underestimate the amount they need. A common rule of thumb is 3-6 months of living expenses, but this can vary depending on individual circumstances. Failing to adequately account for potential expenses can lead to insufficient funds during an emergency.

- Ignoring Insurance Coverage: Relying solely on an emergency fund without adequate insurance coverage can leave you financially exposed to significant losses. Comprehensive insurance coverage acts as a critical safety net.

- Poorly Accessible Funds: Keeping your emergency fund in an inaccessible account can delay crucial access during an emergency. Ensure easy and immediate access to your funds.

- Using the Emergency Fund for Non-Emergencies: This defeats the purpose of an emergency fund. Resist the temptation to dip into it for non-essential expenses.

- Lack of a Written Plan: Failing to create a written emergency plan can lead to confusion and inefficient responses during a crisis. A well-defined plan ensures calm and decisive action.

Concluding Remarks

Building an emergency fund isn’t just about stashing cash; it’s about cultivating a sense of financial security and resilience. By thoughtfully planning your emergency fund, you’re not just preparing for the unexpected—you’re investing in peace of mind. Remember, a well-stocked emergency fund isn’t a sign of impending doom; it’s a testament to your proactive financial savvy. So go forth, my financially astute friend, and build that emergency fund with confidence and a healthy dose of humor. You’ve got this!

Q&A

What if I already have some debt? Should I pay that off first before starting an emergency fund?

Ideally, you should address high-interest debt before aggressively building an emergency fund. However, a small emergency fund (even $500-$1000) can provide a buffer against unexpected expenses that could worsen your debt situation. Prioritize paying down high-interest debt while simultaneously building a minimal emergency fund.

How often should I review and adjust my emergency fund plan?

At least annually, or more frequently if there are significant life changes (job loss, marriage, birth of a child, etc.).

What type of account is best for an emergency fund?

High-yield savings accounts offer a balance between accessibility and earning interest. Consider factors like interest rates, fees, and accessibility when choosing an account.

Can I use my emergency fund for unexpected but non-emergency expenses?

Generally, no. Resist the temptation! Using your emergency fund for non-emergencies defeats its purpose. Explore alternative solutions (budget adjustments, borrowing from friends/family, etc.) before tapping into your emergency savings.